Accounting for cash on account 50 – “Cash desk”

Accounting account 50 is intended for accounting for cash flows, that is, for accounting for cash transactions. Debit 50 is intended to reflect cash inflows, credit 50 is intended to reflect cash outflows.

Documentation of cash transactions

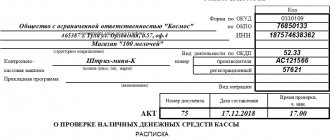

All cash receipts and payments must be reflected in the statutory cash book; its maintenance is mandatory for every organization. All entries in the cash book are made on the basis of primary documents: incoming and outgoing cash orders. The entry of cash into the cash register is formalized by a cash receipt order, unified form KO-1, and the write-off of cash from the cash register is formalized by an expenditure cash order, form KO-2.

Analysis of account 50 shows that account 50 is active, intended to reflect assets (cash), its balance is always debit. An increase in an asset is reflected in a debit, a decrease in a credit.

Transactions with cash necessarily involve the use of cash registers, with the exception of some types of activities for which strict reporting forms can be used; read more about this in this article.

For each organization, a cash balance limit is established, that is, the amount of cash that can remain in the cash register at the end of the day; the amount in excess of the limit must be handed over to the bank at the end of each working day. When transferring cash to the bank, a forwarding slip is issued for the bag. The excess amount of cash can be left only to pay wages and benefits, but no more than five working days, including the day the bank issues the money.

The cash desk can store not only cash, but also monetary documents (paid tickets, vouchers).

Conducting cash transactions is regulated by certain regulatory documents that must be studied for proper cash accounting and proper cash management.

Regulatory documents for cash transactions: (click to expand)

- The Regulation “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation”, approved by the Bank of Russia on October 12, 2011 No. 373P, is the main document regulating cash transactions.

- Regulations on the use of KKM No. 745 1993 (ed. 08.08.2003)

- Directive of the Bank of Russia dated June 20, 2007 No. 1843-U “On the maximum amount of cash settlements between legal entities.” At the moment, the maximum amount of cash payments between legal entities is limited to 100 thousand rubles.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Postings to account 50

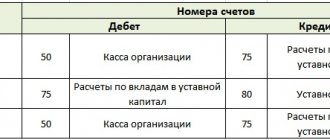

| Debit | Credit | Operation name |

| 50 | 51 | Withdrawing money from a current account |

| 50 | 62 | Receiving payment from the buyer in cash to the cash register |

| 50 | 75 | Contribution to the authorized capital by the founder in cash |

| 60 | 50 | Payment to the supplier in cash |

| 70 | 50 | Payment of wages to employees |

The indicated accounting entries for accounting for cash transactions are the most common standard options; you will find a complete list of entries in the Chart of Accounts ().

Typical accounting entries

The table below shows standard accounting entries for item 50:

| № | Accounting entry | Purpose of the operation |

| 1 | Dt 50.01 Kt 90.01 | Receipt of proceeds from sales of products to the cash register |

| 2 | Dt 50.01 Kt 90.01 | Crediting income from other transactions to the cash register |

| 3 | Dt 51 Kt 50.01 | Transfer of cash from the cash desk to the bank |

| 4 | Dt 55.01 Kt 50.01 | Transfer of cash from the cash register for crediting to a special company account |

| 5 | Dt 60 Kt 50.01 | Payment to the supplier in cash for the products received |

| 6 | Dt 76 Kt 50.01 | Repayment of debt to other creditors |

| 7 | Dt 04 Kt 50.01 | Purchase of intangible assets |

Accounting for non-cash funds to account 51 – “Current account”

All non-cash payments can be made if you have a current account. It opens in a credit institution, otherwise called a bank. How to open a current account and what documents you need to provide, read this article.

To record the movement of non-cash funds of the organization, 51 accounting accounts are intended.

Is he active or passive?

Analysis of account 51 proves that it is active, it keeps records of the company's assets (non-cash money), and it always has a debit balance. The debit of account 51 is intended to reflect the receipt of non-cash funds (an increase in an asset), and the credit of account 51 is intended to reflect the write-off of non-cash funds (a decrease in an asset).

Currently, an organization is allowed to have several current accounts. Accounting account 51 () can be divided into several analytical ones, each of which will keep records for each individual current account of the enterprise.

The primary document confirming the fact of debiting and receiving non-cash funds is a bank statement, which contains information about all amounts received and debited from the organization’s current account.

Funds are written off on the basis of a payment order, which is drawn up in 2 copies and sent to the bank; one copy is marked by the bank stating that the order has been accepted and returned. When you deposit money from the cash register to your current account, an announcement is issued for a cash contribution.

Reflection of information on account credit 91

Account 91, loan entries are made for the following types of business transactions: income from the sale of fixed production assets, proceeds from the gratuitous receipt of assets (current and non-current), fines received, penalties under agreements with counterparties, exchange rate differences, dividends received from participation in other partnerships, income from the provision of loans, advances, proceeds from the sale of intangible assets, innovative developments, amounts of overdue debt to creditors, etc.

Typical transactions for account 51

| Debit | Credit | Operation name |

| 51 | 62 | Receipt of payment or advance from the buyer |

| 51 | 50 | Cash deposit to the bank from the company's cash desk |

| <51 | 75 | Contribution to the Authorized Capital by non-cash means |

| 51 | 66 (67) | Obtaining a short-term (long-term) loan |

| 60 | 51 | Payment to the supplier by bank transfer |

| 50 | 51 | Withdrawing money from an account |

| 75 | 51 | Payment of dividends by bank transfer |

| 66 (67) | 51 | Repayment of credit (loan) |

Summarize:

An organization can use both cash and non-cash money for mutual settlements. To account for the former, a cash register is used, and for the latter, a current account is used. Each cash accounting operation must be documented in primary documents, and the corresponding entry is reflected in the accounting records.

Postings to 91 accounts “Other income and expenses”

Correspondence and main transactions for 91 accounts are shown in the table:

| Dt | CT | Wiring Description | A document base |

| 91 | 01 | Write-off of retired fixed assets at residual/initial value. | OS-1, SP-51 |

| 91 | 02 | Calculation of depreciation on fixed assets that are leased (not an object of activity). | Accounting statement, Depreciation sheet |

| 91 | 03/04 | Write-off of retired income-generating investments in tangible assets (hereinafter referred to as MT)/intangible assets. | Accounting certificate, Acceptance certificate |

| 91 | 07 | Write-off of equipment for installation (sold/transferred free of charge) at cost. | Acceptance certificate, Invoice |

| 91 | 08 | Write-off of the cost of investments in VNA. | Certificate of acceptance and transfer, Certificate of gratuitous transfer of valuables |

| 91 | 10 | Write-off of materials sold/transferred free of charge (upon disposal of fixed assets) at actual cost. | Acceptance certificate, Invoice |

| 91 | 11 | Write-off of the cost of sold animals (not an activity item). | TTN (SP-32) |

| 91 | 14/59/63 | Creation of a reserve to reduce the value of the investment capital/ensure investments in securities/for doubtful debts. Write-off of amounts to reserves – by reverse posting. | Accounting certificate, accounting calculation for creating a reserve |

| 91 | 15 | Reflection of write-off of materials (actual cost). | Acceptance certificate, Invoice |

| 91 | 16 | Write-off of the share of deviations from the accounting cost of materials sold (if a negative value - a red reversal). | Accounting certificate, accounting calculation for writing off deviations |

| 91 | 19 | Write-off of VAT on materials sold (non-refundable). | Accounting information |

| 91 | 20/21/23 /29 | Write-off of expenses for maintaining production facilities/facilities for conservation. | Accounting certificate, accounting calculations |

| 91 | 23 | Write-off of the cost of services of auxiliary production (upon disposal of fixed assets). | |

| 91 | 28 | Write-off of the cost of irreparable defects (work of an operational nature). | |

| 91 | 43 | Write-off of commercial expenses (for the sale of operating systems, materials). | |

| 91/ 19 | 60 | Reflection of amounts accrued by the contractor for work/services performed upon liquidation/sale of fixed assets, other assets/VAT amount. | Invoice |

| 91 | 60/62/76 | The amount of receivables/debt is written off after the expiration of the statute of limitations/ cannot be recovered in any way. | INV-17, Accounting certificate, Minutes/order of the manager |

| 91 | 66/67 | Reflection of the percentage amount payable for using credits/loans. | Accounting certificate, Bank account statement |

| 91 | 68 | VAT accrual (income from the sale of operating systems/materials). | Accounting certificate, VAT accounting calculation |

| 91 | 70/69/10 | Reflection of expenses for liquidation of OS-v. | Work order for piece work, Certificate of write-off of valuables |

| 91 | 75 | Reflection of expenses (simple partnership agreement). | Accounting certificate-calculation |

| 91 | 51/76 | Reflection of violations of the terms of business contracts (paid/recognized for payment). | Bank account statement, Invoice, Accounting certificate |

| 91.02 91.01 | 52/60/62 /58/… + 55/67 | Reflection of exchange rate differences (negative). Positive - reverse wiring. | Act on revaluation of values, Accounting certificate |

| 91 | 73 | Write-off of the cost of material damage (it is unrealistic to recover, for example, a court refusal). | INV-17, Leader's order Accounting information |

| 91 | 76 | Payment for services of credit institutions/costs of consideration of cases in courts. Profit receivable under a simple partnership agreement / interest on loans, income on shares, shares and securities / fines, penalties and interest for violation of the terms of agreements - reverse posting. | Accounting certificate, Notice/Bank statement, Invoice, KO-1 |

| 91 | 79 | Reflection of expenses on transactions with structural divisions (on a separate balance sheet). Reflection of income - reverse posting. | Invoice, Advice |

| 91 | 81 | The difference between actual costs (repurchase of shares/shares) and par value (participant's own shares/shares). When repurchasing, the difference is reflected by reverse posting. | Accounting statement, calculation of the difference between the actual costs of repurchasing shares and their nominal value |

| 91 | 94 | Write-off of the cost of shortage of valuables in excess of the norm / from damage (in the absence of specific culprits). | INV-3, Manager's order, Accounting certificate |

| 91 | 98 | Write-off of other income amounts (future periods). Enrollment – reverse posting. | Accounting information |

| 99.02/ 99.03 | 91 | Write-off of the balance of income/expenses at the end of the month. | Calculation of the balance of other income and expenses, Accounting certificate |

| 96 | 91 | Crediting to income the amount of unused reserve for upcoming expenses/payments. | Accounting information |

| 60/76 | 91 | Crediting of accounts payable/receivable (unclaimed after the expiration of the limitation period). | INV-17 |

| 10/62 | 91 | The amounts of transactions with containers are reflected. | Waybill, Invoice |

| 07/10/11 /41/43/45 08 /20/21/29 /23 | 91 | The surplus/unaccounted amounts of inventory items identified during the inventory are reflected. | INV-3, INV-19, INV-24 |