An individual entrepreneur can pay his taxes and insurance premiums without leaving home and without first visiting an inspector. Paying taxes for individual entrepreneurs online is available to everyone, including those who do not have profiles on the government services portal or the Federal Tax Service website. There are a variety of payment methods - an entrepreneur's current account, an individual's card, electronic wallets and even a mobile phone account.

Free accounting services from 1C

What are fixed contributions and why are they no longer fixed?

Fixed contributions were insurance contributions for compulsory pension insurance and compulsory health insurance paid by individual entrepreneurs, lawyers, notaries and other persons engaged in private practice.

One of the best webinars on how to keep records for entrepreneurs.

Hit "Clerk": "Educational program for individual entrepreneurs: taxes, documents, personnel records." Pay by card and watch right now

Sanctions for late payment of taxes

If the tax is not paid on time, an organization or individual entrepreneur will be subject to penalties. Penalties consist of a penalty and a fine. Penalties are accrued for each day of tax delay; it is determined as a percentage of the unpaid tax amount. To pay a fine, the Tax Code of the Russian Federation has the concept of unintentional non-payment and intentional non-payment of tax. If there was an unintentional failure to pay the tax, then the penalties, namely a fine, will be 20% of the amount of the unpaid tax, and if there was an intentional failure to pay the tax, then in this case the organization or individual entrepreneur will be fined 40% of the amount of the unpaid tax.

Who pays fixed fees

Contributions in a fixed amount are required to be paid by all individual entrepreneurs, regardless of the taxation system for individual entrepreneurs, business activities and the availability of income. In particular, if an individual entrepreneur works somewhere under an employment contract, and insurance premiums are paid for him by the employer, this is not a basis for exemption from paying contributions calculated in a fixed amount.

Since 2013, you can avoid paying fixed contributions for the following periods:

- conscription service in the army;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than three years in total;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total.

However, if entrepreneurial activity was carried out during the above periods, then contributions will have to be paid (clause 7 of Article 430 of the Tax Code of the Russian Federation).

What determines the size of contributions?

Until January 1, 2022, the amount of individual entrepreneur contributions depended on the minimum wage.

However, due to the fact that the minimum wage was increased to the subsistence level, individual entrepreneurs’ contributions were decided to be “delinked” from it, and starting in 2022, the fixed amount of contributions paid per year is indicated in the Tax Code.

Since 2014, the amount of fixed contributions also depends on the annual income of the individual entrepreneur, since if the income exceeds 300 thousand rubles during the year. it is necessary to charge another 1% contribution on the amount of income exceeding 300 thousand rubles.

Income is calculated as follows:

- Under OSNO - income accounted for in accordance with Article 210 of the Tax Code of the Russian Federation. i.e. those incomes that are subject to personal income tax (applies only to income received from business activities). When determining these incomes, expenses are taken into account (Resolution of the Constitutional Court of November 30, 2016 No. 27-P);

- Under the simplified tax system with the object of taxation, “income” is income taken into account in accordance with Article 346.15 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the simplified tax system (such income is indicated in column 4 of the book of income and expenses and is indicated in line 113 of the tax return under the simplified tax system);

- Under the simplified tax system with the object of taxation “income reduced by the amount of expenses” - income taken into account in accordance with Article 346.15 of the Tax Code of the Russian Federation. When determining income, you can take expenses into account. Those. the calculation is made from the same amount as the tax is calculated. The Federal Tax Service was forced to agree with this calculation under pressure from judicial practice.

- Under the Unified Agricultural Tax - income accounted for in accordance with paragraph 1 of Article 346.5 of the Tax Code of the Russian Federation. Those. those incomes that are taxed under the Unified Agricultural Tax (such income is indicated in column 4 of the book of income and expenses and is indicated in line 010 of the tax return under the Unified Agricultural Tax). Expenses are not taken into account when determining income for calculating contributions;

- With PSN - potential income, calculated according to the rules of Article 346.47 of the Tax Code of the Russian Federation and Article 346.51 of the Tax Code of the Russian Federation. Those. the income from which the cost of the patent is calculated.

- If an individual entrepreneur applies several tax systems at the same time, then the income from them is added up.

Deadline for payment of UTII tax

The reporting period for UTII is a quarter (three months). The UTII tax must be paid up to and including the 25th day of the month following the reporting period . When you need to pay this tax is clear from the following list:

- For the 1st quarter of 2022, payment must be made by 04/25/2022;

- For the 2nd quarter of 2022, payment must be made by July 25, 2022;

- For the 3rd quarter of 2022, payment must be made by October 25, 2022;

- For the 4th quarter of 2022, payment must be made by 01/25/2022.

If the last day for tax payment falls on a weekend or holiday, then the deadline for payment in this case is the first working day following the holiday or weekend.

Fixed Contribution Tariffs

IN 2021

The following tariffs apply

for payments to individual entrepreneurs “for themselves”

:

| Payers | Pension Fund, insurance part | FFOMS |

| Individual entrepreneurs (regardless of the taxation system), notaries, lawyers and other persons obligated to pay fixed fees | 22.0% (of which 6% is the joint part of the tariff, 16% is individual) | — |

Why do we need contribution rates if they are not calculated as a percentage of income for individual entrepreneurs? And how many pension points you will be awarded depends on the Pension Fund’s contribution rate. Those. Not the entire amount of paid contributions will be credited to the individual personal account, but only 32448 × 16/22 = 23596.

Calculation of contributions for incomes over 300 thousand rubles

If the income of the payer of insurance premiums for the billing period exceeds 300,000 rubles, in addition to the fixed pension contributions indicated above (32,448 rubles), contributions are paid in the amount of 1% of the income exceeding 300,000 rubles. Note! Health insurance premiums for incomes over 300 thousand rubles are not paid

! Those. The amount of contributions to the FFOMS is fixed for all individual entrepreneurs, regardless of the amount of annual income.

Example:

The income of an individual entrepreneur in 2022 was: 350,000 rubles. for activities subject to the simplified tax system and 100,000 rubles. for activities for which UTII is applied (how income is calculated is indicated above). Total 450,000 rub. The amount of contributions to the Pension Fund for 2022 will be 32,448 (450,000 − 300,000) × 1% = 33,948 rubles. The amount of contributions to the FFOMS is 8,426 rubles.

The total amount of fixed insurance contributions to the Pension Fund for the year cannot be more than eight times the fixed amount of insurance contributions established for the year. Those. no more than 32,448×8 = 259,584 rubles.

Example:

The income of an individual entrepreneur using the simplified tax system in 2022 was: 30,000,000 rubles. The amount of contributions for 2022 would be 32,448 (30,000,000 − 300,000) × 1% = 329,448 rubles, however, since it is greater than the maximum possible contributions of 259,584 rubles, 259,584 rubles are paid. contributions to the Pension Fund and contributions to the Federal Compulsory Medical Insurance Fund in the amount of 8,426 rubles.

How to fill out receipts for mandatory insurance premiums for individual entrepreneurs “for yourself” in 2022?

Important update. Please note that from January 1, 2022, it is necessary to indicate new details of the Federal Treasury when paying taxes and contributions (although there will be a transition period, but read about this in the article at the link below). Moreover, there will be one more mandatory detail that will need to be filled out in the payment order.

Read more in the article:

Important: New details from 2022 when paying taxes and contributions

Good afternoon, dear individual entrepreneurs!

Let’s assume that a certain individual entrepreneur without employees decided to pay mandatory contributions “for himself” for the full year 2022. Our individual entrepreneur wants to pay mandatory contributions quarterly, in cash, through a branch of SberBank of Russia.

Also, our individual entrepreneur from the example wants to pay 1% of the amount exceeding 300,000 rubles per year at the end of 2022, but we will talk about this case at the very end of this article.

Of course, individual entrepreneurs on the simplified tax system “income” with zero annual income, or less than 300,000 rubles per year should not pay this 1%.

In this case, our individual entrepreneur must pay the state for 2021:

- Contributions to the Pension Fund “for yourself” (for pension insurance): RUB 32,448.

- Contributions to the FFOMS “for yourself” (for health insurance): RUB 8,426.

- Total for the full year 2022 = RUB 40,874.

- Also, don’t forget about 1% of the amount exceeding 300,000 rubles of annual income (but more on that below)

A little hint. To understand where these payment amounts come from, I advise you to read the full article on individual entrepreneur contributions “for yourself” for 2022:

https://dmitry-robionek.ru/calendar/strakhovyye-vznosy-ip-za-sebya-v-2021-godu.html

I remind you that you can subscribe to my video channel on Youtube using this link:

https://www.youtube.com/c/DmitryRobionek

But back to the article... Our individual entrepreneur wants to pay quarterly in order to evenly distribute the load throughout 2022.

This means that he pays the following amounts every quarter:

- Contributions to the Pension Fund: 32448: 4 = 8112 rubles.

- Contributions to the FFOMS: 8426: 4 = 2106.5 rubles.

That is, our individual entrepreneur prints two receipts for payment of insurance premiums every quarter and goes with them to Sberbank to pay in cash.

Moreover, the deadlines for quarterly payments are as follows:

- For the first quarter of 2022: from January 1 to March 31

- For the second quarter of 2022: from April 1 to June 30

- For the third quarter of 2022: from July 1 to September 30

- For the fourth quarter of 2022: from October 1 to December 31

In our example, we will consider exactly the case when an individual entrepreneur pays quarterly. Almost all accounting programs and online services offer these terms for payment of contributions. Thus, the burden of mandatory insurance contributions for individual entrepreneurs is distributed more evenly.

And an individual entrepreneur using the simplified tax system of 6% can still make deductions from advances under the simplified tax system. Please note that if you have an individual entrepreneur account with a bank, it is strongly recommended that you pay contributions (and taxes) only from it. The fact is that banks, starting from July 2022, control this moment. And if you have a bank account for an individual entrepreneur, then be sure to pay all taxes and contributions only from the individual entrepreneur’s account, and not in cash.

How to fill out receipts?

Follow the link to the official website of the Federal Tax Service:

https://service.nalog.ru/payment/payment.html?payer=ip#paymentEdit

We agree to the processing of personal data and click on the “Continue” button.

Select the payment method “Filling out all payment details of the document”

Since we pay as individual entrepreneurs, we check the boxes as follows:

Click on the “Next” button and you will be taken to the next step.

In the “IFTS Code” field, enter the code of your tax office. Let our individual entrepreneur live in the mountains. Ivanovo, its tax office code is 3702, and its OKTMO code is 24701000 (see screenshot below).

Of course, you will enter your tax office code and your OKTMO. If you don’t know them, you can check with your tax office.

Or try to determine the code of your tax office + OKTMO using the “Determine by address” function.

Check the box next to “Locate by address” and enter your registered address. But, nevertheless, I recommend checking this data again with your tax office if you are not completely sure.

Moreover, pay attention to two switches:

- The Federal Tax Service and OKTMO are located in the same region

- The Federal Tax Service Inspectorate and OKTMO are located in different regions

In our example, let them be in the same region, so the following setting was chosen:

If you are in doubt about what to choose, it is better to check with your tax office. The fact is that, indeed, sometimes the tax office may be located in a different region than OKTMO. This happens when one tax office registers entrepreneurs from several regions of the Russian Federation. For example, from remote villages and small settlements. It’s even better to use programs and services for maintaining accounting/tax records for individual entrepreneurs. These receipts are automatically generated in them in a few clicks.

And we press the “Next” button...

And we immediately indicate the required KBK

- If we pay a mandatory contribution to pension insurance “for ourselves,” then we enter the BCC for 2022: 18210202140061110160

- If we pay a mandatory contribution to health insurance “for ourselves,” then we introduce a different BCC for 2022: 18210202103081013160

Important: enter KBK WITHOUT SPACES and immediately click on the “Next” button!

That is, when you issue these two receipts for pension and health insurance, you will do this procedure twice , but at this step you will indicate different BCCs and different amounts of payments for pension and health insurance of individual entrepreneurs “for yourself.”

Let me remind you once again about the payment amounts for the full year 2022:

- Contributions to the Pension Fund “for yourself” (for pension insurance): RUB 32,448.

- Contributions to the FFOMS “for yourself” (for health insurance): RUB 8,426.

If you pay quarterly, the amounts will be as follows:

- Contributions to the Pension Fund: 32448: 4 = 8112 rubles.

- Contributions to the FFOMS: 8426: 4 = 2106.5 rubles.

It is clear that if the individual entrepreneur has worked for less than a full year, then you will have to recalculate the contributions yourself, taking into account the date of opening (or closure of the individual entrepreneur). Instead of paying fees for a full year.

And again click on the “Next” button.

- We select the status of the person who issued the payment as “13” - taxpayer (payer of fees) - individual entrepreneur.

- TP – current year payments

- And indicate the tax period: GY-annual payments 2021

- Enter the payment amount (of course, you may have a different amount)

Please note that starting from October 1, 2022, in field 101 instead of code “09” you will need to write code “13”

Changes when filling out field 101 when paying taxes and contributions from October 1, 2022

And again click on the “Next” button.

Next, enter your information. Namely:

- Surname

- Name

- Surname

- TIN

- Registration address

Please note that you need to pay fees on your own behalf.

Click the “Next” button and check everything carefully again...

After making sure that the data is entered correctly, click on the “Pay” button.

If you want to pay in cash using a receipt, then select “Generate receipt” and click on the “Generate payment document” button

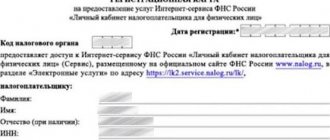

That's it, the receipt is ready

- Since we entered KBK 18210202140061110160 , we received a receipt for payment of mandatory contributions to the pension insurance of individual entrepreneurs “for ourselves”.

- In order to issue a receipt for payment of the mandatory contribution for medical insurance of an individual entrepreneur “for yourself,” we repeat all the steps, but at the stage of entering the BCC, we indicate a different BCC: 18210202103081013160

Example of a receipt for a quarterly payment for compulsory pension insurance:

An example of a receipt for a quarterly payment for compulsory health insurance (note that the BCC in the receipt is different):

We print these receipts and go to pay at any Sberbank branch (or any other bank that accepts such payments).

Payment receipts and receipts must be kept!

Important: It is better not to delay the deadline for paying mandatory contributions “for yourself” until December 31, as the money may simply “get stuck” in the depths of the bank. It happens. Please pay at least 10 days before the due date.

How to generate a receipt for payment of 1% of an amount exceeding 300,000 rubles per year?

Indeed, those individual entrepreneurs whose annual income in 2022 will be MORE than 300,000 rubles are also required to pay 1% of the amount exceeding 300,000 rubles. In order not to repeat myself, I am sending you to read a more detailed article about individual entrepreneur contributions “for yourself” in 2021:

Insurance premiums for individual entrepreneurs “for themselves” in 2022: examples and answers to frequently asked questions

We are now more interested in another question: where can I get a receipt for paying this 1%?

Let me remind you once again that this payment must be made strictly before July 1, 2022 (based on the results of 2022, of course).

So here it is. There is no separate BCC for payment of 1%. This means that when it comes time to pay this 1%, you will need to generate exactly the same receipt as for paying contributions to compulsory pension insurance.

That is, when issuing a receipt for payment of 1%, indicate BCC 18210202140061110160 (but it is possible that this BCC will change in 2022. Therefore, follow the news and update your accounting programs in a timely manner).

In fact, you will receive exactly the same receipt as when paying a mandatory contribution to pension insurance. Only there will be a different payment amount, of course.

That's all, actually.

But finally, I will repeat once again that such payments need to be processed in accounting programs and services. There is no need to do everything manually in the hope of saving several thousand rubles...

For example, these two receipts can be issued in 1C. Entrepreneur" in literally three clicks. Without thoughtfully studying such boring instructions =)

Best regards, Dmitry Robionek.

Dear entrepreneurs!

A new electronic book on taxes and insurance contributions for individual entrepreneurs on the simplified tax system of 6% without employees for 2022 is ready:

“What taxes and insurance premiums does an individual entrepreneur pay on the simplified tax system of 6% without employees in 2022?”

The book covers:

- Questions about how, how much and when to pay taxes and insurance premiums in 2022?

- Examples for calculating taxes and insurance premiums “for yourself”

- A calendar of payments for taxes and insurance premiums is provided

- Frequent mistakes and answers to many other questions!

Find out the details!

Dear readers, a new e-book for individual entrepreneurs is ready for 2022:

“Individual Entrepreneurs on the simplified tax system 6% WITHOUT Income and Employees: What Taxes and Insurance Contributions Do I Need to Pay in 2022?”

This is an e-book for individual entrepreneurs on the simplified tax system of 6% without employees who have NO income in 2022. Written based on numerous questions from individual entrepreneurs who have zero income and do not know how, where and how much to pay taxes and insurance premiums.

Find out the details!

Receive the most important news for individual entrepreneurs by email!

Stay up to date with changes!

By clicking on the “Subscribe!” button, you consent to the newsletter, the processing of your personal data and agree to the privacy policy.

Due date for payment of contributions

Insurance premiums for the billing period are paid by individual entrepreneurs no later than December 31 of the current calendar year, with the exception of contributions in the amount of 1% on income exceeding 300 thousand rubles.

Insurance premiums calculated on the amount of income of the payer of insurance premiums exceeding 300,000 rubles for the billing period are paid by the payer of insurance premiums no later than July 1 of the year following the expired billing period.

Contributions (including contributions for compulsory health insurance) are paid from January 1, 2022 not to the Pension Fund, but to the tax office. Including contributions for previous years.

Increasing the amount of insurance premiums for individual entrepreneurs from 2022

The amount of fixed contributions to funds that entrepreneurs pay for themselves increases every year (Article 430 of the Tax Code of the Russian Federation). In 2020, entrepreneurs will pay more contributions. The amount of fixed payments will increase by almost 4,600 rubles. Here is a comparison table of payments. These are the minimum amounts that a businessman must pay for a whole year.

However, from all your income over 300,000 rubles. For a calendar year, individual entrepreneurs additionally pay pension contributions at a rate of 1%. Excess health insurance premiums are not paid.

KEEP IN MIND

Federal Law No. 172-FZ of 06/08/2020 for individual entrepreneurs affected by coronavirus reduced the monthly fixed contributions to compulsory pension insurance (for oneself) by 1 minimum wage for the entire year 2022 - from 32,448 rubles. up to 20,318 rubles. For more information, see “Features of payment of insurance premiums by organizations and individual entrepreneurs for the 2nd quarter of 2020.”

An example of calculating insurance premiums for an income of more than 300 thousand rubles in 2022

In 2022, the individual entrepreneur conducted business activities on the simplified tax system. The entrepreneur’s income for the year according to the Accounting Book amounted to 10 million rubles. Since the entrepreneur worked out the entire billing period, he paid fixed amounts for 2020 no later than December 31, 2022. No later than December 31, 2022, transferred:

- 1. For pension insurance OPS: 32,448 rubles;

- 2. For medical insurance - compulsory medical insurance: 8,426 rubles.

The calculation based on income is 97,000 rubles. ((10 million rubles – 300,000 rubles)) x 1% The entrepreneur transferred 97,000 rubles to the Pension Fund no later than July 1, 2021.

However, there is a maximum amount of annual contribution to pension insurance. It is eight times the fixed contribution to the compulsory pension insurance. This means that an individual entrepreneur can pay no more than 268,010 rubles for 2022, of which:

- 259,584 rubles for compulsory pension insurance (32,448 rubles x 8);

- 8,426 rubles for health insurance.