Closing accounting accounts: postings

The main transactions accompanying the closure of accounts are, for example, the following:

| Operation | D/t | K/t |

| Costs taken into account: | ||

| 20, 23 | 02, 10, 60, 62, 69, 70, 71, 76 |

| 25, 26 | 02, 10, 29, 60, 69, 70, etc. |

| At the end of the reporting period, production accounts are closed | 90, 91 | 20, 23, 25, 26, 29 |

| If according to 90 (91) credit turnover is greater than debit turnover (profit will be reflected in credit account 99) | 90/9 (91/9) | 99 |

| If the debit turnover exceeds the loan amount, then a loss is incurred - a debit to the account. 99 | 99 | 90/9 (91/9) |

Procedure for closing accounting accounts

They start resetting the data from the block of production accounts, i.e. those that accumulate costs for the main, auxiliary and service production (accounts 20, 23, 29), general production/general expenses (accounts 25,), or for the sales expense account in trading enterprises (account 44). In the course of the enterprise’s activities, these expenses are summarized in the debit of these accounts, and at the end of the month or year they are transferred from credit to debit in sales accounts and other expenses (accounts 90 and).

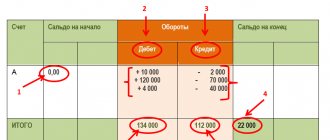

The purpose of closing is to generate a financial result, therefore the main stage of closing the month is to reset the data on the productive accounts - 90 and 91. To do this, it is necessary to compare the debit and credit turnovers - if the credit one is greater than the debit one, then we are talking about profit, and, conversely, if it exceeds debit turnover - about losses at the end of the period. Let's figure out how to formalize the closing process in accounting.

We launch the procedure “Closing the month”

Let's see how our turnover has changed.

I'll comment a little.

Look, account 26 at the end of the month was “closed” - it became 0. This is good. Here's a wiring diagram showing how it happened.

As we can see, expense accounts “transfer” their accumulated amounts from their Credit to Debit account to the financial result account. Remember the financial result formula? What accounts are involved?

So, Debit 90 and 91 accounts collect the expenses of our company for the current month. Now we can calculate the financial result for each of them. Calculating the financial result is some kind of action on 90, 91 accounts. As you remember, accounts 90 and 91 after summing up the financial result should be equal to 0. And the final result of financial activity will be on account 99.

Zero balances for accounts 90 and 91 should be for the account as a whole. Sub-accounts of these accounts will have balances until December 31, pending the procedure - balance reformation. But more on that later.

This is how the situation looks in our SALT for accounts 90, 91 and 99. This situation arises after the “transfer” of expenses to account 90, BUT before closing 90, 91.

Look, I have highlighted key accounts from the entire SALT to show the intermediate stage of “closing the month”. We see that account 26 has been closed: its balances are zero. And, in our case, the amount of account 26 was displayed in the Debit of account 90.

In our example, the company has only account 26. If there were an account 44, it would also be closed and the amount from it would go to the Debit of account 90.

Thus, Debit 90 of account collects amounts from the company’s expense accounts, plus accumulates the cost of goods sold and products. Cost, as you understand, is available to manufacturing and trading companies. For us, only accumulated expenses from account 26.

Now we see that on accounts 90 and 91 different amounts were formed for Debit Turnover (DO) and Credit Turnover (CR). It turns out that for each of these accounts there is a final balance: 1705778.54 and 11374.53. Now it doesn’t make much difference for us where this balance is - in Debit or Credit. Only one thing is important to us:

Closing accounts 90 and 91 implies such actions so that the balance turns to zero. Those. we must make such entries for each account in correspondence with 99 so that our numbers - 1705778.54 and 11374.53 - go away. Those. the remainder would become zero. This is the rule for closing a total of 90 and 91 accounts - the balance on them should be zero.

And in order for the balances to become zero, we must transfer the existing differences between DO and KO (these are final balances) by posting to account 99. In other words, for account 90 we will “add” 1705778.54 to Debit. — for 91 accounts we will “add” 11374.53 to the Credit

The following report shows how we “add the necessary numbers” through postings, thereby closing accounts 90 and 91. The closure of these accounts will be correct if, after that, their balances at the end of the period (month) become 0.

As you can see, the closure of accounts 90 and 91 goes through their internal subaccounts 90.9 and 91.9 in correspondence with account 99. Where 90.9 (91.9) will appear in the Debit or Credit entry depends on where there are not enough amounts so that the account at the end of the period gives 0.

Account 91 Other income and expenses: typical transactions

Account 91 “Other income and expenses” is intended to summarize information on other income and expenses of the reporting period.

In the credit of account 91 “Other income and expenses” during the reporting period the following is reflected:

- receipts related to the provision for a fee for temporary use (temporary possession and use) of the organization's assets - in correspondence with the accounts of settlements or cash;

- receipts related to the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property - in correspondence with accounts of settlements or cash;

- receipts related to participation in the authorized capitals of other organizations, as well as interest and other income on securities - in correspondence with settlement accounts;

- profit received by the organization under a simple partnership agreement - in correspondence with account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for due dividends and other income”);

- receipts related to the sale and other write-off of fixed assets and other assets other than cash in Russian currency, products, goods - in correspondence with the accounts of settlements or cash;

- receipts from operations with containers - in correspondence with container accounting and settlement accounts;

- interest received (receivable) for the provision of funds to the organization for use, as well as interest for the use by a credit organization of funds located in the organization’s account with this credit organization - in correspondence with the accounts of financial investments or funds;

- fines, penalties, penalties for violation of the terms of contracts, received or recognized for receipt - in correspondence with accounts of settlements or cash;

- receipts related to the gratuitous receipt of assets - in correspondence with the accounting account for deferred income; receipts for compensation of losses caused to the organization - in correspondence with settlement accounts;

- profit of previous years, identified in the reporting year, - in correspondence with the accounts of settlements;

- amounts of accounts payable for which the statute of limitations has expired - in correspondence with accounts payable accounts;

- exchange rate differences - in correspondence with accounts for cash, financial investments, settlements, etc.; Other income.

The debit of account 91 “Other income and expenses” during the reporting period reflects:

— expenses associated with the provision for a fee for temporary use (temporary possession and use) of an organization’s assets, rights arising from patents for inventions, industrial designs and other types of intellectual property, as well as expenses associated with participation in the authorized capital of other organizations — in correspondence with cost accounts;

- the residual value of assets for which depreciation is charged, and the actual cost of other assets written off by the organization - in correspondence with the accounts of the corresponding assets;

- expenses associated with the sale, disposal and other write-off of fixed assets and other assets other than cash in Russian currency, goods, products - in correspondence with cost accounts;

— expenses for operations with containers — in correspondence with cost accounts;

- interest paid by an organization for providing it with funds (credits, borrowings) for use - in correspondence with the accounts of settlements or funds;

- expenses associated with payment for services provided by credit institutions - in correspondence with settlement accounts; fines, penalties, penalties for violation of the terms of contracts, paid or recognized for payment - in correspondence with the accounts of settlements or cash;

- expenses for the maintenance of production facilities and facilities under conservation - in correspondence with cost accounts;

- compensation for losses caused by the organization - in correspondence with settlement accounts;

- losses of previous years recognized in the reporting year - in correspondence with the accounts of settlements, depreciation, etc.;

- deductions to reserves for the depreciation of investments in securities, for a decrease in the value of material assets, for doubtful debts - in correspondence with the accounts of these reserves;

- amounts of receivables for which the statute of limitations has expired, other debts that are unrealistic for collection - in correspondence with the accounts receivable; exchange rate differences - in correspondence with accounts for cash, financial investments, settlements, etc.;

- expenses associated with the consideration of cases in courts - in correspondence with accounts of settlements, etc.; other expenses.

Subaccounts can be opened to account 91 “Other income and expenses”: - 91-1 “Other income”; — 91-2 “Other expenses”; — 91-9 “Balance of other income and expenses.” Subaccount 91-1 “Other income” takes into account receipts of assets recognized as other income. Subaccount 91-2 “Other expenses” takes into account other expenses.

Subaccount 91-9 “Balance of other income and expenses” is intended to identify the balance of other income and expenses for the reporting month.

Entries in subaccounts 91-1 “Other income” and 91-2 “Other expenses” are made cumulatively during the reporting year. By monthly comparison of debit turnover in subaccount 91-2 “Other expenses” and credit turnover in subaccount 91-1 “Other income”, the balance of other income and expenses for the reporting month is determined. This balance is written off monthly (with final turnover) from subaccount 91-9 “Balance of other income and expenses” to account 99 “Profits and losses”. Thus, synthetic account 91 “Other income and expenses” does not have a balance as of the reporting date.

At the end of the reporting year, all subaccounts opened to account 91 “Other income and expenses” (except for subaccount 91-9 “Balance of other income and expenses”) are closed with internal entries to subaccount 91-9 “Balance of other income and expenses”.

Analytical accounting for account 91 “Other income and expenses” is carried out for each type of other income and expenses. At the same time, the construction of analytical accounting for other income and expenses related to the same financial and business transaction should provide the ability to identify the financial result for each operation.

WHAT IS PERIOD CLOSURE?

In a computerized accounting system, closing a period means performing a set of routine operations . Depreciation is calculated, cost accounts are closed, sub-accounts (accounts) for sales, other income and expenses, sub-accounts (accounts) for accounting for financial results.

Closing a period also means limiting access rights to transactions in a computer database in completed months . Usually only the viewing mode remains.

This is necessary so as not to mistakenly reflect transactions of the reporting period in previous months and not to change the recorded financial information of past periods. After all, if you submit late documents in the month that has ended, for which declarations and calculations have already been generated, all the results will change.

This entails endless updated declarations and calculations, constant adjustments to internal financial reports. To avoid such problems, the period is closed - the rights to edit entered documents and transactions are limited.

Closing a period is not only a software functionality. It is based on compliance with certain requirements of accounting legislation:

- monthly calculation of depreciation amounts;

- monthly closure of cost accounts if there is no work in progress;

- monthly closing of account 90 “Sales” and account 91 “Other income and expenses”;

- at the end of the year - reformation of the balance sheet, that is, the closure of sub-accounts opened to accounts 90 and 91, account 99 “Profits and losses”.

FOR YOUR INFORMATION

Reformation of the balance sheet is the distribution of profits received during the reporting year or the write-off of losses received during the year, which represents the closure of financial results accounts.

Period closure is understood as a set of accounting and software actions, the implementation of which implements the requirements of the accounting methodology, including in relation to the software functionality of computerized accounting systems.

Closing a period concerns not only accounting, but also other departments. Data on the execution of budgets and new forecasts depend on the closing date of the period. This is a direct connection with financiers and economists. These are the deadlines for submitting documentation and presenting forecast data, allocating new funding for other departments.

How to determine the financial result?

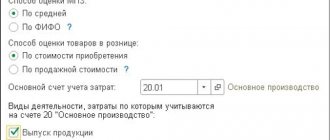

In this case, account 90 is closed, all subaccounts remain with an open balance. To close synthetic balances, it will be necessary to make correspondence with account 90.09. The posting depends on whether the sales result is profitable or unprofitable. The financial result is calculated using the formula:

- Revenue (90.01) - cost (90.02-90.08).

If the difference is positive, then a profit is generated and reflected by the posting:

- Dt 90.09 Kt 99 “Profits and losses.”

Therefore, a negative difference implies a loss and forms a reverse entry:

- Dt 99 Kt 90.09.

For example, Sandman LLC provided services for holding events in the amount of 52,952,105.23 rubles, including VAT 8,077,439.78. The cost amounted to 38,745,863.10 rubles. During the month the following transactions were reflected:

- Dt 62 “Settlements with buyers and customers” Kt 90.01 – sales in the amount of 52,952,105.23 rubles;

- Dt 90.03 Kt 68.02 “Value added tax” - VAT is charged for payment of sales of 8,077,439.78 rubles;

- Dt 90.02 Kt 41 “Goods” - the cost of sales was written off in the amount of RUB 38,745,863.10.

You can calculate the financial result that needs to be reflected to the accountant:

- 52,952,105.23 - 38,745,863.10 - 8,077,439.78 = 6,128,802.35 rubles.

Since in the end there was a profit, it is necessary to close the month with the following posting:

- Dt 90.09 Kt 99 - in the amount of 6,128,802.35 rubles of profit received.

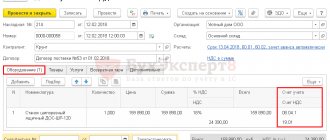

The correspondence of turnover is clearly visible in the download from the program:

Table 1. Analysis of invoice 90 for January 2022, Sandman LLC

| Check | Cor. Check | Debit | Credit |

| 90.01 | Turnover | 52.952.105,23 | |

| Closing balance | 52.952.105,23 | ||

| 90.02 | Turnover | 38.745.863,10 | |

| Closing balance | 38.745.863,10 | ||

| 90.03 | Turnover | 8.077.439,78 | |

| Closing balance | 8.077.439,78 | ||

| 90.09 | Turnover | 6.128.802,35 | |

| Closing balance | 6.128.802,35 | ||

| 90 | Turnover | 52.952.105,23 | 52.952.105,23 |

| Closing balance |

Output data: BU (accounting data)

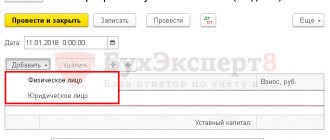

Stages of balance reform

Let's remember what happens in practice when reforming the balance (note that if you work in the program, then it performs all operations automatically when you press one button). So, the balance sheet reformation takes place in several stages.

- Closing accounts in which income and expenses were recorded during the reporting year. These are accounts 90 “Sales” and 91 “Other income and expenses”. After the reformation there should be no balances in these accounts. These accounts are closed in correspondence with account 99 “Profits and losses”.

- Formation of an indicator of retained earnings or uncovered loss for the financial year. That is, this is the closure of account 99, when the data from this account is written off as a credit or debit to account 84 “Retained earnings (uncovered loss).”

In other words, by writing off the balances on account 99 to account 84, the financial result obtained by the company over the past year is included in retained earnings or uncovered losses.

Read in the berator “Practical Encyclopedia of an Accountant”

Balance Reformation

Example. How is the balance sheet reformation reflected in the accounting accounts? Let’s assume that in the reporting year the company reflected the following business transactions:

- Debit 62 Credit 90

- 100,000 rub. – income received from the sale of goods;

- 70,000 rub. – the cost of goods sold is written off;

- 10,000 rub. — interest accrued on the loan issued;

- 5,000 rub. – corporate income tax has been assessed.

On December 31, the accountant reformed the balance sheet:

- Debit 90 Credit 99

- 30,000 rub. (100,000 – 30,000) - profit from the sale of goods is reflected;

- 10,000 rub. — profit from the operation of issuing a loan is reflected;

- 35,000 rub. (30,000 + 10,000 – 5,000) - reflects retained earnings of the reporting year.