As it was before

Until 2022, all insurers were required to issue all their employees with a copy of the reports submitted for them in the SZV-M form. Organizations and individual entrepreneurs were obliged to do this by paragraph 4 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.” It said that a copy of the SZV-M had to be given to employees within the deadline established for submitting the SZV-M. That is, employers were required to issue copies no later than the 10th day of the month following the reporting month.

In addition, previously some additional deadlines for issuing copies were previously provided for in certain cases (clause 4 of article 11 of the Federal Law of 01.04.96 No. 27-FZ):

- performers (contractors) - it was necessary to issue a copy of the SZV-M on the day of termination of the civil contract;

- for those who quit – on the day of dismissal;

- for those who retire - within 10 calendar days from the date when the employee submits an application that he requires documents to be submitted to the Pension Fund.

Is it necessary to issue SZV-M if an employee quits his job?

All employers (organizations and individual entrepreneurs) are required to submit a monthly report to the regional pension fund in the SZV-M form “Information about insured persons.”

This report records all citizens with whom official employment contracts or GPC agreements have been concluded. Authorities say the report helps track working retirees. Starting from the report for May 2022, a new form SZV-M is in effect (approved by Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p). You can download it on our website, and you can read more about the changes in it here.

In addition to submitting the SZV-M to the Pension Fund, it must be handed over to the employee.

IMPORTANT! Law No. 27-FZ states that the SZV-M certificate must be issued upon dismissal of employees, when insured persons submit an application upon retirement, and also monthly along with the submission of a report to the regulatory authority.

In this case, you need to obtain written confirmation from the insured person that the document was actually transferred to him.

What were the difficulties?

The obligation to issue copies of SZV-M to employees and contractors caused many complaints among accountants. They were connected with the fact that many issues were simply not regulated by law, for example:

- it was not said which month a copy of the SZV-M should be given to resigning employees;

- it was not specified in what form exactly copies of the SZV-M should be given to employees (considering that they contain personal data of other employees);

- it did not explain how to confirm that employees had received copies. Do I need to take receipts with it?

We discussed these issues in detail in the article “Copy of SZV-M to employees and contractors: to issue or not?”

At the same time, we note that until 2022 there was no liability for failure to issue copies of SZV-M to employees. In this regard, many policyholders simply ignored the requirement to provide employees with copies of the SZV-M.

Now we’ll tell you what to do regarding issuing copies of SZV-M upon dismissal in 2022.

SZV-M – what kind of report is this?

SZV-M is one of the simplest reports.

Every employer, regardless of the size and form of its organization, is obliged to submit it monthly to the territorial body of the Pension Fund of Russia. But there are also exceptions. The following types of employers do not fill out the form:

- peasant and farm enterprises operating without hired employees;

- private practitioners (lawyers, notaries, accountants) paying fixed insurance premiums only for themselves;

- employers in relation to foreigners staying in the Russian Federation temporarily and not falling under the law on compulsory pension insurance;

- employers in relation to employees of the Ministry of Internal Affairs, the FSB and military personnel (if they are not registered as civilian employees) - special state guarantees apply to these categories of workers.

The report contains data for each employee of the enterprise:

- FULL NAME.;

- SNILS number;

- TIN.

you can do it for free by clicking on the image below

The main goal of SZV-M for the Pension Fund is to track working pensioners, since special conditions for the calculation and indexation of pensions apply to this category of persons. But nevertheless, information is provided for all employees of the enterprise, and not just for employees of retirement age. Among others, the act includes persons working under GPC agreements and founders, even if no agreements have been concluded with them.

SZV-M includes information about employees with whom relations were established in the reporting month. Moreover, the duration of their work activity in this period does not matter. Even if a person leaves on February 1, he must receive SZV-M upon dismissal for February and is included in the general February report.

The document submission format depends on the size of the organization’s staff. If the number of workers exceeds 25 people, the report is submitted only in electronic form. Employers with fewer than 25 employees have the right to choose to send SZV-M in paper or digital form.

Copies of SZV-M: what to do in 2022

The legislation was amended to paragraph 4 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ, which regulated the issue of issuing copies of SZV-M to employees. Let us explain the procedure for issuing copies of SZV-M to employees in 2022.

Copy of SZV-M upon request

In 2022, an organization or individual entrepreneur (policyholder) is obliged to issue to the insured persons copies of the SZV-M handed over for them no later than five calendar days from the date of its application. Thus, in 2022, policyholders are required to issue copies of SZV-M solely at the request of employees or contractors. There is no need to issue copies of monthly reports based on the results of each month.

But in what form should the request come from an employee or contractor? The law says nothing on this matter. In our opinion, in 2022 the employer can issue copies of SZV-M upon oral request to employees. However, in this case, it is not entirely clear how to ensure that the employer complies with the issuance deadlines?

To protect yourself, it may make sense to ask employees (contractors) for written applications to provide them with copies of SZV-M reports. Of course, there is no form for such an appeal. Its employees have the right to draw it up in any form. A sample employee appeal, in our opinion, may look like this:

Having received such a request, the policyholder will be obliged to provide the employee or contractor with a copy of the required SZV-M report no later than five calendar days from the date of the request. Accordingly, if the employee applied on January 18, 2022, then a copy must be issued no later than January 22, 2022.

An employee has the right to submit an application for a copy of SZV-M in 2022 at any time. And he is not obliged to explain why he needed such a copy.

Copies of SZV-M upon dismissal and for contractors

The provisions of paragraph 4 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ, in force in 2022, provide that the policyholder is obliged to issue copies of the SZV-M:

- on the day of dismissal of the employee;

- on the day of termination of a civil contract for which insurance premiums are calculated.

Note that in 2022, in paragraph 4 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ, there is no provision that employers are required to issue a copy of the SZV-M to employees retiring.

In 2022, copies of SZV-M must be issued on the day of dismissal or termination of a civil contract. No applications from employees or contractors are required for this.

Are dismissed employees included in SZV-M?

When handing out a copy to the person being dismissed

This form is personalized, that is, upon termination of the employment relationship, the document is issued to the person leaving personally. There is no need to include other people here, because this information is considered personal data and is protected by law.

In addition, in accordance with the law, the employer must not only issue this document, but also obtain documentary evidence that the SZV-M was issued to the person.

How to issue copies: procedure

Unfortunately, no innovations that would more clearly explain how exactly to issue copies of SZV-M to employees in 2022 have appeared in the legislation. In this regard, we consider it appropriate to remind you that an exact copy of the SZV-M with data on all employees of a company or individual entrepreneur cannot be issued to anyone. The fact is that the reports contain personal data (full name, SNILS and INN). This information is considered secret, which the policyholder has no right to disclose to other employees. This follows from Article 7 of the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data”.

In order not to violate anything, employees can be given extracts from the submitted reports, which will relate directly to the insured persons themselves. Such statements, as a rule, allow you to create many accounting programs necessary for submitting electronic reporting. Here is a sample extract from SZV-M, which can be issued to employees as copies of the report:

Extract form from SZV-M upon dismissal in 2020.

The extract is a full-fledged form of SZV-M for the required period (form approved by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p). Its only difference from the report submitted to the Pension Fund is that the list contains information only about the resigning employee. The form is signed by the manager or authorized person of the employer. If available, a stamp is placed. The document is dated to the last day of the contract with the employee. This is followed by the issuance of an extract from the SZV-M to the employee upon dismissal. A sample of filling out a document for an employee dismissed on September 18, 2020 is shown below:

For the extract, the date of sending the report to the Pension Fund does not matter, since the document is generated on the last working day of the resigning employee. And, conversely, the day of calculation and receipt of SZV-M by an employee does not affect the date of submission of reports to the Pension Fund.

Delivery confirmation

To confirm that the accounting department has issued the SZV-M form to an employee, it makes sense to take appropriate confirmation from the individual. Such a document can be drawn up in any form.

SAMPLE CONFIRMATION OF ISSUANCE OF FORM SZV-M TO AN EMPLOYEE

Also in 2022, there are other possible options for obtaining confirmation of receipt of copies, namely:

- the employee’s signature on the second copy of the SZV-M copy;

- maintaining a log of issuing copies of SZV-M.

Read more about this in the article: “Copy of SZV-M to employees and contractors: to issue or not?”

Documents on request

If there is an application from the dismissed employee, it is necessary to give him the remaining documents.

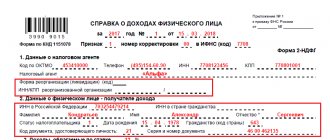

Certificate of income

According to paragraph 3 of Art. 230 of the Tax Code of the Russian Federation, starting from income received in the first quarter of 2022, this certificate must be drawn up in accordance with the form available in Appendix No. 4 to the order of the Federal Tax Service dated 10.15.20 No. ED-7-11 / [email protected] Whereas for income for 2022 - 2022, the form from Appendix No. 5 to the order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11 / [email protected] . Both certificates do not need to indicate the position of the person who endorsed the paper, as well as in the seal. For details, see “Instructions for filling out an income certificate for an individual.”

Help for the employment service

The official name of this document is “Certificate of average earnings for the last three months at the last place of work (service) for registration as an individual.” For example, when it is compiled according to form No. T-8, approved by Decree of the State Statistics Committee dated 01/05/04 No. 1.

If several employees are dismissed under one order (for example, form No. T-8a is used), then the extract can be issued in any form. The extract must contain information about the date, order number, information about the employee, full name, position, department), reason and date of dismissal. In addition, there must be information regarding the person who signed the order (position and full name).

Note-calculation

According to form No. T-61, the note must contain data on unused and used vacations at the time of dismissal, and in addition, the calculation of the corresponding payments.

Other documents

In addition, if there is an application from the dismissed person, copies of all other documents related to work (providing leaves, punishments and rewards, transfers, hiring orders, etc.) should be submitted.

Attention! We should not forget that all the documents mentioned in this part should be given to the employee only after his request. At the same time, it must be taken into account that this requirement needs to be formalized in writing (Articles 62 and 80 of the Labor Code of the Russian Federation). At the same time, a certificate of income must be issued upon oral application (clause 3 of Article 230 of the Tax Code of the Russian Federation). As a result, this certificate is usually received upon dismissal among the mandatory documents discussed in the first part.

An employee resigns: employer actions

Surely, most of us wanted to find a stable job, preferably with the opportunity for career growth, and calmly conduct our working life. Unfortunately, in the current environment this is rare. Sometimes an employee quits even from a good job, where everything seems to be satisfactory. Just at one fine moment the thought comes that we need to move on and change something. As they say, fish look for something deeper, but people look for something better.

There is nothing extraordinary about an employee leaving. Let's consider dismissal in stages:

- In most cases, the employee writes a letter of resignation of his own free will.

- After the director has signed such a statement, a two-week period begins when the organization is looking for a new employee for the vacated position, and the employee himself finishes his current affairs. If there is already a candidate for the position, the resigning employee transfers all matters to him. It is worth noting here that an employee can withdraw his resignation if certain conditions are met.

- The enterprise's personnel service and accounting department prepare a package of documents on the eve of the employee's dismissal. The dismissal order is printed, certificates are generated, the last entries are made in the employee’s personal card, the work book is filled out, and documents for payment of funds are prepared.

- The day of dismissal has arrived, the last day of work at this enterprise. The employee did not change his decision and did not withdraw the application. The most important task that an employee will have to do on this day is signing personnel documents related to dismissal and receiving a package of documents in hand.

On the day of dismissal, the employee receives all payments due. In addition to wages for a month worked, this may be compensation for unused vacation or other payments provided by the enterprise.

In addition, the employee receives a whole package of documents that will be useful to him at his next job. These include:

- Help 2NDFL. Every employee needs it and confirms the amount of income received during the last year of work at the enterprise. Information from the certificate helps when calculating wages at a new place of work.

- Certificate of income of the employee for 2 years before dismissal. It will be useful when calculating sick leave.

- Extract from the SZV report – EXPERIENCE. This is an innovation of the Pension Fund. The report reflects periods of work in the organization.

- A copy of the SZV-M form. It is needed to confirm the employee’s length of service.

- Employment history.

It doesn’t matter for what reason an employee is fired, the list of basic documents for handing out does not change.

Let us reflect in the table the main articles according to which the dismissal of employees may occur.

| Type of dismissal | Article of the labor code |

| Dismissal at your own request | clause 1 part 3 article 77 |

| Dismissal by agreement of the parties | Article 78 |

| Dismissal due to staff reduction | Article 180 |

| Other reasons | An article is selected depending on the reason for dismissal |

What sanctions are applied to the organization if they “forgot” to include an employee in the SZV-M report?

Sometimes, for some reason, the employee responsible for forming the SZV-M may not include information about the employee. Usually the report is sent to the Pension Fund, where it is successfully accepted and this is where the story ends for the time being. But then there comes a moment when this “unaccounted for” employee pops up and the accountant feverishly sends a report to the fund with the “additional” information type.

So, if, before sending the “supplementing” form, the Pension Fund has not identified an error in the initial report, then no sanctions will be imposed on the organization.

If the Pension Fund finds a discrepancy before the organization’s accountant, a fine will be imposed.

When working with any form of reporting, you must be especially careful and be very attentive, then problems will not arise.