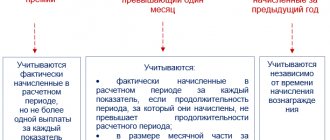

Calculation period for 2022

To correctly calculate vacation, you need the Regulations from the Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the peculiarities of the procedure for calculating the average salary” (hereinafter referred to as Resolution No. 922).

According to paragraph 4 of Resolution No. 922, the calculation period for paid leave is 12 months that precede its start. We are talking specifically about calendar months.

That is, if an employee goes on vacation in February 2022, then the months from February 1, 2022 to January 31, 2021 are taken into the calculation period.

If there was parental leave in the billing period, the billing period can be replaced . In this case, take 12 months before maternity leave. This approach is reflected in the letter of the Ministry of Labor of Russia dated November 25, 2015 No. 14-1/B-972, as well as in paragraph 6 of Resolution No. 922.

Vacation pay for less than six months of service

Upon their request, the employer must provide certain categories of employees with leave for the first year of work before the expiration of six months of continuous work: women before or after maternity leave, minor workers, in other cases provided for by federal laws (Part 3 of Article 122, Article 123 , Article 286 of the Labor Code of the Russian Federation).

In such cases, the billing period for calculating average earnings is determined according to special rules. It is equal to the number of calendar months from the date of entry into force of the employment contract, including the month preceding the vacation.

Example 4

The employee was hired on January 25, 2021 and goes on vacation for 28 calendar days from June 28, 2021.

Settlement period: from January to May 2022. The amount of accrued salary is 138,000 rubles.

Calculation of the number of days for calculating vacation pay:

- for fully worked months (from February to May) - 117.2 days. (4 months x 29.3);

- for January - 4.73 days. (5 days x 29.3 / 31 days).

———————————————————–

Total number of days worked in the billing period: 121.93 days. (117.2 + 4.73).

Average daily earnings: 138,000 rubles / 121.93 days. = 1,131.80 rub.

Vacation pay amount: RUB 1,131.80. x 28 days = 31,690.40 rub.

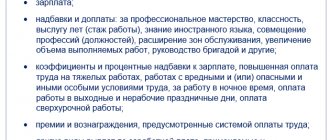

What payments are included in average earnings when calculating vacation?

In accordance with paragraph 2 of Resolution No. 922 and part 2 of Art. 139 of the Labor Code of the Russian Federation, the average earnings for calculating vacation pay include all payments that are provided for by the company’s remuneration system for the billing period.

If during the billing period the employee did not have wages or working days, then the average earnings are calculated for the 12 months that preceded the billing period. This situation may arise, for example, if the employee was on maternity or child care leave.

To calculate vacation pay for 2022, you can use a calculation note about granting vacation to the employee. This form combines both the vacation order and the calculation itself. The form of this calculation note can be downloaded for free here:

NOTE-CALCULATION ON PROVIDING LEAVE TO AN EMPLOYEE

The form of the order for the provision of leave or its calculation is not approved . The company has the right to develop it independently . Also, no one prohibits the use of unified forms.

In any case, the forms of accepted documents must be approved by order and included in the accounting policy.

The accountant calculates vacation days after signing the vacation order.

You can read about the preparation of this order in our article “Sample order for vacation in 2022.”

An employee can go on vacation according to the planned vacation schedule or in agreement with management.

For information about the schedule, see the article “How to draw up and approve a vacation schedule for 2020 ” (relevant in 2022).

Calculation of vacation pay in 2022: indicators for calculation

Duration of vacation

The standard duration of annual leave is 28 calendar days. An employee registered only under an employment contract can take advantage of the right to leave. Vacation is provided in accordance with the vacation schedule for 2018 or at other times by agreement with management. An employee can also take leave after the first 6 months of work and take early leave in the event of: upcoming maternity leave or after it; adoption of a child under the age of 3 months; the employee is not yet 18 years old. It is important to remember that in addition to annual paid leave, the employee has the right to receive leave without pay (Article 128 of the Labor Code of the Russian Federation). In this case, you do not need to calculate anything, but leave without pay for more than 14 days affects the working year and length of service for which the employee is entitled to annual paid leave. The employee was hired on February 2, 2016. Working year is the period from February 1, 2016 to January 31, 2018. Leave without pay - 30 days. The working year for which 28 days of vacation is due is from February 1, 2016 to February 16, 2018 (adjustment by 16 days).

The working year and the number of actual vacation days due to the employee affect the amount of the vacation pay reserve.

Note-calculation on granting leave to an employee (fragment)

Calculation period for vacation pay

To calculate vacation pay, you must take the previous 12 months and the actual time worked in them. The company can establish a different pay period (for example, 6 or 3 months), enshrining it in the collective agreement, but this should not worsen the situation of employees and reduce the amount of vacation pay.

For employees hired in the middle of the year and who worked part of the period, the actual time worked is taken into account.

Days excluded from the billing period

It is necessary to exclude days in which the employee was on sick leave, maternity leave, or child care leave. The full list of such periods is determined by paragraph 5 of the Regulations (approved by Resolution No. 922).

When determining excluded days, you should take into account the clarifications of the Ministry of Labor (letter dated April 15, 2016 No. 14-1/B-351) regarding holidays that fall during the vacation period. Vacation is automatically extended for holidays without payment. In accordance with the position of officials, such holidays are not excluded in the future. For example, if an employee was on vacation from December 25, 2016 to January 15, 2022, then when determining the period for the next vacation, holidays are counted as worked.

The following situation is also possible: the period is excluded completely. Then you need to take the previous period, which has been fully worked out. If the previous period is excluded, the current month and the accruals in it must be taken into account.

Days of downtime caused by the employer are also excluded from the calculation period. Downtime is a temporary suspension of work for reasons of production or organizational and technical nature. That is, companies themselves determine whether the reasons are sufficient to introduce a downtime regime. For example, if deliveries have ended and resumption is not expected, or serious problems have been discovered in the equipment, these are all sufficient reasons for introducing downtime.

The company pays for the period during which employees did not work due to downtime in the amount of at least 2/3 of the average salary (Article 157 of the Labor Code of the Russian Federation). This earnings and downtime are not included in the calculation of vacation pay.

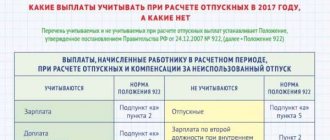

Payments in the billing period

To calculate vacation pay in 2022, you must also determine the payments included in the calculation of average earnings and excluded from it. According to Resolution No. 922, all payments to an employee approved in the regulations on remuneration and labor incentives are taken into account, regardless of the method of payment (in cash or in kind).

How to take bonuses into account in average earnings

Fully - one bonus for one indicator.

At the end of the year - no more than 12.

Completely—the quarter is fully included in the billing period.

Partially - according to the number of months included in the billing period.

Fully - payments accrued for the previous calendar year.

Proportional to the time worked - the billing period has not been fully worked or there are excluded periods.

The calculation does not include payments:

- bonuses and remunerations not taken into account in the salary regulations;

- financial assistance to employees;

- compensation for transportation and food expenses;

- payment for training and advanced training.

Formula for calculating vacation pay 2022

According to paragraph 9 of Resolution No. 922, the formula for calculating vacation in 2021 is as follows:

Average daily earnings for 2022 are calculated as follows:

Days worked include all days the employee worked. However, weekends and holidays are not excluded from days worked.

They subtract from days worked for which payment was already made based on average earnings. These are: business trips, vacations, days on sick leave and other reasons (clause 5 of Resolution No. 922, letter of the Ministry of Labor dated 04/15/2016 No. 14-1/B-351).

Paid non-working days in 2022, introduced by decrees of the President of the Russian Federation during the coronavirus period, are also not included in the calculation. This clarification was issued by the Ministry of Labor (letter dated May 18, 2020 No. 14-1/B-585).

This way you can check yourself and the correctness of calculating vacation payments to employees in 2022.

So, for each month worked they take 29.3 days . This is the accepted average monthly norm, which is calculated as follows:

(365 days – 14 holidays) / 12 months

If the month is not fully , taking into account clause 10 of Resolution No. 922, the number of days worked should be calculated using the formula:

This situation could arise when an employee was sick or on vacation, or did not work on those days that the President of the Russian Federation declared non-working due to the coronavirus pandemic.

should not take these non-working days when calculating the amount of vacation pay. This rule contains in subsection. e clause 5 of Resolution No. 922. In confirmation of the above, the Ministry of Labor issued a letter dated May 18, 2020 No. 14-1/B-585. Later, Rostrud published its letter dated July 20, 2020 No. TZ/3780-6-1, in which it confirmed the correctness of this position.

REFERENCE

June 24, 2022 was declared a non-working day, which was paid at the usual rate and should be taken into account in the standard working hours (letters of the Ministry of Labor dated June 17, 2020 No. 14-1/B-733, No. 14-1/B-727).

July 1, 2022 was declared a non-working day, which was paid as a non-working day (holiday) and must be taken into account in the standard working hours (paragraph 2, part 5, article 2 of the Law of the Russian Federation on the amendment to the Constitution of the Russian Federation of March 14, 2020 No. 1-FKZ, information from Rostrud dated June 15, 2020).

If your employees went to work on days when they were released from work, then these periods are taken into account in the billing period - in the general manner, as well as the amount of payment for them (letter of Rostrud dated July 20, 2020 No. ТЗ/3780-6-1 ).

Procedure for granting leave

When granting an employee regular leave, the following must be taken into account:

- the duration of vacation must be at least 28 calendar days, excluding holidays and non-working days;

- upon dismissal, the employee is entitled to monetary compensation for unused vacation;

- after one continuous year of work, an employee can be granted leave without having to take the six months required by law;

- accrued vacation pay is issued to employees no later than three days before the start of the vacation;

- if an employee refuses to take leave, he is entitled to compensation (issued upon the employee’s written application). It can be accrued over several calendar periods. It is prohibited to replace the main regular leave with monetary compensation , but additional leave is possible - in cases established by the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation);

3 cases when replacing vacation with compensation is unacceptable (Article 126 of the Labor Code of the Russian Federation):

- the employee is a pregnant woman;

- minor;

- engaged in work with harmful or dangerous working conditions.

- leave may be granted compulsorily every six months based on a written application from the employee;

- at the request of the employee, vacation can be postponed, but no more than 2 times in a row;

- vacation can be divided into several parts with the condition that one part in any case will be at least 14 calendar days in a row.

The right to the first annual leave at a new place of work arises for an employee after six months of continuous work in the company (Part 2 of Article 122 of the Labor Code of the Russian Federation). However, by agreement with management, leave may be granted in advance.

Note!

The right to leave for a duration of employment of less than 6 months must be granted to:

- minors (Articles 122, 267 of the Labor Code of the Russian Federation);

- women before maternity leave or immediately after it or at the end of leave related to child care (Articles 122, 260 of the Labor Code of the Russian Federation);

- working people who have adopted a child under 3 months of age;

- in other cases provided for by law.

Vacations are granted based on the vacation schedule. In accordance with legal requirements, the vacation schedule indicates the procedure and time for granting vacations to employees for the next year. It must be approved no later than December 17 annually.

The employee must be notified of the start time of the upcoming vacation against signature no later than two weeks before its start (Part 3 of Article 123 of the Labor Code of the Russian Federation).

Example of calculating vacation pay 2022

During the period of self-isolation in 2022, some employees took leave without pay.

Details about unpaid leave are set out in our article “ Leave at your own expense during coronavirus quarantine .”

However, such unpaid leave does not deprive the employee of the right to paid leave.

Let's look at the calculation of vacation in 2022 using an example.

EXAMPLE

Driver Mironov O.D. The next paid leave was granted for 14 days from January 11 to January 24, 2022.

This means that the billing period is from January 1, 2022 to December 31, 2020.

The amount of wage payments included in the calculation was 530,000 rubles.

During the pay period, the employee:

- was on paid leave - 7 days in February 2020;

- was sent on a business trip - from March 2 to March 29, 2022 and from October 1 to October 31, 2020;

- did not work on days declared non-working – from March 30, 2022 to April 30, 2022, from May 6 to May 8, 2020;

- June 24, 2022 and July 1, 2022 worked;

- I was sick and took sick leave – 7 calendar days in December 2020.

So, let’s determine the number of months fully worked by the employee: January, June, July, August, September, November 2022. Total - 6 months.

Let us remind you that we take June and July 2022 into account, because on days declared non-working, the employee went to work.

Number of days in months that are not fully worked:

- February 2022 – 22.23 days ((29 – 7)/29 × 29.3);

- May 2022 – 26.46 days ((31 – 3)/31 × 29.3);

- December 2022 – 22.68 days ((31 – 7)/31 × 29.3).

The average daily earnings is 2144.27 rubles (530,000.00 rubles / (29.3 × 6 months + 22.23 + 26.46 + 22.68).

Vacation pay amount:

2144.27 rub. × 14 days = RUB 30,019.78

Accounting for bonuses when calculating vacation pay

If the company pays bonuses, there is a special procedure for calculating vacation amounts. It all depends on what bonuses the organization pays: monthly, quarterly, annual.

The Labor Code pays very little attention to the issue of bonuses for employees. This is due to the fact that the Labor Code places emphasis on the tariff system of remuneration. What difficulties may arise when accounting for bonuses and financial assistance, read in the berator.

Monthly bonuses, which are accrued along with wages, are taken into account in full. Moreover, if, for example, bonuses are established for achieving certain indicators, then in the billing period they are taken into account in a single amount when such indicator is achieved.

As for quarterly bonuses, it is determined: if the duration of the period for which they are accrued does not exceed the billing period, then they must be taken into account in the actual accrued amounts. If premiums are accrued for a period exceeding the billing period, then they need to be taken into account only in the monthly part for each month of the billing period.

Remuneration based on the results of work for the year, a one-time remuneration for length of service (work experience), other remuneration based on the results of work for the year, accrued for the calendar year preceding the event, regardless of the time the remuneration was accrued.

If the period is not fully worked, the bonus must be included in the calculation in proportion to the time worked.

The exception is remuneration that is paid based on actual time worked. Example 2

Head of Sales Department of Astra LLC I.D. Danilina is going on vacation for 10 days from July 18, 2012. The billing period is one year (from July 2011 to June 2012). The amount of income for the year amounted to 780,000 rubles. In April 2012, Danilina was on sick leave for 14 days. At the end of 2011, she received a bonus in the amount of 150,000 rubles. Since the bonus was paid at the end of the year, but in April the employee was on sick leave, it must be adjusted in proportion to the days worked: (365 - 14) : 365 = 0.96164;150 000 rub. x 0.96164 = 144,246.57 rubles. The total amount of income taken into account for calculating vacation pay will be: 780,000 + 144,246.57 = 924,246.57 rubles. The billing period will be: 29.4 x 11 + 29.4: 30 x (30 - 14) = 323.4 + 15.68 = 339.08. We determine the average daily earnings: 924,246.57 rubles. : 339.08 = 2725.75 rubles. Vacation pay will be: 2725.75 rubles. x 10 = 27,257.5 rub.

An example of calculating vacation pay 2022 based on the minimum wage

Next, let's look at the example of calculating vacation pay in 2022 based on the minimum wage. According to paragraph 18 of Resolution No. 922, I calculate vacation pay based on the minimum wage in the case when the average monthly earnings of an employee who full working hours for the billing period is less than the minimum wage.

Recalculation of vacation pay according to the minimum wage must also be done if the minimum wage has increased during the vacation.

EXAMPLE

Cameraman Sergeev S.V. from December 23, 2020, I was on vacation for 28 days, of which 9 days were in December, 19 in January 2022. Vacation pay was accrued from the average daily earnings - 419 rubles / day.

Average daily earnings:

- from the minimum wage 2022 – 413.99 rubles/day. (RUB 12,130 / 29.3);

- from the minimum wage 2022 – 436.59 rubles/day. (RUB 12,792 / 29.3).

The average daily earnings for vacation days in January 2022 are less than the minimum wage (419 rubles/day < 436.59 rubles/day). Additional payment of vacation pay up to the minimum wage – 334.21 rubles. ((436.59 rub./day – 419 rub./day) × 19 days).

Determining the amount of vacation pay for salary increases

A salary increase affects the calculation of vacation pay if this happens:

- before or during vacation;

- in the billing period or after it.

If the salary was increased for all employees of the institution, then before calculating the average salary, its rate and all allowances should be indexed to the rate that was set at a fixed amount.

The period of salary increases affects the indexation order. Payments are usually indexed by an increase factor. To determine the amount of vacation pay, we find the coefficient (K):

K = Salary of each month for the billing period / Monthly earnings on the date of going on leave.

If the salary increased during the vacation, only part of the average income needs to be adjusted, and it must fall on the period from the end of the vacation to the date of the increase in earnings; if after the calculated period, but before the start of the vacation, the average daily payment should be adjusted.

Situation 5. The salary was increased after the pay period, but before the start of the vacation.

Chemist-expert E.V. Deeva was granted the next main leave from 08/10/2015 for 28 calendar days. Monthly salary - 25,000 rubles. The billing period - from August 2014 to July 2015 - has been fully worked out.

Let's calculate the amount of vacation pay:

(RUB 25,000 × 12) / 12 / 29.3 × 28 calendars. days = 23,890.79 rub.

In August 2015, all employees of the institution received a 10% salary increase, therefore, the salary increased taking into account indexation:

(25,000 × 1.1) = 27,500 rubles.

The amount of vacation pay after adjustment will be:

RUB 23,890.79 × 1.1 = 26,279.87 rub.

Situation 6. Increase in salary during the billing period

Technician I.N. Sokolov goes on regular leave of absence lasting 28 calendar days from 10/12/2015. The calculation period for calculating vacation pay is from 10/01/2014 to September 2015 inclusive.

The technician’s salary is RUB 22,000. In September it was increased by 3,300 rubles. and amounted to 25,300 rubles. Let's determine the increase factor:

RUB 25,300 / 22,000 rub. = 1.15.

Therefore, salaries need to be indexed. We calculate:

(RUB 22,000 × 1.15 × 11 months + 25,300) / 12 / 29.3 × 28 = RUB 24,177.47

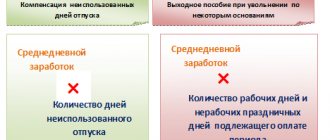

We determine the amount of compensation for unused vacation days paid upon dismissal

Upon dismissal, an employee has the right to receive compensation for days of unused vacation.

To determine the number of unused calendar days of vacation, the following data is required:

- duration of the employee’s vacation period (number of years, months, calendar days);

- the number of vacation days that the employee earned during the period of work in the organization;

- the number of days used by the employee.

The only current regulatory document explaining the procedure for calculating compensation for unused vacation remains the Rules on regular and additional vacations, approved by the People's Commissar of the USSR on April 30, 1930 No. 169 (as amended on April 20, 2010; hereinafter referred to as the Rules).

Determining the vacation period

The first working year is calculated from the date of entry into work for a given employer, subsequent ones - from the day following the end of the previous working year. If an employee is dismissed, his vacation period ends. When an employee gets a new job, he begins to earn vacation leave again from the first day of work.

Calculating the number of vacation days earned

The number of vacation days earned is determined in proportion to the vacation period as follows:

| Number of vacation days earned | = | Duration of vacation in calendar days | / | 12 months | × | Number of months of employee's vacation period |

For your information

Usually the last month of vacation period is incomplete. If 15 calendar days or more were worked in it, then this month is rounded up to the whole month. If less than 15 calendar days have been worked, the days of this month do not need to be taken into account (Article 423 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation)). (clause 35 of the Rules)

The number of vacation days allotted for each month of the year is calculated depending on the established vacation duration. Thus, for each fully worked month, 2.33 days of vacation are due, for a fully worked year - 28 calendar days.

Cash compensation for all unused days of annual paid leave that the employee has acquired since starting work in the organization is paid only upon the employee’s dismissal (Article 127 of the Labor Code of the Russian Federation).

Question on topic

How to compensate unused vacation days for an employee who quits without working the accounting period?

An employee who has not worked in the organization for a period giving the right to full compensation, upon dismissal, has the right to proportional compensation for calendar days of vacation. Based on clause 29 of the Rules, the number of days of unused vacation is calculated by dividing the duration of vacation in calendar days by 12. This means that with a vacation duration of 28 calendar days, 2.33 calendar days must be compensated. days for each month of work included in the length of service giving the right to receive leave (28/12).

__________________

Unlike regular vacation, which is granted in whole days, when calculating compensation for unused vacation, vacation days are not rounded.

Absenteeism, vacation granted without pay, exceeding 14 days, reduce the vacation period (Article 121 of the Labor Code of the Russian Federation).

Note!

Employees with whom civil law contracts have been concluded are not entitled to compensation for unused vacation, since the norms of the Labor Code of the Russian Federation do not apply to them.

We determine the period for payment of compensation for vacation upon dismissal

Borisov P.I. was accepted into the organization on December 8, 2014, dismissed on September 30, 2015. In June 2015, he was on leave for 14 days, and in July 2015, he was on leave without pay for 31 calendar days. The period of work in the organization was 9 months 24 days. Since the duration of vacation at one’s own expense exceeded 14 calendar days per working year, the total length of service must be reduced by 17 calendar days (31 – 14). This means that the vacation period will be (9 months 24 days - 17 days).

Since 7 calendar days are less than half a month, according to the rules they are not taken into account. It follows from this that only 9 whole months will be counted towards the length of service giving the right to leave.

The employee used two weeks of the main vacation; he does not have to pay compensation for them. In this case, the employee is entitled to compensation for 6.97 calendar days (9 months × 2.33 – 14 days).