In the article we will look at sick leave after dismissal, how to get it, its maximum and minimum amount, as well as an example of calculation. A hospital benefit is a monetary compensation paid to a person insured by the Social Insurance Fund, from whose income mandatory social contributions are deducted. The benefit can be received by an employed person from his employer, while the first three days are paid by the employer himself, the subsequent days are reimbursed by the fund. In addition, a person who falls ill in the first thirty days after dismissal can count on receiving compensation payments.

Payment of sick leave compensation is made to employees upon the occurrence of cases prescribed in Article 5. Law No. 255-FZ of December 29, 2006 (as amended on March 9, 2016):

- Illness, injury that prevents the performance of work functions (up to 75 days inclusive);

- Caring for a sick relative (up to 30 days a year);

- Caring for a sick minor child (if the age is less than seven years old, then paid for up to 60 days per year inclusive, from 7 to 15 years - up to 45 days in total per year);

- Caring for a child recognized as disabled (up to 120 days per year).

- Quarantine of the child or a member of his family (paid for the entire period);

- Performing prosthetics in a hospital;

- Recovery period after illness in a sanatorium-resort area (no more than 24 days).

Is it possible to take it?

It is important for an employee to know whether he can go on sick leave on the last day before dismissal. A former employee can submit a sick leave certificate to the accounting department of the enterprise if it was opened within 30 calendar days after the termination of the employment agreement (Part 2 of Article 5 of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with motherhood").

For example, if you went on sick leave on February 9, and your dismissal took place on January 19, then the accounting department is obliged to accept payment for it. Accordingly, it is simple to figure out whether they will pay if an employee fell ill on February 22 - such a document is not subject to payment.

There is one more condition: whether the sick leave will be paid depends on the time during which it was brought to the previous organization. You need to apply there before six months have passed from the date of dismissal.

Who pays?

If in these cases the employee has every right to submit sick leave, then the decision to pay for it is made by the previous employer depending on whether the person got a new job or not. When he has already concluded an employment contract at a new place, the previous enterprise has no financial obligations to the employee.

Now paying sick leave is the responsibility of the new employer . To confirm that he is not yet employed, the employee must submit, along with the certificate of incapacity for work, a copy of the work book, in which there are no other entries after dismissal. You will also need a copy of your passport to pay benefits.

But in what period and at whose expense the payment is made: the employer pays for the first three days from his own funds, then - at the expense of the Social Insurance Fund. This is regulated by Federal Law No. 255-FZ.

Regardless of the former employee’s length of service, benefits will be paid in the amount of 60% of the average daily earnings.

It is possible that the citizen has not yet found a new job, but after his dismissal he registered with the employment service. The Central Health Care Center will not pay him sick leave, but will pay him unemployment benefits during his illness. This is established in the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On employment in the Russian Federation” (Article 28, paragraph 1).

There are no restrictions in the law regarding the simultaneous payment of both unemployment benefits and disability benefits (sick leave) from a former employer. The FSS explains: unemployment benefits and disability benefits are two different types of state compensation; their simultaneous use is not excluded by law (the seventh question in the “Q&A” section on the topic “Certificate of Incapacity for Work”).

However, in practice, obtaining both of these benefits is not easy. To pay unemployment benefits during illness, you will need to bring a sick leave certificate to the Central Employment Center . It puts Fr. The details of the former employer are not indicated. In this case, two sick leaves are not issued. This creates difficulties when applying for unemployment benefits both from the employer and from the Social Insurance Fund branch, which provides the bulk of payments.

In this regard, the FSS explains: unemployment benefits and disability benefits are two different types of state compensation, their simultaneous use is not excluded by law (the seventh question in the “Q&A” section on the topic “Certificate of Incapacity for Work”). Therefore, the conclusion is this: you can receive both unemployment benefits and disability benefits through your former employer if you formalize everything correctly and insist on your own.

However, immediately before issuing a sick leave upon discharge, it is better to check with the local Social Insurance Fund what needs to be indicated on the sick leave and in what order it should be presented for payment.

Required help

Upon dismissal, each employee must be issued a sick leave certificate along with earnings data. He will need it when calculating sick leave at his new place of work. Also see “2-NDFL for a new job.”

If such a certificate is not taken upon dismissal to calculate sick leave, then the future employer has the right to rely on his own data. Moreover, at the moment when the employee nevertheless decides to bring a certificate from his previous place of work, a recalculation must be made in accordance with the new information.

Is the employer obligated to do this for the employee or not?

The enterprise's obligation to pay for sick leave depends on the period in which it was submitted by the former employee.

Within a month

One calendar month is the period established by law for sick leave to be submitted to the enterprise. The reason for refusal may be new employment.

Based on Art. 7 (Part 2) of Federal Law No. 255-FZ, a former employee cannot be paid child care benefits.

Read more about whether sick leave is required to care for a child after dismissal.

After 30 days

If a ballot is submitted after the monthly deadline, it may also be subject to payment. The main condition is that the certificate of incapacity for work was opened within 30 days after the termination of the employment contract. In this case, the rule applies - sick leave must be presented for payment within six months from the date of its closure.

In other words, if, within six months from the date of recovery, you bring sick leave to your previous place of work, which was opened within one month from the date of dismissal, the company is obliged to pay compensation.

If the employee did not manage to bring sick leave on time for a good reason, benefits may still be assigned. Such a reason may be a long-term illness (order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2007 No. 74). In this case, you need to contact the FSS directly.

Maternity nuances

But the law provides an exception for employees who have valid reasons for dismissal. Sick leave after dismissal by agreement of the parties in 2022 for pregnancy and childbirth, if it occurs within 30 days after dismissal, must be paid by the employer for the reason (clause 14 of the order of the Ministry of Health and Social Development dated December 23, 2009 No. 1012):

- inability to live and (or) work in a given region due to health reasons;

- transfer of the spouse of a pregnant employee to work in another region, her relocation to her husband’s place of residence;

- needs of supervision of sick relatives or disabled people of group I.

Each of the reasons for dismissal - before maternity leave or dismissal of an employee on sick leave, by agreement of the parties - must be proven documented: certificates from social security, medical institutions, from the husband’s place of work, from the housing department, homeowners’ association at the place of residence, etc.

Payment order

The employee can choose how to receive funds . He indicates his own desire when presenting a certificate of incapacity for work to the organization. He can receive cash at the company's cash desk, to his current account (or to a card) or by postal order. In this case, when transferring to a bank account, you must immediately indicate the full details in the application, and if you choose the option by mail, then you must write the exact address, including the zip code.

An employee can receive direct payments from the Social Insurance Fund. The pilot project began operating in 2011 and operates in 39 regions. The application still needs to be submitted to the employer, but the funds will be transferred to the account by the FSS.

Conditions

The employer must accrue benefits within 10 days after the employee has submitted all the necessary documents, and the employer has verified them and accepted them for execution.

To calculate the amount of payment, the last two calendar years that the employee worked at this enterprise must be taken into account.

What documents does the employee need?

Along with the closed certificate of incapacity for work, the following should be submitted to the accounting department:

- a copy of the Russian passport;

- a copy of the work book;

- application for payment of sick leave.

The application must be addressed to the head of the company, for example:

“Director of Cascade LLC A.V. Sviridov”; write your details - last name and initials, address and contact details. This is indicated in the first upper corner of the application.

The text of the appeal itself must express a request to accrue benefits, for example:

“I ask you to calculate and issue temporary disability benefits according to sheet No. 12345678 dated January 11, 2019 in accordance with clause 2 of Art. 7 of Federal Law No. 255-FZ of December 29, 2006. Please transfer the benefit to my account at Sberbank PJSC: (specify current account, BIC, recipient).”

Next you need to list the applications:

- copy of passport;

- a copy of the work book confirming the dates of work;

- certificate of incapacity for work.

At the end of the application, the date of preparation and the signature of the applicant with a transcript are indicated.

Where to submit?

Documents should be submitted to your former place of work. But in some cases you need to contact the Social Insurance Fund office directly - all these cases are listed in Part 4 of Art. 13 of Federal Law No. 255-FZ. Sick leave and an application for payment of benefits must be submitted to the Social Insurance Fund if:

- After the employee’s dismissal, the organization was liquidated, and he simply does not have the opportunity to turn there.

- There are not enough funds in the employer's accounts; payment requests are executed in order of priority.

- The location of the employer cannot be determined, and there must be a court decision establishing the fact of non-payment of benefits.

- The employer is in bankruptcy.

How is voluntary dismissal processed while on sick leave?

Regardless of whether the employee is on sick leave or working, he can exercise his right to dismissal in accordance with the provisions of Art. 80 of the Labor Code of the Russian Federation, that is, on one’s own initiative. Therefore, if a person’s desire to quit arose while he was on sick leave, from a legal point of view this is considered in the same way as if he had done it while he was at work.

Having received a letter of resignation from an employee on sick leave under Art. 80 of the Labor Code of the Russian Federation, the employer can agree with him on the immediate termination of the contract or wait 2 weeks, during which the employee can still have time to go to work, and only after that formalize the termination of the employment relationship.

If the sick leave lasts more than 2 weeks or the date of termination of the contract by agreement has already arrived, the employee will continue to receive compensation for sick leave, while being in the status of dismissed. Thus, in this interpretation, the 2-week period after the employee submits a letter of resignation cannot always be considered as mandatory for working off. In this case, it is a formality, the observance of which is dictated by the norms of the Labor Code of the Russian Federation.

The official termination of an employment contract with an employee generally requires his or her appearance at the employer’s office. But what if a person, for example, has a high temperature and cannot come to work?

Read about the rules for filling out a resignation letter in the material “How to write a resignation letter correctly - sample?”

Deadline for receiving benefits: in how many days?

Payment of benefits (in cash or by bank or postal transfer) is made on the nearest date after accrual of wages in the organization (Part 1, Article 15 of Federal Law No. 255-FZ).

For example, a former employee brought a piece of paper and documents on April 17. The accountant checked them and accepted them the same day. Therefore, no later than April 27, he must accrue benefits. The company has two dates for the payment of wages: the 10th and 25th of each month. Then the benefit should be issued in cash at the cash desk or transferred to the employee’s card on May 10.

If an employee applies directly to the Social Insurance Fund for this reason or because of the liquidation of the organization, he must receive the benefit within 10 calendar days from the date of filing the application (Part 2 of Article 15 of Federal Law No. 255-FZ).

Size and calculation: what percentage of earnings?

As already mentioned, the amount of temporary disability benefits for a former employee is calculated based on 60% of the average daily earnings . An example calculation is given below.

The employee was dismissed from the company on June 5, 2019. After some time, namely on June 22, 2019, he submitted a closed sick leave certificate for payment.

The total work experience of the dismissed employee is 10 years. Sick leave covers 12 calendar days. For the first calendar year preceding dismissal, the employee received a salary of 18,000 rubles. per month, in the second - 19,000 rubles. Thus, in the first year his total income was 18,000 * 12 = 216,000 rubles, in the second year - 19,000 * 12 = 228,000 rubles.

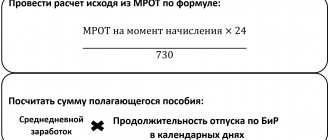

First you need to determine your average daily earnings:

(216,000 + 228,000) / 730 days = 608.22 rubles.

In this case, 730 is the total number of days in two calendar years.

To pay for sick leave after dismissal, you must take 60% of the calculated figure:

RUB 608.22 * 60% = 364.93 rub.

Then the full benefit amount will be:

RUR 364.93 * 12 days = 4,379.16 rubles.

The payments themselves will be distributed as follows:

- employer pays for 3 days. * RUR 364.93 = RUB 1,094.79;

- The remaining amount must be paid from the Social Insurance Fund.

Would you like to learn more about the connection between sick leave and dismissal? We advise you to study the articles of our experts on whether an employee can be fired for frequent sick leave and how to terminate an employment contract by agreement of the parties during illness, how to formalize the continuation of BL after dismissal from a position, on payment of sick leave during vacation with subsequent dismissal.

When can they refuse?

A former employer has the right to refuse to pay a citizen in a number of cases:

- the certificate of incapacity for work was submitted after 6 months from the date of its closure;

- sick leave was opened after a 30-day period from the date of dismissal;

- the sick leave certificate itself was issued in violation of the requirements for its completion.

Sometimes the period of incapacity is paid, but in a smaller amount (Article 8, paragraph 1 of Federal Law No. 255-FZ):

- if the patient did not comply with the instructions of the attending physician;

- he did not appear at the appointed time for a medical examination;

- if the injury or illness was received in a state of toxic, narcotic or alcoholic intoxication.

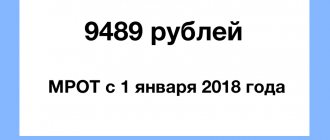

In any of these cases, temporary disability benefits can be calculated based on the minimum wage .

If none of the above reasons occurred, but the former employer refused to accept the certificate of incapacity for work, then the employee can file a complaint with the Labor Inspectorate, the local branch of the Social Insurance Fund, or file a claim in court.

The employee has the right to apply to his previous place of work for payment of the certificate of incapacity for work, which was opened after dismissal. In some cases, the employer must accept it for payment. To do this, you need to attach copies of your passport and work book. If it is impossible to contact the company, you can submit documents to the Social Insurance Fund.

Various bases

Let's look at how sick leave is paid after dismissal from work for various reasons. The above procedure applies to all types of dismissals during sick leave :

- when reducing personnel;

- of one's own free will;

- by agreement with management, etc.

The reason does not affect whether sick leave is paid after dismissal . Also see “Sick leave after dismissal due to staff reduction.”