If the product does not comply with the terms of the contract or is of poor quality, the buyer has the right to return it to the supplier. Registration of returning goods to a supplier in 1C has a number of features that we will consider in the article.

You will learn:

- how to make a return to the supplier in 1C 8.3;

- what documents need to be used;

- what transactions for returning to the supplier are generated in 1C 8.3.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

What you need to pay attention to when returning to the supplier in 1C 8.3

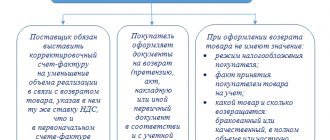

Registration of a return transaction to a supplier in 1C 8.3 Accounting depends on some nuances:

- whether the Organization (buyer) is a VAT payer;

- whether the goods are registered before they are returned.

In this case, a quality or low-quality product is returned, does not affect the design.

Returning materials to a supplier in 1C 8.3 is no different from returning goods, so the step-by-step instructions for returning goods to a supplier are also suitable for returning other materials. Postings in 1C 8.3 for returning materials to the supplier are similar.

Let's look at step-by-step instructions on how to return goods to a supplier in 1C in various circumstances and what transactions are generated by 1C Accounting 8.3 in each case.

Return to the supplier of goods not accepted for registration in 1C 8.3

On September 10, the organization’s warehouse received the goods “Chairman Parm” Sofa (10 pcs.) from the supplier MebelLand LLC in the amount of 300,000 rubles. (including VAT 20%). Upon acceptance of the goods, a defect was discovered (5 pieces).

On September 13, the defective product was returned to the supplier.

If a defective product is taken into custody or only part of it is returned, then the low-quality product is first registered and then returned to the supplier.

Receipt of goods

How to issue a return to a supplier in 1C 8.3? Document the receipt of goods at the warehouse using the document Receipt (act, invoice, UPD) transaction type Goods in the Purchases .

In the document, indicate the quality and defective goods in separate lines:

- % VAT : for quality goods - 20% ;

- for defective goods - Without VAT ;

- for quality goods - 41.01 “Goods in warehouses”;

Postings

Postings upon receipt of goods not accepted for registration.

The document generates transactions:

- Dt 60.01 Kt 60.02 - offset of advance payment to the supplier;

- Dt 41.01. Kt 60.01 - acceptance of quality goods for accounting;

- Dt 002 - reflection of goods not accepted for registration;

- Dt 19.03 Kt 60.01 - for quality goods, VAT is accepted for accounting.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice, UPD) and click the Register .

Invoice document will be automatically filled in.

When the Reflect VAT deduction in the purchase book by the date of receipt , the document generates the following posting:

- Dt 68.02 Kt 19.03 - VAT on quality goods is accepted for deduction.

Returning goods to the supplier

How to return goods to the supplier in 1C? For the return of goods not accepted for registration to the supplier, document the return of goods to the supplier transaction type Purchase, commission based on the document Receipt (act, invoice, UPD) transaction type Goods (invoice, UPD) or in the Purchases .

If the document was created based on receipt, the data will be filled in automatically. In the document, leave only the line with the item being returned.

Postings

The document generates transactions:

- Kt 002 - goods returned to the supplier, not accepted for registration.

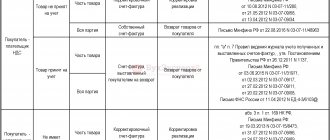

An invoice for the return of goods not accepted for accounting is not issued. An adjustment invoice from the supplier issued for a partial return of goods is not registered in the purchase book (Letter of the Ministry of Finance of the Russian Federation dated February 10, 2012 N 03-07-09/05). If necessary, save the CSF in the archive.

Return of quality goods: how to record them

The return of quality goods occurs as part of a normal purchase and sale transaction. In this case, the goods are sold at the cost of acquisition. In this situation, no reversal entries are made.

An example will help us understand the transactions for returning a quality product to a supplier.

Shop No. 7 LLC received a batch of men's suits from the supplier Tekhnologiya LLC. However, it later turned out that the suits were shipped in the wrong size range: instead of the ordered running sizes M and L, all the suits turned out to be size 5XL. The costumes “for giants” had to be returned to the supplier ─ there was no demand for them.

The following entries were made in the accounting of LLC “Magazin No. 7”:

| Accounting entries | Contents of operation | |

| Debit | Credit | |

| 41 | 60 | A batch of men's suits has been received |

| 19 | 60 | VAT allocated |

| 68 | 19 | VAT is accepted for deduction |

| 62 | 90 | Revenue from the return of quality goods is reflected |

| 90 | 41 | The cost of the returned goods is written off |

| 90 | 68 | VAT is charged on the cost of the returned goods |

| 60 | 62 | Debt to supplier offset |

The accounting of the supplier (Technology LLC) will also have two blocks of postings:

- sale of costumes to the buyer;

- receipt of returned suits from the buyer (as part of reverse sales).

How to fill out a return invoice is described in this publication.

Return to the supplier of goods accepted for registration in 1C 8.3

On January 10, the Organization purchased the “Imperial” Table (100 pcs.) from the supplier “CLERMONT” LLC for the amount of RUB 240,000. (including VAT 20%). On the same day, the goods arrived at the warehouse and were accepted for accounting.

On February 7, part of the goods (38 pieces) was returned due to a defect.

Receipt of goods

The purchase of goods is documented with the document Receipt (act, invoice, UPD) transaction type Goods (invoice, UPD) in the Purchases .

Study in more detail 1C: Typical scheme for purchasing goods in wholesale trade

Postings

Postings are generated:

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

- Dt 19.03 Kt 60.01 - VAT accepted for accounting.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

When the Reflect VAT deduction in the purchase book by the date of receipt , the document generates the following posting:

- Dt 68.02 Kt 19.03 - VAT accepted for deduction.

Returning goods to the supplier

How to reflect the return of goods to the supplier in 1C? Fill out the return of goods accepted for registration with the document Return of goods to supplier transaction type Purchase, commission based on the document Receipt (act, invoice, UPD) transaction type Goods (invoice, UPD) or in the Purchases .

It does not matter whether part of the goods or the entire batch is returned.

If the document was created based on receipt, the data will be filled in automatically.

Calculations

tab unchanged.

Postings

Postings are generated:

- Dt 76.02 Kt 41.01 - goods returned to the supplier;

- Dt 76.02 Kt 68.02 - VAT on returned goods has been restored.

The return of goods to the supplier is reflected according to Dt 76.02 “Calculations for claims” (chart of accounts 1C). If the returned goods have not previously been paid for, then when returning to the supplier in 1C 8.3, an additional entry Dt 60.01 Kt 76.02 is generated, which automatically reduces the debt to the supplier by the amount of the returned goods.

Registration of CSF supplier

Register the adjustment SF at the bottom of the document form Return of goods to supplier .

Adjustment invoice received will be automatically created .

- Operation type code — .

Return of goods: Reverse sales or corrective postings?

Situations when the buyer is forced to return the goods to the supplier are very common in practice. The reasons for the return may be different. The answer to the question depends on these reasons: does the so-called reverse implementation occur in one case or another or not? Let's try to figure it out.

All cases of returning goods can be divided into two groups: - when goods are returned that do not meet the terms of the contract - defective, supplied in the wrong quantity or assortment, etc. (we will call them low-quality goods);

– when, by agreement of the parties, a quality product is returned. Let's look at each of them in detail. Return of low-quality goods

The company can return the goods to the supplier, refusing the purchase and sale agreement, in one of the following cases: – the goods were not delivered in the quantity stipulated by the contract (Article 466 of the Civil Code of the Russian Federation); – the terms of the assortment agreement were violated (Article 468 of the Civil Code of the Russian Federation); – incomplete goods were delivered, and the seller did not comply with the buyer’s requirements to complete the goods within a reasonable time (Article 480 of the Civil Code of the Russian Federation); – low-quality goods were supplied, and the defects of the goods are significant, that is, they cannot be eliminated or this requires disproportionate costs, time, etc. (Article 475 of the Civil Code of the Russian Federation).

It must be said that in the first three of these cases, returning the goods is not the only way out of the situation. For example, having received products in quantities other than those stipulated in the sales contract, the purchasing company can simply demand additional delivery from the supplier. And if you receive a product of the wrong assortment, make a request to the supplier to replace the product. However, in practice, buyers, having received a product that does not comply with the terms of the contract, no longer trust such a supplier, seeking to break off all contractual relations with him. In this case, we are interested in how such a break in relations will be recorded in accounting? So, if the buyer terminates the purchase and sale agreement with the supplier for the reasons provided for by the Civil Code of the Russian Federation, we can say that the obligations of the parties under the agreement have not been fulfilled (the supplier did not deliver the required goods, and the buyer did not accept it, and it is possible that did not pay). And if so, then there is no fact of implementation. This means that when returning goods, we do not have a reverse transfer of ownership, but a waiver of ownership of the received goods. In other words, if the buyer has already recorded the goods in accounting, then he needs to make corrective (reversing) entries. If the buyer discovers that the goods are of poor quality before accepting them for accounting, then until such goods are returned, they must be reflected on the balance sheet - on account 002 “Inventory assets accepted for safekeeping.”

Now let's talk about what to do with the invoice received from the supplier. If the buyer discovers defects in the goods during the acceptance process, then he does not register the supplier's invoice in the purchase book. Accordingly, “input” VAT is not subject to deduction. When returning goods that have not been accepted for registration, the buyer does not issue an invoice for it to the supplier. This was indicated by the Russian Ministry of Finance in a letter dated March 7, 2007 No. 03-07-15/29. In turn, the seller makes corrections to his own invoice originally issued to the buyer. He does this on the day the returned goods are accepted for registration. In the revised invoice, the supplier additionally indicates the quantity and value of the returned goods. And then registers this document in the purchase book (for the amount of the return). Thus, the failed seller receives the right to deduct VAT (the same tax was previously assessed upon shipment of goods) on returned valuables (clause 5 of Article 171 of the Tax Code of the Russian Federation).

**************** OUR REFERENCE 1****************** The wording of paragraph 5 of Article 171 of the Tax Code of the Russian Federation reads verbatim as follows: “Deductions are subject to the amounts of tax presented by the seller to the buyer and paid by the seller to the budget when selling goods, in the event of the return of these goods... or refusal of them.”

In practice, tax authorities like to interpret these words literally. And they allow sellers to offset VAT on returned valuables only after the tax accrued on the sale of these valuables has been paid to the budget.

******************END OF OUR REFERENCE 1**************** Example 1 In March 2008, Ariadna LLC shipped by rail transport to Perseus CJSC a consignment of goods in the amount of 100 units in the amount of 11,800 rubles, including VAT - 1,800 rubles.

In April 2008, Perseus partially capitalized these goods: 20 units worth 2,360 rubles. (including VAT - 360 rubles) were not accepted for accounting due to defects. In the same month, the low-quality products were returned to the supplier.

The accountant of Ariadna LLC makes corrections to the invoice issued to Perseus when shipping goods. In it, he shows the quantity (80 units) and cost (9440 rubles) of goods actually registered by the buyer. It is these data that Perseus CJSC will register in its purchase book as soon as it receives the corrected document.

In addition, the accountant of Ariadna LLC additionally indicates the quantity (20 units) and cost (2360 rubles) of the returned goods. The supplier registers the corrected invoice in its purchase book for April 2008 as follows: – in columns 5, 5a and 5b of the book, indicates its name, tax identification number and checkpoint; – in column 7 – the cost of the returned goods including VAT (RUB 2,360); – in column 8a – the cost of the returned goods without VAT (2000 rubles);

– in column 8b – VAT on the returned shipment (360 rubles).

************END OF EXAMPLE****************

A similar procedure applies if the buyer rejects the entire shipment of goods. The only difference is that in this case the former buyer will not have to register anything in the purchase book at all. And the unsuccessful seller will reflect in his purchase book the entire amount of the invoice previously issued for the product that the partner was not satisfied with.

But what if the buyer received the goods, registered the seller’s invoice in the purchase book, accepted the “input” VAT for deduction, and only then discovered defects in the goods? In this case, the Ministry of Finance of Russia, in the same letter No. 03-07-15/29, recommends doing so. The buyer must issue his invoice to the supplier and record it in the sales ledger. This must be done for the tax period in which the goods are returned.

Example 2

Mania LLC entered into a purchase and sale agreement for the purchase of a batch of electric kettles (1000 pieces at a price of 1,770 rubles per piece, including VAT - 270 rubles per piece). Having received the goods in February 2008 and reflected it in accounting, Mania LLC discovered that the kettles were defective - their heating element did not work. However, by this time the company had already registered the teapots and deducted the “input” VAT on them from the budget (goods are accounted for at purchase prices). The accountant reflected the receipt of the goods with the following entries:

DEBIT 41 CREDIT 60 – 1,500,000 rub. ((1,770,000 rubles - 270 rubles) X 1000 pcs.) – the goods are capitalized;

DEBIT 19 CREDIT 60

– 270,000 rub. (270 rub. X 1000 pcs.) – VAT on the product is reflected;

DEBIT 68 subaccount “Calculations for VAT” CREDIT 19 – 270,000 rub. – VAT on goods has been accepted for deduction from the budget.

The algorithm for returning defective goods to the supplier (the return takes place in April 2008) is as follows. First, you need to adjust the transactions for the receipt of goods by making the following corrective entries:

DEBIT 41 CREDIT 60

– 1,500,000 rubles – the posting of goods was reversed;

DEBIT 19 CREDIT 60

– 270,000 rub. – the “input” VAT on the capitalized goods was reversed;

DEBIT 68 subaccount “VAT calculations” CREDIT 19

– 270,000 rub. – the deduction of “input” VAT has been reversed.

Mania LLC must then issue an invoice to the former supplier for the cost of the returned goods. The company must register this invoice in the sales book in the second quarter of 2008, that is, in the tax period in which the goods are returned.

*** ********end of example*******************

As for the seller, he (if the buyer has already accepted the goods for accounting) needs to act like this. Having received an invoice issued by an unsuccessful buyer, you need to register it in the purchase book. Having reflected the receipt of returned goods, the seller can deduct the VAT specified in this document (clause 5 of Article 171 of the Tax Code of the Russian Federation).

Return of quality goods

It happens that, having purchased a product, a company cannot sell it due to low demand or simply does not have time to sell it before the product expires. By agreement with the supplier, these reasons may also be grounds for returning the goods. But let’s make a reservation right away: such a return is not provided for by the Civil Code of the Russian Federation and is possible only by agreement of the parties. And here it is no longer possible to say that the terms of the purchase and sale agreement are canceled. The obligation to supply goods of proper quality has been fulfilled and terminated (Article 408 of the Civil Code of the Russian Federation). Therefore, the return of such goods is considered a reverse sale.

*******************TAKE OUT 3******************************** If, after purchasing the product, the company cannot sell it due to low demand, then it can no longer be said that the terms of the purchase and sale agreement are canceled. Therefore, such a return is considered a reverse implementation

****************************END OF TAKEAWAY 3******************

The buyer pays VAT (level 2)

In this case, the former buyer will no longer have to make corrective entries, but will have to reflect the full sale of the goods (of course, by issuing an invoice and registering it in the sales book).

Example 3 Let's use the conditions of example 2. But let's assume that under the terms of the agreement between the supplier and the buyer (Mania LLC), the latter can return the teapots if they are not sold before April 1, 2008. All kettles are in good working order. Mania LLC did not sell a single piece from the batch within the established period. Therefore, the company returns the goods to the supplier. On the day of return, the buyer's accountant issued an invoice in the amount of RUB 1,770,000. and registered it in the sales book.

The following entries are made in the accounting of Mania LLC:

DEBIT 62 CREDIT 90 – 1,770,000 rub. – the return of goods is reflected;

DEBIT 90 CREDIT 68 subaccount “VAT calculations” – 270,000 rubles. – VAT is charged on sales;

DEBIT 90 CREDIT 41 – 1,500,000 rub. – the cost of the returned batch of teapots has been written off.

***********END OF EXAMPLE***************

The seller’s actions in this situation are similar to those in the case of returning a low-quality product accepted for registration by the buyer. The former supplier will receive an invoice from the former buyer and record it in the purchase ledger. The seller will capitalize the returned goods and deduct VAT on them.

The buyer does not pay VAT (level 2)

Let’s assume that the former buyer of the product (and now its seller) applies the “simplified tax system”, pays UTII, that is, is not a tax payer. This means that he cannot issue an invoice upon return. In such a situation, does the former supplier have the right to deduct VAT on returned goods? Oddly enough, the Ministry of Finance now believes that it has the right (letter dated March 7, 2007 No. 03-07-15-29). Financiers propose to act in the same way as in the case when the buyer refused a low-quality product without having time to register it. Namely, the former seller must correct its own invoice previously issued to the buyer. Then register this document in the purchase book (for the refund amount). And it turns out that the failed seller will be able to offset VAT on the returned values.

In this case, it does not matter for what reason the goods are returned and whether the buyer - a VAT evader - accepted the value for accounting at the time of return or not.

What should a seller do if a person returns the goods? In this case, financiers recommend registering in the purchase book the details of the cash receipt issued when returning money from the cash register. After registering the returned goods, the seller will be able to deduct VAT.

***********FROM THE EDITOR*************** Some experts believe that when returning goods, the former buyer must transfer VAT to the supplier by payment by order. They say that a transaction is taking place similar to commodity exchange operations, the offset of mutual claims and settlements with securities. And in such transactions, the tax must be transferred to the partner in real money (Clause 4 of Article 168 of the Tax Code of the Russian Federation).

However, this point of view is wrong. If the goods are returned to the supplier, then “tax amounts... are subject to deductions and are not compensated at the expense of the buyer...”.

This means that when returning goods to the seller, the buyer does not have to transfer the amount of tax by payment.

This is exactly what financiers said in a letter dated April 27, 2007 No. 03-07-11/128.

********************************END FROM EDITOR**********************

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Return of goods by VAT non-payer

On March 29, the organization’s warehouse received the goods Computer desk “Boomerang-3N(M)” (10 pcs.) from the supplier KMH LLC in the amount of 144,000 rubles. (including VAT 20%).

On April 8, part of the goods (2 pieces) was returned due to a defect.

Receipt of goods

The purchase of goods is reflected in the document Receipt (act, invoice, UPD) transaction type Goods (invoice, UPD) in the Purchases .

Study in more detail 1C: Typical scheme for purchasing goods in wholesale trade

Postings

Postings are generated:

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice, UPD) and click the Register .

Invoice document will be automatically filled in.

Returning goods to the supplier

Fill out the return of goods with the document Return of goods to supplier transaction type Purchase, commission based on the document Receipt (act, invoice, UPD) transaction type Goods (invoice, UPD) or in the Purchases .

Return invoice in 1C 8.3 Accounting.

In the form we indicate:

- Receipt document - the document from which the batch is returned. It may not be indicated if it is not known from which batch the goods are being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Quantity - the number of returned goods;

- Price —the purchase price of MPZ including VAT;

- % VAT - Without VAT , because a company using the simplified tax system is not a VAT payer and does not issue an invoice (clause 5 of article 168 of the Tax Code of the Russian Federation).

Calculations tab unchanged.

Return of goods to the supplier in 1C 8.3 postings.

Postings are generated:

- Dt 76.02 Kt 41.01 - goods returned to the supplier;

- Dt 60.01 Kt 76.02 - the debt to the supplier was reduced by the amount of the returned goods.

Procedure for returning goods for various reasons

All cases of goods returned to the supplier can be considered as one of three aspects.

- Inadequate quality, defects, discrepancies in assortment, set or packaging are detected upon acceptance - then a return is issued without transferring the goods to the buyer, it is immediately returned to the supplier, since acceptance does not occur.

- Despite the detected deficiencies, the receiver is forced to accept the goods, knowing that he will have to issue a return later. In this case, the products are accepted by the buyer for safekeeping.

- Planned returns of products not sold on time - the so-called reverse sales.

The reasons for the return are fundamental when processing the transaction. The accounting entries used depend on them. The key point is whether ownership has already passed from the supplier to the buyer, or not yet.

How can a buyer get a refund when returning a product of good quality to the supplier ?

Return of low-quality products

If the buyer discovers the poor quality of the goods, he can choose one of several ways:

- Return of products with refund of money paid.

- Return of low-quality goods for exchange for quality ones.

How can a buyer return money when returning a low-quality product (defective) to the supplier ?

The procedure is regulated by Articles 518 and 475 of the Civil Code of the Russian Federation. It differs in a number of nuances:

- If minor defects are found on the product that can be quickly corrected, the buyer has only one option - returning the product to eliminate the defects.

- If a defect is detected not on the entire product, but only on part of the set, only this part is replaced.

- If a product is purchased by a legal entity for the purpose of resale (for example, products are purchased by a retail store), only the provisions of the Civil Code of the Russian Federation will apply, and not the Law on the Protection of Consumer Rights. The return procedure applicable to retail customers does not apply in this case.

Returns may be made within the warranty or expiration date. However, there are exceptions. You can return products within 2 years under the following circumstances:

- The buyer can prove that the deformation occurred before he received the goods (according to Articles 471 and 477 of the Civil Code of the Russian Federation).

- If the product does not have an expiration date or warranty period.

You can prove the presence of deformations using photos, videos and witness testimony.

Registration of return of low-quality goods

If the buyer finds any defects, he must immediately notify the supplier. This procedure is stipulated in Article 483 of the Civil Code of the Russian Federation. If no notification was sent to the seller, then he has the right to refuse the return.

IMPORTANT! The buyer, according to Article 514 of the Civil Code of the Russian Federation, must accept low-quality products for safekeeping until they are actually returned. Until this moment, it is he who is responsible for the safety of the goods.

If the supplier agrees with the claims presented to him, the following documents are drawn up:

- A report on detected defects (can be drawn up in the TORG-2 form), which sets out existing claims.

- Return invoice for goods (can be issued using the TORG-12 form).

If the defects are minor, the products are returned to be corrected. It makes sense to draw up a document that specifies the deadline for correcting all detected defects.

If the supplier undertakes to eliminate defects in the shortest possible time, there is no need to issue a return invoice. The rule is stipulated by Article 518 of the Civil Code of the Russian Federation.

The supplier may also deny that the product is of poor quality. In this case, it is necessary to prove the presence of defects using the following documents:

- Claims.

- Notifications to the supplier about the date of the examination.

- Protocol on preparation for examination.

- Expert opinion.

ATTENTION! A report on detected defects, drawn up unilaterally, is not evidence of low quality products. But there is an exception: the agreement between the parties specifies the application of the instructions “On the procedure for accepting goods” dated April 25, 1966.

Return of quality products

The buyer has the right to return quality goods to the supplier if the following grounds exist:

- Rights to products are vested in other persons (Article 460 of the Civil Code of the Russian Federation).

- The supplier did not timely deliver the accompanying documentation and components for the goods (Article 464 of the Civil Code of the Russian Federation).

- A smaller quantity of products was received than agreed upon (Article 466 of the Civil Code of the Russian Federation).

- The range of products was not observed (Article 468 of the Civil Code of the Russian Federation).

- There is no complete set (Article 480 of the Civil Code of the Russian Federation).

- The packaging does not meet the requirements for it established by law or agreement (Article 482 of the Civil Code of the Russian Federation).

You can add to the list yourself. For example, the supplier undertakes to transfer accompanying documents within a certain period of time. If he does not do this, the buyer has the right to issue a return. Additions must be fixed in the agreement between the parties. If the parties to the transaction have previously agreed, the products can be returned even without serious reasons. For example, a return is issued if the buyer does not sell the product within the agreed time frame.

Registration of return of products that could not be sold

As mentioned earlier, the contract can provide for the possibility of returning goods that could not be sold within the specified time frame. From a tax point of view, the transaction has signs of reverse sale. That is, the supplier becomes the buyer, and the buyer becomes the supplier. To complete the procedure, the following documents are required:

- Packing list.

- Invoice.

IMPORTANT! Large retail chains do not have the right to return goods if they could not be sold. The exception is the sale of bakery products.

FOR YOUR INFORMATION! It is difficult to carry out such a transaction when selling alcoholic products, since the sale of alcohol requires the availability of separate licenses.

Refunds from the supplier: postings in 1C 8.3

On February 7, part of the goods (3 pieces) was returned due to a defect.

On February 8, payment was received to the bank account for the returned goods in the amount of 72,000 rubles.

The return of funds from the supplier is formalized using the document Receipt to the current account, transaction type Return from supplier in the Bank and cash desk - Bank statements section or based on the document Return of goods to supplier the Create based button .

In the form we indicate:

- Advances account - 76.02 “Calculations for claims.”

- Document —a document for returning goods.

Postings

Wiring is generated:

- Dt Kt 76.02 - refund from the supplier for returned goods.

We looked at how to process the return of goods to the supplier in 1C.