A table with togs codes which can be found on the Rosstat website of the required territorial body

- The easiest way is to contact the relevant department of state statistics. To do this, you need to collect a certain package of documents, which includes copies of the TIN, OGRN and extracts from the register, as well as a covering letter. The first contact with the State Statistics Service is free;

- You can find out the codes when registering a business;

- This can also be done through special services that connect to the official websites of the State Statistics Service. To do this, it is enough to know only the TIN, as well as the region in which the LLC or individual entrepreneur is registered.

Objective information about various processes can be obtained by statistics that systematize, generalize and compare various data. If the collection, recording, processing and analysis of information is carried out competently, then it becomes possible to look at situations from the most acute angle. In this case, physical, mathematical and economic methods are used. Information on statistics is necessary for almost everyone, from ordinary businessmen and the media to government authorities. At the same time, it is important that the unity of collection and processing of information is maintained. Therefore, the most rational solution was that the organization of state statistics in the Russian Federation is carried out by one body, which was called the Federal State Statistics Service. Its abbreviated name is FSGS RF or Rosstat.

Audit of financial statements

The financial statements of some organizations are subject to mandatory audit (Part 1, Article 5 of Federal Law No. 307-FZ of December 30, 2008). Such organizations, for example, include insurance companies. A complete list of cases of mandatory audit of financial statements for 2022 can be found in the Information of the Ministry of Finance.

If the accounting records of an organization are subject to mandatory audit, then in addition to the financial statements themselves, you must also submit an audit report to your Rosstat department (Part 2, Article 18 of Federal Law No. 402-FZ of December 6, 2011). It is served:

- or together with financial statements;

- or no later than 10 business days from the day following the date of the audit report, but no later than December 31 of the year following the reporting year.

There is no need to submit an audit report to the Federal Tax Service.

Togs how to find out the number by tax identification number

Thanks to the successful activities of Rosstat, every resident of the Russian Federation has the opportunity to observe the progress of the country’s development, the ongoing transformations in it, the deterioration or improvement of the general situation in the state.

Now legal entities and individual entrepreneurs can obtain statistics codes online and print out the Notification from the Rosstat Statregister independently without personally contacting the territorial body of Rosstat. Information on identification by OK TEI codes is freely available and can be obtained from the databases of the territorial bodies of Rosstat.

Composition of financial statements

Report forms are filled out according to the sample approved by Order of the Ministry of Finance of the Russian Federation No. 66n. Those enterprises that use a simplified accounting system (this includes SMP) send simplified reporting to Rosstat.

The list of accounting reports submitted by legal entities to Rosstat is:

- Balance.

- Income statement.

- Appendixes to the balance sheet and financial statements. results.

The package of statistical reporting documents depends on what activities the company carries out, as well as on what business entity it belongs to. Rosstat provides information on what forms are needed to submit statistical reporting 2022 on its portal in free access for each organization.

The list of reporting forms submitted to statistics depends on the category of the company. In general, this is a balance sheet and a statement of financial results (Form 2) with appendices.

The currently valid forms of financial statements are approved by order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. Non-profit organizations, instead of Form 2, fill out a report on the intended use of funds.

The format of reports and the number of applications may also differ depending on the category of the enterprise. The following types of legal entities have the right to conduct accounting and submit reports in a simplified form:

- Small businesses.

- Non-profit organizations.

- Participants of the Skolkovo project.

These categories of enterprises have the right to fill out the balance sheet and Form 2 in a simplified form and not make attachments to them. However, the use of simplified accounting does not cancel the general requirements for reporting, in particular, for its completeness and reliability. Therefore, if two reporting forms are not enough for full disclosure of information about the company, the corresponding appendices should also be filled out.

In addition, there are a number of categories of legal entities whose reporting is subject to mandatory audit. They are listed in Art. 5 of the Law of December 30, 2008 No. 307-FZ “On Auditing Activities”.

- Joint stock companies.

- Companies whose securities are traded in organized trading.

- Organizations engaged in certain types of activities (for example, banks, insurance companies, non-state pension funds)

- Organizations providing consolidated reporting.

- Companies whose financial indicators exceed the following values:

- revenue for the year preceding the reporting year – more than 400 million rubles;

- balance sheet assets at the end of the year preceding the reporting year - more than 60 million rubles.

All listed organizations must include an auditor’s report in their financial statements in TOGS for 2022.

This option is the most convenient, because... in this case, the possibility of sending different reports to regulatory authorities in terms of the identity of the information reflected in them is excluded.

To use this option, you must first generate financial statements for submission to the tax authority.

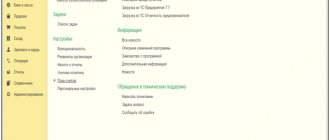

To do this, in the “Reporting” section of the main menu of the program, you need to go to the “Federal Tax Service” tab and “Create a report”, selecting the regular or simplified form of accounting (financial) reporting.

By responding positively to this message, the program will automatically generate financial statements that can be sent to TOGS.

Attention! If the list of proposed TOGS does not contain the one you need, you can select it by clicking on the “Show all” button. Next, select the appropriate region and TOGS in this region.

This option allows you to send reports to statistical authorities without waiting for the receipt result from the tax authority.

To generate financial statements for Rosstat, you must first fill them out for the tax office.

After filling out and checking the reports, you must go to the “Rosstat” tab. Here you also need to “Create a report” by selecting “Accounting (financial) reporting in TOGS” from the list of statistical reports.

In the “Details” section the name of the TOGS to which the reports are submitted is indicated.

This option is suitable for those users whose accounting statements are filled out in another accounting program, and they only need to be sent to TOGS.

After downloading, the reports can be sent to TOGS, having previously indicated the name of TOGS in the “Details” section.

The list of reporting forms submitted to statistics depends on the category of the company. In general, this is a balance sheet and a statement of financial results (Form 2) with appendices.

These categories of enterprises have the right to fill out the balance sheet and Form 2 in a simplified form and not make attachments to them. However, the use of simplified accounting does not cancel the general requirements for reporting, in particular, for its completeness and reliability. Therefore, if two reporting forms are not enough for full disclosure of information about the company, the corresponding appendices should also be filled out.

- revenue for the year preceding the reporting year - more than 400 million rubles;

- balance sheet assets at the end of the year preceding the reporting year - more than 60 million rubles.

Accounting statements must give a reliable picture of the financial position of the organization (Part 1, Article 13 of the Federal Law of December 6, 2011 N 402-FZ).

Reporting is prepared on the basis of data from accounting registers and in accordance with the provisions of PBU 4/99 “Accounting statements of an organization”.

How to find out the TOGS number (territorial body of state statistics)

Organizations and individual entrepreneurs from St. Petersburg and the entire region operate differently. They submit reports to the Federal Tax Service PETROSTAT. At the same time, city residents enter the code 78-00 in their reports, and representatives of the region - 47-00.

- Rostov region . The statistics body for this region collects information through accredited telecom operators. You need to select one of the companies from the list, draw up an agreement with it and go through the registration procedure. The final code depends on the place of registration and the operator. Most often it is 61-01.

- Moscow region . In the Moscow Region, with the exception of Moscow, there are 50 departments. Each of them has its own code. It is selected from a list on a specialized web resource. If the subscriber is unable to find his area, he must use the "universal" recipient code, which looks like 50-00.

- Saratov region . Its residents submit statistical reports using the services of telecom operators or independently through a form on the website. For this, a single code designation 64-05 is used.

- Kemerovo region . A similar situation arises for legal entities that are related to the Novokuznetsk department, located in the Kemerovo region. In the case of electronic reporting, the code designation 42-00 is used instead of 42-01.

- Krasnodar region . Rosstat in this region is engaged in receiving and processing information from legal entities that are registered in the region and in Adygea. Data transfer is carried out through the operator, 3 codes are used. 23-00 is used for residents of Krasnodar and Sochi. 23-99 – for persons who have registered in other cities. 01-00 – for residents of Adygea.

- Republic of Crimea . Its residents, like residents of Sevastopol, send electronic reports in accordance with the standards established at the federal level. For this purpose, the Russian statistics body entered into agreements with several operators simultaneously. So, for Crimea this designation is 91-00, for Sevastopol - 92-00.

Change of place of registration of an organization

If a company changes its official registration address and moves to another constituent entity of the Russian Federation, the territorial division of Rosstat changes . In accordance with the norms of current legislation, a change of address is carried out through the Federal Tax Service. After completing this procedure, the new tax office informs Rosstat of the respondent’s arrival within 5 days.

If reporting is submitted to a new address, a different region code is indicated. Adjustments are reflected in 1C. Most often, firms agree to renegotiate the agreement, and the telecom operator synchronizes its client's accounting transactions with its own software.

If reporting is submitted on the FSGS website, the change is carried out independently. When changing the registration address within one subject of the Russian Federation, the code designation remains the same.

How to get statistics codes online by TIN for individual entrepreneurs and organizations? The answer is below in the instructions.

Code of the territorial body of Rosstat Moscow

In 80 subjects (including federal cities) a single Rosstat code of the form XX-00 . In the Krasnodar Territory, Kemerovo, Moscow, Rostov, and Saratov regions, there are several divisions of State Statistics (different codes) that control individual areas of the region.

Information in the databases is updated several times a month, as a rule, this happens after the 15th and 30-31st of each month. Therefore, if there is no data about you in the database yet, and the Notification is urgently needed, you can personally contact the territorial statistics office at the place of your registration with an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. Addresses and telephone numbers of district statistics departments are presented above. Attention!

Change of place of registration of an organization

If an organization changes its “registration” - moves to another region - accordingly, the territorial division of Rosstat also changes.

According to the law, a change of legal address takes place through the Federal Tax Service. After the procedure, the new Federal Tax Service is obliged to notify Rosstat about the respondent within 5 working days; you do not need to report anything yourself.

When filing reports at a new address, a different region code is entered. Adjustments must be reflected in 1C. Most often, the organization renews the contract with the telecom operator, and the latter synchronizes the client’s accounting with its software. When submitting reports via a web form on the FSGS website, the code should be changed independently in 1C in the card with the company details.

If an organization changes its place of registration within one constituent entity of the Russian Federation, the TOGS code remains the same .

Thus, the codes of the territorial divisions of Rosstat are unique numbers assigned to the branches of the Federal State Statistics Service in the constituent entities of the Russian Federation and locally. They are necessary for submitting accounting reporting forms in the form of an electronic document. With their help, the system determines the recipient (addressee).

Most often, each region of Russia has its own Rosstat code. For respondents from the Krasnodar Territory, Moscow and Rostov regions, it depends on the district, city of registration of the organization or intermediary operator. You can find out the code of your reporting recipient by contacting Rosstat in person, by phone or on the website.

How to get statistics codes online? Find out in this video.

Rebus Company

Taking into account that the Notification is of an informational and reference nature and is not included in the system of organizational and administrative documentation defined by the All-Russian Classification of Management Documentation (OKUD), it is not subject to the requirements for the preparation and execution of documents established by GOST R 6.

Information in the databases is updated several times a month, usually after the 15th and 30th-31st of each month. If the data is not yet in the database, and you need the Notification urgently, you can personally contact the territorial statistics office at your place of registration with an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. You can find out the addresses of regional statistics departments by clicking on the link of your territorial body of the Federal State Statistics Service in the list on the left. Many banks still require statistics codes to open a bank account.

How to find the code of the territorial body of Rosstat

Lytkarino 50-73 Department of State Statistics TOGS MO No. 73 (Krasnoarmeysk) Moscow Region Krasnoarmeysk 50-74 Department of State Statistics TOGS MO No. 74 (Korolev) Moscow Region City Korolev 50-75 Department of State Statistics TOGS MO No. 75 (Korolev) Bronnitsy) Moscow region Bronnitsy 50-76 Department of state statistics TOGS MO No. 76 (Dolgoprudny) Moscow region Dolgoprudny 50-77 Department of state statistics TOGS MO No. 77 (Troitsk) Moscow region Troitsk 50-78 Department state statistics TOGS MO No. 78 (Dubna) Moscow region Dubna 50-80 Department of state statistics TOGS MO No. 80 (Fryazino) Moscow region Fryazino 50-83 Department of state statistics TOGS MO No. 83 (Khimki) Moscow region Khimki 50-90 Department of State Statistics TOGS MO No. 90 (Elektrostal) Moscow Region Elektrostal 50-93 Department of State Statistics TOGS MO No. 93 (Yubileiny) Moscow Region

Information in the databases is updated several times a month, usually after the 15th and 30th-31st of each month. If the data is not yet in the database, and you need the Notification urgently, you can personally contact the territorial statistics office at your place of registration with an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. You can find out the addresses of regional statistics departments by clicking on the link of your territorial body of the Federal State Statistics Service in the list on the left.

How to find out tax by inn

Information in the databases is updated several times a month, usually after the 15th and 30th-31st of each month. If the data is not yet in the database, and you need the Notification urgently, you can personally contact the territorial statistics office at your place of registration with an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs.

Primary information about the OKPO code is contained in the extract from the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs. There are no identical OKPOs. This means that if the type of activity changes, the OKPO code also changes. The first digits of the code (seven or nine) indicate the serial number, the last digits refer to the control ones.

Analysis of financial statements

Having received the organization’s financial statements, tax authorities analyze them. For example, the indicators of the income statement are compared with the data of the annual income tax return. Indeed, sometimes identified discrepancies may indicate that an organization has underestimated its income or overstated its expenses for tax purposes.

In addition, the balance of the organization is studied. So, for example, if an organization is a candidate for inclusion in the on-site inspection plan, inspectors look to see if the organization has fixed assets and other property from which it will be possible to recover the arrears that arose as a result of additional accruals based on the results of the inspection.

TOGS for the Kaliningrad region (Kaliningradstat)

If you have an electronic signature, statistical reporting can be submitted without the participation of a special operator through the WEB collection system. To submit reports, you must register in the WEB collection system and download the necessary programs from the website of your territorial state statistics office.

You can find out to which territorial division of the statistical body for the subject of the Russian Federation you need to submit accounting and statistical reports on the TOGS website (section “About TOGS” -> “District Departments”). You can go to the TOGS website using the link above.

Location of organizations and individual entrepreneurs related to this TOGS

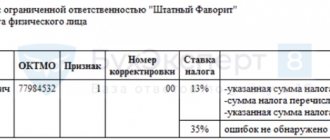

OKTMO

Territory name

You can find out your OKTMO code at the organization’s address using the “Find out OKTMO” service.

In addition, you can find out the OKTMO code from the Notification of Codes issued by the territorial body of Rosstat. It can be generated online using the service posted on the Rosstat website.

You can find the website of the Rosstat authority for your subject of the Russian Federation in our directory (see link at the bottom of the page).

The first two digits of the OKTMO code (the first three digits for regions with a code starting with 118, 718, 719) indicate the region (subject of the Federation).

| Name | Instructions for preparing statistical reporting by respondents using the off-line module for preparing reports 2013 |

| page | 6/10 |

| Type | Instructions |

filling-form.ru > application form > Instructions

How to find out the code of the territorial body of Rosstat

It is preferable to do this online, via telecommunication channels. Most often, legal entities enter into an agreement with an intermediary operator and submit reports through it. If there is an enhanced digital signature, the company can send information independently using a web form on the Rosstat website. Submission of electronic reporting involves its generation in 1C, then uploading to the website of the Federal Service or to a special operator program. Related to this is the most common question that accountants have when preparing reports - how to find out the TOGS code?

Vologda TOGS for Cherepovets and Cherepovets district Vologda region Novokuznetsk Kemerovo region Losino-Petrovsky Moscow region Balashikha Moscow region Volokolamsk Moscow region Voskresensk Moscow region Dmitrov Moscow region Domodedovo Moscow region Dzerzhinsky Moscow region

How and where to find out

There are no separate legislative acts that list the codes of Rosstat territorial bodies. Order No. 5/MM-3-11/ [email protected] does not fully reflect the state of affairs that has developed by 2022. Thus, it does not take into account the subsequent separation of some local departments into independent units that collect statistics from respondents; it does not mention the Republic of Crimea and the city of Sevastopol.

However, information can be found in several ways :

- Call the territorial office of Rosstat or contact in person and ask. The telephone number, address and operating hours of departments are published on regional versions of the FSGS portal.

- Go to the website of the regional division of the Federal State Statistics Service www.gks.ru (on the main portal, find it on the map or manually enter the subject of the Russian Federation, follow the link). Next, select the “Reporting” section from the menu, the “Electronic reporting” and “Providing statistics through trusted telecom operators” subsections. The code can be indicated directly on the page (Saratovstat, Krasnoyarskstat, etc.) or in a file that is downloaded from here (Mosoblstat, Mosgorstat, Rostovstat, etc.).

- Use the table with TOGS codes, which can be found on the Rosstat website of the required territorial body.

- Call your carrier. Some of them have special services for new clients on their online resources, which contain a list of codes. For example, from the main Taxcom website taxcom.ru, you can go to the “Subscriber Support” menu, the “Internet Reporting” submenu, and select the “Subscriber Service” section. On the page that opens there will be a list of useful services, including the “List of connected TOGS”.

Special software from telecom operators, which legal entities use to send reports, is provided with the details already filled out. The programs are integrated with 1C installed on the client’s computer.

A table with togs codes which can be found on the Rosstat website of the required territorial body

Rosstat) correctly address (or forward) the document sent by the company, that is, transfer it through online channels precisely to the TOGS (Territorial Body of State Statistics) that is responsible for collecting data on enterprises in the region or municipality where the reporting company operates.

Some regions are united under the control of one division of Rosstat - the regional Directorate of the Federal State Statistics Service. For example, respondents from the Nenets Autonomous Okrug and the Arkhangelsk Region send reports to a single UFSGS . Despite this, they provide different codes:

Definition of TOGS

TOGS code is the original number assigned to the territorial body of the FSGS. Defined as XX-YY , where XX is the code of the region (subject of the Russian Federation), Y is the site.

In 80 subjects (including federal cities) a single Rosstat code of the form XX-00 . In the Krasnodar Territory, Kemerovo, Moscow, Rostov, and Saratov regions, there are several divisions of State Statistics (different codes) that control individual areas of the region.

In the Moscow region (excluding the city of Moscow) there are 50 departments of State Statistics, each of which is assigned its own code. You must select from the list on the Mosoblaststat msko.gks.ru. If the subscriber does not find his area in the list of those presented, he should use the “universal” recipient code 50-00.

Rostovstat (Rostov region) mainly collects information through accredited telecom operators. A legal entity must select one from the list, enter into an agreement with him and register. The FSGS territorial unit code will depend on:

- place of registration (district, city);

- operator.

Krasnodarstat (Krasnodar Territory) receives and processes information from legal entities registered in the region and the neighboring Republic of Adygea. Statistics are mainly transmitted through telecom operators. 3 recipient codes are used:

- 23-00 - for respondents in the cities of Sochi and Krasnodar;

- 23-99 - for those registered in other localities of the region;

- 01-00 - for legal entities from the Republic of Adygea.

Respondents from the Saratov region, regardless of location (district, city), submit statistical reporting with the help of telecom operators or independently through a web form on the FSGS website, using a single addressee code 64-05. The same applies to legal entities belonging to the Novokuznetsk department of Rosstat of the Kemerovo region : when submitting electronic reports, they use code 42-00 (and not “their own” 42-01).

Respondents

of the Republic of Crimea and the city of Sevastopol can send electronic reports according to federal rules from mid-2016.

To do this, Rosstat has entered into agreements with several operators (they can be selected from the list). TOGS code for Crimea is 91-00, for Sevastopol - 92-00.

Some regions are united under the control of one division of Rosstat - the regional Directorate of the Federal State Statistics Service. For example, respondents from the Nenets Autonomous Okrug and the Arkhangelsk Region send reports to a single UFSGS . Despite this, they provide different codes:

- 29-00 is used by legal entities registered in the Arkhangelsk region;

- 83-00 is used by respondents from the Nenets Autonomous Okrug.

Organizations and individual entrepreneurs from St. Petersburg and the Leningrad region submit reports to the Federal Tax Service Petrostat. In this case, the former address the forms to code 78-00, the latter - to 47-00. A similar situation has developed in the Federal State Statistics Service Tyumenstat :

- 72-00 code is provided for respondents from the Tyumen region;

- 86-00 - from Khanty-Mansiysk Autonomous Okrug;

- 89-00 - from the Yamalo-Nenets Autonomous Okrug.

Togs how to find out the number by tax identification number

- You can call the territorial representative office of Rosstat in the region - using the contact information on the agency's website - and ask for the code from any specialist.

- Find out directly on the websites of the territorial departments of Rosstat in the “Electronic reporting” section.

- You can make a search request in Google or Yandex, for example: “TOGS Kazan code” - and the required information will be available in the search engines’ response to your request.

- You can request the necessary codes from the statistical reporting operator or the certification center where the company issued an electronic digital signature for sending documents via the Internet. Some of the operators post convenient interfaces on their websites with which you can find the required TOGS code. A similar service is available, for example, on the website.

If you have an electronic signature, statistical reporting can be submitted without the participation of a special operator through the WEB collection system. To submit reports, you must register in the WEB collection system and download the necessary programs from the website of your territorial state statistics office.

Necessity

TOGS codes were first introduced by Order of Rosstat and the Federal Tax Service dated January 18, 2008 No. 5/MM-3-11/ [email protected] This was necessary to optimize information cooperation between the two departments (during that period, the active formation of a unified state network space).

The Federal Tax Service shared information about taxpayer organizations with Rosstat, and Rosstat in response sent the reports that these legal entities submitted. For regional interaction, each local branch of the FSGS was assigned a code corresponding to the number of the territorial Federal Tax Service.

Now this code is used to submit financial statements in electronic form: through specialized software of a telecom operator or a web service on the FSGS website online.gks.ru (if an electronic signature is available). The forms are pre-filled in 1C. The TOGS code is indicated in the program interface (in the card with the organization’s details) so that the reports are sent to the desired territorial unit, and the Rosstat server can receive it.

In most cases, the TOGS code is entered automatically depending on the place of registration of the legal entity. If this does not happen, when you try to send a form with a report, the program will display the error “Recipient address not found.” How to fix it:

- in the “Directories and accounting settings” menu, select the “Organizations” section, then find the one you need;

- In the “Statistics codes” tab, enter the required parameter in the “Rosstat territorial body code” field and save.

Code togs g ramenskoye

- How to find out the code of the territorial body of Rosstat

- Rosstat regulatory authorities codes

- Statistical authority code for electronic reporting

- List of connected togs

- Statistics codes by inn

- How to find out and check statistics codes for tax identification numbers?

- Code togs how to find out number by tax identification number

TOGS. Orenburg 56-01 Department of state statistics TOGS of the Orenburg region No. 1 (Abdulino) Orenburg region, Abdulino 56-02 Department of state statistics TOGS of the Orenburg region No. 2 (p. Adamovka) Orenburg region p. Adamovka 56-03 Department of state statistics TOGS Orenburg region No. 3 (Akbulak village) Orenburg region Akbulak village 56-04 State statistics department TOGS of the Orenburg region No. 4 (Aleksandrovka village) Orenburg region Alexandrovka village 56-05 State statistics department TOGS of the Orenburg region No. 5 (Asekeyevo village) Orenburg region Asekeevo village 56-06 Department of state statistics TOGS Orenburg region No. 6 (Belyaevka village) Orenburg region Belyaevka village 56-07 Department of state statistics TOGS Orenburg region No. 7 (Buguruslan) Orenburg region Buguruslan 56-08 Department of state statistics TOGS Orenburg region No. 8 (Buzuluk) Orenburg region Serpukhov) Moscow region Vologda and Vologda district Vologda region 36-00 FSGS TO for the Voronezh region Voronezh region 37-00 FSGS TO for the Ivanovo region Ivanovo region 38-00 FSGS TO for the Voronezh region Irkutsk region Irkutsk region 39-00 FSGS technical service for the Kaliningrad region Kaliningrad region 40-00 FSGS technical service for the Kaluga region Kaluga region 41-00 FSGS technical service for the Kamchatka Territory Kamchatka Territory 42-00 FSGS technical service for the Kemerovo region Kemerovo region 43-11 FSGS technical service for the Kamchatka region Kirov region Kirov region 44-00 FSGS service in the Kostroma region Kostroma region 45-00 FSGS service in the Kurgan region Kurgan region 46-00 FSGS service in the Kursk region Kursk region 47-00 FSGS service in the Leningrad region Leningrad region 48-00 FSGS service in Lipetsk region Lipetsk region 49-00 TO FSGS for the Magadan region Magadan region 50-04 Department of state statistics TOGS MO No. 4 (city. Information in the databases is updated several times a month, as a rule, this happens after the 15th and 30-31st of each month. Therefore, if there is no data about you in the database yet, and the Notification is urgently needed, you can personally contact the territorial statistics office at the place of your registration with an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. The addresses and telephone numbers of district statistics departments are presented above. Attention! From March 1, 2016, a transition is being made to a unified Rosstat database, which is available at the link: Receive a Notification with OK TEI codes The service may not work on weekends and holidays. It may not display correctly in Internet Explorer, but functionality has been confirmed in Chrome, Opera and Firefox browsers. If for some reason the service page does not open, refresh it by pressing the F5 key, or try logging in later.

Who submits financial statements to TOGS

All companies submit a balance sheet and financial statements. Let us note that organizations must submit an annual balance sheet, a statement of financial results and appendices to them to the state statistics authorities at the place of registration (clause 1 of article 18 of the Federal Law of December 6, 2011 No. 402-FZ). Read about that in the book “Simplified. Annual report – 2017.” To read articles for the magazine “Simplified” for 3 days.

Thus, the legal copy of the financial statements for 2022 must be submitted no later than three months after the end of the reporting period, that is, until March 31, 2022 inclusive.

Attention! Absolutely all companies submit this form. To do this, you do not need to receive any letter from Rosstat. Entrepreneurs do not submit financial statements, since they are not allowed to do accounting.

If you have a micro-enterprise or individual entrepreneur, then you only need to report to “statistics” based on the results of the year. Other small firms report every quarter. In the table, see what forms the companies and individual entrepreneurs included in the sample submit at the beginning of 2022.

| Who rents | In what form | When? |

| Individual entrepreneurs | ||

| Microenterprises | ||

| Other small companies |

* From the first quarter of 2022, submit a new form No. PM, approved. .

- List of statistical reports for 2022 (when and which ones to submit)

- How to submit a report to statistics for small businesses for 2017

- What statistical reports will individual entrepreneurs and LLCs submit in 2022?

In 2022, observation is selective (Clause 1, Article 5 of Federal Law No. 209-FZ of July 24, 2007). This means that the forms are filled out only by those companies and individual entrepreneurs that were included in the sample.

The financial statements submitted to TOGS must include (Part 1, Article 14 of Federal Law No. 402-FZ dated December 6, 2011, clause 6 of the Procedure, approved by Rosstat Order No. 220 dated March 31, 2014):

- balance sheet;

- income statement;

- applications to them.

The forms of financial statements are approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

Organizations that have the right to use simplified methods of accounting (such organizations include small businesses that are not subject to mandatory audit (clause 1, part 4, article 6 of the Federal Law of December 6, 2011 No. 402-FZ)) submit financial statements according to simplified forms.

Statistical reports must be submitted (Article 5 No. 209-FZ):

- bodies of state power and local self-government;

- legal entities of the Russian Federation;

- individual entrepreneurs;

- branches and representative offices of Russian organizations.

Further we are talking only about 2-4 categories of accountable persons. So, the law distinguishes small, medium and large businesses, which are required to submit statistical reports. Who is a small business? The law defines the categories for classifying companies and individual entrepreneurs as small and medium-sized businesses (Article 4 Categories

). The basic requirements are:

- The share of participation of other Russian legal entities in the authorized capital of the LLC cannot be higher than 25%, and the share of foreign companies - 49%;

- The number of employees should not exceed the limits established by law: for micro-enterprises no more than 15 people, for small enterprises - the maximum allowable value of 100 people, for medium-sized enterprises - no more than 250 people;

- Annual income should not exceed the limits: micro-enterprises - 120 million rubles; small enterprises – 800 million rubles; medium-sized enterprises – 2 billion rubles (Resolution of the Government of the Russian Federation dated April 4, 2016 No. 265).

Companies that are not small and medium-sized businesses submit basic statistical reporting and additional reporting, which depends on the area of activity. To finally understand whether your organization is a small business, use the tax service service “Small Business Register”. We wrote how to get into it in a separate article - how to check the presence of a company in the small business register.

It’s easy to get a list of reports to Rosstat for your enterprise:

- Let's find out the TIN of the enterprise ();

- We go to the Rosstat statistical reporting service, enter our details and receive a list of reports for the organization.

The service has been operating since February 2022, generating a list of statistical reporting forms that a specific legal entity must submit, indicating their name. Information on the site is updated monthly. If questions arise, the organization can contact the territorial body of Rosstat with an official written request for a list of reports (clause 2 of Rosstat’s letter dated January 22, 2018 No. 04-4-04-4/6-smi).

On the Rosstat website you can see a list of all forms of statistical observation, but it is quite difficult to parse it in relation to yourself. We do not provide a complete list of forms here; it changes regularly. There are quite a few forms of statistical reporting. The popular SPS Consultant Plus tried to assess the scale of statistical reporting and created the Stat Calendar service. reporting

some annual reports from the 2022 report:

- 1-enterprise “Basic information about the activities of the organization”;

- MP (micro) – in kind “Information on the production of products by a micro-enterprise”;

- MP (micro) “Information on the main performance indicators of a micro-enterprise”

monthly from the January 2022 report:

- 1-DAP “Survey of business activity of organizations in mining and manufacturing industries providing electricity, gas and steam, and air conditioning”

quarterly from the report for January – March 2022:

- 1-NANO “Information on the shipment of goods, works and services related to nanotechnology”;

- PM “Information on the main performance indicators of a small enterprise.”

quarterly from the report for the first quarter of 2022:

- DAP-PM “Survey of business activity of small enterprises in mining and manufacturing industries providing electricity, gas and steam, and air conditioning”;

- 6-oil “Information on the cost of oil production, production of petroleum products”;

weekly from the report for the 1st week of January 2022: 1-motor gasoline “Information on the production of petroleum products”

with a frequency of once every 3 years for the report for 2022: 9-APK (meat) “Information on the processing of livestock and poultry and the yield of meat products.”

Exclusively all organizations are required to report on their financial results to Rosstat. Small and medium-sized businesses use a simplified procedure for submitting statistical forms. Rosstat requests reporting from organizations at different frequencies and with a different list of reporting forms.

For example, small organizations are required to submit statistical forms only once every five years. The exception is some small businesses that are included in the list of those who submit forms every month or quarter. Rosstat employees inform the manager in writing about whether an enterprise has been included in this list or not.

Accounting and statistical reporting may be submitted to Rosstat using one of the following options:

- by mail (it is necessary to issue a letter with notification of its receipt by the addressee);

- upon a personal visit to the State Statistics Department (by the head of the enterprise or his representative, an accountant);

- in electronic form via the Internet.

To simplify reporting, the State Statistics Department has developed a Web document collection portal. Thanks to the online system, all legal entities can use it to transmit information via the Internet. Therefore, submit the book to Rosstat. reporting and statistical forms have become much easier.

The obligation to submit reports to state statistics bodies is established by law dated December 6, 2011 No. 402-FZ “On Accounting” (Article 18). This regulatory act determines that all economic entities conducting accounting (except for the Bank of the Russian Federation and government institutions) must provide a copy of the report to TOGS.

The obligation to keep accounting is also regulated by Law No. 402-FZ (Article 6). Only individual entrepreneurs and branches (representative offices) of foreign organizations are exempt from accounting, subject to maintaining tax accounting.

Thus, those who submit financial statements to TOGS are all Russian legal entities (except for government agencies and the Central Bank of the Russian Federation).

As for entrepreneurs, they can keep records and submit reports to the tax authorities on a voluntary basis. This may be necessary, for example, if you need to provide a report to a bank or other investor. But in this case they do not have the obligation to submit a copy of the report to TOGS.

The main purpose of statistical bodies is to provide objective and complete statistical information about economic indicators in the country. To cope with this function, Rosstat identifies companies from which it requests the necessary data either by a continuous method or selectively based on certain criteria. Large and medium-sized businesses often fall into his sphere of attention.

Depending on their type of activity, companies are required to submit reports to Rosstat using special forms. The frequency of submission for each form is different: quarterly, annually, once and every three years. Whether you need to submit reports, in what forms and when - find out at your local statistics office.

An organization is considered small if the following conditions are met:

- The share of participation of other legal entities not related to small and medium-sized businesses in the management company is no more than 25%;

- The average number of employees in the previous year did not exceed 100 people;

- The volume of revenue received (excluding VAT) in the previous year did not exceed 800 million rubles.

In this case, statistical reporting is submitted in a simplified manner. This advantage is mentioned in the Federal Law “On the Development of Small and Medium Enterprises in the Russian Federation” No. 209-FZ dated July 24, 2007. The simplified procedure implies that the complete collection of statistical data occurs once every five years, and in other cases a selective monitoring method is used .

Small businesses occupy the largest share among legal entities, so it is not surprising if your organization has never submitted statistical reporting. Often, statistical authorities notify organizations in writing of the need to submit statistical data.

How to find out the togs Moscow code for statistics

Taldom 50-55 Department of state statistics TOGS MO No. 55 (Roshal) Moscow region Roshal 50-56 Department of state statistics TOGS MO No. 56 (Chekhov) Moscow region Chekhov 50-57 Department of state statistics TOGS MO No. 57 (city . Shatura) Moscow region Shatura 50-58 Department of State Statistics TOGS MO No. 58 (p.

Rostov-on-Don 61-72 Leninsky representative office of the state statistics department Rostov region Rostov-on-Don 62-00 FSGS TO for the Ryazan region Ryazan region Ryazan 63-00 FSGS TO for the Samara region Samara region Samara 64-04 Atkarsky district (department of state statistics in Petrovsk (Atkarsky district)) Saratov region Petrovsk 64-05 Department of state statistics in Saratov Saratov region Saratov 64-07 Balakovsky district (department of state statistics in Balakovo) Saratov region Balakovo 64-08 Balashovsky district (department of state statistics in Balashov) Saratov region Balashov 64-11 Volsky district (department of state statistics in Volsk) Saratov region Volsk 64-12 TO FSGS for Voskresensky district in the city of Saratov, Saratov region

Rosstat authority code by inn

This code allows the program (or the receiving Rosstat server) to correctly address (or forward) a document sent by the company, that is, transfer it through online channels to the TOGS (Territorial Body of State Statistics) that is responsible for collecting data on enterprises in the region or the municipality where the reporting firm operates.

- You can call the territorial representative office of Rosstat in the region - using the contact information on the agency's website - and ask for the code from any specialist.

- Find out directly in the “Electronic reporting” section.

- You can make a search request in Google or Yandex, for example: “TOGS Kazan code” - and the required information will be available in the search engines’ response to your request.

- You can request the necessary codes from the statistical reporting operator or the certification center where the company issued an electronic digital signature for sending documents via the Internet. Some of the operators post convenient interfaces on their websites with which you can find the required TOGS code. A similar service is available, for example, on the website.

How to confirm the date of presentation

— when submitted directly to the statistical authorities, the date indicated in the note of the statistical authority on the acceptance of the financial statements;

- when submitted by registered mail with acknowledgment of receipt - the date of sending the registered mail with acknowledgment of delivery;

— when submitted electronically, the date of dispatch of the annual financial statements, recorded by the statistical body or specialized operators, indicated in the notice of receipt.

The presence of an appropriate document confirming the date of submission of financial statements by an economic entity will help avoid possible conflict situations with statistical authorities. Let us remind you that the fine for failure to submit financial statements to statistical authorities is for legal entities - from 3 to 5 thousand rubles (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

The electronic form of the balance sheet recommended by the Federal Tax Service contains the line “Date of approval of statements.” What date should I indicate in this line?

As you know, financial statements must be submitted to the Federal Tax Service and Tax Service no later than three months after the end of the reporting year (Clause 5, Clause 1, Article 23 of the Tax Code of the Russian Federation, Part 2, Article 18 of the Federal Law of December 6, 2011 N 402-FZ), i.e. no later than March 31 of the year following the reporting year. If March 31 falls on a weekend, the reporting deadline is postponed to the first working day following this date (clause 7, article 6.1 of the Tax Code of the Russian Federation, clause

7 of the Order, approved. Order of Rosstat dated March 31, 2014 N 220). So, for example, in 2022, financial statements must be submitted no later than 04/02/2018 (March 31 – Saturday). Consequently, if the organization manages to approve it before submitting the reporting to the regulatory authorities, then the date of approval is indicated in the corresponding line of the balance sheet. If the reporting has not yet been approved, then the line “Date of approval of reporting” does not need to be filled out.

— the annual financial statements of a commercial organization consist of a balance sheet, a statement of financial results (for 2012, a profit and loss statement) and appendices to them;

— the annual financial statements of a non-profit organization consist of a balance sheet, a report on the intended use of funds and appendices to them.

Small businesses submit simplified forms of balance sheet and profit and loss statement (see “Ministry of Finance: small businesses can submit financial statements in a simplified form”).

For more information about financial statements, see “What you need to consider when preparing financial statements for 2012.”

Submission deadline

The procedure for submitting a legal copy of annual accounting (financial) statements is determined by Rosstat Order No. 670 dated December 29, 2012 (hereinafter referred to as Order No. 670). The procedure establishes the deadlines and methods for presenting financial statements.

A mandatory copy of the annual accounting (financial) statements is submitted no later than three months after the end of the reporting period to the territorial body of state statistics (TOGS) at the place of registration of the economic entity.

In cases where the last day of the reporting submission period coincides with a weekend (non-working) day, the submission deadline is postponed to the next working day. In 2013, the last day for submitting reports to Rosstat is April 1.

— personally bring it to TOGS;

— send by registered mail with return receipt requested;

— send electronically using duly certified electronic signature means.

According to information posted on the Rosstat website, electronic submission of annual financial statements for 2012 to statistical authorities and tax authorities is carried out in the same formats.

It should be noted that there are no other ways of presenting financial statements. If previously it was possible to send financial statements by simple mail, now this is unacceptable.

Code of my Rosstat territorial Moscow

- OKPO (All-Russian Classifier of Enterprises and Organizations);

- OKATO (All-Russian Classifier of Objects of Administrative-Territorial Division);

- OKTMO (All-Russian Classifier of Municipal Territories);

- OKOGU (All-Russian Classifier of Public Power and Management Bodies);

- OKFS (All-Russian Classifier of Forms of Ownership);

- OKOPF (All-Russian Classifier of Organizational and Legal Forms).

- participation in state tenders;

- opening new branches;

- changes in information about an individual entrepreneur (full name, registration);

- obtaining documents from the customs department;

- changes in legal address;

- renaming the company;

- passing audits;

- obtaining licenses;

- opening a current account;

- and others.