Double entry in accounting

First of all, let's define the concept.

Double entry is a way of reflecting business transactions and economic facts in accounting, which allows you to systematize and group the facts of a subject’s economic activity according to individual characteristics. In other words, the double entry method in accounting means the reflection of the facts of the enterprise’s economic activity on interconnected accounting accounts, which are regulated in the organization’s working chart of accounts. Consequently, one transaction must be reflected as a debit to one account and at the same time as a credit to another, and in one total amount.

Deviations from this rule violate key accounting principles.

Double entry: its essence and meaning

The essence of double entry is to reflect any financial and economic transaction of an enterprise on two accounts simultaneously. In this case, a debit entry is generated for one account, and a credit entry for the second. Depending on the type of account (passive, active-passive or active), the monetary value is reflected by increasing one part and decreasing the other.

This principle of double entry in accounting is a fundamental rule for controlling the balance sheet of an organization. If there is no equality in debit/credit (including balances and turnover), then an error has been made. Additionally, the double entry system allows you to track changes in both the company’s property (assets) and its sources (liabilities). In this way, correspondence of accounts is carried out on the basis of primary documentation.

Section “Assets” and “Liabilities”:

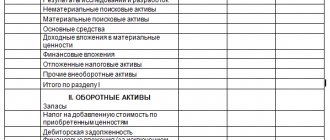

- The “Assets” of the balance sheet include: fixed assets of the enterprise, cash (cash and non-cash), intangible assets, inventories, all types of accounts receivable, long-term financial investments.

- The “liabilities” of the balance sheet include the authorized capital of the enterprise, all types of formed reserves, accounts payable (including to the budget and extra-budgetary funds), profits/losses.

Double entry of business transactions is confirmed by primary documents or accounting registers. Account assignment is certified by the responsible accountant. The essence of double entry is the formation of meaning - where the funds/property came from, where they were disposed of, how they were formed, what result (loss or profit) they led to in the organization’s activities.

Important! The lack of supporting primary documents can lead to problems with tax inspection authorities, casting doubt on the transaction. After all, the concept of double entry is the main tool for generating information about the financial position of an enterprise, a way of reflecting business transactions in terms of income and expenses.

The essence of the concept

In accordance with the provisions of Law No. 402-FZ, the principle of double entry in accounting must be applied everywhere. There are no exceptions to this rule. That is, all economic entities are required to use this principle when organizing and maintaining accounting records.

The essence of double entry is that each transaction must be reflected as a debit and a credit simultaneously on two accounting accounts. Moreover, entries are made taking into account the account attribute (active, passive, active-passive). That is, not only an increase, but also a decrease can be reflected in the debit of the account, and vice versa in the credit.

Who are these convinced

First of all, the great poet and thinker Wolfgang Goethe (1749-1832), who considered double entry to be the greatest invention of the human mind. Then - Oswald Spengler (1880-1936), author of the prophetic book “The Decline of Europe.” He believed that only three people truly changed the world: Columbus, Copernicus and Pacioli, the creator of double-entry bookkeeping. And finally, the famous sociologist and economist Werner Sombart (1863-1941) sincerely believed and proved “with facts in hand” that only through double-entry bookkeeping capitalism became possible. And this is true, because it is impossible to calculate profit without resorting to cumbersome inventory without double entry.

This is how the debit-credit system lives - both in the best of times and in times that are far from the best. Always with us.

Examples

Let's look at the key essence of this principle using specific examples.

Operation: “The organization’s funds are withdrawn from the current account and deposited into the cash register for cash payments.”

Debit 50 Credit 51.

Account 50 “Cashier” and 51 “Current Account” are active. That is, the debit of active accounting accounts reflects an increase, and the credit, respectively, a decrease. Consequently, there are fewer funds in the current account - we reflect the movement on the loan, and the increase in cash in the cash register - on the debit. However, the total value of the enterprise's assets has not changed, the structure of assets has been adjusted (increase in cash, decrease in non-cash funds).

As you can see, double entry ensures the relationship between synthetic accounting accounts. But in fact, this principle shows a direct connection between the property, assets, liabilities of the institution and the sources of their formation.

Operation: “Purchase of inventories for production.”

Debit 10 Credit 60.

Account 10 “Materials” is active, and account. 60 “Settlements with suppliers and contractors” - active-passive. Therefore, according to count. 10 the increase is reflected in the debit, and for the account. 70 - the loan reflects the increase in the creditor to the supplier of materials.

The simultaneous change in the turnover of the debit and credit of the accounting accounts equalizes the balance. In other words, DZ equalizes the indicators of assets and liabilities.

T-account

A useful place to start learning about the double entry system is by looking at the T-account. The simplest account model includes three elements: (1) a name that characterizes the account for the asset, liability, or component of shareholders' equity; (2) the left side, which is called debit; (3) the right side, which is called credit. The T-account is so called because it resembles the shape of the letter T. The model is used to analyze transactions and looks like this:

| Account name | |

| Debit | Credit |

| (left-hand side | (Right side |

Any entry made on the left side is a debit to the account or a debit entry, and any entry made on the right side is a credit to the account or a credit entry. The words "debit" (short form in English - Dr. - from the Latin "debere") and "credit" (short form in English - Cr. - from the Latin "credere") are simply accounting terms for the right and left sides counting, but not to indicate increase or decrease. We will present a more formal version of the T-account later when we consider general ledger accounts.

Double entry in reporting

The key feature of the DZ principle, as we noted above, is the alignment of the institution’s assets and liabilities according to the accounting accounts used to reflect transactions in the reporting period. That is, when maintaining accounting according to established rules, asset indicators must be equal to liability indicators for the reporting period or as of a specific date.

If this principle is violated, it is impossible to generate reliable and complete reporting. These discrepancies will be identified in all forms of accounting without exception.

For example, if the DZ principle is violated, the balance sheet indicators (Form No. 1) for assets and liabilities will not be equal. Let's consider the form of the balance sheet of a non-profit organization:

As we can see, the asset and liability indicators of the reporting form are equal.

Tax accounting using the double entry method

S.A. Mashkov,

Auditing and consulting group “What to do Consult”

Published: Everything for an accountant љ 19 (91) 2002

The third reporting period for income tax has ended. Starting from 2002, at the end of the first and second reporting periods, taxable profit of organizations should have been calculated from tax accounting data. We can try to draw some preliminary conclusions.

In the period from 08/06/2001, when the need to introduce tax accounting was proclaimed, and until the end of February 2002, accountants engaged in the ongoing work of maintaining accounting records, preparing for the transition to a new chart of accounts, and preparing annual reports for 2001, were not very successful. rushed to fulfill the requirements formulated in Chapter. 25 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), believing that instructions and guidelines will soon be published on the issue of how to organize, how to maintain tax accounting and how to obtain the amount of taxable profit from tax accounting data. There were detailed instructions (with numerical examples) on the procedure for calculating and paying VAT, income tax for enterprises and organizations, corporate property tax, taxes going to road funds, income tax, etc. Usually, following the publication of official regulatory materials, methodological articles were published in various accounting publications, in which these issues were discussed in detail in relation to each area of enterprise activity, to each possible more or less typical case.

Unfortunately, by January 2002, the date from which organizations were supposed to start keeping tax records, no official instructions or methodological materials for accountants had appeared. On the contrary, by mid-December 2001, so many shortcomings and omissions were revealed in the wording of the articles of Chapter. 25 of the Tax Code of the Russian Federation, that a law has already been developed and adopted in the first reading on introducing amendments to Chapter. 25љ Tax Code of the Russian Federation. By the end of December 2001, the so-called tax accounting registers developed by specialists of the Ministry of Taxes of the Russian Federation were published. So-called because these were not the usual tabular forms for accountants for registering facts of economic activity, but only a list of details that should be included in a particular tax register, without indicating in what order they should be filled out, without examples of their completion and without explanations of how to obtain the tax base for income tax from the data entered in these registers.љ

Based on the given descriptions of tax accounting registers, the author of this article compiled tax accounting registers in the form of tabular forms, which are accounting statements or development tables, the columns of which represent the details given in the descriptions, and the rows of which should contain information about the objects of accounting1. All this, although it was some help for accountants in organizing tax accounting at their enterprise, but, frankly speaking, did not make this work much easier for them.

____________________________________

1 Mashkov S.A. Tax accounting registers // “Accounting in publishing and printing”. 2002. N 4 (40).

_____________________________________

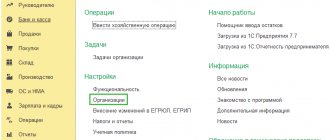

In Art. 314 of the Tax Code of the Russian Federation “Analytical registers of tax accounting” formulates the requirement that analytical registers of tax accounting - consolidated forms of systematization of tax accounting data for the reporting (tax) period should be maintained without distribution (reflection) among accounting accounts. This means, in our opinion, that tax accounting should be carried out in parallel with accounting, without mixing them. However, many, including developers of accounting programs, understood this article of the Tax Code of the Russian Federation as a requirement to maintain tax records without using the principle of double entry.љ In many widespread accounting programs (1C, BEST, INFIN, etc.) for maintaining tax accounting, special off-balance sheet accounts are allocated, which should reflect tax accounting indicators without using the double entry method.

In principle, accounting can be maintained without using the double entry method. In some Arab countries, in particular in the United Arab Emirates, accounting is currently carried out without using the double entry method. The double entry method was invented more than 500 years ago by the Italian monk and mathematician Luca Pacioli (his Treatise on Accounts and Records was published in 1494) and became widespread and established in all European countries, including Russia.

Since European accountants have been accustomed to the double entry method for more than 500 years, and many accountants do not even imagine that it is possible to conduct accounting without using the double entry method, and most importantly, since tax accounting is “spun off” from accounting, it seems It is natural that tax accounting should be carried out, like accounting, using the double entry method familiar to Russian accountants. Moreover, tax accounting must be carried out on the basis of primary accounting documents, the data from which is reflected in accounting using the double entry method.

Maintaining accounting records using, and tax accounting without using the double entry method, creates additional difficulties for accountants and is a source of additional errors.

By the end of March 2002, by the end of the first reporting period for income tax, accountants realized that, firstly, there were still no official methodological materials and instructions for organizing tax accounting; secondly, that in the text of Ch. 25 of the Tax Code of the Russian Federation, a large number of shortcomings, omissions and inaccuracies were discovered that do not allow organizing, correctly maintaining tax records and obtaining taxable profit from tax records; thirdly, that in maintaining tax records and calculating income taxes, you cannot rely on modified accounting programs, since they were finalized in a hurry, almost every week they were replaced with new versions, which eliminated errors and shortcomings found in previous versions , and that they (the programs) may still contain errors, and errors in determining income taxes can lead, at best, to penalties, and in the worst case, to bankruptcy of the enterprise. And finally, fourthly, and this is the most important thing for accountants, there are no penalties for “ignorance” of tax accounting, for the lack of tax registers, provided that the income tax is calculated correctly and the corporate income tax return is correctly filled out, introduced by order of the Ministry of Taxes and Taxes of the Russian Federation dated December 7, 2001 No. BG-3-02/542.

љIn view of all the above reasons, most accountants in reporting for the first quarter of 2002 calculated income tax in the old fashioned way, in the process of filling out the aforementioned Declaration, introducing amendments to the taxable profit received in accounting. Consequently, the problem of organizing tax accounting at enterprises remains, only the deadlines have moved at least by one quarter. And after organizing tax accounting, it will need to be maintained retroactively, starting from 01/01/2002.

In one of the previous articles, we formulated the requirements that a computer program must satisfy, with the help of which it would be possible to conduct both accounting and tax accounting using the double entry method2. Unfortunately, as we noted above, the developers of the most common accounting programs did not follow this path.

_______________________________

2 Mashkov S.A. What is tax accounting and how it fights against organizations. // “Everything for an accountant.” 2002.љ N 1 (73).

___________________________________

Below we will describe how you can conduct tax accounting using the double entry method using a regular, unmodified accounting program, the program with which accounting was carried out in 2001 and earlier, but for now we are exploring the issue of correlating accounting and tax accounting.

Many results of calculations of various accounting indicators, such as, for example, salary calculation (as well as calculated taxes and contributions), VAT, sales tax, property tax, calculated in the accounting system, љљ it is reasonable to enter into tax accounting from the accounting , and not calculate it again as part of tax accounting. And, conversely, the income tax calculated within the framework of tax accounting should appear in accounting in the exact amount in which it was calculated in tax accounting, and not in the amount as it could be calculated within the framework of accounting.

Before the entry into force of Ch. 25 of the Tax Code of the Russian Federation, accounting in organizations was structured according to the following scheme:

Primary documents ==> Accounting registers ==> Accounting statements ==> Adjustment of accounting data ==> Tax reporting.

After the entry into force of Ch. 25 of the Tax Code of the Russian Federation and organizations at tax accounting enterprises along with accounting from the same primary documents, the authors of Ch. 25 of the Tax Code of the Russian Federation, apparently, assumed that accounting at enterprises would be carried out according to the following schemes:

Primary documents ==> Accounting registers ==> Accounting statements and

љPrimary documents ==> Tax accounting registers ==> Tax reporting.

That is, tax accounting was supposed to be carried out independently of accounting from the same primary documents, and the taxable base for income tax was to be calculated directly from the indicators contained in the tax accounting registers, bypassing both the stages of developing financial statements and entering corrective information at the end of the reporting period. period from accounting indicators.љ These, apparently, were the intentions of the authors of the introduction of tax accounting. The reality is that, firstly, throughout the tax period there will be a constant “transfer” of data from accounting to tax accounting and back. As we mentioned above, the calculation of labor costs and the payment of related taxes and fees is carried out in accounting, and the results of these calculations should be used in tax accounting. Therefore, procedures must be developed for “transferring” individual accounting indicators to tax accounting and vice versa.

Secondly, after the end of the reporting period for income tax and before proceeding with the determination of taxable profit, a stage of adjustments is necessary. For example, in the tax accounting register “Register-calculation of the reserve for doubtful debts of the current reporting (tax) period” there is a detail “Revenue from sales of the reporting (tax) period”. The amount of revenue from sales in the reporting period will be known only after the end of the tax period, since the last batch of goods can be sold on the last working day. But a doubtful debt may arise, or rather, be discovered at the beginning of the reporting period. The reserve for doubtful debts should be formed as these doubtful debts are discovered, that is, perhaps at the beginning of the tax period, when the amount of revenue from sales in the reporting (tax) period is not yet known. The only thing that can be suggested to accountants in this case is to enter the expected, estimated value of the amount of revenue from sales in the reporting (tax) period into the tax accounting register and calculate the reserve for doubtful debts. Then, at the end of the tax period, introduce an adjustment, that is, make a recalculation based on the actual, real value of revenue from sales, the value of which is determined from accounting data.љ

Another example. In the tax accounting register “Register-calculation of current period expenses for voluntary insurance of employees,” the maximum amounts of payments (contributions) for various types of voluntary insurance are defined as 3% and 12% of the amount of labor costs of the current period. But the amount of labor costs of the current period is unknown until the end of the tax period, since the last payroll will be made at the end of the reporting period or even at the beginning of the next, after closing work orders for work performed, submitting time sheets to the accounting department, and presenting certificates of incapacity for work (sick leave). ) etc. Again, the only thing that can be offered to accountants in this case is to enter the expected, estimated value of the amount of labor costs for the current period into the tax accounting register and calculate the maximum amounts of payments (contributions) for various types of voluntary insurance, based on this expected value . Then, at the end of the tax period, introduce an adjustment, that is, make a recalculation based on the actual, real value of the amount of labor costs for the current period.љ

And there are many such examples. For example, standard expenses such as entertainment expenses, travel expenses or advertising expenses, etc. can be carried out at the beginning of the tax period, when neither the amount of labor costs nor the amount of revenue is known. Since at this moment it is still impossible to determine which part of these expenses can be attributed to the costs of the current period, and which part - to profit or to the costs of future periods, then again you need to use the expected, estimated values of labor costs or the amount of revenue from implementation, and then, at the end of the tax period, introduce adjustments. In the program used for tax accounting, you need to somehow mark the data that needs to be adjusted according to accounting data after the end of the tax period.

Thus, in reality, tax accounting cannot be maintained separately from accounting; they are very closely related to each other and will be jointly maintained in organizations according to the following schemes:

Primary documents ==> Accounting registers ==> Indicators from tax accounting registers ==> Accounting statements and

Primary documents ==> Tax accounting registers ==> Indicators from accounting ==> Adjustments at the end of the tax period with data from accounting ==> Tax reporting.

These stages of transferring indicators from accounting to tax and from tax accounting to accounting and the stage of entering adjustments into tax accounting at the end of the tax period from accounting nullify the seemingly coherent logical picture of organizing and maintaining tax accounting in parallel with accounting and independently of accounting from the same primary documents in order to determine the taxable base for income tax.

That is, the separation of tax accounting from accounting is imaginary. In fact, the organization maintains a unified record of the facts of economic activity, and tax accounting is a way of determining the taxable base for income tax, but it is overly and unjustifiably complicated.

Precisely because not only the data from primary documents, but also various intermediate and final indicators from time to time need to be “transferred” from accounting to tax accounting and vice versa, it is reasonable to conduct tax accounting using the double-entry method, just like accounting.

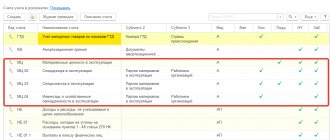

To maintain tax accounting using the double entry method, you must first develop a tax accounting chart of accounts. In the mentioned work2 it was substantiated in detail that it is advisable to use a working chart of accounts for tax accounting as a chart of accounts for tax accounting.

If for any tax accounting indicators there are no corresponding accounting accounts, then, as necessary, sub-accounts with the necessary properties should be opened for some of the tax accounting accounts. Taxable profit should be automatically generated on account 99 “Profits and losses” of the tax accounting chart of accounts.

By definition, tax accounting is not the same as accounting. If it coincided, there would be no need to introduce tax accounting along with accounting. This means that, in principle, it is possible and will always be such business transactions for which the debit account and the credit account of the accounting accounts, which reflect the amounts characterizing this business transaction, do not coincide in content, name and codes with the debit and/or credit accounts tax accounts, which should reflect the same amounts characterizing the same business transaction. In other words, there will always be such business transactions that in accounting and in tax accounting this business transaction will correspond to different entries, even if the tax accounting chart of accounts completely coincides with the accounting chart of accounts in content, names and codes of accounts. Because of this, both accounting and tax accounting cannot be simultaneously maintained in the same database using the same (not modified) program, the one in which accounting was carried out in 2001 and in previous years.

If this accounting program, with the help of which accounting was carried out in 2001, is such that it (the program) provided the user with the means and the ability to make changes both to the chart of accounts and printed analytical statements, as well as to generate new printed forms, then Such a program can be used to maintain tax accounting using the proposed double entry method.

Let’s say that in this kind of program, tax accounting is carried out, like accounting, using the double-entry method, but according to the rules formulated in Chapter. 25 Tax Code of the Russian Federation. Comparing a set of transactions for the same reporting period in the journal of business transactions of accounting and in the journal of business transactions of tax accounting, we will see that, firstly, there are such business transactions for which transactions in the journal of business transactions of tax accounting completely coincide with the entries in the journal of business accounting transactions. As a rule, these are operations that do not generate either income or expenses, neither in accounting nor in tax accounting, and therefore the corresponding entries pass without changes from accounting to tax accounting. Or, on the contrary, these are operations that generate income or expense in the same way both in accounting and tax accounting, and therefore the corresponding entries pass from accounting to tax accounting without changes. Let us call such business transactions operations of the first type. Such operations for organizations engaged in ordinary activities are the vast majority. For example, according to sub. 1 clause 1 art. 251 of the Tax Code of the Russian Federation, property and (or) property rights, work and (or) services received from other persons in advance payment (advance payments) for goods (work, services) by taxpayers who determine income and expenses on an accrual basis are not considered income. This type of transaction does not generate income either in accounting or tax accounting, and therefore the corresponding entries are transferred from accounting to tax accounting without changes:

Debit account 50-1.љ Credit account. 62-2љ 2,000 rub. — an advance payment of 2,000 rubles was received. for product.

Secondly, there may be business transactions for which the entries in the tax accounting business transactions journal coincide with the entries in the accounting business transactions journal in terms of amounts, debit and credit account codes, but differ in dates. This is possible if accounting and tax accounting define methods for recognizing income and expenses differently. Let us classify such business transactions as the second type. Of course, from the point of view of bringing tax and accounting accounting closer together and reducing the complexity of tax accounting, it would be better to define the same method of recognizing income and expenses in the accounting policy for accounting and tax accounting purposes. But an accountant should think not so much about reducing the labor intensity of his work as about increasing the enterprise’s profit, calculated in accounting, albeit by reducing taxable profit, and therefore, the income tax calculated in tax accounting. And if this goal is achieved by defining different methods for recognizing income and expenses in accounting and tax accounting, then you need to go for it.

Thirdly, there may be business transactions for which there are no entries in the tax accounting business transactions journal that correspond to the entries in the accounting business transactions journal. Let us classify such business transactions as the third type. Thus, some types of receipts of cash and other assets are income in accounting, but are not income in tax accounting. In Art. 251 of the Tax Code of the Russian Federation “Income not taken into account when determining the tax base” lists all such cases. Conversely, some types of asset losses are expenses in accounting, but are not recognized as expenses in tax accounting. In Art. 270 “Expenses not taken into account for tax purposes” of the Tax Code of the Russian Federation lists all such transactions.

For example, according to subparagraph 22, paragraph 1 of Art. 251 of the Tax Code of the Russian Federation “are not income of the amount of accounts payable of the taxpayer to budgets of various levels, written off and (or) reduced otherwise in accordance with the legislation of the Russian Federation and (or) by decision of the Government of the Russian Federation.”

In accounting, writing off such accounts payable to the budget is “other income”, and this operation is described by the following entry:

Debit account љ68, љ Credit account љљ 91-1, 20,000 rub. — tax debt is written off in accordance with the law and (or) by decision of the Government of the Russian Federation. There is no corresponding entry in tax accounting for this transaction.

Fourthly, there may be business transactions for which the entries in the tax accounting journal of business transactions do not coincide with the entries in the accounting journal of business transactions, differing from them in amounts or in debit and/or credit account codes, or both and something else at the same time. As a rule, these are operations of standardized expenses, for example, for advertising, travel and entertainment expenses, etc., as well as depreciation for those accounting objects for which the methods of depreciation in accounting and tax accounting do not match. Let us call such business transactions transactions of the fourth type.љ

Example. Let the management of the enterprise give the employee 1,260 rubles to report, with which the latter bought paint for the organization in retail sale, paying 1,260 rubles. Of these 1,260 rubles. 1,000 rub. — cost of paint, 200 rubles. — VAT and 60 rub. — sales tax. Since the paint was purchased at retail, the employee was not given an invoice, so the organization cannot submit a VAT refund. In accordance with accounting rules, VAT and sales tax are included in this case in the cost of inventories, and according to tax accounting standards, VAT and sales tax are included in other expenses. Therefore, in accounting, this business transaction will be described by the following entries:

Debit account љ71, Credit account љљ 50.љ 1,260 rub. — issued in the report 1,260 rubles;

Debit account 10, Credit account 71, 1,260 rub. — the advance report was approved and the paint was capitalized at the purchase price.

In tax accounting, this business transaction will be described by the following entries:

Debit account 71, Credit account љљ 50, 1,260 rub. - issued in the report 1260 rubles;

Debit account 10, Credit account. 71, 1,000 rub. — the advance report was approved and the paint was capitalized at the purchase price excluding VAT and sales tax;

Debit account 26, Credit account 71, 260 rub. — the advance report was approved and VAT and sales tax were included in other expenses.

The first entry from accounting went into tax accounting without change, and the second was divided into two.

There are quite a lot of different types of business transactions for which the entries in the tax accounting journal of business transactions do not coincide with the entries in the accounting journal of business transactions, but listing them can take several dozen pages (Articles 249 - 270 of the Tax Code of the Russian Federation). But for each given specific organization carrying out economic activities in one or two areas of activity (production of goods, trade, construction, provision of services), various types of business transactions for which the entries in the tax accounting journal of business transactions do not coincide with the entries in the accounting journal There are very few business accounting transactions. The development of rules for converting entries from the journal of business transactions of accounting into entries in the journal of business transactions of tax accounting is, in essence, the organization of tax accounting at the enterprise.

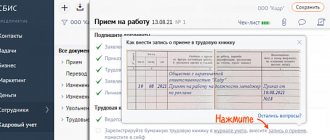

Thus, the method of maintaining tax accounting using the double entry method is proposed as follows. After the end of the reporting period, when both the total amount of revenue and the total amount of the wage fund are already known and all other taxes have been accrued, except for income tax, the directory (or “folder” in Windows terms) in which the accounting database is located is copied to another directory in which the tax accounting database will be created. Then, in this directory, the journal of business transactions (journal of transactions) is analyzed and for each business transaction it is determined whether the transactions characterizing this business transaction are converted. In this case, you should be guided by the following rules. Leave the postings as is if the business transaction belongs to the first type. Change the posting date if the business transaction is of the second type. If it belongs to the third type, then delete the posting, or it is better not to delete it, but to reverse it, so that it is easier to restore it, if later, when checked, it turns out that it was classified as the third type by mistake. If the operation belongs to the fourth type, then change the debit or credit code or amount in it. Again, it is better not to change the original transaction, but to completely reverse it, and then next to it, based on this transaction, enter another one, with a changed debit or credit code or amount. In this case, “traces” will remain from the activity of converting accounting entries into tax accounting entries, which will allow you to return to the original version and make corrections if errors are discovered or additional amendments are introduced in Chapter. 25 Tax Code of the Russian Federation.

All this must be done if accounting is carried out using any accounting program. If accounting is carried out “manually”, then you need to use a photocopier to make a copy of the business transaction journal, declare this copy as the tax accounting journal, and perform the above steps manually for each business transaction.

As for tax accounting registers, the journal of business transactions, maintained on the basis of the tax chart of accounts, is itself one single tax register, since it records all business transactions on the basis of which taxable profit is formed in account 99. In ch. 25 of the Tax Code of the Russian Federation does not regulate exactly how many registers there should be, which means that it is enough to have one single tax register. If someone is not satisfied with this decision, then please create balance sheets for each of the accounts (and possibly sub-accounts) of the tax chart of accounts. Any modern accounting program provides the ability to generate balance sheets for accounts. Call each such balance sheet for each of the tax plan accounts the corresponding tax accounting register. Not a single tax inspector will be able to find fault with you in this case for allegedly not keeping tax records.

In addition to converting the entries, you need to somehow convert the balances on the accounting accounts as of December 31, 2001 into the initial balances on the tax accounting accounts as of January 1, 2002, or, which is the same thing, convert the balances on the accounting registers as of as of 12/31/2001 to the opening balances on tax registers as of 01/01/2002. In the next reporting (or tax) periods, this problem will no longer exist. Balances in tax accounting accounts (on tax accounting registers) as of the beginning of any next reporting period will be equal to balances in tax accounting accounts (on tax accounting registers) as of the end of the previous reporting period.

Unfortunately, the Tax Code of the Russian Federation (as amended by Federal Law No. 57-FZ of May 29, 2002) does not regulate how initial balances should be obtained on tax accounting registers (which taxpayers must develop independently).љ And this is a fundamental question.

The specialists of the Ministry of Taxes of the Russian Federation should have dealt with the problem of determining the initial balances on tax accounting registers and tried to solve it even before submitting the first version of the text of Chapter to the State Duma of the Russian Federation. 25 of the Tax Code of the Russian Federation, and even more so now, when even without this problem, quite a lot of flaws have been discovered in the text of this chapter of the Tax Code of the Russian Federation.

We have already studied the problem of initial balances in detail in the mentioned work2, in which we came to the conclusion that for business entities that have been operating for some time, tax accounting is either erroneous, since there is no way to correctly calculate the initial balances on tax accounting registers from accounting data, or tax accounting is redundant if there is still a way for a given organization to calculate initial balances on tax accounting registers from accounting data. Tax accounting can be started anew (as well as accounting) only for newly created organizations.

To illustrate this point, consider the following example. Let's assume that as of December 31, 2001, all accounting documentation of all economic entities in the country on all tangible media was destroyed. And an order was received to organize and maintain accounting records from January 1, 2002 on the basis of the Law and accounting regulations. For newly created organizations there will be no problems with organizing accounting, but for all other organizations serious problems will arise. It will not be difficult to conduct an inventory of material assets based on quantitative (physical) indicators. But there will be difficulties with determining cost indicators, as well as with inventory of accounts payable and receivable. Even greater difficulties will arise when trying to determine the opening balances on the remaining accounts of the chart of accounts. As a result, accounting in most organizations will be restored with errors.

Added to this problem is the problem of determining the tax base for the transition period. Upon careful study of the regulatory documents, it turns out that the transition period is the “moment” between 12/31/2001 and 01/01/2002. And for this transition period, for this moment, the tax base must be determined, and income tax must be calculated and paid. If this transition period profit tax turns out to be sufficiently large, comparable to the profit tax based on the results of 2001, then it is allowed to be paid in installments over several reporting periods. If there is a loss for this transition period, then this loss is “forgiven”, is not recorded anywhere, and the next reporting (and tax) period begins as if there was no trace of any transition period.

In essence, all this means that the results of the organizations’ activities for 2001 were subject to “retroactive” yet another tax, the rate of which and the method of calculating the taxable base of which were not properly brought to the attention of the organizations by the beginning of the tax period, that is, by November 30, 2000.

But let's return to determining the initial balances on the accounts of the tax chart of accounts. We can offer the following compromise solution. Set the opening balances on the accounts of the tax chart of accounts equal to the ending balances on the accounts of the accounting chart of accounts, and then, taking advantage of the fact that the tax base for income tax based on the results of the first and second reporting periods of 2002 has already been calculated (income tax returns for the first quarter and for the first half of 2002 have already been submitted) clarify these balances, select their values so that account 99 (“Profits and Losses”) of the tax chart of accounts would have the same values that appeared in the submitted income tax returns.

Mashkov Sergey Alekseevich

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up