What information does the certificate of fulfillment of the obligation to pay taxes contain?

This certificate will reflect the presence or absence of debts in principle, as of a certain date. Such a certificate is generated for taxes, fees, and penalties, fines and interest, without a detailed breakdown (that’s why it is commonly called a certificate of no tax arrears). If there is any debt(s) to the budget, this will be reflected in the certificate, with the addition of the inspection code(s) in which these debts “hang.”

It is possible that these certificates will not reflect reality. In case of disagreement, you should initiate a reconciliation of calculations with the budget in order to identify discrepancies, state your claims in the act, indicate your accounting data, etc.

Certificate of fulfillment of the obligation to pay taxes

In the Online Sprinter , reconciliation with the Federal Tax Service is included in the basic set of services. And when switching from another operator, there is a 50% discount right now.

Certificates on taxes and duties: which one to choose

When talking about a tax certificate, we usually mean:

- certificate of fulfillment of the obligation to pay taxes;

- or a certificate about the status of settlements with the budget.

Both are issued by the tax office at the request of the taxpayer-organization. Certificates of absence of tax debts for individual entrepreneurs and ordinary “physicists” are also issued.

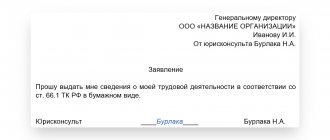

To obtain a certificate on paper, you must submit an application to the inspectorate. You can compose it in free form, or in the form recommended by the Federal Tax Service (it can be downloaded here), or on this form.

An example of a written request for a certificate is given in the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

This application is the same for both certificates; you can select the one that is required by ticking it. Or you can order both at once. And by the way, this is the best thing to do. We'll explain why next.

In the application you need to indicate the date you need the certificate, as well as how you want to receive it: in person at the tax office or by mail. You can submit your application directly to the Federal Tax Service. Or you can scan it and send it through an EDF operator. In the information message to which you will attach the scan, be sure to indicate that you need a certificate on paper.

If a paper document with a blue seal from the Federal Tax Service is not important to you, get an electronic version (it will be certified by an electronic signature from the Federal Tax Service). In this case, you do not need to fill out an application, just send an electronic request through your operator.

If you have a personal account on the Federal Tax Service website, you can order a certificate there. You will receive a paper document with the necessary signatures and seal (you can choose the delivery method - in person or by mail). Tax authorities will also duplicate it electronically and upload it to the service.

Read more here.

Now see how to choose the right type of tax certificate.

How to obtain such a certificate?

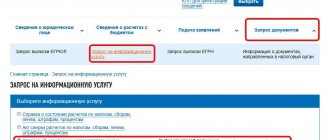

The main three options for requesting such certificates are: visiting the INFS with a paper application, sending a request through the personal account of a taxpayer - a legal entity or individual entrepreneur, sending an application via TKS.

The final choice depends on whether you need it in traditional paper or digital form. So, if you need to get good old paper, it’s enough to draw up an application on paper in the form KND 1114237 and submit it to your Federal Tax Service (at the place of registration).

You can also ask to submit a “paper” certificate by filling out an electronic application through the taxpayer’s personal account - a workable option, except for the fact that this service does not always demonstrate stability and speed of response.

Well, to receive an electronic certificate as soon as possible, you should choose the option of sending a request via TKS - it is much faster and more reliable.

OPTION 4: Certificate KND 1120101 - through the tax website.

The next available option for obtaining a certificate of no debt is to make a request through the tax office website.

To do this, you will need to register in the personal account of a legal entity on the Federal Tax Service website.

- Disadvantages of this method:

- To send a request through your personal account, you will need an electronic signature and a Crypto Pro license. The cost today ranges from 3000-5000 rubles.

- The received certificate KND 1120101 will be on paper, which will not allow the use of this certificate in the interface of some trading platforms.

What to indicate in the application KND 1114237

The application must contain the full name and TIN of the applicant. It would also be useful to indicate the date on which you want to record the absence of debts (if you do not indicate it, the Federal Tax Service will issue a certificate about the status of settlements as of the date of registration of the application). It is also worth indicating the code for the method of issue (receipt) - if it is not specified, the tax authorities will send the document by mail (if you use TKS, the field “Method of issuing a certificate” is not filled in).

With the help of Taxcom, you can order a certificate of fulfillment of the obligation to pay taxes in a matter of seconds. Errors in filling out the form are excluded.

To submit a paper certificate, you will need free legs, several hours and a second copy (to affix the admission stamp). The certificate must be issued (sent by mail, received electronically) within 10 working days , counting from the date of receipt of the application (request).

Order of the Federal Tax Service of the Russian Federation dated January 20, 2017 No. ММВ-7-8/ [email protected]

1. A certificate confirming the fulfillment by a taxpayer (fee payer, insurance premium payer, tax agent) of the obligation to pay taxes, fees, insurance premiums, penalties, fines, interest (hereinafter referred to as the Certificate) is generated using the tax authority’s software according to the information resources of the tax authority and contains information about the fulfillment of the obligation to pay taxes, fees, insurance premiums, penalties, fines, interest by the applicant - taxpayer (payer of the fee, payer of insurance premiums, tax agent), including in connection with the fulfillment of the obligation of a responsible participant in a consolidated group of taxpayers (hereinafter – KGN).

2. The certificate is generated on the date specified in the applicant’s request.

If the applicant's request does not indicate the date as of which the certificate is generated, or the request specifies a future date, the certificate is generated on the date of registration of this request with the tax authority.

3. When generating the Certificate, the entry “does not have an unfulfilled obligation to pay taxes, fees, insurance premiums, penalties, fines, interest payable in accordance with the legislation of the Russian Federation on taxes and fees” is made in the event of absence according to the tax authority as of the date on which the Certificate is generated, arrears, debts on insurance premiums, penalties, fines, interest, with the exception of the amounts:

1) for which a deferment (installment plan) or investment tax credit has been granted in accordance with the legislation of the Russian Federation on taxes and fees;

2) which are restructured in accordance with the legislation of the Russian Federation;

3) for which there is a court decision that has entered into legal force recognizing the applicant’s obligation to pay these amounts as fulfilled.

4. If, on the date as of which the Certificate is generated, there are arrears, debts on penalties, fines, interest, with the exception of the amounts specified in subparagraphs 1 - 3 of paragraph 3 of this Procedure, according to at least one tax authority, an entry is made “ has an unfulfilled obligation to pay taxes, fees, insurance premiums, penalties, fines, interest payable in accordance with the legislation on taxes and fees.”

In this case, the appendix to the Certificate indicates the code of the tax authority, according to which the applicant has an unfulfilled obligation.

5. When generating the Certificate, the entry “does not have an unfulfilled obligation to pay taxes, fees, insurance premiums, penalties, fines, interest payable in accordance with the legislation of the Russian Federation on taxes and fees” is reflected only upon receipt of information about the absence of arrears, debts on penalties, fines, interest from all tax authorities with which the applicant is registered on the grounds provided for by the Tax Code of the Russian Federation.

6. For applicants who are participants in the CTG, the entry “has an unfulfilled obligation to pay taxes, fees, insurance premiums, penalties, interest for the use of budget funds, fines payable in accordance with the legislation on taxes and fees of the Russian Federation” is also made if there is unfulfilled obligation to pay corporate income tax under the consolidated tax group, while the appendix to the certificate indicates the code of the tax authority with which the responsible participant in the consolidated group tax is registered.

7. The certificate on paper is signed by the head (deputy head) of the tax authority and certified by a seal.

8. The certificate is generated in electronic form and is signed with an enhanced qualified electronic signature, which allows identifying the issuing tax authority (the owner of the qualified certificate).

Why do you need a certificate about the status of settlements with the budget?

Unlike the one described above, such a certificate is ordered, as a rule, for internal use - for example, to reconcile balances with the budget. However, it is also suitable for external users who want to verify the integrity of the company or individual entrepreneur. In addition, it can replace a certificate of no debt when participating in tenders. This certificate reflects the specific amounts of debt or overpayments for mandatory payments, insurance premiums, fines and penalties on a specific date.

Certificate on the status of settlements with the budget

Certificate of presence (absence) of tax debt: where and how to get it

To obtain information about the fulfillment of taxpayer obligations, you must contact the Federal Tax Service. The document can be obtained from the tax office:

- in paper form with the seal and signature of the head of the Federal Tax Service;

- in electronic form with the digital signature of the head of the Federal Tax Service.

The form does not contain specific debt figures. If there is no debt, then a certificate of no debt will be received from the Federal Tax Service. If there is a debt, then a corresponding entry will be made in the form, and the Appendix will indicate the codes of the inspections with which the taxpayer has a debt.

If you receive information about the existence of a debt to the budget, you do not agree with this, you should check with the Federal Tax Service to detect and correct the error.

How to get a certificate about the status of settlements with the budget?

Such a certificate can also be obtained in both traditional and digital form, in the manner described above, by filling out a request using the KND form 1160080. However, you must keep in mind the following. If your company is registered with several Federal Tax Service Inspectors, then upon receipt of the request, each tax office will provide data on those mandatory payments that it controls. To receive a certificate with information on all inspections, you must:

- make a request electronically;

- enter “0000” in the “IFTS code” column;

- Leave the “Checkpoint” field blank.

If you have separate divisions registered with the same Federal Tax Service, then in order to receive a certificate of the status of settlements taking into account the divisions, you must indicate the inspection code, leaving the “Checkpoint” field blank.

KND 1120101: what kind of certificate

In order to confirm the absence or presence of debt to the budget or to verify balances, there are several documents (Article 32 of the Tax Code of the Russian Federation):

- information on the status of settlements (KND 116080 and 116081);

- information on the fulfillment of the taxpayer’s obligation (form KND 1120101);

- reconciliation report on taxes and fees (KND 116070).

All these documents can currently be obtained in both paper and electronic forms.

Today we will dwell in more detail on what constitutes a certificate of tax arrears in the KND form 1120101. The document form was approved by Order of the Federal Tax Service dated January 20, 2017 No. ММВ-7-8/ [email protected]

KND 1120101 (form)

When can I receive a certificate about the status of settlements with the budget?

Having received an electronic or paper request, tax authorities must issue this certificate within no more than 5 working days. It is possible that, having received the certificate, you will be surprised by its contents; it is often difficult to understand where all these debts and (less often) overpayments came from.

An extract of transactions for settlements with the budget, which can be requested through your personal account or via TCS, will help resolve doubts.

Attention ! Statements of budget settlement transactions can only be requested in digital form! the benefits of electronic document management with the Federal Tax Service right now .

Only a statement of transactions will help clarify the history of transactions for a specific period. If the extract does not eliminate questions and doubts, a joint reconciliation of calculations will help.

Finally, we note that if you need to confirm the absence of debts right now, you can simultaneously order a certificate about the fulfillment of the obligation and the status of settlements with the Federal Tax Service. If the existing debt is small, the payment slip attached to the certificates will confirm your cleanliness before the budget in the eyes of your counterparties.

How to obtain a certificate KND 1120101 on electronic media?

When submitting an application to participate in an open competition or auction, you must provide a certificate of the taxpayer’s fulfillment of the obligation to pay taxes KND 1120101. The certificate is provided in electronic form, signed with a qualified electronic signature of the Federal Tax Service of Russia.

The easiest way to obtain a Certificate of compliance by the taxpayer with the obligation to pay taxes (KND 1120101) is by using an (ION) request.

(ION) is a service that allows you to create a request to the tax authority to receive certificates, acts and other documents. Stands for: Taxpayer Information Service.

Features of receiving in paper form

In order for the tax office to issue a paper tax certificate, you must fill out an application. In your application please indicate:

- organization data: name, address, TIN;

- the date on which the document is drawn up;

- method of receipt: in person or by mail;

- manager's signature.

A written request to fill out a form with the KND code 1120101 is submitted in person to the inspectorate, sent by mail or through the taxpayer’s personal account.

The application form is not strictly regulated. It consists of:

- in any form;

- on the form recommended by Federal Tax Service Order No. GD-4-19/ dated November 28, 2019;

- according to the form recommended by Appendix 8 of Order No. 99n of the Federal Tax Service dated 07/02/2012.

Features of receiving electronically

To receive an electronic document, make a request through your telecom operator or, in short, TKS. The electronic request will be generated using the KND form 166101 (approved by Order of the Federal Tax Service No. ММВ-7-6/ dated 06/13/2013). The procedure for drawing up an application is similar to an application on paper. The digital signature of the manager is signed and sent through the TKS operator to the tax office at the place of registration.

In response, the Federal Tax Service will send you a Federal Tax Service certificate confirming the absence of debt within the established ten-day period. The answer will arrive via telecommunication channels. The inspectorate responds to an electronic request faster than a paper one. Consequently, the taxpayer will be able to satisfy the counterparty’s request for confirmation of good faith more quickly.