What is changing in the payment of social benefits?

Firstly, benefits will now be paid without application.

Let us recall that until 2022, the organization transmitted information to the Social Insurance Fund after receiving applications from an employee on sick leave. And then the employee received money from the fund.

Starting this year, an employee application is no longer required. The employee does not even need to provide electronic sick leave numbers. But at his request, they can issue an extract from the electronic sick leave.

Now the fund will only need to receive a closed electronic certificate of incapacity for work from a medical institution, which it places in the special Social Insurance system, and on its basis pay benefits to the employee.

If the fund does not have enough information about the insured person, it will independently request data from other sources (PFR, Federal Tax Service, Civil Registry Offices, employers).

With the help of SPS ConsultantPlus, you will easily navigate the legislation and track all changes in a timely manner.

As soon as the status of the electronic certificate of incapacity for work changes (opened, extended, closed, cancelled), employers will receive an automatic message from the Social Insurance Fund. The employee's consent is not required for this.

In turn, employees will be able to track this information through their personal account on the website https://lk.fss.ru/recipient/ (login and password for their personal account on the government services portal). Thus, both parties see the entire payment process.

Thus, the employer’s participation will be minimal - only upon request, send data about the employee (for example, what payments he has; whether regional coefficients apply; about vacations and release from work). Employers undertake to transfer the requested data to the fund within three working days.

Secondly, all communication between the Social Insurance Fund and employers is now carried out in electronic format. To do this, you need to provide a connection to the special service “Social Electronic Document Management” (SEDO).

This can be organized through:

- the policyholder's account on the website lk.fss.ru;

- free automated workplace software “Preparing calculations for the Social Insurance Fund” at the link https://lk.fss.ru/eln.html;

- any commercial accounting program (1C, SBISS++, Parus and others). They are all already adapted now. This option is preferable.

A specific algorithm for interaction between employers and the Social Insurance Fund is enshrined in the Decree of the Government of the Russian Federation of November 23, 2021 No. 2010 “On approval of the Rules for the receipt by the Social Insurance Fund of the Russian Federation of information and documents necessary for the appointment and payment of temporary disability benefits, maternity benefits, and lump-sum birth benefits child, monthly child care allowance.”

With the help of SPS ConsultantPlus, you will easily navigate the legislation and track all changes in a timely manner.

Direct benefit payments for participants of the Social Insurance Fund pilot project

In case of illness or maternity, the employee is paid benefits

.

Essentially, a benefit is an insurance payment. In this case, the employer is the insurer

, since by paying contributions to the Social Insurance Fund for cases of temporary disability and maternity, he insures the employee.

The employee is accordingly an insured person

.

When an insured event occurs - illness or maternity, the employee receives social benefits

or, in other words, insurance. The benefit amount is partially or fully paid from the social insurance fund (SIF).

There are currently two insurance payment mechanisms:

- credit system

; - direct payments

.

Credit system for payment of benefits

The employer first independently calculates the amount of social benefits, and then pays it to the employee from his own funds.

Due to the fact that the employer is obliged to pay monthly insurance premiums in case of VNII, he has the right to compensation for the costs of paying benefits.

To compensate for expenses under the offset

system

, the policyholder has the following options.

- Offset

of expenses incurred for social benefits against the repayment of insurance premiums accrued in the corresponding period for VNiM. - Reimbursement

from social insurance for expenses incurred if the cost of sick leave and other benefits exceeds the amount of accrued contributions.

For reimbursement

The following documents must be submitted to the social insurance fund.

- Statement

- Help-calculation

- Breakdown of expenses

- Supporting documents

In our opinion, the main disadvantage

The offset system is an independent calculation by the employer of the amount of social benefits, and then payment of them from his own funds. At the same time, the process of reimbursement of expenses incurred is quite lengthy.

If social insurance employees discover errors in calculating the amount of benefits, the employer may assess additional insurance premiums, penalties and fines.

Direct payments or pilot project

Legislators have developed a direct payment mechanism to pay benefits directly

, and not through the employer.

This mechanism is called pilot project

.

The pilot project does not operate everywhere, but only in some regions of the Russian Federation. Those registered in such a subject automatically participate in the pilot project:

- organizations;

- separate divisions that independently pay salaries to employees.

An employer participating in the Social Insurance Fund pilot project should take into account the following features:

.

- There is no need to calculate and pay

some social benefits to employees. They are paid directly by the FSS to insured persons. - It is necessary to pay insurance premiums for VNiM in full

, without reducing the amount of expenses for benefits. - an application

and

documents

from the employee for payment of benefits and

transfer the information

to the Social Insurance Fund. - You must still pay at your own expense for the first three days of sick leave.

- You must pay at your own expense for additional days off to care for a disabled child, funeral benefits and expenses to reduce injuries. These amounts cannot be counted

against the payment of insurance premiums; they can only

be reimbursed

from the fund’s budget. - It has become easier to fill out form 4-FSS and calculate insurance premiums. The reports do not need to include data on social benefits.

What should the employee and employer do with direct payments?

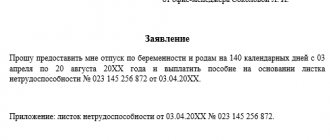

- The employee must submit to the employer a completed application accompanied by supporting documents.

- The employer must submit this application and the documents necessary to receive social benefits to the Social Insurance Fund within 5 calendar days.

- As a general rule, the social insurance fund has 10 calendar days to make a decision and pay benefits.

The money is transferred by the fund to the employee’s bank account specified in the application, or by postal order.

Thus, the employer participating in the pilot project only needs to submit a package of documents to the fund.

- Documents submitted by the employer to the Social Insurance Fund

- Methods for presenting these documents

The employer, no later than 5 days from the date of receipt of the application and documents from the employee, must transfer them to his social insurance department along with the inventory. The list of documents depends on the type of payment.

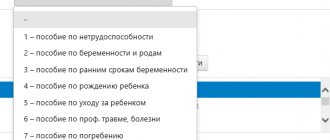

| P/n | Type of benefit | List of required documents |

| 1 | For temporary disability |

|

| 2 | For pregnancy and childbirth | |

| 3 | For women registered in the early stages of pregnancy |

|

| 4 | At the birth of a child |

|

| 5 | Caring for a child until he reaches the age of 1.5 years |

|

Sample of filling out an application by an employee for payment of benefits

A package of documents for payment of benefits can be submitted in two ways:

- In paper form – application, documents and inventory;

- In electronic form – an electronic register of information.

A pilot project participant can choose any method of submitting documents if the average number of employees does not exceed 25 people. If the number of employees is more than 25 people

, then the information is provided only in

electronic form

.

Please note that the FSS pilot project is provided for five types of benefits:

- for temporary disability;

- for pregnancy and childbirth;

- women who registered in the early stages of pregnancy;

- at the birth of a child;

- for child care until he reaches the age of 1.5 years.

For other payments, for example, when paying for additional days off to care for a disabled child, the policyholder pays, as before, from his own funds. But these expenses cannot be counted against the payment of insurance premiums; they can only be reimbursed from the Social Insurance Fund budget.

What's new in temporary disability benefits

The employer also continues to pay for the first three days. The rest of the payment algorithm will be as follows:

- The medical organization opens a sick leave certificate for the employee and places it in the Social Insurance system.

- The FSS receives information about open sick leave.

- The FSS, using SNILS, requests the Pension Fund for information about the employment of the insured employee.

- The Pension Fund of the Russian Federation looks at the data in the employee’s electronic work book and promptly provides data on which organization the employee works for within one calendar day.

- The FSS sends a message to the employer that his employee has opened a sick leave.

- After the sick leave is closed, the Social Insurance Fund notifies the employer about this and sends pre-filled information for payment of benefits. Pre-filled information is practically the same register of information that the fund has. The employer, in turn, confirms/changes/supplements this information and sends it back to the fund. For example, the fund has information about the employee’s experience of 5 years, and the employer has information about the employee’s experience of 9 years. This means that the employer makes corrections to the length of service. The Fund takes into account the corrected information from the employer.

- If necessary, the fund requests additional data to calculate benefits. For example, by length of service, salary, regional coefficients, work mode (full/part-time), time of suspension/absence from work.

- The employer sends the requested data within three working days.

- The Social Insurance Fund pays benefits and informs the employee about this in his personal account on public services.

- The Social Insurance Fund informs the employer and employee about the payment of benefits.

If it turns out that there is no data on the employee either in the Social Insurance Fund or in the Pension Fund of the Russian Federation due to the fact that the information is not entered into the electronic work book, then a delay in the payment of benefits is possible. This situation is possible with part-time workers. Then the employee himself comes to his employer, brings a closed electronic sheet, and the employer sends the information to the Social Insurance Fund, thereby initiating the payment of benefits.

Thus, the accountant only needs to receive pre-filled information from the Social Insurance Fund, fill it out and send it back. And that’s it, the employer’s participation ends here. And all calculations, assignments and payments are taken care of by the FSS.

In the shortest possible time, the payment is received on the Mir card - within one day. For other accounts - up to a week, depending on the servicing bank.

The “ABC of Law” by SPS ConsultantPlus presents up-to-date answers to everyday questions and describes the procedure with references to legislation.

municipal formation hero city Novorossiysk

From January 1, 2022, the Krasnodar Territory will switch to the “direct payment” mechanism.

The topic of the Krasnodar Territory’s transition to direct payments is becoming more relevant every day and is increasingly of concern to employers. There are six months left before the official transition, but the branches of the Krasnodar regional branch of the Social Insurance Fund are already trying to prepare policyholders as much as possible for the innovations.

Currently, on the territory of the constituent entities of the Russian Federation participating in the implementation of the “Direct Payments” project, when transferring insurance payments by the territorial bodies of the Fund directly to insured persons to a bank account, a separate technology for transferring insurance payments using the details of the “Mir” card is additionally used.

This method speeds up the process of citizens receiving benefits transferred by the territorial bodies of the Fund. To receive funds, the employee needs to fill out an application indicating the Mir card number. You can get a card at any bank that offers this service.

How will the transition to direct payments affect working citizens who are entitled to benefits?

For an employee who is entitled to benefits, the document processing procedure will not actually change. As before, he brings to the employer documents confirming the right to benefits (certificate of incapacity for work, birth certificate of a child, etc.), the only innovation is an application that the employee writes and indicates the details for which it is more convenient for him to receive benefits (account in bank or postal address).

The employer prepares a set of documents for the payment of benefits and, no later than 5 calendar days from the date of receipt of the application from the employee, sends them to the regional office of the Fund, which, within 10 calendar days from the date of receipt of the full set of documents, makes a decision on the appointment and pays the benefit.

Are there any time limits for the submission of documents by the employee and the employer to receive benefits?

The employee himself can apply for benefits no later than 6 months from the date of termination of the insured event, i.e., for example, for a one-time benefit for the birth of a child - no later than 6 months from the date of birth, for child care - no later than 6 months from the date the child reaches the age of one and a half years. The employer, within 5 calendar days from the moment the documents are submitted and the employee writes the application, is obliged to transfer them to the branch of the Social Insurance Fund.

Can an employer fill out an application for benefits (vacation pay) instead of an employee?

The employer can fill out the application, but the employee must check the details for transferring funds (bank account, postal address) and personally sign the application.

If during the process of processing documents and transferring benefits, a Fund branch or bank discovers an error, the documents will be returned to the employer for correction. This will result in a delay in payment of benefits. Signing for an employee is not allowed. In addition, forgery of a signature is a crime under Art. 327 of the Criminal Code of the Russian Federation.

How long will it take for an employee to receive temporary disability benefits, maternity benefits, and monthly child care benefits when a constituent entity of the Russian Federation switches to direct payments?

The regulation on the specifics of the appointment and payment of insurance coverage to insured persons for compulsory social insurance in case of temporary disability and in connection with maternity and other payments in the constituent entities of the Russian Federation that have switched to direct payments establishes a general period for payment of benefits - 10 calendar days from the date of receipt of the application and documents necessary for the assignment and payment of the corresponding type of benefit.

This period is also established for the payment of monthly child care benefits upon provision of documents or registers for the past time; subsequent payments are made before the 15th day of the month following the month for which the benefit is due.

If the money does not come to the employee’s account, what should I do, where should I go?

If after 01/01/2021 your benefit payment is delayed, first of all, you should contact your employer and find out whether your documents were sent to the Krasnodar regional branch of the Social Insurance Fund of the Russian Federation, when this was done.

If the documents have been sent, you can call the Krasnodar regional office on the hotline (phone numbers are listed on the Fund’s website), provide the full name of the organization where you work, your full name, the date the documents were submitted by the employer, what benefit you were not paid and contact information telephone. The Fund’s specialists will sort out the reason for the delay in transferring benefits as quickly as possible.

Will the Krasnodar Regional Department of the Federal Tax Service of the Russian Federation issue 2-NDFL certificates? How will benefits be taken into account when withholding income taxes?

Yes, upon application by the employee, the branch of the regional office will issue him a 2-NDFL certificate. When withholding income tax, branches of the regional office will not take into account income tax benefits, since the Tax Code provides that standard tax deductions are provided to the taxpayer by one of the tax agents who is the source of payment of income at the taxpayer’s choice based on his written application and documents confirming the right to such deductions.

If the FSS withholds personal income tax, how will the employee be able to collect documents to provide a property deduction?

According to clause 2. Art. 219 of the Tax Code, property tax deductions are provided when the taxpayer submits a tax return to the tax authorities at the end of the tax period, unless otherwise provided by this article.

Thus, the taxpayer must contact the branch of the regional branch of the Social Insurance Fund of the Russian Federation for a 2-NDFL certificate.

Who will pay for the first three days of temporary disability from 01/01/2021, the enterprise or the Social Insurance Fund of the Russian Federation?

Temporary disability benefits for the first 3 days of temporary disability are assigned and paid by the policyholder at his own expense, and for the remaining period, starting from the 4th day of temporary disability, by the territorial body of the Fund at the expense of the Fund’s budget.

Thus, the payment of temporary disability benefits on this basis will not change from 01/01/2021.

What documents should the insured person submit in order to receive temporary disability or maternity benefits directly from the territorial body of the Federal Social Insurance Fund of the Russian Federation if the employer has ceased its activities?

If the employer has ceased its activities, the employee can directly apply to the territorial body of the Federal Social Insurance Fund of the Russian Federation for temporary disability or maternity benefits by submitting the following documents:

— application for payment of the corresponding benefit;

— certificate of incapacity for work in the established form;

— certificate(s) about the amount of wages, other payments and remuneration; application of the insured person to send a request to the territorial body of the Pension Fund for the provision of information on wages, other payments and remuneration;

— documents confirming insurance experience.

Who has the right to apply to the Social Insurance Fund to collect alimony?

First of all, you need to contact the bailiffs, who will send to the Fund a decree on foreclosure along with a certified copy of the writ of execution.

According to Part 2 of Art. 9 of Law No. 229-FZ, simultaneously with the writ of execution, the claimant submits an application in free form, which must indicate his full name, details of the identity document, and data for transferring funds. If a representative of the claimant applies, he must also present a document certifying his authority.

The following may apply to the branch of the FSS branch to withhold alimony:

— The claimant with the application and the original writ of execution.

— The insured, on behalf of the claimant, with the original writ of execution on the foreclosure of wages and other income of the debtor and the claimant’s application, which must include the details for the transfer.

— Bailiff by sending a decree on foreclosure along with a copy of the enforcement document certified by him.

The debtor's application is required only if the submitted enforcement documents do not allow him to be clearly identified.

Documents on the basis of which alimony is withheld

In accordance with Part 1 of Art. 12 of Law No. 229-FZ, the executive documents are:

— Writs of execution issued by courts of general jurisdiction and arbitration courts on the basis of judicial acts adopted by them;

— Court orders;

— Notarized agreements on the payment of alimony or their notarized copies;

— Decrees of the bailiff.

Subparagraph “c” of paragraph 2 of the List of types of wages and other income from which alimony for minor children is withheld, approved by Decree of the Government of the Russian Federation dated July 18, 1996 No. 841, establishes that alimony is withheld from temporary disability benefits only by court decision and a court order for the collection of alimony or a notarized agreement on the payment of alimony.

In case of loss of the original of the writ of execution, the basis for execution is its duplicate, issued in the prescribed manner by the court, other body or official who adopted the relevant act

Where will sick leave certificates be stored from 01/01/2021, at the enterprise or in the Federal Social Insurance Fund of the Russian Federation?

Applications and documents sent to the territorial body of the Fund for the appointment and payment of relevant types of benefits are returned to the policyholder, who stores them in the manner and within the time limits established by the legislation of the Russian Federation.

How to calculate benefits according to payroll?

Temporary disability benefits for the first 3 days of temporary disability are assigned and paid by the policyholder at his own expense, and for the remaining period, starting from the 4th day of temporary disability, by the territorial body of the Fund at the expense of the Fund’s budget.

Consequently, only the amount of temporary disability benefits accrued at the expense of the employer is included in the payroll payroll.

More detailed information can be obtained on the website kubanfss.ru, as well as by calling the hotline 8(861) 214-34-11.

Additionally, we inform you that the organization has a personal manager for the transition to direct payments – Tatyana Georgievna Fedorova, tel. 76-30-52.

What's new on maternity benefits

The basis for payment of maternity benefits is also a closed electronic sick leave certificate.

The scheme is like this:

- The medical institution places a closed sick leave certificate in the Social Insurance system. It will be immediately closed for all 140 days.

- The FSS receives information about sick leave.

- The FSS sends pre-filled information to the employer.

- An employee applies for maternity leave. The declarative procedure is maintained here.

- After the vacation is issued, the employer sends the completed information with the order number, vacation dates, etc. That is, in this case, the data is sent after receiving the vacation application.

- If necessary, the fund requests additional data to calculate benefits.

- The accountant must submit the requested data within three working days.

What's new in a lump sum benefit for the birth of a child?

Employees will no longer need to submit either applications or other documents (for example, a birth certificate for a child). The fund will receive basic data through interdepartmental cooperation.

The scheme is like this:

- The FSS learns about the birth of a child by a message from the registry office.

- The FSS makes a request to the Pension Fund about the employment of the insured employee.

- The FSS checks the assignment/non-appointment of benefits through the social security information system. If the benefit has already been assigned, the procedure is considered completed.

- If the benefit is not assigned, the FSS sends pre-filled information.

- If necessary, the fund can request data from the employer based on the regional coefficient to calculate benefits. No other information is requested.

- The accountant undertakes to send the requested information within two working days from the date of receipt of the request.

What has changed regarding the monthly child care benefit?

The scheme is like this:

- The employee submits an application for parental leave and benefits. The declarative procedure is maintained here.

- The employer sends the “Information for the assignment of benefits” form to the fund within three working days.

- The fund calculates, assigns and pays benefits. If an employee returns to full-time work early, he will lose the right to a monthly care allowance. Then the employer undertakes to notify the fund within three working days, and the payment will stop.

Now certain types of benefits will be transferred by the Social Insurance Fund directly to insured persons to their personal accounts opened with credit institutions or by postal order to the address specified by the recipient. These are the following types of benefits:

– due to temporary disability,

– for pregnancy and childbirth,

– one-time benefits for women registered in medical institutions in the early stages of pregnancy,

– one-time benefit for the birth of a child,

– monthly child care allowance until the child reaches the age of 1.5 years,

– payment for additional leave for the period of sanatorium-resort treatment provided to a person in the form of rehabilitation in connection with an industrial accident or occupational disease (in addition to the annual paid leave established by the legislation of the Russian Federation) for the entire period of treatment and travel to the place of treatment and back.

To receive funds on a bank card, you will need to clarify the personal accounts of these cards with the appropriate bank to indicate them in the application.

What employees and employers need to know

- The application for payment of benefits, as well as the documents necessary for the assignment of benefits, the employee, as before, will submit at his place of work. In the application, he must indicate the details to which benefits will be transferred: a personal bank account or postal address.

- The employer, within 5 calendar days from the date the employee signs the application, is obliged to transfer a set of documents with an inventory or a register of information in electronic form for the assignment of benefits to the regional office of the Social Insurance Fund.

- The Social Insurance Fund, within 10 calendar days from the date of receipt of the documents, makes a decision on the assignment and payment of benefits and transfers funds according to the details specified in the employee’s application.

- Payment for the first three days of temporary disability, as well as 4 additional days for caring for disabled children and social benefits for funerals, as before, is made by the employer at his own expense.

- The Social Insurance Fund transfers funds to the current accounts of employers to reimburse expenses for: payment for 4 additional days off to care for a disabled child, social benefits for funerals, temporary disability benefits through interbudgetary transfers, financing of preventive measures to reduce industrial injuries.

The policyholder provides the regional office with documents confirming the right to receive compensation and an application in the form approved by order of the Federal Insurance Service of the Russian Federation.

About preparatory activities

To ensure timely provision of state social insurance benefits to insured citizens, employers need to carry out the following preparatory measures:

1) bring to the attention of employees the new procedure for the payment of social insurance benefits,

2) inform employees about the need to open a personal bank account and provide accurate information about the place of registration and place of residence, indicating the postal code,

3) collect applications in advance in the form approved by the order of the Social Insurance Fund from employees who are on parental leave until they reach the age of 1.5 years and receive the corresponding benefit.

PILOT PROJECT “Direct payments” in the Smolensk region

From January 1, 2022, the scheme for paying compulsory social insurance benefits is changing in the Smolensk region. Most of the benefits will be calculated not by the enterprise’s accounting department, but by the Smolensk regional branch of the Social Insurance Fund of the Russian Federation and paid to working citizens directly to a personal bank account or by mail.

The system for paying insurance contributions to the Social Insurance Fund will change for all enterprises and organizations - the offset mechanism for paying contributions will be abolished. According to the new scheme, accrued insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity to the Federal Tax Service, as well as for compulsory social insurance against industrial accidents and occupational diseases, are transferred in full to the Social Insurance Fund.

Consultation on the new procedure for paying benefits can be obtained by calling 8(48135) 3-44-32, 3-55-86, 3-44-50, 3-21-66, 3-45-26.

Follow the news on the website of the Smolensk regional branch of the FSS of the Russian Federation: r67.fss.ru.

Branch No. 5 of the Smolensk regional branch of the Social Insurance Fund of the Russian Federation

What hasn't changed for employers

As in previous years, employers continue to pay:

- the first three days of sick leave;

— four additional days of leave to care for a disabled child;

- funeral benefits.

The costs of these payments are not counted towards the payment of insurance premiums. The Fund reimburses them to the policyholder's bank account.

Ready-made solutions from SPS ConsultantPlus will tell you how to act in a specific situation: step-by-step instructions, sample documents, links to legal acts.