An organization or entrepreneur can register as a UTII payer if the conditions for applying this special regime are met and the applicant has the physical indicators to calculate the tax. For example, employees or retail space.

A complete list of such indicators for the application of UTII is contained in paragraph 3 of Article 346.29 of the Tax Code of the Russian Federation. As long as there are no physical indicators necessary for calculating UTII, you will not be able to register as a payer of this tax. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated September 22, 2009 No. 03-11-11/188.

Where to register

To apply UTII, an organization needs to register (register with tax authorities) in each municipality in whose territory it conducts activities subject to this tax.

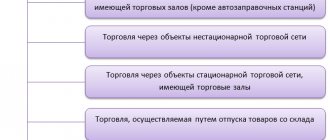

There are exceptions to this rule. Thus, organizations are required to register for taxation with only one inspectorate at their location if they are engaged in:

- transportation of passengers and cargo;

- delivery (distribution) trade;

- placement of advertising on vehicles.

This procedure is provided for in paragraph 2 of Article 346.28 of the Tax Code of the Russian Federation.

For example, an organization is registered in a municipality, where UTII does not apply to the above types of activities. But the opportunity to switch to UTII for such areas of business is in the territory of another municipality, where the organization actually operates. However, at such a place of business (including through a separate division), the organization will not be registered as a UTII payer, since this regime is not provided for at the place of registration. In this case, at the place where the organization actually carries out its activities, it will have to pay taxes either according to the general taxation system or under a simplified tax system. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated October 30, 2009 No. 03-11-06/3/262.

Transition deadlines

The application must be filled out correctly to avoid having to submit it twice. Submission for registration with the tax authority is carried out within a 5-day period from the date of commencement of business activity. The same amount is required to register a new tax regime by specialists from the Federal Tax Service.

Important! According to the norms of federal legislation, tax authority specialists undertake the obligation to timely notify an individual entrepreneur of the decision made regarding the submitted application - registration as a payer of imputed tax or refusal of intentions to initiate a transition.

In case of a negative decision, the tax service must provide a written explanation of the reasons and offer to choose a different regime. In case of an unjustified refusal, it is possible to appeal by filing a corresponding complaint.

Registration procedure

To register as a UTII payer, an organization needs to submit an application to the tax office using the UTII-1 form, approved by order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941. Entrepreneurs submit an application using the UTII-2 form, approved by order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941.

The application must be submitted within five working days from the date on which the imputed activity began. This date must be indicated in the application. This procedure is provided for in paragraph 3 of Article 346.28, paragraph 6 of Article 6.1 of the Tax Code of the Russian Federation. Application forms approved by order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941 are applied from January 1, 2013 (letter of the Federal Tax Service of Russia dated December 25, 2012 No. PA-4-6/22023).

The tax inspectorate, having received an application for registration as a UTII payer, is obliged to notify the organization (entrepreneur) of the registration within five working days thereafter. The date of registration as a single tax payer will be the date of commencement of application of UTII specified in the application. This procedure is provided for in paragraph 3 of Article 346.28 of the Tax Code of the Russian Federation.

Situation: should an organization re-register as a UTII payer in the municipality in which it will conduct imputed activities if it is already registered there for other reasons?

Answer: yes, it should.

As a general rule, you need to register as a UTII payer in each municipality where the organization conducts activities for which it intends to apply this special regime. This is provided for in paragraph 2 of Article 346.28 of the Tax Code of the Russian Federation. There are no exceptions in the tax legislation for those who are already registered in these municipalities for tax purposes on other grounds. And without registering as a UTII payer, the organization simply will not be able to exercise its right to apply this special regime. This procedure follows from the provisions of paragraph 1 of Article 346.28 of the Tax Code of the Russian Federation.

An example of registering an organization as a UTII payer

The organization begins to engage in activities subject to UTII without creating a separate division. In the municipality where the organization will conduct activities subject to UTII, the organization is already registered for tax purposes on a different basis.

The organization in the city of Pushkino, Moscow region, has a property (building). At the location of this facility, the organization is registered with the tax office.

In May 2015, the organization installed a vending machine for selling newspapers and magazines in Pushkino. This activity is not related to the creation of a separate unit.

Despite the fact that the organization is already registered with this municipal entity for tax purposes on a different basis, the organization’s accountant sent an application in the form of UTII-1 to the tax office at the location of the vending machine.

Comments

Maria 01/15/2017 at 18:02 # Reply

You can switch to UTII throughout the year, not only from January 1

Natalia 01/16/2017 at 12:09 # Reply

Maria, good afternoon. You have confused the concepts of “switching to UTII” and starting to “apply UTII”. You can start using UTII not only from January 1, but you can switch from another taxation system to UTII only from the beginning of the calendar year. For example, you cannot switch from the simplified tax system to any taxation system within a year. I quote from the Tax Code of the Russian Federation, Article 346.13, paragraph 3. “Taxpayers using the simplified taxation system do not have the right to switch to a different taxation regime before the end of the tax period, unless otherwise provided by this article.” If you have lost the right to use the simplified tax system, then you can only switch to OSNO within a year. It’s the same with other tax regimes - they can only be changed from the beginning of the calendar year. If you added another type of activity during the year for which you did not apply, for example, the simplified tax system, then you have the right for this type of activity to apply for the use of UTII within a year (within 5 days after the start of the activity on UTII). Thus, switching to UTII and starting to apply UTII are different concepts.

Inna 05/25/2017 at 12:56 # Reply

Strange article and strange answer, Natalia. “If you added another type of activity during the year for which you did not apply, for example, the simplified tax system, then you have the right for this type of activity to apply for the use of UTII within a year (within 5 days after the start of the activity on UTII). » — What if I didn’t add any new types of activities, but simply decided to provide services not to organizations, but to the population, which naturally fall under household services. I can use the simplified tax system for settlements with organizations, and UTII for settlements with the population. And don’t wait for your January 1st next year! Your article is not correct, it gives incorrect information.

Natalia 05/25/2017 at 01:28 pm # Reply

Inna, good afternoon. Read the letter of the Ministry of Finance of the Russian Federation No. 03-11-11/29241 dated July 24, 2013, which states that UTII and the simplified tax system cannot be applied simultaneously for the same type of activity. So you will have a violation if you provide the same services to organizations using the simplified tax system and to the population using UTII. In this case, even January 1 will not help. The letter provides an example with retail trade, but if this seems strange to you, send a letter to the Federal Tax Service for a more accurate answer. Once again I will repeat the quote from the Tax Code of the Russian Federation (Article 346.13. Procedure and conditions for the beginning and termination of the application of the simplified taxation system): 3. Taxpayers using the simplified taxation system do not have the right to switch to a different taxation regime before the end of the tax period, unless otherwise provided by this article . 6. A taxpayer applying a simplified taxation system has the right to switch to a different taxation regime from the beginning of the calendar year, notifying the tax authority no later than January 15 of the year in which he intends to switch to a different taxation regime. Quote (Article 346.19. Tax period. Reporting period): 1. The tax period is a calendar year.

07/04/2017 at 01:57 pm # Reply

You can refuse the simplified tax system until January 15. But why refuse if you can, within 5 days from the start of your activity, register for secondary registration as a UTII payer at any time of the year, maintain 2 systems in parallel, and at the beginning of the year abandon the simplified tax system?

ostapx1 07/04/2017 at 16:29 # Reply

“Should we abandon the simplified tax system at the beginning of the year?” The article says “you can refuse the simplified tax system until January 15.”

The procedure for filling out the UTII-1 form

The application form for registration as a UTII payer (UTII form-1) and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941.

At the top of the application, indicate the tax identification number and checkpoint; you can view them in the registration notice.

In the “tax authority code” field, enter the code of the tax office at the place of registration. Take it from the notice of registration of a Russian organization (clause 6 of Appendix No. 9 to the order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941).

Also, the code of the Federal Tax Service of Russia can be determined by the registration address using the Internet service on the official website of the Federal Tax Service of Russia.

In the “organization name” field, indicate the full name that corresponds to the constituent documents (for example, charter, constituent agreement).

Indicate the OGRN number in accordance with the state registration certificate. You can also view this number in the notification of registration with Rosstat.

Enter the date from which the taxation system in the form of a single tax on imputed income will be applied for certain types of activities.

Indicate the number of pages on which the annex to the application is compiled. For example, if the application contains a two-page attachment, indicate “2—”. If you attach copies of documents to the application, indicate the number of sheets that confirm the authority of the representative of the organization.

Provide information about who is submitting the application on the title page in the field “Power of attorney and completeness of the information specified in this document, I confirm.” If this is the head of the organization, then indicate “3”, and if a representative – “4”. Below, write your last name, first name, and patronymic in full - as in your passport. Next, you need to indicate his TIN and telephone number where you can contact the person who confirms the information.

On page 2 of the UTII-1 form, in the “Code of type of entrepreneurial activity” field, indicate the code in accordance with Appendix No. 5 to the Procedure approved by Order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/353. For example, if the type of activity of the organization is the provision of repair, maintenance and washing services for vehicles, then enter the code “03”. This field must be filled in (clause 20 of Appendix No. 9 to the order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941).

Enter the address at which the organization or entrepreneur will conduct the imputed activity. Namely, postal code, region code, district, city, town, street, house number, building, apartment (office). Take the digital region code from the directory in Appendix No. 2 to the Procedure, approved by Order of the Federal Tax Service of Russia dated December 11, 2012 No. MMV-7-6/941.

Who has the right to apply a single tax

The list of types of activities that are allowed for imputed taxation is given in Art. 346.26 Tax Code of the Russian Federation. In particular, you can switch to this mode if the individual entrepreneur is engaged in:

- provision of household services;

- provision of services for repair, maintenance and washing of motor vehicles and maintenance of parking lots;

- provision of motor transport services;

- retail trade and catering;

- advertising;

- leasing of land plots, housing and non-residential premises.

At the same time, specific works and services in each region are approved by local authorities. Individual entrepreneurs have the right to combine the single tax with other regimes: general and simplified. In this case, the conditions for the transition to UTII in 2022 are to select those allowed from the list approved in the constituent entity of the Russian Federation.

Separate units

Situation: what documents need to be submitted to the tax office if an organization creates a separate division at the place of business on UTII? The organization is not engaged in the transportation of passengers and cargo, distribution (distribution) trade and does not place advertising on transport.

The answer to this question depends on where the organization creates a separate division and where it is registered with the tax authorities as a payer of UTII.

According to the general rules, the organization is obliged to register with the tax inspectorates at the location of each separate division. Moreover, such an obligation does not depend on whether she is listed in these inspections for other reasons. This procedure follows from the provisions of paragraph 2 of paragraph 1, paragraph 1 of paragraph 4 of Article 83 of the Tax Code of the Russian Federation and is confirmed by letter of the Ministry of Finance of Russia dated August 16, 2012 No. 03-11-06/3/60.

To register an organization at the location of its separate division (except for branches and representative offices), you need to submit a message. Compile it according to form No. S-09-3-1, approved by order of the Federal Tax Service of Russia dated June 9, 2011 No. MMV-7-6/362. In this case, no documents confirming the creation of a separate division need to be submitted.

The tax inspectorate will register the branch or representative office at its location independently based on the information from the Unified State Register of Legal Entities. This procedure is provided for in paragraph 1 of paragraph 4 of Article 83, paragraph 2 of paragraph 2 of Article 84 of the Tax Code of the Russian Federation.

If, by the time the separate division is created, the organization is already registered in the municipality as a UTII payer, then it is not required to re-register for taxation in this capacity (letter of the Ministry of Finance of Russia dated August 16, 2012 No. 03-11-06/3/60). It is enough to send only a message in form No. S-09-3-1 to the tax office at the location of the separate division.

You can submit a message about the creation of a separate division to the tax office in one of three ways. The first is through a representative of the organization. The second way is by mail (registered mail). And the third - through telecommunication channels. Such rules are established by paragraph 7 of Article 23 of the Tax Code of the Russian Federation.

All possible options for registering separate units when using UTII are listed in the table.

An example of registering an organization as a UTII payer

An organization opens a separate division in the municipality in which it is already registered for tax purposes on a different basis.

The organization is engaged in wholesale trade (general taxation system) in the city of Pushkino, Moscow region and is registered with this municipal entity for tax purposes at the location of the head office. In May 2015, the organization opened a new retail outlet (a separate division) in Pushkino. The head office of the organization and its separate division operate in the territory under the jurisdiction of one inspection. In this regard, the organization submitted to this tax office an application in the form of UTII-1 and a message in form No. S-09-3-1 about the creation of a separate division.

Situation: does a separate division arise if the activities for which the use of UTII is allowed (provision of household services to the population) are carried out on behalf of the organization by employees working under civil law contracts?

Answer: no, it does not occur.

As a general rule, a separate division is formed only where stationary workplaces are equipped, geographically remote from the location of the organization, for a period of more than one month (Article 11 of the Tax Code of the Russian Federation). And it is mandatory to equip such places only for those with whom the organization has entered into employment contracts (paragraph 4, part 1, article 21 of the Labor Code of the Russian Federation). Labor legislation does not apply to those working under civil contracts (for example, under contract or paid services) (Article 11 of the Labor Code of the Russian Federation). That is why the place where employees work under a civil contract is not a separate unit.

However, if an organization decides to apply UTII for household services, then it will have to register for taxation at the place where such activities are carried out. The procedure for applying UTII does not depend on who performs work or provides services on behalf of the organization: full-time employees or those with whom civil contracts have been concluded. In this situation, the contractor itself under contracts concluded with customers is the organization itself as a legal entity. Therefore, if an organization provides household services in a municipality where UTII is applicable for such activities, then it needs to register as a payer of this tax on a general basis. This must be done within five working days from the date of commencement of activities (clause 3 of Article 346.28 of the Tax Code of the Russian Federation). This moment can be considered the day when the first contract for the provision of services (performance of work) was concluded. If an organization provides personal services in the territory of different municipalities (including through mobile teams of its employees), then it needs to register for tax purposes in each of these entities.

This follows from the provisions of Article 346.28 of the Tax Code of the Russian Federation.

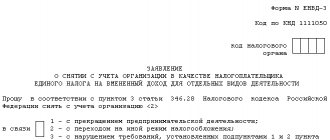

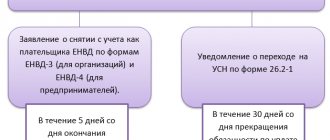

Removal from the register

Within five working days after a voluntary or forced refusal of UTII, an organization or entrepreneur must be deregistered as a payer of this tax. To do this, you need to submit an application to the tax office:

– organizations – according to the UTII-3 form, approved by order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941;

– entrepreneurs – according to the UTII-4 form, approved by order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941.

The inspectorate that received such an application is obliged to execute it and send the organization (entrepreneur) a corresponding notification within five working days.

There can be three reasons for deregistration. The first is due to the fact that the organization ceases activities in respect of which UTII was applied. As a general rule, in this case the date of deregistration will be the date specified in the application. However, if the application for deregistration is submitted late, the date of deregistration will be the last day of the month in which the application was submitted to the inspectorate.

The second reason is a violation of the conditions for applying UTII in terms of the number of employees and the structure of the authorized capital (for organizations). In this case, the date of deregistration will be the beginning of the quarter in which the violation was committed.

And the third is a voluntary transition to another taxation system. In this case, the deregistration date can only be December 31 of the current calendar year.

This follows from the provisions of paragraph 1 and paragraphs 3–5 of paragraph 3 of Article 346.28 of the Tax Code of the Russian Federation and letter of the Federal Tax Service of Russia dated December 29, 2012 No. ED-4-3/22651 (agreed with the Ministry of Finance of Russia).