In 2022, legislators have not made any major changes to the Tax Code for persons applying a special tax regime. The “simplistic” ones should take into account the following points:

- from 01/01/2018, a new edition of KUDiR is mandatory for everyone (as amended by Order of the Ministry of Finance of the Russian Federation dated 12/07/2016 No. 227n). Read more about the new income and expense accounting book here;

- The list of income exempt from taxation under the simplified tax system has been expanded - from 2022, unclaimed dividends and assets contributed as a contribution to the Criminal Code have been added (Law of September 30, 2017 No. 286-FZ, Article 251 of the Tax Code of the Russian Federation).

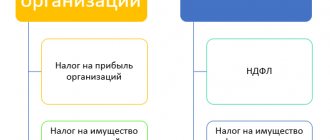

Let us recall what characterizes the simplified taxation regime for Russian companies and.

Advantages of switching to simplified tax system

For small enterprises, the use of “simplified” is, as a rule, quite profitable.

There are several reasons for this. 1. The tax burden under this special regime is very gentle. After all, the company does not need to transfer such (unaffordable for many) budget payments as profit tax, VAT and property tax (however, there are certain exceptions - see clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

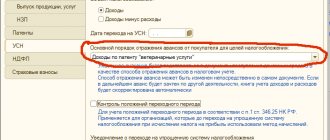

2. The ability to choose the object of taxation (“income” or “income minus expenses”), which allows the company to adapt the fiscal burden to the indicators of its business activities. Moreover, if the company made a mistake in its choice, the object of taxation can then be changed (from the beginning of the new calendar year).

3. Not so high tax rates (6 and 15 percent), which regional authorities can also lower (Article 346.20 of the Tax Code of the Russian Federation). It must be said that many subjects of the Russian Federation actively use this right (for example, in the capital, a 10 percent rate is provided for a number of “income-expenditure” simplifications - Moscow Law No. 41 dated October 7, 2009).

4. The cost of fixed assets and intangible assets acquired during the period of application of the simplified tax system is included in expenses during the year (clauses 1 and 2 of clause 3 of Article 346.16 of the Code, letter of the Ministry of Finance of the Russian Federation dated June 14, 2017 No. 03-11-11/36922 ). That is, much faster than in the general mode.

5. Tax accounting of a company using the simplified tax system is carried out in a book of income and expenses, which is quite simple to fill out and does not have to be certified by the Federal Tax Service. And the declaration is presented as “simplified” only based on the results of the tax period (that is, the calendar year), which also cannot but arouse interest.

Recently, legislators significantly increased the “simplified” limits, which makes it possible for a much larger number of organizations to apply this special regime next year. Let's talk about how to competently switch to the simplified tax system and what nuances should be kept in mind.

Results

In 2022, the income limit for using the simplified tax system is 200 million rubles.

for the annual income of a simplifier and 116.1 million rubles. for the previous 9 months for income that allows you to switch to the simplified tax system in 2022. It should be borne in mind that some income that is not subject to simplified tax is not taken into account when calculating income. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Limits and conditions for applying the simplified tax system

First, you need to understand whether the company can, in principle, switch to a simplified regime next year.

Thus, the company’s income for 9 months of 2022 (excluding VAT) should not exceed 112.5 million rubles (clause 2 of Article 346.12 of the Tax Code of the Russian Federation). For comparison, in order to switch to the simplified tax system from 2022, this figure for 9 months of 2016 should not exceed 59.805 million rubles (letter of the Ministry of Finance of the Russian Federation dated January 24, 2017 No. 03-11-06/2/3269).

Please note that until January 1, 2020, the use of the deflator coefficient for the purpose of calculating this standard is suspended. And one more nuance - to determine this limit, the amount of income from sales and non-operating income is used (Article 248 of the Tax Code of the Russian Federation).

One more threshold value must be observed: the accounting residual value of fixed assets as of January 1, 2018 should be no more than 150 million rubles. It is interesting that in this case we are talking only about those fixed assets that are subject to depreciation and are recognized as depreciable property in accordance with Chapter. 25 of the Tax Code of the Russian Federation (clause 16, clause 3, article 346.12 of the Code). That is, for example, land and other environmental management objects, objects of unfinished capital construction are not taken into account (Article 256 of the Tax Code of the Russian Federation).

Please note: exceeding the 150 million limit as of October 1 or the date of filing the notification is not an obstacle to the transition to the “simplified” system. The main thing is that the residual value of fixed assets does not exceed the legally established standard starting from 01/01/2018.

The general conditions for using the simplified version must also be met. Namely, the enterprise should not have branches, the average number of its employees should not exceed 100 people, and the maximum share of other companies in the authorized capital should be 25 percent. In addition, banks, insurers, non-state pension funds, pawnshops, government and budget institutions, as well as a number of other organizations are not entitled to operate on the simplified tax system.

Sample of filling out the simplified taxation system “income” declaration

To help you understand the procedure for filling out the simplified tax system “income” declaration, we have prepared an example of tax calculation and a sample of filling out the report.

Example

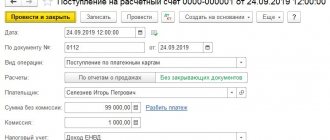

LLC "Kadrovik", type of activity - provision of accounting and legal services. The staff has a director (he is also the only founder, he does not receive a salary) and 1 employee (salary 30 thousand rubles per month). Contributions to pension, medical and social insurance are transferred from the employee’s salary - 30.2% of the salary amount. The tax rate under the simplified tax system for “income” is standard - 6%.

The accountant of Kadrovik LLC will fill out the simplified taxation system declaration for 2022 based on the following data:

| Reporting period | Amount of income, rub. | Line number in section 2.1.1 | Payroll fund, rub. | Contributions from the payroll fund, rub. | Line number in section 2.1.1 | Tax payable, rub. | Line number in section | Tax payable including insurance premiums for employees, rub. | Advance and annual tax, rub.. | Line number in section 1.1 |

| 1st quarter | 350 000 | 110 | 90 000 | 10 500 | 140 | 21 000 | 130 | 10 500 | 10 500 | 020 |

| half year | 720 000 | 111 | 180 000 | 21 600 | 141 | 43 200 | 131 | 21 600 | 11 100 | 040 |

| 9 months | 935 000 | 112 | 270 000 | 28 050 | 142 | 56 100 | 132 | 28 050 | 6 450 | 070 |

| year | 1 110 000 | 113 | 360 000 | 33 300 | 143 | 66 600 | 133 | 33 300 | 5 250 | 100 |

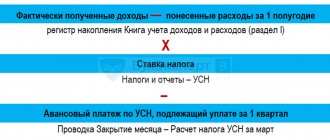

The tax payable is calculated as 6% of the income. It is reduced by insurance premiums, but not by more than half.

The advance for the 1st quarter is equal to the amount of tax payable taking into account employee insurance contributions for the 1st quarter. The advance for the half-year is calculated as the difference between the tax payable taking into account employee insurance contributions for the half-year and the advance paid for the 1st quarter. The advance payment for 9 months and the annual tax to be paid are calculated in the same way.

sample of filling out the simplified tax system “income” declaration for 2022.

We notify tax authorities

To switch to the simplified tax system starting next year, an organization must submit a notification to the Federal Tax Service at its location no later than December 31 of the current year.

However, December 31, 2022 falls on a day off - Sunday. This means, according to clause 7 of Art. 6.1 of the Tax Code of the Russian Federation, the deadline for filing a notification is postponed to the 1st working day of the next year - 01/09/2018. The validity of this conclusion is confirmed by the letter of the Ministry of Finance of the Russian Federation dated October 11, 2012 No. 03-11-06/3/70. It is necessary to report a change in the special regime, since companies that did not promptly notify the tax authorities about the transition to the “simplified system” do not have the right to apply it (clause 19, paragraph 3, article 346.12 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated February 13, 2013 No. 03-11- 11/66). The justice of this is illustrated by the latest verdict of the highest arbitrators - Ruling of the Supreme Court of the Russian Federation of September 29, 2017 No. 309-KG17-13365. Let's look at it in a little more detail.

A citizen who registered as an individual entrepreneur conscientiously applied the simplified tax system: submitted a declaration and transferred the tax to the budget. However, in the middle of the year, the fiscal authorities demanded a VAT return from him, and until it was submitted, they blocked the businessman’s bank account. The reason is that the individual entrepreneur did not submit a notification about the transition to the special regime before December 31 of the previous year, therefore, he does not have the right to the “simplified” regime.

It is interesting that the court of first instance supported the entrepreneur, pointing out that he actually applied the simplified tax system in the absence of objections from inspectors, which means that the requirement to work under the general regime is illegal. However, all subsequent authorities, including the RF Armed Forces, sided with the controllers, referring to the clear prescription of the norm of paragraphs. 19 clause 3 art. 346.12 of the Code. The same fact that a businessman submitted a simplified taxation system declaration, and the inspection accepted it, without any comments, does not indicate approval of the use of the “simplified tax” by the fiscal authorities. After all, the Federal Tax Service does not have the right to refuse to accept a declaration submitted by the payer (Article 80 of the Tax Code of the Russian Federation).

A similar point of view was expressed by the RF Supreme Court earlier (Determination No. 307-KG16-11322 dated September 20, 2016). The AS of the Moscow District also agrees with her (resolutions dated May 2, 2017 No. F05-3020/2017, dated April 27, 2016 No. F05-4624/2016). Detailed arguments in favor of the considered position can also be found in the Resolution of the AS of the West Siberian District dated December 10, 2014 No. F04-11632/2014.

It is important that in this case there is no need to submit other documents to the inspectorate besides the notification. The auditors also do not have the right to demand any additional information from the organization.

And one more thing - enterprises already operating under the simplified regime do not need to notify tax authorities about continuing to use it next year. This is exactly what the servants of Themis believe (Resolution of the Federal Antimonopoly Service of the Moscow District dated September 19, 2007, September 24, 2007 No. KA-A40/9540-07).

Please note that the transition to the simplified tax system during the year is impossible, including due to the emergence of new types of business activities for the company (letter of the Ministry of Finance of the Russian Federation dated April 21, 2014 No. 03-11-11/18274).

How to submit a notification to the Federal Tax Service

The notification can be submitted to the inspectorate (either or):

- on paper (the recommended form is approved by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. ММВ-7-3/ [email protected] ). Let us note that the company has the right to submit a notification in any form, taking into account the requirements of Art. Code 346.13;

- in electronic form (format approved by Order of the Federal Tax Service of the Russian Federation dated November 16, 2012 No. ММВ-7-6/ [email protected] ).

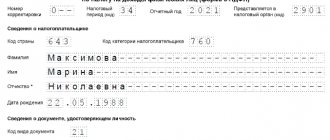

Let us pay attention to some features of filling out the notification form recommended by the fiscal authorities by an organization switching to the simplified tax system from the general tax regime.

In the “Taxpayer Identification” field, enter “3”, and in the line “Switches to a simplified taxation system” - “1”. And do not forget that the amount of income for 9 months of this year is shown without VAT. A dash is placed in empty lines of the notification. The document is signed by the head of the company and certified by its seal (if any).

In general, the form, consisting of only one page, is quite easy to fill out. There shouldn't be any difficulties with it.

The notification can be submitted to the Federal Tax Service in person, through an authorized representative, or sent by registered mail. In the first and second cases, the filing date will be the day the document is received by the secretariat or inspection office. In the latter - the day indicated on the postmark.

Please note that if the notification is submitted through a representative of the company, its lower field reflects the name of the document confirming the authority of this person. This document (a copy of it) should be attached to the notification.

The procedure for submitting the simplified taxation system “income” declaration

You can submit the declaration:

- personally;

- through a representative by proxy - please note that inspections require a notarized power of attorney from the representative of the individual entrepreneur;

- sending by mail - we recommend sending by registered mail with an inventory and receipt of receipt: then in a controversial situation you will be able to confirm to the inspection that you have fulfilled your obligation to submit the report;

- electronically, signing with an electronic signature.

You need to submit a report:

- for an entrepreneur - to the inspectorate at the place of registration;

- for a legal entity - to the inspectorate at the location, that is, at the legal address.

Which object to choose

The notification must indicate the selected object of taxation, the residual value of the fixed assets and the amount of income as of October 1, 2022.

Selecting a taxable object is the most important procedure for an organization. As a rule, the “income” object is more profitable if the company’s expenses are not so significant. If the costs are significant and at the same time it will be possible to reduce the base for the simplified tax system (remember that the list of “simplified” expenses is closed - Article 346.16 of the Tax Code of the Russian Federation), then it is more profitable to use the “income-expense simplification”.

The approximate benefit can be calculated by comparing the tax bases and rates of two simplified taxation system objects, from which it follows: if a company’s expenses are less than 60 percent of its income, it is better to choose the “income” object. If more, then there is an alternative option.

However, for a more accurate calculation, you should take into account a number of other factors, including what single tax rates are set for 2018, depending on the type of activity and category of taxpayer in your region. And only after a detailed analysis, record your choice in a notification.

What if the notification has already been submitted, but a little later the company decides to change the initially selected object of taxation? Then the company can (up to the above-mentioned deadline) submit to the Federal Tax Service a new notification with a different object of taxation, attaching a letter stating that the original one is canceled (letters of the Ministry of Finance of the Russian Federation dated October 14, 2015 No. 03-11-11/58878 and dated January 16, 2015 No. 03-11-06/2/813). If the deadline (in our case - 01/09/2018) is missed, then the company will be able to change the object only from the beginning of the new tax period, that is, from 2019. It will not be possible to do this during 2022 (clause 2 of Article 346.14 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation for Moscow dated 05/07/2009 No. 20-18/2/ [email protected] ).

In practice, there are cases when an organization actually applies a taxation object that is not specified in the notification. The Federal Tax Service will probably consider this unlawful and will recalculate the company’s tax liabilities with all the ensuing consequences. And the judges will most likely agree with the fiscals. For example, in the Resolution of the Sixth AAS dated 01.10.2014 No. 06AP-5107/2014 it is noted: the transition to a simplified regime, the choice of an object of taxation, despite its voluntary nature, is carried out by the payer not arbitrarily, but in compliance with the conditions and procedures clearly specified in Chapter. 26.2 Tax Code of the Russian Federation. And if an organization, in violation of the established procedure, actually changed the simplified tax system object, it will have to answer for it.

You can take into account the costs of training online

One can call absolutely fresh news the changes to the simplified tax system in 2018 in terms of the emergence of the opportunity to take into account a new type of cost from 01/01/2018 - expenses for network training of personnel (Law No. 169-FZ dated 07/18/2017). The rules for their tax accounting are similar to the income tax (clause 3 of Article 264 of the Tax Code of the Russian Federation). Previously, the Tax Code of the Russian Federation did not regulate this issue in any way.

The list of expenses for the online form of training simplified for personnel/individuals in the Tax Code of the Russian Federation is open. Among them:

- maintenance of the employer's premises and equipment that participate in the training;

- salary;

- the cost of property transferred to organize the training process;

- other expenses within the framework of the agreement on online training.

You can take into account the costs of online training for personnel according to the simplified tax system if the following mandatory conditions are met:

- in the tax period, at least one person completed his online training;

- this person signed an employment contract with the simplified worker;

- The duration of this contract is at least 1 year.

For more details, see “New in the Tax Code of the Russian Federation: the network form of personnel education reduces income tax.”

Should I expect a reaction from inspectors?

The transition to the simplified tax system is of a notification nature.

And they do not issue any special permission to use fiscal taxes. Therefore, an organization (IP) can conduct activities without receiving confirmation from the Federal Tax Service on the application of the simplified tax system (letter of the Ministry of Finance of the Russian Federation dated February 16, 2016 No. 03-11-11/8396). At the same time, the taxpayer has the right at any time to send a request to his inspectorate to confirm the fact of his application of the simplified special regime. The recommended request form can be found in Appendix No. 6 to the Administrative Regulations, which was approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n. However, the request can also be made in any form.

The Federal Tax Service, in accordance with clause 93 of the Administrative Regulations, within 30 calendar days from the date of registration of the request, must send the payer an information letter in form 26.2-7 (approved by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. ММВ-7-3 / [email protected] ) . It also includes the date the payer submitted the notice of transition to the “simplified system” to the inspectorate - but nothing more.

Thus, all responsibility for compliance with the criteria necessary both for the transition to this special regime and for its further application lies entirely with the organization itself.

An independent reaction should be expected from inspectors only in one case: if the company violates the deadline for submitting a notification. Then officials will send a message to the enterprise in form 26.2-5 (approved by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. ММВ-7-3 / [email protected] ), meaning that it is impossible to use the “simplified approach”.

We wanted to switch to the simplified tax system, but then we changed our minds...

It happens that an organization that has expressed a desire to switch to the “simplified” system from next year and has submitted a notification to the Federal Tax Service, for some reason changes its mind and decides to remain in the general tax regime.

What should you do in such a situation? According to officials, the organization is obliged to notify fiscal officials of its new decision before January 15 of the year from which it was planned to apply the simplified tax system. A similar conclusion was made on the basis of clause 6 of Art. 346.13 of the Tax Code of the Russian Federation, despite the fact that this norm refers to payers who are already working under the “simplified tax system” and who want to switch to a different taxation regime from the beginning of the calendar year. So, if the company does not do this, it, according to the departments, will not be able to apply the OSN in 2022 (letter of the Ministry of Finance of the Russian Federation dated May 30, 2007 No. 03-11-02/154, sent for information and use in work by letter of the Federal Tax Service of the Russian Federation dated June 27 .2007 No. ХС-6-02/ [email protected] , letter of the Federal Tax Service of the Russian Federation dated July 19, 2011 No. ED-4-3/11587).

However, the servants of Themis do not support officials in this matter. Take, for example, the Resolution of the AS of the West Siberian District dated 05/06/2016 No. Ф04-1942/2016, which states: the taxpayer has the right to independently, in the absence of approval from the Federal Tax Service, change his decision and remain on the OSN, regardless of the reason, before the application of the simplified tax system begins. . The determining factor is the actual conduct of activities in accordance with the tax regime chosen from the beginning of the year.

In the Resolution of the FAS of the East Siberian District dated November 3, 2010 No. A33-2847/2010, the judges also emphasized: it is of legal significance that the taxpayer, having notified the inspectorate about the transition to the simplified tax system, did not begin to apply it, in fact working under the general tax regime, that is abandoned the “simplified” approach before using it. This approach is also shared by the Federal Antimonopoly Service of the North Caucasus District, which noted that only companies and entrepreneurs who have notified the Federal Tax Service about this and have actually switched to this tax regime are considered to have switched to the simplified tax system (Resolution dated March 14, 2014 No. A53-10176/2013).

However, in order to avoid unnecessary disputes with fiscal authorities, we advise you to notify them of a change in your initial decision. Fortunately, this is not a labor-intensive task, and can save a lot of time and nerves.

Changes for 2022

Basic

There are few key changes directly related to the simplified tax system, these are:

- Increasing the income limit for switching to the simplified tax system from other taxation regimes.

- Cancellation of indexation by the deflator coefficient until 2022.

- Increasing the maximum value of fixed assets allowing the use of simplified taxation system.

- Changing the deadline for transition to the simplified tax system from other taxation regimes.

- Changing the form of the book of income and expenses (KUDiR).

Indirect

There are slightly more changes affecting simplifiers along with other individual entrepreneurs and organizations under other special tax regimes:

- Introduction of a tax deduction for expenses on the purchase of cash register devices for certain categories of simplified customers.

- Changing the calculation procedure and increasing the amount of fixed insurance premiums for individual entrepreneurs for themselves.

- Postponement of the deadline for payment of the contribution in the amount of 1% on income exceeding 300 thousand rubles.

- Changing the maximum contribution amount from income exceeding 300 thousand rubles.

- Increasing the amount of maximum income, upon reaching which insurance premiums to the Pension Fund and Social Insurance Fund are calculated at reduced rates.

Let's look at the changes in the simplified tax system in tabular format in comparison with 2017.

Table No. 1. System of taxation in 2022 and 2022: list of changes

| 2017 | 2018 |

| Maximum income for switching to the simplified tax system | |

| 45 million rubles | 112.5 million rubles. |

| Deflator coefficient | |

| 1,425 | 1,481 |

| Maximum value of fixed assets | |

| 100 million rubles | 150 million rubles |

| Dates for transition to the simplified tax system in 2022 | |

| until December 31, 2016 | until 01/09/2018 |

| KUDiR form | |

| The old KUDiR form is valid (approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n) | A new KUDiR form is in effect (approved by Order of the Ministry of Finance of Russia dated December 7, 2016 N 227n) |

| Deduction for the costs of purchasing and installing a new cash register | |

| No | Yes* * for those simplifiers who combine the simplified tax system with UTII or a patent |

| Deadline for switching to online cash registers for certain categories of simplifiers | |

| until 07/01/2018 | until 07/01/2019 |

| Amount of fixed contributions of individual entrepreneurs for themselves | |

| Contributions to compulsory health insurance and compulsory health insurance are calculated based on the minimum wage approved at the beginning of the new year | Contributions are not calculated independently and are paid in the amount established by the Tax Code of the Russian Federation |

| Calculation of contribution to pension insurance (1% of excess income over 300 rubles) | |

| Minimum wage x 8 | Size specified in the Tax Code of the Russian Federation x 8 |

| Deadline for payment of pension insurance (1% of excess income over 300 rubles) | |

| before April 1 of the year following the reporting year | before July 1 of the year following the reporting year |

| The maximum income of an employee, upon reaching which contributions to compulsory pension insurance and compulsory social insurance are paid at reduced rates | |

| Pension insurance (PIP) – 876,000 Social insurance (OSS) – 755,000 | OPS – 1,021,000 OSS – 815,000 |

Let's look at each of the changes in more detail.

Calculation of the simplified tax system for individual entrepreneurs and LLCs

Do you have an individual entrepreneur or LLC using the simplified tax system ? Submit reports and pay taxes in 2 clicks!