Is an employee eligible to receive the standard personal tax deduction in 2022?

Yes, he has the right.

A tax deduction for an employee in 2022 is provided in the amount of 3,000 and 500 rubles. The maximum deduction is RUB 3,000. is provided to employees who are: Chernobyl survivors, disabled people of the Great Patriotic War, disabled military personnel who became disabled in groups I, II and III due to injury, concussion or injury received during the defense of the USSR, the Russian Federation, other persons named in subparagraph 1 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation. The right to a tax deduction for personal income tax in the amount of 500 rubles. in 2022 have employees who are: Heroes of the Soviet Union and Heroes of the Russian Federation; disabled since childhood, disabled people of groups I and II; parents and spouses of military personnel who died defending the USSR and the Russian Federation; other persons named in paragraphs. 2 p. 1 art. 218 Tax Code of the Russian Federation.

If an employee is entitled to two standard deductions, he or she is entitled to the maximum of them. That is, you cannot add up deductions and use them at the same time.

Discussed here.

Standard tax deductions for personal income tax

Certain groups of persons with a certain status have the right to receive standard tax deductions for personal income tax (Article 218 of the Tax Code of the Russian Federation). Thus, people who were involved in the liquidation of the Chernobyl accident and the consequences of other nuclear disasters, as well as military disabled people, can receive a deduction. In addition, Heroes of the Soviet Union and Russia, participants in military conflicts, as well as people who have suffered radiation sickness have the right to reduce their personal income tax on this basis.

One of the most popular in this category is the personal income tax deduction for children. It is provided to citizens who have one or more children in their care, that is, parents, guardians, adoptive parents.

To receive deductions, it is enough to submit supporting documents and an application at your place of work.

Read more about standard deductions in the material “Standard tax deductions in 2017 (personal income tax, etc.)” .

Who is entitled to the standard deduction for children?

Standard “children’s” personal income tax deductions are provided for in clause 4, clause 1, art. 218 Tax Code of the Russian Federation. Those persons who support the child can apply for a deduction:

- parents,

- spouses of the child's parents,

- adoptive parents,

- parents from a foster family,

- guardians,

- trustees.

If a person is recognized as the only one supporting a child, his child tax deduction doubles. By single parent we mean cases where paternity has not been established, there is no record of the father in the birth document, or the second parent has died, or the court has declared him missing (letters of the Ministry of Finance of the Russian Federation dated April 17, 2014 No. 03-04-05/17637, dated July 3 .2013 No. 03-04-05/25442). One of the spouses raising a child alone after a divorce is not considered a single parent.

Having entered into marriage, the single parent loses this status, and the application of the double deduction for the child ceases - from the next month the deduction will be single. However, the new spouse of the parent also gains the right to receive a deduction; it is not necessary to adopt a child for this.

A double amount of the child tax deduction is available to one of the parents even if the other parent refuses the “children’s” tax deduction in writing and confirms its absence with a 2-NDFL certificate.

What deduction for children is possible if the second spouse does not have taxable income? Only single - double deduction is not applicable here. For example, if the child’s mother does not work, then his father will be able to receive a “children’s” deduction for personal income tax only in a single amount.

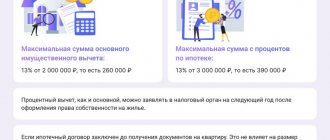

The amount of property deduction in 2017

There were no changes to the property deduction in 2022. The latest changes are valid from January 1, 2014 to the current time:

- The maximum deduction per taxpayer is 13% of the value of the property (share), but not more than 260,000 rubles.

- If real estate costs more than 2 million rubles, and was purchased during marriage, then the second spouse can apply for a deduction, since according to the Family Code of the Russian Federation, family expenses are common expenses. It does not matter in whose name the real estate documents are issued. The maximum deduction for a spouse is also no more than 260,000 rubles. Thus, if the cost of housing is more than 4 million rubles, a family (husband and wife) can receive 520,000 rubles.

For what years is registration possible in 2022?

A property tax deduction in 2022 can be issued maximum on the income of the past 3 years (and for pensioners - on the income of the past 4 years), while real estate can be purchased more than 3 years ago. But do you have grounds for registration for all 3 years (and for pensioners for 4 years):

- If less than 3 years have passed since the year you received the rights to real estate , then you can apply for a deduction starting from the year in which you received the rights to real estate (this exception does not apply to pensioners - for them registration is possible based on the income of the past 4 years). For example: real estate was purchased under a sales contract in 2014, and the rights were registered in 2015 (the certificate of ownership indicates 2015 - the date of entry in the register of real estate rights). You can apply for income in 2015 and 2016 (and for pensioners - 2013-2016).

- If more than 3 years have passed since the year the rights to real estate were obtained , then you can apply for a deduction based on the income of the past 3 years, and for pensioners - on the income of the past 4 years. For example: an apartment was purchased in 2010 under a DDU agreement, the transfer and acceptance certificate was signed in 2011. 3-NDFL in 2022 will be issued for 2014, 2015 and 2016. The deduction for income 2011-2013 in 2017 can no longer be issued.

New deduction codes

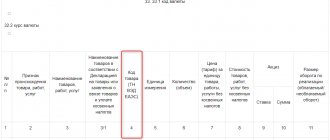

In the 2-NDFL certificates submitted in 2022, section 3 reflects the codes and amounts of income, as well as the following personal income tax deductions:

- payments that are not subject to personal income tax within the limit (daily allowance, financial benefits, etc.);

- professional deductions;

- amounts that reduce the tax base in accordance with Articles 213.1, 214, 214.1 of the Tax Code of the Russian Federation.

In section 3 of the 2-NDFL certificate, tax deductions are shown opposite the corresponding income. If several deductions are allowed to be applied to one type of income, the first deduction is reflected opposite the income in the columns “Deduction Code” and “Deduction Amount”, the second – in the line below, etc. In this case, the fields “Month”, “Income Code” and “Amount” income" opposite the second and subsequent deductions are not filled in. Section 4 shows standard, social, investment and property deductions for the purchase (construction) of housing.

There is a new tax deduction for individuals in Russia

The basis for the introduction of a new tax deduction for individuals was the entry into force of Federal Law No. 238-FZ “On Independent Assessment of Qualifications” dated July 3, 2016. This innovation applies to citizens who independently paid for the procedure for professional development. Accordingly, every citizen of the Russian Federation who has paid for participation in a professional assessment of their activities is now entitled to receive a social tax deduction for personal income tax. The amount of the deduction is determined taking into account the actual costs of assessment, however, the total amount during the reporting period of 12 months cannot exceed 120 thousand rubles. You must declare your desire to receive a tax deduction in your personal income tax return by submitting the reporting document directly to the Federal Tax Service.

Deduction for certain categories of citizens

The persons named in clause 2 of Art. also have the right to a standard deduction. 218 Tax Code of the Russian Federation

Table of the amounts of standard deductions for beneficiaries specified in clauses 1-2 of Art. 218 Tax Code of the Russian Federation

| Category of citizens | Benefit amount | Chernobyl victims, liquidators, persons affected by nuclear weapons tests | 3,000 rub. | WWII veterans | 3,000 rub. | Other citizens named in paragraph 1 of Art. 218 Tax Code of the Russian Federation | 3,000 rub. | Participants of the Second World War, survivors of the siege | 500 rub. | Disabled people of groups 1 and 2 (including people with disabilities since childhood | 500 rub. | Other categories of citizens named in paragraph 2 of Art. 218 Tax Code of the Russian Federation | 500 rub. |

Note : a pensioner himself does not have the right to receive this benefit if he does not have the grounds listed in Art. 218 Tax Code of the Russian Federation. If, for example, a pensioner is a Chernobyl survivor, then, in this case, he has the right to count on a benefit in the amount of 3,000 rubles.

Limit of deductions for children in 2022

“Children’s” deductions are applied from the beginning of the year until income taxed at a rate of 13% does not exceed RUB 350,000. (this amount does not include dividends received). For example, a mother whose income is 60,000 rubles. monthly, will receive a standard deduction for children in 2022 from January to May inclusive. In June her income will be 360,000 rubles. (RUB 60,000 x 6 months), threshold of RUB 350,000. exceeded, which means the right to deduct is lost until the end of the year. The “children’s” deduction does not apply from the month in which income “exceeded” the limit.

Personal income tax deductions for children can begin from the month of the child’s birth (registration of guardianship, adoption). The reduction in the tax base continues until the end of the year of the child’s 18th birthday, or continues during the period of his education until he is 24 years old, including the period of academic leave.

Child Tax Credit: Sizes

For every child under 18 years of age and children who study full-time, graduate students, residents, interns, cadets up to 24 years of age, tax deductions for children are provided for personal income tax. There is a direct relationship between the size of the deduction and the birth of the child in the family:

- deduction for the first - 1400 rubles,

- for the second – 1400 rubles,

- for the third and each subsequent youngest child - 3,000 rubles.

The Ministry of Finance of the Russian Federation, in letter dated March 15, 2012 No. 03-04-05/8-302, explained that when determining the amount of standard deductions for children, it is necessary to take into account their total number in the family. Even when the eldest child is much more than 18 years old and no deduction is provided for him, he still remains the first of the children. For example, there are three children in a family: 26, 17 and 15 years old - what deduction for 3 children is applicable in this case? The first child (26 years old) is no longer entitled to a deduction, the second (17 years old) – 1,400 rubles, and the third (15 years old) – 3,000 rubles.

Disabled children are a special category for which personal income tax deductions are provided at an increased rate. The deduction for a disabled child under 18 years of age, or a disabled person of group I or II, studying full-time until the age of 24, is equal to:

- 12,000 rub. – for parents, their spouses, adoptive parents;

- 6000 rub. – for adoptive parents, guardians and trustees of the child.

It is noteworthy that the amount of deductions does not depend on the order of birth of disabled children, and is summed up with regular “children’s” personal income tax deductions.

When can you apply for a property deduction for 2022?

You can apply for the deduction at the end of the year, during 2018-2020 (for pensioners: 2018-2021). There are no deadlines for filing during the year.

Many people believe that the 3-NDFL declaration for 2022 must be submitted by April 30, 2022, but this is not so. Until April 30, 2022, 3-NDFL is submitted only by those who need to declare income received for 2022, for example, property was sold whose tenure was less than 3 years.

Thus, you can apply for a property deduction on any day during the year. When submitting in person to the tax office, it is necessary to take into account the days and hours of operation of the tax office.

When must property be purchased to receive the 2022 deduction?

The property deduction for 2022 can be issued during 2018-2020, while the right to deduction could arise in 2022 or earlier:

- In order to receive a deduction for 2022 when purchasing real estate under a sales contract , title must be obtained before January 1, 2018.

- If an agreement on shared participation in construction or an agreement on the assignment of rights under an agreement on shared participation in construction or a housing cooperative agreement , then it is necessary that the transfer and acceptance certificate of housing be received before January 1, 2022. In this case, the date of registration of ownership does not affect the deduction.

Exception: persons receiving a pension. They can apply for a deduction for 2017 during 2018-2021, and their right to a deduction may arise both before 2022 and after, but no later than 2022. If the deduction becomes eligible in 2022, the deduction for 2022 will not be available.