Excessively transferred funds can come not only from regular customers and clients, but also from random companies that have every right to demand the return of their own funds.

If you received money that was transferred by mistake by the buyer, or the client returned a previously purchased product, then you have grounds to return the money back to him. We are also talking about situations where you overpaid or returned goods to the supplier by mistake. In this case, you can demand that he return the money. It is necessary to note that in fact, there can be a huge number of reasons for returning a product, for which you will then have to return the money. For example, there are cases when the buyer made an advance payment and expected the arrival of goods that were never shipped. In such a situation, it is important to return his money back. This article discusses ways to correctly reflect a refund to a buyer or process a refund of funds received from a supplier in the 1C Accounting 8.3 program.

The main reasons for returning money to the buyer

During settlements between counterparties, situations often arise when funds are transferred by mistake. The main reasons for erroneous transfers include:

- There was an error in the payment amount.

- The error consists of incorrectly specifying the counterparty.

- There was a change in supplier and it was decided to return previously paid advances.

- The product was selected incorrectly and a decision was made to return it.

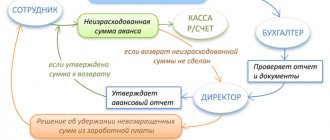

It should be noted that an individual entrepreneur (legal entity) must return erroneously received funds based on a claim from the counterparty. This letter indicates the reasons and details where the funds can be returned. It should be remembered that the return must be reflected in 1C Accounting on the day the funds are written off from the current account.

To issue a refund to the client, you can use a letter that lists the bank details for payment or indicates the reason for returning the goods. If you pay attention to retail trade, then in this case a corresponding statement is drawn up in any form. Additionally, the reason for returning the item is indicated. In order to return money to 1C, suppliers need to carry out a certain operation when debiting from a current account or issuing cash. A special transaction is registered in the buyer's accounting.

Below you can read in more detail the instructions that allow you to issue a refund to the buyer in 1C Accounting 8.3.

Return of goods in 1C 8.3 from the buyer

Let's see how to make a return to 1C using an example, and analyze each of the options.

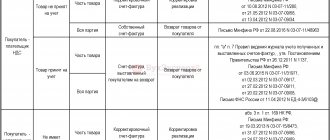

Since the buyer had no demand for the previously sold goods, the parties agreed to return part of the batch (3 pieces). The return is processed within the framework of the previous contract.

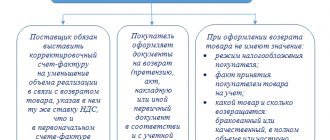

On February 14, the returned inventory items were capitalized, and the buyer received an adjustment invoice for them.

Return of goods from the buyer

Capitalize the returned goods and materials using the document Return of goods from the buyer . Fill it out with all the necessary information based on the sale of goods. To fill it out manually, create it in the Sales – Returns from Customers section.

When returning an incomplete batch, specify the number of goods and materials returned to the warehouse.

When setting the CSF, leave the recommended value on the VAT and write it down.

When selling goods back, put the switch on Invoice received from the buyer . Then fields will appear for filling out the SF data and registering it in the database.

Postings

If you need to reflect mutual settlements on another account, set a new account on the Settlements .

Implementation adjustments

Let's create the same example using a different option.

Based on the sales, fill out the Sales Adjustment document or go to the Sales – Sales Adjustment section to fill it out manually.

Correct the Quantity column (after change) , reflecting the actual quantity of goods and materials sold to the buyer after the return is reflected.

Postings

Since accrued VAT on returned goods is not automatically deductible, complete this operation yourself. To do this, go to the Operations section - Regular VAT operations and select Create - Generating purchase ledger entries.

To automatically fill in VAT on the Reducing sales cost , use the Fill and check the amount of VAT accepted for deduction.

Differences in return processing methods

There is no big difference in registration for an accountant. But if the return is processed by managers, it is more convenient to use the document Return of goods from the buyer .

The return of other goods and materials does not have any special differences and is carried out in the same ways.

We will set up any reports, even if they are not in 1C

We will make reports in the context of any data in 1C. We will correct errors in reports so that the data is displayed correctly. Let's set up automatic sending by email.

Examples of reports:

- According to the gross profit of the enterprise with other expenses;

- Balance sheet, DDS, statement of financial results (profits and losses);

- Sales report for retail and wholesale trade;

- Analysis of inventory efficiency;

- Sales plan implementation report;

- Checking of employees not included in the time sheet;

- Inventory inventory of intangible assets INV-1A;

- SALT for account 60, 62 with grouping by counterparty - Analysis of unclosed advances.

Order report customization

Features of returning funds to the client in 1C

Returning funds to the client's card

Various trade organizations often return funds to their clients using a regular plastic card. This method is applicable if the buyer previously paid for the item with this card, and then decided to return it back within two weeks. To process a money transfer using an accounting program to a card, you need to go to the “Bank and cash desk” section and click on the “Payment card transactions” link. After this, a window with the operations created earlier will appear in front of the user.

In the window that appears, you need to find and click on the “Create” button. Next, select the “Return to Buyer” option. After this, a special form for returning funds will open in front of the user in the 1C program.

This form requires the following information:

- Name of the organization.

- Counterparty. For example, “Individual (retail)”.

- Refund amount.

- Type of payment. For example, “Payment by card”.

In order to save and post a document, you need to click the following buttons “Record” and “Post”. Next, you need to click on the “DtKt” button to check the accounting records. After this, the window for making transactions will open.

In the posting window, you can see the operation on the debit of account 62.01 “Settlements with buyers and customers” and the credit of account 57.03 “Sales by payment cards” for the amount of the refund. After the financial institution debits funds from the current account, the balance on account 57.03 will become zero.

After some time, the funds will be debited from the current account and transferred to the acquiring bank. Well, or the amount of the refund will simply reduce the receipt of card payments. It must be remembered that all transactions carried out on the current account are usually downloaded from the client bank.

If the refund was reflected as a separate transaction on the current account, then it is recommended to include the correct details in the write-off document. To do this, go to the “Bank and Cash Office” section and click on the “Bank Statements” link. Only after this the window with operations will open.

In this statement you should find the required operation called “Write-off from the current account.” Some changes need to be made to the relevant fields. Namely:

- Type of operation. Here you should indicate “Other write-off”.

- Recipient. You must select “Individual”.

- Expense item. You need to select the appropriate value: for example, “Refund to the buyer.”

- Debit account. You need to put "57.03".

- Counterparty. You need to select an acquiring bank from the directory.

- Contracts. You should specify the details of the agreement with the bank.

The next step is to reflect the operation in accounting, for which it is recommended to click on the following buttons: “Post” and “Record”. To familiarize yourself with the accounting entries, you need to click on the “DtKt” button. After which the posting window will open in front of the user.

In the posting window you can see the debit operation of account 57.03 “Sales by payment cards”. Here you can also familiarize yourself with the transaction on crediting account 51 “Current account” for the transfer amount. From this moment on, the account balance 57.03 will be equal to 0.

How to make a cash refund?

This procedure is simple because it is done using one document. The user is recommended to find the appropriate section “Bank and cash desk”, and then click on the link “Cash documents”. Next, a cash transactions window will appear in front of him.

The next step is to click on the title “Issue” in the window that just opened. Next, the user will be able to familiarize himself with a form in which some data must be entered.

It is recommended to include the following information here:

- Name of the organization.

- The type of operation performed. You should select the “Return to Buyer” option.

- Receiver name.

- Refund amount.

- Agreement concluded with the buyer.

To complete the procedure, press the “Record” button, and then “Perform”. To familiarize yourself with the postings, it is important to click on “DtKt”. After this, a window with postings will open in front of the user.

It should be noted that in the transactions there was an operation on the credit of account 50.01 and the debit of account 62.01. Consequently, a refund was issued.

Refund to the buyer's bank account

To carry out the operation, you only need one document. It is recommended to go to the “Bank and Cash Office” section, and then click on the “Bank Statements” link. Next, the corresponding window for transactions carried out on the bank will open.

Many companies download transactions from the system to the client bank. In this case, to process a refund, you must correct the type of transaction being performed. To do this, you need to enter the required debit from the current account and indicate the desired type of operation “Return to buyer”. Additionally, it is recommended to check the remaining details that were downloaded from the client bank. The next step is to press the “Record” key. Next, you need to click on the “Proceed” button. In order to view the postings, you need to click “DtKt”.

In the postings you can see the operation of debiting the account and crediting the account for the amount of the refund. You can verify that the return has been generated.

Refund after sale

Accounting for non-cash funds that the seller is forced to return to the payer if the goods were nevertheless shipped is also carried out as a credit to account 51 and a debit to account 62.

However, in this case, the accounting of the selling company already has an additional entry for the sales amount: debit 62 “Settlements with buyers and customers” – credit 90 “Sales”, subaccount 90.1 “Revenue from the main activity”. If we are talking about the sale of goods, then the debit of account 90 (subaccount 90.02 “Cost of sales”) reflects the cost of the objects transferred to the buyer that is written off in accounting (under credit 41).

After the goods are returned, the seller, based on the return invoice from the buyer, will have to reverse these entries, that is, make transactions for the same amounts as when accounting for sales, but with a minus sign.

The return of funds to the buyer by bank transfer in this case will remain, so to speak, a direct posting: debit 62 – credit 51. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

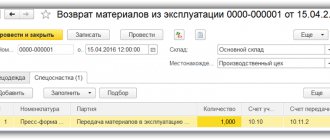

Processing a refund from a supplier in 1C

If you are a buyer, and the supplier returns funds according to your letter, then you need to register a receipt to the account with the transaction type “Return from supplier”. Often companies download bank transactions from a system called client-bank. In such a situation, the only thing that needs to be done is to correct the type of operation. To do this, go to the “Bank and Cash Office” section, and then click on the “Bank Statements” link. After completing these steps, a window for transactions carried out in the bank will open in front of the user.

Here you need to click on the required document of receipt to the current account. In the receipt form that appears, you should indicate the type of operation. Namely “Return from supplier”. Next, you need to check all the other details that were loaded from the client bank, and then click on the “Record” and “Post” buttons. In order to familiarize yourself with the wiring, you need to click “DtKt”.

In the postings you can see the operation of the debit of account 51, as well as the credit of account 60. The program has registered a refund from the supplier.

Still have questions? Book a consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Refund to payment card

The method is relevant when paying for a product item with a bank card. To reflect the operation, go to the “Bank and Cash Desk” section and go to the “Payment Card Transactions” position. From the provided list of actions, activate the “Create” button.

In the electronic form of the new document, select the type of operation: “Return to buyer.” After which the program will ask you to fill in the fields:

- Name of the organization. If several organizations are kept simultaneously in one information base, we select from the issued directory the one from whose current account money will be debited to the buyer’s card.

- Counterparty. In this column we indicate the buyer who requested a refund.

- Payment amount.

- An agreement concluded with a counterparty.

- Type of payment. In our case, “Bank card”.

We assign a number and save the document by clicking on the “Post and Close” button.

After some time, the required amount will be written off in favor of the bank.