Article 220 of the Tax Code of the Russian Federation on property tax deductions is the main source that regulates exactly how the tax base is reduced in the case of the purchase of real estate and what conditions must be met.

However, most individuals still have some questions after reading this legislative act. In this regard, this article will describe as clearly as possible the procedure for obtaining a property-type tax discount.

Article 220 of the Tax Code of the Russian Federation

An individual who has incurred expenses for the purchase of various types of real estate - an apartment, room, house or land, has the right to return some of the money spent, but only if 13% of personal income tax is deducted from his income every month.

It should be noted that an income tax refund is possible even if the property was acquired with a loan, is in shared or joint ownership, as well as for expenses associated with the construction of housing or its repair.

If a taxpayer claims to receive financial compensation for the purchase of a land plot, then, first of all, he should understand that such a procedure can only be implemented if there is a house on the given territory.

In what situations is a property deduction not allowed?

The Tax Code of the Russian Federation, namely Article 220, stipulates that a tax discount for housing is not accrued in the following cases:

- If the transaction took place between relatives. Sometimes it happens that real estate is sold to each other by individuals related by close forms of kinship - husband and wife, parents and children, brothers and sisters. In this situation, tax legislation prohibits reducing the tax base. This also applies to property transactions concluded between a manager and his subordinate.

- If the taxpayer has already issued a property deduction. Today, there is a certain rule that states that the income tax refund for real estate is charged once. Therefore, if an individual has already received compensation, for example, for buying a house, then it will no longer be possible to return personal income tax for the land.

- If the applicant for deduction does not have the required package of documents. Sometimes individuals rush to apply for a tax rebate before they have received all the necessary documents. One of the main documents that gives the right to a personal income tax refund is the right to own housing, therefore, without this paper, submitting all other documents for verification is inappropriate.

When can you receive compensation?

Unlike most tax deductions, the accrual of which has time limits, reducing the size of the tax base associated with property is feasible regardless of the time frame. Thus, even if the housing or land was purchased quite a long time ago, the taxpayer still has the right to receive compensation. But it is worth remembering that income tax will be returned only for the last three years.

ATTENTION! Many taxpayers believe that by purchasing real estate this year, they can immediately apply for and receive a deduction. This opinion is incorrect, since you can fill out a declaration for a property discount no earlier than the next year after the purchase.

Comments to ST 220 Tax Code of the Russian Federation

Article 220 of the Tax Code of the Russian Federation. Property tax deductions

Commentary on Article 220:

If the taxpayer purchased or built housing, he will be able to reduce his taxable income by the amounts spent. In other words, get a property deduction. The maximum deduction amount is RUB 1,000,000. Federal Law No. 144-FZ of July 27, 2006 clarified that a property deduction can be obtained when purchasing or constructing not only a residential building and apartment, but also a room or share(s) in them.

In this case, two options are possible.

First option: during the year the taxpayer earned more than he paid for the apartment. Then, having submitted a declaration, he can adjust the amount of tax that tax agents withheld from his income, and return the difference from the budget.

The second option: a person earned less during the year than he paid for the apartment. In this case, the entire amount of tax that tax agents withheld from your income during the year can be returned from the budget. In addition, the remainder of the funds spent will reduce income in subsequent years until the maximum deduction amount (RUB 1,000,000) is used in full.

Please note the following important points.

1. Property tax deduction can be applied only to those incomes that are taxed at a rate of 13 percent.

2. Money spent on buying an apartment will reduce income only if the housing is your property. A new apartment can be sold at the construction stage, when ownership has not yet transferred to the buyer. Until the ownership is officially registered, you cannot take advantage of the deduction.

3. If an apartment or residential building is owned by several persons, its value reduces the income of each owner in accordance with their share of ownership. At the same time, the maximum amount of deduction for one object cannot exceed 1,000,000 rubles, even if several people apply for the deduction.

To receive a property deduction, you need to write a corresponding application in free form to the tax office and provide:

— a copy of the purchase and sale agreement;

— a copy of the housing acceptance certificate;

— a copy of the certificate of ownership;

- documents confirming payment for property (counterfoil for cash receipt order, postal order receipt, receipt for transfer of money, etc.).

If questions arise, the inspector may ask you to show the originals of the listed papers.

4. When preparing documents, pay attention to the following. It often happens that a child is listed as the owner of a share of an apartment. In this situation, despite the fact that the parents actually paid for the purchase, they will not be able to take advantage of the deduction for the part of the cost of the apartment that falls on the child’s share. This circumstance must be taken into account when you register ownership of housing.

In addition, if you did not pay for housing at your own expense (for example, it was done by a company or a relative), you will not be able to return the money from the budget. It turns out that it is more profitable to issue payment documents to the person who will own the apartment.

5. Keep in mind: you will not be given the amount of tax due in cash in cash. Therefore, make sure in advance that you have an open bank account where you can transfer money.

6. Since 2005, you can receive a property deduction for purchased housing not only from the tax office, but also from your employer. To do this, you must submit to the accounting department at your main place of work a permit from the tax inspectorate in the form approved by Order of the Federal Tax Service of Russia dated December 7, 2004 N SAE-3-04 / [email protected] , as well as an application for deduction in any form. No other documents are needed. Moreover, the new procedure applies not only to housing purchased in 2005. You can also receive a property deduction from your employer if the apartment or house was purchased in 2004 or earlier.

Please note that the inspection permit must contain the name, tax identification number and checkpoint of the organization that will provide the deduction. If another company is indicated in this document, the employee must apply for a deduction to it.

As long as the employee’s income from the beginning of the year in which the permit was received does not exceed the amount of property deduction indicated in it, personal income tax does not need to be withheld from him. In this case, the remaining amount of the tax deduction is transferred to the next year until it is fully used (subclause 2, clause 1, article 220 of the Tax Code of the Russian Federation).

If a taxpayer sells a house, apartment or other property during the year, he does not have to pay tax on the entire amount of income received. He has the right to take advantage of the property deduction, which is provided for in Article 220 of the Tax Code of the Russian Federation.

The amount of the deduction and the procedure for its provision depend on the type of property that was sold:

- residential building, apartment, dacha, garden house, land plot;

— other property (except for securities);

- securities.

When selling a residential building, apartment, cottage, garden house or land plot, two tax deduction options are possible.

First option. The taxpayer sold a residential house, apartment, dacha, garden house or land plot that he had owned for at least 5 years. Then you don’t need to pay tax at all - the deduction amount is equal to the income received.

Second option. The sold residential building (apartment, dacha, garden house, land plot) was owned by the taxpayer for less than 5 years. Then there is a choice:

— reduce taxable income by 1,000,000 rubles. (or an amount equal to income if it is less than RUB 1,000,000),

- reduce income by the amount of documented expenses associated with the sale.

When selling other property, two options are also possible.

First option. The taxpayer sold property that he had owned for at least 3 years. Then you don’t need to pay tax at all - the deduction amount is equal to the income received.

Second option. The property sold was owned by the taxpayer for less than 3 years. Then he has a choice:

- reduce income by 125,000 rubles. (or an amount equal to income if it is less than RUB 125,000),

- reduce income by the amount of documented expenses associated with the sale.

Federal Law No. 144-FZ of July 27, 2006 supplemented the list of housing. Now you can get a deduction when selling a room.

However, even before the amendments were introduced, the Russian Ministry of Finance was, in general, not against the taxpayer receiving a property deduction when selling rooms (see, for example, letter dated July 3, 2006 N 03-05-01-03/69) .

Please note that if you sold securities you owned during the year, you may also not pay tax on the entire amount of the income received. But the property deduction when selling securities has its own characteristics (see commentary to Article 214.1 of the Tax Code of the Russian Federation).

The following important points should be considered.

1. Property tax deduction can be applied only to those incomes that are taxed at a rate of 13 percent.

2. If the property sold was in common shared ownership, the tax deduction is distributed among the co-owners in proportion to their shares. And if the property sold was common joint property, the deduction is distributed among the co-owners by agreement.

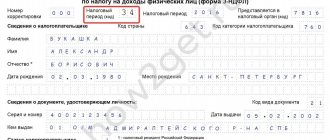

3. To receive a tax deduction for sold property, you need to write a corresponding application in any form and fill out a tax return in form 3-NDFL.

In addition, if you decide to reduce income by the amount of expenses associated with the property sold, you will need documents confirming the expenses incurred:

— copies of real estate purchase and sale agreements;

— copies of the certificate of ownership;

— copies of contracts for reconstruction or repair of premises, as well as documents confirming payment of expenses (receipts, cash receipts, etc.).

‹ Comments to ST 219 of the Tax Code of the Russian FederationupComments to ST 220.1 of the Tax Code of the Russian Federation ›

Paragraph 1

The first part of the legislative act, to which we turned for help earlier, states that an individual can reduce the size of his tax base in the following cases:

- When selling a property. This can be not only the sale of an object that is entirely owned by the taxpayer, but also an object that is in shared ownership. Also, an individual may qualify for a tax discount when leaving the ranks of shared owners.

- In case of loss of rights to land territory. In some cases, the state seizes this property from the taxpayer, who is the legal owner of the land plot, as well as the housing facility located on it, for the purpose of municipal needs. In such a situation, a deduction is charged to the individual.

- When buying or building housing. If an individual decides to invest material resources in the purchase of a house or part of it, an apartment, a room in a communal apartment, a plot of land, or spend money on the construction of a property, then he automatically receives the right to a tax discount.

- When paying interest on property. Today, due to the fact that the cost of housing reaches quite high limits, individuals are increasingly using mortgage or loan services. When taking out a loan, the taxpayer undertakes to pay not only the full cost of housing, but also additional interest, for which personal income tax is also returned.

Article 220 of the Tax Code of the Russian Federation. Property tax deduction

clause 1 subclause 1 clause 1 subclause 2 clause 1 subclause 3 clause 1 subclause 4 clause 1 clause 2 subclause 1 clause 2 subclause 2 clause 2 subclause 2.1 clause 2 subclause 2.2 clause 2 subclause 3 clause 2 subclause 4 clause 2 subclause 5 clause 2 clause 3 subparagraph 1 paragraph 3 subparagraph 2 paragraph 3 subparagraph 3 paragraph 3 subparagraph 4 paragraph 3 subparagraph 5 paragraph 3 subparagraph 6 paragraph 3 subparagraph 7 paragraph 3 paragraph 4 paragraph 5 paragraph 6 paragraph 7 paragraph 8 paragraph 9 paragraph 10 paragraph 11

1. When determining the size of the tax base in accordance with paragraph 3 of Article 210 of this Code, the taxpayer has the right to receive the following property tax deductions, provided taking into account the specifics and in the manner provided for by this article:

1) property tax deduction for the sale of property, as well as share(s) in it, share(s) in the authorized capital of the company, when leaving the company's members, when transferring funds (property) to a company participant in the event of liquidation of the company, when the nominal value decreases shares in the authorized capital of the company, upon assignment of rights of claim under an agreement for participation in shared construction (under an investment agreement for shared construction or under another agreement related to shared construction);

(Clause 1 as amended by Federal Law dated 06/08/2015 N 146-FZ)

2) property tax deduction in the amount of the redemption value of a land plot and (or) other real estate located on it, received by the taxpayer in cash or in kind, in the event of seizure of the specified property for state or municipal needs;

3) property tax deduction in the amount of expenses actually incurred by the taxpayer for new construction or acquisition on the territory of the Russian Federation of residential houses, apartments, rooms or share(s) in them, acquisition of land plots or share(s) in them provided for individual housing construction, and land plots or share(s) in them on which the acquired residential buildings or share(s) in them are located;

4) property tax deduction in the amount of expenses actually incurred by the taxpayer to repay interest on targeted loans (credits) actually spent on new construction or the acquisition on the territory of the Russian Federation of a residential house, apartment, room or share(s) in them, the acquisition of land plots or shares ( shares) in them provided for individual housing construction, and land plots or shares (shares) in them on which the acquired residential buildings or share (shares) in them are located, as well as for the repayment of interest on loans received from banks for the purpose of refinancing (on-lending) loans for new construction or the acquisition on the territory of the Russian Federation of a residential building, apartment, room or share (shares) in them, the acquisition of land plots or share (shares) in them provided for individual housing construction, and land plots or shares ( shares) in them, on which the purchased residential buildings or share(s) in them are located.

- Property tax deduction provided for by subparagraph 4 of paragraph 1 of Article 220 (as amended by Federal Law No. 212-FZ of July 23, 2013), in the amount of expenses actually incurred by the taxpayer to repay interest on targeted loans (credits) received by the taxpayer before the day the above came into force Federal Law, as well as for the repayment of interest on loans received from banks for the purpose of refinancing (on-lending) of such loans, is provided without taking into account the restrictions established by paragraph 4 of Article 220 of Part Two of the Tax Code of the Russian Federation

(clause 4 of article 2 of Federal Law dated July 23, 2013 N 212-FZ)

2. The property tax deduction provided for in subclause 1 of clause 1 of this article is provided taking into account the following features:

The provisions of subparagraph 1 of paragraph 2 of Article 220 (as amended by Federal Law No. 382-FZ of November 29, 2014) apply to real estate acquired after January 1, 2016.

1) property tax deduction is provided:

in the amount of income received by the taxpayer in the tax period from the sale of residential houses, apartments, rooms, including privatized residential premises, dachas, garden houses or land plots or share(s) in the said property that were owned by the taxpayer for less than the minimum maximum period of ownership of the real estate property property established in accordance with Article 217.1 of this Code, not exceeding in total 1,000,000 rubles;

in the amount of income received by the taxpayer in the tax period from the sale of other real estate that was owned by the taxpayer for less than the minimum maximum period of ownership of the real estate object established in accordance with Article 217.1 of this Code, not exceeding in total 250,000 rubles;

in the amount of income received by the taxpayer during the tax period from the sale of other property (except for securities) that was owned by the taxpayer for less than three years, not exceeding a total of 250,000 rubles; (Clause 1 as amended by Federal Law dated November 29, 2014 N 382-FZ) (see text in the previous edition)

2) Instead of receiving a property tax deduction in accordance with subparagraph 1 of this paragraph, the taxpayer has the right to reduce the amount of his taxable income by the amount of expenses actually incurred by him and documented in connection with the acquisition of this property.

- When selling a share (part thereof) in the authorized capital of a company, when leaving the company's members, when transferring funds (property) to a company participant in the event of liquidation of the company, when reducing the nominal value of a share in the authorized capital of the company, when assigning rights of claim under a participation agreement in shared construction (under an investment agreement for shared construction or under another agreement related to shared construction), the taxpayer has the right to reduce the amount of his taxable income by the amount of expenses actually incurred by him and documented expenses associated with the acquisition of this property (property rights). (as amended by Federal Law dated 06/08/2015 N 146-FZ) (see text in the previous edition)

- The taxpayer's expenses associated with the acquisition of a share in the authorized capital of a company may include the following expenses: (paragraph introduced by Federal Law No. 146-FZ of June 8, 2015)

- expenses in the amount of cash and (or) the cost of other property made as a contribution to the authorized capital when establishing a company or when increasing its authorized capital; (paragraph introduced by Federal Law dated 06/08/2015 N 146-FZ)

- expenses for acquiring or increasing a share in the authorized capital of the company. (paragraph introduced by Federal Law dated 06/08/2015 N 146-FZ)

- In the absence of documented expenses for the acquisition of a share in the authorized capital of the company, a property tax deduction is provided in the amount of income received by the taxpayer as a result of termination of participation in the company, not exceeding a total of 250,000 rubles for the tax period. (paragraph introduced by Federal Law dated 06/08/2015 N 146-FZ)

- When selling part of a share in the authorized capital of a company owned by a taxpayer, the taxpayer’s expenses for the acquisition of this part of the share in the authorized capital are taken into account in proportion to the decrease in the share of such taxpayer in the authorized capital of the company. (paragraph introduced by Federal Law dated 06/08/2015 N 146-FZ)

- When income is received in the form of payments to a company participant in cash or in kind in connection with a decrease in the authorized capital of the company, the taxpayer’s expenses for acquiring a share in the authorized capital of the company are taken into account in proportion to the decrease in the authorized capital of the company. (paragraph introduced by Federal Law dated 06/08/2015 N 146-FZ)

- If the authorized capital of the company was increased due to the revaluation of assets, when it is reduced, the taxpayer’s expenses for acquiring a share in the authorized capital are taken into account in the amount of payment to the company participant exceeding the amount of the increase in the nominal value of his share as a result of the revaluation of assets; (paragraph introduced by Federal Law dated 06/08/2015 N 146-FZ)

2.1) upon the sale of property (property rights) received during the liquidation of a foreign organization (termination (liquidation) of a foreign structure without forming a legal entity) by a taxpayer - shareholder (participant, shareholder, founder, controlling person of a foreign organization or controlling person of a foreign structure without forming a legal entity), whose income in the form of such property (property rights) was exempt from taxation in accordance with paragraph 60 of Article 217 of this Code, such a taxpayer has the right to reduce the amount of his taxable income from the sale of such property (property rights) by an amount equal to the value of the property (property rights) according to the accounting records of the liquidated organization on the date of receipt of property (property rights) from such organization, specified in the documents attached to the taxpayer’s application submitted in accordance with paragraph two of paragraph 60 of Article 217 of this Code, but not higher than the market value of such property (property rights) determined taking into account Article 105.3 of this Code; (Clause 2.1 introduced by Federal Law dated 06/08/2015 N 150-FZ; as amended by Federal Law dated 02/15/2016 N 32-FZ)

2.2) when selling property rights (including shares, shares) acquired from a controlled foreign company, if the income of such a controlled foreign company from the sale of these property rights (including shares, shares) and expenses in the form of the price of their acquisition are excluded from profit (loss) of such a foreign company on the basis of paragraph 10 of Article 309.1 of this Code, a taxpayer recognized as a controlling person of such a controlled foreign company or being a Russian interdependent person of such a controlling person, the amount of expenses actually incurred in the form of the value of property rights (including shares, shares ) is determined based on the lower of the following costs:

documented value according to the accounting data of a controlled foreign company on the date of transfer of ownership of the specified property rights (including shares, shares) from the controlled foreign company,

the market value of the specified property rights (including shares, interests) on the date of transfer of ownership from a controlled foreign company, determined taking into account the provisions of Article 105.3 of this Code; (clause 2.2 introduced by Federal Law dated February 15, 2016 N 32-FZ)

3) when selling property that is in common shared or common joint ownership, the corresponding amount of property tax deduction is distributed among the co-owners of this property in proportion to their share or by agreement between them (in the case of the sale of property that is in common joint ownership);

4) unless otherwise provided by subclause 2.1 or 2.2 of this clause, the provisions of subclause 1 of clause 1 of this article do not apply to income received: (as amended by Federal Law No. 32-FZ of February 15, 2016) (see text in the previous edition)

from the sale of real estate and (or) vehicles that were used in business activities;

from the sale of securities;

5) when selling property received by a taxpayer-donor in the event of dissolution of the target capital of a non-profit organization, cancellation of a donation, or in another case, if the return of property transferred to replenish the target capital of a non-profit organization is provided for by the donation agreement and (or) Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations”, the expenses of a taxpayer-donor are recognized as documented expenses for the acquisition, storage or maintenance of such property, incurred by the taxpayer-donor on the date of transfer of such property to a non-profit organization - the owner of the endowment capital to replenish the endowment capital of a non-profit organization. The period of ownership of real estate received by a taxpayer-donor in the event of dissolution of the target capital of a non-profit organization, cancellation of a donation, or in another case, if the return of such property transferred to replenish the target capital of a non-profit organization is provided for by the donation agreement and (or) Federal Law dated 30 December 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations”, is determined taking into account the period of such property being in the ownership of the taxpayer-donor until the date of transfer of such property to replenish the endowment capital of a non-profit organization in the manner established by Federal Law dated 30 December 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations.”

3. The property tax deduction provided for in subparagraph 3 of paragraph 1 of this article is provided taking into account the following features:

1) a property tax deduction is provided in the amount of expenses actually incurred by the taxpayer for new construction or the acquisition on the territory of the Russian Federation of one or more pieces of property specified in subparagraph 3 of paragraph 1 of this article, not exceeding 2,000,000 rubles.

If the taxpayer has exercised the right to receive a property tax deduction in an amount less than its maximum amount established by this subclause, the balance of the property tax deduction until its full use may be taken into account when receiving a property tax deduction in the future for new construction or acquisition on the territory of the Russian Federation residential building, apartment, room or share(s) in them, acquisition of land plots or share(s) in them provided for individual housing construction, and land plots or share(s) in them on which the acquired residential buildings or share are located (shares) in them.

In this case, the maximum amount of a property tax deduction is equal to the amount in force in the tax period in which the taxpayer first acquired the right to receive a property tax deduction, as a result of which a balance was created that is carried forward to subsequent tax periods;

2) when purchasing land plots or a share(s) in them provided for individual housing construction, a property tax deduction is provided after the taxpayer receives a certificate of ownership of the residential building;

3) The actual costs of new construction or the acquisition of a residential building or share(s) in it on the territory of the Russian Federation may include the following costs:

- costs for the development of design and estimate documentation;

- expenses for the purchase of construction and finishing materials;

- expenses for the acquisition of a residential building or share(s) in it, including those not completed construction;

- expenses associated with construction work or services (completion of a residential building or share(s) in it that has not been completed) and finishing;

- costs of connecting to electricity, water and gas supply and sewerage networks or creating autonomous sources of electricity, water and gas supply and sewerage;

4) The actual costs of purchasing an apartment, room or share(s) in them may include the following costs:

- expenses for the acquisition of an apartment, room or share(s) in them or rights to an apartment, room or share(s) in them in a house under construction;

- expenses for the purchase of finishing materials;

- expenses for work associated with finishing an apartment, room or share(s) in them, as well as expenses for developing design and estimate documentation for finishing work;

5) deduction of expenses for the completion and finishing of an acquired residential building or share(s) in them or the finishing of an acquired apartment, room or share(s) in them is possible if the agreement on the basis of which such acquisition was made provides for the acquisition of unfinished construction of a residential building, apartment, room (rights to an apartment, room) without finishing or share(s) in them;

6) To confirm the right to a property tax deduction, the taxpayer submits to the tax authority:

- an agreement on the acquisition of a residential building or a share(s) in it, documents confirming the taxpayer’s ownership of a residential building or a share(s) in it - during the construction or acquisition of a residential building or a share(s) in it;

- an agreement on the acquisition of an apartment, room or share (shares) in them and documents confirming the taxpayer’s ownership of the apartment, room or share (shares) in them - when purchasing an apartment, room or share (shares) in them into ownership;

- an agreement for participation in shared construction and a transfer deed or other document on the transfer of a shared construction object by the developer and its acceptance by a participant in shared construction, signed by the parties - when acquiring rights to a shared construction object (an apartment or a room in a house under construction);

- documents confirming the taxpayer's ownership of a land plot or share(s) in it, and documents confirming ownership of a residential building or share(s) in it - when acquiring land plots or share(s) in them provided for individual housing construction, and land plots on which the acquired residential buildings or share(s) in them are located;

- child's birth certificate - when parents purchase a residential house, apartment, room or share(s) in them, land plots or share(s) in them provided for individual housing construction, and land plots or share(s) in them, on in which the acquired residential buildings or share(s) in them are located, into the ownership of their children under the age of 18;

- decision of the guardianship and trusteeship body to establish guardianship or trusteeship - when guardians (trustees) acquire a residential house, apartment, room or share (shares) in them, land plots or share (shares) in them provided for individual housing construction, and land plots or shares (shares) in them, on which the acquired residential buildings or share (shares) in them are located, in the ownership of their wards under the age of 18 years;

- documents confirming expenses made by the taxpayer (receipts for receipt orders, bank statements on the transfer of funds from the buyer's account to the seller's account, sales and cash receipts, acts on the purchase of materials from individuals indicating the address and passport details of the seller and other documents) ;

7) a property tax deduction is provided to the taxpayer on the basis of documents confirming the emergence of the right to the specified deduction, payment documents drawn up in the prescribed manner and confirming expenses incurred by the taxpayer (receipts for receipt orders, bank statements about the transfer of funds from the buyer’s account to the seller’s account, commodity and cash checks, acts on the purchase of materials from individuals indicating the address and passport details of the seller and other documents).

4. The property tax deduction provided for by subclause 4 of clause 1 of this article is provided in the amount of expenses actually incurred by the taxpayer to pay interest in accordance with the loan (credit) agreement, but not more than 3,000,000 rubles in the presence of documents confirming the right to receive a property tax deduction, specified in paragraph 3 of this article, a loan (credit) agreement, as well as documents confirming the fact of payment of funds by the taxpayer in repayment of interest.

5. Property tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of this article are not provided in relation to the taxpayer’s expenses for new construction or the acquisition on the territory of the Russian Federation of a residential house, apartment, room or share(s) in them, covered by the funds of employers or other persons, maternal (family) capital funds allocated to ensure the implementation of additional measures of state support for families with children, through payments provided from the budgets of the budgetary system of the Russian Federation, as well as in cases where the purchase and sale transaction of a residential building, apartment, rooms or share(s) in them is committed between individuals who are interdependent in accordance with Article 105.1 of this Code.

6. The right to receive property tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of this article are taxpayers who are parents (adoptive parents, foster parents, guardians, trustees) and who carry out new construction or purchase on the territory of the Russian Federation at their own expense of a residential building, apartment , rooms or share(s) in them, acquisition of land plots or share(s) in them provided for individual housing construction, and land plots or share(s) in them on which the acquired residential buildings or share(s) in them, into the property of their children under 18 years of age (wards under 18 years of age). The amount of property tax deductions in the case specified in this paragraph is determined based on the actual expenses incurred, taking into account the restrictions established by paragraph 3 of this article.

7. Property tax deductions are provided when the taxpayer submits a tax return to the tax authorities at the end of the tax period, unless otherwise provided by this article.

8. Property tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of this article may be provided to the taxpayer before the end of the tax period when he submits a written application to the employer (hereinafter in this paragraph - tax agent), subject to confirmation of the taxpayer's right to property tax deductions by the tax authority in a form approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

- The property tax deduction provided for in subparagraph 4 of paragraph 1 of this article can be provided only in relation to one piece of real estate.

- The taxpayer has the right to receive property tax deductions from one or more tax agents of his choice. If, having received a property tax deduction from one tax agent, the taxpayer applies for a property tax deduction to another tax agent, the specified property tax deduction is provided in the manner prescribed by paragraph 7 of this article and this paragraph. The tax agent is obliged to provide property tax deductions upon receipt from the taxpayer of confirmation of the right to property tax deductions, issued by the tax authority, indicating the amount of property tax deductions that the taxpayer has the right to receive from each tax agent specified in the confirmation.

- The taxpayer’s right to receive property tax deductions from tax agents in accordance with this paragraph must be confirmed by the tax authority within a period not exceeding 30 calendar days from the date of filing the taxpayer’s application and documents confirming the right to receive property tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of this article.

- If, at the end of the tax period, the amount of the taxpayer’s income received from all tax agents was less than the amount of property tax deductions determined in accordance with paragraphs 3 and 4 of this article, the taxpayer has the right to receive property tax deductions in the manner provided for in paragraph 7 of this article.

- If, after the taxpayer has submitted in the prescribed manner an application to the tax agent for receipt of property tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of this article, the tax agent withheld the tax without taking into account property tax deductions, the amount of tax withheld in excess after receipt of the application shall be returned to the taxpayer in the procedure established by Article 231 of this Code.

9. If during a tax period the property tax deductions provided for in subparagraphs 3 and (or) 4 of paragraph 1 of this article cannot be used in full, their balance may be transferred to subsequent tax periods until they are fully used, unless otherwise provided by this article.

10. For taxpayers receiving pensions in accordance with the legislation of the Russian Federation, property tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of this article may be transferred to previous tax periods, but not more than three, immediately preceding the tax period in which the transferred balance of property assets was formed. tax deductions.

11. Repeated provision of tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of this article is not allowed.

Basic settings

In addition to the above rules regarding the calculation of property and material compensation, the following provisions of Article 220 of the Tax Code of the Russian Federation require attention:

- Maximum deduction amount. An individual who has become the owner of an expensive property can apply for a deduction in the amount of no more than two million rubles, that is, receive the maximum possible compensation in the amount of 260,000 rubles. For example, if the cost of a house is 10,000,000 rubles, then 13% of it will be equal to 1,300,000 rubles, but this amount cannot be obtained. The taxpayer will be credited only 260,000 rubles.

- Repair costs. If the contract for the purchase of a housing property indicates that it requires repair work, then the new buyer can take advantage of a tax discount if money is spent on improving living conditions. As a rule, this includes finishing the premises, installing electrical supplies, gas supply, costs for design documentation, as well as some other services.

- Availability of necessary documents. In addition to the basic papers required for calculating a deduction of any type, in order to return personal income tax for property, you will need a contract for the purchase of a housing property, title to property, payment documents, as well as a number of additional papers, depending on the specific situation.

Standard tax deductions

Article number 220 relates not only to tax discounts of the property type, but also of the standard type. We are talking about situations when parents decide to register a property in the name of their son or daughter, who is currently a minor.

In such a case, if a child is the owner of the property, his father or mother also has the right to return income tax. To do this, you must include a certified copy of the birth certificate in the main documentation package.

If the property was transferred into the ownership of the child not by his natural parent, but by the adoptive one, then in addition to a copy of the certificate, a document issued by the guardianship authorities will be required, which confirms the taxpayer’s right to education.