Why do you need a desk inspection report?

Upon completion of any desk audit, the tax authority must draw conclusions about whether the taxpayer has violated tax laws or not.

If facts of violation have been identified, then the inspector must formalize the results of the inspection in the form of a desk inspection report, this is what clause 5 of Art. 88 and para. 2 p. 1 art. 100 Tax Code of the Russian Federation. The functions assigned to the desk tax audit report are as follows:

- It is a document included in the materials of the desk audit. Based on the conclusions set out in it, the head of the inspection or an authorized person makes a decision on whether it is worth holding the taxpayer accountable for the tax offense he has committed or not (Clause 1 of Article 101 of the Tax Code of the Russian Federation).

- And brings to the attention of the taxpayer the preliminary results of the desk audit, on the basis of which, according to clause 6 of Art. 100 of the Tax Code of the Russian Federation, the latter may raise objections.

The timing of a desk audit can be found in the material “The inspection must complete a desk audit within 3 months .

Registration of the results of a desk tax audit in the form of an act

A desk audit often ends without drawing up a final document.

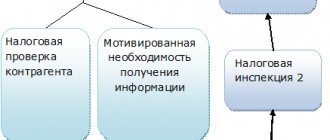

In this case, it should be assumed that there are no deviations from legal norms in the submitted documents. The tax authority draws up a desk tax audit report only if violations are discovered during the audit (clause 5 of Article 88 of the Tax Code of the Russian Federation). Before drawing up a desk tax audit report, if any discrepancies or contradictions are detected in the documents, the tax authority sends a request for explanations, to which the person being audited must respond within 5 days (clause 3 of Article 88 of the Tax Code of the Russian Federation).

According to the legal position of the Constitutional Court, this is not a right, but an obligation of the tax authority (definition of the Constitutional Court of the Russian Federation of July 12, 2006 No. 267-O). The decision on whether to exercise the right to provide explanations and documents remains with the person being inspected. At the same time, their failure to provide any information may become the basis not only for drawing up a report, but also for a subsequent critical assessment of the taxpayer’s argumentation in court (see the resolution of the AS SZO dated 03/02/2016 No. F07-2677/16 in case No. A26-5668/ 2015).

What are the consequences of failure to draw up an audit report by a tax inspector?

The position of the courts is that if the inspector does not draw up a desk audit report, this may serve as a basis for canceling the decision made by the tax authorities based on the results of consideration of the audit materials (such conclusions were made by the FAS Moscow District and the FAS North Caucasus District in resolutions dated September 23, 2009 No. KA-A40/8182-09-2 and dated 11/12/2009 No. A53-5911/2009, respectively).

Thus, if an inspector discovers facts of violation of tax legislation by a taxpayer, a report must be drawn up. Otherwise, the decision of the tax authority, based on the results of the desk audit, will be declared invalid (clause 14 of Article 101 of the Tax Code of the Russian Federation).

When else decisions of tax officials can be declared invalid, read the article “The Inspectorate must ensure the participation of the taxpayer in the consideration of audit materials .

Solution

10 working days after the expiration of this period, the inspection must make a decision. If during the consideration of the inspection materials additional documents are needed, the head of the inspection may extend the period for their consideration by a month.

If additional measures are assigned during the inspection, then a decision on the inspection materials must be made no later than 10 days from the date of their completion (clause 1 of Article 101 of the Tax Code of the Russian Federation). If the taxpayer has objections to the results of additional measures, then he can submit written objections within 10 days from the date of their completion (clause 6.1 of Article 101 of the Tax Code of the Russian Federation).

note

Even if the taxpayer has not filed his objections to the act, the inspectorate must invite the company to review the audit materials. This will give her the opportunity, if necessary, to verbally present her objections to the inspectors’ conclusions (clause 2 of Article 101 of the Tax Code of the Russian Federation). If representatives of the organization were not invited to the meeting, this may become grounds for canceling the decision.

The payer who has been subject to a tax audit can familiarize himself with the audit decision and tax control materials. Such documents are allowed to be inspected, copies taken from them or extracts made (clause 2 of Article 101 of the Tax Code of the Russian Federation).

A decision to hold a taxpayer accountable for committing a tax offense must contain the circumstances of the tax offense committed, how they were established during the tax audit, references to documents and other information confirming what is stated in the decision, as well as circumstances aggravating the taxpayer’s liability.

The decision must indicate the articles of the Tax Code that provide for penalties for tax offenses committed and the penalties applied to the taxpayer, as well as proposals for the payment of sanctions, tax arrears, and penalties accrued on the date of the decision for late payment of taxes.

The decision must be served within five days from the date of issuance. It will not come into force immediately, but when one month has passed from the date of its delivery to the organization.

This time can be used to appeal the inspector’s decision to a higher tax authority (clause 9 of Article 101 of the Tax Code of the Russian Federation). The department will consider the complaint within a month from the date of receipt. It may cancel the inspector's decision or approve it in whole or in part. The tax inspection decision will come into force only after a “superior” verdict has been issued.

What requirements must be met when drawing up an inspection report?

When drawing up an act, tax authorities must be guided by the Tax Code (clause 4 of Article 100), the regulations on the Federal Tax Service, approved by Decree of the Government of the Russian Federation dated September 30, 2004 No. 506 (clause 1), and the requirements for drawing up a tax audit report set out in Appendix 24 to the order of the Federal Tax Service of Russia dated 05/08/2015 No. ММВ-7-2/ [email protected] (hereinafter referred to as the Requirements).

Here are the main requirements:

- drawing up an inspection report in 2 copies (clause 5 of the Requirements);

- compliance with the strictly approved form if the act is drawn up on paper (clause 4 of article 100 of the Tax Code of the Russian Federation, clause 2 of the Requirements);

- signing of the act by the inspector on the one hand and by the taxpayer being inspected or his representative on the other hand (clause 2 of article 100 of the Tax Code of the Russian Federation, clause 4 of the Requirements);

- 10 working days are allotted for drawing up a report from the date of completion of the inspection if, as a result of its results, violations were discovered (paragraph 2, paragraph 1, article 100, paragraph 6, article 6.1 of the Tax Code of the Russian Federation);

- delivery of a copy of the act to the taxpayer (his representative) within 5 working days from the moment it was drawn up.

Find out how to authorize a company employee to sign desk inspection reports here.

Should the inspector draw up a desk inspection report if the identified violations did not result in an understatement of the amount of tax payable? Find out the answer to this question in the ConsultantPlus Tax Guide by getting trial access for free.

Drawing up an inspection report

Tax legislation establishes clear requirements for the execution of a desk audit report (clauses 3, 3.1, 4 of Article 100 of the Tax Code of the Russian Federation, Requirements approved by order of the Federal Tax Service of Russia dated December 25, 2006 No. SAE-3-06/892). For more information about what information inspectors must include in the desk inspection report, see the table.

Situation: is it possible to cancel the inspection decision made based on the results of a desk audit? The inspection drew up a desk inspection report containing violations (errors).

It is possible if violations (errors) committed during the preparation of the act led to the adoption of an incorrect decision based on the results of a desk audit.

The decision on a tax audit is subject to cancellation if the inspection violates the essential conditions of the procedure for considering audit materials. Thus, the inspection decision is canceled if the inspection does not provide the organization with the opportunity to participate in the consideration of the inspection materials and provide explanations on them. This is stated in paragraph 2 of paragraph 14 of Article 101 of the Tax Code of the Russian Federation. In addition, other violations related to the procedure for reviewing materials that could lead to the adoption of an incorrect decision (paragraph 3, paragraph 14, article 101 of the Tax Code of the Russian Federation) may become grounds for canceling the inspection decision.

The desk audit report is one of the main materials of the tax audit, after consideration of which the inspectorate makes a final decision based on the results of the audit (clause 1 of Article 101 of the Tax Code of the Russian Federation). Consequently, violations committed by the inspectorate when drawing up the report may become the basis for making an incorrect decision based on the results of the desk audit. In this case, the inspection decision is subject to cancellation in full or in part related to the violation. In arbitration practice, there are court decisions that confirm the legitimacy of this conclusion. Thus, the inspection decision made based on the results of a desk audit can be canceled (in whole or in part) if the inspection made the following violations (errors) when drawing up the report:

- incorrectly applied the legislation and made incorrect conclusions, which were subsequently reflected in the final decision (see, for example, resolutions of the Federal Antimonopoly Service of the Ural District dated November 23, 2009 No. F09-9114/09-S2, Volga District dated August 29, 2008 No. A12-1355/08, dated August 29, 2008 No. A12-1370/08, Volga-Vyatka District dated July 10, 2008 No. A29-7897/2007, Moscow District dated June 11, 2009 No. KA-A40/5275 -09, North-Western District dated August 19, 2009 No. A56-59434/2008, East Siberian District dated November 12, 2008 No. A19-6820/08-30-F02-5529/08);

- additionally accrued taxes, penalties and fines in the act for periods that are not subject to desk audit, the same additional accruals were reflected in the final decision (see, for example, resolutions of the Federal Antimonopoly Service of the Ural District dated October 21, 2008 No. Ф09-7599/08-С2 , East Siberian District dated August 27, 2007 No. A58-6343/06-F02-5686/07, Northwestern District dated March 5, 2007 No. A56-16972/2006);

- provided erroneous references to articles of the Tax Code of the Russian Federation on holding an organization liable, these references were reflected in the final decision (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated November 14, 2007 No. F08-7548/07-2513A);

- reflected in the act the fact of a tax violation without proper justification, in the final decision the inspectorate held the organization liable for this violation (see, for example, paragraph 10 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 No. 71, resolution of the FAS Volga District dated 19 December 2008 No. A55-8594/008, Moscow District dated July 30, 2009 No. KA-A40/7115-09).

What are the requirements for the content of the inspection report?

The current tax code in paragraph 3 of Art. 100, as well as the Requirements, which establish standards that the content of the inspection report must comply with.

The structure of the act in accordance with clause 3 of the Requirements should look like this:

- First comes the introductory part, which provides general provisions.

- This is followed by a descriptive part, which reveals facts of violation of tax laws with mandatory documentary evidence, as well as circumstances that make it possible to mitigate or aggravate responsibility for committing an offense.

- Finally, in the final part, the inspector draws conclusions based on the results of the inspection and makes proposals.

In addition, the annexes drawn up to the inspection report are an integral part of the document being compiled.

The act is drawn up on a special form, which you can download on our website.

You may need information on objections to the KNP act. Then read the article “Objections to a desk tax audit report - sample” .

After delivering the report to the taxpayer, the Federal Tax Service issues a decision on the identified violations. Tax authorities can also take additional measures after the tax audit is completed. When such additional the activities are legal and what the taxpayer needs to do, find out in the Review prepared by ConsultantPlus experts. Get a free trial and explore exclusive content.

Presentation of the organization's act

The inspection must give the organization its copy of the act within five working days from the date of signing the act (clause 5 of article 100, clause 6 of article 6.1 of the Tax Code of the Russian Federation).

The inspection can hand over the act:

- personally to the legal or authorized representative of the organization against signature;

- in another way indicating the date of receipt of the act by the organization (for example, through a courier service).

This follows from paragraph 5 of Article 100 of the Tax Code of the Russian Federation.

Upon receipt of the act, the representative of the organization must put two signatures on it:

- on receipt of the act (clause 5 of article 100 of the Tax Code of the Russian Federation);

- about familiarization with the contents of the act. If a representative of the organization refuses to sign the act (for example, due to his incompetence), then the corresponding note about the refusal to sign will be made in the act (clause 2 of Article 100 of the Tax Code of the Russian Federation).

Situation: what to do if the desk inspection report was delivered late?

Receive the act and familiarize yourself with it.

The fact is that violation of the deadline for delivery of the act in itself cannot be grounds for canceling the decision of the tax inspectorate based on the results of the audit. Such an omission on the part of the inspectors does not apply to significant violations of the procedure for considering inspection materials (clause 14 of Article 101 of the Tax Code of the Russian Federation).

The courts are also unlikely to help in such a situation (see, for example, decisions of the FAS Moscow District dated April 9, 2014 No. A40-76732/13-99-232, Ninth Arbitration Court of Appeal dated December 16, 2013 No. 09AP-40446/ 2013).

Results

A report based on the results of a desk audit is issued if errors and/or contradictions are found in the tax return submitted by the taxpayer. The act discloses facts of violation of tax laws with mandatory documentary evidence, as well as circumstances that make it possible to mitigate or aggravate liability for committing an offense.

If the taxpayer does not agree with the information contained in the report, he has the right to submit his objections.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.