What documents are needed to receive an income tax refund for treatment?

Declaration 3-NDFL, application for deduction, certificate of income 2-NDFL, passport - with this set of documents any person who decides to exercise his right to receive a refund of personal income tax from the amounts spent on treatment will need to start processing the deduction.

IMPORTANT! The possibility of a tax deduction for treatment expenses is provided for in subparagraph. 3 p. 1 art. 219 of the Tax Code of the Russian Federation.

To ensure that collecting documents for a tax deduction for treatment does not turn into a waste of time, you first need to check whether all legally established conditions and restrictions associated with the use of a social deduction are met, clarifying the following points:

- The person who paid the medical expenses and received the medical service is the same person or the indicated persons are close relatives.

IMPORTANT! Close relatives are considered to be parents, spouses and children under the age of 18 (including adopted children and wards). See also “You can receive social benefits if the person ordering the treatment is your spouse.”

- The person who paid the medical expenses and the deductible claimant are the same person.

IMPORTANT! If the treatment was paid for by the company, the tax authorities will refuse the deduction.

- The taxpayer claiming the deduction has income taxed at a rate of 13% and paid personal income tax to the budget.

IMPORTANT! Pensioners or individual entrepreneurs using the simplified tax system and UTII will be able to claim a deduction only if they have income taxed at a rate of 13%.

If the above conditions are met, you can safely begin collecting the following documents to deduct personal income tax for treatment (this will be discussed below).

You can familiarize yourself with the procedure for filling out the 3-NDFL declaration in the article “Sample of filling out the 3-NDFL tax return” .

Sign up for a free trial access to K+ and get full information about the procedure for receiving a new social deduction for fitness starting in 2022.

How to get a deduction for medications

In order to receive a deduction for medicines from the tax office, you will need to provide them with a package of documents, including:

- declaration in form 3-NDFL;

Note! For reporting for 2022, Form 3-NDFL must be completed on an updated form, approved. by order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/ [email protected]

ConsultantPlus experts told us what has changed in the form. Get free demo access to K+ and go to the Review Material to find out all the details of the innovations.

- a certificate from the employer in form 2-NDFL;

Read about the specifics of issuing a 2-NDFL certificate in this article..

You will find the main codes of social deductions in the material “Tax deduction codes for personal income tax - table for 2022”.

- prescriptions filled out by a doctor indicating that they were issued for the tax authorities;

- checks or payment receipts confirming the fact of payment for medicines.

The tax return must be filed by an individual who pays income tax by April 30 of the year following the reporting year.

However, taxpayers who file returns only to receive a deduction (that is, are not required to file reports to declare their income) are not tied to the deadline for filing a return. True, you need to apply for a deduction no later than 3 years from the end of the year in which the right to a deduction arose (Clause 7, Article 78 of the Tax Code).

The tax deduction is returned to the taxpayer after a desk audit of the data specified in the declaration and the documents submitted with it. The money will be returned one month after the end of the verification. The inspection itself is carried out within 3 months from the date of filing the declaration and the documents attached to it.

Read about the timing of a desk audit in our article “What are the deadlines for a desk tax audit?” .

In addition to the option considered, there is another way to receive a deduction for medications through your employer. This can be done without waiting for the end of the year in which the expenses were made. To do this, the employee must contact the employer with an application for a deduction and a notification from the tax authority, which confirms the employee’s right to receive a social deduction. A notification confirming the employee’s right to receive a social deduction is issued within 30 calendar days from the date the taxpayer submits an application to the tax authority. The application must be accompanied by documents confirming the right to deduction (prescription marked for tax authorities, cash receipts).

Expensive treatment: when is a personal income tax return declaration issued?

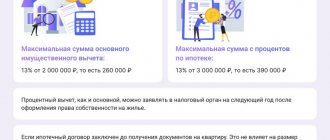

In some cases, there is a need for expensive treatment, and here you need to have a good idea of what documents are needed for 3-NDFL. The fact is that a tax deduction is allowed in such circumstances, and in an almost unlimited amount, but subject to certain conditions:

- firstly, the type of treatment must be included in the list approved by Decree of the Government of the Russian Federation dated 04/08/2020 No. 458 ();

- secondly, you should start filling out a return of income tax for treatment only after receiving a specific certificate issued by a medical institution (approved by order of the Ministry of Health of the Russian Federation No. 289).

When receiving a certificate, you should pay attention to the service code. For expensive treatment, the corresponding field should contain the number 2. When one appears there, the deduction will be limited to the usual limits of 120,000 rubles.

What kind of treatment can I get a tax deduction for?

A complete list of medical services for obtaining a deduction is in Decree of the Government of the Russian Federation No. 458. It includes tests, ultrasound and other types of diagnostics, dental assistance, medical procedures and much more. There is no deduction for cosmetic services, since they are not aimed at improving health. In addition to procedures, deductions are available for the purchase of prescription drugs.

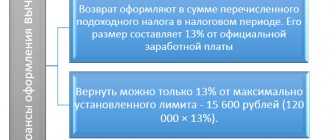

The amount for which the social tax deduction for treatment and medicines is calculated cannot exceed 120 thousand rubles per year. That is, the maximum deduction for the year is 13% of 120 thousand, or 15,600 rubles.

Example

: Ruslan injured his leg while playing badminton. To quickly recover from the injury, he went to a private clinic for a minor operation. The services cost Ruslan 87 thousand rubles. The amount of social tax deduction for treatment is 11,310 rubles.

Separately, Government Decree No. 458 provides a list of expensive treatment services. The 120 thousand limit does not apply to them. The size of the personal income tax deduction for treatment will depend only on the amount you spent and your official salary. The deduction amount cannot be greater than the amount of your personal income tax contributions for the same period.

Income is taken for the same year in which the medical services were provided.

Example

: Inna turned to the center for reproductive medicine for the service of in vitro fertilization, which is included in the approved list of types of expensive treatment. The cost of the assistance provided to her amounted to 280 thousand rubles. She returned 36,400 rubles as a deduction.

Examples of services included in the list of expensive treatment:

- treatment of congenital pathologies,

- surgical intervention,

- organ transplantation,

- treatment of oncological diseases.

Example

: Valeria’s child was diagnosed with cancer at one of the early stages. She spent 1.3 million rubles on treatment. 13% of this amount will be 169 thousand rubles.

Valeria's salary is 90 thousand rubles per month. Therefore, for the year the amount of her personal income tax contributions will be: 90,000 * 12 * 13% = 140,400 rubles. This is the maximum deduction amount that is available to her during the year. Valeria will be able to return the rest next year.

Moreover, if the deduction is issued by Valeria’s husband Eduard with a salary of 150 thousand rubles per month, then the amount of the deduction will be 169 thousand rubles - exactly 13% of the amount spent on treatment. After all, the amount of Eduard’s personal income tax contributions for the year is 234 thousand rubles. However, in this case, payment documents for all medical services provided must be issued to Eduard.

Certificate from a medical institution

When submitting documents to the tax office for a personal income tax refund for treatment, special attention should be paid to the certificate issued by the medical institution.

This paper will be needed if medical expenses have been paid.

IMPORTANT! The form of the certificate of payment for medical services was approved by order of the Ministry of Health and the Ministry of Taxes of Russia dated July 25, 2001 No. 289/BG-3-04/256.

At the same time, other documents confirming the fact of payment (receipts, checks, bills, etc.) are not needed, since this certificate is issued only if the services have already been paid for. This position is shared by both officials of the Ministry of Finance and tax authorities (letters of the Ministry of Finance of Russia dated March 29, 2018 No. 03-04-05/20083, dated April 17, 2012 No. 03-04-08/7-76, Federal Tax Service of Russia dated March 7, 2013 No. ED- 3-3/ [email protected] ).

See the material “Certificate or checks for treatment? The Ministry of Finance says - a certificate.”

Such a certificate can also be obtained after undergoing sanatorium-resort treatment. At the same time, it will not indicate the cost of the voucher, but only the price of treatment (less expenses for food, accommodation, etc.) and the amount of additionally paid medical services.

If you have the above certificate and the type of service provided is included in the list, to receive a deduction you will need 2 more documents from the medical institution that provided the service: a contract and a license. If the medical institution does not have a license to carry out medical activities or the treatment was carried out not by a Russian, but by a foreign clinic, the deduction will be denied.

Tax officials must provide a certified copy of the agreement with the medical institution. Particular attention should be paid to the terms of this document if expensive treatment was carried out, and you purchased materials or medical equipment at your own expense that were not available in this clinic. This will allow you to receive a full deduction.

The license is presented in the form of a certified copy. It is not necessary to attach a license separately if its details are specified in the contract.

What to do if the tax deduction is not exhausted by the end of the year

Let us remind you: you have the right to receive a deduction through your employer only in the year in which the treatment was paid for.

If at the end of the year there is still uncollected money, it is not carried over to the next year. To avoid losing them, you should contact the tax office and declare your right to a deduction: collect supporting documents, fill out a 3-NDFL declaration and an application.

After a desk audit, which takes about four months, you will receive the balance in your account.

Recipe (form 107/1-у)

This small piece of paper will be required by the deductible applicant if the money was spent on medications that were prescribed by a doctor. The prescription is issued by the attending physician simultaneously with a similar form for the pharmacy. If form 107/1-у is missing, it can be obtained later from a medical institution based on the entries in the medical record.

The prescription must be stamped: “For the tax authorities of the Russian Federation, Taxpayer INN.” The stamp is also required after the cancellation of the medicinal list (see letter of the Ministry of Health dated December 30, 2019 No. 25-1/3144694-13771).

You can claim a deduction for the amount of paid medications for periods starting from 2019 for any medications prescribed by a doctor.

Tax officials must provide the original prescription and certified copies of payment documents. In this case, their presence is mandatory.

About recipe forms

In prescriptions, the names of drugs are displayed in Latin, and the method of using the medicine must be indicated in Russian, and general phrases like “internal” are unacceptable. It is allowed to prescribe medications only on prescriptions issued on forms No. 148-1/u-88, No. 107-1/1, No. 148-1/u-04 (l) or No. 148-1/u-06 (l).

When writing prescriptions, doctors follow the procedure prescribed in the order of the Ministry of Health dated January 14, 2019 No. 4n. Recipes can be made on the computer. You cannot make changes to recipes; if an error is made, it is better to fill out a new prescription form.

For more information about handling strict reporting forms, read the material “Procedure for recording and storing strict reporting forms” .

To confirm that the purchased medications were prescribed by a doctor, the taxpayer must be prepared to present a prescription, which will be marked with an indication of the payer’s tax number. Such a prescription is issued on the basis of the order of the Ministry of Health dated July 25, 2001 No. 289/BG-3-04/256 (Appendix 3).

In accordance with the order of the Ministry of Health dated January 14, 2019 No. 4n, form No. 148-1/u-88 is used for discharge:

- psychotropic drugs from List III or registered medications (and narcotic and psychotropic drugs from List II are prescribed on a special prescription form in Form 107/u-NP);

- anabolic steroids;

- medications with low contents of narcotic and psychotropic drugs (precursors);

- individually prepared medicines containing narcotic substances and psychotropics from list II in a small dose (not more than the highest single dose).

On forms No. 148-1/u-04 (l) and 148-1/u-06 (l) medications are prescribed for free receipt, as well as for citizens entitled to a discount.

The following medications are prescribed on prescription form No. 107-1/u:

- subject to control, which, in addition to small psychotropic and narcotic doses, contain other pharmacological components;

- all other medications not listed above.

The validity period of issued prescription forms varies - from 10 days to 3 months (noted by the doctor). Completed prescription forms in form No. 107-1/u are valid for 2 months, and in special cases (for chronic diseases) - up to a year. The standard deadline for each of the forms is indicated in clause 21 of the procedure approved by Order of the Ministry of Health dated December 20, 2012 No. 1175n.

It is also important to pay attention to the fact that on the completed prescription form, at the top left, there is a stamp of the medical institution indicating all its contact information. On the forms No. 148-1/u-04(l) and No. 148-1/u-06(l) there is a space allocated for applying a special code. You can decipher the recording yourself if you read clause 5 of Appendix 3 of Order No. 1175n of the Ministry of Health dated December 20, 2012.

A prescription on forms No. 148-1/u-04(l) and No. 148-1/u-06(l) is drawn up by a doctor on 2 identical forms (same numbers and series): one is issued to the patient - for the pharmacy, and the second - remains in the medical record. At the pharmacy, notes are made on the prescription about the dispensing of medications in full/incomplete quantities. The entry is dated.

Due to the fact that for a large number of medications that are purchased with patients’ money, prescription form No. 107-1/u has been established, it is this prescription that is recommended to be written out in order to receive social benefits. A prescription in form No. 107-1/u for tax authorities can be issued by the attending physician at the request of the taxpayer within 3 years after the end of the tax period (calendar year) in which expenses for the purchase of medicines were incurred, indicating the date of the actual prescription of the medicine. Such prescriptions are issued on the basis of entries made in the medical record (letter of the Ministry of Health of the Russian Federation dated February 12, 2002 No. 2510/1430-02-32).

Insurance policy

A deduction can also be obtained in cases where no medical procedures were performed, no medications were purchased, and the money was spent on paying for a voluntary health insurance policy. In this case, the deductible applicant will need a certified copy of the insurance policy or agreement with the insurance company.

A deduction will be possible only if the insurance contract provides for payment for treatment services, and the insurance organization has a license to carry out this type of activity.

A certified copy of the license is submitted to the inspection. Or a link to its details should be given in the contract.

The above documents must be accompanied by certified copies of payment documents indicating that the funds were spent on paying insurance premiums.

Which option for receiving a deduction for treatment is preferable: through the employer or the Federal Tax Service?

Before you claim your right to a tax deduction, you need to decide which of the options discussed above is preferable for your situation.

Advantages of receiving a deduction through your employer:

- Fewer documents: you do not need to fill out a 3-NDFL declaration and get a 2-NDFL certificate from the accounting department.

- You can receive money already this year, rather than waiting for next year and the lengthy verification of your documents by the Federal Tax Service.

Therefore, if the refund amount is not large and can be paid before the end of the year, it makes sense to issue a deduction through the employer.

When is it better to receive a tax deduction through the tax office:

If next year you plan to file a 3-NDFL declaration for some other items. In order not to collect documents twice, you can include a deduction for treatment in the same declaration.

If, when applying for a deduction from your employer, you do not have time to receive the entire tax refund amount before the end of the current year. For example, you paid for treatment at the end of the year or paid a significant amount for expensive treatment. Then next year you will have to receive the remaining deductions through the tax office, and this again means collecting documents and wasting time.

If you paid for treatment several times during the year. In order not to prepare requests to the Federal Tax Service each time and transmit them to the employer, it is more convenient to do this through the tax office - once for the whole year.

If you don't want to go to the tax office several times. In the best case, if all the documents are correct, this is done twice: the first time to submit an application, the second time to receive notification to the employer. To receive a deduction through the Federal Tax Service, you have a more convenient way - send documents through the taxpayer’s personal account on the Federal Tax Service website or by mail.

Birth certificate and other documents

A birth certificate will need to be submitted in the package of documents for deduction in 2 cases:

- if the deduction applicant wants to return the money spent on the treatment of children, the child’s birth certificate will be required;

- if the applicant’s parents were treated and the applicant paid for their treatment, the applicant’s birth certificate must be attached.

If the deduction is issued for the treatment expenses of the applicant's spouse, you will have to provide a marriage certificate.

All of the above evidence is needed to confirm the degree of relationship between the person who spent the money and the recipient of the medical service. They are transferred to the tax authorities in the form of certified copies.

IMPORTANT! Copies of documents for filing a tax deduction can be certified in 2 ways: notarized or independently by the deduction applicant (on each page of all documents you must write: “Copy is correct,” sign, decipher the signature and date it).

For information on income not taken into account when calculating personal income tax, read the article “Income not subject to personal income tax taxation (2021 - 2022).”

Having collected all the necessary documents, you can begin to prepare the 3-NDFL declaration. Our article will help you with this.

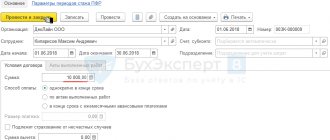

From what month is personal income tax not withheld and can an employer return tax for previous months?

As can be seen from the situation given above, the taxpayer turns to the employer to receive a deduction not at the beginning of the year, but in May. In this regard, the question arises: from what moment will the employer stop withholding income tax?

Based on para. 2-3 p. 2 tbsp. 219 of the Tax Code of the Russian Federation, a social tax deduction for treatment is provided to the taxpayer by the employer starting from the month in which the taxpayer applied to the employer to receive them.

Example: Terikhov D.M. paid for dental services in September. I received a notice in November and asked my employer to refund the tax paid earlier this year. The employer rightfully refused, saying that tax would not be withheld only from the month of filing the application, that is, from November.

Results

It is not difficult to collect documents for income tax refund for treatment. You need to write an application, obtain 2-NDFL certificates, make a copy of your passport, take a certificate of payment for medical services or a prescription form (in case of purchasing medicines), attach copies of the contract, license for medical activities and payment documents, and also fill out a 3-NDFL declaration .

The specified list will have to be supplemented with documents confirming the degree of relationship (birth or marriage certificates) if the applicant of the deduction paid for the treatment of his close relatives.

A deduction can also be claimed for the costs of paying voluntary insurance premiums. In this case, you will additionally need a certified copy of the agreement with the insurance company or an insurance policy, as well as a copy of the license to carry out insurance activities and payment documents.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation of 04/08/2020 No. 458

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is a tax deduction for treatment?

According to the legislation of the Russian Federation (Article 219 of the Tax Code of the Russian Federation), when paying for treatment or medications, you can count on a tax deduction and return part of the money spent on treatment .

A tax deduction is the portion of income that is not subject to tax. Therefore, you can return the tax paid on the expenses incurred for treatment. If you officially work and pay income tax, have paid for your treatment or the treatment of your relatives , you can get back part of the money in the amount of up to 13% of the cost of treatment .