When changes are made to the Unified State Register of Legal Entities

The list of information contained about legal entities in the Unified State Register of Legal Entities is quite large.

Having studied Art. 5 and 18 of the Law “On State Registration...” dated 08.08.2001 No. 129-FZ, we have identified the most common reasons for making changes to the Unified State Register of Legal Entities. You must change the data in the Unified State Register of Legal Entities if you have changed:

- information about the legal address of the company;

- head of the company;

- one or more participants;

- charter;

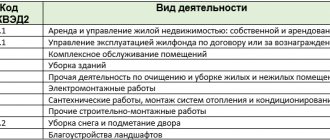

- types of economic activity (OKVED);

- shares of the authorized capital.

When making changes to the Unified State Register of Legal Entities, the manager must be guided by the company’s charter, which sets out the procedure for making decisions on this issue, as well as the procedure for registering changes.

There are two groups of grounds for changing data in the Unified State Register of Legal Entities:

- Related to amendments to the charter. For example, when the address, the size of the authorized capital, or the structure of governing bodies changes.

- Not related to changes in the charter.

There is no need to make changes to the Unified State Register of Legal Entities when changing the surname, passport data, or residence address of the founder or director.

Failure to timely submit information about an organization to the tax inspectorate for registration of changes in the Unified State Register of Legal Entities entails administrative liability under Part 3 of Art. 14.25 of the Code of Administrative Offenses of the Russian Federation, which provides for a fine of 5,000 rubles. If you did not provide information at all, the fine increases to 10,000 rubles under Part 4 of Art. 14.25 Code of Administrative Offenses of the Russian Federation.

How to submit electronic documents

Another important issue that must be addressed when submitting electronic documents to the tax office is the method of presentation. Documents in electronic form can be sent to the TCS inspection through an EDI operator or through personal accounts of taxpayers (clause 2 of Article 93 of the Tax Code of the Russian Federation).

Is it possible to submit paper primary documents in electronic form? Yes, this allows clause 2 of Art. 93 of the Tax Code of the Russian Federation - in the form of electronic images created by scanning with the preservation of their details in established formats. The same article of the code stipulates that if the requested electronic documents are transmitted via TCS, then they must be certified by the enhanced CEP of the person being inspected or his representative.

By order of January 18, 2017 No. ММВ-7-6/ [email protected] the Federal Tax Service approved the format of the list of documents that accompanies the electronic document flow between tax authorities and taxpayers (it came into force on January 15, 2018, clause 1.1 of the Federal Tax Service order dated December 27, 2017 No. MMB-7-6/ [email protected] ).

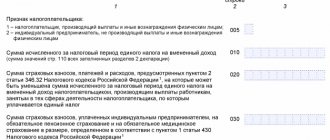

Individuals not related to business activities can also submit documents electronically. For example, a citizen can attach scanned images of supporting documents to the electronic 3-NDFL declaration when applying for a property or social deduction. The scans signed with an electronic signature along with the declaration will be sent to the inspectorate in electronic form.

In any case, tax officials reserve the right to familiarize themselves with the original documents.

Step-by-step procedure for registering changes in the Unified State Register of Legal Entities

ConsultantPlus has ready-made solutions, including those on the procedure for making changes to the Unified State Register of Legal Entities related to changes in the constituent document of a legal entity. If you don't have access yet, get it for free on a temporary basis. You can also get the current K+ price list.

To register changed information about an organization in the Unified State Register of Legal Entities, you must do the following:

- Based on the company’s charter, make a decision, for example a decision to change the legal address.

- Pay the state fee. The payment can be made at the bank’s cash desk, through an ATM or via the Internet: on the State Services portal, in the Sberbank.online personal account.

Important! When sending documents certified by a notary in electronic form or through the MFC, no fee is paid.

- Fill out an application for amendments. It is drawn up according to the new form P13014, approved by order of the Federal Tax Service dated August 31, 2020 No. ED-7-14 / [email protected] The applicant’s signature must be approved by a notary, with the exception of applications certified by an electronic signature.

Note! It is convenient to fill out an application using the Russian Federal Tax Service program “Preparation of documents for state registration”, posted on the website www.nalog.ru.

- Attach documents to the application: minutes of the general meeting or the sole participant on making changes, one copy of the constituent document in a new edition, if the charter is changed; payment order or receipt for payment of state duty.

- Submit a petition and documents to the interdistrict inspectorate of the Federal Tax Service. The papers can be presented in person (by courier), through a representative acting under a notarized power of attorney, or sent by mail with a list of the contents and the declared value of the letter.

- Documents are checked by the tax office within 5 working days. If everything is correct, the district Federal Tax Service issues a sheet of registration of the Unified State Register of Legal Entities with the data entered in the Unified State Register of Legal Entities and the charter with a seal.

When is it possible and when is it mandatory to send documents to the tax office electronically?

The flow of documents between tax authorities and taxpayers is enormous.

This is not only the submission of regular tax reports, but also various types of responses to requests, notifications, submission of documents, requirements, etc. Gradually becoming a thing of the past, the days when the taxpayer had to run to the inspector with each piece of paper or bring him boxes with confirming documents on a truck documents. Although the legislation does not contain a ban on paper document flow. Controllers will still accept most documents in paper form. Mandatory sending of documents to the tax office in electronic form is provided only in certain cases. For example, filing VAT returns and documents related to this tax (books of purchases and sales, journal of invoices), as well as sending explanations on VAT reporting to tax authorities is possible only in electronic form (with rare exceptions) .

Find out more about this on our website:

- “Rules for writing and submitting explanations to the VAT return”;

- “The journal for recording issued and received invoices - a new format.”

What is the procedure for submitting documents required by the tax authority? Find out the answer to this question in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Tax authorities accept other types of tax reporting both in electronic and paper form. It all depends on the number of employees of the taxpayer who sends the report (clause 3 of Article 80 of the Tax Code of the Russian Federation). At the same time, ordinary citizens can communicate with controllers and submit any documents to them in a wide variety of ways:

- through the taxpayer’s personal account;

- by coming directly to the inspection;

- by sending documents by post.

It is important to remember the basic rule: if you submitted your return electronically, then further interaction with controllers regarding this tax report should occur electronically. This rule follows from the order of the Federal Tax Service dated April 15, 2015 No. ММВ-7-2/ [email protected] Let’s look at this document in more detail.

ConsultantPlus experts explain in detail how to submit requested electronic documents to the Federal Tax Service that are not compiled in established formats. Get trial access to the system and go to the Tax Guide for free.

Documents for making changes to the Unified State Register of Legal Entities

If the charter is changed, the following must be attached to the application:

- protocol on amendments to the company's charter;

- one copy of the charter in the new edition;

- document confirming payment of the state duty.

If changes that are not related to amendments to the constituent document are subject to registration, it is enough to fill out form P13014 and submit it to the inspectorate.

ConsultantPlus has ready-made solutions, including how a legal entity can make changes to information about it in the Unified State Register of Legal Entities. If you don't have access yet, get it for free on a temporary basis. You can also get the current K+ price list.

What is important to remember about deadlines when transferring electronic documents

Typically, taxpayers transfer documents to the tax office electronically at the end of each reporting or tax period. According to the TKS, a significant part of them submit tax and accounting reports to the inspectorate.

But there are other reasons why you need to submit documents to the tax office electronically: tax officials may request documents during an audit (desk, on-site, counter) or offer to clarify the declaration data or make corrections to them. What should you consider when submitting documents electronically to the inspectorate?

First of all, remember the deadlines:

- 10 working days are given to the taxpayer to prepare and submit documents requested during tax audits;

- 5 working days are given to submit clarifications and correct the declaration (clause 3 of article 88, clause 5 of article 93.1 of the Tax Code of the Russian Federation);

The deadlines must be counted from the date of receipt of the requirement from the inspection. Violation of deadlines is fraught: for each document not submitted, a fine of 200 rubles is provided. (Article 126 of the Tax Code of the Russian Federation).

There are other deadlines to keep in mind. For example, to file objections to a tax audit report under the TKS, the taxpayer has 1 month (clause 6 of Article 100 of the Tax Code of the Russian Federation).

If you have not sent a receipt for the electronic request of the Federal Tax Service for the submission of documents, use the advice of ConsultantPlus experts and find out whether it is possible to avoid liability. Get trial access to the system and study the material for free.

The procedure for filling out an application on form P13014

When drawing up an application for registration of changes in the Unified State Register of Legal Entities, you must follow the rules prescribed in Appendix 13 to the Federal Tax Service order No. ED-7-14 dated August 31, 2020 / [email protected]

- Form P13014 must be filled out by hand or using computer technology. In the latter case, the signs are printed in capital letters, Courier New font, size 18, black. When writing with a pen, use black, purple, or blue ink and write in block letters.

- In each field (squares) only one character is indicated, with the exception of the date, number in the form of a fraction, percentage, monetary units and OKVED codes. To record a date, you need to use 3 fields in order from left to right, separated by a dot, for example: 01.2021. The fraction is divided into two fields by the sign of a vertical inclined line (for example, 1/7), the field with percentages is divided by a dot (for example: 125521.25).

- When indicating the passport series, an indentation is made between the numbers, and the number is written in order in each cell - 14 14 123456, while you also need to skip one square between the series and the number.

- The contact mobile phone numbers are indicated as follows: +79109876543.

- Between words in the text there is a space in the form of empty cells, no hyphen is placed.

- Information about the address of the entrepreneur's location is indicated by using abbreviated names of types of settlements, for example: village. Dubrava.

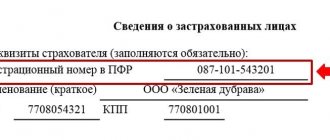

Information about LLC registration with the tax office

Using a special service on the Federal Tax Service website, you can check and also find out whether the LLC registration process went well. The procedure looks like this:

As a result, the result of searching for information regarding the submitted documents when registering an LLC will be returned:

Results

Thus, in 2022, an application for amendments to the Unified State Register of Legal Entities must be filled out using a new form.

When submitting an application in the prescribed form, the main thing is to fill it out correctly. If everything is correct, then within five days all that remains is to receive the Unified State Register of Legal Entities sheet. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Useful services from the Federal Tax Service

The website nalog.ru has many useful services, thanks to which you can get the information you need without leaving your home. We recommend that you familiarize yourself with them:

1. Personal account of a taxpayer - an individual

How is this service useful? You can:

- Contact the tax authorities without a personal visit to the Federal Tax Service;

- Monitor the status of settlements with the budget;

- Receive and print tax notices and tax receipts;

- Pay tax debts and tax payments online through a network of partner banks;

- Fill out online and download the 3-NDFL declaration (this declaration is filled out when receiving income from the sale of real estate and transport, as well as to receive a personal income tax refund from wages when purchasing housing, expenses for education and treatment).

The functionality of this office does not imply the payment of taxes related to business activities, that is, taxes of the simplified tax system, UTII, Unified Agricultural Tax, PSN and personal income tax from business activities. We are talking only about taxes of an individual citizen, such as transport, land, and property of individuals.

There are two ways to gain access to the personal account of a taxpayer - an individual:

- Using the login and password specified in the registration card . You can receive such a card in person or with a notarized power of attorney at any tax office, regardless of your registration. When applying to the Federal Tax Service at your place of residence, it is enough to have only your passport with you, and when visiting any other tax office, additionally - a certificate of assignment of a TIN.

- Using a qualified electronic signature or a universal electronic card. A qualified electronic signature verification key certificate must be issued by a Certification Center accredited by the Russian Ministry of Telecom and Mass Communications.

2. Personal account of a taxpayer - a legal entity

This service allows the organization to obtain a lot of useful information:

- An extract from the Unified State Register of Legal Entities and the Unified State Register of Real Estate in relation to oneself;

- Up-to-date information on tax debts, amounts of accrued and paid tax payments, the presence of overpayments and outstanding payments;

- Find out about decisions to set off and return overpaid (excessively collected) amounts, about decisions to clarify payment, about settled debts, about unfulfilled demands by the taxpayer for the payment of taxes and other obligatory payments, about measures for forced collection of debts;

- Send requests and receive a certificate about the status of settlements for taxes, fees, penalties, fines, interest, an act of joint reconciliation of settlements for taxes, fees, penalties, fines, interest;

- Receive services for registering and deregistering an organization at the location of a separate unit;

- Send messages to the tax authority in form S-09-2 about participation in Russian and foreign organizations;

- Notify about changes in information contained in the Unified State Register of Legal Entities, etc.

Access to the “Personal Account of a Taxpayer - Legal Entity” service is provided using a qualified electronic signature verification key certificate obtained from a certification center accredited by the Russian Ministry of Telecom and Mass Communications.

Initially it was planned that this office would be available not only to taxpayers - organizations, but also to individual entrepreneurs. But for now, individual entrepreneurs cannot reconcile their tax calculations related to business activities, either through this account or through the personal account of an individual.

3. Online appointment for inspection

Everything is clear and convenient here - all taxpayers can make an appointment: legal entities, individual entrepreneurs and ordinary citizens. Registration begins 14 calendar days in advance. You cannot be more than 10 minutes late, otherwise you will have to go to the regular queue. It is possible to receive a person later than the appointed time due to the tax officer being busy, but it is guaranteed that the taxpayer will be received within half an hour.

To get an appointment using such an appointment, you must select the question you are interested in in advance and correctly fill out the details of the document that you will present in person when filling out the application. Information about the exact appointment time and a PIN code for the electronic queue coupon will be sent to the email address you specified.

4. Find out the details of the Federal Tax Service Inspectorate serving this address

How is this service useful? You will be able to find out:

- Details (address, telephone, number and name) of your inspection at the place of residence, in which you will be registered, and submit declarations there;

- Details (address, phone number and name) of the registering tax office that carries out state registration of individual entrepreneurs and LLCs. As a rule, in all large cities there are special registration authorities; in Moscow, for example, this is the famous 46th Federal Tax Service.

- Payment details of the regional department of the federal treasury, according to which you will pay taxes.

5. Fill out a payment order or receipt for payments to the budget

The service allows you to fill out and download a payment order (for non-cash transfers) or a payment document (receipt) for cash payments. Here you can generate documents for paying taxes, fees, payments, duties, contributions, tax sanctions, fines, penalties, interest. It is better to know the BCC (budget classification code) of the payment in advance, although a search is also possible through the form.

6. Electronic service “Transparent Business”

Using the Transparent Business service allows you to obtain comprehensive information about companies, thereby reducing risks when choosing counterparties. To check an organization, you must enter information about the organization in the input field and click the “Find” button. Then, in the search results, select the company you are interested in and click on the mini-card, from which you can find out:

- information from the Unified State Register of Legal Entities (for example, name of the organization, date of registration of the enterprise, address, OKVED, category of the enterprise);

- information about the manager's disqualification. Disqualification is a ban on holding leadership positions for a period of 6 months to 3 years; it occurs only by a court decision when a case of an administrative offense is initiated. A disqualified person does not have the right to manage an organization and sign documents on its behalf;

- information from the unified register of small and medium-sized businesses;

- information from the state register of accredited branches, representative offices of foreign legal entities;

- information from the unified state register of taxpayers about foreign organizations;

- information about multiple participation of an individual in organizations;

- about the addresses indicated during state registration as the location of several legal entities;

- on persons falling under the conditions provided for in subparagraph “f” of paragraph 1 of Article 23 of Federal Law 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs”;

- about publications in the journal “Bulletin of State Registration”, if they exist.

If the data is inaccurate, a “Attention” sign will be displayed next to it.

7. Find out OKATO, OKTMO, KLADR codes and postal code by address

To find out the necessary codes needed to fill out declarations, reports and payments, enter your registration address. The address must be indicated starting with the name of the street, separated by a space – the name of the locality.

8. Find out information about state registration of legal entities, individual entrepreneurs, peasant (farm) farms

A very useful service, thanks to which you will learn:

- Name, address, OGRN, INN/KPP of the legal entity, full information about the state registration of the organization and tax accounting, information about registration with the Social Insurance Fund and the Pension Fund of the Russian Federation, information about the founders and head of the legal entity, the size of the authorized capital, OKVED codes of the organization.

- OGRNIP and TIN of an individual entrepreneur, information about his citizenship, complete information about the state registration of an individual entrepreneur and his tax accounting, information about registration with the Social Insurance Fund and the Pension Fund of the Russian Federation, OKVED codes.

The search is very simple: you can enter the OGRN (OGRNIP) or INN of an organization or individual entrepreneur, and if you don’t know them, you can indicate the full name of an individual entrepreneur or the name of an organization, as well as the region of residence or location.

9. Find out information about legal entities and individual entrepreneurs in respect of which documents for state registration have been submitted

Here you can find out about documents of organizations and individual entrepreneurs you are interested in, such as:

- Re-registration of companies in Crimea and Sevastopol;

- Notification of the formation of a liquidation commission and the appointment of a liquidator;

- Notification of a decision to liquidate a legal entity;

- Statement on changes made to the constituent documents;

- Application-notification of the start of the reorganization procedure;

- Application for amendments to information about individual entrepreneurs;

- Application for amendments to information about the head of the peasant farm;

- Application for termination of the activities of individual entrepreneurs, etc.

True, the period for which information about such documents can be obtained is only a year ago; earlier information is not available.

10. Find out the TIN - yours or another individual

You can find out your TIN online only if it has already been assigned to you. To do this, you must indicate your full name, date of birth and passport details in the request form. You can obtain the TIN of another person by sending a request, paying for this service (100 rubles), and then contacting the specified tax office.

11. Information about organizations that have tax arrears and/or have not submitted tax reports for more than a year

Before concluding a transaction with a counterparty, we recommend that you find out about the fulfillment of his obligations as a taxpayer. In some cases, this may become a basis for the tax inspectorate to refuse to take into account the costs of transactions with such a partner when calculating the tax base.

12. Information stands of the Federal Tax Service by region

This service can be called a wall newspaper of the Federal Tax Service. All the news that is usually posted in your tax office for everyone to see can be found without leaving your home. Select the region and then select the category that interests you.

13. Information about blocked bank accounts

Enter the counterparty's TIN and BIC of his bank to find out if there is a block on the account. Restriction of account transactions may be caused by the fact that the counterparty does not submit reports or does not submit taxes.

We have posted another selection of useful services for businessmen in this article.

If you found this article useful for yourself, please share it with your friends and let it help them too. We will be very pleased!

How to check the readiness of documents at the 46th tax office?

Until recently, the only way to clarify the degree of readiness of documents at the 46th tax inspectorate was the telephone service for checking readiness.

The service's telephone line does not stop ringing for a minute, and it is quite difficult to get through to get up-to-date information. For your convenience, a new unique service of the Federal Tax Service has been launched: Readiness for issuing documents. Thanks to this service, you have the opportunity, without leaving your home, to check whether your package of documents is ready at the 46th tax office for registration, liquidation or reorganization of the company.

CHECK THE READINESS OF DOCUMENTS FOR ISSUANCE AT THE 46 TAX INSPECTION

In order to find out whether a package of documents is ready, you must enter the number of the incoming package with documentation into the search bar of the service. The following information will appear for this number:

Check the readiness of documents for registering an LLC with the 46th tax office

When you contact the Federal Tax Service No. 46 in Moscow, after submitting documents for LLC registration, a receipt is issued. Later, using the incoming number indicated in this receipt, you can check and find out information about the result of registering an LLC with the tax authority. So, you can call or use the Federal Tax Service website.

Find out the result of individual entrepreneur registration with the Federal Tax Service

You can find out about the decision made by the registration authority on the issue of opening an individual entrepreneur by calling the hotline or checking through the Federal Tax Service website, where you can find out the result of opening a business:

Based on the results of registering an individual entrepreneur with the Federal Tax Service, you can check its status by receiving information in the form of:

Blog categories

Popular articles

Law firm services

The Personal Data Subject (hereinafter referred to as the Subject) gives consent to the Legal Limited Liability Company (hereinafter referred to as the Company), located at the address: Moscow, Suschevsky Val 16, building 4, office 509, to process his personal data , including collection, systematization, accumulation , storage, clarification (updating, changing), use, distribution, depersonalization, blocking, destruction of personal data, including using automation tools for the purpose of analyzing purchasing behavior and improving the quality of services provided, as well as providing the Subject of personal data with commercial, informational information and advertising (including special offers and promotions of the Company) through various communication channels, including by mail, SMS, email, telephone, if the Personal Data Subject expresses a desire to receive such information by appropriate means of communication.

The Company takes all reasonable measures to protect the received personal data of the Subject from destruction, distortion or disclosure.

In addition to the Company, the Subjects themselves have access to their personal data; Company employees; persons providing support to the Company's services to the extent necessary to provide such support; other persons whose rights and obligations regarding access to relevant information are established by the legislation of the Russian Federation.

The Company guarantees compliance with the following rights of the Personal Data Subject: the right to receive information about what personal data of the Personal Data Subject is stored by the Company; the right to delete, clarify or correct personal data stored by the Company; other rights established by the current legislation of the Russian Federation. The Company undertakes to immediately stop processing personal data upon receipt of the corresponding request of the Personal Data Subject, drawn up in writing and sent to the Company’s address indicated above.

The consent of the Personal Data Subject to the processing of personal data is valid indefinitely and can be withdrawn at any time by the Personal Data Subject by writing to the Company.

1.1. This document defines the policy of the Limited Liability Company "YurStart" (hereinafter referred to as the Company) regarding the processing of personal data.

1.2 This Policy has been developed in accordance with the current legislation of the Russian Federation on personal data.

1.3 This Policy applies to all processes of collection, recording, systematization, accumulation, storage, clarification, extraction, use, transfer (distribution, provision, access), depersonalization, blocking, deletion, destruction of personal data carried out using automation tools and without the use of such means.

Check individual entrepreneur registration with the tax office online

In order to find out whether the documents confirming the registration of an individual as an individual entrepreneur are ready, you need to go to the Federal Tax Service website: https://service.nalog.ru/uwsfind.do. In a special form you must fill out the search details:

Next, you need to enter the code from the picture on the screen and click the “Find” button. As a result, you can check the displayed data.