Do I need to come to the Federal Tax Service?

A complaint to a higher tax authority must be submitted through your tax office. The inspection is obliged to transfer it to the Federal Tax Service within 3 days.

The Federal Tax Service will consider the complaint or appeal, the documents attached to it, without your participation. However, before making a decision on the complaint, you can submit additional documents that confirm your arguments.

Note! If you did not provide any objections or documents to the inspectorate regarding the tax audit report, the Federal Tax Service will need to explain why you were unable to do this. Only then will the Federal Tax Service consider the documents that you attached to the complaint against the inspector’s decision on your tax offense.

If there are contradictions between the facts that you indicated in the complaint and the information from the tax inspectorate, you will be called to the Federal Tax Service. After all, the tax inspectorate must also submit materials to the higher tax authority regarding your complaint. You will be notified in writing of the time and place for consideration of the complaint. The notice will be signed by the head or deputy head of the Federal Tax Service.

Tip #1: Prepare your arguments

Form a clear legal position, support it with positive judicial practice and scientific doctrine.

To develop a system of arguments for a case, it is first necessary to turn to legal acts. In a tax dispute, the Tax Code of the Russian Federation occupies the first place among legislative acts, so it is necessary to refer to it first of all. Next, select the rules of law in your favor from other federal laws. The standards that should be followed in resolving a case will depend on the specific circumstances of your case. Most often these are the Civil Code of the Russian Federation, the Code of Administrative Offenses of the Russian Federation, the Labor Code of the Russian Federation, the Arbitration Procedural Code of the Russian Federation (APC RF), the Land Code of the Russian Federation (ZK RF), Federal Laws “On State Registration of Legal Entities and Individual Entrepreneurs” No. 129-FZ, “On Companies with limited liability" No. 14-FZ, "On the contract system in the field of procurement of goods, works, services to meet state and municipal needs" No. 44-FZ, "On the use of cash register systems when making cash payments and (or) payments using electronic means payment" No. 54-FZ and many others. Despite the fact that, according to the Arbitration Procedure Code of the Russian Federation, the court makes a decision by assessing the evidence according to its internal conviction, based on a comprehensive, complete, objective and direct study of the case materials, the judges take into account the judicial practice that has developed in your situation. Therefore, we recommend that you always analyze banks of court decisions in search of positive solutions for the taxpayer.

Links to judicial acts of the Constitutional Court of the Russian Federation, the Supreme Arbitration Court of the Russian Federation, the Supreme Court of the Russian Federation will only strengthen your position and increase your chances of winning. If there are none, you can use the explanations of the Ministry of Finance of the Russian Federation or the Federal Tax Service.

To effectively protect your rights, it is also important to know the opposite practice in order to be prepared to present counter-arguments in court.

In disputes on tax law issues, you can also refer to the opinions of authoritative judges: the Constitutional Court, the Supreme Court, famous legal scholars, expressed by them in monographs, comments, articles in the specialized press, interviews in the media.

Results of the complaint consideration

Based on the results of consideration of the complaint (appeal), the higher tax authority:

- leaves the complaint (appeal) unsatisfied;

- cancels the act of the tax authority;

- cancels the decision of the tax authority in whole or in part;

- cancels the decision of the tax authority completely and makes a new decision on the case;

- recognizes the actions or inactions of tax officials as illegal and makes a decision on the merits.

Procedure for going to court

The procedure for appealing actions (inactions) and decisions of the tax authority and its officials involves 2 stages: pre-trial and judicial . Before the trial, it is imperative to contact a higher tax authority and wait for the issue to be resolved or for the expiration of the period allotted to the tax authorities to respond. Otherwise, the court will not accept the application, citing the absence of a mandatory procedure for pre-trial dispute resolution.

A complaint to a higher tax authority can be filed within 1 year from the moment the citizen learned or should have learned about a violation of his rights. For some (special) cases, the law may establish a different period. If the deadline is missed and this is due to valid reasons that can be confirmed, along with the complaint (or in the text of the complaint) you need to prepare an application for reinstatement of the missed deadline.

Often the higher authority refuses to satisfy the complaint. In this case, the citizen has a choice - to file an appeal with the Federal Tax Service or immediately go to court.

As soon as the issue of pre-trial settlement of the dispute is resolved, and it does not give a positive outcome, the citizen has the right to go to court. The first judicial instance will be the district court. You have 3 months to prepare your application. The period must be counted from the moment when the citizen learned (should have known) that his complaint (appeal) was rejected.

An appeal to the court must take the form of an administrative claim and involves putting forward one or more demands , in particular:

- recognition of the tax authority's normative act as invalid;

- recognition of the contested decision (action, inaction) of the tax authority as illegal;

- obliging the tax authority to make a decision on a certain issue or eliminate violations by taking a number of specific actions;

- obliging the tax authority to refrain from certain actions;

- establishing whether or not the tax authority has powers on a controversial issue.

The statement of claim must indicate:

- The name of the court in which the claim is filed.

- Applicant details – full name, place of residence (registration), contact information.

- The defendant’s details – the name of the tax authority, its location.

- Rights and interests that are violated by the contested decision, action or inaction.

- Grounds for the claim and arguments in support of it.

- Requirements for the defendant.

- Information about the pre-trial consideration of the complaint against the Federal Tax Service and its results.

- Petitions before the court (for example, to request evidence, to suspend the effect of a contested decision).

The claim is prepared according to the rules established by Art. 125 CAS RF, as well as:

- Art. 209 CAS RF - if a normative act (order, regulation, etc.) is disputed;

- Art. 220 CAS RF - if a decision, action or inaction is disputed.

Download a statement of claim to the court against the tax office from an individual (sample)

The application must be accompanied by evidence of your position, a copy of the contested act or decision and a copy of the decision of a higher tax authority adopted as part of the pre-trial settlement of the dispute. There is no need to pay state duty. The claim is filed in court at the location of the Federal Tax Service, which is the defendant in the case.

Citizens, at their own discretion, send copies of materials to the defendant - such an obligation is not established by law.

An appeal to the court can be submitted in person, sent by mail, and, if possible, in electronic form.

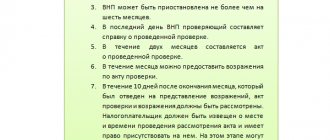

Time limits for making a decision on a complaint

The Federal Tax Service will make a decision on your complaint or appeal against the decision of the tax inspectorate based on the results of the tax audit within one month from the date of receipt of the complaint (appeal).

A decision on other complaints is made within 15 days from the date of its receipt.

These deadlines can be extended by the head or deputy head of the tax authority by no more than 30 days in the first case, and no more than 15 days in all others. You will be notified within three days that the deadline has been extended.

You will also learn about the results of the complaint consideration within three days.

Tip #2: Defend yourself actively!

Taxpayers often believe that, by virtue of clause 6 of Art.

108 of the Tax Code of the Russian Federation they are not obliged to prove anything. There really is no such obligation, it is your right, but do not rely only on the presumption of innocence if you are interested in winning. In paragraph 7 of Art. 3 of the Tax Code of the Russian Federation states that all irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees are interpreted in favor of the taxpayer, which can only be an additional argument to your legal position.

The fact is that the procedure for bringing to tax liability is structured in such a way that the tax authority, based on the results of reviewing the tax audit materials, makes a decision on bringing to liability, which comes into force within a month unless you appeal it. You are sent a demand to pay taxes, penalties, and fines, and in case of non-fulfillment, collection of funds from your current account begins. To prevent this from happening, the taxpayer must urgently go to court (within 3 months) and prove that the tax authority’s decision is illegal.

According to clause 5 of Art. 200 of the Arbitration Procedure Code of the Russian Federation, the obligation to prove the compliance of the contested non-normative legal act with the law or other normative legal act lies with the tax authority. But if you take the position of “let them prove it,” then the case will definitely be lost. Because the tax authority believes that it has already proven everything and set out all the facts in the decision.

For example, if the tax authority conducted an examination and found that the signatures on the documents were made by an unidentified person, the court will not order a repeat forensic examination, but will refer to the results of an existing one. In this case, the taxpayer must obtain an opinion from an independent expert. The same is true with witnesses: if the inspection uses the testimony of one witness, then you must attract three. It's in your best interest. In the Determination of the Armed Forces of the Russian Federation dated January 25. 2016 No. 302-KG15-17939) in case A-78-14492/2014 it is clear how the taxpayer, taking a passive position, himself determined the outcome of the case. The court indicated that the taxpayer referred to the illegality of the inspectorate’s calculation, but at the same time did not provide either a counter-calculation or documents.

Tip #4: Object to new evidence.

During the trial, feel free to object to the inclusion of evidence that was not included in the audit.

The proverb “He who didn’t have time is late” would be appropriate here. From the provisions of Art. 88, 89, 100, 101, 139 of the Tax Code of the Russian Federation it follows that tax authorities, like taxpayers, can collect evidence and submit objections at all stages of tax control before a decision is made by a higher tax authority (UFTS) - at the stage of checking the inspector’s decision to attract to liability for committing a tax offense and at the stage of appeal to the Federal Tax Service. Accordingly, the tax authority, like the taxpayer, cannot present evidence in court that was not present in the trial.

Despite these norms, the issue of admitting new evidence in court is controversial. This position is also indicated in paragraph 78 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57. The Supreme Arbitration Court of the Russian Federation indicated that the collection and disclosure of evidence is carried out during pre-trial proceedings. However, the same paragraph states that taxpayers have the right to present such documents during court proceedings, and the court has the right to accept them.

Regarding clause 78 of the said Resolution, the Federal Tax Service of the Russian Federation gave clarifications in its letter No. SA-4-7/16692 dated August 22, 2014, indicating that requesting documents from taxpayers, their counterparties or other persons relating to the activities of the taxpayer is allowed only during the period of tax control and additional tax control measures regarding it. The same letter states that the tax authority may add additional evidence to the court if it was obtained legally. Thus, we can conclude that this issue in every dispute always remains at the discretion of the court.

Remember that any evidence that the tax authority attaches is evidence against you. Therefore, if the evidence was not included in the audit, feel free to object, referring to the relevant judicial practice and the ability of the tax authority to obtain/request these documents at the stage of verification and pre-trial settlement of the dispute.

How to file a complaint with the tax office

In order to complain to the tax office, you can resort to several methods.

Online on the Federal Tax Service website

In 2022, you can complain about unlawful actions of an organization or employer directly from home, without leaving it. To do this, you should go online and go to the multifunctional official website of the Federal Tax Service of the Russian Federation.

On this online portal, a complaint is created in electronic form, which does not require the creation of a personal account.

The online submission algorithm in a step-by-step form from, for example, an individual is as follows:

- Selecting the “Individuals” position in the menu on the Federal Tax Service website.

- Go to the “Filing a complaint to the tax authorities” section.

- Choose from those offered on the site the one that best suits your real life situation.

- Activation of the “Create request” position.

- Filling out the fields of the forms offered by the site.

There is also the opportunity to submit an application through the Internet resource “Gosuslugi”, which, without considering anything itself, promptly forwards the document to the Federal Tax Service.

Complaint to the tax office

To communicate directly with tax authorities, you will have to personally visit the NSF branch. The time and effort spent by the applicant is fully compensated by the opportunity to:

- get advice on an issue of interest;

- avoid mistakes when drawing up an application;

- make sure it is accepted for consideration;

- in some cases, receive a preliminary answer on the substance of the complaint.

How to complain by mail

To successfully use postal services, you should use registered mail, which guarantees that the item will not be lost. However, despite all the reliability of this type of complaint, it suffers from a significant drawback, namely the impossibility of using it in emergency cases: it takes significant time to deliver correspondence by mail.