Educational program for those who want to understand this profitable tax system. Moreover, UTII will soon be abolished...

Unlike organizations, individual entrepreneurs have the opportunity to apply such a special tax regime as the patent tax system (PTS). It is regulated by Chapter 26.5 “Patent taxation system” of the Tax Code of the Russian Federation (TC RF).

Take a complete online course on the patent tax system in a couple of weeks. You will be able to do your own reporting, keep tax records according to all the rules, understand tax rates under PSN, and combine PSN with other regimes. Pay by card and start right now .

Based on paragraph 1 of Article 346.43 of the Tax Code of the Russian Federation, the PSN is established by the Tax Code of the Russian Federation, put into effect in accordance with the Tax Code of the Russian Federation by the laws of the constituent entities of the Russian Federation and is applied in the territories of these constituent entities of the Russian Federation. PSN is used by individual entrepreneurs along with other taxation regimes provided for by the legislation of the Russian Federation on taxes and fees.

Who can be recognized as a PSN taxpayer?

Taxpayers of PSN in accordance with Article 346.44 of the Tax Code of the Russian Federation are recognized as individual entrepreneurs who have switched to PSN in the manner established by Chapter 26.5 of the Tax Code of the Russian Federation. At the same time, the transition to the PSN and return to other taxation regimes is carried out voluntarily by businessmen. PSN is applied to the types of businesses listed in paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation. At the same time, by virtue of subparagraph 1 of paragraph 8 of Article 346.43 of the Tax Code of the Russian Federation, subjects of the Russian Federation have the right, in order to establish the amount of annual income potentially available to an individual entrepreneur for the types of activities in respect of which the PSN is applied, to differentiate the types of business activities specified in paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation . If such differentiation is provided for by the All-Russian Classifier of Types of Economic Activities (hereinafter - OK 029-2014 (NACE Rev. 2)) and (or) the All-Russian Classifier of Products by Types of Economic Activities (hereinafter - OK 034-2014 (KPES 2008)).

Thus, PSN is a voluntary tax regime, which only individual entrepreneurs have the right to apply. At the same time, in order for an entrepreneur to be able to apply the PSN in the general case, he must meet two conditions - in the territory of the subject of the Russian Federation where the activity is supposed to be carried out, a patent taxation system has been introduced, and the type of activity he carries out is reflected in the regional law on PSN.

Regional authorities may establish an additional list of types of business activities related to household services and not specified in paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation, in respect of which the PSN is applied. Activity codes in accordance with OK 029-2014 (NACE Rev. 2) and service codes in accordance with OK 034-2014 (KPEC 2008) related to household services are determined by the Government of the Russian Federation. This is indicated by subparagraph 2 of paragraph 8 of Article 346.43 of the Tax Code of the Russian Federation.

New types of activities on PSN

One of the main innovations, which will come into force on January 1, 2021, is the actual abolition of the closed list of activities in respect of which PSN can be applied. According to the new rules, the specific areas of application of PSN will be determined by the regions themselves. The Tax Code of the Russian Federation (future edition of paragraph 2 of Article 346.43) establishes an approximate list of types of activities that are subject to a patent, which regional authorities can rely on when adopting their own laws on the application of PSN. This list, enshrined in the Tax Code of the Russian Federation, is open, and regions can supplement and change it at their own discretion.

At the same time, even new types of activities were added to the indicative, approximate list established at the federal level. In particular, the following types of activities were included in the scope of PSN:

- operation of vehicle parking;

- pet care services;

- engraving work on metal, glass, porcelain, wood, ceramics, except jewelry for individual orders of the population;

- repair of toys and similar products;

- repair of sports and tourist equipment;

- services for plowing gardens on individual orders of the population;

- services for sawing firewood on individual orders of the population;

- assembly and repair of glasses;

- production and printing of business cards and invitation cards for family celebrations;

- repair services for siphons and autosiphons, including charging gas cartridges for siphons.

As you can see, the updated list includes, among other things, those types of activities that can now be carried out within the framework of the application of UTII. For example, parking services (providing temporary possession and use of parking spaces, as well as storage of vehicles, with the exception of impound parking).

This was done so that payers who, starting from 2022, will lose the right to use UTII due to the abolition of this special regime, will be able to engage in their usual activities, but within the framework of the PSN.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1. A law has been adopted that maximally expands the scope of application of PSN and brings this taxation system closer to UTII.

2. From 2022, specific areas of application of PSN will be determined by regions. The Tax Code of the Russian Federation establishes an approximate list of types of activities that are subject to a patent, which regional authorities can use as a guide when adopting their own laws on the application of PSN. The updated list includes those types of activities that can now be carried out within the framework of UTII, so that payers who, from 2022, will not be able to receive UTII due to its abolition, can engage in their usual activities, but within the framework of the PSN.

3. The conditions for the application of the patent by catering establishments and retail outlets have been relaxed, and an attempt has been made to bring UTII and PSN as close as possible for the convenience of taxpayers who are losing the right to use “imputation”.

4. A list of activities that cannot be carried out within the framework of the PSN has been established. This ban is absolute and regional authorities cannot authorize the use of PSN in relation to “prohibited” activities.

5. From January 1, 2022, an individual entrepreneur has the right to reduce the cost of a patent by the amount of insurance premiums he pays.

6. For payers who applied UTII in the fourth quarter of 2022, the law allows them to purchase a patent in 2022 using a reduction factor of 0.5.

What taxes are those who switched to PSN exempt from?

It must be said that an individual entrepreneur who has switched to PSN is exempt from the obligation to pay (clause 10 of Article 346.43 of the Tax Code of the Russian Federation):

- personal income tax - in relation to income received from conducting “patent” types of activities;

- property tax for individuals - in relation to property used in the “patent” business (with some exceptions).

For reference: we remind you that individual entrepreneurs using PSN, in relation to real estate used in business activities and included in the list determined in accordance with paragraph 7 of Article 378.2 of the Tax Code of the Russian Federation, taking into account the features provided for in paragraph 2 of paragraph 10 of Article 378.2 of the Tax Code of the Russian Federation, are required to pay property tax for individuals.

According to paragraph 11 of Article 346.43 of the Tax Code of the Russian Federation, an individual entrepreneur using the PSN is not recognized as a taxpayer of value added tax, with the exception of VAT payable:

- when carrying out types of activities for which the PSN does not apply;

- when importing goods into the territory of Russia and other territories under its jurisdiction, including the amount of tax payable upon completion of the customs procedure of the free customs zone on the territory of the Special Economic Zone in the Kaliningrad Region;

- when carrying out transactions taxed in accordance with Articles 161 and 174.1 of the Tax Code of the Russian Federation.

An individual entrepreneur using PSN pays other taxes in accordance with the legislation on taxes and fees, and also fulfills the duties of a tax agent provided for by the Tax Code of the Russian Federation (clause 12 of Article 346.43 of the Tax Code of the Russian Federation). The document certifying the right to use PSN is a patent, the form of which (form N 26.5-P) was approved by Order of the Federal Tax Service of the Russian Federation dated November 26, 2014 N ММВ-7-3/ [email protected] “On approval of the patent form for the right to use the patent system taxation."

At the same time, a patent issued to a merchant can be valid both on the entire territory of the corresponding subject of the Russian Federation, and on the territory of one or more municipalities, as indicated by paragraph 1 of Article 346.45 of the Tax Code of the Russian Federation. Information about the territory of validity of the patent is indicated in the patent itself. In this case, the individual entrepreneur has the right to obtain several patents. By virtue of paragraph 5 of Article 346.45 of the Tax Code of the Russian Federation, an individual entrepreneur can acquire a patent for a period of 1 to 12 months inclusive, but only within one calendar year. To obtain a patent, an individual entrepreneur must submit a corresponding application to the tax authority at the place of residence (Clause 2 of Article 346.45 of the Tax Code of the Russian Federation).

Insurance premiums will reduce the value of the patent

The main change that entrepreneurs have long been waiting for is the ability to reduce the cost of a patent for the insurance premiums paid for themselves and for their employees. And not only for contributions, but also for temporary disability benefits paid for employees (in the part that is paid at the expense of the employer). The rules for such a reduction will be the same as for UTII - individual entrepreneurs without employees will be able to reduce the cost of patents down to zero, and individual entrepreneurs with employees only by 50%.

If an individual entrepreneur has several patents in a calendar year, then not only one of them can be reduced. If the amount of fees and benefits paid exceeds the cost of one patent, the balance that “does not fit” into this patent can be taken into account under another patent. But only within the calendar year in which the fees were paid! Those. The balance of insurance premiums cannot be transferred to another year.

To reduce the cost of a patent, the individual entrepreneur will have to send a notification about this to the Federal Tax Service. The form and format will be approved by the Federal Tax Service.

It may happen that the cost of the patent will be paid earlier than the contributions for which the individual entrepreneur will reduce the tax. In this case, the overpayment of patent tax can either be returned or offset against the next patent.

Violation of the period of issue and refusal to issue a patent

In paragraph 18 of the Review of the practice of consideration by courts of cases related to the application of Chapters 26.2 and 26.5 of the Tax Code of the Russian Federation in relation to small and medium-sized businesses, approved by the Presidium of the Armed Forces of the Russian Federation on July 4, 2018, sent for information and use in work by the Letter of the Federal Tax Service of the Russian Federation dated July 30, 2018 N KCH-4-7/14643, it is said that violation of the period for issuing a patent can be taken into account when determining the validity period of the patent.

A different approach would mean that, having paid for the patent for the relevant period in full, the taxpayer is deprived of the opportunity to carry out activities in that part of the paid period that falls on the days of delay in issuing the patent. Let us note that the basis for refusal to issue a patent to an individual entrepreneur in accordance with paragraph 4 of Article 346.45 of the Tax Code of the Russian Federation is:

- discrepancy in the application for a patent of the type of entrepreneurial activity with the list of types of “patent” activities in respect of which a PSN has been introduced in a constituent entity of the Russian Federation;

- indication of the validity period of a patent that does not comply with paragraph 5 of Article 346.45 of the Tax Code of the Russian Federation, that is, the application indicates an incorrect validity period of the patent (a period of less than a month, a period of more than twelve months, a period falling on different years);

- violation of the condition for the transition to the PSN established by paragraph 2 of clause 8 of Article 346.45 of the Tax Code of the Russian Federation - that is, if the application was submitted in the same year in which the individual entrepreneur lost the right to use the PSN or voluntarily ceased the activity in respect of which the PSN was applied;

- the presence of arrears of tax payable in connection with the application of the PSN;

- failure to fill in required fields in the patent application.

According to Article 346.47 of the Tax Code of the Russian Federation, the object of taxation when applying PSN is the potentially receivable annual income of an individual entrepreneur for the corresponding type of business activity, established by the law of the subject of the Russian Federation. Moreover, as a general rule, the maximum amount of annual income potentially receivable by an individual entrepreneur (hereinafter referred to as PVD) cannot exceed 1,000,000 rubles, as indicated by paragraph 7 of Article 346.43 of the Tax Code of the Russian Federation.

How will quantitative restrictions for a patent change?

Let's consider what restrictions on the scale of business for a patent apply in 2022 and what will change in 2022

| Type of restriction | 2020 | 2021 |

| Revenue per year, million rubles. | 60 | 60 |

| Number of people, people | 15 | 15 |

| Number of vehicles, units. | no limits | 20 |

| Area of the sales area or service area, sq. m | 50 | 150 |

The table shows that the limits on revenue and headcount in 2021 will remain unchanged. A new condition will appear - individual entrepreneurs engaged in road transportation will be able to use no more than 20 cars. Previously, there was no such limitation for a patent, but with up to 15 employees, in most cases it still makes no sense to maintain 20 cars or more.

An important change is the increase in the limit on the area of a sales area or service area from 50 to 150 square meters. m. This limit corresponds to the one that is valid in 2022 for UTII. Therefore, those individual entrepreneurs on the “imputation” who were engaged in retail trade or catering in 2022 will, in general, be able to switch to a patent without “closing up” their business.

However, here you need to keep in mind that regional authorities have received the right to reduce the limits on the area of shops or cafes for the use of a patent (clause 2.1, clause 8, article 346.43 of the Tax Code of the Russian Federation as amended by Law No. 373-FZ). Theoretically, legislators in certain regions could leave the same limit of 50 square meters in 2022. m of area, which is valid for the patent in 2022, or even reduce it.

In addition, starting from 2022, all restrictions on the amount of potential income for a patent have been abolished. Therefore, the authorities of each region will be able to set the cost of a patent for any type of activity at their discretion.

Maximum size of PVD

By virtue of paragraph 9 of Article 346.43 of the Tax Code of the Russian Federation, the maximum size of the PVD is subject to indexation by the deflator coefficient established for the corresponding calendar year. By Order of the Ministry of Economic Development of the Russian Federation dated October 30, 2018 N 595 “On establishing deflator coefficients for 2019”, for the purpose of applying Chapter 26.5 of the Tax Code of the Russian Federation, the deflator coefficient for 2022 was set at 1.518.

Thus, the maximum size of the PVD, which can be established for 2022 by the laws of the constituent entities of the Russian Federation, in the general case cannot exceed 1,518,000 rubles. (RUB 1 million x 1.518). This conclusion is confirmed by the explanations given in the Letter of the Federal Tax Service of the Russian Federation dated January 16, 2015 N GD-4-3/ [email protected] “On the direction of clarifications of the Ministry of Finance of Russia” (together with the Letter of the Ministry of Finance of the Russian Federation dated January 13, 2015 N 03-11- 09/69405).

At the same time, in some cases, constituent entities of the Russian Federation have the right to increase the maximum amount of annual income that an individual entrepreneur can potentially receive. Thus, according to subparagraph 4 of paragraph 8 of Article 346.43 of the Tax Code of the Russian Federation, constituent entities of the Russian Federation can increase the maximum size of the internal income limit, but not more than 3 times, for such types of activities as:

- maintenance and repair of motor vehicles and motor vehicles, machinery and equipment (clause 9, clause 2, article 346.43 of the Tax Code of the Russian Federation);

- provision of motor transport services for the transportation of goods (passengers) by road (clauses 10, 11, clause 2, article 346.43 of the Tax Code of the Russian Federation);

- provision of services for the transportation of passengers (cargo) by water transport (clauses 32, 33, clause 2, article 346.43 of the Tax Code of the Russian Federation);

- engaging in medical activities or pharmaceutical activities by a person holding a license for these types of activities (clause 38, clause 2, article 346.43 of the Tax Code of the Russian Federation);

- ritual services (clause 42, clause 2, article 346.43 of the Tax Code of the Russian Federation);

- funeral services (clause 43, clause 2, article 346.43 of the Tax Code of the Russian Federation).

No more than 5 times for all types of activities for which the PSN is applied, carried out in a city with a population of more than one million people;

And also no more than 10 times for the following types of business activities:

- leasing (renting) residential and non-residential premises, dachas, land plots owned by individual entrepreneurs by right of ownership (clause 19, clause 2, article 346.43 of the Tax Code of the Russian Federation);

- retail trade carried out through a stationary retail chain with a sales floor area of no more than 50 sq. m. for each object of trade organization (clause 45, clause 2, article 346.43 of the Tax Code of the Russian Federation);

- retail trade carried out through objects of a stationary trading network that do not have trading floors, as well as through objects of a non-stationary trading network (clause 46, paragraph 2, article 346.43 of the Tax Code of the Russian Federation);

- catering services provided through catering facilities with a customer service area of no more than 50 square meters. m for each public catering facility (clause 47, clause 2, article 346.43 of the Tax Code of the Russian Federation).

Do not forget that on the basis of subclause 1.1 of clause 8 of Article 346.43 of the Tax Code of the Russian Federation, regional authorities are vested with the right to establish different levels of traffic rules for each municipal entity or group of them, with the exception of patents for carrying out such types of activities as:

- provision of motor transport services for the transportation of goods (passengers) by road (clauses 10, 11, clause 2, article 346.43 of the Tax Code of the Russian Federation);

- provision of services for the transportation of passengers (cargo) by water transport (clauses 32, 33, clause 2, article 346.43 of the Tax Code of the Russian Federation);

- retail trade carried out through objects of a non-stationary trading network, that is, delivery and carry-out retail trade (clause 46, clause 2, article 346.43 of the Tax Code of the Russian Federation).

And, finally, the subjects of the Russian Federation have the right, on the basis of subparagraph 3 of paragraph 8 of Article 346.43 of the Tax Code of the Russian Federation, to establish the size of the PVD depending on:

- average number of employees;

- number of vehicles, carrying capacity of the vehicle, number of seats in the vehicle;

- the number of separate objects (areas) in relation to the types of business activities specified in subparagraphs 19, 45–48 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation;

- from the territory of validity of patents, determined in accordance with subclause 1.1 of clause 8 of Article 346.43 of the Tax Code of the Russian Federation.

According to paragraph 1 of Article 346.48 of the Tax Code of the Russian Federation, the tax base when applying the PSN is defined as the monetary expression of the potential annual income for the type of patent activity established for the calendar year by the law of the subject of the Russian Federation. At the same time, paragraph 2 of Article 346.48 of the Tax Code of the Russian Federation stipulates that the amount of internal tax established for a calendar year by regional law is applied in the next calendar year (following calendar years), unless it is changed by the law of the subject of the Russian Federation.

Patent changes in 2022

On November 11, the State Duma adopted the long-awaited changes to the Tax Code in the third and final reading. These changes determine new conditions for the application of the patent system of taxation for individual entrepreneurs for 2021 and subsequent years.

Now the bill must be approved by the Federation Council and signed into law by the President.

Significant changes are being made to the PSN, and most importantly, the PSN becomes a more profitable taxation system for UTII students than the simplified tax system for use from January 1, 2022.

Let's take a closer look at the main changes to the patent.

Reducing the amount of tax on a patent by the amount of insurance premiums

One of the main changes is the ability to reduce the amount of tax on the amount of insurance contributions for compulsory pension insurance, social insurance, medical insurance, and sick leave benefits.

The main conditions for applying the deduction, as when applying UTII:

- the tax on contributions is reduced within the calculated amounts (that is, overpayment of contributions does not reduce the tax, it will first have to be returned and repaid);

- contributions must be paid in a given tax period - that is, during the period of validity of the patent;

the specified insurance payments and benefits reduce the amount of tax if they are paid for employees engaged in activities under the patent.

Just like in UTII, the limitation on the amount of deduction remains: individual entrepreneurs with employees can reduce the tax by no more than 50%.

If an individual entrepreneur does not involve hired workers when applying PSN, he reduces the patent tax by the entire amount of insurance premiums paid “for himself.” Do not forget about only two mandatory conditions - contributions must be paid during the validity period of the patent and they are taken into account only within the calculated amounts.

If an entrepreneur received several patents in a calendar year, and for one of the patents the amount of contributions paid exceeded the permissible deduction amount, the tax for other patents valid in the same calendar year can be reduced by this excess. The balance of the unused deduction for insurance premiums cannot be carried over to the next calendar year.

How to apply the deduction correctly?

It will be necessary to send to the Federal Tax Service inspectorate, where the patent activity is carried out, a notice of a reduction in patent tax by the amount of contributions paid. As in other cases, notice will be given in writing or electronically. For what period is not established by law. The procedure for submitting this notification and its form must now be approved by the Federal Tax Service. But, in fact, such a notification must be sent to the tax office before the deadline for paying the tax on the patent. The Tax Code also does not limit the number of times this notification can be submitted. In case of an error in payment of contributions or for some other reason, the tax office will refuse to reduce the tax (which you will have to be officially notified about), but you will be able to send the notification again.

If you pay the tax amount before it is reduced, you will have an overpayment that can be refunded or offset.

Changes for retail and catering

Another important change is the increase in the maximum size of the sales area (for retail trade) and the area of the customer service area (for catering) to 150 square meters for the use of PSN (previously it was 50 sq.m). This norm now also corresponds to UTII.

This change will allow a huge number of entrepreneurs, as before when applying UTII, to pay tax in a fixed amount, regardless of real income.

Activities. Changes

1. The types of activities for the application of PSN are established by regional authorities

The legislator abandoned the closed list of activities in the Tax Code. The list of activities will now be determined by laws at the regional level. And the list of activities specified in the Tax Code will, in fact, serve as a guideline, a recommendation. The main thing is that these types of activities comply with the Tax Code of the Russian Federation and OKVED (if they are not specified in the Tax Code of the Russian Federation).

2. Prohibition on the use of certain types of activities

The legislator has determined the types of business activities in respect of which PSN cannot be applied:

in joint activities (creation of a simple partnership);

in the production of excisable goods;

in the extraction and sale of minerals;

for credit and financial services;

for wholesale trade and trade under supply contracts.

3. List of patent activities and the Law on the application of CCP

A list of patent activities is also needed for the Law on the Application of CCP (54-FZ). This Law establishes the right of individual entrepreneurs not to use cash registers. Law 54-FZ contains a reference to specific types of patent activities specified in the Tax Code of the Russian Federation.

4. Restrictions for certain types of activities

Similar restrictions have been established as for UTII:

- by the number of vehicles that the individual entrepreneur uses when transporting goods and passengers - no more than 20 vehicles;

- in terms of sales area for retail facilities - no more than 150 sq.m;

- the area of the customer service hall for catering is no more than 150 sq.m.

Some restrictions are related to the person to whom the service is provided - the population or organization (IP). The following has been added to certain types of activities: “by individual order of the population.” That is, if previously there was no such restriction, and services within the framework of a patent could be provided to both the population and organizations and individual entrepreneurs, now, as with UTII, only the population can be the recipient of the service.

This change affected:

- repair and tailoring of various products;

- repair of household appliances, repair and manufacture of metal products;

- Repair of residential and non-residential buildings was limited to the concept of “existing”.

Renting out real estate

Good news for those who are engaged in the business of leasing residential and non-residential premises and land plots. Now restrictions on the right of ownership have been lifted - from 01/01/2021, a patent can be used when leasing, regardless of the right of ownership of the object - both own and leased real estate.

Expanding the list of patent activities

The law expanded the list of patent types of activities from 63 to 80. This is mainly due to the detailing and specification of the types of activities already included in the Tax Code of the Russian Federation. But there are also completely new ones. For example, it is now possible to obtain a patent for the activities of parking lots for vehicles.

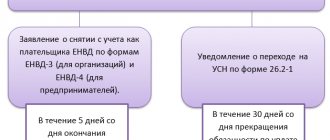

Transition period for UTII payers

It may happen that the authorities of the constituent entities of the Russian Federation will not have time to timely introduce the innovations of the federal authorities into their laws on the patent tax system. It is for such regions in which the updated patent will not come into force on January 1, 2021, that the Legislator has provided a special procedure for calculating the annual cost of the patent.

Such temporary patents have been introduced for individual entrepreneurs if the individual entrepreneur applied UTII for the following types of activities in the fourth quarter of 2022:

- parking lot activities

- retail trade in retail facilities with a sales floor area of more than 50 square meters

- catering in cafes (restaurants, etc.) with a customer service area of more than 50 square meters

- vehicle repair and maintenance

The above patent will be issued until the date of entry into force of the updated regional laws on PSN. In general, the validity period of such patents is limited to March 31, 2022.

The amount of potential annual income for calculating the cost of a “temporary” patent will be calculated using the formula:

Basic return x 12 months. X FP x K1×15/6×0.5, where

DB - basic yield. It corresponds to activities on UTII. For retail - 1800 rubles. for 1 sq.m., catering - 1000 rubles. for 1 sq.m., car repair - 12,000 rubles. for each employee (plus the individual entrepreneur himself), for parking lots - 50 rubles. per sq.m.

FP - physical indicator (sq.m - for retail, catering and parking, number of employees - for auto repair);

K1 - deflator coefficient for UTII, set for 2022 -2.005;

15/6 - conversion factor for the tax rate of UTII and PSN;

0.5 is a reduction factor.

Pay attention to insurance premiums for 2022

All individual entrepreneurs must, by December 31, 2020, correctly calculate and pay insurance premiums for compulsory health insurance and compulsory medical insurance to the budget in a fixed amount. If you do not pay insurance premiums by December 31, 2020, you may lose the right to reduce the single tax under the simplified tax system and UTII by the amount of contributions paid “for yourself.” And if you overpay contributions in 2022, you will not be able to reduce the tax for 2022 by the amount of the overpayment, since you can reduce the tax only on contributions within the calculated amounts. You will also lose the right to a tax reduction in 2022 for the amount of contributions paid in 2022 - the tax was actually paid in a different tax period, not in 2022.

Thus, before the end of 2022 you need to check your insurance premiums. And if necessary, pay additional fees, or write an application for a refund of the overpaid amount of fixed fees. This is especially true for entrepreneurs who are eligible for tax benefits due to COVID.

The federal authorities have established new rules for the use of PSN. Now it's up to the regions.

The law has already been adopted in the Kaliningrad region; in our article you can see specific calculations of the cost of a patent for this region.

But in any case, many UTII payers have already received an answer to the main question of “2021” - what tax regime to replace UTII.

Update dated December 14. The deadline for filing a patent application has been extended from January 1, 2022.

An application for a patent must be submitted no later than 10 days before the start of application of the PSN. A patent is issued from any date of the month specified by the individual entrepreneur in the application for a patent, for any number of days, but not less than a month and within a calendar year.

Please note that if you want to apply a patent from the beginning of 2021, then such an application can be submitted until December 31, 2020.

And when switching from the simplified tax system to a patent within a year for one type of activity, there are nuances.

If you have already decided that the patent tax system is suitable for you, then read our article where we talk in detail about the procedure for maintaining tax accounting under PSN.

And if you don’t want to figure it out, then leave a request for service with our company. Our specialists will be happy to take on the hassle of switching to a patent, advise on how to legally reduce taxes and take on the work of maintaining your accounting and personnel records. You can get acquainted with the services we provide by following the link.

Tax features of Crimea and Sevastopol

According to the laws of the Republic of Crimea and the federal city of Sevastopol, the tax rate for the period 2017–2021 can be reduced for all or certain categories of taxpayers to 4%.

In addition, regional authorities have the opportunity, from January 1, 2015 to January 1, 2021, to introduce so-called two-year tax holidays (that is, a zero rate) in their territories for certain categories of entrepreneurs. By virtue of paragraph 3 of Article 346.50 of the Tax Code of the Russian Federation, regions can provide such a benefit to businessmen conducting business in the production, social and (or) scientific spheres, as well as in the field of consumer services to the population, who were first registered after the entry into force of the regional law introducing a zero rate. At the same time, the laws of the constituent entities of the Russian Federation may also establish restrictions on the use by the above taxpayers of a tax rate of 0%, including in the form of:

- restrictions on the average number of employees;

- restrictions on the maximum amount of income from sales, determined in accordance with Article 249 of the Tax Code of the Russian Federation, received by an individual entrepreneur when carrying out a type of business activity in respect of which a tax rate of 0% is applied.

In case of violation of the restrictions on the application of a tax rate of 0%, established by Chapter 26.5 of the Tax Code of the Russian Federation and the law of the constituent entity of the Russian Federation, the individual entrepreneur is considered to have lost the right to apply the zero rate and is obliged to pay tax at “his” rate for the tax period in which these restrictions were violated. This is indicated by paragraph 3 of Article 346.50 of the Tax Code of the Russian Federation. If an individual entrepreneur receives a patent for a period of less than 12 months, the tax is calculated by dividing the amount of the PVD by 12 months and multiplying the result by the number of months of the period for which the patent was issued.

Why switch to “simplified” at the same time as a patent?

In January 2022, the State Duma adopted in the third reading a bill that allows former “imputed” persons to switch to the simplified tax system from the beginning of 2022 by submitting a notification about this no later than 03/31/2021. Most likely, the law will be signed in the near future. Therefore, those entrepreneurs who did not have time to decide on the choice of a new tax regime will still have time for this.

As mentioned above, regional legislators now have the right to change the conditions for applying a patent to a wider extent, in particular, to set any amount of potential income. Therefore, it may turn out that working on a patent for an entrepreneur in 2022 will turn out to be unprofitable.

In addition, an entrepreneur who is used to working for UTII may not comply with the restrictions on revenue and number, since for a patent they are stricter than for “imputation”.

But in any case, switching to the simplified tax system in the middle of the year will no longer be possible. If an individual entrepreneur decides to abandon the patent or goes beyond the restrictions, then he will have to work on the general tax system until the end of 2022, i.e. pay personal income tax and VAT.

Therefore, it is better to switch to “simplified” in advance for insurance. Then, if the patent is abandoned within a year, the individual entrepreneur will “automatically” begin to work on the simplified tax system. And if no problems arise, and the entrepreneur uses the patent all year, then he will simply submit a zero declaration at the end of the year according to the “simplified” procedure.

To choose the most profitable simplified tax system option, you need to take into account the structure of income and expenses, as well as the tax rates established in the region. Read more about choosing an object for the simplified tax system here .

Reduction of tax on the amount of expenses for cash register equipment

Chapter 26.5 of the Tax Code of the Russian Federation provides the opportunity for individual entrepreneurs using PSN to reduce the amount of tax by the amount of expenses for the acquisition of cash register equipment (hereinafter referred to as cash register equipment) in the manner and amount established by paragraph 1.1 of Article 346.51 of the Tax Code of the Russian Federation.

Thus, individual entrepreneurs using PSN have the right to reduce the amount of tax by the amount of expenses for purchasing a cash register, which includes the costs of purchasing a cash register, a fiscal drive, the necessary software, performing related work and providing services (services for setting up a cash register and others), in including the costs of bringing the CCP into compliance with the established requirements, in the amount of no more than 18,000 rubles. for each copy of the CCT.

At the same time, as a general rule, entrepreneurs have the right to reduce the amount of tax by the amount of expenses in the above-mentioned amount, provided that the specified cash register is registered with the tax authorities in the period from 02/01/2017 to 07/01/2019.

This does not apply to individual entrepreneurs carrying out activities provided for in subparagraphs 45–48 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation and having employees with whom employment contracts were concluded on the date of registration of the cash register in respect of which the tax amount is reduced. The named persons have the right to reduce the amount of tax by the above amount of expenses (in the amount of no more than 18,000 rubles for each copy of a cash register), subject to registration of the corresponding cash register from 02/01/2017 to 07/01/2018 (paragraph 2, clause 1.1, article 346.51 Tax Code of the Russian Federation). Tax payment is carried out by entrepreneurs using PSN at the place of registration with the tax authority. Moreover, according to the general rule of paragraph 2 of Article 346.51 of the Tax Code of the Russian Federation, individual entrepreneurs must pay tax within the following deadlines:

- if the patent was received for a period of up to 6 months (that is, from 1 to 5 months inclusive) - in the amount of the full amount of tax no later than the expiration date of the patent;

- if the patent was received for a period of 6 months to a calendar year (that is, 6 months or more):

- in the amount of 1/3 of the tax amount no later than 90 calendar days after the patent comes into effect;

- in the amount of 2/3 of the tax amount no later than the expiration date of the patent.