An employee of an institution, in accordance with the law and the order of the head, may be paid an incentive bonus to his salary. But there are often cases when an employee’s bonus is deprived.

There may be many reasons for refusing payment. They are contained in the Labor Code of the Russian Federation. Also, information can be provided by an accountant in the absence of a bonus provision.

Sometimes employers violate employee rights to payment. In this case, liability is provided for non-compliance with the law.

Basic Concepts

A bonus is an incentive payment to an employee, which is transferred along with wages or separately from it. It can be one-time or systematic. When determining the possibility of calculating payments, the employee’s fulfillment or non-fulfillment of his obligations and labor plan is taken into account.

Allowances are considered additional to wages. They are not mandatory as they are voluntary. Therefore, the employer has the right to decide for himself whether or not to accrue an additional payment.

The procedure for depriving an employee of a bonus according to the Labor Code of the Russian Federation is carried out in case of a disciplinary offense. It may not be paid in full or may be reduced by a certain portion. The measure is a penalty for failure to comply with internal regulations and is not related to disciplinary action.

The award is variable. If there are grounds, management may not pay the funds. In this case, the reasons for the refusal should be reflected in local documentation or regulations on bonuses for employees.

When is deprivation of a bonus regarded as illegal?

In some cases, deprivation of bonus funds will be illegal. List of options:

- according to internal regulations, the employer does not have the right to such a procedure;

- the violation is not on the list of grounds that can be applied, that is, in the absence of the specified factor in the local documentation, enforcement measures cannot be applied;

- there is no evidence that the employee committed an offense or committed it systematically;

- there are no formalized acts of violation or disciplinary offense. Each case must be documented;

- the order was not reviewed, except in cases where such a process is not required;

- there is no deprivation order if registration is necessary in this case.

Read also: Benefit in early pregnancy in 2021

The latter case refers to the employer’s decision to reduce the payment or eliminate it based on the facts that were established in relation to the personnel.

In practice, most often, cases without proper registration or with the formation of documentation with factual or legal errors become illegal. Another common option is the lack of an established foundation.

Labor Code norms

The Labor Code of the Russian Federation does not contain articles that would prescribe the procedure for depriving a bonus. After all, the law provides for only three punishments for disciplinary offenses.

Penalties are reflected in Article 192 of the Labor Code of the Russian Federation and are:

- warning;

- rebuke;

- dismissal.

Cancellation of incentives is not included in this list.

The Labor Code of the Russian Federation gives the employer the right to apply each of the punishments in the course of organizing work activities. They can be used in internal documentation.

It is recommended not to specify the bonus deduction procedure in local documents. It is worth specifying the conditions under which payment is provided. In such a case, the employee who fails to comply may legally be deprived of payment.

In what cases is it used?

When an employer denies an employee a bonus, he is obliged to clearly formulate the reasons for such a decision. Most often, employees are deprived of these payments for the following violations:

- Violation of disciplinary and behavioral standards, for example: neglect of safety requirements;

- absence from work for 4 or more hours without warning;

- causing damage to the organization’s property, which resulted in losses;

- absence from work without a valid reason;

- failure to comply with management orders;

- reporting to work under the influence of alcohol or drugs.

This is also important to know:

Sample characteristics for an award: when required, writing structure, types

In addition to the listed violations, a person may be subject to penalties for minor violations, for example, for being late or leaving work before the end of the working day. As a rule, in these cases partial depreciation is applied.

Article 192 of the Labor Code of the Russian Federation states that for one violation an employee can be subject to only one type of penalty . For example, an employer does not have the right to simultaneously reprimand and reprimand a violator. In addition, when imposing a punishment, management must take into account the severity of the violation, the presence of consequences and other circumstances.

Who should not be deprived

At the legislative level, there are categories of workers who are prohibited from being deprived of bonuses. It is believed that an employer cannot impose several disciplinary measures against an employee. For example, it is prohibited to deprive an employee of a bonus and impose an additional fine.

Sometimes management deprives an employee of bonuses only because he came to work in clothes that do not comply with the dress code. Such actions by management are considered illegal.

A person's clothing cannot in any way affect the quality of the work performed. Of course, if a special form is not provided for by safety regulations. It is the right of the employer to assign or deny a bonus. There are no clearer deprivation rules.

Rules and step-by-step procedure for depriving an employee of a bonus

Step-by-step instructions are provided for depriving the bonus.

The employer must fulfill all the points provided for by law:

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- First, an act must be received reflecting the employee’s violations of his labor obligations. Most often, the memorandum is drawn up by the head of the structural unit. It sets out the grounds for non-awarding the premium.

- It is important to consider the list of criteria according to which incentive bonuses are calculated. The list may be specified in internal regulations. It is best to indicate them in the employment contract, which is concluded at the time the employee is hired.

- The employee is required to write an explanatory note. In it, he must indicate why he violated the rules and confirm that he did not fulfill the terms of the employment contract.

- The received documentation, memo and explanatory note, is sent to the department that calculates bonuses. Most often, accountants or personnel officers are in charge of these issues in an institution. They study the papers and decide on the punishment for the employee. They also determine the exacting measure.

- After this, an order is prepared in accordance with the approved bonus regulations. After all, any withholding must have documentary evidence.

- After publication, the document is handed over to the employee for review. After reading it, he must certify it with his signature. The terms for deprivation of the bonus must be indicated.

This is also important to know:

Sample order to lift a disciplinary sanction: how to draw it up correctly

If this procedure is followed by the employer, then he will not suffer negative consequences. Therefore, the reduction in bonuses will be considered legal.

Making an order

There is no standard form for a depreciation order. In practice, this administrative document, as a rule, is drawn up according to the general template adopted for drawing up documentation at the enterprise.

The approximate procedure for completing this order is as follows:

- all the necessary details of the organization are indicated in the “header” of the document;

- the “body” of the document contains the full name of the order;

- The full initials of the employee in respect of whom the document is being drawn up must be written down, and his position must also be indicated;

- Next, the fundamental motive for deprivation of bonuses is stated; in the case of partial deprivation of bonuses, the amount of the fine is indicated;

- after this, all the provisions and regulations of the organization are written down, on the basis of which the decision was made to deprive the employee of the bonus;

- the final line is the manager’s signature.

After reviewing the order, one copy of the order, completed and signed by the employee, is given to the violator, and the second remains in the organization’s archives.

How is a depreciation order issued?

If there is no reliable basis for unpopular personnel decisions, then an order to reduce bonuses cannot be avoided. Since the legislation does not use such a term at all, there is no unified form for such an order. The order can be drawn up in any form (in compliance with the requirements of GOST 7.0.97-2016).

The main thing is that when reading it and checking it by regulatory authorities, there are no associations with the procedure for imposing disciplinary punishment. To do this, the “body” of the order simply states that the employee is deprived of the bonus in whole or in part (indicating the exact amount or percentage of reduction). Next, the executor of the order and the person who will control the process are determined.

In the order, you can briefly indicate what caused the negative reaction of the authorities and provide a link to the supporting documents (reports, explanatory notes, primary accounting data).

When is it illegal?

There are cases in which depreciation may be considered illegal:

- The impossibility of depriving a bonus may be due to the absence in local documentation of grounds for deprivation of bonuses and the authority of the manager to make such decisions.

- If the documents on the basis of which the issue of deprivation of the bonus is decided are missing or executed incorrectly, the procedure will be considered illegal.

- If the order is mandatory, failure to execute it will be considered a violation.

- If there is an order, but the employee was not familiarized with it, there is evidence that the actions of the head of the institution were illegal.

Responsibility for illegal deprivation of bonuses

Let us remind you once again that the deprivation of a bonus is not regulated by the Labor Code of the Russian Federation, since the bonus is not a permanent payment. But there are a number of circumstances in which the reduction of bonuses is considered illegal. For example, if the procedure is violated or does not comply with internal local regulations.

Cases of illegal award cancellation:

- If the grounds for this are not listed in the local act.

- If the local act of the company does not provide the employer with the right to make a decision on deprivation of payments.

- Documents for deprivation on the basis of violation of labor discipline by the employee or the presence of a disciplinary sanction are missing or incorrectly completed. There is no act of violation of labor discipline, order of deprivation of payments, or an explanatory statement from the employee regarding the violation of labor discipline.

- There is no order. This is relevant if the decision is made by the employer.

- The employee was not familiarized with the order under signature.

If an employee believes that he was deprived of money illegally, he has the right to apply to the labor inspectorate or court with a claim. To submit a claim to the regulatory organization, you must provide a number of documents: a passport, an application, a copy of the order (upon request), payment documents on the timing and amount of payments made to the employee.

I was deprived of my bonus without an order

Only having this document in hand, with the conditions and reasons for depreciation clearly stated in it, as well as its percentage, will these actions of the administration be considered legal.

- The decision to deprive a bonus must be documented, and the employee to whom it applies must be notified in writing against signature.

- The time frame for deprivation of bonuses is also clearly stated in the company’s internal regulations.

This is also important to know:

Absenteeism from work under the Labor Code of the Russian Federation: punishment

The main point that the administration and the head of the enterprise must take into account when choosing to deprive an employee of a bonus is only if there is a documented fact of violation of labor discipline, non-compliance with the terms of the contract, and is legally justified. Any case of deprivation of a bonus without the presence of this document is illegal.

Russian labor legislation allows an employee who considers non-payment of a cash bonus to be an unreasonable action to appeal the decision to deprive him or her of bonuses to higher judicial authorities and the Federal Labor Inspectorate within 90 days after the relevant order is issued that infringes on his rights.

According to the law, it is possible to deprive a person who has violated discipline of material incentives (bonuses) only within one calendar month from the moment the offense was committed and the fact of its official registration (Article 3 of the Russian Labor Code).

Availability of regulations on bonuses at the enterprise. Only having this document in hand, with the conditions and reasons for depreciation clearly stated in it, as well as its percentage, will these actions of the administration be considered legal.

- The decision to deprive a bonus must be documented, and the employee to whom it applies must be notified in writing against signature.

- The time frame for deprivation of bonuses is also clearly stated in the company’s internal regulations.

Current version of Art. 191 of the Labor Code of the Russian Federation with comments and additions for 2018

The employer encourages employees who conscientiously perform their job duties (declares gratitude, gives a bonus, awards a valuable gift, a certificate of honor, nominates them for the title of the best in their profession). Other types of employee incentives for work are determined by a collective agreement or internal labor regulations, as well as charters and regulations about discipline. For special labor services to society and the state, employees may be nominated for state awards.

Bonus - the right or obligation of the employer: the position of the Armed Forces

Bonuses are built into the pay system of many employers. But it often happens that the salary in the company is small, and the majority of the pay comes from bonuses. If the relationship between the employee and the employer deteriorates and the employee loses this payment, will he be able to recover it in court by proving that it is obligatory? The outcome of a case always depends on the wording in the employer’s local regulations, so the courts have to engage in “literalism” when making a decision, says Intellect-S partner Anna Ustyushenko. It can be difficult for courts to deal with local acts of companies, because only one article is devoted to bonuses in the Labor Code, adds Anna Ivanova, head of the labor law practice at EPAM.

One such case reached the Supreme Court, in which the chief specialist of the analytical systems department of the banking technology department of CB Yugra, Anatoly Lipovets*, recovered a premium of 109,308 rubles. for January and February 2016 - the last two months of my work at this place. Lipovets's salary was 82,800 rubles, and he was entitled to a monthly bonus provided for by local regulations - the regulations on remuneration. The bonus was calculated based on 66.7% of the salary, multiplied by the coefficient of fulfillment of the general bank indicator.

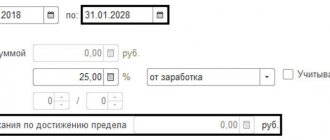

66.7% of salary –

This is the basis for bonuses to Ugra Bank employees (multiplied by the general bank coefficient, which can be, for example, from 50% to 100%).

The bank did not pay Lipovets this bonus for the last two months, because the indicator was 0%, and none of the employees received the bonus. This payment is optional and is transferred only if financially possible, so the claim should be denied, the employer insisted. The former employee, in turn, insisted that the multiplication factor cannot be less than 50%. In support of his words, Lipovets referred to the regulations on remuneration of Ugra, which states that this figure “can be equal to 50%, 70%, 90% and 100%.”

The courts were divided on whether the bank should pay the premium. The Megion City Court of Khanty-Mansi Autonomous Okrug-Yugra rejected Lipovets. The bonus, according to the Labor Code, is an optional incentive bonus, as stated in decision No. 2-1236. The court examined the history of such payments to Lipovets, and it turned out that in some months the plaintiff did not receive it, and in others it turned out to be less than usual. The court of KhMAO-Yugra, on the contrary, agreed with Lipovets that the minimum coefficient of 50% guarantees the employee a monthly bonus. “The employer cannot arbitrarily set the amount of the bonus or not pay it at his own discretion,” says definition 33-9868/2016.

About the essence of the bonus and the shortcomings of the bank

The appeal ruling was overturned by the Supreme Court, which noted that the employment contract with Lipovets did not provide for or guarantee him any bonus. The regulations on remuneration indicate that the payment of such bonuses depends on the results of the bank’s work; they are not included in the list of guaranteed payments. None of these documents states that the monthly bonus is a mandatory part of the salary, as noted in definition No. 69-KG17-22. Art. also speaks about the voluntariness of the award. 191 of the Labor Code, which makes payment dependent on various circumstances: how the employee performs his duties, the economic success of the company itself, or other conditions that the employer determines himself in local regulations.

In addition, the appeal found fault and procedural violations. The district court decided that the bank incorrectly calculated the premium coefficient, but did not invite the parties to justify this or that amount, and also refused to admit the bank to evidence that this figure was 0%. The appeal will have to correct these shortcomings with a new trial of the case.

“Judicial practice on labor compensation has always been based on the fact that bonuses and other incentive payments are not mandatory for the employer and therefore are not subject to recovery by the court. In this sense, the definition of the Armed Forces was predictable"

If an employment contract or a local regulatory act (for example, a regulation on remuneration) does not directly establish that the bonus is a mandatory allowance, then its payment is not guaranteed, Olga Polezhaeva, deputy head of the labor law practice of the Ankor personnel holding, analyzes the outcome of the case. Ivanova gives an argument in favor of the employee: “The bonus is a conditional payment, but it becomes mandatory if the employee has fulfilled all the company’s conditions. In this case, not a single authority established that the plaintiff performed his duties in bad faith.” Advisor to the labor and migration law practice of Baker McKenzie Evgeny Reizman, on the contrary, is confident that the decision of the Supreme Court corresponds to the understanding of the essence of the bonus, which developed back in Soviet times: “Even the famous “thirteenth salary” in the USSR was not guaranteed and was paid at the end of the year from the profit of the enterprise "

As Ustyushenko points out, the employer made a mistake, which led to a lengthy trial. The bank set a clear percentage of the salary (66.7%) as the base bonus, without indicating that even in this case it is not guaranteed - the Intellect-S partner draws attention to this inaccuracy in the act. In her opinion, an important role in the outcome of the case was played by the fact that Lipovets’ salary was quite large by the standards of the region. Ustyushenko suggests that the decision under the same conditions could have been different if the salary had been, for example, 10% and the bonus 90%.

“Judicial practice on labor compensation has always been based on the fact that bonuses and other incentive payments are not mandatory for the employer and therefore are not subject to recovery by the court. In this sense, the decision of the Supreme Court was predictable,” noted lawyer, partner of LDD Law Firm Andrey Popov. “The court found that the payment of the bonus is carried out in accordance with the Regulations on Bonuses. The employer issued an order that the bonus in accordance with the Regulations is 0% for all employees. The situation complies with the law (at least the opposite has not been proven). So the determination of the Supreme Court is quite logical,” agreed Mitra Law Firm lawyer Dmitry Drobyazko. “When considering cases of this category, the courts always attach fundamental importance to the content of a specific employment contract and local acts of the employer regarding bonuses. At the same time, we are studying how these documents are formulated: can a bonus be considered a mandatory component of remuneration or should it be attributed exclusively to the voluntary reward of an employee for conscientious work, and also whether the bonus is included in the remuneration system,” explained the lawyer, partner of AB “ Yablokov and partners", K. Yu. n. Elena Voronina.

Lawyers provided advice to employees and employers in similar disputes.

Dispute about collecting bonuses: how to behave as an employee

Ustyushenko gives advice to the employee:

- Carefully study the local regulations that provide for the procedure for bonuses, keep a copy for yourself or make an extract.

- If at the familiarization stage there are “loopholes” that will allow the employer to cancel the bonus, you can send an official appeal in which you express disagreement with certain points (this can strengthen the employee’s position in further disputes).

- Keep pay slips for the entire period of work, so that later you can prove the systematic payment of bonuses.

Dispute over recovery of bonus: how to behave as an employer

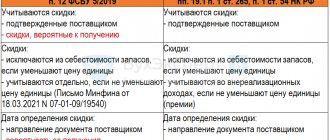

- As the definition of the Sun shows, it is worth pointing out that the bonus is not obligatory and guaranteed.

- Ustyushenko advises to distinguish between two types of bonuses: those that are included in the wage system (Article 129 of the Labor Code), and the so-called incentive bonuses, which are discussed in Art. 191 TK.

- Ivanova recommends explaining in writing why the premium was paid (not paid, reduced), with references to the clauses of the local act. “As soon as you stop doing this, it will become easier for the employee to prove that the bonus refers to unconditional allowances,” warns Ivanova.

- Ustyushenko warns against the idea of indicating an exact percentage or a fixed amount of the bonus, because such wording shows that the bonus is not given “for something” and is not tied to any employee indicators.

- Reisman reminds that bonus rules must be detailed, they must be approved by order and handed over to employees against signature.

- Ustyushenko calls for compliance with the rules of their own local regulations. “If a bonus is awarded, for example, on the basis of a checklist, a memo from the immediate supervisor and an order from the director, there must be such documents,” she insists. And if the rules cannot be followed because they are cumbersome, they need to be changed, the lawyer concludes.

*name and surname have been changed by the editors

- Evgenia Efimenko