Legislative norms

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Certificate 2-NDFL obliges the employer to provide data on employees’ wages in accordance with Article 24 of the Tax Code of the Russian Federation.

This year there have been many changes in tax and accounting, one of them was the change in the form for the 2-NDFL certificate.

Also, based on order MV-7-11/820 of the Federal Tax Service, four new code values were introduced for income and one for deduction.

Order of the Federal Tax Service of Russia dated October 24, 2017 N ММВ-7-11/ [email protected]

There have been innovations related to the submission of reports, which will now have to be submitted in 2 stages for withheld and non-withheld tax.

For late submission or provision of false information, the Tax Code provides for the application of fines to both the organization and the official.

Registration of a power of attorney

The situation becomes more complicated when the company employs a large number of people. It could be 500 or 5000 employees. Who signs the 2-NDFL certificate? The leader again. But it is physically impossible to do this on such a large scale. In this case, the director of the enterprise must select an authorized representative to sign the certificates. And this could be several people at once. The person who signs the 2-NDFL must have the appropriate power of attorney. In addition, a special order from the manager should be issued, which lists all authorized persons. In the certificate itself, it is necessary to make a note that the signature is placed not by the tax agent himself, but by an authorized representative, and also indicate the details of the corresponding power of attorney and order.

***

Certificate 2-NDFL is a document related to reporting, which means its execution must be approached very carefully. If an error is made when signing or specifying data, problems will arise not only when checking the certificate by tax inspectors, but also with the employees to whom the document was issued. Attentiveness is the accountant’s main assistant when preparing such certificates.

Substance of the document

The document is a reporting form that displays the income received by the employee and the amount of taxes paid for him.

Typically, 2-NDFL is formed for the reporting year, for six months, or upon dismissal. But every employee has the right to receive it upon request at any time.

The form is filled out on a model approved by the legislation of the Russian Federation, which changes periodically, so before making a certificate you should make sure that the form is up to date.

Certificate form 2-NDFL

Who forms?

Usually the accounting department at the enterprise is responsible for issuing the certificate.

At the request of the employee, the organization is obliged to issue a certificate within up to 3 working days.

There are companies throughout the country that offer certificates for a fee.

Before turning to the services of such companies, it is important to know that even the slightest mistakes can lead to the document being rejected, for example, when submitted to a bank for a loan, or when contacting social authorities.

To whom is it issued?

Form 2-NDFL is provided by the employer:

- To the Federal Tax Service for each employee who received wages in the organization over the past year, including those dismissed and laid off. To correctly display income in the certificate, regulated income coding is used.

- Employee upon request . The request can be made orally; a written request is not mandatory. Moreover, the employer does not have the right to refuse to issue it, and the employee, in turn, has the right to ask for more than one original.

It is worth considering that a written application to receive form 2-NDFL guarantees the provision of a certificate from the employer within 3 days, in contrast to an oral request, the deadlines for which are not regulated by the tax legislation of the Russian Federation.

From our article you will learn how 2-NDFL differs from 3-NDFL. For what period do you need a 2-NDFL certificate? The deadlines are presented here.

Why do you need a personal income tax certificate 2 for an individual?

In most cases, individuals apply for this certificate and need to submit it to a credit institution to confirm the borrower’s solvency. The information contained in Personal Income Tax Certificate 2 helps bank employees make the right decision in relation to a potential client. Certificate 2 personal income tax for individuals can also be requested in the following cases:

- When applying for a tax deduction from the state. When applying for a tax deduction, certain categories of citizens may be asked for this certificate, for example, from one of the parents of a student who is studying at a higher education institution on a paid basis;

- In cases where an individual takes part in legal proceedings or disputes, a certificate of income of the individual may also be required;

- Certificate 2 of personal income tax is also necessary when applying for an old-age pension, as well as when guarding or adopting a child to confirm your status;

- Upon dismissal, you must take this certificate, since when applying for a new job, the employer will need the data contained in certificate 2 of personal income tax.;

- When applying for a foreign visa, some consulates request this certificate. But in most cases, they just need a salary card account statement and a certificate from their place of work;

- When an individual registers as unemployed at the employment center. The amount of unemployment benefits depends on the information reflected in Certificate 2 of the personal income tax. And the certificate must be provided for the last six months from the last place of work.

Who signs the 2-NDFL certificate in 2022?

Documentary grounds

The 2-NDFL certificate refers to tax documentation, and accordingly, the circle of persons allowed to endorse the document is determined on the basis of Law 402-FZ, which states that both the general director of the enterprise and an authorized person have the right to sign the certificate.

To avoid problems with the delegation of authority to sign, the company must create a document in the form of an order, which will list employees who have the authority to sign 2-NDFL certificates.

General procedure

Only authorized persons have the right to sign the document, namely:

- directly the employer represented by the manager;

- officially approved employee of the organization.

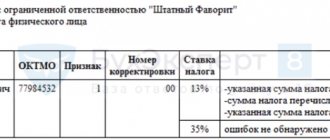

Moreover, in the official document there is a special column for marking the performer, sign 1 is for the employer, and 2 is for the officially approved performer.

If the form is submitted to the tax authority, then additional confirmation should be attached that the responsible person has the right to act with the document.

How to sign correctly

The authorized person with the right to sign undertakes to indicate the surname with initials and position held in the organization.

By proxy

A power of attorney is a document with which the director can delegate his powers, namely, transfer the right to sign.

The document can only be issued by one person at a senior level.

Sample power of attorney 2022:

If an enterprise, according to the Charter, operates using a seal, it must be affixed to the trust document.

Who should and can do this?

General Director (Head)

An authorized employee has the right to sign a 2-NDFL certificate to the general director of an organization. But the rules do not prohibit the manager from visaing his certificate independently.

For an employee

For an employee of an organization, the certificate is most often signed by an employee of the accounting department at the place of employment.

But all persons who are allowed to submit similar reports to the Federal Tax Service have authority.

Chief accountant

The chief accountant does not always have the right to sign a document in Form 2-NDFL. Accordingly, when a certificate is endorsed for him, powers are granted exclusively to the director or a circle of persons who are approved by order of the organization.

For an individual entrepreneur (IP)

An individual entrepreneur does not have reporting on Form 2-NDFL for himself.

If necessary, he provides an annual declaration of income received.

If a businessman has hired personnel, then, regardless of the taxation system, he is obliged to submit reports and remit taxes.

Both the manager himself and an authorized person, most often the chief accountant, can sign certificates for employees who are on the entrepreneur’s payroll.

For the bank

For a bank, a certificate of income of an individual is the main document on the basis of which a decision is made regarding a positive or negative answer when receiving a loan.

The document is signed by the general director, chief accountant or an official authorized to endorse the document.

Is a barcode required for 2-NDFL? What is the penalty for not having a TIN in 2-NDFL? About this - here.

How to fill out 2-NDFL for a foreigner? Find out here.

For tax

For the tax service, form 2-NDFL is required to verify income for all employees and each individual.

A certificate is drawn up by the accounting department and endorsed directly by the head of the organization or by an employee authorized to sign on the basis of an order from the company.

For a tax agent

For a tax agent due to the absence of an authorized person as a result of vacation or illness, Form 2-NDFL must be endorsed by a person approved on the basis of an order during the absence of the first person.

In a separate division (branch)

In a branch, both the head of the head unit and the authorized person of the separate branch have the right to sign the 2-NDFL document.

If there is no chief accountant

If an enterprise does not have a chief accountant on staff, then often the right to sign the document belongs to the head of the enterprise.

Who signs 2-NDFL for employees

Often company personnel need a 2-NDFL certificate. The form is issued on the basis of an application, and, of course, is signed, because an uncertified document has no legal force.

Who signs the 2-NDFL certificate for an employee? The recommendations approved by Order No. ММВ-7-11/ [email protected] do not establish a distinction between the certificate intended for the Federal Tax Service and the one issued to the applicant. Both of them must be signed either by the tax agent or his authorized representative.

Thus, a certificate for an employee is signed by the head of the company or an authorized representative.

Responsibility for violations

The Tax Code provides for liability for late submission of 2-NDFL reports.

The fine is 200 rubles. for each document. That is, if the company has a staff of 20 employees, then the manager will have to pay an amount of 4 thousand rubles.

In addition to delay, inaccuracy of the data provided is also punishable. For each incorrectly filled out form, the tax agent risks paying 500 rubles. for each employee separately.

It is worth noting! Errors to which fines apply are associated not only with the amounts calculated for income, but also with actual information about the employee (registration, passport data, etc.).

Refusal to issue a certificate is subject to a fine of 1 to 3 thousand rubles and is applied to the official responsible for issuing 2-NDFL.

Innovations this year include updating the codes in the certificate, as well as the preparation of an additional document in the form of a register of certificates, according to which reporting is compiled. But, of course, the 2-NDFL form has been updated.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Personal income tax (personal income tax)

Who generates and issues personal income tax certificate 2 upon request?

Each organization develops an accounting policy at the beginning of the year, where it is necessary to clarify all the details of accounting and tax accounting. One of the important annexes to it is the document flow order. Here you should clearly indicate the composition of the forms, the deadlines for submitting each and the persons responsible for the generation and submission of reports.

As a rule, responsibility for the tax base and general information in certificate 2 of the personal income tax is assigned to the employee who calculates the earnings. This is objective, since it is he who is responsible for the completeness of the data presented and the primary information that passes through.

Legal entities with employees are obliged to:

- Keep records of earnings received by employees;

- withhold income tax;

- track the numbers when personal income tax needs to be transferred to the treasury;

- report accrued income for each employee in Form 2 of personal income tax to the Internal Revenue Service and create a consolidated register for them;

- upon application by the employee, within three days, employers are required to generate an original certificate at the place of request and in the required quantity.