The transfer of ownership of goods (work, services) free of charge is recognized as sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). Therefore, VAT must be paid on the cost of goods transferred free of charge (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

Situation: is it necessary to charge VAT when transferring property for free use?

Answer: yes, it is necessary.

The object of VAT taxation, in particular, is the transfer of ownership of goods (work, services) free of charge (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). For the purposes of calculating VAT, the transfer of property for free use should be considered as a service. Therefore, tax on the market value of such a service must be calculated in accordance with the generally established procedure. This point of view is reflected in letters of the Ministry of Finance of Russia dated February 1, 2013 No. 03-03-06/1/2069, dated January 17, 2013 No. 03-07-08/04, dated July 29, 2011 No. 03-07 -11/204.

Some courts share the position of the financial department. They recognize the transfer of property for free use of the service and explain that the market price of such a service (tax base for VAT) must be determined as the cost of renting similar property (see, for example, the definitions of the Supreme Arbitration Court of the Russian Federation dated February 28, 2014 No. VAS-1319/14 , dated January 29, 2009 No. VAS-401/09, resolution of the Federal Antimonopoly Service of the East Siberian District dated November 20, 2012 No. A78-4990/2011, Central District dated October 22, 2013 No. A09-7059/2012, dated 26 August 2011 No. A64-3070/2010, West Siberian District dated May 3, 2011 No. A46-8306/2010, Northwestern District dated October 10, 2008 No. A44-157/2008).

Advice: there are factors that allow organizations not to charge VAT when transferring property for free use. They are as follows.

The right to free use of a thing by the Supreme Arbitration Court of the Russian Federation qualifies as a property right (information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98). For the purposes of Chapter 21 of the Tax Code of the Russian Federation, property rights are not recognized as property, and therefore, as goods (clauses 2, 3 of Article 38 of the Tax Code of the Russian Federation). Therefore, their gratuitous transfer is not a sale (paragraph 2, subparagraph 1, paragraph 1, article 146, paragraph 1, article 38 of the Tax Code of the Russian Federation).

Some courts confirm that when transferring property for free use, the object of VAT taxation does not arise (see, for example, decisions of the Federal Antimonopoly Service of the West Siberian District dated November 12, 2010 No. A46-4140/2010, Moscow District dated June 29, 2006 No. KA-A41/5591-06, dated February 17, 2006 No. KA-A40/13265-05, Volga region dated March 6, 2007 No. A65-13556/2006).

In such conditions, the organization will have to independently decide on the calculation of VAT when transferring property for free use. If an organization decides not to charge VAT, then most likely it will have to defend this position in court. Moreover, if the organization proves that there is no need to charge VAT, then the tax on the transferred property will have to be restored (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation).

Situation: is it necessary to charge VAT when transferring property to a contractor free of charge? According to the terms of the contract, the customer must provide the contractor with the necessary equipment

Answer: yes, it is necessary.

The contract may provide that the work is carried out at the expense of the customer, that is, using his materials, equipment, etc. This follows from the provisions of paragraph 1 of Article 704 of the Civil Code of the Russian Federation. Thus, the customer has the right to transfer property to the contractor for use to perform work under a contract, as well as provide other services (Article 718, paragraph 2 of Article 747 of the Civil Code of the Russian Federation). Customer services can be provided both on a paid and free basis. For VAT purposes, the provision of services free of charge is recognized as sales (Clause 1, Article 39 of the Tax Code of the Russian Federation). Therefore, the customer must charge VAT on the market value of services for transferring property to the contractor for free use (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). This must be done even if after execution of the contract the contractor returns the used property to the customer.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated September 12, 2012 No. 03-07-10/20, dated August 6, 2012 No. 03-07-08/237, dated July 29, 2011 No. 03-07-11/ 204.

It should be noted that in some cases, organizations were able to prove in court that when transferring property for free use, VAT was not required.

Tourist packages

Situation: is it necessary to charge VAT when transferring tourist packages abroad to citizens free of charge? The vouchers were purchased from a Russian tour operator and are given as prizes. The tour operator's invoice highlights the amount of VAT on the agency fee

Answer: yes, it is necessary.

This conclusion is based on the provisions of subparagraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation, according to which the gratuitous transfer of goods (work, services) on the territory of Russia is subject to VAT. The basis for calculating VAT is the market value of the trip (clause 2 of Article 154 of the Tax Code of the Russian Federation). It is impossible to qualify the transfer of vouchers as the provision of tourist services abroad in the situation under consideration. The fact is that the organization that transfers vouchers to citizens does not provide such services. They are sold by the tour operator. This follows from the definitions of tour operator and travel agency activities, which are given in Article 1 of the Law of November 24, 1996 No. 132-FZ. Consequently, only the tour operator is subject to the norms of subparagraph 3 of paragraph 1 of Article 148 of the Tax Code of the Russian Federation, which allows not to charge VAT on the cost of tourist services actually provided abroad.

Since purchased vouchers are used in transactions subject to VAT, the amount of input tax presented by the tour operator, the organization that transfers vouchers to citizens (subject to other mandatory conditions), can be deducted (Article 171 of the Tax Code of the Russian Federation).

When is it not necessary to charge VAT?

There is no need to charge VAT if gratuitous transactions:

- are not recognized as sales for the purposes of calculating VAT (clause 2 of Article 146 of the Tax Code of the Russian Federation);

- are not subject to VAT (exempt from taxation) (Article 149 of the Tax Code of the Russian Federation).

For example, the sale of goods (performance of work, provision of services) as part of the provision of gratuitous assistance in accordance with Law No. 95-FZ of May 4, 1999 (except for excisable goods) (subclause 19, clause 2, article 149 of the Tax Code) is not subject to VAT RF). Also, one of the gratuitous transactions that is exempt from VAT is the sale of shares in the authorized capital of organizations (subclause 12, clause 2, article 149 of the Tax Code of the Russian Federation).

Situation: is it necessary to charge VAT if an organization distributes advertising products for free?

It is necessary, but only if two conditions are met:

– advertising products meet the characteristics of a product, that is, property that has consumer value and can be sold regardless of the promotion;

– the cost of a unit of such advertising products exceeds 100 rubles.

According to the general rule, for VAT purposes, the gratuitous transfer of ownership of property is equated to sale, and therefore is an object of taxation (clause 1, article 39, subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). This rule also applies to free distribution of advertising materials. However, when calculating VAT, two conditions must be taken into account.

Firstly, distributed advertising materials must have independent consumer value. That is, VAT needs to be charged only if the property that is distributed as promotional materials can be sold independently of the promotion. Such products include, for example, samples of the enterprise’s own products or souvenirs (notebooks, pens, lighters, etc.).

Secondly, goods transferred for advertising purposes are exempt from taxation if the cost of their acquisition (creation) is less than or equal to 100 rubles. per unit (subclause 25, clause 3, article 149 of the Tax Code of the Russian Federation). That is, VAT needs to be charged only when distributing advertising materials that cost more.

All kinds of advertising catalogs, brochures, flyers, leaflets, etc. do not have independent consumer value. Their task is to attract attention to the goods (works, services) of the advertiser. Therefore, when distributing such advertising materials, there is no need to charge VAT. Regardless of how much a unit of such products costs.

Another important question. Is it necessary to charge VAT on the cost of gifts or souvenirs that the seller gives to the buyer as an addition to the main product? No no need. But only if the seller can prove that the cost of these gifts is included in the price of the main product. If there is such evidence (for example, in cost calculations or in calculations of selling prices), the provision of gifts in addition to the main goods is not a gratuitous transfer and cannot be considered as an independent object of VAT taxation.

Such conclusions are contained in paragraph 12 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 and the letter of the Ministry of Finance of Russia dated October 23, 2014 No. 03-07-11/53626.

An example of VAT calculation for free distribution of a notebook with an organization’s logo

Alpha LLC is engaged in publishing activities.

In December, for the international book exhibition, Alpha produced notebooks with the organization’s logo and booklets for visitors to the exhibition. The cost of one notebook in both accounting and tax accounting is 120 rubles. The market price of similar goods (excluding VAT) is 400 rubles. for a unit. The cost of one booklet is 110 rubles.

During the exhibition, 500 notebooks and 500 booklets were randomly distributed to visitors.

Since a notebook with a logo can be an independent object of sale, the accountant charged VAT at a rate of 18 percent on the cost of the distributed notebooks. The tax amount was 36,000 rubles. (400 rub./copy × 18% × 500 pcs.). Booklets are not independent goods, they only help promote goods on the market, so the accountant did not charge VAT.

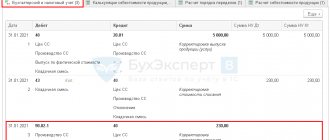

In accounting, the accountant made the following entries:

Debit 44 Credit 43 – 60,000 rub. (120 rubles/copy × 500 copies) – reflects the free transfer of notebooks during a book exhibition; – 55,000 rub. (110 rubles/copy × 500 copies) – reflects the free transfer of booklets during a book exhibition;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 36,000 rubles. – VAT is charged for the free distribution of notebooks.

The Alpha accountant wrote out an invoice for the cost of the notebooks and registered it in the sales book for the fourth quarter.

Situation: what is considered a unit of goods for the purpose of applying the benefits provided for in subparagraph 25 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation?

The Tax Code does not define this concept. Therefore, one should be guided by the norms of related branches of legislation (clause 1 of article 11 of the Tax Code of the Russian Federation).

In the situation under consideration, you can use paragraph 3 of PBU 5/01, according to which the organization has the right to independently determine the unit of accounting for inventories. It can be a product number, batch, homogeneous group, etc. Record your choice in the accounting policy. The procedure for assessing VAT on promotional items will also depend on the option chosen.

For example, an organization participates in an exhibition where it distributes packages containing calendars and pens. According to the accounting policy of the organization, the unit of accounting is the item number. This means that each individual item is considered a unit of goods transferred for advertising purposes. That is, one package, one fountain pen, one calendar.

Situation: can an organization use the VAT benefit when distributing promotional items costing less than 100 rubles? for a unit? Promotional items were received free of charge from a foreign supplier and capitalized at market value

Answer: yes, it can.

The gratuitous transfer of goods for advertising purposes is not subject to VAT if the cost of purchasing a unit of such goods (including VAT claimed by suppliers) does not exceed 100 rubles. (Subclause 25, Clause 3, Article 149 of the Tax Code of the Russian Federation).

Since this norm deals specifically with acquisition costs, the procedure for determining the actual cost of goods received free of charge, established by paragraph 9 of PBU 5/01 (based on market value), does not apply in the situation under consideration. Considering that the goods were received from a foreign supplier, the costs of their acquisition may consist of the amount of customs duties and fees paid, as well as the costs incurred by the organization for the delivery of goods. In addition, when calculating the cost of purchasing goods, you need to take into account the amount of VAT paid at customs.

If the total amount of the listed expenses in terms of a unit of goods does not exceed 100 rubles, when distributing free advertising materials, the organization can use the benefit provided for by subclause 25 of clause 3 of Article 149 of the Tax Code of the Russian Federation. Otherwise, VAT must be calculated on a general basis.

Situation: is it necessary to charge VAT when transferring funds free of charge?

Answer: no, it is not necessary.

The object of VAT is the transfer of ownership of goods (work, services) free of charge (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). Cash does not fall under this definition (subclause 1, clause 3, article 39 of the Tax Code of the Russian Federation). This means that there is no need to pay VAT when transferring them free of charge.

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated April 11, 2011 No. 03-07-11/87, dated November 8, 2007 No. 03-07-11/555.

Situation: is it necessary to charge VAT on the cost of services provided by third-party organizations for holding festive events for the workforce? There is no fee for participation in events from employees

Answer: no, it is not necessary.

As a general rule, the gratuitous transfer of ownership of goods (work, services) is recognized as a sale (clause 1 of Article 39 of the Tax Code of the Russian Federation) and is subject to VAT (subclause 1 of clause 1 of Article 146 of the Tax Code of the Russian Federation). Therefore, if we consider festive events as the transfer to employees and invited guests of a certain amount of food, drinks, expenses for renting a hall and paying for entertainment events, then VAT must be charged on the amount of costs incurred by the organization.

However, when holding holiday events, organizations pursue completely different goals. The main ones are encouraging distinguished employees, solemnly honoring anniversaries, emotional unity of the team, creating an atmosphere of confidence and reliability of the company, unleashing the creative potential of staff in an informal setting, conveying a single corporate idea to each employee. Solving such problems is a necessary condition for the successful operation of every organization. From this point of view, the costs of holding festive events can be qualified as the purchase of goods (works, services) for one’s own needs. But since such expenses do not meet the criteria of paragraph 1 of Article 252 of the Tax Code of the Russian Federation, they do not reduce the tax base for income tax.

The transfer for one's own needs of goods (works, services), the acquisition costs of which are not taken into account when calculating income tax, is subject to VAT (subclause 2, clause 1, article 146 of the Tax Code of the Russian Federation). However, this norm applies only if there has been an actual transfer of goods (performance of work, provision of services) between the structural divisions of the organization (letter of the Ministry of Finance of Russia dated June 16, 2005 No. 03-04-11/132, Ministry of Taxes of Russia dated January 21 2003 No. 03-1-08/204/26-B088). If holiday events are prepared and carried out by third-party organizations, this condition is not met. Food, drinks, concert program, and entertainment events are provided to all participants impersonally, therefore the organization that is the customer of the holiday does not have the obligation to charge VAT (letters of the Ministry of Finance of Russia dated December 13, 2012 No. 03-07-07/133 and from May 12, 2010 No. 03-03-06/1/327). In this case, the amounts of input VAT presented to the organization are not accepted for deduction and are included in the total cost of festive events (subclause 1, clause 2, article 170 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated December 13, 2012 No. 03-07-07/133 ).

In arbitration practice there are examples of court decisions confirming the legality of this approach (see, for example, decisions of the Federal Antimonopoly Service of the Ural District dated January 29, 2007 No. Ф09-12266/06-С3, Moscow District dated September 28, 2006 No. KA-A40/ 7292-06).

In addition, according to some courts, if the holding of festive events is provided for by local regulations (for example, a collective agreement provides for the celebration of anniversaries or the presentation of awards in a solemn atmosphere), such relations between employees and the organization are labor relations (Articles 129, 191 of the Labor Code of the Russian Federation). In this case, it is impossible to qualify the holding of festive events as the sale of goods (performance of work, provision of services) and it is unlawful to demand payment of VAT on the cost of festive events (see, for example, Resolution of the Federal Antimonopoly Service of the North Caucasus District dated October 16, 2009 No. A53-17419/ 2008).

VAT on gratuitous transfer of goods (work, services)

Any organization at least once had to transfer its property or provide services free of charge, i.e. for nothing. According to the norms of Chapter 21 of the Tax Code of the Russian Federation, such an operation is recognized as a sale, and therefore VAT will have to be paid on the cost of the gift. How to determine the tax base for VAT in this case? Is it possible to deduct “input” VAT on property that is intended to be a gift? If you want to do everything correctly, read this article...

T. KRUTYAKOVA, tax consultant

When selling goods (work, services) free of charge, the tax base is determined as the cost of these goods (work, services), calculated on the basis of prices determined in a manner similar to that provided for in Art. 40 of the Tax Code of the Russian Federation, including excise taxes and excluding VAT (clause 2 of Article 154 of the Tax Code of the Russian Federation).

The wording of clause 2 of Art. 154 of the Tax Code of the Russian Federation means that for the purposes of calculating VAT, the value of gratuitously transferred goods (work, services) must be determined based on their market prices on the date of transfer.

The obligation to pay VAT to the budget on the cost of goods (work, services) transferred free of charge arises for the taxpayer in the tax period when the goods were actually shipped (work, services).

When making a gratuitous transfer of goods (work, services), the taxpayer issues an invoice indicating the market value of the transferred goods (work, services) and the amount of VAT calculated for payment to the budget. This invoice is registered in the sales book in the period when the goods were shipped (work performed, services provided).

We would like to pay special attention to the procedure for applying tax deductions in relation to the amounts of “input” VAT on goods (work, services) used later in carrying out operations related to the gratuitous transfer of goods (work, services).

In accordance with paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, amounts of “input” VAT on those goods (work, services) that are used in carrying out transactions subject to VAT are accepted for deduction. In this regard, the amounts of “input” VAT on goods (work, services) intended for use in carrying out operations related to the gratuitous transfer of goods (work, services) are subject to deduction in the generally established manner (letter of the Ministry of Finance of Russia dated April 10, 2006 N 03- 04-11/64).

Example 1. The management of an enterprise, in connection with the celebration of the 50th anniversary of the founding of the enterprise, decided to give gifts to the ten oldest employees. For this purpose, the company purchased 10 color televisions by bank transfer with a total cost of 118,000 rubles. (including VAT - 18,000 rubles). The decision to issue gifts was formalized by a corresponding order from the head of the enterprise.

The televisions were purchased in March 2007. The gifts were presented to employees in April 2007. Since the televisions were purchased by the enterprise from a trading organization, the purchase price of the televisions corresponds to the level of market prices for similar televisions.

In enterprise accounting, the purchase and issuance of gifts is recorded using the following entries.

March:

Debit 41 - Credit 60 - 100,000 rub. — TVs were capitalized at cost excluding VAT;

Debit 19 - Credit 60 - 18,000 rub. — VAT is reflected on purchased TVs;

Debit 68 - Credit 19 - 18,000 rub. — submitted for deduction of VAT on purchased televisions.

April:

Debit 91 - Credit 41 - 100,000 rubles. — reflects the book value of televisions donated to employees of the enterprise;

Debit 91 - Credit 68 - 18,000 rubles. — VAT is assessed for payment to the budget at a rate of 18% of the market value of donated televisions <*>.

————————

<*> The amount of VAT accrued on the cost of goods (work, services) transferred free of charge does not reduce the tax base for income tax (letter of the Ministry of Finance of Russia dated September 22, 2006 N 03-04-11/178).

In what order should the tax base be determined for the gratuitous transfer of property recorded on the balance sheet at cost, including VAT? Today there is no clear answer to this question.

For the purpose of calculating VAT, the gratuitous transfer of property is recognized as the sale of this property (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation), therefore, in our opinion, in the case of a gratuitous transfer of property recorded at cost including VAT, the tax base should be determined in in the manner provided for in paragraph 3 of Art. 154 Tax Code of the Russian Federation. This means that the amount of tax payable to the budget should be determined in this case at a calculated rate of 18/118 or 10/110 of the difference between the market price of the transferred property and its book (residual) value.

If the market value of the transferred property is lower than its book (residual) value, then the tax base will be zero. In this case, the taxpayer will not have an obligation to pay VAT when transferring such property free of charge.

Example 2. The management of an enterprise decided to give its employee a car that is on the company’s balance sheet. The car was purchased by the company in 2000 as a service vehicle and was recorded on account 01 at its cost including VAT. The book value of the car is 60,000 rubles, the amount of depreciation accrued at the time of transfer of the car to the employee is 50,000 rubles.

The market price for similar cars on the date of transfer was 30,000 rubles. In this case, the amount of VAT payable to the budget when transferring a car free of charge is determined at a rate of 18/118 of the difference between the market price of the car (30,000 rubles) and its residual value (10,000 rubles) and amounts to 3,050.85 rubles . ((30,000 rub. - 10,000 rub.) x 18/118).

In the accounting of an enterprise, the transfer of a car to an employee is documented with the following entries:

Debit 01/"Disposal of fixed assets" - Credit 01 - 60,000 rub. — the book value of the car is written off;

Debit 02 - Credit 01/"Disposal of fixed assets" - 50,000 rubles. — the amount of depreciation is written off;

Debit 91 - Credit 01/"Disposal of fixed assets" - 10,000 rubles. — the residual value of the car transferred to the employee is written off;

Debit 91 - Credit 68 - 3050.85 rubles. — VAT is charged to the budget on the difference between the market and residual value of the car.

Note! Many accountants in practice “forget” about the need to include in the VAT tax base the cost of free work performed (services provided).

Most often, such “forgetfulness” is observed when property is transferred for free use to third parties. But in this case, the organization provides a monthly service to a third party to provide property for use. Moreover, this service is provided free of charge. Therefore, every month the organization must include in the VAT tax base the market value of the service provided (the market rent charged for the rental of similar property).

The validity of this approach is confirmed by numerous arbitration practices (see, for example, decisions of the FAS of the Volga-Vyatka District dated 03/27/2006 N A82-9753/2005-14, Northwestern District dated 07/28/2006 N A26-10169/2005-216).

***

Considering the issue of calculating VAT when transferring goods free of charge, we will dwell in more detail on one situation that is often encountered in practice, which traditionally raises numerous questions among accountants. We are talking about goods (samples) provided free of charge for advertising purposes. Is it necessary to charge VAT on the cost of goods transferred free of charge?

Until January 1, 2006, the issue of the need to charge VAT on the cost of goods (work, services) distributed free of charge for advertising purposes was controversial.

Tax authorities (see letters from the Ministry of Taxes and Taxes of Russia dated 02/26/2004 N 03-1-08/528/18 and dated 07/05/2004 N 03-1-08/1484/ [email protected] ) and the Ministry of Finance of Russia (see letter from the Ministry of Finance of Russia dated 31.03.2004 N 04-03-11/52) have always insisted that the free distribution of goods for advertising purposes should be considered as a gratuitous transfer of goods and, therefore, should be subject to VAT. However, many organizations managed to prove the opposite in court <*>.

————————

<*> See, for example, resolutions of the Federal Antimonopoly Service of the North-Western District dated December 14, 2004 N A05-3624/04-22, Moscow District dated August 19, 2003 N KA-A40/5796-03P.

From January 1, 2006, it became pointless to argue with tax authorities on this issue. The fact is that from this date a new VAT benefit came into force, providing for the exemption from taxation of transactions for the transfer for advertising purposes of goods (work, services), the cost of acquiring (creating) a unit of which does not exceed 100 rubles. (Subclause 25, Clause 3, Article 149 of the Tax Code of the Russian Federation).

By introducing this new benefit, the legislator indirectly confirmed that the advertising distribution of goods (works, services) is, in principle, subject to VAT. When distributing low-value (up to 100 rubles) goods (works, services) for free, you can take advantage of the discount and not charge VAT. If more expensive goods (works, services) are distributed, VAT must be charged. In this case, “input” VAT related to distributed products (goods, works, services) is accepted for deduction in the general manner (see letter of the Ministry of Taxes of Russia dated February 26, 2004 N 03-1-08/528/18).

Example 3. A company entered into an agreement with an advertising agency for the production of advertising booklets and calendars with the company’s logo. The cost of manufacturing these products is 118,000 rubles. (including VAT 18% - 18,000 rubles), including the cost of production: - booklets (1000 pcs.) - 35,400 rubles. (including VAT - 5400 rubles); — calendars (500 pcs.) — 82,600 rub. (including VAT - 12,600 rubles).

The products were received in December 2006. In January 2007, the company took part in the exhibition. All produced booklets and calendars were distributed free of charge to exhibition visitors.

The cost of one booklet was 30 rubles. (excluding VAT), therefore, free distribution of booklets for advertising purposes is not subject to VAT on the basis of subclause. 25 clause 3 art. 149 of the Tax Code of the Russian Federation. This means that the “input” VAT on booklets (5,400 rubles) is not accepted for deduction.

The cost of one calendar is 140 rubles. (excluding VAT), so free distribution of calendars must be subject to VAT. In this case, the “input” VAT on calendars (12,600 rubles) is accepted for deduction in the general manner in December 2006. The following entries are made in the company’s accounting records.

December:

Debit 60 - Credit 51 - 118,000 rubles. — money was transferred to the advertising agency;

Debit 10 - Credit 60 - 35,400 rub. — the receipt of booklets at the company’s warehouse is reflected (at cost including VAT) (Clause 2 of Article 170 of the Tax Code of the Russian Federation);

Debit 10 - Credit 60 - 70,000 rub. — the receipt of calendars at the company’s warehouse is reflected (at cost excluding VAT);

Debit 19 - Credit 60 - 12,600 rubles. — reflected “input” VAT according to calendars;

Debit 68 - Credit 19 - 12,600 rubles. — submitted for deduction of “input” VAT according to calendars.

January:

Debit 44 - Credit 10 - 35,400 rub. — the cost of free booklets distributed is reflected in advertising expenses;

Debit 44 - Credit 10 - 70,000 rub. — the cost of freely distributed calendars is reflected in advertising expenses;

Debit 91 - Credit 68 - 12,600 rubles. — VAT is charged on the cost of freely distributed calendars.

In the VAT Declaration for January 2007, the cost of freely distributed calendars (70,000 rubles) is reflected in Section 3 in column 4 of line 100, and the amount of accrued VAT (12,600 rubles) is reflected in column 6 of the same line. The cost of free booklets distributed (RUB 35,400) is reflected in the same Declaration, but in Section 9 (transaction code 1010275).

Note! If the free transfer of goods (performance of work, provision of services) is carried out within the framework of charitable activities, then such transfer is exempt from taxation on the basis of subsection. 12 clause 3 art. 149 of the Tax Code of the Russian Federation.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Calculation options

To calculate VAT, it is necessary to determine the market price of the gratuitously transferred property (work, services) in accordance with the requirements of Chapter 14.2 of the Tax Code of the Russian Federation. If the parties to the transaction are not interdependent persons, the price indicated in the primary accounting documents used to formalize the gratuitous transfer can be used as the market price (letter of the Ministry of Finance of Russia dated October 4, 2012 No. 03-07-11/402).

Calculate VAT depending on how the property (work, services) transferred free of charge was accounted for:

- at a cost that includes the amount of input tax;

- at a cost that does not include tax.

In the first case, charge VAT on the difference between prices (clause 3 of Article 154 of the Tax Code of the Russian Federation). Calculate the amount of VAT that needs to be charged on the value of the property transferred free of charge as follows:

| VAT | = | Market price of gratuitously transferred property, including VAT | – | Purchase value of property transferred free of charge (residual value taking into account revaluation) including VAT | × | 18/118 (10/110) |

In the second case (if there is no input tax in the cost of donated goods), calculate VAT based on the market price taking into account excise taxes (for excisable goods) and without including the amount of tax (clause 2 of Article 154 of the Tax Code of the Russian Federation).

Determine the amount of VAT that needs to be charged on the cost of goods (work, services) transferred free of charge as follows:

| VAT | = | Market price of gratuitously transferred goods (works, services) including excise taxes (for excisable goods) without VAT | × | 18% (10%) |

An example of reflecting VAT in accounting when transferring goods free of charge

OJSC "Proizvodstvennaya" sells both its own products (confectionery) and purchased goods (food products).

In the second quarter, during a corporate holiday - the anniversary of the Master confectionery factory - former employees of the factory were given free of charge:

- from the finished product warehouse - a batch of confectionery products with a cost of 6,000 rubles. (subject to VAT at the rate of 18%);

- from a warehouse of purchased goods - a batch of food products (pasta, cereals, vegetable oil) with a cost of 2000 rubles. (subject to VAT at a rate of 10%, subparagraph 1, paragraph 2, article 164 of the Tax Code of the Russian Federation).

Market prices determined taking into account the requirements of Chapter 14.2 of the Tax Code of the Russian Federation are the following indicators (excluding VAT):

- for confectionery products – 15,000 rubles;

- for food – 3000 rubles.

The total amount of VAT payable to the budget for this operation will be 3,000 rubles, including:

- for confectionery products – 2700 rubles. (RUB 15,000 × 18%);

- for food – 300 rub. (RUB 3,000 × 10%).

In the second quarter, Master’s accountant made the following entries:

Debit 91-2 Credit 43 – 6000 rub. – a batch of own-produced products was donated free of charge;

Debit 91-2 Credit 41 – 2000 rub. – a batch of food products was donated free of charge;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 3000 rubles. – VAT payable to the budget has been accrued.

An example of reflecting VAT in accounting for gratuitous services is the placement of outdoor advertising. In February, the organization placed an advertisement for its partner on one of the billboards free of charge. The costs associated with the provision of such services amounted to RUB 20,000.

The market price of services, determined taking into account the requirements of Chapter 14.2 of the Tax Code of the Russian Federation, is recognized as the amount of 25,960 rubles. (in view of VAT).

The amount of VAT payable to the budget for this operation will be: RUB 25,960. × 18/118 = 3960 rub.

In February, Alpha’s accountant made the following entries:

Debit 91-2 Credit 20 – 20,000 rub. – the cost of services provided free of charge is written off;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 3960 rubles. – VAT payable to the budget has been accrued.

Corporate income tax and VAT

Question: What taxes must a company pay while on OSNO if it has received non-residential premises for free use and rents it out?

Answer:

Under an agreement for gratuitous use (or a loan agreement), one party (the lender) undertakes to transfer or is transferring an item for gratuitous temporary use to the other party (the borrower), and the latter is obliged to return the same item in the condition in which it received it, taking into account normal wear and tear or in a condition stipulated by the contract (Article 689 of the Civil Code of the Russian Federation). The rules on the lease agreement provided for by certain provisions of the Civil Code of the Russian Federation apply to the agreement for gratuitous use. So, according to paragraph 1 of Art. 615 of the Civil Code of the Russian Federation, the tenant is obliged to use the leased property in accordance with the terms of the lease agreement, and if such conditions are not specified in the agreement, in accordance with the purpose of the property. And in accordance with paragraph 2 of the same article, with the consent of the lessor, he has the right to sublease the leased property.

For a taxpayer using OSNO, receiving property for free use and subsequently renting it out are sources of two independent types of income subject to income tax.

INCOME FROM RENTING PROPERTY

Let's start with the obvious. According to paragraph 4 of Art. 250 of the Tax Code of the Russian Federation, non-operating income of a taxpayer includes income from leasing (subleasing) property, if such income is not determined by the taxpayer in the manner established by Art. 249 of the Code, that is, they are not income from ordinary activities.

In other words, if a taxpayer leases premises on OSNO and receives rent from the tenant stipulated by the agreement, then income arises that is taken into account in the tax base for income tax and VAT in the general manner. This is the first type of income received.

INCOME WHEN OBTAINING PROPERTY RIGHTS UNDER A LOAN AGREEMENT

Now let’s figure out why for a taxpayer using OSNO, receiving property for free use also generates taxable income.

According to paragraph 8 of Art. 250 of the Tax Code of the Russian Federation, non-operating income includes income in the form of gratuitously received property (work, services) or property rights, except for the cases specified in Art. 251 Code.

So, in paragraphs. 11 clause 1 art. 251 of the Tax Code of the Russian Federation states that property received by a Russian organization free of charge is not subject to taxation:

•from an organization, if the authorized (share) capital (fund) of the receiving party consists of more than 50 percent of the contribution (share) of the transferring organization;

•from an organization, if the authorized (share) capital (fund) of the transferring party consists of more than 50 percent of the contribution (share) of the receiving organization;

•from an individual, if the authorized (share) capital (fund) of the receiving party consists of more than 50 percent of the contribution (share) of this individual.

In this case, the received property is not recognized as income for tax purposes only if, within one year from the date of its receipt, the specified property (except for cash) is not transferred to third parties.

Please note that this provision deals with property, but not with property rights. This means that in this case this factor is decisive, therefore it does not matter from whom the taxpayer received property rights free of charge, even if it is a founder with a share in the authorized capital of more than 50 percent.

VALUATION AT MARKET PRICE

Now about the assessment in which income under a loan agreement is accepted for taxation.

Let's return to paragraph 8 of Art. 250 of the Tax Code of the Russian Federation. It says here that when receiving property (work, services) free of charge, income is assessed based on market prices determined taking into account the provisions of Art. 105.3 “General provisions on taxation in transactions between related parties” of the Tax Code of the Russian Federation.

Financiers in their Letter No. 03-11-11/42295 dated 08/25/2014 emphasized that the principle of determining income when receiving property free of charge, which consists in its assessment based on market prices, determined taking into account the provisions of Art. 105.3 of the Code is also applicable when assessing property rights, including the right to use a thing.

Based on Art. 105.3 of the Tax Code of the Russian Federation, the market price is the price applied in a transaction to which the parties are persons who are not recognized as interdependent, or to a transaction to which the parties are interdependent persons.

This means that when calculating the tax base for persons who are not recognized as interdependent, the price determined in the transaction is taken into account.

In the second case, this price is recognized as a market price (and is used when determining the tax base) until its non-market nature is proven by the tax authority in the prescribed manner or the taxpayer himself admits that the price specified in the transaction does not correspond to the market price, and does not will make appropriate adjustments in the manner established by clause 6 of Art. 105.3 of the Tax Code of the Russian Federation.

Thus, a taxpayer who receives property for gratuitous use under an agreement includes in income income in the form of the gratuitously received right to use the property, determined on the basis of the market prices at which he leases this property.

Let us explain with an example from arbitration practice. The organization received from a legal entity under an agreement for free use of a production base (office, garage, boiler room, outbuildings). Its cost was not included in income. Then the base was leased in parts on the basis of different agreements, each of which established a specific rental amount. These facts were established during an on-site tax audit. They served as the basis for additional tax and penalties.

To determine the market value of the lease of the disputed property and the economic benefits received by the taxpayer from its use, the amount of rent under individual lease agreements was accepted (Resolution of the Federal Antimonopoly Service of the East Siberian District dated February 17, 2014 in case No. A58–1964/2013).

Finally, clause 8 of Art. 250 of the Tax Code of the Russian Federation requires that information on prices be confirmed by the taxpayer - the recipient of the property (work, services) documented or through an independent assessment. Documentary evidence of the market value of an object received free of charge under a loan agreement can be an agreement under which this property is leased and which indicates its value (market rental rate).

The official position of financial authorities regarding the procedure for determining the market price in this situation is as follows: in tax accounting, the organization recognizes non-operating income from the gratuitous use of property, determined on the basis of commonly applied rental rates charged for the use of similar property (Letter of the Ministry of Finance of Russia dated August 30, 2012 No. 03 -03-06/1/444).

A similar position is set out in paragraph 2 of the Review of the practice of resolving cases by arbitration courts related to the application of certain provisions of Chapter 25 of the Tax Code of the Russian Federation (Appendix to the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98).

Article 271 of the Tax Code of the Russian Federation does not contain a special rule regarding the date of recognition of income in the form of gratuitous use of property. An organization can recognize in tax accounting the specified non-operating income on the last day of the expired month of using the property (clause 3, clause 4, article 271 of the Tax Code of the Russian Federation).

When the lender transfers the OS to the borrower, the ownership of this OS does not pass to the borrower; therefore, such a transfer of the OS by the lender to the borrower and its return by the borrower to the lender is not a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation).

Accordingly, when returning fixed assets received for free use, no consequences arise in the tax accounting of the borrower.

VAT WHEN RECEIVING PROPERTY UNDER A LOAN AGREEMENT

Receiving property for temporary use does not entail any obligations for the borrower to calculate and pay VAT.

VAT DEDUCTIONS FROM THE HOST PARTY

Even if the lender issues an invoice for the cost of renting identical property, the tax cannot be deducted (clause “a”, clause 19 of the Rules for maintaining a purchase ledger).

In case of gratuitous transfer, VAT is not payable to the acquirer.

Invoices received during the gratuitous transfer of goods (work, services), including fixed assets and intangible assets, are not registered in the purchase book (clause 1, paragraph “a”, clause 19 of the Rules for maintaining the purchase book, approved by the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137). The party receiving property (goods, work, services) free of charge, including fixed assets and intangible assets, does not deduct VAT on such a transaction. This is also explained by the Russian Ministry of Finance (Letter No. 03-07-11/197 dated July 27, 2012).

PROPERTY TAX WHEN RECEIVING PROPERTY UNDER A LOAN AGREEMENT

The borrower does not pay property tax in respect of the fixed asset received for use. This is due to the fact that the object of taxation is movable and immovable property, recorded on the balance sheet as fixed assets in the manner established for accounting (clause 1 of Article 374 of the Tax Code of the Russian Federation). In accounting, such objects are reflected in accounts 01 “Fixed Assets” and 03 “Profitable Investments in Material Assets”. Consequently, in relation to objects received for free use and accounted for in off-balance sheet account 001 “Leased fixed assets”, the borrower does not have an obligation to pay property tax.

When preparing the answer, the author used materials from the ConsultantPlus ATP: “Tax Guide. Practical guide to VAT”, “Guide to transactions. Loan. Borrower." And also the article “Commentary to the Letter of the Ministry of Finance of Russia dated August 25, 2014 No. 03-11-11/42295 <USN: accounting for income when receiving property for free use and transferring it for rent (sublease) to third parties>” (Svain B. L ., “Regulatory acts for accountants”, 2014, No. 20), correspondence of accounts “How is the receipt and return of a fixed asset received for free use reflected in the accounting of the borrower organization?..” (“Expert Consultation”, 2015) and the article “ Nuances of reflecting in accounting and tax accounting property received under a loan agreement" (Deeva E., Kirichenko A., "Russian Tax Courier", 2014, No. 15).

ANNA ZADUBROVSKAYA

, TAX LAWYER, AUDITOR, GENERAL DIRECTOR OF PROFCONSULTING LLC

Source of publication: information monthly “The Right Decision” issue No. 6 (176) release date of 06/20/2017.

The article was posted on the basis of an agreement dated October 20, 2016, concluded with the founder and publisher of the information monthly “Vernoe Reshenie” LLC “.

Invoice

For the cost of gratuitously transferred goods (work, services), no later than five days after their shipment (fulfillment, provision), issue an invoice (subclause 1, clause 3, article 169, clause 3, article 168 of the Tax Code of the Russian Federation). In the invoice, indicate the market value of the transferred goods (work, services) or the price difference, as well as the amount of VAT calculated for payment to the budget. Register the issued invoice in the sales book in the period when the goods were transferred (work performed, services provided) (clauses 1, 3 of Section II of Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).