Where to pay in 2022

In 2022, the Federal Tax Service will continue to control the calculation and payment of insurance contributions for compulsory pension, medical and social insurance (with the exception of contributions for injuries). The listed types of insurance premiums in 2022 must be paid to the Federal Tax Service, and not to the funds. Accordingly, the payment order for the payment of contributions in 2022 must be completed as follows:

- in the TIN and KPP field of the recipient of the funds - TIN and KPP of the tax inspectorate;

- in the “Recipient” field - the abbreviated name of the Federal Treasury body and in brackets - the abbreviated name of the Federal Tax Service;

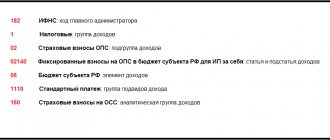

- in the KBK field - budget classification code, consisting of 20 characters (digits). In this case, the first three characters indicating the code of the chief administrator of budget revenues should take the value “182” - Federal Tax Service.

In 2022, there were a number of changes in the legislation on insurance premiums. You can see a detailed overview in the article “Changes in insurance premiums from 2022”.

Deadlines for payment of insurance premiums in 2022

As you know, insurance premiums for compulsory medical insurance, compulsory medical insurance and compulsory health insurance in case of VNiM are paid to the Federal Tax Service in accordance with the norms of the Tax Code of the Russian Federation, while contributions “for injuries” are transferred to the territorial body of the Social Insurance Fund in accordance with the provisions of Federal Law No. 125-FZ (hereinafter referred to as Law No. 125-FZ). But despite these differences, the same payment deadline is set for all types of insurance premiums - this is the 15th day of the month following the reporting month (clause 3 of Article 431 of the Tax Code of the Russian Federation, clause 4 of Article 22 of Law No. 125-FZ). Moreover, if the 15th falls on a weekend or holiday, then the payment must be transferred on the next working day following it (weekend or holiday).

Thus, the deadlines for paying insurance premiums in 2022 will be as follows (see table).

Table 5 – Deadlines for payment of insurance premiums for employees and other individuals in 2022

| For what period are contributions paid? | Payment deadline |

| For December 2022 | No later than 01/15/2018 |

| For January 2022 | No later than 02/15/2018 |

| For February 2022 | No later than March 15, 2018 |

| For March 2022 | No later than 04/16/2018 |

| For April 2022 | No later than 05/15/2018 |

| For May 2022 | No later than June 15, 2018 |

| For June 2022 | No later than July 16, 2018 |

| For July 2022 | No later than 08/15/2018 |

| For August 2022 | No later than September 17, 2018 |

| For September 2022 | No later than 10/15/2018 |

| For October 2022 | No later than 11/15/2018 |

| For November 2022 | No later than 12/17/2018 |

Keep in mind! Individual entrepreneurs, when paying insurance premiums “for themselves,” must comply with the deadlines established by clause 2 of Article 432 of the Tax Code of the Russian Federation.

Thus, fixed payments for compulsory health insurance and compulsory medical insurance contributions for the billing period (year) are transferred no later than December 31 of the current year. And if the entrepreneur’s annual income turns out to be above 300 thousand rubles, then from the excess amount you must also pay 1% “pension” contributions until July 1 of the year following the previous one.

Pay attention again! The deadline for individual entrepreneurs to pay additional “pension” contributions (1%) in accordance with Federal Law No. 335-FZ of November 27, 2017 was postponed from April 1 to July 1. You need to focus on the new date when transferring contributions for billing periods starting from 2022.

Taking into account the provisions of clause 2 of Article 432 of the Tax Code of the Russian Federation, the rules for transferring clause 7 of Article 6.1 of the Tax Code of the Russian Federation, as well as data on weekends and non-working holidays next year, in 2022 the individual entrepreneur must make insurance contributions “for himself” no later than the following dates (see table).

Table 5 – Deadlines for individual entrepreneurs to pay insurance premiums “for themselves” in 2018

| The period for which individual entrepreneur contributions are paid | Payment deadline |

| For 2022 | No later than 01/09/2018 |

| For 2022 (additional payment of contributions to mandatory pension insurance on income for 2022 exceeding RUB 300,000) | No later than 07/02/2018 |

| For 2022 | No later than December 31, 2018 |

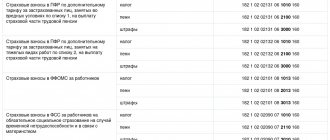

KBK table for payment of insurance premiums for employees and other individuals in 2022

| Payment | KBK payments | ||

| on compulsory pension insurance (OPI) | for compulsory health insurance (CHI) | for compulsory social insurance (OSI) | |

| Contributions | 182 1 0210 160 | 182 1 0213 160 | 182 1 0210 160 |

| Penalty | 182 1 0210 160 | 182 1 0213 160 | 182 1 0210 160 |

| Fines | 182 1 0210 160 | 182 1 0213 160 | 182 1 0210 160 |

BCC for VAT in 2022

A company that mistakenly indicated the KBK of another tax in its payment has the right to clarify the payment. This was officially confirmed by the Federal Tax Service. For example, a profit tax code was entered in the VAT payment slip. Because of this, a debt arose for VAT, and an overpayment arose for profits.

If you submit an application to clarify the payment, then the tax authorities must correct the BCC in the budget settlement card and reset the penalties to zero (clause 7 of Article 45 of the Tax Code of the Russian Federation). But in order not to create unnecessary problems for yourself, check the KBK of value added tax for 2022 in advance using our table.

KBK for VAT transfer in 2022

| Payment Description | Mandatory payment | Penalty | Fines |

| VAT on goods (work, services) sold in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| VAT on goods imported into Russia (from the Republics of Belarus and Kazakhstan) | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| VAT on goods imported into Russia (payment administrator - Federal Customs Service of Russia) | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

KBK table for payment of pension contributions by employers at the additional tariff in 2018

| Payment | KBK payments on OPS | |

| the tariff does not depend on the special assessment | the tariff depends on the special assessment | |

| For insured persons employed in the work specified in clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 1) | ||

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0200 160 | |

| Fines | 182 1 0200 160 | |

| For insured persons employed in the work specified in paragraphs. 2-18 Part 1 Article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 2) | ||

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0200 160 | |

| Fines | 182 1 0200 160 | |

New BCC (budget classification codes) for 2022, table, changes

Incorrect BCCs in payments when transferring taxes and contributions lead to arrears.

Of course, the details in field 104 can be clarified. But this takes time. After all, you need to draw up an application and submit it to the inspectorate. Therefore, it is easier to check the BCC in advance not only in payments, but also in calculations and declarations. This article will help you fill out the BCC correctly in payment orders and reporting. It contains all the KBK 2022 (budget classification codes) for 2022. Just select the desired tax and the most suitable code. We have brought all the BCCs taking into account the changes of 2018. After all, the budget classification codes have changed.

KBK table for individual entrepreneurs to pay insurance premiums “for themselves” in 2022

| Payment | KBK payments | |

| on compulsory pension insurance (OPI) | for compulsory health insurance (CHI) | |

| Fixed contributions | 182 1 0210 160 | 182 1 0213 160 |

| Contributions of 1% on income over RUB 300,000. | – | |

| Penalty | 182 1 0210 160 | 182 1 0213 160 |

| Fines | 182 1 0210 160 | 182 1 0213 160 |

KBK for personal income tax for 2022 for legal entities

In field 104 of the payment slip, the tax agent indicates the budget classification codes. The latest changes have not affected the BCC for personal income tax for employees in 2022. But remember that the codes are different for the tax itself, penalties and fines. BCC for personal income tax for employees in 2022 is in the table below.

KBK for personal income tax on the income of employees, legal entities and individual entrepreneurs for 2018

| Employee income tax | 182 1 0100 110 |

| Penalties on employee income tax | 182 1 0100 110 |

| Employee income tax penalties | 182 1 0100 110 |

| Tax paid by entrepreneurs on the general system | 182 1 0100 110 |

| Penalties on the tax paid by entrepreneurs on the general system | 182 1 0100 110 |

| Tax penalties paid by entrepreneurs on the general system | 182 1 0100 110 |

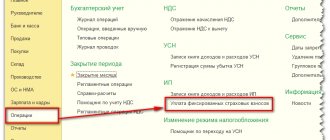

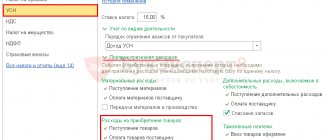

KBK according to the simplified tax system for 2022

The minimum tax on the simplified tax system with the object “income minus expenses” no longer has a separate budget classification code. It must be paid according to the KBK regular tax. This is what the Russian Ministry of Finance decided (order No. 90n dated June 20, 2016).

BCCs under the simplified tax system vary depending on the object of taxation. For the object “income” there are some codes, for the object “income minus expenses” - others. In addition, BCCs differ depending on the purpose of the payment. If this is a basic payment, there is only one code. If penalties are different, for fines it’s third. See all BCCs under the simplified tax system in 2022 in the table below.

KBK on simplified tax system – 2022 (income)

| Purpose of payment | KBK |

| Advances and tax for the object “income” | 182 1 0500 110 |

| Penalties for the object “income” | 182 1 0500 110 |

| Fines for the object “income” | 182 1 0500 110 |

KBK on the simplified tax system - 2022 (income minus expenses)

| Purpose of payment | KBK |

| Advances, tax and minimum tax for the object “income minus expenses” | 182 1 0500 110 |

| Penalties for the object “income minus expenses” | 182 1 0500 110 |

| Fines for the object “income minus expenses” | 182 1 0500 110 |

KBK on excise taxes in 2022

Execute payment orders for the transfer of excise tax in accordance with the Regulations of the Bank of Russia dated June 19, 2012 No. 383-P and the Rules approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. In field 104, put KBK - we have listed them in the table below.

KBC for the transfer of excise taxes in 2022

| Purpose | Mandatory payment | Penalty | Fine |

| Excise taxes on goods produced in Russia | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| ethyl alcohol from non-food raw materials | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| wine, grape, fruit, cognac, calvados, whiskey distillates | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcohol-containing products | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| tobacco products | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| electronic nicotine delivery systems | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| nicotine-containing liquids | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| tobacco and tobacco products intended for consumption by heating | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| automobile gasoline | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| straight-run gasoline | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| cars and motorcycles | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| diesel fuel | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| motor oils for diesel, carburetor (injection) engines | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| beer | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| cider, poiret, mead | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| benzene, paraxylene, orthoxylene | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| aviation kerosene | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| middle distillates | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| wines with a protected geographical indication, with a protected designation of origin, except for sparkling wines (champagnes) | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| sparkling wines (champagnes) with a protected geographical indication, with a protected designation of origin | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise duties on goods imported from member states of the Customs Union (payment of excise duty through tax inspectorates) | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| distillates – wine, grape, fruit, cognac, calvados, whiskey | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| cider, poiret, mead | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| ethyl alcohol from non-food raw materials | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcohol-containing products | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| tobacco products | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| electronic nicotine delivery systems | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| nicotine-containing liquids | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| tobacco and tobacco products intended for consumption by heating | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| automobile gasoline | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| cars and motorcycles | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| diesel fuel | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| motor oils for diesel, carburetor (injection) engines | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| beer | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| straight-run gasoline | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| middle distillates | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on goods imported from other countries (payment of excise duty at customs) | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| distillates – wine, grape, fruit, cognac, calvados, whiskey | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| cider, poiret, mead | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| ethyl alcohol from non-food raw materials | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcohol-containing products | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| tobacco products | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| electronic nicotine delivery systems | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| nicotine-containing liquids | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| tobacco and tobacco products intended for consumption by heating | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| automobile gasoline | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| cars and motorcycles | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| diesel fuel | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| motor oils for diesel, carburetor (injection) engines | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| beer | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| straight-run gasoline | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| middle distillates | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

New BCCs for insurance premiums to the Pension Fund from April 23, 2022

On April 23, 2022, an order of the Russian Ministry of Finance adjusted the BCC for penalties, fines and interest on insurance pension contributions paid at additional tariffs.

Main changes in insurance premiums for employees entitled to early retirement. If the employer has not carried out a special assessment of working conditions at the workplaces of such employees, then the tariff is 9% or 6% depending on the category of employees. If there are results of a special assessment, then for each category of employee additional differentiation of the tariff is provided depending on the class and subclass of working conditions.

Until April 23, the dependence of the KBK on the conduct or non-conduct of a special assessment was established only for the payment of insurance premiums under the additional tariff and was unchanged for all categories of workers for whom such contributions are transferred. Whereas the budget classification differentiated penalties, fines, and interest on payments by periods (before and after January 1, 2022). From April 23, 2022, penalties, fines and interest are differentiated depending on whether the rate of insurance premiums depends on the results of a special assessment of working conditions.

Insurance premiums at an additional tariff for workers employed in underground work, in work with hazardous working conditions and in hot shops, for the payment of an insurance pension

| KBK | Edition valid from 04/23/2018 |

| 182 1 0210 160 | The contributions themselves, including arrears or recalculation, if the tariff does not depend on the results of a special labor assessment |

| 182 1 0220 160 | The contributions themselves, including arrears or recalculation if the tariff depends on the results of a special labor assessment |

| 182 1 0200 160 | Penalties if the additional tariff depends on the results of the special assessment |

| 182 1 0210 160 | Penalties if the additional tariff does not depend on the results of the special assessment |

| 182 1 0200 160 | Interest on payment if the additional tariff depends on the results of the special assessment |

| 182 1 0210 160 | Interest on payment if the additional tariff does not depend on the results of the special assessment |

| 182 1 0282 160 | Monetary penalties and fines if the additional tariff depends on the results of the special assessment |

| 182 1 0210 160 | Monetary penalties and fines if the additional tariff does not depend on the results of the special assessment |

| 182 1 0282 160 | Other supply |

| 182 1 0282 160 | Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff depends on the results of the special assessment |

| 182 1 0210 160 | Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff does not depend on the results of the special assessment |

Insurance premiums at an additional tariff for other employees entitled to early retirement for payment of an insurance pension

| KBK | Edition valid from 04/23/2018 |

| 182 1 0210 160 | The payment of contributions itself, including arrears or recalculation, if the tariff does not depend on the results of a special labor assessment |

| 182 1 0220 160 | The payment of contributions itself, including arrears or recalculation, if the tariff depends on the results of a special labor assessment |

| 182 1 0200 160 | Penalties if the additional tariff depends on the results of the special assessment |

| 182 1 0210 160 | Penalties if the additional tariff does not depend on the results of the special assessment |

| 182 1 0200 160 | Interest on payment if the additional tariff depends on the results of the special assessment |

| 182 1 0210 160 | Interest on payment if the additional tariff does not depend on the results of the special assessment |

| 182 1 0282 160 | Monetary penalties and fines if the additional tariff depends on the results of the special assessment |

| 182 1 0210 160 | Monetary penalties and fines if the additional tariff does not depend on the results of the special assessment |

| 182 1 0282 160 | Other supply |

| 182 1 0282 160 | Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff depends on the results of the special assessment |

| 182 1 0210 160 | Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff does not depend on the results of the special assessment |