All organizations necessarily have to deal with credit institutions. The bank provides services related to finance, and you have to pay for these services. The company incurs fixed costs for banking operations.

What kind of expenses can be considered such expenses? How to correctly reflect them in accounting? How are they treated for tax purposes? What wiring should I use? We explain in detail below, and also consider how specific issues related to the qualification of bank commissions for the most popular services provided to legal entities are correctly resolved.

Question: How is payment for bank services for the monthly transfer of funds from the organization’s current account to the bank accounts of employees when paying wages reflected in the organization’s accounting? In accordance with the collective agreement, wages are transferred to the bank accounts of employees. The cost of the bank's services for transferring funds when paying wages this month, according to the acceptance certificate for services provided, amounted to 7,000 rubles. View answer

What determines financial relations with a bank?

When working with a banking organization, a legal entity enters into a relationship with it with certain obligations of both parties. In order for cooperation to begin, it needs to be documented. These obligations are governed by the agreement signed between the parties:

- to open a bank account (Article 845 of the Civil Code of the Russian Federation);

- for placing a deposit (Article 834 of the Civil Code of the Russian Federation);

- to receive credit funds (Article 819 of the Civil Code of the Russian Federation);

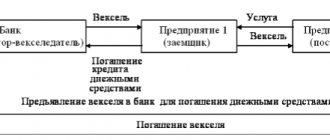

- factoring (financing against the assignment of a claim on funds);

- other financial relationships permitted by the Charter of the credit organization and the legislation of the Russian Federation.

Question: Is it possible for a developer to take into account the costs of bank services for sending an equity participation agreement to Rosreestr under the simplified tax system? View answer

Banking transactions expensed

In accordance with the above-mentioned law, the following are related to the costs caused by banking transactions:

In addition to basic banking operations in Art. 5 of Law No. 395-1 provides a list of services of credit institutions, which, according to the same letter from the Ministry of Finance, are allowed to be accepted for expenses:

Accepted costs must be confirmed by the corresponding primary source. They are taken into tax accounting at the time of payment (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

All other expenses that arise in the course of interaction with banks, not mentioned above, cannot be taken into account for calculating the simplified tax. Let us dwell on individual services of creditors that raise questions when accepted as costs for the simplified tax system.

Paid banking services

Banking operations regulated by domestic legislation are listed in Art. 5 of Federal Law No. 395-1 of December 2, 1990 “On Banks and Banking Activities” as amended on July 26, 2022. The most popular and frequently encountered among them are the following:

- opening and maintaining accounts of legal entities;

- cash settlement services (payments, collection, cash issuance, etc.);

- sale of currency (cash and non-cash form);

- issuing loans;

- trust management of funds and/or property;

- rental of safe deposit boxes for storing papers and valuables;

- lessor functions, etc.

All these operations for the bank client are subject to a commission - a fee for the provision of these services under the concluded agreement.

How to take into account bank services when calculating income tax ?

Refund of bank commission - postings in 1C 8.3

It happens that the bank returns the withheld commission for various reasons: incorrect tariff, excessive withholding, etc.

The reflection of this operation depends on the moment of return:

- immediately after holding;

- after the write-off of the commission is reflected in the reporting.

Refund of commission immediately after deduction

If the write-off and return are reflected in the same period, return to the commission write-off document and correct it to:

- Type of transaction - Other write-off ;

- Debit account - 76.02 “Calculations for claims.”

Select the expense item with the type of movement Other payments for current operations .

Postings

Reflect the return of the commission in the document Receipt to the current account (Bank and cash desk - Bank statements).

Postings

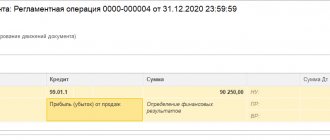

Refund of commission after reporting

Since at the time of withholding it was not known that the commission was withheld unlawfully, its recognition as expenses is not considered an error, and in the return period, income is reflected in the accounting system (clause 2 of PBU 22/2010) and NU (Letter of the Ministry of Finance of the Russian Federation dated 08/13/2012 N 03-03-06/1/408, dated 01/30/2012 N 03-03-06/1/40).

If the commission has already been taken into account in expenses and the period is closed, reflect the return in the document Receipt to the current account (Bank and cash desk - Bank statements).

Postings

If the organization takes a cautious approach and believes that there is no basis for reporting in this case:

- expenses for deducting the commission (clause 1 of Article 252 of the Tax Code of the Russian Federation);

- income from the return of the commission (clause 1 of article 41 of the Tax Code of the Russian Federation),

That:

- reverse the expense to reflect the write-off of the commission in NU;

- do not reflect the income from the return of the commission in tax accounting (indicate the directory article Other income and expenses with the Reflect in tax accounting checkbox cleared);

- submit an updated declaration, because the tax is underestimated (clause 1 of article 81 of the Tax Code of the Russian Federation).

Learn more about ways to adjust your income tax return in 1C 8.3:

- Error: the amount of costs when purchasing services is overestimated. Corrections for income tax: manual completion of an updated declaration

- Error: the amount of costs when purchasing services is overestimated. Corrections for income tax: automatic completion of an updated declaration

We looked at how to reflect operations on deduction and return of bank commissions in 1C 8.3 Accounting.

Test yourself! Take a test on this topic using the link >>

Features of charging fees for banking services

The amount of the bank commission is established in a contractual form. It cannot be changed by any party - neither the client nor the bank; to do this, you will have to change the existing agreement or accept a new one.

FOR YOUR INFORMATION! Commissions are not paid separately; during the operation, the bank withdraws these funds from the customer’s account and issues a special bank order for them.

Clause 9.3 of Regulation No. 383-P, which was approved by the Bank of Russia on June 19, 2012, specifies two equally legitimate options for withdrawing payment for bank services from the client:

- with preliminary acceptance - that is, before money for services is withdrawn, the client must agree to this;

- without informing the payer - automatically.

How to take into account the costs of banking services ?

The terms for collecting commissions are negotiated individually; this can be either a daily calculation or other selected and agreed upon periods.

What services may be included in the RKO package

The set of RKO services usually includes:

- maintaining records of funds in the client's current account;

- crediting cash receipts to the account;

- accepting and crediting cash from the client to the account;

- execution of the company’s instructions to make payments from its account;

- issuing cash from the account, including registration of a checkbook;

- carrying out other operations on the account provided for by law or concluded agreement.

Banks have the right to formulate a tariff policy, drawing up separate packages of settlement services for businessmen and corporate clients with key conditions in the tariffs. The cost of cash settlement depends on the number of commissions included in it for various services.

In most cases, the bank sets the fee for cash settlement services at a fixed amount, which it can write off as a subscription fee even in the absence of settlement transactions. Determining the amount of commission for making payments to another bank is also practiced in a fixed amount for each transfer. And the amount of the commission for issuing funds and acquiring is calculated as a percentage of the amounts for the corresponding transactions. Taking into account all these nuances, the bank forms the cost of a specific set of cash settlement services.

The listed services are not subject to VAT. But there is also a block of taxable services, for example, collection or SMS information. The division of banking services into taxable and non-taxable VAT must be taken into account using separate accounting accounts.

Ambiguous issues of accounting and tax accounting of bank commissions

The organization's fixed costs for paying commissions for banking services must be correctly recorded in accounting. This seemingly simple question contains several pitfalls that a competent accountant needs to avoid.

What are these expenses: other or non-operating?

What cost item should be included in the money charged for services by the bank? On the one hand, these are funds directly related to the activities of the organization. But on the other hand, this connection when paying for banking transactions is not always obvious. For example, a company took out a loan and opened an account to support it. Since this account accompanies a targeted loan intended for running a business, we can talk about “other expenses for production and sales” (clause 1 of Article 264 of the Tax Code of the Russian Federation). But the accompanying invoice itself has nothing to do with the main activity of the legal entity, it only accompanies the loan, so the commission for it can be qualified as non-operating expenses (clause 1 of Article 265 of the Tax Code of the Russian Federation).

IMPORTANT! Tax authorities will not consider any of the positions adopted by the organization an error, since neither other nor non-operating expenses affect the income tax base.

Difficulties of lending

Taking out a loan is a popular and widely demanded banking service. Often, the loan agreement includes conditions for the company to make additional payments to the bank. How to correctly account for the commission for these services? The Ministry of Finance responds in two ways:

- if commissions are expressed as a fixed figure, then these expenses can be regarded as other or as non-operating expenses;

- if the commission represents a certain share (percent), the expenses will be treated as “interest on debt obligations” (Article 269 of the Tax Code of the Russian Federation).

NOTE! The commission for a number of other banking services, such as opening a letter of credit, factoring agreement, etc. should also be qualified as a percentage of the debt obligation (letters of the Ministry of Finance of the Russian Federation dated June 18, 2009 No. 03-03-06/1/408 and dated May 13 2009 No. 03-07-11/136).

Making payments for the purchase of assets

The bank can participate in such operations not only by processing payment instruments, but also, for example, by opening a letter of credit. The accountant has a question: are bank commissions included in the initial cost of the asset purchased in this way? After all, it consists of all the costs of acquiring it. Or should we include it among other or non-operating expenses as a fee for a banking service?

The last position is more profitable for the company because:

- the amount is written off from taxable income immediately and not through depreciation;

- contracts for the purchase of an asset and for payment for a banking service are not related to each other.

Salary card service

This is the predominant method of paying labor remuneration today. The bank, of course, charges a commission for crediting money to employees’ card accounts, as well as for the plastic cards themselves. Tax authorities do not recognize the same expenses:

- The fee for processing documents for crediting salary funds is part of the production costs for organizing settlements with personnel. Therefore, it is legitimate to take this money into account as production costs that reduce the organization’s profit (letters from the Ministry of Finance of the Russian Federation dated April 20, 2009 No. 03-03-06/2/88 and dated August 4, 2008 No. 03-04-06-02/88).

- The payment to the bank for issuing, re-issuing and servicing plastic cards is not directly related to the costs of paying salaries, that is, it is not justified from the point of view of the company’s expenses (the costs are borne by the organization, and employees use the cards). In light of the latest clarifications from the Ministry of Finance, these costs are allowed to be included in other expenses, while excluding them from the income of employees, because employees do not choose this particular form of receiving wages, it is prescribed in their employment contracts, which means that the cards are made by the bank specifically for the company, and not for them personally.

Commission for “non-banking” services provided by the bank

One of the important points when reflecting bank commissions as expenses reflected on the taxable base is to determine whether they relate directly to banking services. If the bank charged a commission for a service not included in the list of Federal Law No. 395, for example, provided advice, the company can no longer recognize these funds as other or non-operating expenses and reduce taxable profit. It will be necessary to qualify such payments as costs for consulting and other services or as other costs of production or sales (subparagraphs 15 and 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation).

Commission of the bank

Commission of the bank

Banking fees are a common expense item for a company. The bank charges a fee for each service provided. Paid services include: current account services, processing payment orders, issuing bank statements and much more.

Let's look at accounting:

In accounting, bank services are classified as other expenses (clause 11 of PBU 10/99) and are accounted for as the debit of account 91.02 “Other expenses”.

Let's look at tax accounting:

For profit tax purposes, banking services are classified as non-operating expenses (clause 15, clause 1, article 265 of the Tax Code of the Russian Federation).

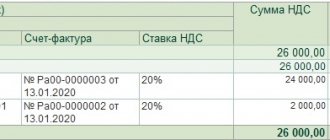

Most banking services are not subject to VAT, so tax is not deductible for them. At the same time, there are banking services for which the bank charges VAT and issues invoices.

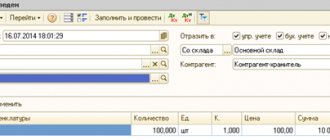

Let's look at how the bank commission is reflected using the example of the 1C: Enterprise Accounting configuration, edition 3.0.

Expenses for bank services (bank commission) are reflected in the program as the document “Write-off from the current account”.

In the Bank and cash desk - Bank statements section, click Write-off. Fill in the required fields.

- document transaction type - “Bank Commission”;

- in the “Recipient” field, select the servicing credit institution;

- in the “Amount” field, indicate the amount of the bank commission written off;

- in the “Expense Item” field, indicate the cash flow item (if accounting in the program is carried out according to cash flow items).

In order for an expense item to be added automatically, you must fill in the “Use by default in operations” field in the item itself, indicating the value “Payment of bank commission”.

The document generates a posting to the debit of account 91.02 “Other expenses” and the credit of account 51 “Current accounts”.

Please note that if your postings on account 91.02 also did not contain analytics as indicated in the figure above, then you need to check the following settings.

In the Directories section - Income and expenses - Other income and expenses. In the directory of items of other income and expenses, we find the one we need (if necessary, create a new one) and fill in the “Default Use” field, indicating the value “Document “Write-off from the current account”, used when downloading from the client bank.”

Save the settings and repost the document. Let's look at the result of the document. Now the necessary analytics are filled in on account 91.02.

The consultation was prepared for you by a specialist from our Consultation Line.

Order a test consultation on your program with us by phone.

*To provide consultation, you must provide the TIN of your organization, the registration number of your program (for 1C:Enterprise programs of the PROF version, an active 1C:ITS PROF agreement is required)