What documents are needed to receive an income tax refund for treatment?

Declaration 3-NDFL, application for deduction, certificate of income 2-NDFL, passport - with this set of documents any person who decides to exercise his right to receive a refund of personal income tax from the amounts spent on treatment will need to start processing the deduction.

IMPORTANT! The possibility of a tax deduction for treatment expenses is provided for in subparagraph. 3 p. 1 art. 219 of the Tax Code of the Russian Federation.

To ensure that collecting documents for a tax deduction for treatment does not turn into a waste of time, you first need to check whether all legally established conditions and restrictions associated with the use of a social deduction are met, clarifying the following points:

- The person who paid the medical expenses and received the medical service is the same person or the indicated persons are close relatives.

IMPORTANT! Close relatives are considered to be parents, spouses and children under the age of 18 (including adopted children and wards). See also “You can receive social benefits if the person ordering the treatment is your spouse.”

- The person who paid the medical expenses and the deductible claimant are the same person.

IMPORTANT! If the treatment was paid for by the company, the tax authorities will refuse the deduction.

- The taxpayer claiming the deduction has income taxed at a rate of 13% and paid personal income tax to the budget.

IMPORTANT! Pensioners or individual entrepreneurs using the simplified tax system and UTII will be able to claim a deduction only if they have income taxed at a rate of 13%.

If the above conditions are met, you can safely begin collecting the following documents to deduct personal income tax for treatment (this will be discussed below).

You can familiarize yourself with the procedure for filling out the 3-NDFL declaration in the article “Sample of filling out the 3-NDFL tax return” .

Sign up for a free trial access to K+ and get full information about the procedure for receiving a new social deduction for fitness starting in 2022.

How to get a tax deduction for medical services

First of all, it is necessary to understand that the citizen first pays all expenses independently. Keep all payment documents supporting expenses. And they are issued to an individual applying for compensation. Let's figure out how to apply for a tax deduction for medical services and what documents are needed for this.

There are two ways to receive funds: through the employer or the Federal Tax Service.

Method 1. Refund through the employer

It is easier for a working citizen to obtain a refund of money spent on treatment through an employer. And this is the only way to make a tax deduction for medical services and receive money before the end of the calendar year. To do this, you must submit a corresponding application.

To confirm the legitimacy of your claims, prepare:

- payment documents;

- a copy of the contract for the provision of medical services;

- a copy of the license of the medical organization;

- original certificate of payment for treatment;

- a copy of a document confirming the relationship (if medical care was provided to a relative and not to the applicant).

If you purchased medications, you will need a prescription form with the stamp “For the tax authorities of the Russian Federation, Taxpayer INN.”

To reimburse the costs of voluntary health insurance you need:

- a copy of the insurance contract;

- a copy of the insurance company's license;

- a copy of a document confirming relationship.

With this package of documents, go to the Federal Tax Service and receive a notification confirming your right to deduction. Please contact your employer with it and the corresponding application.

Method 2. Refund of personal income tax through the Federal Tax Service

Let's look at how to return a tax deduction for medical services through the tax authority.

Before contacting the Federal Tax Service, you must collect the same package of documents plus a certificate of income from the employer in Form 2-NDFL.

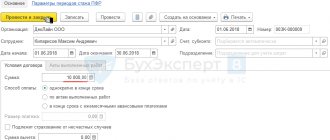

Then a tax return is filled out in form 3-NDFL and an application for a refund of overpaid taxes (KND 1150058).

All these papers are submitted to the Federal Tax Service within three years from the date of the expenditure.

After this, tax authorities will conduct an audit within three months, as a result of which they will decide on a refund of the overpaid tax.

Expensive treatment: when is a personal income tax return declaration issued?

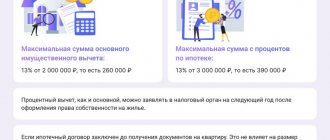

In some cases, there is a need for expensive treatment, and here you need to have a good idea of what documents are needed for 3-NDFL. The fact is that a tax deduction is allowed in such circumstances, and in an almost unlimited amount, but subject to certain conditions:

- firstly, the type of treatment must be included in the list approved by Decree of the Government of the Russian Federation dated 04/08/2020 No. 458 ();

- secondly, you should start filling out a return of income tax for treatment only after receiving a specific certificate issued by a medical institution (approved by order of the Ministry of Health of the Russian Federation No. 289).

When receiving a certificate, you should pay attention to the service code. For expensive treatment, the corresponding field should contain the number 2. When one appears there, the deduction will be limited to the usual limits of 120,000 rubles.

Amount of deduction for medicines in 2022

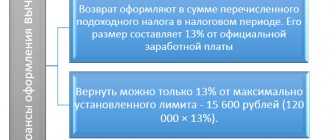

The amount accepted for deduction is limited. The maximum tax deduction for medicines in 2022 is 120,000 rubles. per year (clauses 2, 3, clause 1, article 219 of the Tax Code of the Russian Federation). That is, you can return personal income tax in the amount of 13% of expenses, but not more than 15,600 rubles. (120,000 x 13%).

Example

In 2022, Maksimov spent 37,000 rubles on the purchase of medicines. At his place of work, personal income tax of 13% was withheld from his salary during the year. The salary for the year amounted to 480,000 rubles, tax - 62,400 rubles. To return part of the tax, Maksimov filed a 3-NDFL declaration, in which he declared a tax deduction for medicines in 2022. The following was transferred to him from the budget:

37,000 x 13% = 4810 rub.

It should be borne in mind that the total amount of the limit (120,000 rubles) includes not only the cost of medicines, but also the cost of treatment, education, and other social expenses incurred during the year and declared by the taxpayer for deduction (with the exception of the cost of expensive treatment and education of minors).

Certificate from a medical institution

When submitting documents to the tax office for a personal income tax refund for treatment, special attention should be paid to the certificate issued by the medical institution.

This paper will be needed if medical expenses have been paid.

IMPORTANT! The form of the certificate of payment for medical services was approved by order of the Ministry of Health and the Ministry of Taxes of Russia dated July 25, 2001 No. 289/BG-3-04/256.

At the same time, other documents confirming the fact of payment (receipts, checks, bills, etc.) are not needed, since this certificate is issued only if the services have already been paid for. This position is shared by both officials of the Ministry of Finance and tax authorities (letters of the Ministry of Finance of Russia dated March 29, 2018 No. 03-04-05/20083, dated April 17, 2012 No. 03-04-08/7-76, Federal Tax Service of Russia dated March 7, 2013 No. ED- 3-3/ [email protected] ).

See the material “Certificate or checks for treatment? The Ministry of Finance says - a certificate.”

Such a certificate can also be obtained after undergoing sanatorium-resort treatment. At the same time, it will not indicate the cost of the voucher, but only the price of treatment (less expenses for food, accommodation, etc.) and the amount of additionally paid medical services.

If you have the above certificate and the type of service provided is included in the list, to receive a deduction you will need 2 more documents from the medical institution that provided the service: a contract and a license. If the medical institution does not have a license to carry out medical activities or the treatment was carried out not by a Russian, but by a foreign clinic, the deduction will be denied.

Tax officials must provide a certified copy of the agreement with the medical institution. Particular attention should be paid to the terms of this document if expensive treatment was carried out, and you purchased materials or medical equipment at your own expense that were not available in this clinic. This will allow you to receive a full deduction.

The license is presented in the form of a certified copy. It is not necessary to attach a license separately if its details are specified in the contract.

New form 3-NDFL for 2022

Next year, for expenses incurred in 2022, you must fill out a new 3-NDFL form. It was updated in accordance with the Order of the Federal Tax Service of Russia dated October 15, 2021 No. ED-7-11/ [email protected]

An example of filling out the title page of the new 3-NDFL form in 2022.

The tax return has changed:

- page barcodes,

- applications,

- some sections.

For taxpayers who want to get back part of the income tax previously paid to the state for expenses on medical services and medicines, there are no particularly serious changes in the formation of the document. Read the article to the end and everything will become clear to you.

On the page of our website there is a sample form 3-NDFL in excel format. Download it and use it to submit in 2022 the amount of treatment spent in 2022. You can also find the completed form at the end of the article, posted as an appendix.

Recipe (form 107/1-у)

This small piece of paper will be required by the deductible applicant if the money was spent on medications that were prescribed by a doctor. The prescription is issued by the attending physician simultaneously with a similar form for the pharmacy. If form 107/1-у is missing, it can be obtained later from a medical institution based on the entries in the medical record.

The prescription must be stamped: “For the tax authorities of the Russian Federation, Taxpayer INN.” The stamp is also required after the cancellation of the medicinal list (see letter of the Ministry of Health dated December 30, 2019 No. 25-1/3144694-13771).

You can claim a deduction for the amount of paid medications for periods starting from 2019 for any medications prescribed by a doctor.

Tax officials must provide the original prescription and certified copies of payment documents. In this case, their presence is mandatory.

Insurance policy

A deduction can also be obtained in cases where no medical procedures were performed, no medications were purchased, and the money was spent on paying for a voluntary health insurance policy. In this case, the deductible applicant will need a certified copy of the insurance policy or agreement with the insurance company.

A deduction will be possible only if the insurance contract provides for payment for treatment services, and the insurance organization has a license to carry out this type of activity.

A certified copy of the license is submitted to the inspection. Or a link to its details should be given in the contract.

The above documents must be accompanied by certified copies of payment documents indicating that the funds were spent on paying insurance premiums.

Filling out 3 personal income taxes for deductions for medical services in 2022.

To return funds spent on your health, including the purchase of medicines, the taxpayer prepares the following pages of the form:

- title page;

- section 1. Personal income tax is indicated here, which is subject to return to the citizen;

- part 2. here the refundable tax amount is calculated;

- Appendices 1 and 2. Income and income tax withheld at the source of payments are shown.

The first application reflects the receipts of money from Russian enterprises, the second - from foreign companies.

Birth certificate and other documents

A birth certificate will need to be submitted in the package of documents for deduction in 2 cases:

- if the deduction applicant wants to return the money spent on the treatment of children, the child’s birth certificate will be required;

- if the applicant’s parents were treated and the applicant paid for their treatment, the applicant’s birth certificate must be attached.

If the deduction is issued for the treatment expenses of the applicant's spouse, you will have to provide a marriage certificate.

All of the above evidence is needed to confirm the degree of relationship between the person who spent the money and the recipient of the medical service. They are transferred to the tax authorities in the form of certified copies.

IMPORTANT! Copies of documents for filing a tax deduction can be certified in 2 ways: notarized or independently by the deduction applicant (on each page of all documents you must write: “Copy is correct,” sign, decipher the signature and date it).

For information on income not taken into account when calculating personal income tax, read the article “Income not subject to personal income tax taxation (2021 - 2022).”

Having collected all the necessary documents, you can begin to prepare the 3-NDFL declaration. Our article will help you with this.

We reduce tax through the employer

The employee has the right to contact the employer and reduce income subject to personal income tax by the amount of medical expenses. To do this you need:

- Receive a notification from the Federal Tax Service about the right to apply a deduction for treatment.

- Submit a written application in any form to the employer.

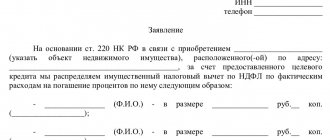

To receive notification of the right to deduction, you must contact the Federal Tax Service with an application and documents confirming the medical expenses incurred. The application form for a refund due to illness to receive notification of confirmation is established by letter of the Federal Tax Service No. BS-4-11 / [email protected] dated January 16, 2017. When filling out the form, indicate the full name, tax identification number, passport details of the applicant and the amount of expenses. Be sure to include documents confirming the costs incurred.

Sample application for receiving 13 percent of the provision of medical services

After receiving the notification, it is necessary, together with a statement drawn up in any written form, to submit it to the employer.

Starting from the next salary payment, the employer will begin to apply the deduction. If, before applying for a refund, the employee had already been paid income, a recalculation will be made from the beginning of the year and the excess tax withheld will be returned.

Results

It is not difficult to collect documents for income tax refund for treatment. You need to write an application, obtain 2-NDFL certificates, make a copy of your passport, take a certificate of payment for medical services or a prescription form (in case of purchasing medicines), attach copies of the contract, license for medical activities and payment documents, and also fill out a 3-NDFL declaration .

The specified list will have to be supplemented with documents confirming the degree of relationship (birth or marriage certificates) if the applicant of the deduction paid for the treatment of his close relatives.

A deduction can also be claimed for the costs of paying voluntary insurance premiums. In this case, you will additionally need a certified copy of the agreement with the insurance company or an insurance policy, as well as a copy of the license to carry out insurance activities and payment documents.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation of 04/08/2020 No. 458

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.