An act in form INV-15 is the main document that is used to record the results of a sudden check of funds stored in the cash register or, more simply, an inventory of cash. This check can be carried out either at the request of tax inspectorate specialists or at the initiative of the organization’s management, on the basis of a specially issued order.

If the inventory takes place as necessary, in connection with a change in the financially responsible employee, then this document is drawn up in three copies: one each for the former and new financially responsible person, and the third for the organization’s accounting department. If this is a routine check, then two copies are enough.

Briefly about the main points of a sudden check of funds stored in the cash register

Inventory can be carried out for several reasons:

- identifying excess or shortage of cash in the cash register;

- end of the calendar year;

- change of financially responsible person;

- liquidation of the enterprise;

- force majeure circumstances (fires, floods, etc.).

The inspection must be carried out by a commission consisting of several employees, as well as in the presence of a person who is responsible for compliance with the standards for storing cash. Based on the results of the inventory, a corresponding act must be drawn up, with a decision made to eliminate the detected violations.

The procedure for taking inventory of cash at the cash desk

The procedure for auditing cash at the cash desk consists of the following steps:

- Approval of the composition of the commission in an order using the unified form INV-22 (or similar to it, developed independently).

For an example of a cash inventory order, see ConsultantPlus. Trial access to the legal system is free. - Receiving a receipt from the cashier confirming the absence of unpaid cash and unaccounted for cash documents. The cashier also provides the commission with the latest cash report.

- Recalculation of funds and documents, comparison of the result with accounting, verification of the availability and movement of strict accounting forms with the information reflected in their registration log.

- Registration of inventory results in the INV-15 form.

Attention! The inventory of funds at the cash desk is carried out in the presence of the person financially responsible for the funds (usually the cashier).

Cash inventory in the INV-15 form can be found on our website.

Cash book

The 1C:Accounting program implements the functionality of creating a cash book (form KO-4). The cash book in 1C 8.3 is located in the journal PKO and RKO. To open it, click on the “Cash Book” button.

In the report header, indicate the period (the default is the current day). If your program maintains records for more than one organization, it must also be indicated. In addition, if necessary, you can select a specific division for which the cash book will be generated.

For more detailed report settings, click on the “Show settings” button.

Here you can specify how the cash book will be generated and some of the settings for its design in 1C.

After you have made any changes to the settings of this report, click “Generate”.

As a result, you will receive a report with all cash movements at the cash desk, as well as balances at the beginning / end of the day and balances.

General provisions on inventory

This procedure involves checking the cash stored in the cash register. It can be initiated by managers, the tax inspectorate, and other inspection bodies. Absolutely any organization is interested in having this inventory carried out regularly. This is explained by the fact that such checks make it possible to identify shortages in a timely manner. In addition, they force cashiers to be as disciplined as possible and not abuse their powers.

As you might guess, the inventory must be carried out in the presence of a responsible person. This is how the employee will be sure that the check is carried out in accordance with the rules.

( Video : “Cash Inventory Act”)

When is a cash register inventory carried out?

Cash registers are subject to inspection in accordance with the order of the Ministry of Finance. It all depends on the organization and type of inspection. For example, the head of the company can schedule an internal audit at any time. Here he has the right to act at his own discretion. If an organization is subject to a full audit by regulatory authorities, for example, the tax inspectorate, then the audit may be sudden. In some companies, managers draw up plans for regular inspections. But besides this, there are situations in which the law requires an inventory:

- it is discovered that there is more or less than the required amount of cash in the cash register;

- the end of the calendar year, when the accounting department must draw up an annual report;

- another employee becomes financially responsible for the cash register;

- the organization completely ceases its activities;

- fires, floods and other unforeseen situations, after which it is necessary to check the cash at the cash desk;

- the company underwent a reorganization, for example, a change of management, merger with another organization.

However, in most of these situations, the responsible person can predict the likelihood of an audit. Managers have the right to schedule a surprise inventory at any time. This is done to strengthen control over cash. Perhaps an error has been discovered in the accounting; such a check will reveal it. As for an unscheduled inspection, the law does not define any deadlines here. They are determined solely by management. But when creating an order, you must indicate the reason for the unscheduled inventory.

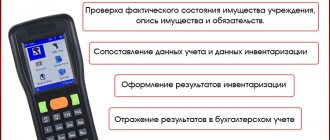

Cash inventory: goals and frequency

Cash inventory, as an effective control tool, is the main activity for checking the timeliness of cash transactions and acceptance for accounting, as well as compliance with legal requirements when registering them. A cash audit can be carried out as an independent audit, or be one of the sections of a comprehensive audit of the company’s production and financial activities. It takes place in two stages:

- inventory of cash and comparison of documented information with the actual availability of money;

- checking compliance with cash discipline.

The company’s internal auditors, as well as external auditors - the bodies of Rosfinnadzor and the Federal Tax Service - can monitor compliance with cash discipline.

As part of an internal audit, the frequency of inventory is established by the manager, and the procedure for conducting it is developed and fixed by local acts.

The cash register is usually checked:

- once a month, quarter or six months (in accordance with the adopted accounting policies), and always on the 1st day of the year following the financial one;

- when transferring the cashier's powers to another employee;

- during reorganization/liquidation of the company;

- in case of force majeure circumstances.

The attention of Rosfinnadzor authorities is drawn to companies that receive government investments, quotas and loans from the budget or extra-budgetary funds. They check the movement of funds through the cash register and in accounts, considering the intended purpose and legality of spending. Representatives of the tax authorities, when initiating an audit of the cash register, pay attention to the completeness of the receipt and accounting of revenue. As a rule, external inspectors ensure surprise inspections, which does not happen when control activities are planned within the company.

The obligation and procedure for conducting an inventory of the cash register, as well as all assets of the company, is regulated by the Methodological Instructions approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49.

Purpose of the document

The company's management is interested in conducting a regular inventory of cash.

With the help of an audit, cash balances in the cash register are checked and the fact of their theft by the financially responsible person is recorded.

The frequency of its conduct during internal audits is determined by the director of the enterprise. Inventory can also be of a sudden nature.

There are cases specified by law (Order of the Ministry of Finance No. 49 of June 13, 1995) when inventory must be carried out:

- before preparing reports for the calendar year;

- change of responsible employee (cashier);

- identifying cases of surplus, theft of cash from the cash register

In all of these cases, the result is an inventory report drawn up in the INV-15 form.

Useful purpose of INV-15

For management, the cash inventory act (with or without the violations indicated in it) is always useful, as it allows:

- draw the necessary conclusions regarding the competence and discipline of cashiers and accountants;

- respond in a timely manner to deficiencies identified during the cash register inventory;

- be aware of the valuation and the list of valuables in the cash register.

INV-15 has a useful psychological property. This act can discipline cashiers. Regular cash inventories and the need to provide written explanations (fill out the back of the INV-15), as well as make up for cash shortages, motivate them:

- be more attentive to the organization’s funds;

- perform official duties carefully;

- avoid cash irregularities.

The cash inventory act also helps management:

- promptly stop possible abuses in the work of involved employees with cash and other valuables;

- reduce the potential risks of fines for cash violations.

For INV-15 to truly help management, it must be reliable and well-written. We will talk about the rules for filling out INV-15 in the next section.

Who conducts cash register inventory in 2022

Regardless of whether it is a planned inspection or not, the head of the organization must issue an appropriate order. With his help, he appoints members of the commission that will deal with the inventory. Usually a permanent commission is created. However, there are situations when an organization needs to perform a large amount of inventory work. In this case, you can additionally create working commissions. Typically, the audit team includes:

- accounting workers;

- representatives of the company's management;

- internal audit employees and employees of independent audit organizations;

- managers;

- economists;

- company security officers.

Each participant is personally approved by the director. All members of the inspection team must be present during the inspection. If one of them is missing, the check will be considered invalid. If there have been no personnel changes in the company, the manager has the right to use the same order on the composition of the inspection team that was issued last time.

The procedure for taking inventory of cash at the cash desk

As already mentioned, this procedure begins with the issuance of an appropriate order by the manager. Before the inspection team begins to fulfill its obligations, all operations carried out by this cash register are stopped. The cashier or other financially responsible person must give a receipt stating that there is no unaccounted money or cash in the cash register that has not been capitalized. In this case, the commission is presented with all expenditure and receipt documents.

After this, the inspection team begins the actual inspection. To do this, all funds currently available in the cash register are recalculated. This procedure is carried out in the presence of all members of the commission and under the strict supervision of the responsible employee. The amount obtained during the calculation is compared with the amount indicated in the documents. As you can assume, the result of the check can be one of three options:

- excess cash has been identified;

- shortage detected;

- actual availability corresponds to the information specified in the documents.

The final stage of the inventory is the registration of its results. To do this, fill out the corresponding act. The number of its copies depends on the specific situation. Usually two copies are made: one is intended for accounting, the second is given to the responsible employee. If the inspection was carried out due to a change in the financially responsible person, the document is made in triplicate. After entering all the necessary information in the document, each member of the inspection team must sign their autograph.

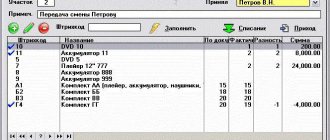

Inventory of funds on a current account in 1C 8.3

Both the assets of the organization and its liabilities are subject to inventory in accordance with the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. When taking inventory of funds at an enterprise, the actual availability of funds in accounts and in the cash register is verified with accounting data.

The procedure for conducting an inventory of funds is indicated in the Method. instructions for inventory of property and financial obligations (Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49).

How to make an order to conduct an inventory using the INV-22 form in 1C 8.3

There is no special document for inventorying funds on a current account in 1C 8.3 Accounting 3.0. But, in order to print the order for inventory taking form INV-22 from the 1C 8.3 program, we will use the printed form of other documents. For example, Inventory of goods. For this:

- Create a new document Inventory of goods. Section Warehouse – Inventory – Inventory of goods:

Create button:

- Fill out the Inventory bookmark.

Here you should indicate the period for conducting the inventory, details of the order, and the reason for the inventory:

- Fill out the Inventory Commission tab.

The table lists the members of the commission and checks the name of the chairman:

- We create and edit the printed form of the order INV-22.

Button Print – order by f. INV-22:

On the screen: Preview mode unified form INV-22 Order to conduct an inventory:

We turn on the printing form editing mode and fill in the empty required lines, for example, “Inventory is subject to...”, etc. The document in 1C 8.3 can be printed (Print button) or saved as a file (Save to disk button).

How to edit documents for printing manually in 1C 8.2 (8.3), see our video tutorial:

How to take inventory of funds in a current account in 1C 8.3

Inventory is carried out by comparing cash balances on accounts (settlement or foreign exchange) registered in accounting with information obtained in 1C from bank statements. Account turnover for each day must be reconciled so that the amounts at the beginning of the day coincide with the balance received at the end of the previous day.

Bank statement (or personal account statement) is a document containing information about the current state of the organization’s accounts. In 1C Accounting 8.3, the documents “Receipt to a bank account” and “Write off from a bank account” are used to conduct cash transactions. You can view balances at the beginning of the day, turnover during the day and balances at the end of the day from the Bank Statements list. Section Bank and cash desk – Bank – Bank statements:

We indicate the bank account, organization, select any document for the date of interest - now you can view the necessary data: cash balances and account turnover for the selected day:

Also for analysis in 1C 8.3 there is a convenient opportunity to use standard reports. For example, the report Account turnover for account 51. Section Reports – Standard reports – Account turnover:

Let's configure the report (Show settings button):

- In the header of the report, set the period, indicate the account - 51, select the organization.

- On the Grouping tab, indicate the frequency of report generation – By day and grouping method – Bank accounts:

- On the Selection tab, select the desired bank account:

- On the Indicators tab, specify the data to be displayed in the report:

Click the Generate button. On the screen: report Account turnover 51:

The data displayed in the report in 1C 8.3 allows you to check the balances and turnover of funds in the current account for each day of the selected period.

It is very difficult to imagine that with automated accounting, both shortages and, less often, surpluses may appear in the current account, but such situations are possible. Let's consider what needs to be done in 1C 8.3 Accounting in these situations.

If there is a surplus in the current account

Suppose that as a result of the analysis at the end of the day on March 31, 2016, it was discovered that the balance according to the accounting data is less than the balance according to the bank statement by 1,000.00 rubles. The balance according to the bank statement is 1,713,118.45 rubles, the balance according to accounting data is 1,712,118.45 rubles).

Surpluses are reflected in accounting. accounting (BU) by posting Dt 51 - Kt 91.01, in tax accounting (NU) - this is Other non-operating income and expenses. In 1C 8.3, this operation is carried out using the document Receipt to a bank account:

- Enter the document Receipt to the account." Section Bank and Cash – Bank – Bank statements – Receipt button.

- Fill in the fields of the document:

- Document operation (type) – Other receipt;

- Payer – may not be filled in;

- Amount – identified discrepancy;

- Loan account – 91.01;

- Other income and expenses – Other non-operating income (expenses) accepted for tax accounting (the “Accepted for tax accounting” flag is set in the directory element):

- We post the document (Post button) and check the movements made by the document:

- Let's build a report Account turnover for 51 accounts and make sure that as of 04/01/2016. The account balance corresponds to the balance indicated in the bank statement:

You can check transactions on account 91.01 using the Account balance sheet report. We will create the report as of the date of adjustment – 04/01/2016. The report shows that the discrepancy amount is RUB 1,000.00. reflected in BU and NU:

If “deficiencies” are detected in the current account

A shortage of funds can be identified both during inventory and during the daily routine work of an accountant. There are situations when the bank unintentionally debits any amounts from the current account. Having discovered such “deficiencies”, you should first of all submit a written application to the bank so that the bank credits the written-off amounts to the organization’s account.

According to Art. 856 of the Civil Code of the Russian Federation, if the bank unreasonably debits funds from the client’s account, the bank must pay interest. The procedure for calculating interest is specified in Art. 359 of the Civil Code of the Russian Federation.

Let’s say that when checking bank statements, an accountant discovered a write-off of RUB 10,000.00. in favor of an unknown counterparty.

In 1C 8.3, this situation will be formalized by the document Write-off from a personal account, posting Dt 76.02 - Kt 51.

- We create the document Write-off from a personal account. Section Bank and Cash – Bank – Bank statements – Write-off button.

- Fill in the fields of the document:

- Document transaction type – Other write-off;

- Recipient – can be left blank;

- Amount – identified discrepancy;

- Debit account – 76.02 “Calculations for claims”:

- We post the document (Post button) and check the movement of the document:

The accountant transmits information about the shortage in writing to the bank. After a few days, the bank returns the written-off funds to the bank account and pays interest in the amount of 52.00 rubles.

The transfer of funds will be carried out using the document Receipt to a cash account, posting Dt 51 – Kt 76.02.

1. Create a document Receipt to a bank account. Section Bank and Cash – Bank – Bank statements – Receipt button.

- Fill in the fields of the document:

- Document operation (type) – Other receipt;

- Payer – may not be filled in;

- Amount – identified discrepancy;

- Loan account – 76.02 “Settlements of claims”:

- We post the document (Post button) and check the movement of the document:

Similarly, we will credit the bank account with the interest transferred by the bank for erroneous debiting of funds (entry Dt 51 - Kt 76.02).

We will calculate interest for the bank’s erroneous debiting of funds from a personal account in 1C 8.3 using the Operation document. Section Operations – Accounting – Operations entered manually – Create button:

Posting for interest accrual: Dt 76.02 – Kt 91.01. In tax accounting, interest received is recognized as other income:

Let's build a SALT report for account 76.02 to check the correctness of document posting in 1C 8.3:

What violations at the cash register will INV-15 tell you about?

The cash inventory report INV-15 will tell management that regulatory requirements regarding compliance with cash discipline are not fully met and/or cashiers are committing abuses. The inventory results reflected in INV-15 help:

- identify shortages of cash and other property of the organization to be stored in the cash register (securities, stamps, etc.);

- compare the actual cash balance in the cash register with the established cash limit and assess the risks of imposing a fine if the limit established by the organization is violated once or regularly (representatives of small businesses may not set a cash limit);

- draw conclusions about the professional suitability of cashiers and other personnel whose responsibilities include monitoring the implementation of cash discipline.

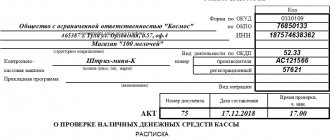

The procedure for filling out an act in form INV-15 when taking inventory of the cash register

As a rule, there are no difficulties in filling out a unified form. But due to the fairly large amount of information, some may still encounter points that are not entirely clear. The process of filling out this form can be divided into three main parts:

Part 1: organization details and inspection date

Filling out the document begins with the most important information, which includes the date of the inventory and information about the company. It is necessary to indicate the legal form, the name of the company and the activities in which it is engaged. In this part, mention should be made of the order, which became the basis for the inspection.

Part 2: receipt of the financially responsible person and data on the results of the inspection

As mentioned above, the cashier must give a receipt before checking. This is how he documents that all expenditure and receipt documents were sent to the accounting department. Also, the responsible person confirms that the cash desk contains exactly the amount that should be there. The cashier writes his position, signs an autograph with a transcript, and indicates the date.

After counting the funds, the amount received is indicated in the appropriate line. In addition to money, checks, stamps and other securities may be subject to inventory. All of these funds must be listed separately. The amount is noted not only in numbers, but also in words.

Below there is a column indicating the amount stated in the accounting documents. Ideally, these amounts should be identical. However, it is possible that discrepancies will be found here. If there is a surplus or shortage, these amounts should be indicated in the appropriate lines.

Part 3: signatures of the inventory commission

This part identifies all the employees who carried out the inspection. The chairman of the commission and its members are noted. The positions of each member of the inspection team are indicated. Autographs with transcripts are affixed in the corresponding lines. The financially responsible person also puts his signature at the bottom of the document. This is how it confirms that it fully agrees with the information specified in the document.

If during the check there are discrepancies in the amounts, this must be additionally mentioned on the reverse side of the sheet. Not only the fact of the discrepancy is noted here, but also the comments of the cashier or other responsible employee are recorded. It is highly desirable that he explain in his commentary why the amount in his cash register does not correspond to the amount indicated in the accounting documents. After reading the explanations, the manager decides what to do with the shortages and surpluses.

For example, if there is a shortage, a decision may be made to recover the missing amount from the cashier's salary. Although in each specific case an individual decision is made. It should also appear on the back of the document. This information is certified by the company’s seal and the autograph of its director.