Legislation on charitable activities consists of the relevant provisions of the Constitution of the Russian Federation, the Civil Code, Federal Law of August 11, 1995 No. 135-FZ “On charitable activities and charitable organizations,” other federal laws and laws of the constituent entities of the Russian Federation.

Charitable activities are understood as voluntary activities of citizens and legal entities for the disinterested (free of charge or on preferential terms) transfer of property to citizens or legal entities, including money, disinterested performance of work, provision of services, provision of other support (Article 1 of the Federal Law on Charitable activities and charitable organizations; hereinafter referred to as Law No. 135 Federal Law).

Free does not mean charity

If you donated property or provided a service for free, this does not mean that you have engaged in charity. It is important for what purposes the funds were allocated and for what activities the property you transferred will be used. The goals of charitable activities are defined in Article 2 of Law No. 135-FZ. Here are some of them:

- social support and protection of citizens;

- preparing the population to overcome the consequences of natural disasters and catastrophes,

- providing assistance to victims of natural disasters, social, national, religious conflicts, victims of repression, refugees and internally displaced persons;

- promoting the strengthening of peace, friendship and harmony between peoples, the prevention of social, national, and religious conflicts;

- promoting the protection of motherhood, childhood and paternity;

- promoting activities in the field of education, science, culture, art, enlightenment, spiritual development of the individual;

- promoting activities in the field of prevention and protection of public health, physical culture and mass sports.

In 2011, the goals of charitable activities were significantly expanded. Corresponding changes to Law No. 135-FZ were made by Federal Law No. 383-FZ of December 23, 2010. Starting this year, the following is recognized as charity:

- preparing the population for protection from emergency situations, promoting knowledge in the field of protecting the population and territories from emergency situations and ensuring fire safety;

- social rehabilitation of orphans, children without parental care, street children, children in difficult life situations;

- providing free legal assistance and legal education to the population;

- promoting volunteerism;

- participation in activities to prevent neglect and juvenile delinquency;

- promoting the development of creativity and education of children and youth.

Other forms of providing assistance to commercial organizations, either financially or with property, are not recognized as charity.

Supporting political parties, movements, groups and campaigns is not charitable activity. In addition, it is prohibited to conduct pre-election campaigning or campaigning on referendum issues simultaneously with charitable activities. Such conditions are expressly provided for in Law No. 135-FZ.

Performers and characters

Article 5 of Law No. 135-FZ defines the concept of participants in charitable activities. These are recognized as philanthropists, volunteers and beneficiaries.

Philanthropists are persons who disinterestedly, that is, free of charge or on preferential terms:

- transfer of ownership of property, including funds and (or) intellectual property;

- granting the rights of ownership, use and disposal of any objects of property rights;

- performance of work, provision of services.

Philanthropists have the right to determine the purposes and use of their donations.

Beneficiaries are persons who receive charitable donations from philanthropists or the help of volunteers.

Volunteers are citizens who carry out charitable activities in the form of free labor in the interests of the beneficiary, including in the interests of a charitable organization. A charitable organization may pay the expenses of volunteers associated with their activities in this organization (travel expenses, transportation costs, etc.).

Charitable foundation: legal aspects

Charitable organization is a general concept for specially created associations engaged in charity. According to the Law “On Charitable Activities and Charitable Organizations” dated August 11, 1995 No. 135-FZ, charitable organizations must be non-profit, without the participation of the state or its subjects. They can be created in the form:

- public organizations (associations) - Art. 6 of the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ;

- funds - art. 7 of Law No. 7-FZ;

- institutions (if the founder is a charitable organization) - Art. 9 of Law No. 7-FZ, etc.

Charitable organizations must maintain accounting and reporting in accordance with paragraph 1 of Art. 19 of Law No. 135-FZ. The annual report must be publicly available; it is also submitted to the body that made the decision on state registration of such an organization, and to the tax authority (clauses 2–3 of Article 19 of Law No. 135-FZ).

What is a charitable foundation (hereinafter - CF)? This is a non-profit organization (NPO), which can be established by citizens or legal entities through voluntary contributions for charitable purposes (Article 7 of Law No. 7-FZ). The CF is the owner of the property that was transferred to it as contributions by the founders. The goals of the charitable foundation must be stated in the charter. The Board of Trustees is the main body of the Charitable Foundation.

Good intentions and taxes

General taxation system. Income tax and VAT

If you decide to engage in charity, then keep in mind that you can “do good” solely through pure profit. However, it will not be possible to reduce taxable income for such expenses.

The cost of gratuitously transferred property and expenses associated with such transfer are not taken into account for profit tax purposes in accordance with paragraphs 16 and 34 of Article 270 of the Tax Code. Explanations from the Finance Ministry on this matter can be found in letters dated April 16, 2010 No. 03-03-06/4/42, dated April 4, 2007 No. 03-03-06/4/40. The Russian Ministry of Finance believes that expenses incurred by an organization as part of charitable activities do not meet the requirements of Article 252 and, therefore, cannot reduce the tax base for income tax.

VAT

If the inability to take into account charitable expenses for profit tax purposes reduces your desire to help your neighbors, then we hasten to inform you that the situation in the legislation with value added tax is different.

According to subparagraph 12 of paragraph 3 of Article 149 of the Tax Code, the transfer of goods (performance of work, provision of services) free of charge within the framework of charitable activities in accordance with Law No. 135-FZ is not subject to VAT (exempt from taxation) on the territory of the Russian Federation.

The norm of subclause 12 of clause 3 of Article 149 of the Tax Code of the Russian Federation provides for an exception. When transferring excisable goods to a beneficiary, the benefactor becomes obligated to pay VAT.

To ensure that good intentions do not turn out to be a road to hell for you in proceedings with the tax authorities, be careful when preparing the relevant documents. Discuss in advance with the beneficiary what documents you need to receive from him to submit to the tax office.

To be exempt from VAT, you must submit to the tax authority:

- an agreement for the gratuitous transfer of goods (performance of work, provision of services), concluded by the benefactor with the recipient of charitable assistance;

- copies of documents confirming the fact that the beneficiary has registered goods received free of charge (work performed, services rendered);

- acts and (or) other documents indicating the intended use of goods (work, services) received (performed, provided).

Such a list of documents is given in the letter of the Federal Tax Service of Russia for Moscow dated December 2, 2009 No. 16-15/126825. The same letter states that if the recipient of charitable assistance is an individual, then a document is submitted to the tax office that confirms the actual receipt of goods (work, services) by the specified person.

It is important

From January 1, 2009, the cost of materials is recognized as expenses as they are taken into account, that is, the fact that they are written off for production no longer matters.

What taxes does the charity pay?

By default, all legal entities, including BFs, must apply the general taxation system, unless they have switched to a special regime. Accordingly, the taxation system of a charitable foundation determines which requirements of the Tax Code of the Russian Federation it must follow and what it is a taxpayer of.

The CF has the right to conduct business activities, for example, produce goods that meet the CF's goals, buy and sell securities, participate in business companies, etc. Profits go to the CF's goals and cannot be distributed among participants. Income and expenses for entrepreneurship are accounted for separately from income and expenses for statutory charitable activities.

If a charitable foundation (like other non-profit organizations) conducts only statutory activities and is not engaged in entrepreneurial activities, the obligation to submit accounting and tax reports is not removed from it. The Guide from ConsultantPlus will help you fill out the Report on the intended use of funds, which is prepared by charitable organizations. Get trial access to the legal system for free and proceed to the material.

Restore VAT

Do not forget to restore VAT if, as a charitable donation, you transferred property that was previously acquired and used for activities subject to VAT. Obviously, you previously deducted the amount of “input” tax on the specified property.

The obligation to restore VAT follows from the requirement of the norm of subparagraph 2 of paragraph 3 of Article 170 of the Tax Code

The VAT amount should be restored to the amount previously accepted for deduction. In relation to fixed assets and intangible assets, VAT is restored in an amount proportional to the residual value without taking into account revaluations.

However, you have the right to refuse the VAT exemption benefit. In accordance with paragraph 5 of Article 149 of the Tax Code, the taxpayer has the right to refuse this benefit. To do this, you must submit a corresponding application to the tax office at the place of registration. The application deadline is no later than the 1st day of the tax period from which the taxpayer intends to waive the exemption or suspend its use.

It is important to note that you will receive the right not to use the VAT benefit for a whole year. Refusal or suspension of tax-exempt transactions for a period of less than one year is not permitted.

In addition, the refusal or suspension of the benefit will apply to all transactions carried out by you, provided for by one or more subparagraphs of paragraph 3 of Article 149 of the Tax Code. Exemption of any individual transaction depending on who is the buyer (purchaser) of the relevant goods (works, services) is not allowed.

Perhaps you have decided to engage in charity work seriously and for a long time and plan to purchase goods for this regularly. In this case, by refusing the VAT benefit, in accordance with paragraph 1 of Article 172 and paragraph 1 of Article 171 of the Tax Code, you will be able to deduct the amount of input VAT.

Philanthropist on special regime. Expenses under the simplified tax system

A philanthropist using the simplified tax system cannot reduce income by the amount of expenses associated with charity, since such expenses are not included in the list of expenses given in Article 346.16 of the Tax Code.

A philanthropist who uses the simplified tax system takes into account the cost of materials including VAT as expenses in the month of their acquisition as payment is made (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Expenses for the purchase of materials used in the production of finished products donated for charitable purposes are not considered economically justified, since they are not related to activities aimed at generating income. According to paragraph 2 of Article 346.16 of the Tax Code, when determining the tax base for the tax paid in connection with the application of the simplified tax system, expenses are accepted subject to their compliance with the criteria specified in paragraph 1 of Article 252 of the Tax Code (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). Therefore, when donating finished products to charity, the cost of materials previously recognized as an expense should be restored. Reinstatement is made in the month in which the gratuitous transfer occurred. This conclusion is confirmed by the consultation dated March 10, 2009 by Yu.V. Podporin, Deputy Head of the Department of Special Tax Regimes of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia.

General mode or simplified tax system

NPOs have the right to choose whether to be on the general taxation system or switch to a “simplified” one. NPOs - payers of the simplified tax system are limited to a single tax, without paying:

- income tax;

- property tax;

- VAT.

As you know, for applying the simplified tax system there is an income limit of 45 million rubles. for the last 9 months of work. For non-profit organizations, this amount does not include receipts for targeted needs (grants, donations, subsidies, contributions from founders and members, etc.).

ATTENTION! The benefit on the tax rate on employee salaries for non-profit organizations when applying the simplified tax system is no longer valid.

Let's look at examples of how transactions related to charity are reflected in accounting

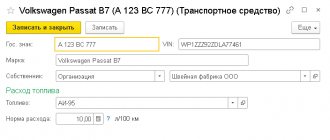

Example 1 An organization donates an excisable product for charity - a car with an engine power of 150 hp. With.

According to the approved price list, the selling price of the car is 200,000 rubles. The actual cost, according to the accounting certificate, is 110,000 rubles.

Excise taxes

According to subparagraph 6 of paragraph 1 of Article 181 of the Tax Code, a passenger car is an excisable product. The transfer of ownership rights to excisable goods by one person to another person free of charge is recognized as the sale of excisable goods (paragraph 2, subparagraph 1, clause 1, article 182 of the Tax Code of the Russian Federation).

From January 1 to December 31, 2011 inclusive, the excise tax rate for passenger cars with engine power over 0.75 kW (90 hp) and up to 112.5 kW (150 hp) inclusive is set at 27 rubles. for 0.75 kW (1 hp) (clause 1 of article 193 of the Tax Code of the Russian Federation).

In this case, on the date of gratuitous transfer, the organization charges excise tax in the amount of 4,050 rubles. (27 rubles x 150 hp) (clause 1 of article 194, clause 2 of article 195 of the Tax Code of the Russian Federation).

Excise tax amounts calculated upon the sale of excisable goods free of charge are attributed to the corresponding expenses for these excisable goods (paragraph 2, clause 1, article 199 of the Tax Code of the Russian Federation).

Value added tax (VAT)

As stated above, when transferring excisable goods for charity, the benefactor has an obligation to charge VAT (paragraph 2, subparagraph 1, paragraph 1, Article 146, subparagraph 12, paragraph 3, Article 149 of the Tax Code of the Russian Federation). The tax base in this case is determined as the cost of the transferred car, calculated on the basis of prices determined in a manner similar to that provided for in Article 40 of the Tax Code. According to the approved price list, the selling price of the car is 200,000 rubles. Until the contrary is proven, it is assumed that this price corresponds to the level of market prices (clause 1 of article 40 of the Tax Code of the Russian Federation). So, the amount of VAT in this case is charged on the sales amount, taking into account excise tax without VAT, RUB 36,729. (200,000 rubles + 4050 rubles) x 18% (clause 2 of article 154 of the Tax Code of the Russian Federation).

Corporate income tax

When transferring free of charge, the cost of finished products is not taken into account for profit tax purposes. Profits and expenses associated with such transfer, namely the amounts of accrued excise duty and VAT, are not recognized as expenses for tax purposes. This is indicated by the direct provision of paragraph 16 of Article 270 of the Tax Code.

Accounting. PBU 18/02

In accounting, the organization’s expenses in the amount of the actual cost of the transferred finished product, as well as accrued excise tax and VAT are taken into account as part of other expenses (clause 11 of the Accounting Regulations “Organization expenses” PBU 10/99, approved by order of the Ministry of Finance of Russia dated May 6, 1999 city No. 33n). Recognition of other expenses is reflected in the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses” (Instructions for using the Chart of Accounts).

Expenses of an organization made for charitable purposes are not taken into account in tax accounting, but are recognized in accounting.

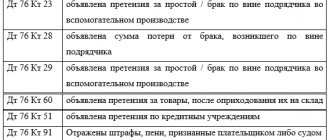

As a result, a permanent difference arises and a corresponding permanent tax liability (PNO) (clauses 4, 7 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n). Accounting entries Amount, rub. Debit 91-2 Credit 43 The organization transferred a passenger car for charitable purposes 110,000 Debit 91-2 Credit 68 excise taxes Accrued excise tax 4050 Debit 91-2 Credit 68 VAT Accrued VAT 36729 Debit 99 Credit 68 Income tax (110,000 rub. + 4,050 rub.+ RUB 36,729) x 20% Reflected PNO30,156

Accounting for donations. Donation forms

One of the most popular and important elements of accounting in NPOs is accounting for donations. As mentioned above, a non-profit organization is obliged to keep records of such revenues, as well as the procedure for using them.

First, let's start with the fact that according to Letter No. 03-03-06/4/113 of the Ministry of Finance of Russia dated October 7, 2011, a non-profit organization has the right to receive donations for the conduct of statutory activities, which are reflected in the constituent documents, and such revenues can be ignored when calculating income tax, subject to the following requirements:

- Received free of charge;

- Spent on time to carry out statutory activities for the intended purpose;

- Accounted for separately;

It is important to understand that all three conditions must be met, otherwise donations will have to be taken into account when calculating income tax.

A non-profit organization can receive monetary donations in two forms: cash and non-cash.

In the first case, if the donor wishes to make a transaction using cash, you should fill out a cash receipt order, and its number, date of registration and the amount entered are recorded in the cash book. In the case of a non-cash donation, your organization’s accountant must register the receipt of funds based on a bank statement and payment order.

If a non-profit organization is donated not money, but some property, then an act of acceptance and transfer of such property must be drawn up.

Moreover, donors can donate works and services to NPOs, as is directly stated in the letter of the Ministry of Finance of Russia dated October 29, 2013 No. 03-0306/4/46052), as well as the work of volunteer citizens (letter of the Ministry of Finance of Russia dated September 29, 2013). .2009 No. 03-03-06/4/112).

It seems most reasonable to formalize any donations in favor of a non-profit organization by drawing up a donation agreement, which should indicate not only the subject of the donation, but also the gratuitousness of the transfer itself, as well as the rights of the parties and the socially beneficial purposes for which the property or money is transferred.