16.02.2019

The head of the organization was invited to the commission on legalization of the tax base to give explanations regarding the application of deductions based on invoices issued on behalf of a shell company. From the new form of notification of summoning a taxpayer (approved by Order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2 / [email protected] ) the clause on administrative liability for disobedience to a legal order or requirement of an official of the Federal Tax Service is excluded. Does this mean that now the head of an organization cannot be fined for failure to appear at the inspection without good reason?

On the rights of controllers when demanding explanations from taxpayers.

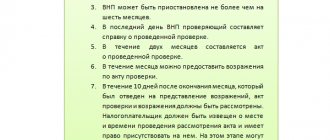

The rights of tax authorities are listed in Art. 31 Tax Code of the Russian Federation. Paragraph 4 of the norm states that inspectors are allowed to call the taxpayer to the inspectorate to give explanations:

– in connection with the payment and transfer of taxes to them; – in connection with a tax audit; – in other cases related to the taxpayer’s compliance with legislation on taxes and fees.

As we can see, the wording of the norm is very vague, which means it allows inspectors to legally require the taxpayer to appear at the inspectorate and ask him any questions regarding the taxation of his activities.

In a rather old Letter No. AS-4-2/12837 dated July 17, 2013, the tax department cited, as an example, several specific situations where clause 4 of Art. 31 Tax Code of the Russian Federation.

Situation 1. It is immediately necessary to obtain clarification from the taxpayer on issues related to his compliance with the norms of the Tax Code of the Russian Federation, including during a meeting of the tax authority commission on legalization of the tax base. In other words, the taxpayer may be summoned to the inspectorate, so to speak, for a conversation. And there are plenty of topics for such a conversation: low (compared to the industry average) tax burden, a significant (exceeding the regional average) share of tax deductions, the use of deductions based on invoices of dubious suppliers, systematic reimbursement of VAT from the budget, failure to fulfill the obligation to pay tax , including additional accrual based on the results of a tax audit.

Let us add: as a rule, commissions on the legalization of the tax base are carried out outside the framework of a tax audit. Judges have long recognized that this does not violate the rights of businessmen. Thus, in the Resolution dated 05/08/2014 in case No. A27-10859/2013, the FAS ZSO emphasized that, by virtue of Art. 82 of the Tax Code of the Russian Federation, such tax control measures as obtaining explanations can be carried out by tax authorities during inspections and in other situations related to the implementation of tax legislation. The Resolution of the AS PO dated May 26, 2016 No. F06-8745/2016 in case No. A12-27923/2015 noted that obtaining explanations from the taxpayer is possible not only during audits. Inspectors are not limited in the field of tax control by the right to receive and analyze information about the activities of the taxpayer only on the basis of tax returns submitted by the taxpayer himself. According to the FAS FAS (Resolution No. F03-917/2013 dated March 27, 2013 in case No. A51-14534/2012), holding commissions aims to suppress cases of incomplete reflection by taxpayers in accounting for business transactions, to identify falsified reporting, and tax evasion schemes.

Situation 2. During control activities, inspectors had questions that could only be resolved in a personal meeting with the person being inspected. Let us recall that clause 3 of Art. 88 of the Tax Code of the Russian Federation obliges the Federal Tax Service Inspectorate to notify the taxpayer that a desk audit has revealed errors (contradictions) in the reports submitted by him or a discrepancy between the information he has submitted and the information available to the tax authority. In order to implement this norm, the inspection sends a request to the inspected person to provide explanations. It is considered fulfilled if, within five working days, the taxpayer substantiates the reasons for the contradictions or inconsistencies identified by the audit or clarifies his tax obligations.

However, there are cases when the explanations provided by the taxpayer to the controllers are not enough. Then they can take advantage of the right that clause 4 of Art. gives them. 31 Tax Code of the Russian Federation. As the Federal Tax Service noted, the need to appear can be determined from the volume of errors, contradictions and inconsistencies identified by the audit, the scale and complexity of the current situation, when answers to questions are required that can only be posed after receiving answers to interim questions.

Situation 3. It is necessary to personally hand over any documents to the person being checked (as a rule, evading the check or preventing it from being carried out) or familiarize him with them against his signature. Obviously, in this case, the taxpayer’s appearance at the Federal Tax Service is required in connection with a desk or field audit.

There are other situations in which tax officials can exercise the right to summon the person being inspected to the inspectorate.

For your information:

In

Letter No. ED-4-2/16015 dated August 13, 2014,

the Federal Tax Service drew attention to the need to obtain explanations from the taxpayer regarding each fact identified by the on-site audit (before its completion) that suggests the commission of a tax offense of a significant nature. Receiving clarifications during an on-site audit helps to identify the taxpayer’s position before drawing up a report on its results and, in some cases, allows one to avoid making insufficiently substantiated claims.

The taxpayer’s explanations received during a personal meeting are recorded (otherwise, what’s the use of them?). Since the current legislation does not provide for the drawing up of a protocol or other document based on the results of receiving explanations from a businessman, the tax authority itself decides how to do this (the main thing is that the taxpayer does not mind). Explanations may be enshrined in writing or other means, including the use of technical means.

Results

Loss commission is an event carried out in connection with the filing of an income tax return in which the taxpayer showed a loss.

You cannot ignore the invitation of the tax authorities - liability for failure to appear at the tax commission can be applied under Art. 19.4 Code of Administrative Offenses of the Russian Federation. However, when going to a loss commission, you need to know both your rights and the rights of the tax authorities. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

On the responsibilities of taxpayers.

The responsibilities of taxpayers are specified in Art. 23 Tax Code of the Russian Federation. This norm does not provide for the obligation to come to the inspection when called to give explanations. Doesn't this mean that reporting to the tax authority can be regarded as a taxpayer's right?

The Ministry of Finance does not think so. In Letter dated 04/09/2010 No. 03-02-08/21, the department referred to paragraphs. 7 clause 1 art. 23 Tax Code of the Russian Federation. This establishes the taxpayer’s obligation to comply with the legal requirements of the tax authority to eliminate identified violations of the legislation on taxes and fees, and also not to interfere with the activities of tax authorities officials in the performance of their official duties. It is likely that the taxpayer’s failure to exercise the legal right of inspectors to have a personal meeting with him is regarded by officials as an obstacle to the activities of the Federal Tax Service.

There is one more question left. Is a taxpayer who appears at the request of the tax authority to give explanations obliged to give these explanations? Everything is quite simple here: according to paragraphs. 7 clause 1 art. 21 of the Tax Code of the Russian Federation, it is the taxpayer’s right to provide tax authorities and their officials with explanations on the calculation and payment of taxes. Therefore, we believe he may refuse to answer questions from tax officials. There is only one case when giving explanations is the responsibility of the taxpayer - this is the issuance by the tax authority on the basis of clause 3 of Art. 88 of the Tax Code of the Russian Federation requires the provision of explanations (we discussed this above). But to fulfill this obligation, the appearance of the person being inspected at the tax authority is not provided for by law.

I do not know anything. Why did they call me?

Any individual who may be aware of any circumstances relevant to the implementation of tax control may be invited to testify. Inspectors assess this probability independently and do not have to prove it.

As the Primorsky Regional Court noted, disagreement in itself with a summons for questioning as a witness does not mean that the rights of an individual have been violated.

In addition, the courts indicate that reading out the questions posed to the witness, as well as explaining them, is not the responsibility of the official interrogating the witness. An individual is not deprived of the right to ask clarifying questions if he has any doubts, or to ask for clarification of the essence of a particular issue.

On the form and content of the notice of summoning a taxpayer.

According to paragraphs. 4 paragraphs 1 art. 31 of the Tax Code of the Russian Federation, the taxpayer is summoned to the inspectorate on the basis of a written notification. This is the only condition for controllers to exercise their rights.

The form of notification of a taxpayer's summons is approved by order of the tax department. The current notification (form according to KND 1165009) is contained in Appendix 2 to the above-mentioned Order of the Federal Tax Service of Russia No. ММВ-7-2/ [email protected]

The notice of summons of the taxpayer must indicate:

– a question on which clarification is required (the notification must contain a detailed description of the grounds for calling the taxpayer, otherwise he will not be able to prepare for a conversation with representatives of the inspectorate; a previously known purpose of the visit to the tax authority will help the businessman formulate explanations on the substance of tax requirements, support his explanations with relevant documents, and if necessary, use legal assistance); – the exact place where the meeting will take place (address of the tax authority, office number); – date and time of arrival at the tax authority (either a specific date and time, or visiting days and opening hours of the inspection, so that the taxpayer himself decides when it is convenient for him to appear).

For your information:

the courts insist on a detailed description of the grounds for the summons (

decrees of the FAS VSO dated 07/04/2013 in case No. A58-6024/2012

,

FAS DVO dated 03/27/2013 No. F03-917/2013 in case No. A51-14534/2012

,

FAS PO dated 10.24.2013 in case No. A55-35598/2012

), and controllers (

Letter of the Federal Tax Service of Russia dated 10.09.2015 No. ED-4-2/17621

).

If the court considers that the purpose of the appearance indicated in the notice cannot be recognized as specific and does not allow establishing for what reason and during what tax control measures the taxpayer was summoned, the summons to the inspectorate will be declared illegal (Resolution of the Federal Antimonopoly Service dated May 27, 2013 in case No. A68-7925/2012

).

As we can see, from the contents of the notice the taxpayer must find out exactly why, where and what time he must arrive to give explanations. Therefore, the use by the tax authority of an out-of-date notification form is not of fundamental importance. Thus, the Perm Regional Court, in its Resolution dated November 16, 2017 in case No. 44-a-1601/2017, did not recognize the notification on the old form, which had lost its legal force, as improper. The court decided that all the requirements imposed by current legislation for notification of a taxpayer's summons were met by the inspectorate. It contains all the required details: addressee, date, time, address and place (office) of the commission meeting, the purpose of calling the taxpayer. The notification was signed by the appropriate person of the Federal Tax Service, his signature is deciphered.

The legislation does not establish specific methods for delivering a notice of summons to a taxpayer. This means, in fact, the Federal Tax Service can transfer the document in any of the ways provided for in paragraph 4 of Art. 31 Tax Code of the Russian Federation:

– hand over to a representative of the organization (legal or authorized) in person against signature; – send by registered mail; – send electronically via TKS.

Meanwhile, VAT payers need to consider the following. In accordance with paragraph. 5 paragraph 3 art. 80, paragraph 5 of Art. 174 of the Tax Code of the Russian Federation, they must submit VAT returns exclusively in electronic form using the TKS. Clause 5.1 art. 23 of the Tax Code of the Russian Federation obliges them to ensure electronic interaction with tax authorities. According to the Order of the Federal Tax Service of Russia dated December 31, 2015 No. [email protected], the transfer of tax documents via TKS to taxpayers connected to electronic document management is a priority method of sending documentation. And only if these persons evade receiving documents under the TCS, they are allowed to be sent on paper.

Note:

When the inspectorate sends a notification under the TCS, the taxpayer is obliged to send the controllers a receipt of acceptance of this document.

This must be done via TKS no later than six working days from the date the notification was sent by the tax authority. Otherwise, the Federal Tax Service will use the provisions of clause 3 of Art.

76 of the Tax Code of the Russian Federation and will suspend taxpayer transactions on bank accounts and electronic money transfers. Mention of these sanctions for non-compliance with tax laws is contained in the notification form.