Restrictions on donation

The gratuitous transfer of valuables or property rights is essentially a donation (Clause 1, Article 572 of the Civil Code of the Russian Federation).

The transferred objects can be:

- fixed assets;

- goods;

- in cash;

- finished products;

- intangible assets;

- materials;

- securities;

- property claims (rights), for example, this may be the right to use a land plot disinterestedly transferred by a commercial organization to a non-profit institution or a disinterested assignment by a commercial enterprise of the right to demand payment of the debt of its debtor to a non-profit organization.

For commercial enterprises, an acceptable limit for the value of gratuitously transferred valuables has been established - up to 3 thousand rubles. This restriction does not apply to transactions with individuals and public organizations, charitable and other foundations, budgetary institutions, consumer cooperatives, religious and other non-profit organizations. In addition, it is possible to transfer property free of charge to commercial organizations-founders, but provided that such operations are stipulated in the charter. Donation of valuables between commercial organizations in the amount of more than 3 thousand rubles. is considered a violation of the requirements of the law, and such a transaction may be declared invalid (clause 1 of Article 168, subclause 4 of clause 1 of Article 575 of the Civil Code of the Russian Federation).

When donating valuables worth over 3 thousand rubles. a citizen or non-profit organization should draw up a written gift agreement (Articles 574 and 575 of the Civil Code of the Russian Federation).

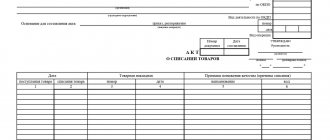

The transaction of gratuitous transfer of valuables is confirmed by a delivery note or an acceptance certificate.

For information about the form used to draw up the consignment note, read the article “Unified form TORG-12 - form and sample.”

When is the gratuitous transfer of property subject to VAT?

In tax legislation, values or rights transferred to the recipient without issuing counter obligations are considered to be received free of charge (clause 2 of Article 248 of the Tax Code of the Russian Federation). The accrual and payment of a particular tax occurs only if there is a tax base. For the purposes of calculating and paying VAT, the gratuitous transfer of valuables is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). This means that the party must also pay VAT on the value of the valuables transferred free of charge.

ConsultantPlus experts explained in detail how to calculate VAT when transferring property free of charge. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

VAT is calculated for the gratuitous transfer of valuables at the time the transaction itself is performed (clause 1 of Article 167 of the Tax Code of the Russian Federation). The transfer date is considered to be the date of execution of the primary documents:

- in case of transfer of goods - the date of issue of the invoice;

- if services were provided free of charge (work performed) - the date of drawing up the acceptance certificate.

Read about the details that are a mandatory component of such an act in the material “Accounting - Postings for Services”.

IMPORTANT! According to the Law “On Amendments...” dated 06/08/2020 No. 172-FZ, taxpayers have the right not to pay VAT when gratuitously transferring property used for the prevention, diagnosis or treatment of coronavirus. This provision applies to legal relations arising from January 1, 2022. In this case, the tax previously accepted for deduction does not need to be restored.

The tax base is determined by the market price of the transferred property on the date of the transaction (clause 3 of Article 105.3 of the Tax Code of the Russian Federation, clause 2 of Article 154 of the Tax Code of the Russian Federation).

As for the VAT rate, in case of gratuitous transfer, the rate provided for this type of product (work, service) is applied.

The cost of the property or other benefits transferred free of charge, as well as the amount of VAT calculated for payment to the budget, are reflected in the invoice. This document is registered in the sales book during the period of transfer of valuables (clauses 1, 3 of the rules for maintaining the sales book, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

Read about the specifics of preparing an invoice for services in the article “Invoice for services - sample filling”.

In the case of accrual and payment of VAT upon gratuitous transfer, input VAT paid to suppliers for the acquisition of gratuitously transferred property can be deducted (subclause 1, clause 2, article 171 of the Tax Code of the Russian Federation).

How to formalize the transfer of goods to the founder for his own needs?

Our company LLC is on the general taxation system.

The sole founder (employee of the organization) needed a product for his own needs. How to formalize the transfer of goods to the founder in this case? In the described situation, the following options are possible:

1. Your organization has the right to pay dividends due to the founder (individual) by transferring property, i.e., in goods.

The company has the right to make a decision quarterly, once every six months or once a year on the distribution of its net profit among the company's participants. The decision to determine the part of the company's profit distributed among the company's participants is made by the general meeting of the company's participants.

Part of the company's profit intended for distribution among its participants is distributed in proportion to their shares in the authorized capital of the company, unless a different procedure is established by the company's charter. The term and procedure for payment of distributed profit are determined by the company's charter or a decision of the general meeting of company participants. The period for payment of part of the distributed profit of the company should not exceed sixty days from the date of the decision on the distribution of profit between the participants of the company (clauses 1-3 of Article 28 of the Federal Law of 02/08/1998 No. 14-FZ).

When dividends are paid in the form of property, the ownership of this property, which previously belonged to your organization, passes to its participants, therefore:

In the accounting of your organization (transferring party)

the above transfer of property is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation).

Income from the sale of this property will be included in the income taken into account when determining the tax base for income tax. The transfer of goods to repay debts on dividend payments is subject to VAT. The tax base is defined as the cost of goods, calculated on the basis of market prices (clause 1 of Article 154, clause 1 of clause 1 of Article 146 of the Tax Code of the Russian Federation).

Please note that the transfer of goods to the participant to repay debt on dividends means that the transaction price is equal to the amount of declared dividends (income). It is assumed that this price corresponds to the level of market prices. Otherwise, if the regulatory authorities prove that the actual price of the goods transferred to the founder as payment of dividends differs from the market price by more than 20%, then the tax will be calculated based on the latter.

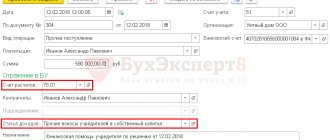

In accounting, the transfer of goods to the founder on account of dividends due to him is reflected by the entry (Instructions for the use of the chart of accounts for accounting financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, hereinafter referred to as Instruction No. 94n):

- Debit 84 Credit 70 (75.2)

- reflects the debt to the participant for dividends due (account 70 is used if the founder is an employee of the organization, account 75.2 - if the founder does not work in the organization); - Debit 62 Credit 90.1

– goods were transferred to the founder on account of dividends due; - Debit 90.02 Credit 41

– the cost of the transferred goods is written off; - Debit 90.03 Credit 68

– VAT is charged on the transferred goods; - Debit 70 (75.2) Credit 62

– reflects the offset of the transferred goods against dividends.

From the founder (host)

:

When paying income in the form of dividends to an individual, your organization is recognized as a tax agent. The organization calculates personal income tax on the amount of accrued dividends (paid in kind), calculated according to the formula given in paragraph 5 of Article 275 of the Tax Code of the Russian Federation. The tax rate on income in the form of dividends is set at 9% (clause 1, clause 1, article 208, clause 1, article 209, clause 1, article 211, clause 2, article 214, clause 4, article 224 Tax Code of the Russian Federation).

The amount of tax on income in the form of dividends subject to withholding at the source of payment is reflected by the entry: Debit 75.2 Credit 68.

If the founder is an employee of the organization, then personal income tax on dividends can be withheld by the organization when paying him the next salary. In this case, the amount of personal income tax withheld from the founder will be reflected in the accounting of your organization by the posting: Debit 70 Credit 68.

For more information about calculating personal income tax on dividends in 1C:Enterprise, read the reference book “Personnel records and settlements with personnel in 1C programs” in the “Personnel and remuneration” section in the 1C:ITS information system

2. Free transfer of goods from your organization to an individual (founder).

In this case , in the accounting of your organization (transferring party)

:

- When transferring goods free of charge, its value is written off as other expenses. In this case, an entry is made to the debit of subaccount 91.02 and the credit of account 41 (clause 11 of PBU 10/99 “Organizational expenses”, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n, Instruction No. 94n);

- for the purpose of calculating profit tax, the value of gratuitously transferred property and expenses associated with such transfer are not taken into account for profit tax purposes (clause 16 of Article 270 of the Tax Code of the Russian Federation);

- For the purposes of calculating VAT, the gratuitous transfer of goods is a sale and is subject to VAT. The amount of VAT is reflected in the accounting record: Debit 91.02 Credit 68 (clause 11 PBU 10/99 “Organizational expenses”, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n, clause 1 clause 1 article 146 of the Tax Code of the Russian Federation, Instruction No. 94n).

Please note that if goods are received free of charge by an individual who is not registered as an individual entrepreneur, then your organization transferring the goods is a tax agent for personal income tax.

From the founder (host)

:

The market value of goods transferred free of charge is included in the tax base for calculating personal income tax as income received in kind (clause 1 of Article 211 of the Tax Code of the Russian Federation). The personal income tax rate for such income is 13%.

In the 1C:ITS information system you can get even more information:

- on the calculation of VAT upon gratuitous transfer and on its reflection in “1C:Enterprise” - in the directory “Accounting for Value Added Tax” in the “Accounting and Tax Accounting” section;

- about expenses that do not reduce the tax base for income tax - in the directory “Organizational Income Tax” in the “Taxes and Contributions” section.

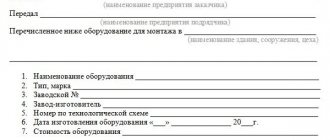

3. Any fact of transfer of goods into the ownership of another person (free of charge or as dividends) is documented, as a general rule, with shipping documents (waybill, waybill), drawn up in accordance with the requirements of the current legislation of the Russian Federation.

The 1C:ITS information system is updated every day and contains ready-made advice on accounting, tax and personnel records. It is quite possible that the answers to the specific practical questions that you are currently looking for are already in the “Auditor Answers” section of the 1C:ITS Information System. And in order not to miss the latest expert advice and other useful information, you can subscribe to the free newsletter: https://its.1c.ru/news/subscription.php

You can enter into an information technology support agreement with a recommended partner

More about 1C:ITS

When you don't have to pay tax

The Tax Code of the Russian Federation contains lists of gratuitous operations that:

- are not considered sales for the purposes of calculating and paying VAT (clause 2 of Article 146 of the Tax Code of the Russian Federation);

- are exempt from paying tax (Article 149 of the Tax Code of the Russian Federation).

Let's look at some of them.

Transfer of property is not a sale

Free transfer of fixed assets to state and municipal institutions, authorities and local self-government, as well as state unitary enterprises and municipal unitary enterprises is not considered a sale (subclause 5, clause 2, article 146 of the Tax Code of the Russian Federation). Therefore, the transferring party does not need to calculate VAT.

The gratuitous transfer of funds is also not regarded as a sale, therefore it is not subject to VAT on the transferring party (subclause 1, clause 3, article 39 of the Tax Code of the Russian Federation, subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

The gratuitous transfer of valuables or other benefits for the implementation of the main activity specified in the charter of the enterprise and other than entrepreneurial activity to non-profit organizations will not be considered a sale (subclause 3, clause 3, article 39 of the Tax Code of the Russian Federation). In this situation, the basis for calculating and paying tax is not formed, which means there are no obligations to calculate and pay VAT.

From 07/01/2019 the following are not recognized as subject to VAT:

- free transfer of socio-cultural objects to the treasury of a constituent entity of the Russian Federation or municipal entity;

- gratuitous transfer of real estate to the treasury of the Russian Federation;

- free transfer of property to Russia for scientific research in Antarctica.

Let's consider an example of a gratuitous transfer of valuables to an educational institution.

An educational institution can act both as a non-profit organization and as a commercial one. Legally, an educational institution can be a legal entity of any organizational and legal form, the main activity of which is educational activity, which must be noted in the organization’s charter and is based on passing accreditation in the established order. Individual entrepreneurs engaged in educational activities can also be classified as educational organizations. That is, when carrying out a transaction for the gratuitous transfer of valuables to an educational institution, enterprises may encounter both institutions belonging to non-profit structures and commercial organizations.

The gratuitous transfer of property to an educational institution belonging to a non-profit organization (for example, a state educational institution), aimed at carrying out the main activities reflected in the charter of this enterprise, will not be subject to VAT.

At the same time, it is important to indicate in the gift agreement the further use of gratuitously transferred material assets and other benefits in the main (registered in the charter) activities of the recipient enterprise, which is a non-profit organization.

Drawing up an invoice for the gratuitous transfer of valuables to non-profit organizations, if the benefits received are used only in the statutory activities of the enterprise other than business, is not required (clause 3 of Article 169 of the Tax Code of the Russian Federation).

Find out whether the gratuitous transfer of gift certificates to employees is subject to VAT in ConsultantPlus. To do everything correctly, get trial access to the system and go to the material. It's free.

The gratuitous transfer of property will be subject to VAT if the recipient of assistance turns out to be a commercial enterprise (for example, a private educational institution).

When transferring property, there is a VAT benefit

It is possible not to pay tax in cases where the benefit under Art. 149 of the Tax Code of the Russian Federation, which exempts this operation from VAT.

Thus, the distribution of advertising magazines, booklets, leaflets and other things is exempt from VAT if no more than 100 rubles were spent on the creation or purchase of a copy of this assortment. including VAT (subclause 25, clause 3, article 149 of the Tax Code of the Russian Federation).

There is no need to pay VAT when transferring valuables free of charge for charitable purposes (subclause 12, clause 3, article 149 of the Tax Code of the Russian Federation). The exception is the transfer of excisable goods.

Charity in the legislation is considered as an activity for the disinterested (free) transfer of material assets or other benefits to legal entities or individuals on a voluntary basis (Article 1 of the Law “On Charitable Activities...” dated 08/11/1995 No. 135-FZ. But this benefit is possible only if compliance with the following conditions:

- the assistance provided must strictly correspond to the charitable purposes specified in the list of paragraph 1 of Art. 2 Law No. 135-FZ;

- recipients of material assets, as well as gratuitous assistance in the form of other benefits, can only be non-profit organizations or individuals;

- the gratuitous transfer of valuables must be documented (letters of the Ministry of Finance of Russia dated October 26, 2011 No. 03-07-07/66, Federal Tax Service of the Russian Federation for Moscow dated December 2, 2009 No. 16-15/126825): an agreement on the agreement of the parties to transfer free of charge;

- copies of documents confirming the acceptance of valuables for registration by the recipient of gratuitous assistance;

- acts or other documents confirming the intended use of the transferred values.

When a charitable transfer of material assets occurs, the transaction is considered taxable, but exempt from tax. The obligation to draw up an invoice for transactions exempt from VAT from January 1, 2014 on clause 3 of Art. 3 of the Law “On Amendments...” dated December 28, 2013 No. 420-FZ). Therefore, when transferring valuables in the form of charitable assistance, an invoice need not be drawn up.

On the application of Art. 149 of the Tax Code of the Russian Federation, read more in this section of our website.

Transfer of the organization's property into the ownership of individuals

Real estate on the balance sheet of an organization can be transferred into the ownership of the founders of the organization in three legal ways:

— through a purchase and sale agreement;

- by transfer to one of the participants of the company, upon his exit from the company, as payment for the actual value of his share

- by distribution among participants upon liquidation of the company.

Let's consider each of the options:

Sales under a purchase and sale agreement.

The company has the right to sell its property to any individual, including one of its participants. The transfer of property occurs in this case under a purchase and sale agreement. Proceeds from the sale of property are recognized as income of the organization at the time of receipt of funds to the account or cash desk of the organization and are subject to the simplified tax system at a rate of 6% (clause 1 of Article 346.17 of the Tax Code of the Russian Federation, Decision of the Supreme Arbitration Court of the Russian Federation dated January 20, 2006 N 4294/05, Letters of the Ministry of Finance Russia dated December 18, 2008 N 03-11-04/2/197 (clause 2), dated July 21, 2008 N 03-11-04/2/108).

If the costs of building a building and land were previously taken into account by the organization as expenses, when applying the simplified tax system of 15%, these expenses will have to be excluded from the book of income and expenses of previous periods, the tax base will have to be recalculated and the arrears of tax and penalties will have to be paid (paragraph 14, paragraph 3 Article 346.16 of the Tax Code of the Russian Federation). This will have to be done even if at the time of sale of the land and building the LLC applies the simplified tax system (income 6%) (Letters of the Ministry of Finance of Russia dated 03/26/2009 N 03-11-06/2/50, dated 03/26/2009 N 03-11-06/2 /51, dated 02/27/2009 N 03-11-06/2/30).

The sales price in a purchase and sale agreement between an individual (founder) and an LLC can be established by the parties to the transaction by agreement. The legislation does not prohibit the establishment of a balance or cadastral price.

Advantages of this scheme:

- Simplicity and speed in its implementation; for the registration authority, it is sufficient to submit a purchase and sale agreement concluded in simple written form.

- Settlements between counterparties are not required at the time of registration of the contract and transfer of ownership; therefore, there is the possibility of prolonging settlements, and, accordingly, the possibility of deferring the payment of taxes.

- There is no need to contact the registering tax authorities to make changes to the Unified State Register of Legal Entities.

- There is no need to prepare financial statements.

- Buyers - individuals, founders, do not have any tax obligations when applying this scheme.

Tax risks and disadvantages:

The buyer (founder) and the seller (LLC) may be recognized by the tax authorities as interdependent persons. If there is a significant deviation of the contract price from the market price, and if interdependence is identified, the tax authorities have the right to assess additional tax payments on two grounds:

- receipt by an individual - the founder of income in the form of material income from the acquisition of goods (work, services) in accordance with a civil contract from an organization that is interdependent in relation to the taxpayer (clause 2, clause 1, article 212 of the Tax Code of the Russian Federation). In this case, the income of an individual will be recognized as the excess of the sales price of identical property over the sales price specified in the sales contract. Such a difference will be taxed at a rate of 13% - clause 1 of Art. 224 Tax Code of the Russian Federation

- adjustment by tax authorities of the price specified in the purchase and sale agreement taking into account the market price level (clause 2 of article 40 of the Tax Code of the Russian Federation). In this case, the organization may be additionally charged the tax paid in connection with the application of the simplified tax system.

Despite the above risks, in practice tax authorities rarely used this right in such transactions. .

In addition, there is a practical difficulty in determining the real market value of the property, because Until now, no algorithm has been developed for the tax authorities to determine the market value of real estate, except for comparative ones. Since a significant number of transactions are registered with an understatement of the market price in the contract, when compared with them, it is very difficult to identify the real price from which the tax should be calculated.

Transfer of the organization's real estate to one of the company's participants upon his withdrawal from the company as payment for the actual value of his share.

According to Art. 94 of the Civil Code of the Russian Federation, a participant in a company has the right to leave it by alienating to the company his share in its authorized capital. In this case, he must be paid the actual value of his share or given property corresponding to such value in the manner, manner and within the time limits provided for by Federal Law No. 14-FZ of 02/08/1998 “On Limited Liability Companies” and the company’s charter. When a participant leaves the company, the actual value of his share in the authorized capital is determined on the basis of the financial statements for the last reporting period - clause 4 of PBU 4/99 “Accounting statements of the organization”. In order to transfer the land plot and building to the withdrawing participant, the company decides to pay the actual value of the share to the participant by transferring real estate to him. The basis for such a transfer is this decision and the act of transferring property to the withdrawing participant.

When transferring property under this scheme, the company, as in the case of a sale, has the obligation to exclude expenses on real estate from the accepted expenses of previous years, recalculate the tax base and pay additional taxes and penalties. The company no longer has any tax obligations.

In this case, tax obligations to pay personal income tax on the value of the share at a rate of 13% arise for the withdrawing participant (clause 1 of Article 210 of the Tax Code of the Russian Federation, clause 1 of Article 224 of the Tax Code of the Russian Federation). In this case, the company is recognized as a tax agent and is obliged to transfer information about the income received to the tax authority - clause 5 of Art. 226 Tax Code of the Russian Federation. Payment of tax by the former participant is made on the basis of a tax notice received from the inspectorate in the manner provided for in paragraph 5 of Art. 228 of the Code. In this case, the participant does not need to submit a 3NDFL declaration independently.

Advantages of this scheme:

- There is no need to liquidate the company and, accordingly, subject the company to inspection, conduct reconciliations with tax authorities and pay possible arrears and fines from previous years.

- A one-time application to the tax authorities is required to make changes to the Unified State Register of Legal Entities.

Risks and disadvantages:

- A company using the simplified tax system needs to maintain accounting records and prepare financial statements to determine the actual value of the share.

- There is still no clarity in tax legislation regarding how to calculate the tax when paying a participant the actual value of a share by transferring the company’s property to the participant. Since the actual value of the share is calculated according to accounting data, and the real estate is registered by the organization at the price of its acquisition, and, as a rule, it is not revalued, the market value of the transferred property differs significantly from the balance sheet. According to current practice, an organization, as a tax agent, usually indicates in the 2NDFL certificate an amount of income equal to the actual value of the share according to the accounting reports. The tax authority duplicates this same amount in the notification sent to the company member. However, in recent years, the Ministry of Finance and tax authorities believe that the calculation should be made based on the market value of the transferred property - Art. 40 Tax Code of the Russian Federation Art. 211 of the Tax Code of the Russian Federation, as when receiving income in kind (Letter of the Ministry of Finance of Russia dated 09.09.2011 N 03-04-05/4-647.

Distribution of property between participants upon liquidation of the company.

When a company is liquidated, its property, after settlements with creditors, is subject to distribution among its participants. Property is distributed among the participants in proportion to their shares. The tax obligations of the company and its participants are the same as in the second scheme.

Advantages of this scheme:

In our opinion, there are no advantages compared to previous schemes.

Risks and disadvantages:

- Lengthy procedure for liquidation of the company (term not defined)

- On-site inspections are possible - clause 11 of Art. 89 of the Tax Code of the Russian Federation and, accordingly, the emergence of new tax obligations associated with the identification of arrears and the imposition of fines.

- The need for accounting, appointment of a liquidation commission, search and notification of creditors, drawing up a liquidation balance sheet.

- Multiple applications to the tax authorities for registration actions related to the liquidation of the company.

- The calculation of personal income tax upon receipt of property into the ownership of participants must be made based on its market value (Letter of the Ministry of Finance dated September 9, 2011 N 03-04-05/4-647, Letter of the Ministry of Finance dated 29.01.2010 N 03-04- 05/2-16, etc.).

Recommendations:

As can be seen from the above diagrams, the most profitable and less labor-intensive option for an LLC and its participants is the first option - sale through a purchase and sale agreement to one of the company's participants. The main tax risk in this case is the interdependence of the participant and the company. From our point of view, the solution is to combine the first two schemes. One of the participants in the company leaves it, leaving his shares to the company or selling (donating it) to another participant or a third party. The data is entered into the Unified State Register of Legal Entities. After this, the company sells its real estate to the withdrawing participant through a purchase and sale agreement at a price agreed upon by the parties, for example, cadastral. Thus, the obvious interdependence between the buyer - a former participant and the seller of the LLC, disappears, and, accordingly, the possibility of adjusting the contract price and accruing arrears and penalties by the tax authorities.

Tax consultant, member of the Chamber of Tax Consultants of the Russian Federation. (valid certificate No. 004853 dated January 30, 2007).

Oganjanyants Svetlana Viktorovna

Results

The obligation to charge and pay VAT upon gratuitous transfer of property arises in cases where:

- the recipient of the valuables is a commercial organization (the transferring party will have to calculate VAT and pay it to the budget);

- a charitable transfer of valuables to a non-profit organization or individual is carried out; however, based on the benefits under sub. 12 clause 3 art. 149 of the Tax Code of the Russian Federation, tax may not be paid when registering a transaction, taking into account all established requirements.

The gratuitous transfer of property will not be subject to VAT if:

- funds are transferred (subclause 1, clause 3, article 39, subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation);

- the receiving party is a non-profit organization (for example, a state educational institution) and the values received as a gift are aimed at carrying out the main activities reflected in the charter of this institution (subclause 3, clause 3, article 39 of the Tax Code of the Russian Federation);

- gratuitous transactions are not recognized as sales for the purposes of calculating VAT (clause 2 of article 146 of the Tax Code of the Russian Federation).

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Common questions and controversial situations

Situation No. 1. The organization receives property from outside for temporary use. What kind of wiring should I do? And is there a need to pay taxes?

The essence of gratuitous use is that the receiving organization undertakes to return the property to the owner upon expiration of the term. Therefore, no income arises from this operation. What about VAT? In recent appeals, tax officials limit their explanations to what, in this case, is the transfer of ownership and use rights. Accordingly, the obligation to calculate and pay VAT remains. The tax calculation algorithm occurs on the day of payment for the use of property, regardless of the lease term, or on the last day of the tax period.

Documents substantiating the arguments of officials - Article 146 of the Tax Code of the Russian Federation, paragraph 2, paragraph 5, which clearly states that the property is transferred for use temporarily, free of charge. The Ministry of Finance supports this position with letters 03-07-11/25628, 03-07-11/19393 dated April 2016.