The obligation of all citizens is to pay mandatory fees in the form of taxes, insurance premiums and other fees to the state treasury. If the payment deadline is missed, there is no payment, or payment is made incompletely, the tax authority has the right to take measures to force the return of funds.

In this article we will tell you how the statute of limitations is calculated during which a taxpayer can be charged with tax arrears and held accountable for failure to pay this debt.

The question is relevant in connection with the onset of the crisis and restrictions on doing business during the pandemic.

The statute of limitations for taxes for individual entrepreneurs and individuals in 2022 is the permissible period within which forced collection of debt is possible.

Liability for debt is limited for a period

This period, guided by clause 1 of Article 113 of the Tax Code of the Russian Federation, is limited to three years. Consequently, an individual and individual entrepreneur cannot be held accountable for committing a tax offense if, from the day it was committed or from the next day after the end of the tax (accounting) period during which this offense was committed, and until the decision is made to bring three years have expired (the statute of limitations).

However, this period does not coincide with the period during which the Federal Tax Service has the right to go to court.

This calculation of the statute of limitations from the date of the violation does not apply to all tax offenses. The exception is tax offenses provided for in Art. 120,122,129.3 and 129.5 of the Tax Code of the Russian Federation. With regard to tax offenses in the above articles of the Tax Code of the Russian Federation, the statute of limitations is calculated from the next day after the end of the corresponding tax period .

The term “tax violation” means non-payment or incomplete payment.

Tax payments, insurance premiums, as well as violation of the deadline for their payment.

The procedure for withholding funds from the violator is possible on the basis of a court document and in the event that the Federal Tax Service managed to go to court before the statute of limitations expired.

The concept of the limitation period for collecting taxes from individuals in Russian legislation is very vague. The procedure for proceedings with the debtor and the timing of filing claims depend on a number of factors:

- debtor status;

- type of collection;

- amount of debt.

Statute of limitations for tax offenses: how many years and why?

If you ask any more or less competent accountant when the statute of limitations on the obligation of his organization expires, then, almost without hesitation, he will immediately answer: three years and one day after its occurrence. And he will add: this is directly stated in Articles 196 and 200 of the Civil Code of the Russian Federation.

An accountant with more work experience, who has already gained a lot of knowledge in dealing with both counterparties and tax authorities, will try to clarify: for what specific obligation and to whom?

Because when dealing with the state regarding the payment of taxes, contributions and fees, one should also be guided by the fact that civil legislation does not apply to tax and other financial and administrative relations, unless otherwise provided by law (clause 3 of article 2 of the Civil Code of the Russian Federation).

Therefore, if we are talking about the calculation and payment of taxes, then first of all we read the Tax Code of the Russian Federation.

Article 113 specifies the statute of limitations for holding people accountable for committing a tax offense. In general, they are the same three years.

And if the tax authorities have identified some kind of violation in your case, but the statute of limitations on it has expired, then in this case they can only shake their finger at you, but they cannot fine you, no matter how much they would like it.

The main violation, which, perhaps, was committed by almost everyone, was the incorrect determination of the base for a particular tax, which ultimately led to the formation of arrears for it. Whether it was done intentionally or not is the tenth thing.

The sanctions for committing this tax violation are specified in Art. 122 of the Tax Code of the Russian Federation.

If the tax authorities do not prove that the arrears arose as a result of a deliberate understatement of the base, then the organization faces 20% of the amount of the arrears that arose (identified) plus penalties (clause 1 of Article 122 of the Tax Code of the Russian Federation).

And what is the statute of limitations in this case? Three years. But how to count them?

We look at the third paragraph of paragraph 1 of Art. 113 of the Tax Code of the Russian Federation, according to which the calculation of the limitation period in this case will begin from the next day after the end of the corresponding tax period.

And here it turns out not three years, but somewhat longer.

What's new in tax interrogations now? We'll figure it out in a free webinar on September 2.

Let's say that the other day (in August 2022) you yourself discovered that somewhere in September 2022 a certain amount was not reflected in your income. Even though it’s not particularly big, it’s also not the smallest that you can easily ignore it.

From what date should you count these same three years, so that you can then politely send the tax authorities if they discover that you have underestimated the amount of income tax accrued for 2022?

The tax period for income tax is a calendar year. Therefore, according to normal logic, which the author also adheres to, we count the next three years - 2022, 2022 and 2022, and come to the conclusion that in 2022 it is no longer necessary to send an update on income tax for 2022. More than three years have passed, and they will not be able to punish us for the arrears in 2022.

But this is according to the usual logic, which does not always work in relations with the state. According to tax logic, and even supported by the courts, it is somewhat different.

We read paragraph 15 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57 “On some issues that arise when arbitration courts apply part one of the Tax Code of the Russian Federation.”

This paragraph states that payment of the tax amount is made until March 25 of the year following the expired tax period. That is, the tax violation arose not in 2022, in which the tax base was underestimated, but in 2022, in which the tax was not paid in full. And the statute of limitations in this case should begin to count not from March 26, 2022, when the violation became punishable, but from January 1, 2022, after the end of the period in which the offense was committed.

Exactly the same conclusions were made in the Ruling of the RF Armed Forces dated December 19, 2018 No. 304-KG18-13502.

Therefore, three years during which we must correct this mistake and replenish the state’s coffers are 2022, 2022 and 2022. And only in 2022 will we no longer have to worry about it.

This is how the arithmetic works out.

With a slight movement of the hand, the trousers turn... trousers turn....

Through a peculiar reading of the legislation, three years turned into five. And you can't argue with the courts.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

In what period can the Federal Tax Service begin collection?

The Federal Tax Service may begin the collection procedure within a time frame that is calculated depending on the type of violation:

- In case of incorrect financial accounting or delay in payment, the period begins on the next day of the end of the tax period. This rule applies to those fees for which the tax period is 12 months.

- In other situations, the statute of limitations for taxes of individuals and organizations begins on the day following the discovery of violations. However, most often underpayments are discovered only during a tax audit, so the date of the violation can be difficult to determine.

Example

The individual entrepreneur was held accountable for tax evasion. The deadline for making payments is March 30, 2022. The taxpayer failed to pay the required fees on time by the due date, thus the date of the offense is March 30, 2022. However, in his case, the limitation period began only from the new tax period, that is, from January 1, 2022. It will end on December 31, 2023.

Limitation period for personal taxes in 2021

- If the amount of underpayment is more than 500 rubles, the period for filing claims is 90 days from the date of discovery of the underpayment.

- If the amount of underpayment is up to 500 rubles, the period for filing claims is 12 months from the date of delay.

- If the amount of the underpayment is less than 3,000 rubles, the period for filing a claim is 6 months from the date of delay.

- If over 3 years the amount of underpayment is more than 3,000 rubles, then the deadline for filing claims is 6 months from the expiration of 3 years.

Statute of limitations for refund or offset of insurance premiums

An application for offset or refund of overpaid insurance premiums must be submitted to the Pension Fund of Russia office within three years from the date of payment of these contributions (Clause 13, Article 26 of the Federal Law of July 24, 2009 No. 212-FZ). But the fact of an overpayment can be revealed later, for example, after a reconciliation with the Pension Fund of the Russian Federation, when the overpayment will be confirmed by a Certificate of the status of settlements for insurance premiums, penalties and fines, or even an Act of joint reconciliation of settlements, signed by both parties. Do these documents interrupt the deadline for applying for a credit or refund of the overpayment? By analogy with tax relations, the presence of certificates and acts does not interrupt the statute of limitations, because the issuance of these documents to the policyholder is the responsibility of the Pension Fund, which does not at all indicate recognition of the debt.

Thus, within 3 years from the date of payment, the policyholder can submit an application for a refund or offset of insurance premiums to the Pension Fund of the Russian Federation, and after this period, go to court, citing the fact that the statute of limitations has not yet expired. For example, explaining this by the fact that less than 3 years have passed since the day when the policyholder learned or should have learned about the violation of his right, and not at all from the date of payment of contributions. As we have already said, the Act of joint reconciliation of calculations, which indicates the overpayment, is proof that the policyholder learned about the overpaid amount. Accordingly, the limitation period can be calculated from this date (Resolution of the Federal Antimonopoly Service of the Moscow Region dated July 20, 2009 No. KA-A40/6223-09).

Time limits for forced collection through court

The Federal Tax Service has the right to enforce through the court the collection of tax debts, including accrued penalties, within 3 years from the date of formation of the debt.

However, the missed deadline for filing an application with the court can be restored. Thus, litigation and enforcement against the debtor may drag on for a period exceeding three years.

The collection procedure also depends on the type of tax:

Payment for property and land taxes can only be collected for the three previous years following the date of receipt of the written request by the defaulter.

Similar rules apply to transport tax - the Federal Tax Service may require payment of fees only for the last 3 years. However, if the vehicle is used for seasonal work, then its owner has the right to partial tax exemption, which means that the Federal Tax Service’s demands for debt payment for the period outside the season will be illegal.

Law on writing off debts of individual entrepreneurs under amnesty

The tax amnesty 2022 is still ongoing, as debt write-off is carried out by special commissions of the Federal Tax Service. You can find out what decision was made through the taxpayer’s personal account on the Federal Tax Service website, or upon request to the inspectorate at the place of registration.

Who can benefit

The 2022 tax amnesty applies to active and closed individual entrepreneurs, as well as persons engaged in private practice (lawyers, notaries). Write-offs are also provided for taxes for individuals who have never registered an individual entrepreneur.

There is no need to specifically give up business for the amnesty. If the debt arose for the taxes of an individual and an individual entrepreneur, they can be written off simultaneously.

What debts can be written off and what is not subject to amnesty?

For physical persons, a tax amnesty is provided for:

- on property;

- transport;

- land.

There are restrictions for tax payments, fines and penalties for individual entrepreneur taxes. All debt is written off except

- excise taxes;

- customs duties;

- mineral extraction tax.

Art. 12 of Law No. 436-FZ allows you to get rid of arrears under the simplified tax system, UTII, property and land tax, income tax, VAT

, other types of payments. The tax authority itself will check what taxation regime the entrepreneur worked under.

Debt that has already been collected by order of the Federal Tax Service, by decision or order of the court, if the documents were sent for retention, cannot be written off. In this case, the debt does not fall under the criterion of bad debt.

If the total amount of debts of an individual entrepreneur, including loans and debts to counterparties, exceeds 500,000 rubles, and the situation allows filing for bankruptcy, as a result of this procedure all tax debts will be written off.

Over what period is debt written off?

The fiscal amnesty of Law No. 436-FZ applies to tax obligations that arose before 01/01/2015. All debts, fines and penalties accumulated before this date will be forgiven by the state. If the arrears arose after January 2015, they will be collected and retained according to the general rules.

Debt write-off amount under tax amnesty

The amount of arrears under the fiscal amnesty is not important, since the grounds are determined only by the type of tax and the period of occurrence - before January 1, 2015. If an entrepreneur partially repaid debts voluntarily, the money will not be returned to him.

How debts are written off

The decision to write off is made by the Federal Tax Service Commission. Documents on bad debt and the amount of arrears are verified without applications from citizens and entrepreneurs. Since a large amount of data needs to be processed, the process is still ongoing. Taxpayers are not notified of the decision; they need to check the status of the settlements themselves.

Amnesty on insurance premiums

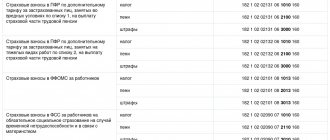

Law No. 436-FZ also contains provisions on writing off debts on insurance contributions to the Pension Fund, Social Insurance Fund, and Compulsory Medical Insurance Fund. The procedure includes the following features:

- overdue fees are written off for active and closed individual entrepreneurs, notaries and lawyers;

- overdue contributions for hired employees cannot be written off

; - The amount of arrears does not matter.

Note!

The period for which insurance premiums are written off is longer than for tax arrears. Debt that arose before January 1, 2017 will be closed. The decision is made by the Federal Tax Service inspection, since it administers all insurance premiums.

It is not necessary to submit an application for write-off of insurance premiums. The decision made is reported through the Personal Account on the Federal Tax Service website, or upon written request.

This might also be useful:

- Fixed payments for individual entrepreneurs in 2022 for themselves

- What taxes does the individual entrepreneur pay?

- Calculation of income tax from salary

- VAT return 2022

- Inspection of individual entrepreneurs by the tax inspectorate

- How much taxes does an individual entrepreneur pay in 2022?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!