Don’t forget to get statements from all your banks

There are spare (reserve) current accounts, in case one bank gets sick, you can try to transfer funds to another bank in time (“transfer of your own funds”).

Yes, and this happens - after all (as it turns out in fact) the fact that you use a current account in some bank and store some money there - it is you who are at risk, not the bank. These are today's realities.

Don’t forget to download the statements there, because the commission is most likely being charged, i.e. there is movement.

VAT on advances received

When selling products (goods, services) to the buyer, a mandatory condition may be specified in the contract - advance payment in the amount of up to 100%.

On the received advance, the organization issues a tax return and charges VAT at a rate of 18/118%. The amount of this advance is included in the sales book as accrued VAT, that is, a tax that the organization is obliged to pay to the budget.

Get 267 video lessons on 1C for free:

In practice, after issuing a SF for the advance received, 3 situations are possible:

- during the advance period the sale occurred;

- no sales occurred during the advance period;

- return of advance payment to the buyer (termination of contract, change of conditions, etc.).

In the first case, after the shipment has been made, the selling organization has the right to present previously paid VAT on the advance received for deduction. That is, the advance SF is closed with a purchase ledger entry.

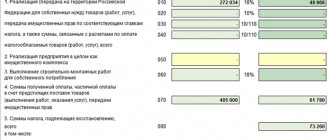

In the second case, the amount of the advance and the VAT accrued on it is reflected in the VAT return for the current period in line 070 of Section 3.

In the case of an advance refund, it is also possible to claim the VAT paid for deduction, that is, an entry is created in the purchase book. You can take advantage of the deduction within a year after termination of the contract.

In the event of liquidation of the purchasing organization before full fulfillment of the delivery conditions, if it is impossible to return the advance payment, VAT accrued upon receipt of the advance payment is not subject to deduction.

Suppliers count 60

60.01 D remainder = 0! 60.02 K remainder = 0 !

76.VA D balance = 0 76.VA K = 60.02*18/118 - provided that all suppliers have issued an account for the advance. But in reality this doesn’t happen: 76.VA loan

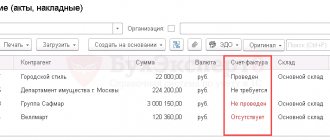

It is useful to view the status of documents - Invoices from suppliers

60 - see Purchases - Invoices from suppliers? status = Not Received!

19.3 19.4 VAT from suppliers

19.3 balance Credit = Debit = 0 - everything should be closed without balances, all debit turnovers within the quarter are equal to credit ones.

The first option for restoring VAT in 1C

Let's consider the option with an advance payment from the buyer (Fig. 1.).

The 1C program itself determines the amount received as an advance and generates the corresponding transactions (Fig. 2).

The posting to VAT accounts is generated by the advance invoice (Fig. 3). Please note that advance invoices can be issued both at the time of receipt of funds to the current account, and at the end of the month through special processing.

Upon sale, the advance amount is automatically reversed (Fig. 4)

The sales invoice does not make any postings, but generates movements in other registers that are needed for further work with VAT (Fig. 5).

“Recovery” of VAT occurs in the document “Creating purchase ledger entries” (Fig. 6)

The “Received advances” tab in 1C 8.3 is filled in automatically and contains all the amounts for “restoring” VAT on previously received advances (postings in Fig. 7).

The final picture can be seen in the “Sales Book” and “Purchases Book” reports.

The sales book in 1C (Fig. 8) contains two entries for the Achilles counterparty. One entry is for an advance payment (dated 01/10/2016), the second is for sale (dated 01/26/2016).

The purchase book also contains an entry for this counterparty. It compensates for the advance entry in the sales book. All three entries are for the same amount (RUB 7,627.12).

As a result, you will only have to pay to the budget once.

Let's check that account 76.AB is closed (Fig. 10).

Buyers 62.01 62.02

62.01 K remainder = 0 62.02 D remainder = 0

do not forget to create sales ledger entries and create purchase ledger

Look in “ VAT reporting ”. I have a document created by 1C itself once at the end of the quarter.

This is where interesting moments arise in accounting. In fact, VAT from the buyer’s advance payment falls into the document “formation of the purchase book”. This is how things are - it’s like you’re buying VAT.

don't forget to make a count. in advance to buyers!

1C can do this automatically. Look in “ VAT reporting ”.

76.AB K balance = 0 Remember balance debit 76.AB = 62.2*0.18/1.18. We do SALT exactly 62.2 (i.e. under subaccounts we divide from 62.1 and 62.2)

Note: during the transition from 18% to 20%, this formula will not work.

We will talk about a program that makes it easier to work in 1C: Accounting 8. In accounting practice, a situation often arises when it is necessary to restore the sequence of document processing. In many 1C configurations, standard processing of document re-posting is available, but the peculiarity of its operation is that re-posting is carried out for each type of document separately. Those. First, all sales for the period are carried out, then all receipts for the period, etc. In such a situation, offsets of advances may not occur correctly.

For a more correct restoration of the sequence, our organization has developed a program that builds and retransmits documents in a clear chronology for all types of documents at once.

Also, this operation often goes side by side with such a pressing accounting problem as balancing the balance on account 76.AB in accordance with the balance on the account of advances from customers 62.02. If the organization is a VAT payer, the balance on account 76.AB must correspond to the balance on advance accounts 62.02 using this formula at a rate of 18% VAT. 76.AB = 62.02 * 18 / 118

And from the new year 2022 at a VAT rate of 20% and the corresponding formula 62.02 * 20 / 120. If you have encountered this task, then you know that a lot of effort and time is spent on reconciling account data manually. For this purpose, a program has also been developed that does this work for you. It looks like this:

As you can see, not only the compliance of account balances 62.02 and 76.AB is checked here. But another common error is also revealed that prevents the correct submission of VAT reports - a simultaneous balance for both payments and advances, i.e. to 62.01 and 62.02. There is a function to hide minor (penny) discrepancies. It is possible to leave only errors in the report.

The second tab is dedicated to document sequence alignment. Here you can repost all documents at once. Likewise, specifically for a specific counterparty.

In our experience, this tool turns out to be an indispensable assistant in correcting VAT accounting errors and allows the accountant to concentrate on really important accounting issues, rather than performing a huge mechanical job of checking accounts.

We provide this processing free of charge to all our clients. Or for a nominal fee to all official users of 1C programs. If you are interested in this development, we will be happy to install it for you.

To do this, you just need to call us by phone or send a request by email. This email address is being protected from spambots. You must have JavaScript enabled to view it. with the heading “Processing VAT check”.

Fool's method

There is a cool method when, without understanding anything about the algorithms for calculating VAT payable, we focus only on the fact that 1C knows what it is doing.

We take it as a fact that, for example, “Express check of accounting (VAT)” checks everything correctly.

Let’s say our 62.2/6 does not beat 76AB (2019Q2), but there are suspicions that everything was done correctly (during the transition to 20% VAT). Those. "Express VAT check" shows that everything is Gut!

We do this:

We remove one line from the formation of the purchase book and see that “Express VAT check” noticed and began to swear. Aha - that means everything is correct in the document for creating the purchase book .

Next, we’ll post one invoice for the advance in the same way and see what “Express VAT Check” noticed and started swearing. The conclusion and invoices for advance payments are also correct.

It's cool isn't it.

And so on …

Accounting entries for VAT recovery from advance payment

The VAT recovery posting will always be the same for each individual invoice:

Dt 76/VA Kt 68/2,

68/2 - subaccount for accounting for settlements with the budget for VAT on account 68;

76/VA - subaccount for accounting for VAT on advances issued in account 76.

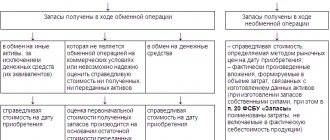

The results of VAT recovery for specific advance invoices will vary depending on the ratio of the amount of the advance and the cost of supply associated with it:

- for the first 2 cases (the amounts of the advance and delivery are the same or the amount of the advance is less than the cost of delivery), with this posting the amount of tax on the advance, listed in subaccount 76/AB, will be closed completely;

- in the 3rd and 4th cases (the amount of the advance is greater than the cost of delivery or the contract contains a condition on partial offset of the advance towards payment for the supply), in subaccount 76/AB after the restoration of VAT there will be a balance of unrecovered tax.

Read about the latest changes in the document reflecting tax restoration operations in the material “Sales Book - 2022: new form”

.

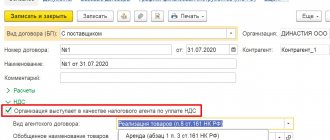

Invoice: Reflect the VAT deduction in the purchase book by the date of receipt

If payment and shipment (receipt) are in the same period, then everything is taken into account very simply: all my documents “Receipt of goods” in the Invoice received have a checkbox “Reflect VAT deduction in the purchase book by the date of receipt.” Those. here we immediately make postings for VAT refund ( 68.02 All shipments are similar and there are postings accordingly (90.03

Thus, as a result, the document formation of the purchase book and sales book is almost empty. And all sorts of advances and other evil spirits ended up there, which makes the life of an accountant bright and eventful. The problem is that if you give up and don’t deal with the advances, then it will all come out anyway. Therefore, we are looking for algorithms for checking advances.

During the transition to VAT 20% (2018/2019)

We analyze invoice 90.03 and see if we issued invoices with 18% VAT in Q1. 2022 — We correct it by 20%.

What follows is old nonsense, it’s better not to read: What logic first tells us (or an amateur is delusional) is that all options (where there are 2 periods, payment in one, shipment in the other) are divided into:

- 1.

- 1.1 client prepayment

- 1.1a счф. for advance payment (76АВ

- 1.2 shipment of goods to the client + regular invoice (there are no postings here, but see its shipment 90.03

- 1.2a we cancel the SCHF. for an advance payment (occurs when creating a purchase book - oddly enough).

- 2.

- 2.1 shipment of goods to the client

- 2.2 payment by the client

- 3.

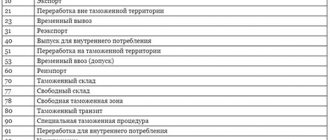

- 3.1 prepayment to the supplier

- 3.1a supplier to you SCHF. for advance payment (68.02 Purchases - invoice for advance payment

- 3.2 receipt of goods from the supplier + regular invoice (68.02

- 3.2a we cancel the SCHF. for advance payment (76VA

- 4.

- 4.1 receipt of goods from the supplier (19.03

- 4.2 payment to the supplier

Please note that for paragraphs. 2 and 4 no SCHF is created. for advance They only appear if payment is made first.

76AB This appears as a result of creating an invoice for the advance payment. The verification algorithm is as follows: according to 62.2, we look at the total amount at the end of the period, highlight from it how much VAT there will be, and this amount is the total according to 76.AB. This is provided, of course, that all goods have the same VAT.

God, how can I check all this crap with contractors, since since 2015. Each invoice must contend with the counterparty's accounting department.

Let's look at what the document “formation of a purchase book” contains. Attention! : the document can only be found through this path: Operations - Regulatory VAT reports

(it is not in the log of all transactions).

- “Creating a purchase book” - there is a division here:

- acquired values 68.02

- advances received 68.02

- Let’s look at what the document “formation of a sales book” contains:

- recovery on advances 76VA

First conclusions:

1. If the transaction has gone through 2 stages (shipment and payment) in full, then logically this can be seen in account 62 (there are no balances there) and, as a result, all advances are on the account. 76 of this counterparty must close, i.e. There should also be no leftovers.

2. If the client has an advance payment (there is a balance on account 62.2), then accordingly there will be a balance on account 76 in the ratio (62.2*0.18/1.18=76.AB). This is where a report on 62 with additional would be stupid. column according to the formula (62.2*0.18/1.18=76.AB).

3. If we made an advance payment to the supplier, then by law he must make an invoice. for an advance payment and send it to us, but usually this does not happen for obvious reasons: the supplier has made an SSF for himself. for an advance payment (paid VAT), but he doesn’t care about you - your problems, you need it - come for the SCHF yourself. for advance And it can also be understood - invoice documents and regular invoices are handed over with the delivery of goods, usually in boxes. If, after all, there is such a financial system. for an advance payment from the supplier, then it must be handled in Purchases - Invoices received - Invoice for advance payment

.

4. If there were schf. for an advance from the supplier, then after the full cycle the balance is on the account. 60 of our supplier is empty and, accordingly, the balance of 76.VA for our supplier is empty.

5. If there is a balance left in the prepayment to the supplier at 60.2, then there should also be a balance at 76.VA, in the ratio (60.2*0.18/1.18=76VA).

That's all, miracles don't happen. Everything is very simple! And by the way, having calmly spent 1 day getting to grips with the meaning of VAT charges and another 1-2 days sorting out mutual settlements with suppliers and customers, as well as re-processing documents + re-closing months 30 times, I had noticeable confidence (turning into euphoria ) that we did VAT correctly.

We reclose sequentially January, February, March through “close month”. In the same place, see the formation of a book of purchases and sales; by the way, the creation of these documents must be controlled manually, since it has been noted that they may not be created automatically.

We prepare a VAT return for the 1st quarter. It appears in Reports - Regulated reports - list (VAT Declaration)

. There is a sequence for filling out Sections - see the icon on the right? .

The restoration of VAT on advances issued is the result of its deduction and is not used very often. How to correctly recover VAT from advances? What conditions must be met in order to accept advance VAT as deduction? What entries need to be made in both cases? Let's look at all the pros and cons of VAT on advances in our article.