The Federal Tax Service (FTS of Russia) is a federal executive body charged with state economic supervision.

To get acquainted in more detail with the service, its activities, services and services addressed to both individuals and legal entities, the Tax Office’s official website allows you to get acquainted with it in more detail.

Official site

About the Federal Tax Service of Russia

First of all, the web resource allows you to get a more complete picture of the tax service. The first tab of the main menu of the site is dedicated to the relevant information.

It contains information regarding official data about the Federal Tax Service of Russia, its mission, main areas of activity and the strategic map of the service. The structure is also described here and materials related to the Public Council under the Federal Tax Service are posted. It is also possible to get acquainted with information about the coordination and advisory bodies formed by the tax service.

About the Federal Tax Service of Russia

This section also provides information about the functions, history and activities of the Federal Tax Service of Russia. Materials related to the reduction of administrative barriers and reform of control and supervisory activities are also posted here.

Among other things, information is provided about the subordinate organizations of this federal body, the state civil service in the Federal Tax Service. It also provides information on measures in emergency situations, information on procurement, as well as materials on working with citizens’ appeals.

You can also find information about printed publications here, as well as open data. In addition, the official website provides information regarding state information systems and the Federal Tax Service certification center. Materials on the public initiative and the quality management system of the Federal Tax Service are also available here.

Activities of the Federal Tax Service of Russia

If you are directly interested in the activities of this federal executive body, you should go to the second tab of the main menu, dedicated to this issue.

It contains materials related to taxation in the Russian Federation, control work, statistics and analytics, international interaction, and other functions of the Federal Tax Service of Russia.

Activity

The section devoted to taxation in the Russian Federation includes information related to taxes and fees in force in Russia, tax legislation, and judicial settlement of tax issues. Among other things, information on tax and accounting reporting, control work, as well as taxation of non-profit organizations is reflected.

Information regarding the taxpayer’s consent to recognize information constituting a tax secret as publicly available is also presented here. Bankruptcy and debt issues are also covered here. You can also familiarize yourself with information related to transfer pricing, a consolidated group of taxpayers and taxation of Russian citizens working abroad.

This section also contains materials on recycling fees, insurance premiums, trade fees, as well as controlled foreign companies and controlling persons.

Control work includes tax control activities, desk audits, control over the use of special bank accounts, and tax monitoring. You can also familiarize yourself with the issues of filing updated declarations and filing objections to tax audit reports.

Test

The section devoted to control work also covers issues of control and supervision in the field of state-regulated activities and control over the completeness of accounting for cash proceeds. Here you can also find answers to frequently asked questions about this type of activity.

Among other things, issues related to on-site inspections, as well as control over the use of cash register equipment, are covered.

“Statistics and Analytics” is another section that the official website allows you to familiarize yourself with. It is also available in the "Activities" tab of the main menu.

Statistics and analytics

Here you can get acquainted with tax analytics, data on statistical tax reporting forms, the efficiency of the Federal Tax Service of Russia, statistics on state registration of legal entities and individual entrepreneurs, the use of budget funds, work with citizens’ appeals, information on procurement, and open data.

Among other things, the tax office on its website allows you to get acquainted with information about the minimum and maximum retail prices for tobacco products produced in the Russian Federation.

Here you can also familiarize yourself with statistics on notifications submitted by individuals to the tax authorities about the implementation of activities to provide services to individuals for personal, household and (or) other similar needs.

As for the section on international interaction, here you can find information related to deoffshorization and the fight against international evasion. It also covers issues of multilateral international cooperation, bilateral cooperation and technological assistance, as well as technical assistance and technology exports.

International interaction

Presented here is a current list of sample signatures of officials authorized to sign documents confirming the status of a tax resident of the Russian Federation.

The official website allows you to get acquainted with other functions of the Federal Tax Service: accounting for organizations and individuals, registration of legal entities and individual entrepreneurs, state-regulated activities, currency control, statistics and analytics, prevention of corruption offenses, interaction with financial market organizations.

It also sets out issues related to the Unified Register of Small and Medium Enterprises, as well as registers and verification of counterparties.

Services

The tax service pays significant attention to services and government services on the website.

The first include personal accounts, business registration, TIN information, payment of taxes and duties, business risks, information from registers, tax calculators, tax accounting, reference information, feedback/help, international taxation, software tools.

Services

On the website of the federal body, personal accounts are available for individuals, taxpayers of legal entities, payers of professional income tax (self-employed), individual entrepreneurs, as well as taxpayers of a foreign organization.

Business registration is an opportunity for state registration of legal entities and individual entrepreneurs, as well as creating your own business. Information about this registration is available in the corresponding section.

Information about the TIN is another service that the official website of the Federal Tax Service of Russia allows you to use. Here you can search for valid TIN of legal entities, submit an application for registration by an individual, and obtain information about the TIN of an individual. Here you can also find information about invalid TIN certificates for legal entities and individuals, and about invalid TINs for individuals and legal entities.

TIN information

Payment of taxes and duties is the payment of taxes and insurance premiums for individuals, state duties, trade fees, and taxes for third parties. You can also fill out a payment order here.

Another service “Business Risks”. Here you can find materials related to transparent business, as well as checking yourself and your counterparty (information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs). In addition, you can complete a request to send information about the fact of submitting documents to the tax authority upon state registration of a legal entity or individual entrepreneur. Among other things, information is available about legal entities and individual entrepreneurs in respect of which documents for state registration have been submitted.

Information from registers is also among the services that the official website of the tax service offers its users. Here you can provide information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs in electronic form, the Unified Register of Small and Medium Enterprises, integration and access to the Unified State Register of Legal Entities and Unified State Register of Individual Entrepreneurs databases.

The Federal Address Information System and the State Register of Accredited Branches and Representative Offices of Foreign Legal Entities (RAFP) are also available here. It is also possible to check the arbitration manager here. In addition, it is possible to access open and publicly available information from the Unified State Register of Real Estate about foreign organizations and the Register of Disqualified Persons.

The Federal Tax Service also allows you to use various calculators on its website. Among these are a tax calculator - calculating the cost of a patent and a tax calculator - choosing a tax regime.

Calculators are also available: calculation of insurance premiums; FL transport tax; land tax and property tax for individuals; for calculating the tax burden.

Insurance premium calculator

Another service is tax accounting. This is the presentation of tax and accounting reports; checking the availability of an application for the import of goods and payment of indirect taxes (EAEU); provision of information about gambling participants from whom bets on official sporting events are accepted. Here you can also check the correctness of filling out invoices and check whether information on the documents required to confirm the 0 percent VAT rate (exemption from excise taxes) has been received from the Russian Federal Customs Service.

Considerable attention is paid to reference information. Here you can find background information on property tax rates and benefits. Letters from the Federal Tax Service of Russia sent to territorial tax authorities are also presented here. The website also contains regulatory and methodological materials from the Federal Tax Service. In addition, you can familiarize yourself with decisions on complaints, answers to frequently asked questions, information stands, and also subscribe to the mailing list of the Federal Tax Service website.

Among other things, the official website allows you to receive feedback or help. In this case, you will be able to make an appointment with the inspectorate, contact the Federal Tax Service of Russia, and find out about the complaint. Here you can obtain the necessary information about the address and payment details of your inspection. You also have the opportunity to go to the site forum, take a survey, or contact the technical support service of online services.

Feedback/Help

Among the services provided by the tax service, international taxation is also represented. In the corresponding section, the VAT office of an Internet company, confirmation of the status of a tax resident of the Russian Federation, a message about a client who is a foreign taxpayer, as well as a report on foreign clients according to the OECD Standard are available.

Among other things, software is also presented. This is a declaration, taxpayer legal entity, Tester and other software.

What is necessary?

Logging into your personal tax office is not so easy. There are no simple solutions at the tax office; the article on how to file an electronic return will not let you lie. Therefore, carefully read the necessary requirements below and only if they are met, proceed directly to the instructions.

- Registered Legal Entity or Individual Entrepreneur

- Electronic digital signature (USB key)

- Computer with Windows XP, 7, 8, 8.1, 10

- Browser Internet Explorer 9 or higher

Requirements taken from the tax website.

The last 2 points are excellent: on the one hand they talk about support for Windows XP, on the other they say that the minimum version of IE is 9. Microsoft is at a loss from our mega-programmers, since the latest announced version of IE for XP is 8, you won’t install nine - it simply does not exist for this OS. In short, if you have Windows XP, most likely you will not succeed. Everything should work out, tested on XP with IE8.

Personal Area

Among the services, the personal account deserves special attention. The official website has several similar online services addressed to both individuals and legal entities.

LC for individuals is a service that provides access to up-to-date information regarding property and vehicles, as well as the amounts of accrued and paid tax payments. Information about the presence of overpayments and tax debts to the budget is also available here.

Login to your account for individuals

With the help of this service, monitoring the status of settlements with the budget becomes available. With its help, you can receive and print tax notices, as well as receipts for payment of tax payments. Here it is also possible to pay tax debts, as well as tax payments through banks that are partners of the Federal Tax Service of Russia.

In addition, individuals through their personal account can download programs designed to fill out a personal income tax return in Form No. 3-NDFL, fill out a declaration in Form No. 3-NDFL online, and also send a declaration in form to the tax authority No. 3-NDFL in electronic form, signed with the electronic signature of the taxpayer.

Here the tax office allows you to track the status of a desk audit of tax returns using Form No. 3-NDFL. In addition, an individual has the opportunity to contact the tax authorities at any time without the need for a personal visit to the inspectorate.

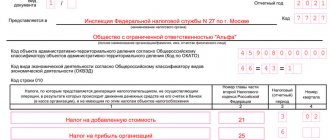

The personal account of a taxpayer of a legal entity also opens up wide opportunities for the user. With its help, it is possible to obtain up-to-date information regarding tax debts to the budget, the amounts of accrued and paid tax payments, the presence of overpayments, outstanding payments, decisions made by the tax authority for offset and refund of overpaid (excessively collected) amounts.

Personal account of a legal entity

Information is also available here about decisions made to clarify payments, about settled debts, about unfulfilled demands by the taxpayer to pay taxes and other obligatory payments, as well as about measures to enforce debt collection.

Allows such an office to apply for an extract from the Unified State Register of Real Estate in relation to itself. Here you can send a request and receive a certificate about the status of payments for taxes, fees, penalties, fines, and interest. In addition, an act of joint reconciliation of such calculations is available.

Through their personal account, legal entities can send a request to receive a certificate of fulfillment of the obligation to pay taxes, fees, penalties, fines, and interest. It is also possible to draw up and send to the tax authorities applications for clarification of an unclear payment, an application for clarification of payment documents in which the taxpayer discovered errors in registration. It is also possible to submit an application for offset/refund of overpayment, as well as an application to initiate reconciliation of settlements with the budget.

Among other things, you can send messages to the tax authority on form C-09-6 about participation in Russian organizations. It is also possible to receive services for registering and deregistering an organization at the location of a separate division, making changes to information about a separate division on the basis of formalized electronic messages from the taxpayer in forms No. S-09-3-1, S-09-3-2, 1 -6-Accounting, 3-Accounting, as a UTII taxpayer based on applications in forms No. UTII-1, UTII-3, 3-Accounting.

Also, the Federal Tax Service, through the LC, allows you to send documents for state registration of persons or making changes to the information contained in the Unified State Register of Legal Entities to the tax authority to carry out state registration procedures or making changes to the Unified State Register of Legal Entities. Here you can also obtain information regarding the progress of execution of applications and requests to independently monitor the timing of the provision of services by the tax authority. It is also possible to obtain a decision from the tax authority regarding the submission of applications.

Registration of individual entrepreneurs online

Every adult citizen can try himself in business. To start a business legally, you need to register as an individual entrepreneur. A common option is to collect documents and visit the tax office yourself. But you can also submit an application to open an individual entrepreneur remotely.

To create an individual entrepreneur through your personal account, you need to follow the link. Scroll down the page and reach the third section (methods for submitting documents). Select “Remotely”, there will be two ways to submit an application.

Clicking on both links will lead directly to entrepreneur registration. But first you need to log in or register in the system.

An application for registration of individual entrepreneurs is submitted on the Federal Tax Service website (form 21001). There the passport details, TIN, contact phone number and e-mail of the taxpayer are indicated. You will also need to enter a digital combination to protect against hacking and confirm that you are not a robot.

Advice!

After data entry is complete, each application is assigned an individual number. It is recommended to write it down - you will have to track the status of the application using the number.

Tax officials review documents within three days. During this period, it is necessary to pay the state fee (800 rubles), otherwise the application will be rejected.

Obtaining a login and password from the Federal Tax Service inspection

To authorize and constantly work with your personal account, each entrepreneur must receive a login and password. The service is available to all taxpayers who are residents of the Russian Federation. You can obtain data for subsequent authorization in your personal account at the nearest tax office (the place of residence and registration of the citizen does not matter).

The tax officer will require you to present your passport, tax identification number, and business registration certificate. You will also need to fill out a registration card. In fact, this is a regular questionnaire and the process will take 5-10 minutes. When you complete filling out the card, the employee will verify the authenticity of the information through the database and provide the initial login and password for authorization in your personal account. Activating your account will take a day.

Important!

The provided password must be changed within a calendar month. Otherwise, access to the personal account for individual entrepreneurs will be closed.

You can change the login at your discretion (using a TIN is allowed). And the Federal Tax Service has requirements for the password (an elementary security measure): it must include numbers, upper and lowercase Latin letters, and symbols. The minimum password length must be 7 characters.

Government services

In addition to services, the Federal Tax Service also provides a number of government services, to familiarize yourself with which you should go to the corresponding tab available in the “Services and government services” section.

As a result, you will be directed to the official website of the State Services, where you will be able to familiarize yourself with the full list of services provided by the Federal Tax Service of Russia, as well as use the ones you need. The functions assigned to this federal executive body are also presented here.

Public services

All available services are divided into electronic and non-electronic. The former can be obtained remotely; to obtain the latter, you will need to contact the inspectorate directly.

Electronic services are free information for taxpayers, fee payers, insurance premium payers and tax agents about current taxes, fees and insurance premiums, legislation on taxes and fees and regulations adopted in accordance with it, the procedure for calculating and paying taxes, fees and insurance contributions, rights and obligations of taxpayers, fee payers, insurance premium payers and tax agents, powers of tax authorities and their officials.

These also include the submission of an extract from the Unified State Register of Taxpayers. We also accept tax returns (calculations). State registration of legal entities, individuals as individual entrepreneurs and peasant (farm) farms is also available in electronic form. In addition, you can obtain information from a certificate of income of an individual in form 2-NDFL, and also find out your TIN.

In addition to electronic services, non-electronic services are also available. These include the following: maintaining the State Register of cash registers; maintaining, in accordance with the established procedure, the state register of self-regulatory organizations of organizers of gambling in bookmakers, the state register of self-regulatory organizations of organizers of gambling in betting shops; maintaining a unified register of lottery terminals.

Non-electronic services

The Federal Tax Service also provides non-electronic services such as the issuance of various types of documents, in particular certificates: on the registration of a person carrying out transactions with benzene, paraxylene or orthoxylene; certificate of registration of a person carrying out transactions with straight-run gasoline; on registration of a person performing operations for processing middle distillates; on registration of an organization carrying out transactions with denatured ethyl alcohol; on registration of an organization carrying out operations with middle distillates.

Also, the Federal Tax Service of Russia is engaged in issuing special stamps for labeling tobacco products produced in the Russian Federation. It also exercises control over the implementation of foreign exchange transactions by residents and non-residents within the competence established by the Regulations on the Federal Tax Service.

In addition, this service is entrusted with the state function of monitoring the implementation of foreign exchange transactions by residents and non-residents who are not credit institutions or currency exchanges. The Federal Tax Service also monitors compliance with the requirements for cash register equipment, the procedure and conditions for its registration and use. She also carries out control and supervision over the completeness of accounting for cash proceeds in organizations and individual entrepreneurs.

The Federal Tax Service of Russia also carries out licensing of activities for the organization and conduct of gambling in bookmakers and sweepstakes and licensing of activities for the production and sale of counterfeit-proof printed products.

Licensing of activities related to the organization and conduct of gambling in bookmakers and sweepstakes

This service, among other things, carries out licensing control of activities related to the organization and conduct of gambling in bookmakers and sweepstakes; licensing control of activities for the production and sale of counterfeit-proof printed products; federal state supervision over the activities of self-regulatory organizations of organizers of gambling in bookmakers and self-regulatory organizations of organizers of gambling in betting shops.

It is also entrusted with the functions of providing information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs, as well as providing interested parties with information contained in the register of disqualified persons.

Among other things, the tax service checks the technical condition of gaming equipment and registers, in accordance with the established procedure, cash register equipment used by organizations and individual entrepreneurs in accordance with the legislation of the Russian Federation. It also carries out federal state supervision of lotteries.

Make an appointment with the tax office

Link: Make an appointment with the tax office

You will need to enter Category: (select from the list) (Individual, legal entity, Individual entrepreneur), Full name: INN: Telephone: Email: Inspection: (select) Services: (select) for example, Acceptance of reports from individual entrepreneurs, notaries, lawyers Reception date: (select) Reception time: (select)

If the employee providing the appointment for the selected service is busy, the appointment may begin later than the selected time, while the taxpayer is guaranteed an appointment within half an hour.

If the taxpayer is late by more than 10 minutes, the taxpayer loses the right to priority service and is served in the general queue.

Priority service by appointment is provided subject to:

compliance of the data of the presented identification document with the data specified when registering online.

applying for the service selected when registering online.

Next you will be assigned a PIN code

To receive the selected service in the Federal Tax Service hall, you must receive an electronic queue coupon before the appointed time. To do this, you must enter the 'PIN code' specified in the current coupon in the electronic queue terminal and receive a printed electronic queue coupon.

Documentation

The official website of the Federal Tax Service of Russia also allows you to familiarize yourself with the documents. This is the Tax Code, regulations developed by the tax service, letters from the Federal Tax Service sent to territorial tax authorities and other documents.

Documentation

The Tax Code of the Russian Federation includes 2 parts, 11 sections and 34 chapters. Regulatory legal acts issued and developed by the service, as well as other documents, are presented in the sections of the same name. They can be searched by text, date of signing, type of document (orders, decrees, letters, regulations, resolutions, decisions, agreements, Federal laws, draft Administrative Regulations, draft orders, regulations, protocols, orders, definitions, plans, codes, projects requirements, instructions, laws, the Constitution, draft orders, draft orders, instructions, methodological recommendations, laws, federal constitutional laws, appendices to the order, agreements, lists, passports, regulations, draft agendas).

It is also possible to search for the necessary documents by the authority that accepted them. The region can also be specified here (federal documents, all regions, or just a selected one). Once the information required for the search has been specified, click on the “Apply” button.

Search documents

When searching for letters from the Federal Tax Service of Russia sent to territorial tax authorities, you can specify the text, date of signing or date of publication (set a time range). The type of tax (subject), article and status of the letter can also be indicated here. Once all the necessary data is specified, all that remains is to use it to search for the required letters. Here you can subscribe, available through the tab of the same name.