If the statute of limitations on receivables has expired, then such debt can be considered completely uncollectible.

Accounts receivable are funds that a specific organization owes to its counterparties. Typically, these types of debts arise if a company sells goods or provides services on credit.

Receivables are usually viewed from three main perspectives: as cash that can be used to pay off debts, as products or services sold but not yet paid for, and as a share of the company’s working capital, which is financed with borrowed money or its own money.

Debt is divided into two categories: overdue and normal. The first type is different in that there are debts that were not repaid on time. But the second type is characterized by the fact that there are obligations for which the due date has not yet arrived, therefore, the counterparty still has the opportunity to repay such a debt. Moreover, overdue receivables are divided into two more types: doubtful and hopeless. Particular attention should be paid to the second type. Bad debt is a debt whose statute of limitations has expired. Another name for this type of accounts receivable is debts that cannot be collected. Such debts appear in the following cases:

- When the debtor was liquidated.

- When the debtor is bankrupt.

- When the statute of limitations has expired.

How long does the debt last?

This period is the period during which the creditor can come to court to protect his rights (in other words, to ensure that the debt is forcibly collected from the counterparty). Moreover, this period is exactly three years. This period was determined by Article 196 of the Civil Code of the Russian Federation. The three-year period is the minimum statute of limitations. This period may be increased, but not by more than 10 years. This period applies to situations where the limitation period is suspended for a certain time.

It is noteworthy that the limitation period cannot be changed even by agreement of both parties. This is due to the fact that this period is established by regulations and laws.

An interesting point: at the federal level, both shorter and longer statutes of limitations for debt can be established. Under transport expedition agreements, claims can only be made through going to court (and only twelve months are allotted for this). More information about this can be found in Article No. 13 of the Federal Law.

Results

The general limitation period for receivables is 3 years. Moreover, this period is legally allowed to be interrupted, suspended, and even restored if it is missed with justification (though only for individuals).

At the end of the period (if there was no court decision), the company has the right to write off the debt as an expense.

Such an operation will be legal both in accounting and tax accounting. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When does the deadline start?

It was discussed above what period of receivables was established by the legislative bodies. Next we will figure out how to correctly calculate this period.

Few people know that the limitation period begins to expire from the very moment when a person became aware or should have learned that his own rights were violated. This rule also applies to the expiration date of the debt. It begins to count from the day following the last day of fulfillment of obligations. The agreement specifies the deadlines for when money should be credited to the account. If this does not happen on the specified day, then the next day the period of claim begins to expire.

The time for fulfilling obligations is not always specified accurately. In some cases, this period is not defined at all or is even indicated by the moment before demand. In such situations, the period of claim is counted from the moment when the debtor was presented with an official claim for the return of money from the creditor. Another period of claim debt begins to count upon completion of the period allotted for payment of the debt specified by the creditor.

It should be noted that the limitation period can not only be interrupted, but also suspended. In the first case, it is simply reset to zero and the countdown starts from the very beginning. But in the second case, the period continues to expire after the cessation of certain circumstances.

How to interrupt

To interrupt the running of the limitation period, the provisions of the Civil Code of the Russian Federation, namely Article 203, will also be used. In accordance with its provisions, it is possible to interrupt the running of the limitation period. However, in order for this right to be exercised by the creditor, the debtor, for his part, must comply with the following conditions:

- recognize the existing debt by acknowledging the claims made against him with demands for repayment of the existing debt within the period set by the creditor in the official letter of claim sent to him;

- making changes to an existing agreement by signing an additional agreement , if from such changes the court or authorized bodies, upon their involvement, can conclude that the debtor has admitted the existence of a debt;

- the creditor received an official letter from the debtor requesting a deferment in debt repayment or the use of an installment payment mechanism;

- an act of reconciliation of mutual settlements was signed , with the representative of the debtor, who is an authorized person, acting as a signatory.

In this case, the calculation of the limitation period begins again from the date recorded on the available documents. In this case, the old term is not counted, and its flow is completely stopped.

Resetting (interrupting) the limitation period

It is interrupted in the following cases:

- If part of the existing debt has been repaid.

- If the debtor has recognized the existence of a debt.

- If the parties decide to negotiate a change in conditions (restructuring).

You can get acquainted with all the reasons for resetting the statute of limitations of receivables in Resolution of the Plenum of the Armed Forces of the Russian Federation No. 43.

After a certain break, the period begins to count from the very beginning. The period that has already expired is not taken into account.

As for the fact of recognition of the existence of a debt, it, like any other, must be confirmed in writing.

For example, in order to prove the existence of a debt, the debtor will have to express consent regarding the amount of the debt and create an act of reconciliation of payments with seals, as well as signatures of both parties (debtor and creditor).

If the debtor recognized only part of the debt, this will not be considered recognition of the full amount of the debt. As practice shows, in such cases, judicial authorities often deny creditors’ claims.

If the court makes a decision that the debt was recognized by the organization in part, then it will not be possible to write off this amount after the expiration of the statute of limitations. Moreover, a debt can be recognized as bad only in two main cases:

- If the debtor was liquidated, and the corresponding entry about him was erased from the Unified State Register of Legal Entities.

- Enforcement proceedings were completed based on the decision made by the bailiff.

Suspension of the limitation period

It may also be suspended. This is possible in the following two cases:

- If one of the parties is part of the armed forces transferred to a special position.

- If the law regulating the legal relations between both parties ceases to apply.

- If obligations cannot be fulfilled due to the introduction of a moratorium (suspension of fulfillment of obligations).

- If there was an emergency: a major accident, a natural disaster (flood, hurricane), a strike at an enterprise.

Here it is recommended to pay attention to such an important point: the statute of limitations on receivables can be paused only when the situation occurred in the last six months. If the period itself is six months or less, then at any time during its course.

Another reason for putting the period of receivables on pause is the mutual desire of the person who issued the loan and the debtor to resolve the dispute amicably without involving third parties. You can find out about this in paragraph 16 of the resolution of the Plenum of the Supreme Court of the Russian Federation No. 43. From the regulatory legal act you can find out that the limitation period is paused for the time provided by the legislative bodies for resolving the conflict without trial. If this period has not been established, then six months is taken as the basis.

The countdown starts from the day the peaceful resolution of the dispute began.

If after the end of the break there are less than six months remaining from the limitation period, then it is extended for another six months. If the period itself is six months or less, then until this period.

How to restore the statute of limitations?

If the creditor had serious reasons why he missed the expiration date of the receivables, then he has the right to restore it through the court. Of course, the legislation does not have a specific list of grounds, but, as practice shows, the court can satisfy the requirements in the presence of the following circumstances:

- The creditor was on a long business trip, which is why he missed the expiration date of the receivables.

- The creditor was being treated for a serious illness.

- The creditor was in a helpless state.

Moreover, a valid reason can be called one that occurred in the last 6 months of the statute of limitations.

If the period is six months or less, then absolutely at any time during its course. More information about this can be found in Article 205 of the Civil Code of the Russian Federation.

It should be noted that only an individual should be involved in restoring the statute of limitations on accounts payable and receivable. Moreover, this opportunity was not provided for various companies, organizations and individual entrepreneurs. To find out more about this, you can read the resolution of the Plenum of the RF Armed Forces and the Plenum of the Supreme Arbitration Court of the Russian Federation dated February 28, 1995 No. 2/1.

Expired statute of limitations

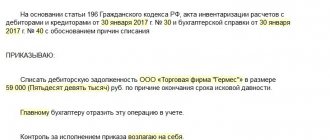

Debt with an expired statute of limitations must be written off. Moreover, the procedure depends on whether the company has created a reserve or not.

Before you start writing off, an inventory must be taken. During this process, the exact amount of debt is determined.

The company needs to issue a management order to liquidate the debt based on a certificate provided by the accountant and the corresponding act confirming the fact of the inventory. Moreover, the certificate must indicate the exact amount of the receivable, tell in detail about the situation with the debt, and list the reasons why the debt became hopeless. Additionally, you should leave a link to the number and date of the inventory report.

We must remember that it is always possible to resolve a dispute peacefully without necessarily going to court.

To effectively work at the judicial stage of collection, our company, based on the experience of implementation in many credit institutions, offers for consideration the “BIT.Debt Management” program, which will provide you with the following opportunities:

- Automatic generation of a package of documents individually and en masse for a group of agreements (Statement of Claim, Settlement Agreement, Agreement on Debt Forgiveness, Payment Order, Certificate of Debt Repayment, etc.);

- Access to contact information of bailiffs: phone number, work hours, postal address, position, in which OSP works, manager, which is automatically updated;

- Automatic tracking of the delivery of documents to the court and setting tasks for employees for further work;

- The program will automatically assign a task to the responsible employee, for example, “Call the court”;

- Automatic sending of documents to the court en masse for a group of contracts;

- Automatic receipt of information on the status of enforcement proceedings en masse for a group of contracts;

- Calculation of state duty.

Read more Get demo access

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

The nuances of accounts receivable accounting

What should an accountant do with accounts receivable when counterparties refuse to pay, citing an epidemic? In what cases is a debt considered bad, what to do if the buyer is a foreigner, and in what order to write off the debt of a counterparty with several debts, said Nadezhda Chetvergova, leading economic consultant.

Every accountant is well acquainted with the concept of accounts receivable. Accounts receivable (hereinafter referred to as receivables) is the amount of debts and obligations of debtors to the organization. Debtors (debtors) are persons who have monetary and other obligations to the organization: suppliers and contractors, buyers and customers, employees, budget, extra-budgetary funds, etc.

What should an accountant do with a loan when counterparties refuse to pay under contracts, citing the epidemic? “Of course, write it off as an expense,” the accountants will answer.

The answer is correct, but you can write off the remote control only when it becomes hopeless. The grounds for recognizing a debt as bad in tax accounting are determined by Article 266 of the Tax Code of the Russian Federation[1].

According to paragraph 2 of Article 266 of the Tax Code of the Russian Federation[2], these are:

* expiration of the limitation period (Article 196 of the Civil Code of the Russian Federation[3]);

* impossibility of fulfilling an obligation for reasons beyond the will of the parties (Article 416 of the Civil Code of the Russian Federation[4]). For example, due to force majeure circumstances (natural disasters, military operations, terrorist attacks, etc.);

* termination of an obligation based on an act of a state authority or local government (Article 417 of the Civil Code of the Russian Federation[5]);

* liquidation of the debtor organization (Article 419 of the Civil Code of the Russian Federation[6]);

* resolution of the bailiff about the impossibility of collecting the debt due to the fact that it was not possible to establish the location of the debtor, property, there is no information about the debtor’s funds and other valuables in banks.

From January 1, 2022, amendments made to Article 266 of the Tax Code of the Russian Federation[7] expanded the list of grounds for recognizing a debt as bad. These now include the debts of Russians declared bankrupt. If the basis is declaring an individual bankrupt in accordance with Federal Law No. 127-FZ of October 26, 2002 “On Insolvency (Bankruptcy),” the company has the right to write off receivables as expenses.

The company has the right to include in non-operating expenses the amounts of receivables if there is one of the grounds listed in paragraph 2 of Article 266 of the Tax Code of the Russian Federation[8].

Thus, the list of cases when debts to an organization are recognized as bad in tax accounting is closed. Not all types of receivables that cannot be collected are recognized as bad debts. As you can see, good reasons are needed to write off a loan.

Now, regarding the debt arising in connection with the coronavirus. The Tax Code of the Russian Federation does not allow writing off damages arising in connection with the spread of coronavirus infection, since there are no grounds for this. But can a company write off a counterparty’s debt, citing the impossibility of fulfilling an obligation for reasons beyond the control of the parties?

Unfortunately, there is no clear answer.

If the dispute goes to court and the debtor manages to prove that the reason for failure to fulfill the obligation was force majeure, then the further fate of the obligation itself depends on whether its fulfillment will be possible after the termination of force majeure. If not, then the obligation will cease due to the impossibility of fulfillment (clause 1 of Article 416 of the Civil Code of the Russian Federation[9]). Thus, whether a company can write off a counterparty’s debt arising in connection with the spread of coronavirus infection depends only on the outcome of the trial.

But let’s not forget that PD can arise not only in connection with the spread of coronavirus infection. Therefore, let us consider interesting cases encountered in practice. They may seem ordinary, but don’t rush to conclusions.

- For example, how to write off accounts receivable if there is a signed reconciliation report?

The creditor organization has a liability in its books with an expired statute of limitations (more than three years). The debtor organization has not been liquidated, it acknowledges its debt to the creditor by signing a statement of reconciliation of mutual settlements, but no income is expected from them, therefore the creditor’s accountant decided to write off such debt as expenses on the basis of the expiration of the statute of limitations.

But the creditor’s accountant should take into account that there is an important nuance associated with determining the statute of limitations for the purpose of transferring a debt to the category of bad debt. The general limitation period is three years (Article 196 of the Civil Code of the Russian Federation[10]). In accordance with Article 203 of the Civil Code of the Russian Federation[11], the signing by the debtor of an act of reconciliation of mutual settlements interrupts the limitation period for the debt recognized by him, in particular, the time elapsed before the break is not counted towards the new period and the limitation period begins anew. According to the position of the Ministry of Finance of Russia (letter dated July 10, 2015 No. 03-03-06/39756[12], dated July 19, 2011 No. 03-03-06/1/426[13]), the Federal Tax Service of Russia (Letter dated December 6, 2010 No. ShS-37-3/1695[14]) and the Federal Tax Service of Russia for Moscow (Letter dated April 17, 2007 No. 20-12/036354[15]) DZ can be recognized as expenses three years after the last reconciliation for it. There are judicial acts confirming this point of view (Resolution of the Federal Antimonopoly Service of the Ural District dated 02/01/2013 No. F09-150/13 in case No. A71-4334/2012[16], Resolution of the Federal Antimonopoly Service of the Ural District dated 02/16/2010 No. F09-6971/08- C2 in case No. A47-3325/2008[17]).

- The debtor organization was excluded from the Unified State Register of Legal Entities based on a decision of the tax authority. Is it necessary to write off the debt on the date of the Federal Tax Service’s decision?

Details: the creditor organization is registered as a subsidiary, the debtor organization, by decision of the tax authority, is recognized as an inactive legal entity (the organization has not submitted tax reports for the last 12 months) and is excluded from the Unified State Register of Legal Entities. Can a creditor write off a loan on this basis?

Maybe, but it wasn't always like that.

For relationships that arose before 09/01/2014, the exclusion of an organization from the Unified State Register of Legal Entities was not considered liquidation, and the official clarifications issued at that time boiled down to one thing: the creditor could not include the receivables of an inactive legal entity excluded from the Unified State Register of Legal Entities as part of non-operating expenses, since The Tax Code of the Russian Federation does not provide for such a basis for classifying an organization’s debt as bad debts, such as the exclusion of the debtor from the Unified State Register of Legal Entities (Letter of the Ministry of Finance of Russia dated 02/27/2013 No. 03-03-06/1/556[18], dated 12/11/2012 No. 03-03 -06/1/649[19], Letter of the Federal Tax Service of Russia for Moscow dated December 6, 2007 No. 20-12/116512[20]).

On September 1, 2014, Federal Law No. 99-FZ dated May 5, 2014[21] came into force, which supplemented Chapter 4 of Part One of the Civil Code of the Russian Federation with Article 64.2[22]. According to paragraph 2 of Article 64.2 of the Civil Code of the Russian Federation[23], the exclusion of an inactive legal entity from the Unified State Register of Legal Entities entails legal consequences provided for by the Civil Code of the Russian Federation and other laws in relation to liquidated legal entities.

Thus, for relationships that arose after 09/01/2014, the exclusion of an organization from the Unified State Register of Legal Entities by decision of the tax authority is equivalent to liquidation, and the creditor organization can write off as tax expenses the debts of a legal entity that has actually ceased its activities in the manner established by Article 266 of the Tax Code of the Russian Federation [24], from the date of exclusion of this person from the Unified State Register of Legal Entities (letter of the Ministry of Finance of Russia dated March 25, 2016 No. 03-03-06/1/16721[25], dated January 23, 2015 No. 03-01-10/1982[26]).

- How to properly write off the debt of a foreign buyer?

Writing off a Russian buyer's hopeless loan agreement should not cause any difficulties for an accountant. But the situation is different with the write-off of a hopeless loan from a foreign buyer, since the relationship in this case can be regulated by the laws of both countries.

Let's look at an example.

The seller organization from the Russian Federation shipped the goods to a foreign buyer. The buyer has not paid for the goods and has not contacted us. The seller did not attempt to collect the debt in court. Can the seller of goods write off debt due to the statute of limitations (three years) to reduce taxable profit? Provided that the parties agree on the choice of applicable law:

— regulated by Russian legislation;

— regulated by foreign law;

- if the parties have not chosen the law that applies to their rights and obligations under the contract.

Let us immediately note that debt can be taken into account in expenses (if there are grounds for this) regardless of the measures taken to collect it (Decision of the Supreme Court of the Russian Federation dated January 19, 2018 No. 305-KG17-14988 in case No. A41-17865/2016[27], Letter of the Ministry of Finance of Russia dated November 25, 2008 No. 03-03-06/2/158[28], etc.).

A hopeless claim is written off in the period in which the expiration date of the limitation period falls (letter from the Ministry of Finance of Russia dated June 20, 2018 No. 03-03-06/1/42047[29], dated August 25, 2017 No. 03-03-06/1/ 54556[30]).

To write off the receivables of a foreign debtor, it is important to understand in accordance with the legislation of which country the limitation period to be applied to the relevant relationship will be determined.

The rules established by civil legislation apply to relations with the participation of foreign legal entities, unless otherwise provided by federal law (Clause 1, Article 2 of the Civil Code of the Russian Federation[31]).

The law to be applied to civil legal relations with the participation of foreign legal entities or civil legal relations complicated by another foreign element, including in cases where the object of civil rights is located abroad, is determined on the basis of international treaties of the Russian Federation, the Civil Code of the Russian Federation, and others laws and customs recognized in the Russian Federation (clause 1 of Article 1186 of the Civil Code of the Russian Federation[32]).

The parties to the agreement, when concluding it or subsequently, can choose, by agreement among themselves, the law that is subject to application to their rights and obligations arising within the framework of this agreement (Clause 1 of Article 1210 of the Civil Code of the Russian Federation[33]).

In the absence of an agreement between the parties on the applicable law, the law of the country where, at the time of conclusion of the contract, the place of residence or the main place of activity of the party that carries out the performance, which is of decisive importance for the content of the contract, is located (clause 1 of Article 1211 of the Civil Code of the Russian Federation[34] ). The party that carries out the performance, which is of decisive importance for the content of the purchase and sale agreement, is recognized as the party that is the seller (clause 1, clause 2, article 1211 of the Civil Code of the Russian Federation[35]).

In this case, the limitation period is determined by the law of the country to be applied to the relevant relationship (Article 1208 of the Civil Code of the Russian Federation[36]).

Thus, if the debt of a foreign counterparty is recognized as bad in accordance with the legislation of the Russian Federation, then the taxpayer has the right to take this debt into account as part of non-operating expenses.

Based on the above legislative norms, we can draw the following conclusion: the application of the general limitation period established by Article 196 of the Civil Code of the Russian Federation[37] depends on the conditions and essence of the obligation with a foreign buyer.

If the agreement stipulates that the relations of its parties are regulated by the norms of Russian legislation, then the limitation period of three years established by Article 196 of the Civil Code of the Russian Federation[38] is subject to application.

If the parties have agreed that the contract concluded between them is governed by the rules of foreign law, then the limitation period of three years, determined by Russian legislation, is not subject to application, but the limitation period established in accordance with the legislation of the buyer’s state is applied.

If the parties have not chosen the law that applies to their rights and obligations under the contract, then the law of the supplier country, that is, Russian legislation, will apply to the legal relations of the parties. This means that the limitation period of three years, established by Article 196 of the Civil Code of the Russian Federation[39], is subject to application.

Thus, when recognizing the profit of a foreign company as unreliable for tax purposes due to the expiration of the statute of limitations for its recovery, the Russian party to the transaction must take into account the above-mentioned legal nuances.

A similar point of view is contained in the Letter of the Ministry of Finance of Russia dated March 23, 2015 No. 03-03-06/1/15719[40], which states that if the debt of a foreign counterparty is recognized as bad in accordance with the legislation of the Russian Federation, the taxpayer has the right to take into account the specified debt as part of non-operating expenses in the manner established by the Russian Federation.

- In what order should I write off the debt of a counterparty that has more than one debt to the organization for various reasons?

In practice, there is a situation when a debtor has more than one debt to an organization under different agreements (for example, supply, provision of services, rent). Moreover, according to one of them, there is a court decision on collection, for example, under a supply agreement, and the bailiff confirmed the impossibility of establishing the location of the debtor and the absence of property on which collection can be imposed. Can a creditor also write off debt under service and lease agreements for a given counterparty?

It would seem that the answer is obvious. But, alas. The answer is no. According to the Ministry of Finance of Russia, debts, the impossibility of collection of which is not confirmed by the order of the bailiff on the completion of enforcement proceedings (or other circumstances specified in paragraph 2 of Article 266 of the Tax Code of the Russian Federation[41]), cannot be considered hopeless for tax purposes ( see letters dated 05/30/2018 No. 03-03-06/2/36758[42], dated 07/21/2015 No. 03-03-06/2/41683[43], dated 08/12/2013 No. 03-03-06/ 1/32519[44]). Thus, only that specific debt can be taken into account in expenses for tax purposes in respect of which there is a decree from the bailiff on the completion of enforcement proceedings.

- What are the nuances of writing off debt acquired under an agreement on the assignment of claims?

The creditor (assignor), to whom the debtor has an obligation, transferred the right of claim on it to a new creditor (assignee), concluding with him an agreement on the assignment of the claim (assignment) (clause 1 of Article 382 of the Civil Code of the Russian Federation[45]). The debtor has not repaid the debt to the new creditor, and the statute of limitations expires. The question arises: can a new creditor take into account in non-operating expenses debt acquired under an agreement on the assignment of claims for which the statute of limitations has expired?

“Why not,” the accountant will think and write it off, guided by the Tax Code of the Russian Federation, namely paragraph 2 of Article 266[46] and subparagraph 2 of paragraph 2 of Article 265[47]. But don't rush.

According to the official position expressed by the Ministry of Finance of Russia (letters dated October 28, 2013 No. 03-03-06/1/45488[48], dated March 23, 2009 No. 03-03-06/1/176[49]) and the Federal Tax Service of Russia for the city Moscow (Letter dated January 30, 2012 No. 16-15/ [email protected] [50]), the debt received under an agreement on the assignment of claims is not related to the sale of goods, works, services and is not taken into account in non-operating expenses.

In this situation, there are court decisions in favor of taxpayers. Thus, in the decisions of the Federal Antimonopoly Service of the West Siberian District dated April 28, 2012 in case No. A27-4466/2011 and dated March 18, 2011 in case No. A27-8234/2010[51], the Federal Antimonopoly Service of the Ural District dated February 16, 2010 No. Ф09-6971/ 08-C2 in case No. A47-3325/2008 [52], the judges considered a bad debt to be a debt acquired by virtue of the assignment of a claim based on the expiration of the statute of limitations. And in the Resolution of the Federal Antimonopoly Service of the West Siberian District dated March 18, 2011 in case No. A27-8234/2010[53], the court, considering the dispute about the period of inclusion in non-operating expenses of receivables acquired under an assignment of claims, noted that the taxpayer legally wrote off the specified debt with an expired statute of limitations.

Thus, taking into account the existence of positive judicial practice, the organization - the new creditor may decide to write off as non-operating expenses the receivables acquired under the assignment agreement as hopeless, for which the statute of limitations has expired. However, the new creditor should not lose sight of the fact that he may have to defend his position in court.

So, in the article we looked at the features of writing off remote control. The issue of taking into account the remote sensitivities that have arisen in connection with the spread of coronavirus infection remains relevant. This debt can only be written off if certain conditions are met. But if in court proceedings between the creditor and the debtor the impossibility of fulfilling the obligation is proven, then the creditor can write off the bad debt, citing the impossibility of fulfilling the obligation for reasons beyond the will of the parties.

The article also discusses real cases that an accountant may encounter in practice. Based on the above situations, it can be noted that before writing off a hopeless loan, it is necessary to be guided not only by the norms of the Tax Code of the Russian Federation, but also by the Civil Code of the Russian Federation, familiarize yourself with the explanations of official bodies, judicial practice and monitor changes in legislation.

In conclusion, I would like to wish our Clients reliable and solvent counterparties.

[1] Art. 266 of the Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 04/24/2020) {ConsultantPlus}.

[2] Art. 266 of the Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 04/24/2020) {ConsultantPlus}.

[3] Art. 196 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[4] Art. 416 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[5] Art. 417 of the Civil Code of the Russian Federation (part one of November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[6] Art. 419 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[7] Art. 266 of the Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 04/24/2020) {ConsultantPlus}.

[8] Art. 266 of the Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 04/24/2020) {ConsultantPlus}.

[9] Art. 416 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[10] Art. 196 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[11] Art. 203 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[12] Question: About accounting for unpaid receivables when calculating income tax, if there is a guarantee agreement for it or a debt reconciliation act was signed (Letter of the Ministry of Finance of Russia dated July 10, 2015 No. 03-03-06/39756) {ConsultantPlus} .

[13] Question: ... During the on-site tax audit, part of the expenses from the tax base for income tax and VAT deductions were excluded due to the fact that the Federal Tax Service of Russia concluded: the organization created a formal document flow in order to obtain tax benefits without carrying out real business transactions . Based on the court ruling, adjustments were made to the organization’s accounting for expenses from counterparties. Since the excluded expenses were paid in full, a receivable was created. Can accounts receivable be written off as income tax expense in 2011 as a bad debt after the statute of limitations has expired? What moment is considered the expiration of the statute of limitations if the calculations were carried out in 2007, 2008? (Letter of the Ministry of Finance of the Russian Federation dated July 19, 2011 No. 03-03-06/1/426) {ConsultantPlus}.

[14] Letter of the Federal Tax Service of the Russian Federation dated December 6, 2010 No. ШС-37-3/16955 “On confirmation of expenses in the form of amounts of receivables with an expired statute of limitations {ConsultantPlus}.

[15] Question: ... When calculating income tax for the reporting period of 2007, does an organization have the right to take into account as part of non-operating expenses bad debts from amounts of receivables with an expired statute of limitations on the basis of copies of primary documents? The originals were seized by the internal affairs bodies in connection with the initiation of a criminal case against the head of the counterparty organization (Letter of the Federal Tax Service of the Russian Federation for Moscow dated April 17, 2007 No. 20-12/036354) {ConsultantPlus}.

[16] Resolution of the Federal Antimonopoly Service of the Ural District dated February 1, 2013 No. F09-150/13 in case No. A71-4334/2012 {ConsultantPlus}.

[17] Resolution of the Federal Antimonopoly Service of the Ural District dated February 16, 2010 No. F09-6971/08-S2 in case No. A47-3325/2008 {ConsultantPlus}.

[18] Question: ... About accounting for income tax purposes of debt if the debtor is excluded from the Unified State Register of Legal Entities. (Letter of the Ministry of Finance of Russia dated February 27, 2013 No. 03-03-06/1/5556) {ConsultantPlus}.

[19] Question: ... The LLC supplied goods on deferred payment terms to other legal entities that did not fulfill their obligations to the taxpayer to pay for the goods supplied (debtors). By decision of the registration authority, the debtors were excluded from the Unified State Register of Legal Entities as invalid on the basis of Art. 21.1 of the Federal Law of 08.08.2001 No. 129-FZ, while in relation to some of them the enforcement proceedings initiated earlier on the basis of the writ of execution issued by the LLC have not been completed or terminated. Are the debts of inactive legal entities excluded from the Unified State Register of Legal Entities by decision of the registration authority recognized as bad debts for the purposes of calculating income tax? (Letter of the Ministry of Finance of Russia dated December 11, 2012 No. 03-03-06/1/649) {ConsultantPlus}.

[20] Question: The organization uses the cash method. For the purposes of calculating income tax, does it have the right to take into account receivables as non-operating expenses if the statute of limitations has not expired and the debtor organization is in the process of liquidation and is not excluded from the Unified State Register of Legal Entities? (Letter of the Federal Tax Service of the Russian Federation for Moscow dated December 6, 2007 No. 20-12/116512) {ConsultantPlus}.

[21] Federal Law No. 99-FZ dated 05/05/2014 (as amended on 07/03/2016) “On amendments to Chapter 4 of Part 1 of the Civil Code of the Russian Federation and on the recognition as invalid of certain provisions of legislative acts of the Russian Federation” {ConsultantPlus}.

[22] Art. 64.2 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[23] Art. 64.2 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[24] Art. 266 of the Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 04/24/2020) {ConsultantPlus}.

[25] Question: About accounting for bad debts arising in connection with the liquidation of the debtor in income tax expenses (Letter of the Ministry of Finance of Russia dated March 25, 2016 No. 03-03-06/1/16721) {ConsultantPlus}.

[26] Question: On recognizing the debts of a legal entity that has actually ceased its activities as bad for income tax purposes (Letter of the Ministry of Finance of Russia dated January 23, 2015 No. 03-01-10/1982) {ConsultantPlus}.

[27] Determination of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated January 19, 2018 No. 305-KG17-14988 in case No. A41-17865/2016 {ConsultantPlus}.

[28] Question: About the procedure for the bank to write off bad debts in the form of interest on loans for the purpose of calculating income tax (Letter of the Ministry of Finance of the Russian Federation dated November 25, 2008 No. 03-03-06/2/158) {ConsultantPlus}.

[29] Question: On accounting for income tax purposes for expenses identified upon receipt of primary documents relating to previous periods, as well as on the recognition and accounting of bad debts (Letter of the Ministry of Finance of Russia dated June 20, 2018 No. 03-03-06/1/42047 ) {Consultant Plus}.

[30] Question: On recognition of debt as bad and its accounting for income tax purposes (Letter of the Ministry of Finance of Russia dated August 25, 2017 No. 03-03-06/1/54556) {ConsultantPlus}.

[31] Art. 2 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[32] Art. 1186 of the Civil Code of the Russian Federation (part three) dated November 26, 2001 No. 146-FZ (as amended on March 18, 2019) {ConsultantPlus}.

[33] Art. 1210 of the Civil Code of the Russian Federation (part three) dated November 26, 2001 No. 146-FZ (as amended on March 18, 2019) {ConsultantPlus}.

[34] Art. 1211 of the Civil Code of the Russian Federation (part three) dated November 26, 2001 No. 146-FZ (as amended on March 18, 2019) {ConsultantPlus}.

[35] Art. 1211 of the Civil Code of the Russian Federation (part three) dated November 26, 2001 No. 146-FZ (as amended on March 18, 2019) {ConsultantPlus}.

[36] Art. 1208 of the Civil Code of the Russian Federation (part three) dated November 26, 2001 No. 146-FZ (as amended on March 18, 2019) {ConsultantPlus}.

[37] Art. 196 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[38] Art. 196 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[39] Art. 196 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[40] Question: On accounting for receivables from a foreign counterparty when calculating income tax if such debt is considered bad (Letter of the Ministry of Finance of Russia dated March 23, 2015 No. 03-03-06/1/15719) {ConsultantPlus}.

[41] Art. 266 of the Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 04/24/2020) {ConsultantPlus}.

[42] Question: On the recognition of debt at the end of enforcement proceedings as bad for income tax purposes (Letter of the Ministry of Finance of Russia dated May 30, 2018 No. 03-03-06/2/36758) {ConsultantPlus}.

[43] Question: ... On the recognition by the bank of overdue debt under a loan agreement as bad for income tax purposes, if the debt of this borrower under another agreement is recognized as bad (Letter of the Ministry of Finance of Russia dated July 21, 2015 No. 03-03-06/2/41683) { Consultant Plus}.

[44] Question: ... Leasing agreements were concluded between the lessor and the lessee, under one of which the lessor went to court to collect the debt. The bailiff confirmed the impossibility of establishing the location of the debtor and the absence of property on which collection could be imposed. Is debt under other leasing agreements considered bad for income tax purposes? (Letter of the Ministry of Finance of Russia dated August 12, 2013 No. 03-03-06/1/32519) {ConsultantPlus}.

[45] Art. 382 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ (as amended on December 16, 2019, as amended on April 28, 2020) {ConsultantPlus}.

[46] Art. 266 of the Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 04/24/2020) {ConsultantPlus}.

[47] Art. 265 of the Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 04/24/2020) {ConsultantPlus}.

[48] Question: On accounting for income tax purposes of a loss on the acquired right to claim a debt, if it was received in connection with the liquidation of the debtor (Letter of the Ministry of Finance of Russia dated October 28, 2013 No. 03-03-06/1/45488) {ConsultantPlus}.

[49] Question: An organization, under an assignment of claim agreement, acquired the right to claim a debt that it could not collect due to the liquidation of the debtor organization. Which of the norms of the Tax Code of the Russian Federation (clause 2, clause 2, article 265 or clause 7, clause 2, article 265) is subject to application when writing off a bad debt for the purpose of calculating income tax? (Letter of the Ministry of Finance of the Russian Federation dated March 23, 2009 No. 03-03-06/1/176) {ConsultantPlus}.

[50] Question: Is the amount of debt acquired under an assignment agreement recognized as bad debts for income tax purposes if a decree from the bailiff service is received to terminate enforcement proceedings and return the enforcement document to the recoverer? (Letter of the Federal Tax Service of Russia for Moscow dated January 30, 2012 No. 16-15/ [email protected] ) {ConsultantPlus}.

[51] Resolution of the Federal Antimonopoly Service of the West Siberian District dated April 28, 2012 in case No. A27-4466/2011 {ConsultantPlus}.

[52] Resolution of the Federal Antimonopoly Service of the Ural District dated February 16, 2010 No. F09-6971/08-S2 in case No. A47-3325/2008 {ConsultantPlus}.

[53] Resolution of the Federal Antimonopoly Service of the West Siberian District dated March 18, 2011 in case No. A27-8234/2010 {ConsultantPlus}.