Who needs form OS-1 and why?

Fixed assets are transferred both within the organization and between counterparties. To record the transfer of objects, use a special act of acceptance and transfer of fixed assets in the OS-1 form (approved by Resolution of the State Statistics Committee No. 7 of January 21, 2003). This document confirms transactions for the transfer of various fixed assets, cars and even land plots. But the delivery and acceptance of buildings and structures is carried out according to another form 1 - No. OS-1a. A group of fixed assets is transferred according to form No. OS-1b.

IMPORTANT!

Forms from the album of unified forms are optional since 2013. Companies have the right to develop their own register, taking into account organizational and industry characteristics, including in it the details required for primary documents (Article 9 402-FZ of December 6, 2011).

The act is used to formalize the following operations:

- putting the facility into operation, that is, including the property asset in fixed assets;

- disposal (upon sale, exchange) of registered funds to a third party.

If an organization purchased used objects (that is, already in use), then there are two options for activation:

- If the assets are already ready for use and are recognized as a fixed asset at the time of receipt, use the act that was drawn up upon transfer.

- If they are not ready for use and additional costs are required to put them into operation (repair, modernization, installation), a new acceptance certificate is issued. It should be filled out with the date on which the facility will be put into operation.

Is it necessary to have a seal on primary accounting documents in the OS form?

I.V. Antonenko, author of the answer, Ascon consultant for accounting and taxation

QUESTION

During commissioning on OS-1 there are no seals and signatures of the supplier - is this a violation? Is it mandatory to print on primary accounting documents in the OS form?

Situation 1: We will form an OS. For some time we have been accepting something on account 08 from different suppliers. Then we put it into operation. It turns out that there is one act, but there must be several signatories.

Situation 2: If you bought an object today, it was put into operation in 3 months. How then to sign a deed with the supplier?

Situation 3. OS modernization. OS-3: in a unified form there are seals and signatures of the person who handed over the OS object and who modernized it. If they don't exist, is this a violation?

ANSWER

- Application of unified forms of primary accounting documents, incl. OS-1, OS-3, not necessarily from 2013.

- Act OS-1 can be drawn up by the seller when selling property taken into account by the seller as fixed assets. If the seller sells property that is a commodity for him, then when transferring the property to the buyer he draws up an invoice (for example, TORG-12), and the buyer unilaterally draws up an OS-1 act without the signature and seal of the supplier on the date of acceptance of the purchased property as part of fixed assets .

- In our opinion, the absence in the OS-3 form of signatures and seals of third parties who carried out the modernization of a fixed asset will not be a violation if the modernization was carried out by the company itself or if the modernization by a third party is confirmed by other primary documents (for example, a certificate of completion of work) .

JUSTIFICATION

1. Application of unified forms of primary accounting documents, incl. OS-1, OS-3, not necessarily from 2013 (Information of the Ministry of Finance of Russia N PZ-10/2012 “On the entry into force on January 1, 2013 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” ").

Companies independently develop the forms of documents used and approve them as part of their accounting policies for accounting purposes (clause 4 of PBU 1/2008).

2. Act OS-1 can be drawn up by the seller when selling property taken into account by the seller as fixed assets. If the seller sells property that is a commodity for him, then when transferring the property to the buyer he draws up an invoice (for example, TORG-12), and the buyer unilaterally draws up an OS-1 act without the signature and seal of the supplier on the date of acceptance of the purchased property as part of fixed assets . This conclusion follows from the procedure for applying the OS-1 form, approved. Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 N 7.

3. In our opinion, the absence in the OS-3 form of signatures and seals of third parties who carried out the modernization of a fixed asset will not be a violation if the modernization was carried out by the company itself (the procedure for using the OS-3 form, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21 .2003 N 7) or if the modernization by a third party is confirmed by other primary documents (for example, a certificate of completion of work).

Who fills it out

The filling procedure is influenced by the content of the operation for the delivery and acceptance of fixed assets. If the movement occurs within the organization - between departments, then the document in a single copy is filled out by the structural unit that hands over the asset.

If the transaction is carried out between counterparties, then the act is prepared in two copies by the delivery company. One signed copy remains with the giving party, the other is transferred to the receiving party. Technical documentation on the non-current asset must be attached to the completed document.

ConsultantPlus experts discussed how to register the sale of a fixed asset. Use these instructions for free.

Filling procedure

The submitting organization fills out the following fields on the title page of the OS-1 form:

- The stamp “APPROVE” and details of both parties.

- Act number and date.

- Dates of receipt and sale.

- Depreciation group number.

- Inventory and serial numbers.

- Object name.

- Location at the time of transfer.

On the second page you should indicate the following information:

- Date or year of issue.

- Initial date of entry into service.

- Actual service life in years or months.

- Useful life determined in accordance with the Classification of fixed assets included in depreciation groups, approved. Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 (as amended on December 27, 2019).

- The amount of depreciation accrued up to the date of transfer.

- Residual value (purchase price excluding VAT minus accrued depreciation).

- Contract price (the amount for which the fixed asset was sold, including VAT).

- Brief individual characteristics data.

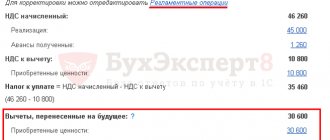

This is what a sample of filling out the OS-1 form looks like with an example of selling an air conditioner:

- book value—RUB 271,666.67;

- depreciation group - 3;

- useful life - 37 months;

- amount of accrued depreciation—RUB 7,342.34;

- sales price—RUB 330,000.00.

On the third page of the OS-1 form, data on the test results and signatures of the responsible persons of the transmitting and receiving parties are filled out.

A separate protocol on the acceptance of the object for registration is drawn up on the results of the commission’s work.

How to fill out form OS-1

The general rules for filling out OS-1 are given in Resolution of the State Constitutional Court No. 7. The form consists of three sections. In addition, it includes information about the participants in the transaction, its direct object and the reflection of the transaction in accounting, characteristics and test results of the asset.

Instructions on how to draw up an act for the delivery and acceptance of property objects:

- We write down the name, addresses and bank details of the parties to the transaction, their OKPO codes.

- We enter the basis for the transfer - an order, instruction or agreement indicating the details.

- We enter the main details of the act - its number, date.

- We determine the object and its location at the time of the transaction, the manufacturing organization.

- We reflect the date of registration and deregistration, accounting account, OKOF code, depreciation group number, inventory and serial numbers.

- We fill out the first section and record information about the condition of the asset as of the date of the transaction.

- We fill out the second section and show the information as of the date of acceptance for accounting.

- We fill out the third section and provide a brief description of the asset.

- If necessary, we reflect the conclusion of the commission. We refer to the technical documentation.

The form is signed by all participants in the transaction, including the employee responsible for the delivery and the chief accountant of the delivery organization. Managers approve the form on the front side of the act.

This is an up-to-date example of how to correctly fill out OS-1 when putting a fixed asset into operation, filled out in accordance with all the rules:

And this is what a sample of filling out the OS-1 form looks like with an example of selling an object:

Who fills it out and on what basis?

Form OS-1 is filled out by an accountant or other responsible person on the basis of technical documentation and approved by the heads of two organizations - the supplier and the buyer. The form was approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

When selling a fixed asset, the delivering organization fills out the left side of the act, and the recipient organization fills out the right side. Pay attention to the sample act OS-1 for the sale of a fixed asset (title page) and the required details.

We bought several identical OSs. How many acts of acceptance and transfer should be drawn up?

Question: An organization acquired several fixed assets (premises in a shopping center) identical in cost and characteristics (hereinafter referred to as real estate). Would it be correct to issue one act of acceptance and transfer of fixed assets for them?

Answer: An organization does not have the right to issue one act of acceptance and transfer of fixed assets for several real estate objects.

Justification: According to Art. 10 of Law No. 57-Z, each business transaction is subject to registration with a primary accounting document.

Primary accounting documents, unless otherwise established by the President of the Republic of Belarus, must contain the following information:

— name of the document, date of its preparation;

— name of the organization, surname and initials of the individual entrepreneur who is a participant in the business transaction;

— the content and basis for a business transaction, its assessment in natural and value terms or in value terms;

— positions of persons responsible for carrying out a business transaction and (or) the correctness of its execution, their names, initials and signatures.

Primary accounting documents may contain other information that is not mandatory.

The forms of primary accounting documents included in the list approved by the Council of Ministers of the Republic of Belarus are approved by the authorized state bodies specified in this list.

This List of primary accounting documents is approved by Resolution No. 360, and it includes an act of acceptance and transfer of fixed assets.

The act of acceptance and transfer of fixed assets is established in the form in accordance with Appendix 1 to Resolution No. 23.

The form of the act of acceptance and transfer of fixed assets provides for indicating the object of fixed assets (objects are not provided for indicating).

According to clause 2 of Instruction No. 23, the act of acceptance and transfer of fixed assets is filled out by the organization transferring the fixed assets listed in accounting, and (or) the organization accepting fixed assets for accounting.

On October 1, 2022, Resolution No. 26 came into force, which added the following to paragraph 2 of Resolution No. 23: the act of acceptance and transfer of fixed assets can be filled out by the donating organization and (or) the recipient organization when accepting and transferring a group fixed assets identical in value and characteristics (except for real estate) , with the inclusion, if necessary, of additional lines and (or) columns in the form of this act.

Thus, for real estate from October 1, 2022, it was no longer possible to fill out one act on the acceptance and transfer of fixed assets with the inclusion, if necessary, of additional lines and (or) columns in the form of this act.

For each unit of real estate, a separate act of acceptance and transfer of fixed assets is filled out.

For reference , immovable things (real estate, real estate) include land plots, subsoil plots, surface water bodies and everything that is firmly connected to the land, that is, objects whose movement without disproportionate damage to their purpose is impossible, including forests, perennial plantings, permanent structures (buildings, structures), unfinished mothballed permanent structures, isolated premises, parking spaces <*>.

Approved Form OC-1 - sample completion

The document is divided into three sections, which contain all the necessary data. If a new operating system is registered, then there are the following regulations for filling out.

In the first section, information about the buyer and seller is filled in. If a tangible asset is purchased at retail, then there is not always complete information about the company where the goods were purchased. In this regard, “—-“ is placed in the “Delivering Organization” field. There will be no problems with the “Recipient organization” field - this is the organization’s data. “The basis for drawing up the act” is, for example, an agreement to conduct a purchase or sale transaction.

The second section contains data on the OS. Name, depreciation group, registration account and other codes. The accountant will not have any questions with this. It also displays cost data and information about operation at the time of transfer of the object. The second sheet consists of three sections.

Section 1 “Information on the condition of the fixed asset item on the date of transfer.” It must be filled out only if the tangible asset was previously used for its intended purpose. In the column about the actual period of use - indicate the period of useful life of the OS. It should be taken into account that depreciation should also have been calculated for the entire period of use. Add to column

“Amount of accrued depreciation” and these numbers are indicated. The “residual value” column represents the difference between the “Acquisition cost” and “Accrued depreciation” columns.

Section 2 “Information about the object of fixed assets as of the date” is filled in if the fixed asset is received by the organization. “Initial cost” is the purchase price minus VAT, but including all additional costs, for example, transport, or costs associated with registration with the traffic police. “Useful life” is defined as the difference between the total life and the time in operation.

Section 3 “Brief individual characteristics of an object of fixed assets” is a section for indicating the characteristics of the object.

The third page contains data on the conclusion of the commission and the signatures of the transferring and receiving parties. Organizational seals are required.

It will not be difficult for a competent accountant to fill out this document. If some information is missing, the Tax Organization will not penalize you for this during the audit. The main requirement is the execution of the transfer and acceptance certificate in the established form.

Unified form OS-2. Sample filling.

The invoice for internal movement OS-2 is filled out in 3 copies, one of which is kept by the person who completed the movement, the second is intended for the receiving party, and the third must be transferred to the accounting department.

In the header of the form on the front side of the invoice for internal movement, fill in the name of the organization, the deliverer and receiver of fixed assets, the form code according to OKUD, the code according to OKPO, the document number and the date of its preparation.

The main part of the OS-2 act consists of a table that contains 7 columns:

- OS number in order;

- OS object name;

- date of purchase;

- inventory number;

- number of objects;

- unit cost;

- cost of everything.

Below the table there are lines to characterize the technical condition of the object. Next come the signatures of the person handing over and receiving the object: position, signature and transcript of the signature, personnel number, date. The unified form OS-2 is signed by the chief accountant.

In order to quickly and without errors fill out the invoice according to form OS-2, download and study the sample filling: