Why is debt written off?

The company's assets and liabilities are reflected in accounting and reporting if they provide useful, timely and truthful information about the financial condition of the business entity. Recognition of debts as impossible to collect obliges the organization to exclude information about them from the accounting data. It is no longer possible to collect debts from debtors, therefore, funds will never reach the company’s account. After the expiration of the statute of limitations for writing off accounts payable, creditors have no right to make claims, and the company is not obliged to satisfy them.

How to draw up an accounts receivable statement

There is no legally established form for such a document, so it is developed based on the rules for drawing up such documents. You can draw up the act by hand on A4 sheet, but for greater readability it is recommended to use a typewritten version.

In the header you need to indicate the following information:

- full and short name of the company, its address, tax identification number, checkpoint;

- name of the paper (act of writing off accounts receivable);

- place of registration of the act;

- date of execution of the act.

The main part contains the following information:

- On the basis of what paper and when was the inventory of settlements with suppliers, customers, etc. made?

- On what date was the inventory taken?

- List of organizations for which the DZ has been established. This item is presented in the form of a table. It may contain the following columns: name of the debtor, details of the agreement with him, date of payment under the agreement, amount of debt, papers that are the basis for writing off debts. At the end of the table, the total amount of debt is calculated.

- That the amount received is subject to write-off and is included in non-operating expenses for income tax. It is necessary to refer to the norms of the law: clause 77 of the Regulations, approved by order of the Ministry of Finance of July 29, 1998 No. 34n and sub. 2 p. 2 art. 265 Tax Code of the Russian Federation.

Next, the chief accountant or another employee assigned this responsibility puts his signature. Draw up the document in one copy.

Attention! Instead of an act, a similar document with a different name can be drawn up: protocol, decision.

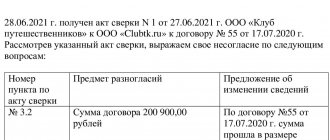

The document must also be accompanied by supporting documents. These may be court decisions, reconciliation acts, primary documents and payment documents. They must be with the organization to confirm the impossibility of a refund.

When can you write off a debt?

Liabilities are subject to write-off if:

- the statute of limitations has expired;

- a bailiff issued a resolution to terminate enforcement proceedings due to the impossibility of debt collection;

- the debtor or creditor is liquidated.

The statute of limitations is the period during which a creditor has the right to go to court to collect a debt. Article 196 of the Civil Code of the Russian Federation sets it equal to three years. The debt is subject to write-off in the reporting period in which the statute of limitations expires.

Has the statute of limitations expired?

These ConsultantPlus instructions will help you write off accounts payable:

- in accounting;

- in tax accounting.

ConsultantPlus experts also told us what to do with expired debts.

to read.

If one of the parties is liquidated, the obligations are written off in the period in which the liquidation or exclusion of the inactive organization from the Unified State Register of Legal Entities by the tax authority occurred.

IMPORTANT!

Special rules have been established for writing off taxes with an expired statute of limitations. An operating organization does not have the right to write off tax debts in accounting even after the expiration of the period of possible collection. Such an action must be coordinated with the tax authorities. In fact, for an organization there is only one opportunity to recognize tax debts as impossible to collect - to obtain a judicial act reflecting the fact that the deadline for collection has expired (clause 9 of the resolution of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013).

A certificate that will simplify the write-off of uncollectible accounts receivable

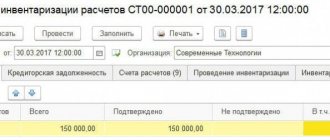

Before writing off receivables for which the statute of limitations has expired, it is necessary to conduct an inventory and draw up three documents: an inventory report, a written justification and an order from the manager. It is impossible to neglect any of these documents - their presence is mandatory in accordance with paragraph 77 of the Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

With the inventory act and the manager’s order, everything is more or less clear.

The first document is drawn up according to the unified form No. INV? 17 (approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88). The order can be of arbitrary content; it is enough to indicate which debt is subject to write-off and on what basis. And such a basis, along with the act, is precisely the written justification for the write-off. Who should draw up this document and how is not stated anywhere. Nevertheless, it is mandatory and without it, tax authorities are unlikely to allow a company to include bad debt in non-operating expenses (subclause 2, clause 2, article 265, clause 2, article 266 of the Tax Code of the Russian Federation). The Federal Tax Service of Russia informed us that a written justification can be called an accounting certificate or have any other name (see sample). The form is free. But the more detailed it is, the easier it will be to justify the increase in costs to inspectors. So, tax authorities will want to see in the written justification a reference to the agreement (number, date of conclusion, counterparty), payment deadline, expiration date of the limitation period, amount of debt, including VAT (letter of the Federal Tax Service of Russia for Moscow dated 06/05/07 No. 20-12 /052920). And also what measures the company took to collect the debt, although from the point of view of the court they are not at all obligatory (decrees of the federal arbitration courts of the North Caucasus District dated 02.28.07 No. F08-731/07-288A, Northwestern District dated 05.10.07 No. A56-15404/2006, Volga District dated May 17, 2007 No. A55-13109/2006). It is worth pointing out that there are no grounds for interrupting the limitation period, for example, filing a claim or recognizing a debt by a counterparty (Article 203 of the Civil Code of the Russian Federation). Or for suspension, for example, when leaving a claim without consideration (Article 204 of the Civil Code of the Russian Federation).

Let us note that the timely preparation of all three documents will avoid disputes with inspectors regarding the period for writing off hopeless accounts receivable. They demand that it be included in expenses in the tax period in which the statute of limitations has expired (letter of the Ministry of Finance of Russia dated January 11, 2006 No. 03-03-04/1/475). Later, unfortunately, it will only be possible through the courts (decrees of the federal arbitration courts of the Ural District dated 05/13/08 No. F09-3304/08-S3, Volga District Courts dated 05/08/08 No. A12-10217/07).

Limited Liability Company "Sfera" October 3, 2008

ACCOUNTING CERTIFICATE No. 10 on writing off accounts receivable

According to order No. 9-P dated September 19, 2008, Sfera LLC carried out an inventory of settlements with buyers, suppliers, other debtors and creditors (except for settlements with the budget, extra-budgetary funds for taxes and fees) as of October 1, 2008.

During the inventory, the commission discovered that under the supply contract dated 01.02.05 No. 2-05, concluded with ZAO Melisa, the statute of limitations had expired.

The amount of accounts receivable is 5252 rubles (including VAT 801.14 rubles). The final payment deadline was August 1, 2005. On August 2, 2005, Sfera LLC sent a claim demanding repayment of the debt. In its response, Melisa CJSC acknowledged the debt and undertook to repay it no later than August 20, 2005. However, the money was not received by Sfera LLC on time.

The limitation period under agreement No. 2-05 is three years. Due to the fact that Melisa CJSC admitted its debt, the statute of limitations was interrupted. Consequently, it expired on August 20, 2008 (Articles 196, 203 of the Civil Code of the Russian Federation). There are no other grounds for a break or suspension of the limitation period. In connection with the identified circumstances, on the basis of the inventory report dated October 2, 2008 No. 6 and in accordance with Articles 265 and 266 of the Tax Code of the Russian Federation, the specified receivables are subject to write-off.

Chief accountant of Sfera LLC Ivanova (Ivanova)

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

How to apply

The rules for reflecting the write-off of accounts receivable with an expired statute of limitations are set out in paragraphs 77 and 78 of the Regulations on Accounting and Accounting (Order of the Ministry of Finance No. 34n dated July 29, 1998):

- Conduct an inventory and document its results.

- Provide a written justification (decision of the inventory commission) for the discovery of debts that need to be written off.

- Issue an order (instruction) from the manager regarding the write-off.

Write-offs are carried out separately for each obligation.

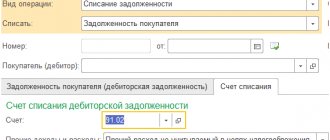

We reflect the write-off of accounts receivable

The recording procedure depends on the availability of a provision for doubtful debts. If it is created, the write-off of receivables with an expired statute of limitations is carried out at its expense. If the reserve was not created, reflect the written-off receivables in other expenses.

| Contents of operation | Debit | Credit |

| Accounts receivable are written off against the provision for doubtful debts | 63 | 60, 62, 76 |

| Receivables are written off as other expenses of the organization | 91-2 | 60, 62, 76 |

If the debtor’s obligations have not been terminated and their collection is possible in the future (the limitation period has expired, but the counterparty has not been liquidated and there is no ruling on the impossibility of collection), reflect the written-off amounts on off-balance sheet account 007. The amounts will be written off from the off-balance sheet account:

- upon liquidation of the debtor;

- when paying off a debt;

- after five years have passed after the amounts are reflected in account 007.

In tax accounting, uncollectible receivables are written off against the reserve for doubtful debts or as non-operating expenses (clause 2, clause 2, article 265 of the Tax Code of the Russian Federation; clause 5, article 266 of the Tax Code of the Russian Federation).

Accounting entries for debt recovery

When funds are received to repay doubtful debts, the amounts are written off from off-balance sheet accounting and taken into account in the corresponding balance sheet accounts for accounting for settlements. The balance sheet records entries that are “reverse” to those entries that were used when writing off receivables from the balance sheet (letter of the Ministry of Finance of Russia dated February 11, 2016 No. 02-07-10/7306).

More on the topic: Information on accounts receivable and payable (f. 0503169, 0503769): how to avoid errors when filling out (Video materials for the annual reporting 2022 - topic 9)

Example. The institution's commission decided to write off doubtful receivables for prepayment for materials from the balance sheet to the off-balance sheet to monitor the possibility of collection. The debtor's property status has changed and funds to repay receivables have been transferred to the personal account.

Decrease in off-balance sheet account 04 – debt is written off from off-balance sheet accounting;

Debit KRB 2,206 34,564 Credit KRB 2,401 20,273 – the debt was accepted onto the balance sheet.