The law does not prohibit taking cash from individual clients. But you can’t just put money in your pocket - the tax office will fine you for working without a cash register and for not issuing checks.

Some entrepreneurs may still not use online cash registers, but even in this case, the buyer must be given a closing document. But not a cash register check, but another one.

The check can be sent by email. True, the time frame is limited. If you didn’t meet the deadline, consider that there was no check and wait for a “letter of happiness” from the tax office.

Everything is complicated, in general. It’s easy to get confused with legal requirements - they depend on the type of ownership and the area in which you work. To ensure that you do not violate anything, we have prepared detailed guidelines for accepting cash payments from individuals.

After studying it, you will learn:

- Who has the right to accept cash payments?

- How to accept cash in accordance with the law:

- At a retail outlet or office

- On the map

- To current account

Payment methods for goods and services

The priority is to use non-cash payment. Cash circulation is gradually fading into the background: in retail outlets, grocery chains, public transport, and in state and municipal authorities, non-cash payments are increasingly used.

Cashless payment is convenient because it does not require the payer to perform any actions: in a few clicks the amount is transferred in the required direction. Service about payment methods in more detail.

Working with cash in 2022

Please note that the new rules for cash payments still limit the amount of payments to 100,000 rubles per contract. Similar to previous years, entrepreneurs have the opportunity to pay wages to employees, make payments to individuals, and also spend cash on personal needs.

By and large, the movement of cash is regulated in accordance with the previous Directive of the Bank of Russia dated December 9, 2019 No. 5348-U, which came into force in April 2022. As well as some items on the circulation of cash, which are related to the fight against criminal and terrorist activities, are regulated by a nationwide law dated August 2001. For example, the seventh article of this document talks about:

- requirements that apply to a legal entity when concluding contracts involving funds, including cash payments;

- powers of enterprises if necessary to counter criminal and terrorist activities, taking into account the control of cash payments.

The basic points for cash payments in 2022 are also:

- the presence of a limit on the amount of mutual settlements using paper and metal cash with the participation of organizations, individual entrepreneurs that are officially registered as entrepreneurs;

- entrepreneurs and corporations in 2022 can legally spend cash from the cash register on settlement transactions.

Types of cash payments

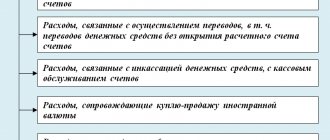

Cash payment is not limited to the option of one person transferring funds to another person. Payment in cash can be made in the following way:

- Transferring money to the cash register (seller) - from hand to hand.

- Transfer through an ATM - with subsequent withdrawal of the amount by the recipient.

- Transfer via money transfer system - Zolotaya Korona, Unistream, Contact, and others.

This form is still used to pay for housing and communal services, loans, supplies of goods, work, purchases, and much more. The cash form of payment does not allow controlling structures to regulate the movement of money, therefore it is closely related to the emergence and development of the shadow economy.

For example, if the owner of an apartment rents it out to tenants for cash payment, then this money will not appear anywhere - it is impossible to track it. The same applies to the fact of renting out housing: it is extremely difficult to prove that the owner receives a permanent income in this way. Therefore, there is less and less cash in the country every year, and the country will come to the point where all payments will be made exclusively in non-cash form.

How to deposit money into the account of an individual entrepreneur or LLC and is it necessary to do so?

After accepting cash payment, a reasonable question arises: “What to do next with the funds received?” There are two options:

- Leave them at the cash register. It is important to remember that legal entities (except those related to small businesses) are required to set a cash balance limit and monitor compliance with it. For exceeding the limit, the following are fined: officials - in the amount of 4,000 to 5,000 rubles, legal entities - in the amount of 40,000 to 50,000 rubles.

- Deposit into your current account. This can be done through a bank cash desk or ATM (so-called self-collection). If possible, indicate in the “Purpose of payment” field that the money is retail revenue.

Non-cash form of payment and its types

The most common form of payment. Non-cash payment is used in all areas: payment for services, purchase of goods, transfers, settlements between individuals and legal entities. The official interpretation of the term is the transfer of funds from the buyer to the seller with the help of a credit institution, by sending money from account to account.

When paying with a bank card, the vast majority of holders do not suspect what complex mathematical processes begin after entering a PIN code or using PayPass technology. This applies to debit and credit cards. Cashless payment is a high-tech process that has several types:

- Payment from bank cards.

- From bank account to bank account or card.

- Use of electronic money.

The described payment methods for goods are used by individuals and legal entities to comply with the requirements of current legislation. This form of payment increases the degree of control on the part of the state over the movement of money within the country and making transfers outside its borders.

Non-cash payments from bank cards

Bank cards are used more often than other methods for non-cash payments. Within one bank, a transfer takes up to several minutes. In large credit institutions, a transfer between cards is completed within a matter of seconds, unless a technical failure occurs.

Transfers between cards of different banks take time: from a few seconds to 3-5 banking days. During the same time periods, the services of another bank are paid - for example, when a loan debt from another bank is paid from a bank card of one credit institution.

Payment from a bank account

Individuals can open current, savings and savings accounts in a bank. For example, a current account is designed for free management of money. Other products may have restrictions on spending transactions.

If a bank card is linked to the account, then an individual can combine payment options: pay from the card to the account, or make a transaction directly from the account. There are several options, and all of them can be implemented through the online banking system.

Using electronic money

Electronic money is one of the types of non-cash payment for goods and services, as well as making transfers. The following online payment systems are most common on the territory of the Russian Federation:

- Yandex money.

- QIWI.

- PayPal.

- WebMoney.

- Payeer.

The use of electronic wallets requires identification in the system. Transactions in which either party remains anonymous are prohibited or subject to mandatory controls. Almost any product or service can be paid for using electronic money. Subsequently, the seller withdraws the money to a bank card or cashes out in another way.

The disadvantage of this type of non-cash payment is the inconvenience when transferring from one online payment system to another. In this case, you will need to link wallets, with the subsequent ability to transfer money with a fairly large commission.

conclusions

Conducting non-cash and cash payments requires the presence of 2 counterparties. Conducting cash payments between individuals who do not carry out entrepreneurial activities occurs without any restrictions. Cash payments from legal entities and individual entrepreneurs are carried out in compliance with cash discipline.

You will learn about the importance of maintaining cash discipline in this article..

Non-cash payments are carried out with the participation of banking institutions that execute their client’s order to write off funds from his current account in favor of another person to his current account opened in the same or another bank with which the bank executing the payment order has established correspondent relations.

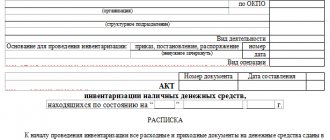

To display cash and non-cash payments in accounting, active synthetic accounts 50 and 51 are used. These accounts may have a balance at the end of the reporting period, which indicates the availability of funds from the organization or entrepreneur.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Answers to questions on the topic

1. Does the seller have the right to insist on non-cash payment?

In accordance with Art. 140 of the Civil Code of the Russian Federation, two forms of payment are used equally on the territory of the Russian Federation - cash and non-cash. In this case, the second form is a priority. But restricting the buyer’s right to pay in cash is initially illegal.

2. What types of remuneration are used in an enterprise or organization?

In Art. 136 of the Labor Code of the Russian Federation states that wages are paid in cash - through the cash desk of an enterprise or organization, and in non-cash form - through the credit institution in which the salary project is registered. Employers are prohibited from restricting employees’ right to choose the procedure for remuneration, as well as independently determining the credit institution on whose card wages will be received.

3. What determines the procedure and form of payment for services under the contract?

The instructions are given in Art. 37 Federal Law “On Protection of Consumer Rights”. In accordance with this norm, the consumer undertakes to pay for the work in the form and manner specified by the contractor. As a rule, the method of payment of remuneration is agreed upon by the parties in advance.

4. What are the ways to pay for utilities?

The most convenient and fastest payment method is the credit institution’s client’s personal account or application. In addition, the following options are provided: the State Services portal, the state housing and communal services information system, cash desks of credit organizations, cash desks of management companies, personal account of the management company, directly to the service provider, terminals and ATMs. Residents of the Moscow region can pay for housing and communal services without commission using a Muscovite social card.

5. How to pay for parking in Moscow?

Parking in Moscow is paid for in several ways. These include: the Moscow Parking mobile application, using a parking meter (payment by credit card), calling +7 (495) 539-54-54 or 3210, and also sending an SMS to the short number 7757 (in the body indicate messages - parking number * car number * number of hours from 1 to 24).

5 / 5 ( 1 voice )

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

What can individual entrepreneurs and organizations spend cash on?

They can spend it for several purposes:

- salary fund and social benefits for employees;

- payment of insurance amounts to individuals who paid insurance premiums in cash;

- payment of cash for personal needs of individual entrepreneurs not related to business activities;

- payment for goods, works and services (except for shares and other securities);

- issuing cash to employees on account;

- refund for goods, works, services previously paid in cash for which the buyer wants to issue a refund;

- issuing cash for transactions as a bank payment agent.

Comments: 1

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Gritsenko Oksana

10/11/2021 at 10:09 pm Excellent article!

Competent, concise and accessible! Reply ↓

Civil Code of the Russian Federation Part 2

| Previous chapter | Content | Next chapter |

| SECTION IV. SPECIFIC TYPES OF OBLIGATIONS |

CHAPTER 46. CALCULATIONS

GENERAL PROVISIONS ABOUT CALCULATIONS

Article 861. Cash and non-cash payments

1. Settlements with the participation of citizens not related to their business activities can be made in cash (Article 140) without limiting the amount or by bank transfer.

2. Settlements between legal entities, as well as settlements with the participation of citizens related to the implementation of their business activities, are made by bank transfer. Settlements between these persons may also be made in cash, unless otherwise provided by law.

3. Non-cash payments are made through banks and other credit organizations (hereinafter referred to as banks) in which the corresponding accounts are opened, unless otherwise follows from the law and is not stipulated by the form of payment used.

Article 862. Forms of non-cash payments

1. When making non-cash payments, payments by payment orders, letters of credit, checks, collection payments, as well as payments in other forms provided for by law, banking rules established in accordance with it and business customs applied in banking practice are allowed.

2. The parties to the agreement have the right to choose and establish in the agreement any of the forms of payment specified in paragraph 1 of this article.

SETTLEMENTS BY PAYMENT ORDERS

Article 863. General provisions on settlements by payment orders

1. When making payments by payment order, the bank undertakes, on behalf of the payer, at the expense of the funds in his account, to transfer a certain amount of money to the account of the person specified by the payer in this or another bank within the period provided for by law or established in accordance with it, if shorter the period is not provided for in the bank account agreement or is not determined by business customs applied in banking practice.

2. The rules of this paragraph apply to relations related to the transfer of funds through a bank by a person who does not have an account with this bank, unless otherwise provided by law, the banking rules established in accordance with it, or does not follow from the essence of these relations.

3. The procedure for making payments by payment orders is regulated by law, as well as the banking rules established in accordance with it and business customs applied in banking practice.

Article 864. Conditions for the bank to execute a payment order

1. The content of the payment order and the settlement documents submitted along with it and their form must comply with the requirements provided for by law and the banking rules established in accordance with it.

2. If the payment order does not comply with the requirements specified in paragraph 1 of this article, the bank may clarify the contents of the order. Such a request must be made to the payer immediately upon receipt of the order. If a response is not received within the period provided for by law or the banking rules established in accordance with it, and in their absence - within a reasonable time, the bank may leave the order without execution and return it to the payer, unless otherwise provided by law, the banking rules established in accordance with it or agreement between the bank and the payer.

3. The payer’s order is executed by the bank if there are funds in the payer’s account, unless otherwise provided by the agreement between the payer and the bank. Orders are executed by the bank in compliance with the order in which funds are written off from the account (Article 855).

Article 865. Execution of instructions

1. The bank that accepted the payer’s payment order is obliged to transfer the corresponding amount of money to the recipient’s bank for crediting it to the account of the person specified in the order within the period established by paragraph 1 of Article 863 of this Code.

2. The bank has the right to attract other banks to perform operations to transfer funds to the account specified in the client’s order.

3. The bank is obliged to immediately inform the payer at his request about the execution of the order. The procedure for execution and requirements for the content of a notice of execution of an order are provided for by law, banking rules established in accordance with it, or agreement of the parties.

Article 866. Liability for non-execution or improper execution of an order

1. In case of non-execution or improper execution of the client’s order, the bank shall be liable on the grounds and in the amounts provided for in Chapter 25 of this Code.

2. In cases where non-execution or improper execution of an order occurred in connection with a violation of the rules for performing settlement operations by the bank hired to execute the payer’s order, the liability provided for in paragraph 1 of this article may be imposed by the court on this bank.

3. If a violation of the rules for conducting settlement transactions by a bank has resulted in the unlawful withholding of funds, the bank is obliged to pay interest in the manner and in the amount provided for in Article 395 of this Code.

SETTLEMENTS BY LETTER OF CREDIT

Article 867. General provisions on settlements under a letter of credit

1. When making payments under a letter of credit, the bank acting on behalf of the payer to open a letter of credit and in accordance with its instructions (issuing bank), undertakes to make payments to the recipient of funds or pay, accept or honor a bill of exchange or authorize another bank (executing bank) to make payments to the recipient of funds or to pay, accept or honor a bill of exchange.

The rules on the nominated bank apply to the issuing bank that makes payments to the recipient of funds or pays, accepts or discounts a bill of exchange.

2. In the case of opening a covered (deposited) letter of credit, the issuing bank, upon its opening, is obliged to transfer the amount of the letter of credit (covering) at the expense of the payer or the loan provided to him at the disposal of the executing bank for the entire duration of the issuing bank’s obligation.

In the event of opening an uncovered (guaranteed) letter of credit, the executing bank is given the right to write off the entire amount of the letter of credit from the account of the issuing bank maintained by it.

3. The procedure for making payments under a letter of credit is regulated by law, as well as the banking rules established in accordance with it and business customs applied in banking practice.

Article 868. Revocable letter of credit

1. A revocable letter of credit is one that can be changed or canceled by the issuing bank without prior notice to the recipient of the funds. Revocation of a letter of credit does not create any obligations of the issuing bank to the recipient of funds.

2. The executing bank is obliged to carry out payment or other operations under a revocable letter of credit, if by the time they are completed it has not received notification of a change in the conditions or cancellation of the letter of credit.

3. A letter of credit is revocable unless otherwise expressly stated in its text.

Article 869. Irrevocable letter of credit

1. Irrevocable is a letter of credit that cannot be canceled without the consent of the recipient of the funds.

2. At the request of the issuing bank, the executing bank participating in the letter of credit operation may confirm an irrevocable letter of credit (confirmed letter of credit). Such confirmation means the acceptance by the nominated bank of an additional obligation to the issuing bank's obligation to make payment in accordance with the terms of the letter of credit.

An irrevocable letter of credit confirmed by the nominated bank cannot be amended or canceled without the consent of the nominated bank.

Article 870. Execution of a letter of credit

1. To execute a letter of credit, the recipient of funds submits to the executing bank documents confirming the fulfillment of all conditions of the letter of credit. If at least one of these conditions is violated, the letter of credit will not be executed.

2. If the executing bank made a payment or carried out another operation in accordance with the terms of the letter of credit, the issuing bank is obliged to reimburse it for the expenses incurred. These expenses, as well as all other expenses of the issuing bank associated with the execution of the letter of credit, are reimbursed by the payer.

Article 871. Refusal to accept documents

1. If the executing bank refuses to accept documents that, by external appearance, do not comply with the terms of the letter of credit, it is obliged to immediately inform the recipient of the funds and the issuing bank about this, indicating the reasons for the refusal.

2. If the issuing bank, having received the documents accepted by the executing bank, considers that they do not correspond in appearance to the terms of the letter of credit, it has the right to refuse to accept them and demand from the executing bank the amount paid to the recipient of funds in violation of the terms of the letter of credit, and for an uncovered letter of credit refuse to reimburse amounts paid.

Article 872. Responsibility of the bank for violation of the terms of the letter of credit

1. The issuing bank is responsible for violation of the terms of the letter of credit to the payer, and the executing bank is responsible to the issuing bank, except for the cases provided for in this article.

2. If the executing bank unreasonably refuses to pay funds under a covered or confirmed letter of credit, liability to the recipient of the funds may be assigned to the executing bank.

3. In the event of an incorrect payment by the executing bank of funds under a covered or confirmed letter of credit due to a violation of the terms of the letter of credit, liability to the payer may be assigned to the executing bank.

Article 873. Closing of a letter of credit

1. The letter of credit is closed at the executing bank:

upon expiration of the letter of credit;

at the request of the recipient of funds to refuse to use the letter of credit before its expiration, if the possibility of such refusal is provided for by the terms of the letter of credit;

at the payer’s request for full or partial revocation of the letter of credit, if such revocation is possible under the terms of the letter of credit.

The executing bank must notify the issuing bank of the closure of the letter of credit.

2. The unused amount of a covered letter of credit must be returned to the issuing bank immediately simultaneously with the closure of the letter of credit. The issuing bank is required to credit the returned amounts to the payer's account from which the funds were deposited.

CALCULATIONS FOR COLLECTION

Article 874. General provisions on collection payments

1. When making collection payments, the bank (issuing bank) undertakes, on the client’s instructions, to carry out actions at the client’s expense to receive payment and (or) acceptance of payment from the payer.

2. The issuing bank, which has received the client’s order, has the right to attract another bank (executing bank) to carry it out.

The procedure for making collection payments is regulated by law, the banking rules established in accordance with it and the business customs used in banking practice.

3. In case of non-execution or improper execution of the client’s order, the issuing bank shall be liable to him on the grounds and in the amount provided for in Chapter 25 of this Code.

If the non-execution or improper execution of the client’s order occurred in connection with a violation of the rules for performing settlement transactions by the executing bank, liability to the client may be assigned to this bank.

Article 875. Execution of collection order

1. If any document is missing or the external appearance of the documents does not correspond to the collection order, the executing bank is obliged to immediately notify the person from whom the collection order was received. If these deficiencies are not eliminated, the bank has the right to return the documents without execution.

2. Documents are presented to the payer in the form in which they were received, with the exception of marks and inscriptions of banks necessary for processing the collection transaction.

3. If documents are payable at sight, the executing bank must make presentation for payment immediately upon receipt of the collection order.

If the documents are subject to payment at a different time, the executing bank must, in order to obtain the payer's acceptance, submit the documents for acceptance immediately upon receipt of the collection order, and the payment request must be made no later than the day the payment deadline specified in the document occurs.

4. Partial payments can be accepted in cases where this is established by banking rules, or with special permission in the collection order.

5. The received (collected) amounts must be immediately transferred by the executing bank to the issuing bank, which is obliged to credit these amounts to the client’s account. The executing bank has the right to withhold from the collected amounts the remuneration and reimbursement of expenses due to it.

Article 876. Notification of transactions performed

1. If payment and (or) acceptance have not been received, the executing bank is obliged to immediately notify the issuing bank of the reasons for non-payment or refusal to accept.

The issuing bank is obliged to immediately inform the client about this, asking him for instructions on further actions.

2. If instructions on further actions are not received within the period established by the banking rules, or in its absence within a reasonable time, the executing bank has the right to return the documents to the issuing bank.

PAYMENTS BY CHECKS

Article 877. General provisions on payments by checks

1. A check is a security containing an unconditional order from the drawer to the bank to pay the amount specified therein to the check holder.

2. Only a bank where the drawer has funds that he has the right to dispose of by issuing checks can be indicated as the payer of a check.

3. Cancellation of a check before the expiration of the period for its presentation is not permitted.

4. The issuance of a check does not extinguish the monetary obligation in fulfillment of which it was issued.

5. The procedure and conditions for the use of checks in payment transactions are regulated by this Code, and in the part not regulated by it, by other laws and banking rules established in accordance with them.

Article 878. Check details

1. The check must contain:

1) the name “check” included in the text of the document;

2) an order to the payer to pay a certain amount of money;

3) name of the payer and indication of the account from which the payment should be made;

4) indication of the payment currency;

5) indication of the date and place of drawing up the check;

6) signature of the person who wrote the check - the drawer.

The absence of any of the specified details in the document deprives it of the validity of a check.

A check that does not indicate the place of its issue is considered to be signed at the place of origin of the drawer.

The percentage statement is considered unwritten.

2. The form of the check and the procedure for filling it out are determined by law and the banking rules established in accordance with it.

Article 879. Payment of a check

1. The check is paid at the expense of the drawer.

In the case of deposit of funds, the procedure and conditions for depositing funds to cover the check are established by banking rules.

2. The check is subject to payment by the payer provided it is presented for payment within the period established by law.

3. The payer of a check is obliged to verify by all means available to him the authenticity of the check, as well as that the bearer of the check is the person authorized by it.

When paying an endorsed check, the drawee is required to verify the correctness of the endorsements, but not the signatures of the endorsers.

4. Losses incurred as a result of the payer paying for a forged, stolen or lost check are borne by the payer or the drawer, depending on whose fault they were caused.

5. The person who paid the check has the right to demand that the check be transferred to him with a receipt of payment.

Article 880. Transfer of rights by check

1. The transfer of rights under a check is carried out in the manner established by Article 146 of this Code, in compliance with the rules provided for by this article.

2. Personal check is non-transferable.

3. In a transfer check, the payer's endorsement has the force of a receipt for receipt of payment.

The endorsement made by the payer is invalid.

A person in possession of a check of exchange received under an endorsement is considered its legal owner if he bases his right on a continuous series of endorsements.

Article 881. Guarantee of payment

1. Payment by check can be guaranteed in whole or in part through Aval.

A guarantee of payment for a check (aval) can be given by any person other than the payer.

2. The aval is placed on the front side of the check or on an additional sheet by writing “considered as aval” and indicating by whom and for whom it was given. If it is not indicated for whom it was given, then it is considered that the aval was given for the drawer of the check.

The aval is signed by the avalist, indicating his place of residence and the date of the inscription, and if the avalist is a legal entity, his location and the date of the inscription.

3. The avalist answers in the same way as the one for whom he gave the aval.

His obligation is valid even if the obligation which he guaranteed is found to be invalid for any reason other than failure to comply with the form.

4. The avalist who pays the check acquires the rights arising from the check against the one for whom he gave the guarantee and against those who are obliged to the latter.

Article 882. Collection of a check

1. Submission of a check to the bank serving the check holder for collection to receive payment is considered presentation of the check for payment.

Payment of the check is made in the manner established by Article 875 of this Code.

2. Funds from a collected check are credited to the check holder's account after receiving payment from the payer, unless otherwise provided by the agreement between the check holder and the bank.

Article 883. Certificate of refusal to pay a check

1. Refusal to pay a check must be certified in one of the following ways:

1) by a notary making a protest or drawing up an equivalent act in the manner prescribed by law;

2) a note from the payer on the check about the refusal to pay it, indicating the date the check was submitted for payment;

3) a note from the collecting bank indicating the date that the check was issued on time and not paid.

2. The protest or an equivalent act must be made before the expiration of the period for presenting the check.

If the check was presented on the last day of the period, a protest or an equivalent act may be made on the next business day.

Article 884. Notice of non-payment of a check

The check holder is obliged to notify his endorser and drawer of non-payment within two business days following the day of the protest or an equivalent act.

Each endorser must, within two working days following the day he received the notice, bring to the attention of his endorser the notice he received. At the same time, a notice is sent to the person who gave the aval for this person.

Those who fail to send a notice within the specified period do not lose their rights. It compensates for losses that may occur due to failure to notify the dishonor of a check. The amount of indemnified damages cannot exceed the amount of the check.

Article 885. Consequences of non-payment of a check

1. If the payer refuses to pay a check, the check holder has the right, at his choice, to file a claim against one, several or all persons obligated on the check (drawer, avalists, endorsers), who are jointly and severally liable to him.

2. The check holder has the right to demand from the indicated persons payment of the amount of the check, their costs for receiving payment, as well as interest in accordance with paragraph 1 of Article 395 of this Code.

The same right belongs to the person obligated on the check after he has paid the check.

3. A claim by the check holder against the persons specified in paragraph 1 of this article may be brought within six months from the date of expiration of the period for presenting the check for payment. Recourse claims on claims of obligated persons against each other are extinguished with the expiration of six months from the day when the corresponding obligated person satisfied the claim, or from the day the claim was brought against him.

| Previous chapter | Content | Next chapter |

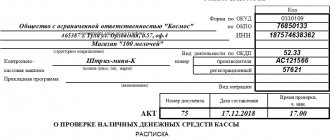

Payment for services of an LLC or individual entrepreneur in cash

Do you sew clothes, repair shoes, consult or provide any other services to the public? You, too, until July 1, 2022, can accept cash from individuals without a cash register, regardless of the tax regime, and instead of checks, issue strict reporting forms to clients.

An exception is catering services. Here, until July 2019, only individual entrepreneurs without employees are allowed to do without a cash register. For others, the indulgence ended on July 1, 2022.

BSO can be purchased at an office supply store or developed independently and ordered from a printing house. In any case, the form must contain the mandatory details listed in clause 3 of the Regulations approved by Resolution 359 of 05/06/2008. The same resolution sets out the rules for recording and storing forms.

You can print forms yourself on a printer only in one case - if special software is used. The automated system keeps records of forms and generates a BSO at the time of settlement with the buyer.

As soon as the period allowed for working without a cash register comes to an end, organizations and entrepreneurs will have to form a BSO using special devices with a fiscal drive and an Internet connection. Essentially these are the same online cash registers.

Do you understand online cash registers?

Let's connect accounting, accounting and cash desk in 20 minutes.

Choose a cash register