The calculation of 6-NDFL has changed significantly. Now, as an attachment to it, there is a certificate of income and taxes of the individual, which previously was an independent document (2-NDFL). The new form has been in use for a year now - since reporting for the first quarter of 2022. But just recently it was updated again. In this article we will talk about the new form of calculation in 2022: what has changed in it and how to correctly reflect the data. We will also look at an example of filling out 6-NDFL.

Submit reports online

Valid form

The new form 6-NDFL was approved by Federal Tax Service order No. ED-7-11/ [email protected] , 2020. The latest changes were made to it on September 28, 2021 (Federal Tax Order No. ED-7-11/ [email protected] ). For the first time, the updated form must be completed when reporting for 2022, that is, before March 1, 2022.

Since last year, the form includes information previously submitted in the 2-NDFL certificate, which has already been cancelled. The latest updates, which came into force in 2022, are mainly related to changes in the procedure for calculating tax on income in the form of dividends. According to the new rules, income tax withheld from dividends received by a Russian organization is counted when determining the personal income tax of the founder of this organization. The updated calculation of 6-NDFL contains other small changes. We will talk about the innovations in more detail when we consider the procedure for filling out the document.

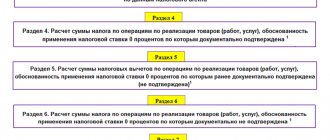

The new form still consists of a title page, two sections and an appendix, which practically repeats the former 2-NDFL certificate, although with some differences. If the report is submitted for a quarter, half a year or 9 months, you only need to fill out the title, Sections 1 and 2. The application is filled out only when submitting 6-NDFL for the year, as well as when liquidating / terminating the activities of an individual entrepreneur with employees.

How to fill out the new form 6-NDFL

The procedure for filling out 6-NDFL (hereinafter referred to as the Procedure) is approved by the same order as the form itself and is contained in Appendix No. 2. Below are step-by-step instructions based on these rules for filling out each section of this form, written, as they say, for dummies.

Title page

The first page of the calculation is filled out in the same way as other forms, for example, any tax return. You need to fill in the following fields:

- TIN of the business entity, additionally checkpoint for organizations;

- adjustment number – “0–”, if the calculation for the period is submitted for the first time. If not, the correction number is indicated, for example, “1–” or “2–”;

- reporting period - for annual calculations, enter code “34”; for other periods, the code must be taken from Appendix No. 1 to the Procedure. Since 2022, the list of reporting periods has been expanded - codes 83-86 have appeared in it for cases when 6-NDFL is submitted in connection with the closure of an individual entrepreneur;

- calendar year, for our example it is “2021”;

- tax office number, for example, “7722”;

- code at the place of registration - “120” for individual entrepreneurs, “214” for organizations. This is a general case, but there are other codes. You need to select the appropriate one in Appendix No. 2 to the Procedure. For example, for a separate division (SU) of a Russian organization, the code “220” is needed;

- name of the tax agent - the abbreviated name of the organization (if the short name is not in the charter, then indicate the full name) or the full name of the entrepreneur;

- code of the reorganization or closure form of the OP, if applicable. You can view it in Appendix No. 4 to the Procedure. In this case, you need to fill out the next line, indicating the TIN of the reorganized legal entity or closed division;

- OKTMO code;

- phone number in the format +79ХХХХХХХХ;

- the number of pages of the form and power of attorney sheets, if 6-NDFL was signed or submitted by a proxy.

In addition, on the title page you need to enter the data in the information confirmation block. The rules for filling out the fields are as follows:

- in the single-cell field the code “1” is indicated if the signature will be put by an entrepreneur or director of an LLC. If the document will be signed by an authorized person, code 2 is indicated;

- the following lines contain the last name, first name and patronymic of the person who signs the document, usually the director. The individual entrepreneur does not register his full name again;

- if the trustee is an organization (for example, accounting has been outsourced), then its name is entered in the lines below;

- in the last two lines you need to enter the details of the power of attorney if the document is submitted by a representative.

Section 1

This section is filled in with information about personal income tax that was withheld from the employee or returned to him (in case of excessive withholding) in the last three months of the reporting period. Only the amounts of tax withheld in accordance with the payment deadline are reflected. This means that if the tax is withheld, and the deadline for its transfer occurs only in the next reporting period, then this personal income tax amount does not need to be reflected in Section 1. There is an exception - if the income is paid on the last working day of the reporting period.

Section 1 is completed in terms of tax rate. If during the period personal income tax was calculated at several rates (13%, 15%, 30%, 35%), then there should be the same number of Sections 1.

The section fields are filled in as follows:

- 010 – KBK for personal income tax payment;

- 020 – the amount of tax withheld from employees, the payment deadline for which falls on the last 3 months of the period;

- 021 – deadline for transfer;

- 022 – total amount of personal income tax withheld as of the date from field 021. The sum of the indicators of all lines 022 must be equal to the indicator of line 020;

- 030 – tax refunded for the last 3 months – total amount;

- 031 – date of return of a specific amount;

- 032 – the amount of the returned tax as of the date from field 031. The sum of the indicators of all lines 032 must be equal to the indicator of line 030.

Section 2

In Section 2, information is reflected at the appropriate rate on an accrual basis from the beginning of the year. If personal income tax was calculated at several rates during the period, an independent Section 2 must be completed for each of them.

Line 100 indicates the personal income tax rate, line 105 indicates the KBK rate.

Line 110 reflects the total amount of income paid to individuals and taxed at the rate from line 100 without taking into account deductions. You need to add up the amounts of income the date of receipt of which falls within the billing period.

In lines 111-113, the amount of income from line 110 is broken down into groups: 111 – dividends, 112 – payments under employment contracts, 113 – under civil contracts.

Line 115 has appeared in form 6-NDFL since 2022. It separately identifies the total amount of payments to highly qualified specialists (HQS) under employment contracts and GPC. The amount reflected on line 115 is included in lines 112 and 113.

Line 120 reflects the number of persons to whom payments were made during the reporting period.

Line 121 also appeared only in 2022. It indicates the total number of HQS to whom payment/remuneration amounts were paid. The indicator in this line is included in the number of employees from line 120.

When counting individuals, there is a rule: if during the year an employee was fired and hired again, he is counted only once.

On line 130 you need to indicate the amount of deductions that reduce the income reflected in line 110. It takes into account all tax-reducing and non-taxable amounts, for example, financial assistance in the amount of 4,000 rubles. The total deduction cannot exceed income.

Line 140 reflects the total amount of accrued personal income tax for all employees and other individuals. The next two lines from this indicator highlight the amounts of income tax: in line 141 - on dividends paid, in line 142 - on payments to highly qualified specialists.

Line 150 is intended to indicate the fixed advance payments that the foreigner paid when obtaining the patent. If there are supporting documents, the personal income tax calculated in relation to the foreigner can be reduced by the amount indicated in field 150.

Line 155 is another new line in 6-NDFL 2022. It should indicate the amount of income tax that was withheld from dividends received by the Russian organization and is subject to offset when determining the amount of personal income tax of an individual on income from equity participation in this organization.

In line 160 you need to reflect the amount of personal income tax withheld since the beginning of the year. Moreover, if the income is reflected on line 110, but the actual payment has not yet been made, then the tax amount does not fall on line 160. This income will be received in another period, accordingly, and personal income tax should also be withheld from it in another period.

Line 170 reflects the amount of personal income tax not withheld. This does not mean the tax that must be withheld in the next period, but the amounts that cannot be withheld. For example, when paying for labor in kind.

Line 180 indicates the amount of tax that was over-withheld by the tax agent.

Line 190 should reflect the amount of personal income tax that was returned (for example, excessively withheld earlier).

General rules for filling out Section 1

Section 1 shows transactions for the last quarter by date of tax /refund .

Previously, Section 2 in the old 6-NDFL (this is an analogue of Section 1 of the new 6-NDFL ) was filled out according to the transfer deadline . Those. the period for which personal income tax was transferred belonged to, the report for that period included data on paid income and withheld personal income tax. This filling was carried out based on the explanations of the controllers.

Section 1 indicates the timing of tax transfer ( line 021 ) and the amount of withheld tax ( line 022 the last three months of the reporting period.

About line-by-line completion of Section 1 of the report (from 2022) :

Section 1 of the 6-NDFL report - filling procedure and control ratios

Application (former 2-NDFL certificate)

As mentioned above, now 6-NDFL includes data from the 2-NDFL certificate as an appendix. The procedure for completing this application at the end of 2022 is essentially the same as last year, although there are some minor changes.

The Appendix to Form 6-NDFL contains information about the income and tax amounts of individuals for the year. It is filled out for each person separately and replaces the 2-NDFL certificate.

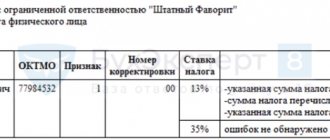

First of all, you need to indicate the unique serial number of the certificate and the correction number “00” if it is not made. If an adjustment is submitted, the number of the primary certificate and the adjustment number “01”, “02”, etc. are indicated. If you need to cancel previously submitted data, indicate the correction number “99”.

Next in the help there are four sections and an Appendix. Let's consider filling them out.

Section 1 Help

Section 1 indicates the data of the individual: TIN, full name (the name of the foreign worker can be indicated in Latin), tax status, date of birth, citizenship, type of document, its series and number (without the No. sign). Let us explain how to fill out some details.

Taxpayer status is the code:

- “1”, for a tax resident of the Russian Federation;

- “2” if the person is not a tax resident;

- “3”, for a highly qualified specialist who is not a resident of the Russian Federation;

- “4”, for participants in the program of voluntary resettlement of compatriots from abroad;

- “5”, if the employee is not a resident of the Russian Federation, he is recognized as a refugee or has received temporary asylum in the country;

- “6”, if a foreigner works in the Russian Federation on the basis of a patent;

- “7” if he is a HQS who is a tax resident of the Russian Federation.

Citizenship is indicated as a country code according to the All-Russian Classifier of Countries (OKSM). Russia code is “643”. If an individual is stateless, you must indicate the code of the state that issued him the identity card.

The code of the type of identification document is indicated in accordance with Appendix No. 5 to the Procedure. For a passport it is “21”.

Section 2 Help

Section 2 of the Certificate reflects the total amounts of accrued and received income, as well as personal income tax at the rate indicated in line 100 of Section 1. If an individual’s income was taxed in the period at different rates, you need to fill out 2 or more pages of the section (according to the number of rates applied).

In the lines of Section 2 you need to reflect:

- KBK;

- the total amount of income without taking into account deductions (taxed at a specific rate);

- tax base, that is, the amount of income minus the deductions specified in Section 3 of the Certificate (see below);

- calculated tax amount;

- withheld personal income tax;

- in relation to a foreigner working on a patent - the amount of advance payments by which the amount of tax is reduced;

- in relation to an individual who owns a share in a Russian organization that has paid income tax on income from dividends - the amount of income tax paid proportional to the person’s share in the organization (his personal income tax is reduced by it);

- the amount of tax transferred;

- the amount of personal income tax withheld in excess, which was not returned to the taxpayer, as well as the resulting overpayment.

Section 3 Help

Section 3 reflects information about standard, social and property tax deductions provided by the tax agent, as well as about notifications issued by the Federal Tax Service.

In the first block of lines you need to indicate the deduction code in accordance with the order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11 / [email protected] (as amended on September 28, 2021) and the deduction amount according to the specified code. There can be several deductions - then the corresponding number of lines in the block is filled in. If there is not enough space for deductions, you need to take an additional sheet of the Certificate, fill in only the TIN (KPP), page numbers, certificates and corrections, and fill in the remaining fields with dashes.

If the Federal Tax Service Inspectorate issued notices for deductions to the taxpayer, you must fill out the corresponding block of fields in Section 2. It should indicate the code of the type of notification, its number, the date of issue and the code of the issuing Federal Tax Service Inspectorate. The notification type code is selected as follows:

- “1” – the taxpayer has been issued a notice for property deduction;

- “2” – the taxpayer has been issued a notice for social deduction;

- “3” – the tax agent has been issued a notice to reduce the tax on fixed payments (for foreigners).

Section 4 Help

There are only two lines in Section 4 of the Help. They need to indicate:

- the amount of income from which the tax agent did not withhold during the personal income tax period;

- the amount of this unwithheld tax.

Help Appendix

The Appendix contains data on the individual’s monthly income and deductions. It is also filled in by rate. In the fields before the main block of the Application, you must indicate the Certificate number, the personal income tax rate and the BCC.

The main block contains the following data:

- number of the month for which the income was received;

- income code (Federal Tax Order No. ММВ-7-11 dated September 10, 2015 / [email protected] (as amended on September 28, 2021). The code “2000” is set for wages;

- the amount of income actually received;

- deduction code for the corresponding income, if provided, from the same order No. ММВ-7-11/ [email protected] Standard, social and property deductions are not indicated in the Appendix;

- the amount of deduction is no more than the amount of income.

If two deductions apply to one income code, the code and amount of the second deduction are indicated on the line below the corresponding income code. That is, additional lines of the block are filled. In this case, there is no need to indicate the month, code and amount of income again (dashes are placed in the fields).

This completes filling out the form. It must be checked, signed on each page and dated there.

So, we figured out how to correctly fill out 6-NDFL on the 2022 form, and offered a sample for filling it out. In conclusion, we would like to remind you that organizations and individual entrepreneurs with more than 10 employees must submit this form electronically using the TKS. Other employers still have the opportunity to submit this calculation on paper.

Which lines of 6-NDFL are filled in with an accrual total?

Section 1 indicates generalized indicators, and this information should be entered on an accrual basis along the following lines:

- 020 - the amount of calculated income for all employees in the aggregate;

- 025 — including the amount of income from dividend payments;

- 030 - the amount of tax deductions provided to employees;

- 040 - the amount of calculated personal income tax on the amount of income;

- 045 - including the amount of tax on dividend payments;

- 060 - the number of individuals who received income indicated in other lines;

- 070 - amount of withheld personal income tax;

- 080 - the amount of personal income tax not withheld by the employer;

- 090 - the amount of tax returned by the employer to the individual.

Thus, according to Section 1, all lines (with the exception of 010 and 050 - they are shown in the figure with a red arrow) must be formed on an accrual basis from the beginning of the calendar year (clause 3.1 of the Order).

As for Section 2, it reflects the dates and amounts of income received and personal income tax withheld specifically for the reporting period based on the results of which the 6-personal income tax calculation is submitted. In other words, all lines of Section 2 must be filled out not with an accrual total, but only based on the results of the reporting quarter. This is evidenced in Section. IV Order No. ММВ-7-11/ [email protected] , which does not contain information about filling out Section 2 on an accrual basis.