The Labor Code does not contain a clear indication of what certificates are issued upon dismissal of an employee. Other federal regulations contain references to various types of certificates that an employee may need when terminating a contract. In order to avoid disputes between the employer and the employee about the final list of documents that should be received upon termination of the contract, we will tell you in the article what needs to be given upon dismissal, provide a sample dismissal certificate and clarify the requirements.

What certificates are given upon dismissal?

The employer, in addition to issuing a work book on the day of departure, upon dismissal, transfers to the employee, upon his request, documents relating to work activity. These may be the following documents that are usually prepared by the accounting department:

- upon dismissal, a salary certificate is issued in accordance with the form approved by Order of the Ministry of Labor of the Russian Federation No. 182n. It informs about the payments that were made in the previous two years and will be necessary for the next employer or the Social Insurance Fund;

- a certificate of insurance premiums upon dismissal is issued in the form of an extract from the calculation of insurance premiums.

Results

Payers of contributions are required to keep personalized records of accruals for insurance premiums. As a register for such accounting, a joint letter from the Pension Fund of Russia and the Social Insurance Fund recommended the form of an individual card. The absence of such a register or errors when filling it out are fraught with fines.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Requirements for salary certificate

Any certificate from the place of employment upon dismissal is certified in the manner established by the organization, if there is a seal - with the seal of the employer. This is necessary to avoid disputes and litigation in court. There is a form approved by Order of the Ministry of Labor No. 182n containing information on wages for the last two years.

This document must be filled out on a computer or in handwritten form. When filling out the text by hand, you need to use black or blue ink. The letters are written without the possibility of double interpretation of what is written. Corrections are not allowed. All necessary information is taken from accounting documents or official reports. If the information contained in the official document is inaccurate, the institution will be fined.

The document will be needed to establish benefits for a person and guaranteed social support measures (payments for sick leave, pregnancy and childbirth, care for children up to one and a half years old).

How to obtain a certificate of non-receipt of a tax deduction

05.05.2021

Such a certificate is needed if for some reason you terminated the insurance contract early and did not receive a tax deduction from the state. If you have a debt, a certificate will help you clear it.

Why does debt occur?

If you did not receive a tax deduction, you do not need to pay the debt.

The appearance of debt is a standard security measure on the part of the state, so that those who received the deduction immediately return it.

A certificate of non-receipt of a tax deduction can be obtained from the tax service in person or online.

Step 1

Get a certificate from the tax office

Step 2

Send us a certificate

How to get a tax certificate online

You can get a certificate online in a few minutes. You must have an account on nalog.ru or State Services.

- Log in to your personal tax office

- Go to the “Life Situations” section

- Select the help you need

- Fill out all fields of the application

Go to nalog.ru and log into your personal account: using your login and password, using an electronic signature, or through your account on State Services.

Next, find “All life situations” and click on “Request a certificate and other documents.”

Click on “Get a certificate confirming the fact of receipt (non-receipt) of social deductions.

It is important to fill out the application correctly - a sample of the correct certificate and how its fields should be filled out can be found here.

The tax service will send you a certificate in several files. Please send us all the files you receive from the tax office.

How to get a certificate from the tax office in hand

You can get a certificate from the tax office at your place of residence ( this will take about 30 times longer than obtaining a certificate online

).

There are often errors in certificates - check it after receiving it, without leaving the tax office.

A sample certificate can be viewed here.

- Select your nearest tax office

- Prepare a package of documents

- Submit your application in person or by Russian Post

- Wait until the certificate is ready

It is not necessary to contact the inspectorate at your permanent registration address. Select the inspection closest to you.

You will need to submit:

— A copy of the life insurance contract — can be downloaded in your personal account

— A copy of payment documents confirming payment of contributions can be downloaded in your personal account

— Written application for the issuance of a certificate - the form will be provided at the tax office

The package of documents can be sent by mail. Send them by registered mail with acknowledgment of receipt and a description of the contents.

This takes some time. The tax office will tell you more about the deadlines. After receiving the certificate, be sure to check it using this sample.

Send us a certificate in your Personal Account or by Russian Post

- To submit online:

- To send by Russian Post:

Log in to your personal account “Renaissance Life”, go to the “Application and Documents” section, click “Submit an Application”. Select the question “Terminate the insurance contract.” Fill out the fields and upload all the files that the tax office sent you. The tax office will send you a certificate with several files. Please send us all the files that you receive from the tax office, without them we will not be able to accept the electronic document.

Send the certificate by registered mail with a description of the attachment to the address: Russia, 115114, Moscow, Derbenevskaya embankment, 7, building 22, floor 4, room. 13, room 11 for SK Renaissance Life LLC

The debt will be canceled ~ within a month after we receive the documents.

How to fill out a salary certificate

The accounting employee fills out the document individually.

The document must be signed by the head and chief accountant of the institution.

The prescribed form consists of four sections which contain:

- Detailed information about the institution.

- Information about the employee who requires the paper.

- Information on the amounts of wages from which the employer made contributions to the Pension Fund of the Russian Federation and the Social Insurance Fund.

- Information about the periods during which no deductions were made.

Filling out the first section begins by indicating the date the paper was provided and its number. The name of the employer (in full form) and the territorial branch of the Social Insurance Fund to which contributions were paid are indicated. It is also necessary to indicate the subordination code of the legal entity, INN, KPP, and location address.

When filling out information about a person, you need to indicate his full name, passport details, address of residence, as well as his pension insurance number (SNILS).

The third section is filled out in ascending order by year (starting with the year of employment), salary amounts are indicated in numbers and in capital text. The amount for which contributions were calculated is taken into account (for 2022, the limit is 876,000 rubles for contributions to the Pension Fund of the Russian Federation, 755,000 rubles for contributions to the Social Insurance Fund).

If a full year has not been worked, the statement includes information only for the period actually worked.

The final section contains information about the periods during which the employee was not able to work, indicating the reason, which is officially confirmed.

Thus, in order to make a correct calculation when dismissing an employee, it is necessary to correctly provide information in the prescribed form.

| Attention! Before calculating the form, it is recommended to update the program to the latest version. |

Certificate “ON THE AMOUNT OF WAGES, OTHER PAYMENTS AND REMUNERATIONS FOR THE TWO CALENDAR YEARS PRECEDING THE YEAR OF TERMINATION OF WORK (SERVICE, OTHER ACTIVITY) OR THE YEAR OF APPLICATION FOR A CERTIFICATE ABOUT THE AMOUNT OF WAGES, OTHER PAYMENTS AND REMUNERATIONS, AND CURRENT CALENDAR YEAR FOR WHICH THE ACCRUALS WERE ACCRUED INSURANCE PREMIUMS, AND THE NUMBER OF CALENDAR DAYS COLLECTING IN THE SPECIFIED PERIOD FOR PERIODS OF TEMPORARY DISABILITY, MATERNITY LEAVE, CHILD CARE LEAVE, PERIOD OF RELEASE OF THE EMPLOYEE FROM WORK WITHOUT ANY OR PARTIAL SALARY RETENTION IN ACCORDANCE WITH THE LEGISLATION OF THE RUSSIAN FEDERATION, IF INSURANCE CONTRIBUTIONS TO THE SOCIAL INSURANCE FUND OF THE RUSSIAN FEDERATION WERE NOT ACCRUED ON THE SAVED WAGES FOR THIS PERIOD” - a certificate of the established form, which, in accordance with clause 2.3 of Article 4.1 of Federal Law 255-FZ, the enterprise is obliged to issue to the insured person on the day of termination of work (service, other activities) or upon a written application of the insured person after termination of work (service, other activities) for this policyholder no later than three working days from the date of filing this application.

The certificate reflects the amount of earnings for two calendar years preceding the year of termination of work (service, other activities) or the year of application for a certificate of the amount of earnings, and the current calendar year for which insurance premiums were calculated, in the form and in the manner established by the federal body executive power, which carries out the functions of developing state policy and legal regulation in the field of social insurance.

The certificate is generated from the employee directory using the context menu item Help No. 182n on contribution bases or from the “Reports | Reporting forms...", indicate the period and on the "FSS" tab open the form "Certificate on the bases of insurance premiums for 2 years."

Next, a form appears in which you must fill out the input fields:

•Select an employee—the field is filled in automatically with the personnel number of the selected employee. If necessary, you can change this personnel number to another by selecting it from the employee directory.

•Issue date—the current date is entered automatically, but it can be changed manually.

•Reference number is indicated manually

•The remaining data is filled in manually as necessary.

| Comment! There are three types of columns on document forms: yellow, gray and white. The program calculates the values of the yellow columns itself, but they can be edited. Gray columns are calculated automatically, both when calculating the form and when changing other columns, without the possibility of manual adjustment. The contents of white columns are always entered manually. |

After entering the data, the form should be recalculated by pressing the button on the control panel. Next, follow the program prompts.

The certificate on the bases of insurance premiums for 2 years in the program has only a printed form. To print the report, click .

The form has no settings.

Requirements for a certificate of insurance premiums

A unified form is used in the form KND 1151111. The employee must be given a copy of section 3. Only information about the employee being dismissed must be included.

The filling out requirements do not differ from the previous document, and you will find detailed instructions in the article on how to correctly fill out the new RSV-1 form.

Remember that the new form was introduced on 01/01/2017. If you need to provide information on insurance payments for 2016 and earlier, you will need to prepare a copy of section 6 of the old RSV-1 form.

Information on accrued and paid insurance premiums

According to para. 3 p. 4 art. 11 of Federal Law N 27-ФЗ on the day of dismissal of the insured person or on the day of termination of a civil law contract for which insurance premiums are calculated in accordance with the legislation of the Russian Federation, the policyholder is obliged to transfer to the insured person the information provided for in paragraph. 1 of this paragraph, and receive from him written confirmation of the transfer of this information to him.

The necessary information is contained in section. 6 “Information on the amount of payments and other remunerations and the insurance period of the insured person” calculation according to the PFR form RSV-1 (approved by Resolution of the Board of the Pension Fund of January 16, 2014 N 2p). This section contains information about the employee for the reporting period in which he resigned: from the beginning of the current year to the date of dismissal.

For your information. For periods before 2014, employers had to fill out forms SZV-6-1 (information on accrued and paid insurance contributions for compulsory pension insurance and the insurance record of the insured person) and SZV-6-4 (information on the amount of payments and other remunerations, accrued and paid insurance premiums for compulsory pension insurance and the insurance period of the insured person), approved by Resolution of the Board of the Pension Fund of July 31, 2006 N 192p.

When submitting information, you should be guided by the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons, approved by Order of the Ministry of Health and Social Development of Russia dated December 14, 2009 N 987n (hereinafter referred to as Instruction N 987n).

To fulfill the requirement of paragraph. 3 p. 4 art. 11 of Federal Law N 27-FZ and clause 35 of Instruction N 987n (receive written confirmation from the employee that he was given information) it is possible to provide the employee’s signature on a copy of section. 6 calculations according to the RSV-1 Pension Fund form, which remains in the organization. You can also record the transfer of information to the employee in the journal of issued certificates.

For your information. From 2022, due to the fact that the functions of administering insurance premiums are transferred to the tax authorities, a new form will be used instead of calculations using the PFR form RSV-1.

What else can an employee request?

In addition to those listed, an employee can make a request to receive other documents:

- order of dismissal or appointment;

- information about existing work experience (represents an extract from the SZV-STAZH form);

- form 2-NDFL;

- information on average earnings (if there is a reduction, if the employee intends to apply to the employment service for benefits);

- information about personalized accounting (includes individual information for the month of dismissal regarding the employee).

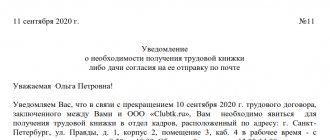

Any of these documents may be needed by an employee in connection with dismissal and must be handed over to him by the employer on the last day of his work.