Calculation formula

Vacation pay is calculated according to the formula:

Vacation pay = Average daily earnings x Duration of vacation in calendar days

Note! The correctness of calculating average daily earnings depends on:

- the amount the employee will receive during the rest period;

- the amount of personal income tax that the employer will transfer to the budget;

- the amount of contributions accrued towards vacation pay.

To correctly calculate your average daily earnings, follow the algorithm presented below and use the support of experts.

Ease of use of the Vacation Calculator software:

This software will help to perfectly automate the processes of vacation planning; the software perfectly saves time on such processes, for example, on manually calculating vacation days. This solution has a special feature: it is an excellent and convenient setup; the software can be easily adapted to interact with the labor legislation of various CIS countries. Namely, the software can be adjusted so that it will take into account any holidays established by the government.

And yet, using standard layouts does not mean that the software cannot be customized to suit your requirements. The software allows you to make changes. By creating your own list, the user will be able to remove any of the proposed government holidays from the schedule and set up a personal schedule with weekly days off, for example, moving it from the beginning to the middle or to the end of the week. You are allowed to start counting from any day. You can select it in a simple interactive calendar.

But there are also disadvantages of the software; the software does not have additional tools used to calculate vacation money received by colleagues.

Algorithm for calculating average daily earnings and accrual of vacation pay

1. Determine the list of payments made to the employee.

The calculation of average daily earnings includes payments prescribed in the regulations of the organization that were accrued to the employee in the billing period. The source of these payments does not matter. But a number of charges are not included in this list:

- various social payments in the form of financial assistance, travel, training, etc. (clause 3 of the Resolution);

- payment for business trips, downtime, periods of incapacity, etc. (clause 5 of the Resolution);

- compensation for the use of personal property in work, etc.

2. Select the billing period.

The calculation period for vacation pay is 12 calendar months before the vacation.

Important! A calendar month is the period from the 1st to the 30th or 31st of the month (for February - from the 1st to the 28th or 29th, depending on the year). For example, if the vacation falls in November 2022, then the billing period will be 11/01/2018 - 10/31/2019.

There are situations when in the 12 months preceding the vacation the employee had no earnings or did not actually work. In this case, clause 6 of the Resolution prescribes calculating the employee’s average daily earnings from the amount of income received for the previous period, similar to the calculated one. If in fact the employee did not work and did not receive wages both in the billing period and in the period preceding it, then the average daily earnings are calculated based on earnings accrued for the actual days of work in the month when the event occurred in connection with which the average daily earnings are retained (p 7 Regulations).

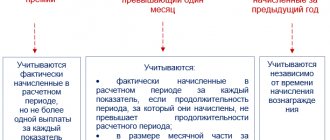

When calculating vacation pay, periods and amounts paid during these periods are taken into account when the employee was present at the workplace in accordance with the work schedule under the employment contract. According to paragraph 5 of the Resolution, when calculating average earnings, time is excluded from the calculation period, as well as amounts accrued during this time, if:

- the employee was accrued disability benefits or “maternity” payments;

- the employee did not work due to downtime for which the employer is to blame, or for reasons that cannot be influenced by either the first or the second, etc.

3. Calculate average daily earnings.

To calculate payment for vacation, which is provided in calendar days, the average daily earnings are determined as wages for the billing period, divided by 12 and 29.3. Where 12 are the months of the billing period, and 29.3 is the average monthly number of calendar days.

If there are months not fully worked in the billing period, the average daily earnings are calculated as follows:

earnings for the billing period / (29.3 x number of months fully worked + number of calendar days in months not fully worked)

The number of days of an incompletely worked calendar month = 29.3 / the number of calendar days of an incompletely worked month x the number of calendar days worked in this month (clause 10 of the Resolution).

4. Withhold personal income tax, pay vacation pay, and calculate contributions.

The amount of vacation pay is determined by multiplying the average daily earnings by the number of calendar days of vacation. When the vacation pay calculation is done, you need to allocate personal income tax and pay the employee the amount minus tax.

According to Art. 136 of the Labor Code of the Russian Federation, vacation pay is paid no later than three days before the start of the vacation. For personal income tax purposes, the day vacation is paid is the day the employee receives income. The deadline for tax payment is until the last calendar day in the month of payment of vacation pay (Article 226 of the Tax Code of the Russian Federation). Read how to correctly reflect vacation pay in 6-NDFL.

Contributions from the amount of vacation pay must be accrued in the month of their accrual. The deadline for transferring contributions to the budget is until the 15th day of the month following the accrual of vacation pay (Article 431 of the Tax Code of the Russian Federation).

Vacation days calculator

When determining vacation time, it is important to know which periods are included in the calculation and which are not.

The included periods include (Article 121 of the Labor Code of the Russian Federation):

- actual work time;

- the time when the employee did not actually work, but his place/position was retained (for example, annual paid leave, days off, non-working holidays, periods of illness, maternity leave, etc.);

- vacation at your own expense, the duration of which does not exceed 14 calendar days during the working year;

- a period of suspension from work that occurred through no fault of the employee (for example, a mandatory medical examination);

- time of forced absence due to illegal dismissal or suspension from work and subsequent reinstatement to the previous job.

Periods that are not included in the vacation period The vacation period is not included (Article 121 of the Labor Code of the Russian Federation):

- parental leave until the child reaches 3 years of age;

- vacation at your own expense exceeding 14 calendar days;

- the time the employee is absent from work without good reason.

Days excluded from the vacation period shift the end of the employee’s working year (Letter of the Ministry of Labor of Russia dated October 18, 2016 N 14-2/B-1045).

For example, an employee was hired on April 1, 2019. From 09/02/2019 to 09/20/2019 he took unpaid leave. If this employee's vacation were 14 calendar days or less, then the working year would end on March 31, 2020. But, since the vacation lasted 19 calendar days, the end of the working year will shift by 5 days (19 days minus 14 days), accordingly, the employee’s working “vacation” year will end on 04/05/2020.

Vacation period for part-time work

If an employee works part-time, then this fact does not affect the calculation of the vacation period in any way (Article 93 of the Labor Code of the Russian Federation). The length of service for such employees is calculated in the same way as for full-time employees.

When can you use vacation?

The right to leave arises for an employee after 6 months of continuous work with a specific employer (Article 122 of the Labor Code of the Russian Federation). By agreement with the employer, leave can be granted before the expiration of these 6 months. Vacation for the second and subsequent years is provided in accordance with the vacation schedule.

Calculation of leave for part-time work upon dismissal

The procedure for calculating leave for a part-time working year is determined by two regulations - the Labor Code of the Russian Federation and the “Rules on regular and additional leaves” (approved by the People's Commissariat of Labor of the USSR on April 30, 1930 N 169), hereinafter referred to as the Rules.

The Labor Code of the Russian Federation determines that the length of service that gives the right to regular leave includes the actual time worked. The rules define the specifics of calculating length of service if an employee has worked for less than a full month or less than a year. There is a contradiction between these two regulations, but, taking into account judicial practice, we can conclude that the courts still take into account the procedure established by the “Rules on regular and additional leaves”, therefore our “Calculator” calculates the days of unused vacation taking into account the Rules .

Thus, in accordance with paragraph 35 of the Rules, when calculating the terms of work giving the right to proportional additional leave or compensation for leave upon dismissal, surpluses remaining less than half a month are excluded from the calculation, and surpluses amounting to at least half a month are rounded up up to a full month.

For example, if an employee worked for 1 year, 6 months and 10 days, vacation days are calculated using the following formula:

1 year = 12 months.

10 days are excluded from the calculation since they constitute less than half of the month.

We find that the employee worked for 18 months.

28 (number of vacation days per year)/12 (number of months per year) = 2.33 days - this is the number of vacation days that the employee “earned” by working one month.

In our example, the employee “earned” 41.9 days of vacation (2.33 x 18).

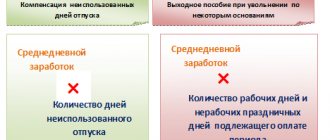

In accordance with paragraph 28 of the Rules, upon dismissal of an employee who has not used his right to vacation, he is paid compensation for unused vacation.

At the same time, employees dismissed for any reason who have worked for the employer for at least 11 months, subject to credit towards the period of work giving the right to leave, receive full compensation. Thus, if an employee worked for 11 months, the calculation is based on a full year - 12 months.

Vacation registration

There are two types of leave - main and additional, the calculation and documentation of which are identical.

The employer must create a vacation schedule for each year. No later than 2 weeks before the start of the vacation according to the schedule, the employee must be reminded in writing about the upcoming vacation. An employee may ask to reschedule a planned vacation. In this case, the transfer is carried out in agreement with management.

If an employee goes on vacation, an order is issued for him. The calculation of vacation pay is presented in the form of a calculation certificate containing a full calculation of the average daily earnings, the amount of vacation pay, withheld tax, and the amount due to be paid to the employee. Find out about changes in the calculation of vacation pay and registration of vacations from Kontur experts.

Legislative norms for calculating vacation days

The procedure for calculating vacation pay is directly fixed in the provisions of the current Russian legislation. And to be sure that the vacation pay calculator works correctly and in accordance with legal regulations, you can independently check the regulatory framework governing the issue under consideration. First of all, the procedure for calculating vacation days is influenced by the following norms of the labor legislation of the Russian Federation:

- Article 115 of the Labor Code of the Russian Federation regulates the normal duration of annual paid vacations.

- Article 120 of the Labor Code of the Russian Federation regulates the principles for calculating the duration of annual main and additional leave.

- Article 121 of the Labor Code of the Russian Federation establishes the procedure for determining the length of service under which an employee receives the right to paid leave.

- Letter of the Ministry of Labor of the Russian Federation dated 01.02.2002 No. 625-ВВ sets out the general principles for resolving disputes related to the principles of calculating the duration of vacation.

Based on legal standards, the number of vacation days in general cases is 28 days per calendar year. At the same time, certain categories of workers and persons in the public service may require the use of other principles for calculating the duration of leave. For such categories of persons, annual leave of longer duration than the standard may be granted.

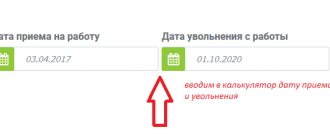

Instructions for using the vacation pay calculator

To quickly calculate your vacation pay, use our free calculator. The principle of its operation is based on three operations:

1. First, specify the rest period in the format “day.month.year”. Then select the type of vacation and specify the billing period.

Please note the auxiliary fields:

- The “There are exclusion periods” field is checked if there were exclusion periods in the billing period (illness, business trips, etc.).

- The field “If there was a salary increase in the billing period...” is marked if there was a salary increase throughout the company. This is done so that the calculator automatically indexes the employee’s earnings for the months preceding the increase.

2. Next, the employee’s income is indicated to calculate the average daily earnings, excluding the amounts of sick leave, etc. (see question mark in the calculator).

3. Receive a full calculation of vacation pay, highlighting the approximate amount of personal income tax and vacation pay to be issued.

Submit reports for employees. Extern gives you 14 days for free!

Try for free

When is it allowed to take after maternity leave?

It is necessary to distinguish between the following types of rest periods that an employee is entitled to count on under current labor legislation:

| Paid annually | Every employee, regardless of gender, profession and family circumstances, has the right to an annual vacation, during which he retains his average earnings. The standard duration is 28 days annually, for some groups of workers it is longer. |

| Unpaid | Provided at the request of the employee without retaining his earnings. |

| For pregnancy and childbirth - BiR | It is provided to pregnant women in the last stages of pregnancy and lasts from 140 to 194 days, depending on the complexity of the birth and whether the citizen gave birth to one or more children. Issued with a sick leave certificate. |

| Child care - Swelling or maternity leave | Provided to an employee, male or female, in connection with the need to care for a newborn until he reaches three years of age. Premature exit from Swelling is allowed. |

Article 260 of the Labor Code of the Russian Federation resolves the question of whether it is possible to take leave immediately after maternity leave: yes, immediately after leaving parental leave, an employee has the right to take annual paid leave. For its provision, work experience is not taken into account - six months of experience is not mandatory. Speaking about when leave is due after leaving maternity leave, it is important to remember that the employee will receive such leave provided that he did not use it before or after sick leave for pregnancy and childbirth.

In addition to the freedom to choose when to take leave after maternity leave, the employee has the right to independently determine the duration of such rest she needs: she has the right to use the full duration established by the employer, which is usually 28 days.