Penalty for failure to submit a VAT return, legislative framework

A fine for failure to submit a VAT return is imposed on a taxpayer if they are late in submitting reports for a certain period.

Starting from 2022, if the reporting was sent to the Federal Tax Service in paper rather than electronic form, it will not be accepted (clause 5 of Article 174 of the Tax Code). Accordingly, the countdown of days of delay in filing documents begins. In order not to receive a fine for late submission of a VAT return when sending reports to the tax office electronically, you need to remember the following things:

- The day the declaration is sent to the tax service is considered the day it is submitted;

- This document, like any electronic documents, is signed with an electronic digital signature.

Failure to submit a declaration

According to experts, the payer of the fee cannot be exempted from the fine if there was a fact of failure to submit reports, even when calculating the fee for the period and paying it on time.

If all fees are paid, there is a possibility of receiving a minimum fine for failure to return a VAT return - it amounts to a thousand rubles. In general, there is no fixed payment; liability depends on the amount of debt the taxpayer has, what violations were committed, whether they were one-time or repeated several times.

Late delivery

However, you can avoid a fine if you do the following (paragraphs 2, 3, 4 - respectively, Article 81 of the Tax Code):

- submit an updated return before the deadline for filing the main VAT return. Then the initial reporting will be considered submitted on the day the updated reporting is submitted;

- submit the updated version after the deadline for submitting the original one, but before the deadline for paying the tax to the state budget, provided that the Federal Tax Service inspection did not inform you of errors in the original one or has not yet managed to inform the taxpayer about the upcoming on-site inspection;

- pay arrears and penalties before submitting updated reports, which were submitted after the deadline for filing the declaration and before the tax was paid, and no errors were identified by the on-site check.

There are different points of view as to whether a minimum penalty of 1,000 rubles will be imposed if there was a fact of late submission of the VAT return, but according to its indicators, the amounts to be calculated are zero. There is no clear answer to this question.

The offense of incomplete payment or general non-payment of tax was committed for the first time

The answer to the question whether the fact that the taxpayer did not pay the tax for the first time or paid it in a smaller amount is a mitigating circumstance is also ambiguous.

In one case, the courts believe that if a tax offense has been committed for the first time, then it can be considered a mitigating circumstance when held accountable for incomplete payment or non-payment of tax. Such arguments are contained, in particular, in the decisions of the Arbitration Court of the Volga District dated May 26, 2016 No. F06-8342/2016 in case No. A72-1808/2015, the FAS Povolzhsky District dated March 26, 2014 in case No. A72-6157/2013 and the FAS North -Caucasian District dated March 14, 2014 in case No. A32-26775/2011.

In another case, the arbitrators are convinced that a tax violation is such even if it was committed for the first time. Tax Code of the Russian Federation in paragraphs. 3 p. 1 art. 112 does not name such cases in the list of mitigating circumstances for non-payment of taxes.

These arguments are contained in the decisions of the FAS of the East Siberian District dated July 10, 2012 in case No. A78-7098/2011 (by the decision of the Supreme Arbitration Court of the Russian Federation dated November 13, 2012 No. VAS-14171/12, the transfer of this case to the Presidium of the Supreme Arbitration Court of the Russian Federation was refused) and the FAS of the Volga District dated September 13, 2011 in case No. A55-25957/2010.

If you missed the deadline for filing a VAT return for the first time, then read the material “Is missing the deadline for filing a return for the first time a mitigating circumstance?” .

Conditions mitigating liability

It is possible to achieve a mitigation of punishment in the form of a reduction in the size of the fine for non-payment of VAT. It is only necessary to prove the presence of mitigating circumstances of the offender.

The list of circumstances is specified in Article 112 of the Tax Code of the Russian Federation and includes:

- Difficult financial situation.

- Personal or family circumstances.

- The taxpayer is under outside influence, coercion or threats.

The list is not final; if necessary, the judge independently decides whether there are mitigating circumstances. In addition, if a citizen has previously been held accountable for a similar offense, this circumstance will be classified as aggravating.

Overpayment of VAT

The legislation does not contain specific explanations for the question of whether an overpayment of taxes is a mitigating circumstance. The decision on this issue remains with the judge; most often in practice, the court makes a decision in favor of the taxpayer and reduces the amount of the fine.

In court, an entrepreneur can insist that an overpayment on his part proves that he has no motive for deliberate tax evasion.

Overpayment of tax

When asked whether overpayment of tax is a mitigating circumstance, there are 2 opposing positions.

The first point of view is based on the assertion that overpayment of tax is a mitigating circumstance in determining the degree of guilt in non-payment of this tax. Decisions of various instances of arbitration courts speak in favor of this position.

Thus, the Federal Antimonopoly Service of the North Caucasus District, in a resolution dated May 13, 2011 in case No. A32-24703/2010, indicated that the presence of an overpayment of tax on an organization’s accounts indicates inaccuracies in calculations, and not a desire to evade the taxpayer’s obligations. Therefore, such circumstances can be considered mitigating, despite their absence in the list given in paragraphs. 3 p. 1 art. 112 of the Tax Code of the Russian Federation.

Similar arguments are contained in the decisions of the FAS of the West Siberian District dated July 10, 2012 in case No. A45-23284/2011 and the FAS of the North Caucasus District dated March 15, 2011 in case No. A32-18613/2010.

The overpayment, which exceeds the amount of the detected arrears at the time of the audit, further convinces the judges of the taxpayer’s innocence. This position is confirmed by the resolution of the Federal Antimonopoly Service of the West Siberian District dated 04/07/2008 No. F04-1668/2008(1938-A45-25) in case No. A45-806/2004-SA40/45.

Similar arguments are presented, in addition, in the decisions of the Federal Antimonopoly Service of the Moscow District dated January 30, 2007, February 6, 2007 No. KG-A40/12966-06 in case No. A40-32425/05-14-286 (determined by the Supreme Arbitration Court of the Russian Federation dated May 31, 2007 No. 6329 /07 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation) and the FAS of the West Siberian District dated March 21, 2007 No. F04-1683/2007 (32718-A75-26) in case No. A75-6311/2006 (as determined by the Supreme Arbitration Court of the Russian Federation dated July 23. 2007 No. 8578/07 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation).

It is noteworthy that arbitration courts made decisions in favor of mitigating liability not only for VAT, but also for income tax, as well as corporate property tax.

An alternative point of view says that overpayment of tax cannot serve as a mitigating circumstance in determining the degree of guilt if late payment of VAT or other tax is committed.

This position is contained in only one judicial act - the resolution of the Federal Antimonopoly Service of the Ural District dated August 20, 2008 No. F09-5323/08-S3 in case No. A71-3098/2007. The arbitration judges indicated that the establishment of mitigating circumstances is within the competence of the judicial authorities. On this basis, the taxpayer's request to reduce the fine was rejected.

KBK VAT penalty

In what cases are fines imposed on an organization? Perhaps the VAT itself was not paid on time, or an error was made when filling out the payment order and incorrect codes were indicated, the money was not received by the tax office on time. But be that as it may, there is a fine and it must be paid.

KBK 18210301000013000110, decrypted in 2022, is a classification code that is divided into several groups. Each group will be able to talk about the tax paid by the company and the government agency that receives the funds.

If a commercial entity pays tax, penalties and fines, then in the classification code itself there are differences in only one digit. You need to be extremely careful when filling out a payment document. BCC for value added tax:

| Budget classification code | |||

| VAT | Tax penalties | Tax penalty | |

| Goods, works or services that are sold in Russia | 18210301000011000110 | 18210301000012100110 | 18210301000013000110 |

The penultimate grouping of numbers is 1000 (tax), 2100 (fines), 3000 (fine). Everything else seems to be absolutely the same.

Late delivery

However, you can avoid a fine if you do the following (paragraphs 2, 3, 4 - respectively, Article 81 of the Tax Code):

- submit an updated return before the deadline for filing the main VAT return. Then the initial reporting will be considered submitted on the day the updated reporting is submitted;

- submit the updated version after the deadline for submitting the original one, but before the deadline for paying the tax to the state budget, provided that the Federal Tax Service inspection did not inform you of errors in the original one or has not yet managed to inform the taxpayer about the upcoming on-site inspection;

- pay arrears and penalties before submitting updated reports, which were submitted after the deadline for filing the declaration and before the tax was paid, and no errors were identified by the on-site check.

There are different points of view as to whether a minimum penalty of 1,000 rubles will be imposed if there was a fact of late submission of the VAT return, but according to its indicators, the amounts to be calculated are zero. There is no clear answer to this question.

Assignment of penalties for late payment of VAT

Any delay in paying the tax fee, even one day, is accompanied by the accrual of appropriate penalties, in accordance with Article 75 of the Tax Code of the Russian Federation. Penalties are accrued for each day the debt is not paid. Their appointment is carried out the next day after the end of the period for depositing funds into the VAT account.

The following factors influence the final amount of penalties:

- period of delay;

- amount of debt not transferred to the budget;

- the refinancing rate applicable during the period of delay.

The amount of penalties is established by Part 4 of Article 75 of the same code and amounts to 1/300 of the refinancing rate of the Central Bank of the Russian Federation of the amount of arrears (in 2022 - 10%).

In addition, tax evasion deprives entrepreneurs of the opportunity to refund VAT.

We recommend material : Fine for illegal trading in the wrong place.

Penalties for non-payment of VAT provided by law

Failure to make VAT payments on time will result in a fine. In addition, if you do not pay your obligations on time, there is a risk of interest being charged. The introduction of a fine for non-payment of VAT, as well as other sanctions, is provided for in Articles 75 and 122 of the Tax Code of the Russian Federation. A fine in accordance with Article 122 is imposed after an inspection by the fiscal authority, if the failure to pay or pay only some portion of the tax was due to incorrect calculation.

If failure to make a payment is due to the fact that when calculating the base, an underestimation was made unintentionally, the fine will be 20% of the amount of the unpaid debt. If the action was intentional, the fine will double. If the payer submitted a declaration and the amount of the fee was indicated correctly, but was not paid on time, penalties are charged, but there is no need to pay a fine. This rule is relevant if the payer submitted an updated document.

Results

For late payment of tax, liability in the form of a penalty always occurs, but a fine is assessed only if the reason for late payment of VAT was an understatement of the tax base.

If the tax authority determines that the understatement was deliberate, the amount of the fine will double - from 20 to 40 percent. The fine may be reduced if the taxpayer has at least one mitigating circumstance. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

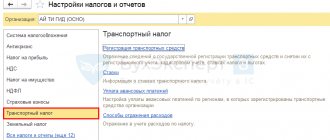

Tax penalties - postings in 1C 8.3

Regulatory regulation and scheme in 1C

The procedure for reflecting penalties must be approved in the accounting policy. The chosen method will affect the reflection of penalties in the financial statements.

Options for calculating tax penalties in accounting and their reflection in the Statement of Financial Results may be as follows:

- Dt 91.02 Kt 68 – page 2350 “Other expenses”;

- Dt 99.01 Kt 68 – page 2460 “Other”.

Accounting expert8 recommends following the Letter of the Ministry of Finance of the Russian Federation dated December 28, 2016 N 07-04-09/78875 and reflecting on:

- Dt 99.01 Kt 68: fine (penalty) for income tax and similar taxes UTII, Unified Agricultural Tax, simplified tax system, PSN;

- Dt 91.2 Kt 68 (69):

fine (penalties) for other taxes except those listed above, as well as fees and contributions.

As for tax accounting, tax penalties are not recognized as expenses. And they are not shown in the income tax return.

Fines imposed by tax authorities are taken into account in the same way as penalties, according to the same rules.

To calculate penalties for income tax in 1C 8.3 postings, use only account 99.01:

- Dt 99.01.1 Kt 68.04.1

For other taxes, apply the rules approved in the accounting policy.

Penalties are accrued from the next day after the payment deadline is violated and are calculated up to and including the day the penalties are paid. In this case, the maximum amount of penalties that can be accrued cannot exceed the amount of the tax debt.

For example, the deadline for paying the first 1/3 of VAT is 01/27/2020. The tax was paid late by the organization on 02/10/2020. Penalties will be accrued for the period from 01/28/2020 to 02/10/2020 inclusive, i.e. in 14 days.

Formulas for calculating penalties can be presented as follows:

- Penalties for late payments up to 30 days (inclusive):

- Late fees starting from 31 days:

Procedure for calculating fines

The principle of determining the amount of the fine for the case when a report to the Federal Tax Service was not submitted at all, or was submitted late, is defined in Article 119 of the Tax Code. This is 5% of the amount of tax payable according to the overdue report for each full or partial month from the date established for its submission. Thus, even one day of delay will result in a 5 percent penalty.

The maximum amount of the fine is also limited - it is 30% of the amount of tax payable. This means that being late for any period beyond 6 months will result in the same amount of sanctions. Within six months, if a delay does occur, it is more logical to eliminate it as quickly as possible.

These rules apply to all reports and declarations on taxes and contributions that taxpayers submit to the Federal Tax Service.