The concept of penalties

The legal concept of “fine” is established in paragraph 2 of Chapter 23 of the Civil Code of the Russian Federation.

According to Article 330, a penalty is a sum of money that the debtor is obliged to pay in case of improper performance of his obligations. Such payments may be:

- established by legislative act;

- are specified in the contract.

The condition on the accrual of a penalty for improper fulfillment of any obligations must be established in writing without fail. The only exceptions are statutory penalties (for taxes and fees).

Penalty for late repayment of debt and other violations of contract terms

Reflection of penalties in accounting at the time of their actual recognition by the debtor.

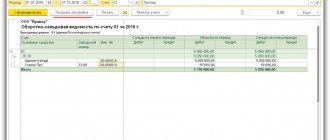

| № | Debit | Credit | Contents of operation |

| Accounting entries for the creditor organization when accruing debt for penalties, fines, penalties for collection | |||

| 1 | 76-2 | 91-1 | The amounts of fines, penalties, penalties receivable for claims made against buyers, customers, transport and other organizations are reflected as part of other income |

| 2 | 91-2 | 68 subaccount “VAT calculations” | VAT is charged on the amount of penalties for late payment, if the amounts of penalties are associated with late payment of goods, works, services sold (late payment under the contract) |

| Accounting entries from the creditor organization when reflecting the fact of receipt of amounts of penalties, fines, penalties from the debtor organization | |||

| 1 | 51, etc. | 76-2 | The debtor's debt to pay penalties, fines, and penalties to the creditor has been repaid |

| Accounting entries for the debtor organization when accruing debt for penalties, fines, and penalties for payment | |||

| 1 | 91-2 | 76-2 | The amounts of fines, penalties, penalties for payment on claims made against buyers, customers, transport and other organizations are reflected as part of other expenses |

| Accounting entries for the debtor organization when repaying the debt to the creditor for the amounts of penalties, fines, penalties for payment | |||

| 1 | 76-2 | 51, etc. | Reflects the payment of penalties, fines, and penalties to the creditor by the debtor |

Reflection in accounting of the offset of the amounts of penalties for violation of the terms of delivery of goods (performance of work, provision of services) stipulated by the contract when repaying the debt to the supplier (contractor).

| № | Debit | Credit | Contents of operation |

| Accounting entries from the purchasing organization (customer) | |||

| 1 | 76-2 | 91-1 | Penalties accrued for violation of the terms of delivery of goods (performance of work, provision of services) stipulated by the contract |

| 2 | 60, 76 | 76-2 | The amount of penalties due to the buyer (customer) is offset against the debt to the supplier (contractor) |

| 3 | 60, 76 | 51 | Payment was transferred to the supplier (contractor) minus accrued penalties |

| Accounting entries for the supplier (contractor) organization | |||

| 1 | 91-2 | 76-2 | Penalties have been accrued for violation of the terms of delivery of goods (performance of work, provision of services) stipulated by the contract |

| 2 | 76-2 | 62, 76 | The amount of penalties due to the buyer (customer) is offset against the repayment of his debt |

| 3 | 51 | 62, 76 | Payment received from the buyer (customer) minus accrued penalties |

Reflection in accounting of a claim brought by a foreign organization against a Russian organization for late payment for goods in the form of penalties. The Russian Federation does not have an agreement on the avoidance of double taxation with the foreign state in which the representative office of this foreign organization is located.

| № | Debit | Credit | Contents of operation |

| Accounting entries at the time the claim is made | |||

| 1 | 91-2 | 76 subaccount “Settlements for claims in foreign currency” | The accrual of penalties for violation of contractual obligations is reflected simultaneously in the currency of settlements and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date of filing the claim (transaction in foreign currency) |

| Accounting entries at the end of the reporting period | |||

| 1 | 76 subaccount “Settlements for claims in foreign currency” | 91-1 | A positive exchange rate difference is reflected in the composition of the organization’s other income when revaluing accounts payable for penalties expressed in foreign currency at the exchange rate of the Central Bank of the Russian Federation as of the reporting date of the financial statements or |

| 91-2 | 76 subaccount “Settlements for claims in foreign currency” | A negative exchange rate difference is reflected in the composition of other expenses of the organization when revaluing accounts payable for penalties, expressed in foreign currency at the exchange rate of the Central Bank of the Russian Federation as of the reporting date of the financial statements | |

| Accounting entries at the time of payment | |||

| 1 | 76 subaccount “Settlements for claims in foreign currency” | 52-1 | The payment of penalties to a foreign organization from a current foreign currency account is reflected simultaneously in the currency of settlements and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date of repayment of the debt (actual transfer of payment) |

| 2 | 76 subaccount “Settlements for claims in foreign currency” | 68 | The withholding of tax on the income of foreign organizations is reflected simultaneously in the currency of settlements and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date of debt repayment (actual transfer of payment) |

| 3 | 76 sub-account “Settlements for claims in foreign currency”91-2 | 91-176 subaccount “Settlements for claims in foreign currency” | The positive exchange rate difference on account 76 is reflected at the rate of the Central Bank of the Russian Federation from the moment the accounts payable for penalties payable (or the date of the last revaluation) until the debt is repaid from the current currency account or The negative exchange rate difference on account 76 is reflected at the rate of the Central Bank of the Russian Federation from the moment of occurrence accounts payable for penalties payable (or the date of the last revaluation), until the debt is repaid from the current foreign currency account |

| 4 | 68 | 52-1 | The transfer of tax to the budget is reflected simultaneously in the currency of settlement and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date of repayment of the debt (actual transfer of payment) |

Reflection in accounting of the payment of a fine by a Russian organization to a foreign organization for violation of customer requirements during the execution of a contract. According to the terms of the agreement, in case of failure to pay the fine on time, penalties will be charged for each day of delay in payment of the fine.

| № | Debit | Credit | Contents of operation |

| Accounting entries at the time of filing a claim by a foreign organization | |||

| 1 | 91-2 | 76 subaccount “Settlements for claims in foreign currency” | The amount of the fine for violation of contractual obligations is reflected simultaneously in the currency of settlement and in the ruble equivalent (RUB/equivalent) at the exchange rate of the Central Bank of the Russian Federation on the date of filing the claim (transaction in foreign currency) |

| Accounting entries at the end of the reporting period | |||

| 1 | 76 subaccount “Settlements for claims in foreign currency” | 91-1 | A positive exchange rate difference is reflected in the composition of the organization’s other income when revaluing accounts payable for a fine, expressed in foreign currency at the exchange rate of the Central Bank of the Russian Federation as of the reporting date of the financial statements or |

| 91-2 | 76 subaccount “Settlements for claims in foreign currency” | A negative exchange rate difference is reflected in the composition of other expenses of the organization when revaluing accounts payable for a fine, expressed in foreign currency at the exchange rate of the Central Bank of the Russian Federation as of the reporting date of the financial statements | |

| Accounting entries at the time of debt repayment by a Russian organization upon payment of fines and penalties | |||

| 1 | 91-2 | 76 subaccount “Settlements for claims in foreign currency” | The amount of the penalty for failure to pay the fine on time is reflected simultaneously in the currency of settlement and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date of payment of the fine and penalty (transaction in foreign currency) |

| 2 | 76 subaccount “Settlements for claims in foreign currency” | 52-1 | The amount of payment of fines and penalties to a foreign organization from a current foreign currency account is reflected simultaneously in the currency of settlement and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date of payment of the fine and penalties (actual transfer of payment) |

| 3 | 76 subaccount “Settlements for claims in foreign currency” | 91-1 | The positive exchange rate difference on account 76 is reflected at the rate of the Central Bank of the Russian Federation from the moment the accounts payable for the fine to be paid (or the date of the last revaluation) until the moment the fine and penalties are paid from the current foreign currency account or |

| 91-2 | 76 subaccount “Settlements for claims in foreign currency” | The negative exchange rate difference on account 76 is reflected at the exchange rate of the Central Bank of the Russian Federation from the moment the accounts payable for the fine to be paid (or the date of the last revaluation) until the moment the fine and penalties are paid from the current foreign currency account | |

Reflection in accounting of the debtor organization's refusal to satisfy the claim. The court supported the debtor's position.

| № | Debit | Credit | Contents of operation |

| 1 | 91-2 | 76-2 | The amount of the claim, the collection of which was refused by the court, was written off at the expense of the organization’s own funds |

Accounting for penalties receivable under contracts

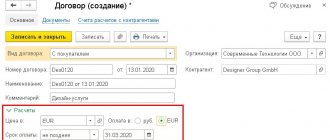

The parties to the contract may establish any sanctions for improper fulfillment of its terms by agreeing on them among themselves. If this condition is specified in the contract, then in order to obtain penalties from the counterparty for improper fulfillment of the terms of the contract, it is necessary to demand payment of a penalty. If the counterparty recognizes the debt and transfers the requested amount of the penalty, then they must be reflected in other income on the date of recognition.

There are often situations when a buyer or supplier who has not fulfilled their obligations does not agree to pay the amount of the penalty. In this case, you can go to court for collection. And it will be necessary to reflect them in income on the date of the court decision on collection.

Penalties for late payment under the contract, postings:

| Operation | Debit | Credit |

| A penalty has been recognized by the counterparty or a court decision has been made to collect | 76 | 91-1 |

| Payment received from the counterparty | 51 | 76 |

In tax accounting, the penalty is recognized as part of non-operating expenses in a similar manner (clause 3 of Article 250 of the Tax Code of the Russian Federation).

Postings on claims

Why and how to file a claim with the supplier?

Sometimes it happens that the partner did not fulfill the agreement. The company that works with this counterparty submits a claim.

NB!

Making a claim to the supplier is the right, not the obligation of each company.

Let's say the supplier shipped a low-quality product. In this case, the organization has the right to file a claim. One way or another, all organizations deal with complaints. And they must be correctly reflected in accounting using entries for claims to the supplier.

Penalties and penalties upon shipment of goods are accrued only if this is provided for in the delivery agreement. The amount of payments is also provided for in this document.

To account for claims, penalties, fines and penalties in accounting, account 76 “Settlements with various debtors and creditors”, subaccount 02 “Settlements for claims” (Order of the Ministry of Finance dated October 31, 2000) is used.

Compensation for losses caused and payments for non-compliance with the terms of agreements are considered other company expenses. They are accepted for accounting in amounts determined by the court or recognized by the enterprise.

In accounting, in accordance with the Instructions for using the chart of accounts, such costs are written off using the entry Dt 91.2 “Other expenses” and Kt 76.2 using the entry “Calculations for claims”.

An example of reflecting a claim in an accounting entry

Let's consider an example of how a claim is reflected in an accounting entry: the supplier Klen LLC had to supply goods to the buyer Osina LLC in the amount of 10,000 rubles. Shipment deadline: 04/25/2020 Payment deadline for goods: 05/10/2020.

Let's say that the supplier underdelivered the goods by 1000 rubles. Osina LLC filed a claim with the supplier:

Dt10 Kt 60 – 9000 rub. The supplier's goods have been received.

Dt 60 Kt 51 – 10,000 rub. payment for goods to the supplier.

Dt 76.2 Kt 60 – 1000 rub. a claim has been made to the supplier.

When the supplier agrees with the claim, you can generate claims transactions:

Dt 51(50) Kt 76 – 1000 rub. receipt of funds to cover the shortfall.

Otherwise, we write off the shortage:

Dt 94 Kt 76.2 – 1000 rub. the amount has been written off.

If the supplier does not comply with the terms of the contract, a fine, penalty or penalty is usually assessed. They are reflected in the expense account.

If a claim is made by a supplier, accounting entries for the claims are made:

Dt 76 Kt 91.2 – recognition of the claim

Dt 51 Kt76.2 – buyer’s payment for the claim

Also, entries when calculating claims can be reflected as follows:

Specialist

Raila Zalipskaya

Accounting for penalties payable under contractual obligations

The payer of penalties for improper fulfillment of contractual obligations, including penalties under a leasing agreement, will have mirror entries. Penalties must be reflected as other expenses on the date on which:

- or you voluntarily acknowledged your obligation to pay them;

- or a court decision on their collection has entered into force.

According to a court decision, payment can be forcibly collected from the debtor through the bailiff service.

Accrual of penalties and postings to the payer:

| Operation | Debit | Credit |

| Sanctions payable recognized | 91-2 | 76 |

| Penalty transferred to recipient | 76 | 51 |

In tax accounting, sanctions are taken into account as part of non-operating expenses in accordance with paragraphs. 13 clause 1 art. 265 Tax Code of the Russian Federation.

Accounting

According to paragraph 11 of the Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n “On approval of the Accounting Regulations “Organization Expenses” PBU 10/99” (hereinafter referred to as PBU 10/99) in the debtor’s accounting, penalties (fines, penalties) are paid for violation of contractual liabilities are included in other expenses.

In accordance with clause 14.2 of PBU 10/99, fines, penalties, penalties for violation of the terms of contracts, as well as compensation for losses caused by the organization, are accepted for accounting in amounts awarded by the court or recognized by the organization. After recognizing (awarding) a penalty, the debtor attributes it to an increase in other expenses and in the same reporting period makes an accounting entry for the corresponding amount:

Debit 91-2 “Other expenses” Credit 76-2 “Settlements on claims” - reflects penalties for violation of contractual obligations awarded by the court or recognized by the organization.

Repayment of debt to a creditor is recorded in an accounting entry:

Debit 76-2 “Calculations for claims” Credit 51 “Settlement accounts” - penalties for violation of contractual obligations were paid.

Example

(to simplify the example, all calculations are given without VAT)On 02/01/2019, organization “A” (seller) shipped (buyer) a consignment of goods worth 260 thousand rubles. According to the terms of the agreement, payment for the goods must be made no later than 04/03/2019; for late payment there is a penalty in the amount of 0.3% of the unpaid amount for each day of delay. paid for the goods on April 10, 2019, thereby violating the terms of the contract.

In accounting, these business transactions were reflected as follows:

01.02.2019

Debit 41 “Goods” Credit 60 “Settlements with suppliers and contractors” - 260 thousand rubles. — goods are accepted for accounting.

10.04.2019

Debit 60 “Settlements with suppliers and contractors” Credit 51 “Settlement accounts” - 260 thousand rubles. — payment for the goods is reflected.

Debit 91-2 “Other expenses” Credit 76-2 “Settlements on claims” - 5460 rubles. (260 thousand rubles x 0.3% x 7 days) - a penalty for late payment for purchased goods is reflected.

Debit 76-2 “Calculations for claims” Credit 51 “Settlement accounts” - 5460 rubles. - the amount of the penalty is listed.

It should be borne in mind that if there is no provision in the supply contract for a penalty for late fulfillment of a monetary obligation, the injured party may demand payment of interest under Article 395 of the Civil Code of the Russian Federation, as well as compensation for losses caused.

However, in such a situation, the injured party must first prove the fact of causing losses. If the supply contract does not contain an agreement on penalties for violation of non-monetary obligations, then the buyer does not have the right to demand payment of interest, but can only count on compensation for losses, which he will have to first prove.

As already noted, in the absence of a contractual penalty, the injured party has the right to demand payment of a legal penalty. If, at the time of the conflict between the partners, the legal penalty has lost force, then the injured party has the right to withdraw from the contract and demand compensation for losses.

Note that a penalty as a method of securing an obligation can in fact be applied to any of the obligations arising from the parties under a supply agreement.

Typical entries for the accrual and payment of fines and penalties for taxes

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| Accounting for fines and penalties on taxes on the account. 99 | ||||

| 99-1 | 68-4 (68-2, 68-1) | 19 000,00 | A fine was assessed for non-payment of tax (95,000.00*20%) | Buh. reference |

| 99-2 | 68-4 (68-2, 68-1) | 574,75 | A penalty has been charged for late payment of taxes. The delay was 22 days | Buh. reference |

| 68-4 (68-2, 68-1) | 51 | 19 574,75 | Payment of accrued fines and penalties for taxes | Plat. order |

| Accounting for fines and penalties on taxes on the account. 91 | ||||

| 91 | 68-4 (68-2, 68-1) | 574,75 | A penalty has been charged for late payment of taxes. The delay was 22 days | Buh. reference |

| 99-1 | 68-4 (68-2, 68-1) | 19 000,00 | A fine was assessed for non-payment of tax (95,000.00*20%) | Buh. reference |

| 68-4 (68-2, 68-1) | 51 | 19 574,75 | Payment of accrued fines and penalties for taxes | Plat. order |

| Accounting for fines and penalties on insurance premiums on the account. 99 | ||||

| 99-1 | 69 | 8 000,00 | A fine was assessed for non-payment of the insurance premium (40,000.00*20%) | Buh. reference |

| 99-2 | 69 | 275,00 | A penalty has been charged for late payment of the insurance premium. The delay was 25 days | Buh. reference |

| 69 | 51 | 8 275,00 | Payment of accrued fines and penalties on insurance premiums | Plat. order |

| Accounting for fines and penalties on insurance premiums on the account. 91 | ||||

| 91 | 69 | 275,00 | A penalty has been charged for late payment of the insurance premium. The delay was 25 days | Buh. reference |

| 99-1 | 69 | 8 000,00 | A fine was assessed for non-payment of the insurance premium (40,000.00*20%) | Buh. reference |

| 69 | 51 | 8 275,00 | Payment of accrued fines and penalties on insurance premiums | Plat. order |

| Imposition of a fine identified during an inspection | ||||

| 99 | 76 | 30 000,00 | Accrual of an administrative fine for non-use of cash registers for cash payments | Protocol |

| 76 | 51 | 30 000,00 | Payment of an administrative fine | Plat. order |

| Additional assessment of taxes and social contributions, payment of taxes and penalties | ||||

| 99 | 68-4 | 10 000,00 | Additional income tax accrual | Buh. reference |

| 90 (91) | 68-2 | 25 000,00 | Additional charge of underestimated VAT | Buh. reference |

| 20 (26, 44, 91) | 69 | 30 000,00 | Additional payment of insurance premium | Buh. reference |

| 91 (20, 26) | 68 | 15 000,00 | Additional assessment of property tax, land tax, transport tax | Buh. reference |

| If VAT is not restored | ||||

| 19 | 68-2 | 25 000,00 | Additional charge of underestimated VAT | Buh. reference |

| 91 | 19 | 25 000,00 | Inclusion of recovered VAT in expenses | Buh. reference |

| Input VAT was incorrectly accepted (reporting not signed) | ||||

| 68 | 19 | 47 000,00 | Additional VAT calculation | Buh. reference |

| 20 (26, 44, 90, 91) | 19 | 47 000,00 | Writing off input VAT on expenses | Buh. reference |

| 01 (04, 10, 41) | 19 | 47 000,00 | Inclusion of input VAT in the cost of the object | Buh. reference |

| 20 (26, 44) | 02 (05) | 7 000,00 | Additional depreciation charge for the amount of input VAT | Amor. statement |

| Input VAT was incorrectly accepted (the reporting was signed) | ||||

| 19 | 68 | 4 700,00 | Additional VAT calculation | Buh. reference |

| 91 | 19 | 4 700,00 | Writing off input VAT on expenses | Buh. reference |

| 01 (04, 10, 41) | 19 | 4 700,00 | Inclusion of input VAT in the cost of the object | Buh. reference |

| 20 (26, 44) | 02 (05) | 700,00 | Additional depreciation for the current year for the amount of input VAT | Amor. statement |

| 91 | 02 (05) | 320,00 | Additional depreciation for the past year in the amount of input VAT | Amor. statement |

We reflect penalties and fines on taxes in accounting and reporting

Accountant

What to do Review / October 2014 #10 (118)

21891

Penalties and fines are not the same thing

One of the grounds for the accrual of penalties and fines is the taxpayer’s failure to fulfill the obligation to pay tax or its fulfillment at a later date.

The reasons for poor performance of these duties may vary. These are errors in accounting entries, incorrect determination of the tax base, use of the wrong tax rate, incorrect application of tax benefits, incorrect application of tax deductions, and even simple technical errors when filling out the declaration. An error in tax calculation can be detected by the taxpayer himself. In this case, if an underestimated amount of tax is detected, he independently pays the missing amount of tax and the corresponding penalties, and then submits an updated declaration to the tax office. But there may be another option. The fact of misrepresentation of information, which led to failure to fulfill the obligation to pay tax in whole or in part, is identified by the tax authority. As a result, the taxpayer receives a decision from the tax authority based on the results of consideration of the tax audit materials (a decision to bring to tax liability or a decision to refuse to bring to tax liability) and a requirement to pay tax arrears, penalties and fines. Regardless of the error detection option, the mechanism for calculating penalties is the same. Penalties are accrued for each calendar day of delay in fulfilling the obligation to pay a tax or fee, starting from the payment day following the payment day established by the legislation on taxes and fees. The interest rate of penalties is assumed to be equal to 1/300 of the Bank of Russia refinancing rate in force on these days. Penalties are calculated separately for each period of validity of a specific rate during the debt period, and the results obtained are then added up. And if penalties are a way of ensuring the fulfillment of the obligation to pay taxes and fees1, then a fine is already a tax sanction in the form of a monetary penalty, which is a measure of the taxpayer’s responsibility for committing a tax offense2. The fine for non-payment or incomplete payment of tax may be 20% of the unpaid amount of tax (fee), and if there is intent - 40%3. Both fines and penalties subject to transfer to the budget are not taken into account when determining the tax base for corporate income tax4. Methods of reflecting penalties and fines in accounting

Since the legislation on taxes and fees distinguishes between the concepts of “penalty” and “fine,” the methods of reflecting them in accounting may be different.

Fines for violation of tax laws in accounting are reflected in the debit of account 99 “Profits and losses” in correspondence with account 68 “Calculations for taxes and fees”. This is directly provided for in clause 83 of the Regulations on Accounting and Financial Reporting5 and the Instructions for the Application of the Chart of Accounts, which clearly states that account 99 “Profits and Losses” during the reporting year reflects “also the amounts of tax sanctions due in correspondence with the account 68 “Calculations for taxes and fees.” The Ministry of Finance of Russia gives similar explanations6. There are two positions regarding the reflection in accounting of penalties subject to transfer to the budget. In the first case, experts follow the path of simplifying accounting. They combine penalties and fines with the term “sanctions for non-compliance with tax rules” and propose to take them into account in the same way as fines, i.e. by debiting account 99 “Profits and losses” in correspondence with account 68 “Calculations for taxes and fees”. With this accounting method, the analyst is asked to maintain accounts 68 in subaccounts in the context of taxes for which penalties and fines are accrued. Another position of experts is that the amounts of penalties for arrears of taxes satisfy the definition of an expense. After all, the accrual of penalties leads to the creation of an obligation for the organization and a decrease in its capital7. This expense is not an expense for ordinary activities, therefore it is classified as “other”8. And they propose to reflect the amounts of accrued penalties on the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses” in correspondence with account 68 “Calculations for taxes and fees”. Due to the presence of several acceptable ways of reflecting penalties in accounting, one of them must be fixed in the accounting policy of the organization9. Penalties - other expenses

Let's consider the algorithms for the taxpayer's actions when reflecting penalties and fines when an error leading to non-payment of tax is discovered by him independently or it is revealed as a result of a tax audit.

In the examples, we assume that the organization reflects penalties as other expenses. Option 1.

The taxpayer himself discovered an error that led to non-payment of tax.

Step 1.

Identify the error in tax payment.

We determine the missing tax amount. The procedure for correcting errors in accounting is regulated by the Accounting Regulations “Correcting Errors in Accounting and Reporting”10, approved by Order of the Ministry of Finance of Russia dated June 28, 2010 No. 63n11. We calculate penalties for each day of delay as a percentage of the unpaid tax amount. #ATTENTION# We prepare the calculation using an accounting certificate. There is no unified form for this document. Therefore, the company needs to develop such a form itself and indicate it in its accounting policies. We reflect transactions for additional tax assessment and the amount of penalties for late payment in accounting (entries for additional tax assessment and correction of errors in accounting are not given in the article). Penalties are recognized as other expenses in accounting. Since they are not taken into account in expenses for profit tax purposes, an organization applying PBU 18/02 must recognize a permanent difference in the amount of penalties and at the same time reflect a permanent tax liability as the product of this constant difference by the established income tax rate12. Step 2. We pay the arrears of tax and the amount of penalties. Step 3.

Submit an updated tax return to the tax office. An explanatory letter and copies of payment orders for payment of taxes and penalties should be attached to the “clarification”. An organization is exempt from liability if it submits an updated declaration after the deadline for filing it and paying the tax has expired, if the missing amount of tax and the corresponding penalties were paid before submitting the updated tax return13.

| Contents of operations | Debit | Credit | Primary document |

| The amount of the penalty is reflected | 91-2 | 68, subaccount “Tax penalties” | Accounting certificate-calculation |

| The permanent tax liability is reflected (amount of penalties x 20%) | 99 | 68, subaccount “Income Tax” | Accounting certificate-calculation |

| Penalties paid to the budget | 68, subaccount “Tax penalties” | 51 | Bank statement on current account |

Option 2.

The tax authority discovered the fact of incomplete payment of tax based on the results of a tax audit. In accounting, the basis for reflecting the amount of arrears, penalties and fines based on the results of a tax audit is the decision of the tax authority.

It already contains information about the amount of tax debt, the amount of penalties and fines. The penalties specified in the decision of the tax authority are calculated at the time of its adoption. In the future, when sending a request to the taxpayer for payment of taxes, penalties and fines, the amount of the penalty will be recalculated on the day the demand was sent14 or on the day the arrears were paid. The decision of the tax authority comes into force one month from the date of its delivery15. At the same time, the taxpayer has the right to voluntarily comply with this decision before it comes into force. Basis: para. 3 clause 9 art. 101 Tax Code of the Russian Federation. Moreover, this decision can be executed in whole or in part. If the taxpayer does not intend to appeal this decision at all or will appeal it in some part, then it is better for him to pay the arrears (the corresponding part of the arrears) as early as possible in order to reduce the amount of the penalty. However, in this case, an overpayment will be recorded in the taxpayer’s personal account, which will be closed after the Tax Authority’s Decision comes into force. Let's consider a situation where the taxpayer does not appeal the decision of the tax authority. Step 1.

We reflect in the accounting records the amount of arrears and fines at the time of receiving the decision of the tax authority.

The amount of the fine is recognized as a loss in accounting. Step 2.

We pay the tax arrears based on the decision of the tax authority.

Step 3.

We reflect in the accounting records the amount of penalties as of the date of repayment of the arrears.

We “add additional” penalties to ourselves for the period from the date of the Decision on the inspection report to the date of payment of the arrears and add this amount to the amount of penalties specified in the Decision. We calculate “additional” penalties in the accountant’s certificate. Penalties are recognized as other expenses in accounting. Step 4.

Pay penalties and fines. There is no need to rush into paying them. In order not to withdraw funds from circulation ahead of time, penalties and fines can be paid after the Decision on the inspection report comes into force within the time limits established in the Request for payment of penalties and fines.

| Contents of operations | Debit | Credit | Primary document |

| The amount of the fine is reflected | 99 “Profits and losses”, subaccount “Tax fines” | 68 | Tax authority decision |

| The amount of penalties for tax arrears is reflected | 91-2, subaccount “Tax penalties” | 68 | Decision of the tax authority Accounting certificate-calculation |

| The permanent tax liability is reflected (amount of penalties x 20%) | 99 | 68, subaccount “Income Tax” | Accounting certificate-calculation |

| Penalties and fines have been paid to the budget | 68 | 51 | Bank statement on current account |

Please note

that if errors are identified by the tax authority, the organization does not need to provide updated declarations for past periods based on the decision made based on the results of the audit16.

We reflect the amounts of penalties and fines in the financial statements

In the accounting option, when accrued penalties are recognized by the organization as another expense and reflected in subaccount 91-2, in the Financial Results Report (form approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n), the amount of penalties will be included to the indicator of line 2350 “Other expenses” and reduce the indicators of line 2300 “Profit (loss) before tax”.

In this case, the permanent tax liability accrued on the amount of penalties and reflected on line 2421 will affect the amount of the current income tax and the indicator on line 2400 “Net profit”. Fragment of the form Report on financial results

#FOOTNOTE#

| Explanations | Indicator name | Code | For ______ 20__ | For ______ 20__ |

| 1 | 2 | 3 | 4 | 5 |

| other expenses | 2350 | ( ) | ( ) | |

| Profit (loss) before tax | 2300 | |||

| Current income tax | 2410 | ( ) | ( ) | |

| incl. permanent tax liabilities (assets) | 2421 | |||

| Change in deferred tax liabilities | 2430 | |||

| Change in deferred tax assets | 2450 | |||

| Other | 2460 | |||

| Net income (loss) | 2400 |

In the accounting option, when the amount of penalties and fines payable to the budget is reflected in the debit of account 99, in the Statement of Financial Results this amount will be indicated on line 2460 “Other” and will reduce the indicator on line 2400 “Net profit”.

The advantage of this method of reflecting penalties is that the interested user analyzing the statements will receive information about the formed indicator of profit (loss) before tax without taking them into account. However, in each of the considered options, the value of the “Net profit (loss)” indicator will not change. Which option for accounting for penalties and fines an accountant should follow depends on the organization’s accounting setup, the type of accounting programs used, the requirements of internal audit, and other things. However, something else is important. The presence of tax sanctions on an organization leads to a deterioration in its financial condition, and therefore it is necessary to take all measures to prevent them. Share

Tweet

Certificate of registration of media: El No. FS77-67462 dated October 18, 2016 Editorial contacts,

On this topic

Let's take the blow, or Instructions for an accountant on working during the period of sanctions 88 List of anti-sanctions measures 2022 128 Which cost item should include personnel training 67

Non-operating income

According to tax accounting rules, all income that is not revenue from the sale of goods (work, services) and property rights is considered non-sales (including those incomes that are considered other in accounting).

The list of non-operating income is in Article 250 of the Tax Code.

This list, and not even in the lowest positions, includes the amounts of fines, penalties and (or) other sanctions accrued for violation of contractual or debt obligations, as well as the amount of compensation for losses (damage) (clause 3 of Article 250 of the Tax Code of the Russian Federation) .

Firms that calculate income tax using the accrual method must include penalties as income on the date they are recognized by the debtor or on the date the court decision enters into legal force.

Read in the berator “Practical Encyclopedia of an Accountant”

Non-operating expenses that are taken into account in the tax base for profits

Formulas for calculation

The accrual of penalties, entries for which are necessarily reflected in the accounting of the customer organization, is regulated by Decree of the Government of the Russian Federation No. 1042 of August 30, 2017. Sanctions are accrued for each day of delay in the fulfillment by the parties of their obligations under the government contract in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation established on the day of payment.

The calculation formula for suppliers is specified in RF PP No. 1042:

The procedure for settlements for the customer is not specified in RF PP No. 1042, therefore, to calculate sanctions for contractual terms not fulfilled by the organization, the provisions of Part 5 of Art. 34 44-FZ. The formula for the customer, in accordance with 44-FZ, will be as follows:

The amount of penalty payments by the customer cannot exceed the price of the government contract (clause 12 of the RF PP No. 1042).

What is a penalty under contract 44-FZ

According to Part 4 of Art.

34 44-FZ, the state contract must include a provision on the responsibility of the customer and supplier in the event of improper fulfillment of obligations. Penalties are accrued under the contract (transaction entries will be presented below) if the parties are late in fulfilling their obligations under the contract, as well as in the event of improper fulfillment of contractual obligations (Parts 5, 6, Article 34 44-FZ).

Thus, a penalty under 44-FZ is understood as the amount of penalties established by contractual relations, which participants in procurement procedures are required to transfer to each other in case of violation of the essential terms of a government contract. At the same time, according to Art. 332 of the Civil Code of the Russian Federation, the party that violated its obligations and is found guilty pays a fine in an amount proportional to the cost of goods, work or services, even if this provision was not specified in the contract.