How is the receipt of proceeds from sales into the current account reflected in accounting?

In practice, most often, proceeds from sales are transferred to the company's bank account via non-cash means.

Counterparties pay for the goods received (products, semi-finished products, services, etc.) by the usual transfer of funds from their current account to the seller’s current account. This is the simplest, most economical and safest way to transfer proceeds to the company’s account. How to record an operation in accounting if non-cash proceeds from sales are received in the current account - what entry should be used for this?

At the time of shipment, the seller reflects the proceeds from the sale of goods (works, services) and the buyer’s receivables. This debt is paid off as soon as the money from the buyer arrives in the seller's account. The following entries are made in accounting:

Postings for recognizing revenue in accounting are made on the basis of shipping documents (invoices, acts, etc.). A document confirming the receipt of money into the account is a bank statement.

When reflecting the receipt of revenue in foreign currency into a bank account, account 52 “Currency accounts” is used instead of account 51 “Currency accounts”.

Learn about the nuances of accounting for foreign currency account transactions in this article.

Conditions for recognizing revenue from ordinary activities in accounting

- the organization has the right to receive revenue, which arises from a specific agreement or is confirmed in another appropriate manner;

- the amount of revenue can be determined;

- there is confidence that as a result of a particular transaction there will be an increase in the economic benefits of the organization. Such certainty exists when the organization received an asset as payment or there is no uncertainty regarding the receipt of the asset;

- the right of ownership (possession, use and disposal) of the product (goods) has passed from the organization to the buyer or the work has been accepted by the customer (service provided);

- the expenses that have been or will be incurred in connection with this operation can be determined.

If at least one of the conditions listed above is not met in relation to the funds and other assets received by the organization, the organization’s accounting records recognize not revenue, but accounts payable.

Revenue from the provision for a fee for temporary use (temporary possession and use) of the organization's assets, rights arising from patents for inventions, industrial designs and other types of intellectual property and from participation in the authorized capital of other organizations is recognized if only three conditions are simultaneously met:

- the organization has the right to receive revenue arising from a specific contract or otherwise confirmed in an appropriate manner;

- the amount of revenue can be determined;

- there is confidence that a particular transaction will result in an increase in the economic benefits of the organization.

To summarize information on income and expenses associated with ordinary activities, as well as to determine the financial result for them by the Chart of Accounts for accounting financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, Account 90 “Sales” is intended.

The amount of revenue from ordinary activities, namely from the sale of goods, products, performance of work, provision of services, when recognized in accounting, is reflected in the credit of account 90 “Sales” and the debit of account 62 “Settlements with buyers and customers.” To account for the receipt of assets recognized as revenue, subaccount 90–1 “Revenue” is provided, entries in which are made cumulatively during the reporting year.

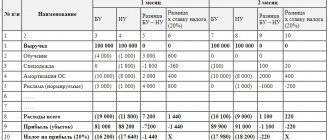

Example. In 2022, the Organization received revenue from the sale of goods in the amount of RUB 1,770,000. (including VAT - 270,000 rubles). The cost of goods sold was 900,000 rubles, expenses for selling goods were 255,000 rubles.

The following entries must be made in accounting:

- Debit 62 Credit 90–1 - RUB 1,770,000. — revenue from the sale of goods is reflected;

- Debit 90–3 Credit 68, subaccount “VAT calculations” - 270,000 rubles. — VAT charged;

- Debit 90–2 Credit 41–900,000 rub. — the cost of goods sold is written off;

- Debit 90–2 Credit 44–255,000 rub. m sales expenses are written off;

- Debit 90–9 Credit 99–345,000 rub. (1,770,000–270,000–900,000–255,000)—profit from sales is reflected.

Cash proceeds handed over to the bank: what entries to make in accounting

It is not always possible for a company to work exclusively with non-cash revenue. If the proceeds from customers are received in cash and the cash balance exceeds the established limit, the excess amount must be deposited into the current account.

We explain how the cash limit is set in this publication.

Cash proceeds from the cash register are transferred to the current account - what kind of entry can be used to record this operation?

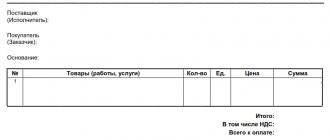

The operation of depositing proceeds into a current account is accompanied by the execution of cash documents (cash expense order, announcement for cash deposits, etc.) and is reflected in accounting by posting:

If the proceeds are not delivered to the bank by a company representative (cashier or other authorized person), additional entries may be required.

Find out what operations are available when your account is blocked here.

What does collection require?

You can’t just call the bank and say: come and collect the money. A number of conditions must be met. For example:

1. Documents. Every time a car comes to collect money, you need to prepare a stack of accompanying documents. Since collectors have a schedule and a route, they have little time to accept money. Therefore, documents need to be prepared in advance, which means that you will have to use the time of an individual employee. If he made a mistake with the documents, the collectors will not wait. They will not accept the money, the company will have to issue a refusal and in any case pay for the visit of the collectors.

allows you to eliminate the human factor for the simple reason that with it there is no need to fill out a bunch of papers. This means there are no errors during collection. The device will allow you to collect revenue at any time and credit it to your account online.

2. Room. To transfer money to collectors, you need a specially equipped room, which must be locked with a key. There should be no extra people present at the time of transfer. If you rent a retail space in the center, you will also have to look for a collection room. Plus, collectors require a free entrance and a place to park a car near the entrance/exit.

The electronic collection device can be installed in any convenient location. At least under the desk of the cashier or accountant responsible for the relevant operations.

When additional entries are required to reflect the receipt of revenue into the current account

Proceeds from the company's cash desk can go to the current account through a special intermediary (bank collector). If the proceeds are handed over to the bank through a collector, what additional posting may be needed?

In this case, an additional entry appears in accounting, taking into account the presence of cash proceeds “in transit” from the cash register to the current account. The appearance of a collector in the chain of movement of proceeds from the cash desk to the bank requires recording the following set of transactions in accounting:

Additional posting to reflect revenue “in transit” is required in one more case: if the company’s cashier hands over the revenue to the bank through the terminal - read more about this below.

We will tell you in this article how to register the transfer to the current account of the authorized capital.

How to process the revenue of an online store if the buyer paid for the order with a card? The answer to this question was given by ConsultantPlus expert T. Bursulaya. If you do not yet have access to the system, get a free trial online access and find out how to make entries for an online store accountant.

A new way to deposit cash through APU

A new method of depositing cash has been introduced for organizations to transfer funds to bank accounts - through an automatic receiving device (ADU). But the APU does not serve individual entrepreneurs.

Representative of the organization:

1) when investing cash in the APU - enters data identifying the organization (personal code, password, etc.) and the bank account to which the amount of funds is credited;

2) after depositing cash into the APU, it displays a printout confirming the operation.

Important

A new method has been introduced for organizations to deposit cash to transfer funds to bank accounts - through APU. But IP APU does not serve.

As you can see, using the APU does not require a bank card. And the printout will reflect information characterizing the operation: about the organization, credit institution, APU identifier, date and time of cash investment, bank account and amount of cash invested (clause 3.7 of the Regulations).

It must be said that the Bank of Russia’s directive No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities...” clearly does not provide for this method. Directive No. 3210-U (clause 3) instructs the authorized representative of the organization to hand over cash for crediting its amounts to a bank account either in a bank or in an organization included in the Bank of Russia system. However, depositing cash into the APU is a cash transaction with a bank, carried out using software and hardware (clause 1.1 of the Regulations). Therefore, the use of APU does not entail a violation of the procedure for working with cash and the procedure for conducting cash transactions (Clause 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

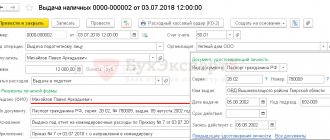

The proceeds were credited to the account through the terminal: we are sorting out the transactions

Banks can provide companies with a self-collection service. This method of transferring proceeds to a current account can significantly reduce the time between receiving cash proceeds and its crediting to a bank account.

Instead of making a daily trip to the bank to deposit cash, the teller deposits it into the bank terminal. To use this service, the company enters into an agreement with a banking institution and receives a special access code, which is entered into the terminal when depositing cash.

The proceeds deposited through the terminal almost immediately go to the company’s current account (minus the commission). A doubt may arise: is this extra posting necessary using account 57 “Transfers in transit” if the money goes straight to the account?

Wiring is still required. The terminal may not accept all banknotes in full, so to reflect the transaction of transferring proceeds to the account, it is safer to use account 57 “Transfers in transit.”

The wiring diagram in this case will be similar to that described above (when money is transferred to the bank through a collector). But the content of the operations will be somewhat different:

After accepting the proceeds, the terminal issues a document confirming the receipt of cash (order check, receipt, etc.).

Should I include in the revenue the tips that the client left to the waiter (or maid) after paying with a card, and is it necessary to withhold personal income tax from them? The answer to this question is in the ConsultantPlus system.

Get free trial access to K+ and watch the full version of the explanation.

This material will introduce you to other transactions on the current account.

Collection cost

It depends on a number of factors:

- transportation amounts;

- collection time;

- complexity of the route;

- distance from the collection point;

- presence of armed guards.

Typically there are the following tariff options:

- fixed rate (for each arrival);

- interest rate (agreed percentage of the deposited amount, but not lower than a certain minimum);

- complex – “tax” for arrival + percentage of the amount.

Let's consider a complex option. It consists of a fixed departure fee and a percentage of the amount handed over to collectors. But these are only direct costs.

To understand how much collection actually costs, you need to take into account the cost of time of each employee involved in the cash collection process from receiving funds to crediting to the account and recording in accounting systems, as well as the cost of the most expensive resource - administrative. It has been empirically established that a manager can simultaneously effectively manage 5-9 processes. The more non-profit-making processes an employee is responsible for, the more expensive the process is for the business as a whole.

You also need to take into account the number of points for collection: the more there are, the more complex the organization of the process. In addition, many companies do not consider the cost of money in the period and the cost of additional financing to maintain working capital. Ultimately, the cost of all company costs for cash collection can reach 1-2% of turnover or more.

Results

To reflect the receipt of revenue into a bank account, accounting entries are made to the debit of account 51 “Currency accounts” (52 “Currency accounts”) and the credit of account 62 “Settlements with buyers and customers.”

If cash proceeds are handed over to the bank by a cashier, account 50 “Cash” is credited in correspondence with account 51 “Cash Accounts” debited. When intermediaries (collectors, terminals) participate in the transfer of proceeds from the cash desk to the bank, account 57 “Transfers in transit” is additionally involved in the postings. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Other income in accounting

- receipts related to the provision of the organization’s assets for temporary use for a fee;

- receipts related to the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

- proceeds related to participation in the authorized capitals of other organizations (including interest and other income on securities);

- profit received as a result of joint activities;

- proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods;

- interest received for providing the organization's funds for use, as well as interest for the bank's use of funds held in the organization's account with this bank;

- fines, penalties, penalties for violation of contract terms;

- assets received free of charge, including under a gift agreement;

- proceeds to compensate for losses caused to the organization;

- profit of previous years identified in the reporting year;

- amounts of accounts payable and depositors for which the statute of limitations has expired;

- exchange differences;

- the amount of revaluation of assets;

- Other income.

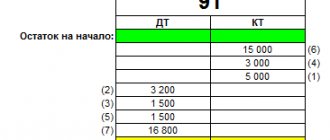

The chart of accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by the Order of the Ministry of Finance of Russia dated October 31. 2000 No. 94n, account 91 “Other income and expenses” is intended to summarize information on other income and expenses of the reporting period.

It is recommended to open the following sub-accounts for account 91 “Other income and expenses”:

- 91–1 “Other income”;

- 91–2 “Other expenses”;

- 91–9 “Balance of other income and expenses.”

Receipts of assets recognized as other income are recorded in subaccount 91–1 “Other income”. Subaccount 91–9 is intended to identify the balance of other income and expenses for the reporting month.

Accounting for account 91 is carried out as follows. Cumulatively during the reporting year, entries are made in subaccounts 91–1 and 91–2. Each month the balance of other income and expenses is determined by comparing the turnover in the debit of subaccount 91–2 and the credit of subaccount 91–1, which is then written off from subaccount 91–9 to account 99 “Profits and losses”. That is, account 91 does not have a balance at the reporting date.

At the end of the reporting year, subaccounts opened to account 91 “Other income and expenses,” with the exception of subaccount 91–9, are closed with internal entries to subaccount 91–9. For account 91, analytical accounting should be kept for each type of other income and expenses in such a way that it is possible to identify the financial result for each operation.

The order in which other income is recognized in the accounting records of an organization is stated in paragraph 16 of PBU 9/99. If all five established conditions for revenue recognition are met, other revenues are recognized in accounting in the following order:

- proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods, as well as interest received for providing the organization’s funds for use, and income from participation in the authorized capital of other organizations (when this is not the subject of activities of the organization). In this case, for accounting purposes, interest is accrued for each expired reporting period in accordance with the terms of the agreement;

- fines, penalties, penalties for violation of the terms of contracts, as well as compensation for losses caused to the organization - in the reporting period in which the court made a decision to collect them or they were recognized as a debtor;

- the amount of accounts payable and depository debt for which the limitation period has expired - in the reporting period in which the limitation period has expired;

- the amount of revaluation of assets - in the reporting period to which the date as of which the revaluation was made relates;

- other receipts - as they are formed (identified).

Let's look at some examples of income classified by PBU 9/99 as other income.

Example . The organization has entered into a lease agreement under which it leases equipment it owns for a period of 1 month. Providing property for rent is not the main activity of the organization. Rental cost - 36,580 rubles, including VAT 18% - 5,580 rubles. The specified amount is transferred to the organization's bank account upon expiration of the lease term. The organization conducts settlements with the tenant on account 76 “Settlements with various debtors and creditors”.

— Debit 76 Credit 91–1 “Other income” — 36,580 rubles. — rent accrued;

- Debit 91–2 “Other expenses” Credit 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT” - 5580 rubles. — the amount of VAT on rent has been accrued;

— Debit 51 “Current accounts” Credit 76–36,580 rub. — the rent amount has been credited to the bank account.

The useful life established by the organization when accepting the vehicle for registration is 5 years, the actual service life until the moment of sale is 3 years.

Depreciation was calculated using the linear method, the amount of accrued depreciation was RUB 202,176. The residual value of the car is RUB 134,784.

- Debit 76 “Settlements with various debtors and creditors” Credit 91–1 “Other income” - 172,280 rubles. — the buyer’s debt for the sold car is taken into account;

— Debit 91–2 “Other expenses” Credit 68 “Calculations for taxes and fees” — RUB 26,280. — VAT is charged on the sales amount;

— Debit 01–2 “Disposal of fixed assets” Credit 01–1 “Fixed assets in the organization” — RUB 336,960. — the disposal of the car as a result of sale is reflected;

— Debit 02 “Depreciation of fixed assets” Credit 01–2 “Disposal of fixed assets” — 202,176 rubles. — the amount of depreciation accrued during the operation of the vehicle is written off;

— Debit 91–2 “Other expenses” Credit 01–2 “Disposal of fixed assets” — 134,784 rubles. — the residual value of the sold car is written off;

- Debit 51 “Settlements” Credit 76 “Settlements with various debtors and creditors” (62 “Settlements with buyers and customers”) - 172,280 rubles. — funds have been received from the buyer;

— Debit 91–9 “Balance of other income and expenses” Credit 99 “Profits and losses” — 11,216 rubles. — profit from the sale of the car is reflected.

Example. The lender organization provided the borrower organization with a cash loan in the amount of 326,000 rubles on July 1, 2022. for a period of 1 month. The interest rate under the loan agreement is 14% per annum. The terms of the loan agreement stipulate that interest under the agreement is paid simultaneously with the repayment of the loan amount.

In the accounting records of the lending organization, operations for granting a loan and calculating interest will be reflected as follows:

In July 2022:

- Debit 58–3 “Loans provided” Credit 51 “Current accounts” - 326,000 - funds provided under the loan agreement are reflected as part of financial investments;

- Debit 76, subaccount “Calculations for interest due”, Credit 91–1 “Other income” - 3876.27 rubles. — interest accrued due for July 2022 ((RUB 326,000 x 14%) / 365 days x 31 days).

In August 2022:

- Debit 51 “Account settlements” Credit 76 “Settlements with various debtors and creditors”, subaccount “Calculations for interest due” - 3876.27 rubles. — interest received under the loan agreement;

- Debit 51 “Current accounts” Credit 58–3 “Loans provided” - RUB 326,000. - the loan amount is returned.

Handing over cash to a collector

The procedure for accepting bags with cash from clients has been simplified. Previously, along with the statement for the bag 0402300, a commercial organization had to put a register of transactions carried out in a bag with cash. And now there is no need to compile such a register (clause 4.2 of the Regulations).

We note that Directive No. 3353-U excluded the clause “(except for the exchange office)” from the text of the Regulations. Why? The fact is that banks no longer have “points” with this name. Exchange offices were either transferred to the status of internal structural divisions (ISU) of credit institutions or closed (clause 1.2 of the Bank of Russia Directive No. 2423-U dated April 2, 2010). As a result, the concept of “exchange office” was abolished.

Another nuance: collection workers may not have service weapons. But in this case, they must be accompanied by armed employees of the internal affairs bodies or a private security organization (clause 7.2 of the Regulations).

Finally, a client who submits dubious banknotes to the bank, instead of the memorial order 0401108, is now issued an order for the transfer of valuables 0402102 (clause 16.7 of the Regulations).

E.Yu. Dirkova

, for the magazine “Regulatory Acts for Accountants”

Help your business grow

Invaluable experience in solving current problems, answers to complex questions, specially selected latest information in the press for accountants and managers. Choose from our catalog >>