How to determine the number of days overdue

The first day of delay is always the day following the day on which the tax (contribution) should have been paid.

The last day of delay for all arrears arising on December 28, 2018 and later is the day the arrears are repaid. Previously, the day of payment was not included in the number of days of delay, so for arrears that arose before December 28, 2022, do not take it into account.

For penalties on advance payments, the last day of delay is considered to be the earliest of the following dates:

- date of actual payment of the advance payment;

- the established tax payment date (the date of payment of the advance payment for the reporting period).

Procedure for paying personal income tax

Currently, personal income tax is charged on income taxed at a rate of 13% (15%), according to clause 3 of Art.

226 of the Tax Code of the Russian Federation, occurs on the date of receipt of income, and its transfer to the budget is no later than the next day after payment (clause 6 of Article 226 of the Tax Code of the Russian Federation). Read more about the procedure for paying personal income tax in the article “The procedure for calculating and the deadline for transferring income tax from wages .

If the income paid is vacation amounts or sick leave benefits, personal income tax can be transferred on the last day of the month of payment (clause 6 of Article 226 of the Tax Code of the Russian Federation).

For information on paying personal income tax on vacation pay, see here.

According to Art. 223 of the Tax Code of the Russian Federation, income for the purpose of calculating personal income tax arises, as a rule, at the time of its receipt. However, there are other situations: when approving an employee’s advance report, when issuing borrowed funds to him with savings on interest, income is considered received on the last day of the month (subclauses 6–7, clause 1, article 223 of the Tax Code of the Russian Federation).

Read about personal income tax on travel expenses here.

You can find out how to correctly fill out a personal income tax payment form, as well as see examples of filling out individual details in the ConsultantPlus ready-made solution. To do this, get trial access to K+ for free.

How to determine the interest rate

The interest rate is calculated based on the current refinancing rate. Depending on who was late and for what period, different rates apply.

| Interest rate | Conditions |

| 1/300 refinancing rate | Organization - for taxes and insurance contributions for compulsory medical insurance, compulsory medical insurance, VNiM. If the delay is up to 30 days inclusive |

| Organizations and individual entrepreneurs - according to contributions for injuries. Does not depend on the period of delay | |

| Individual entrepreneur - all taxes and fees. Does not depend on the period of delay | |

| 1/150 refinancing rate | Organization - for taxes and insurance contributions for compulsory medical insurance, compulsory medical insurance, VNIM for the 31st and subsequent days of delay. If the debt arose after October 1, 2022 |

If the refinancing rate changes during the period of delay, penalties are calculated separately for the days in which each rate was in effect.

How the calculator works

To calculate tax penalties using an online calculator in 2021, you will need the following data:

- category of debtor: citizen, individual entrepreneur or legal entity;

- payment date established by law or contract;

- actual date of debt repayment;

- amount of debt.

We enter this data into the empty fields; the online calculator for calculating penalties for taxes and fees in 2022 will make all the calculations automatically.

Let's show a specific example. Enter the data into the calculator:

- debtor - citizen Ivanov;

- the deadline for paying transport tax for 2022 is December 2, 2022;

- actual payment date is August 26, 2022;

- the amount of debt is 2000 rubles.

Then click the “Calculate” button, and the online calculator for calculating tax penalties in 2022 will make all the calculations automatically. They will show us the amount that citizen Ivanov will have to pay in addition to the principal debt.

We see that during the period of delay, the refinancing rate of the Central Bank of the Russian Federation, which is used by the tax penalty calculator, gradually decreased from 6.5 to 4.25 percent, and then increased again to 6.5%. The total fine is 429.46 rubles. And now citizen Ivanov will have to not only pay a transport tax of 2,000 rubles, but also pay an additional 429 rubles 46 kopecks.

Let's see how the result changes if a debt of 2,000 rubles is incurred by a company or individual entrepreneur due to non-payment, for example, of VAT for the 3rd quarter of 2022. We enter all the necessary data into the online calculator for calculating VAT penalties in 2021 (payment date and payment date, amount), be sure to indicate the desired category of debtor, and click the “Calculate” button.

The calculator shows how much fine you will have to pay.

In the same way, you can calculate penalties online for the mineral extraction tax and any other tax, excise duty, or insurance premiums using the calculator.

IMPORTANT!

On our website it is possible to calculate penalties for taxes using an online calculator for 2022 only for late payments, the collection rules for which are provided for by law. Purchase and sale agreements and other agreements on mutual obligations between organizations or individuals sometimes specify special conditions for calculating the fine, so the calculator will not be able to produce the correct result.

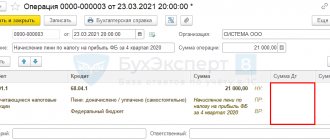

How to reflect penalties in accounting

Depending on the type of tax (contribution), penalties can be reflected in account 91 or 99.

If penalties are paid under income tax, simplified tax system, UTII, unified agricultural tax, they are recorded as the debit of account 99.

Debit 99 Credit 68 - penalties accrued.

If penalties are paid on other taxes or insurance premiums, they are recorded in the debit of account 91. Debit 91-2 Credit 68 - penalties are accrued on taxes (except for income tax, simplified tax system, unified agricultural tax, UTII). If the organization applies PBU 18/02 and this is stated in the accounting policy, then the posting with the accrual of penalties is accompanied by the posting Debit 99 Credit 68, which reflects the recognition of a constant tax expense.

For insurance premiums, account 91-2 corresponds to account 69.

Debit 91-2 Credit 69 - penalties were accrued on insurance premiums.

The procedure for reducing the amount of penalties accrued on an advance payment

The amount of penalties for income tax on advance payments can be reduced on two grounds (clause 14 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 157):

- the amount of the payment calculated at the end of the tax period is less than the amount of advance payments payable during the corresponding period;

- the amount of the advance payment for the reporting period is less than the amount of monthly advance payments paid during this reporting period.

At the same time, the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation does not regulate the mechanism for such a reduction. Regarding the procedure for reducing the amounts of accrued penalties, the regulatory authorities gave the following explanations (letters of the Ministry of Finance of Russia dated January 22, 2010 No. 03-03-06/1/15, Federal Tax Service of Russia dated November 13, 2009 No. 3-2-06/127):

- If the amount of the advance payment or tax calculated for the quarter is equal to the total amount of monthly income tax payments for the same period, then penalties are calculated on the amount of the overdue payment (letter of the Ministry of Finance of Russia dated January 22, 2010 No. 03-03-06/1/15 , Federal Tax Service of Russia dated November 13, 2009 No. 3-2-06/127).

- Penalties are calculated in the same way if the amount of tax (advance payment) exceeds the total amount of monthly payments for the reporting period.

- If the amount of the advance payment or tax for a quarter is less than the total amount of monthly advance payments for the same period, then the calculation is based on the following data:

- The total amount of monthly payments is assumed to be equal to the amount of tax (advance payment) for the quarter:

AP1 + AP2 + AP3 = APkv (N),

where: AP1, AP2, AP3 – monthly advance payments;

APkv – quarterly advance payment;

N – tax amount;

- The amount of monthly payments is adjusted based on the amount of the quarterly advance payment (tax), calculated based on their quarterly profit:

APskor = N (APkv) / 3,

where: APskor – the amount of the adjusted monthly advance payment.

- The adjusted amount of the advance payment serves as the basis for calculating penalties for income tax. The amount of the transferred payments is also taken into account. If the amount of the transferred payments is greater than the payment for the quarter, then no penalties will be charged.

That is, it is possible to reduce penalties only in a situation where the total payment amount for the period is less than the total amount of advances due for payment in it.

How to use the penalty calculator

In order not to get confused in calculating the final amount of penalties and to take into account all the nuances of the legislation, use a special calculator.

The calculator is a small table with special cells. You need to provide data and receive a full calculation.

First, select the type of debtor: individual entrepreneur or legal entity.

Next, enter in the appropriate windows:

- amount of debt in rubles;

- established payment deadline (payment deadline can be viewed in the accountant’s calendar);

- date of actual tax payment.

Be sure to pay attention to the “Include payment day as late” field. If you check the box, the calculator will take into account the day when the arrears were repaid when calculating penalties. Whether to check the box or not depends on the date the arrears occurred. If it appeared on December 28, 2022 or later, check the box.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Percentage of penalties according to law

Legal penalties (Article 332 of the Civil Code of the Russian Federation) allow you to demand the payment of penalties for failure to comply with the parameters of the transaction, regardless of whether such an option is provided for in the agreement between the counterparties or not.

At the legislative level, penalties are established for a wide range of civil law relations. Eg:

- The Law “Charter of Motor Transport and Urban Ground Electric Transport” dated November 8, 2007 No. 259-FZ provides, among other things, for the payment of a penalty:

- for failure to remove cargo under a cargo transportation contract - a fine of 20% of the payment for services;

- late delivery of cargo - a fine of 9% of the freight charge for each day of delay;

- delay in the departure of transport carrying out regular intercity transportation of passengers - 3% of the fare for each hour of delay, but not more than the fare.

- Law “On the contract system in the field of procurement of goods, works, services for the provision of government. and municipal needs" dated 04/05/2013 No. 44-FZ establishes a penalty:

- for untimely fulfillment of a contractual obligation - in the amount of 1/300 of the current key rate of the Bank of Russia of the amount not paid on time;

- failure to fulfill contractual obligations not related to delay - in the form of a fine, the amount of which is determined in accordance with the Decree of the Government of the Russian Federation “On approval...” of August 30, 2017 No. 1042 and is stipulated in the contract.

- The Law of the Russian Federation “On the Protection of Consumer Rights” dated 02/07/1992 No. 2300-I establishes the following amounts of the penalty:

- for late delivery of paid goods - a penalty in the amount of 0.5% of the amount of the prepaid purchase for each day of delay;

- failure to satisfy consumer claims voluntarily - a fine of 50% of the amount awarded to the consumer.

An example of calculating penalties using a calculator

Rybka LLC had to pay VAT in the amount of 21,345 rubles no later than 04/25/2021. In fact, the tax was transferred only on May 31, 2021. The total period of late payment was 36 days. The key rate in force during this period was 5%.

The accountant used an online calculator, entered all the data into the required cells and received the following calculation: (21,345 rubles × 30 days × 5% / 300) + (21,345 rubles × 6 days × 5% / 150) = 149.41 rubles.

It was 149.41 rubles that Rybka LLC transferred to the Federal Tax Service on May 31, 2021, along with the amount of overdue VAT. It is important to remember that the payment slip for the payment of penalties must indicate the appropriate BCC. When paying tax arrears, a different BCC is assigned.

An example of calculating tax penalties

Let's look at how tax penalties are calculated using a specific example.

Individual entrepreneur Yu. V. Serebryakov, who uses the simplified tax system, had to pay an advance payment for the 2nd quarter in the amount of 48,000 rubles. no later than July 25. Individual entrepreneur Serebryakov transferred the tax to the budget only on August 2. That is, the entrepreneur was overdue for the advance payment by 8 days (from July 26 to August 2 inclusive), and penalties must be charged for this entire period of 8 days.

Let's assume that in a given period of time the refinancing rate was set at 7.5%.

Let's calculate the amount of penalties payable:

Penalties = 48,000 × 8 × 1/300 × 7.5% = 96 rubles.

So, penalties in the amount of 96 rubles are subject to transfer to the budget.

Collection of penalties under the contract

Claiming a penalty is possible both voluntarily and in court. In practice, this measure of liability is applied, as a rule, through the courts.

In this case, the plaintiff must attach to the statement of claim a document calculating the penalty required from the defendant. The period for which the calculation should be made is determined as follows:

- Within the meaning of Art. 330 of the Civil Code of the Russian Federation and in accordance with the explanations from Resolution No. 7 (clause 65), the plaintiff’s side is entitled to demand the award of a penalty right up to the day of actual fulfillment of obligations, that is, for example, until the day of actual payment for the goods. Meanwhile, the law or agreement of the parties may define a shorter period for calculating the penalty, or its total amount may be limited.

- If upon completion of the contractual relationship the primary obligation ends, the penalty is calculated for the period until the termination of the obligation (clause 4 of Article 329 of the Civil Code of the Russian Federation).

- If upon termination of the contract the basic obligation is not terminated, you can demand not only the payments specified in the contractual document, but also a penalty for their untimely payment (Articles 622, 689 of the Civil Code of the Russian Federation).

The operative part of the court decision indicates the total amount of the penalty calculated at the time the decision was made. Subsequently, after the decision enters into legal force, the amount of the penalty is collected as part of the enforcement procedure by the bailiff.