To automatically include losses from the sale of fixed assets in expenses in 1C: Accounting 8, a special technique is recommended, which is outlined by methodologists in the proposed article using a specific example.

According to paragraph 3 of Article 268 of the Tax Code of the Russian Federation “Features of determining expenses when selling goods and (or) property rights,” if the residual value of depreciable property, taking into account the expenses associated with its sale, exceeds the proceeds from its sale, the difference between these values is recognized as a taxpayer’s loss, taken into account for tax purposes in the following order.

The resulting loss is included in the taxpayer's other expenses in equal shares over a period defined as the difference between the useful life of this property and the actual period of its operation until the moment of sale.

Income

In tax accounting, in accordance with paragraph 1 of Article 248 and paragraph 1 of Article 249 of the Tax Code of the Russian Federation, proceeds from the sale of a fixed asset (excluding VAT) are recognized as income from sales.

Income is recognized on the day of signing the act of acceptance and transfer of fixed assets in form No. OS-1 (clause 3 of Article 271 of the Tax Code of the Russian Federation).

This operation is reflected automatically when posting the document “Transfer of fixed assets” in the credit of account 91.01.1 “Proceeds from the sale of fixed assets”.

At the same time, in order to correctly reflect the operation in the report “Register - calculation of the financial result from the sale of depreciable property” and the income tax return, for tax accounting you should select the item of other income and expenses with the type “Income (expenses) associated with the sale of fixed assets” .

According to paragraph 7 of PBU 9/99 “Income of the organization” (approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n), in accounting such income is classified as operating income. Therefore, for accounting purposes, it is recommended to select the item of other income and expenses with the type “Other operating income (expenses)”.

Expenses

In tax accounting, the reduction of income subject to income tax includes:

- the residual tax value of the object, which is reflected when posting the document “Transfer of fixed assets” in the debit of account 91.02.1 “Expenses associated with the sale of fixed assets”;

- the amount of expenses directly related to sales (according to paragraph 1 of Article 268 of the Tax Code of the Russian Federation: costs of storage, packaging, maintenance, transportation.

These amounts are reflected when posting documents in the program and manual operations in the debit of account 91.02.1 “Expenses associated with the sale of fixed assets.” In this case, you should select the item of other income and expenses with the type “Income (expenses) associated with the sale of fixed assets.”

According to paragraph 31 of PBU 6/01, the residual value of depreciable property and all expenses from its disposal are taken into account in reducing operating income.

As a result, the difference between the credit turnover of account 91.01.1 and the debit turnover of account 91.02.1 for each fixed asset and for items of other income and expenses with the form “Income (expenses) associated with the sale of fixed assets” will show the financial result of the sale of each depreciable object .

If a loss is received as a result of the sale of some fixed assets, then it is accepted for tax purposes in a special manner established by paragraph 3 of Article 268 of the Tax Code of the Russian Federation.

In order to write off the amount of the loss in tax accounting to the account of deferred expenses, we recommend using the document “Operation”, in which we will create entries on the credit of account 91.09 “Expenses associated with the sale of fixed assets” and the debit of account 97.03 “Negative result from the sale of depreciable property » for each fixed asset.

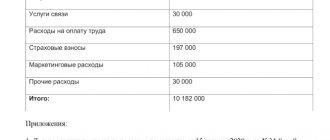

In the new element of the directory “Future expenses” the details are filled in as follows:

- “Type of RBP” - “Negative result from the sale of depreciable property”;

- “Method of recognizing expenses” - by month;

- “Amount”—the amount of loss;

- “Start of write-off” - the date of the beginning of the month following the month of transfer of the object;

- “End of write-off” - the end date of the end of the month of depreciation of this object in the event that the object had not been sold;

- “Account” - 91.02 “Other expenses”;

- “Account (NU)” - 91.02.P “Other expenses”;

- “Subconto BU (NU)” is an item of other income and expenses with the type “Income (expenses) associated with the sale of fixed assets.”

Temporary differences in the assessment of deferred expenses and non-operating expenses are also reflected in the transaction with a posting according to the type of accounting BP from the credit of account 91.02.P to the debit of account 97.03 for the amount of the loss with a minus.

When carrying out the regulatory operation “Write-off of RBP”, losses from the sale of fixed assets will be evenly included in other expenses of the current period. These expenses will be included in the report “Register of accounting for other expenses of the current period” with the type “Loss from the sale of depreciable property” and on page 100 of appendix. 02 sheet 02 “The amount of loss from the sale of depreciable property related to the expenses of the current (tax) period.”

1C Accounting 8 edition 3.0 - Accounting for losses from the sale of depreciable property

Depreciable property is property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer, used by him to generate income and the cost of which is repaid by calculating depreciation (Clause 1 of Article 256 of the Tax Code of the Russian Federation (TC RF)) . In other words, these are fixed assets (fixed assets) and intangible assets (intangible assets).

Depreciable property, today, is property with a useful life of more than 12 months and an original cost of more than 40,000 rubles.

If, as a result of the sale of depreciable property in accounting for income tax, a loss is incurred, then a special procedure for recognizing expenses is applied. In accordance with paragraph 3 of Art. 268 of the Tax Code of the Russian Federation, if the residual value of depreciable property, taking into account the costs associated with its sale, exceeds the proceeds from its sale, the difference between these values is recognized as a loss to the taxpayer. The resulting loss is included in other expenses in equal shares over a period defined as the difference between the useful life of this property and the actual period of its operation until the moment of sale.

Let's look at an example. The organization "Rassvet" applies the general taxation regime - the accrual method and Accounting Regulations (PBU) 18/02 "Accounting for calculations of corporate income tax." The organization is a payer of value added tax (VAT).

The organization has a fixed asset on its balance sheet with an initial cost of 96,000 rubles and a useful life of 48 months. The fixed asset was registered and put into operation in 2012. Depreciation for this fixed asset is calculated using the straight-line method in accounting and for income tax purposes. At the beginning of April 2015, the residual value of the object is 42,000 rubles, the residual useful life is 21 months.

Also on the organization’s balance sheet is an intangible asset with an initial cost of 60,000 rubles and a useful life of 60 months. The intangible asset was registered in 2013. Depreciation is calculated using the straight-line method. At the beginning of April 2015, the residual value is 45,000 rubles, the residual useful life is 45 months.

The above items of depreciable property, as of the beginning of April 2015, are presented in Fig. 1.

Picture 1.

On April 3, 2015, the Rassvet organization sold to the Buyer organization a fixed asset for 41,300 rubles, including VAT 18% (6,300 rubles), and an intangible asset for 41,536 rubles, including VAT 18% (6,336 rubles ). The dismantling of the OS facility was carried out by a contractor; the cost of dismantling is 11,800 rubles, including VAT 18% (1,800 rubles). An invoice has been received from the contractor.

In accounting, income and expenses received as a result of the sale of fixed assets and intangible assets are classified as other income and expenses (clause 7 of PBU 9/99 “Income of the organization”, clause 11 of PBU 10/99 “Expenses of the organization”) and are accepted as accounting at the time of transfer of ownership rights to these objects to the buyer (clause 16 PBU 9/99, clause 18 PBU 10/99).

Sales of goods (including fixed assets and intangible assets) on the territory of the Russian Federation are recognized as subject to VAT taxation (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation). The tax base is defined as the contract price (excluding VAT) of the sold object (clause 1 of Article 154 of the Tax Code of the Russian Federation).

For income tax purposes, proceeds from the sale of fixed assets and intangible assets (excluding VAT) are included in income related to production and sales on the date of transfer of ownership of the objects to the buyer (clause 1, article 248, clause 1 Article 249, paragraph 3 Article 271 of the Tax Code of the Russian Federation).

According to paragraphs. 1 clause 1 art. 268 of the Tax Code of the Russian Federation, the taxpayer has the right to reduce the income received by the residual value of the depreciable property.

The implementation of an OS object in a program is carried out using the OS Transfer document. The “header” of the document indicates the division where the asset being sold is listed, the event – Transfer, the counterparty-buyer and the agreement with him. In the tabular part of the document, the OS object being sold and the price of its sale are selected. Accounts for accounting for income (91.01 “Other income”) and expenses (91.02 “Other expenses”), an account for accounting for VAT on sales (91.02) are established in the document automatically, you only need to indicate a sub-account - an item of other income and expenses with the type Sales of fixed assets and the established check the Accepted for tax accounting checkbox.

An invoice is issued in the “basement” of the document. When carried out, the document will accrue accounting revenue - 41,300 rubles, tax accounting revenue - 35,000 rubles (in tax accounting, revenue excluding VAT) and will charge VAT. An entry will be made in the Sales VAT accumulation register (sales book).

As expected, in accounting and tax accounting, depreciation will be charged for the month of disposal of the asset. Accrued depreciation will be written off on the credit of account 01.09 “Disposal of fixed assets”, and the book value will be written off on the debit of this account. Thus, on account 01.09 the residual value of the fixed assets asset for accounting and tax accounting will be calculated. The residual value will be written off as the debit of account 91.02 Other expenses. Thus, we recognize accounting and income tax expenses in the amount of 40,000 rubles.

Please note that account 91 has a second sub-account - Realized assets, which is used when selling any other assets. Based on this analysis, income and expenses associated with the sale of a specific item of depreciable property are determined. Consequently, when selling this fixed asset, the organization received a loss in the amount of 5,000 rubles (40,000 rubles - 35,000 rubles).

An example of filling out the OS Transfer document and the result of its implementation are shown in Fig. 2.

Figure 2.

The organization had to dismantle the fixed asset. The dismantling was carried out by a contractor. Dismantling costs are included in the costs associated with the sale of depreciable property and, accordingly, increase the loss on sale.

To reflect in the purchase program the services of a third-party organization, we will use the document Receipt with the transaction type of the document and indicate the counterparty-contractor and the agreement with him. In the tabular section, we will select a service item and indicate its cost. As an accounting account, we will select account 91.02 with analytics: item of other income and expenses - Sales of fixed assets, assets sold - Fixed assets. That is, the analytics for account 91.02 must match the analytics in the OS Transfer document. Account for accounting for VAT submitted – 19.04 “VAT on the purchased documents will register the invoice received from the contractor. When carrying out the document, the cost of dismantling without VAT will be taken into account in the debit of account 91.02 in accounting and tax accounting, and the amount of VAT presented by the contractor will be allocated in the debit of account 19.04. An example of filling out the Receipt document and the result of its implementation are presented in Fig. 3.

Figure 3.

Thus, we recognized in accounting and for income tax purposes another 10,000 rubles of expenses associated with the sale of a specific fixed asset. As a result, the loss is 15,000 rubles (5,000 rubles + 10,000 rubles).

The implementation of an intangible asset object in the program is carried out using the document Transfer of intangible assets. The document indicates the buyer counterparty and the contract with him, the intangible asset being sold and the price of its sale. Accounts for accounting for income (91.01) and expenses (91.02), a VAT account for sales (91.02) are set up in the document automatically, you must indicate a sub-account - an item of other income and expenses with the type Sales of intangible assets and the Accepted for tax accounting checkbox selected. An invoice is issued.

When carried out, the document will accrue accounting revenue - 41,536 rubles, tax accounting revenue - 35,200 rubles and VAT will be charged. Will make an entry in the Sales VAT accumulation register.

In accounting and tax accounting, depreciation will be charged for the month of disposal of the intangible asset. The accrued depreciation will be written off against the credit of account 04.01 “Intangible assets of the organization,” which takes into account the book value of the intangible asset. As a result, the residual value of the object for accounting and tax accounting will be calculated on account 04.01. The residual value will be written off as the debit of account 91.02. Thus, we recognized accounting expenses and for income tax purposes in the amount of 44,000 rubles. Consequently, when selling this intangible asset, the organization received a loss in the amount of 8,800 rubles (44,000 rubles - 35,200 rubles).

An example of filling out the document Transfer of intangible assets and the result of its implementation are shown in Fig. 4.

Figure 4.

To check the correctness of our actions, we will create a tax accounting register “Financial results from the sale of fixed assets and intangible assets. See fig. 5.

Figure 5.

I repeat, in accordance with paragraph 3 of Art. 268 of the Tax Code of the Russian Federation, if the residual value of depreciable property, taking into account the costs associated with its sale, exceeds the proceeds from its sale, the difference between these values is recognized as a taxpayer’s loss. The resulting loss is included in other expenses in equal shares over a period defined as the difference between the useful life of this property and the actual period of its operation until the moment of sale.

The generated register shows us the amount of loss from the sale of depreciable property. Our task is to convert the amounts of losses in the program into deferred expenses.

To do this, we will add a new element to the Deferred Expenses directory. We will definitely select the type of deferred expenses for NU - Losses from the sale of depreciable property. The amount of loss is 15,000 rubles. Since expenses should be recognized evenly (in equal shares), we will choose the method of recognizing expenses - By month. Recognition of expenses (writing off account 97 Deferred expenses) should begin on the first day of the next month after the sale of the fixed asset (05/01/2015). Expenses are recognized over a period defined as the difference between the useful life and the actual service life until the moment of sale, which in our case, taking into account the month of sale, is 20 months. Therefore, at the end of the write-off we will indicate December 31, 2016. As a cost account, to the debit of which expenses of future periods will be written off, we will indicate account 91.02 with the article Sales of fixed assets and the sold fixed asset object.

The directory element Deferred expenses for an asset object is shown in Fig. 6.

Figure 6.

Similarly, let’s create another element for an intangible asset in the Deferred Expenses directory. The difference will only be in the amount of the loss - 8,800 rubles, in the write-off end date - December 31, 2018 (the remaining useful life taking into account the month of sale is 44 months) and in the analytics of account 91.02: item of other income and expenses - Sale of intangible assets, sold asset - Intangible asset. The directory element Deferred expenses for an intangible asset object is shown in Fig. 7.

Figure 7.

To generate future income tax expenses, we will use the Operation document (Accounting certificate). Let's start by filling in the loss from the sale of an OS object.

In the tabular section, we will indicate by debit account 97.21 “Other deferred expenses”, we will indicate the division, and as a sub-account we will select the deferred expense we formed for the fixed assets object. Since we must withdraw the loss from the sale of depreciable property in the income tax from the current period, we will select account 99.01.1 for the loan with the analytics Profit, loss from sales.

In accounting, a loss from the sale of depreciable property, as we have already said, is recognized in the period of sale (current period), and in income tax accounting in future periods. Therefore, in the Accounting Certificate we will indicate only the amounts Dt and Kt for tax accounting (15,000 rubles) and create the corresponding temporary differences (-15,000 rubles based on the formula: BU = NU + PR + VR).

We will do the same for the loss from the sale of an intangible asset. Just select the corresponding element of the directory Deferred Expenses, indicate the amounts Dt and Kt for tax accounting (8,800 rubles) and create the corresponding temporary differences (-8,800 rubles).

An example of an Accounting Statement is shown in Fig. 8.

Figure 8.

In accounting, a loss from the sale of a fixed asset and an intangible asset is recognized at a time in the current period, and for income tax purposes, a loss from the sale of depreciable property will be included in expenses in subsequent periods. Consequently, in accordance with clause 11 of PBU 18/02, deductible temporary differences (DTD) are recognized. These VVR, in the amount of minus 15,000 rubles and in the amount of minus 8,800 rubles, are reflected by us in the Accounting Certificate as the debit of account 97.21 and the credit of account 99.01.1. VVR lead to the recognition of a deferred tax asset (DTA). In accordance with the algorithm of the program, in account 99 deferred tax assets (DTA) and deferred tax liabilities (DTL) are not calculated. But VVR reflected in the debit of account 97 will lead to the accrual of a deferred tax asset in the amount of 4,760 rubles in the current month.

SHE = VVR (15,000 rub. + 8,800 rub.) * St np (20%) = 4,760 rub.

The deferred tax asset in accounting is accrued as a debit to account 09 and increases the current income tax (account 68.04.2). SHE and IT are accrued automatically in the program at the end of the month.

Posting of a routine operation Calculation of income tax for April 2015 (the month of sale of depreciable property) is shown in Fig. 9.

Figure 9.

Starting next month, for income tax purposes, losses from the sale of depreciable property will begin to be included in expenses. This will happen by writing off the expenses we generated for future periods. The amount of recognized expenses in the next month (the next 20 months) will be 950 rubles (15,000 rubles / 20 months + 8,800 rubles / 44 months).

The postings of the routine transaction Write-off of deferred expenses for May 2015 are presented in Fig. 10.

Figure 10.

Simultaneously with the write-off of deferred expenses in the income tax, temporary differences are also written off. Consequently, the difference between accounting and tax accounting is reduced. Therefore, from this month the repayment of the deferred tax asset will begin, monthly by 190 rubles (950 rubles * 20%). IT will be fully repaid in 44 months, when for income tax purposes the loss from the sale of depreciable property will be fully recognized.

Posting a regulatory transaction Calculation of income tax for May 2015 is shown in Fig. eleven.

Figure 11.

In the Income Tax Declaration, the financial result from the sale of depreciable property is reflected in lines 030 - 060 of Appendix 3 to Sheet 02, and the recognized loss from the sale of depreciable property is reflected in line 100 of Appendix 2 to Sheet 02.

A fragment of the income tax declaration of the organization “Rassvet” for the first half of 2015 is presented in Fig. 12.

Figure 12.

In our example, the amount of recognized loss from the sale of depreciable property in the current period is 1,900 rubles, since losses were recognized in May and June (950 rubles * 2).