2020-11-23 4883

Is vacation compensation upon dismissal a right or obligation of the employer? The Labor Code gives a clear answer - the company is obliged to compensate the former employee for unused vacation days. Therefore, when starting to calculate and accrue this payment, it is important to take into account the nuances relating to different categories of employees and the size of their work experience. In the material we will consider different cases of calculating vacation compensation and, using a specific example, we will analyze the mechanism for calculating it.

In what cases is vacation compensation paid?

According to Articles 126-127 of the Labor Code of the Russian Federation, monetary compensation to employees is provided to:

- upon dismissal, as well as upon transfer to another enterprise - for all unused vacation days;

- without dismissal - for part of the vacation exceeding 28 days.

On a note!

After working even for half a month, an employee receives the right to compensation for unused vacation days.

This applies to annual paid basic and additional leaves. An employee has the right to compensation regardless of:

- reasons for dismissal;

- professional category;

- working conditions - under a fixed-term employment contract, part-time, etc.

Payments upon dismissal

If an employer pays an employee who is dismissed by agreement of the parties an amount that is not comparable with his contribution to the company’s activities, that is, it is greatly inflated, he needs to be prepared for the fact that he will have to provide justification for this payment and its economic justification.

Payments upon dismissal by agreement of the parties

First, let us recall the norms of labor legislation on dismissal by agreement of the parties.

An employment contract can be terminated at any time by agreement of the parties to the employment contract (Article 78, clause 1, part 1, article 77 of the Labor Code of the Russian Federation).

The cases and amounts of severance pay and other compensation payments paid upon termination of an employment contract are determined by the employment contract (or an additional agreement to the employment contract, which is an integral part of the employment contract) (part 4 of article 178, part 2 of article 307, part 1 Article 9, Part 3, Article 57 of the Labor Code of the Russian Federation).

Upon termination of the employment contract, payment of all amounts due to the employee from the employer is made on the day of the employee’s dismissal (Part 1 of Article 140 of the Labor Code of the Russian Federation).

Tax accounting of payments upon dismissal by agreement of the parties

Now let's look at the features of tax accounting for these payments.

In general, in order to include payments made in favor of an employee as expenses for profit tax purposes, it is necessary to have both formal and actual compliance of such payments with the requirements of the Tax Code of the Russian Federation.

Two conditions must be met simultaneously.

First, these payments must be reflected in the collective and (or) employment agreement or in additional agreements to them with a mandatory indication that such agreements are an integral part of the collective or employment agreement (formal compliance).

Secondly, payments must be of a production nature; they must be related to the work schedule and working conditions (actual compliance). This is stated in the letter of the Federal Tax Service dated July 28, 2014 No. GD-4-3 / [email protected]

All severance benefits provided for in employment contracts or separate agreements with the employee, including agreements on termination of the employment contract, collective agreements and local regulations, are taken into account as part of labor costs (clause 9 of Article 255 of the Tax Code of the Russian Federation).

However, when attributing payments upon termination of an employment contract by agreement of the parties to labor costs, caution should be exercised.

Clause 9 of Article 255 of the Tax Code of the Russian Federation only confirms the possibility of taking into account in labor costs payments under an agreement to terminate an employment contract. But this direct rule does not mean that it is allowed to take into account any expenses without any restrictions that are not economically justified. This is indicated in the Ruling of the Supreme Court of the Russian Federation dated September 23, 2016 No. 305-KG16-5939 in case No. A40-94960/2015.

According to paragraph 1 of Article 252 of the Tax Code of the Russian Federation, expenses are recognized as justified (economically justified) expenses, the assessment of which is expressed in monetary form and provided that they are incurred to carry out activities aimed at generating income. By virtue of paragraph 49 of Article 270 of the Tax Code of the Russian Federation, expenses that do not meet these criteria when determining the tax base are not taken into account.

Economic justification for payments upon dismissal by agreement of the parties

Expenses made outside of the economic activity of the taxpayer, that is, essentially aimed at satisfying the personal needs of dismissed citizens at the expense of the former employer, cannot be recognized as economically justified.

At the same time, the dismissal of an employee is the final stage of his involvement in the activities of the employer. Therefore, it is not correct to clearly recognize expenses incurred upon dismissal of employees as not meeting the requirements of paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

However, the Letter of the Ministry of Finance dated 03/09/2017 No. 03-04-06/13116 states that if the amount of this amount is significant and its obvious inconsistency with the circumstances characterizing the employee’s work activity, the taxpayer bears the burden of disclosing evidence justifying the nature of the payment made and its economic justification .

The financiers also talk about this in the commentary letter.

Based on this, when paying compensation in connection with dismissal by agreement of the parties, you should adhere to the following.

Judicial practice in recent years indicates that in order to recognize the amounts paid as expenses, they should not significantly exceed three times the average monthly salary of the employee.

Why three times?

Let's remember about the taxation of payments upon dismissal with salary taxes. From the amount exceeding three times (six times for workers dismissed from organizations located in the Far North and equivalent areas) the employee’s average monthly earnings, the following must be calculated:

- personal income tax;

- insurance premiums, including insurance premiums for injuries.

This is provided for by subparagraph 2 of paragraph 1 of Article 422 of the Tax Code of the Russian Federation and subparagraph 2 of paragraph 1 of Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases.”

Within the limits of three times the payment amount (six times for regions of the Far North), salary taxes are not levied. So, three times the amount can serve as a criterion for the economic justification of payment upon dismissal by agreement of the parties.

If an excess is nevertheless allowed, but the organization considers it acceptable and intends to take it into account in tax expenses, both the amount itself and the basis for this excess should be specified in the termination agreement, which is an integral part of the employment contract.

Example. Postings for payments upon dismissal

Let’s assume that upon the dismissal of a mid-level manager by agreement of the parties, the company, in accordance with an additional agreement to the employment contract on the termination of employment relations, pays him compensation (severance pay) in the amount of 300,000 rubles. This is for 30,000 rubles. exceeds three times the employee’s average monthly earnings. The additional agreement stipulates that this employee transfers matters to another employee and conducts his initial briefing.

The organization is the payer of insurance premiums. She pays them at a general rate of 30%. The organization pays premiums for insurance against industrial accidents and occupational diseases at a rate of 0.2%.

The compensation is transferred to the employee's bank account.

In tax accounting, the organization uses the accrual method and recognizes labor costs on a monthly basis based on the accrued amount (clause 4 of Article 272 of the Tax Code of the Russian Federation).

The accountant must make the following entries:

Debit 20 Credit 70

– 300,000 rub. – compensation (severance pay) is accrued to the employee upon dismissal by agreement of the parties;

Debit 70 Credit 68

– 3900 rub. (RUB 30,000 x 13%) – personal income tax is withheld from an amount exceeding three times the employee’s average monthly earnings;

Debit 20 Credit 69

– 9060 rub. (RUB 30,000 x 30.2%) – insurance premiums are charged on an amount exceeding three times the employee’s average monthly earnings;

Debit 70 Credit 51

– 296,100 rub. (300,000 rubles - 3900 rubles) - the amount of compensation was paid.

In this case, the excess of the amount of compensation paid can be justified by the obligation of the resigning employee to transfer the affairs and instruct another employee and take into account the entire accrued amount in tax expenses.

Compensation for vacation without dismissal

Employees who, according to the Labor Code, are entitled to extended or additional vacations, can count on replacing part of their vacation with a cash payment. But this is only a right, not an obligation of the employer.

On a note!

If the additional leave for a worker in harmful or dangerous conditions is more than 7 mandatory days, the remaining part can be replaced by compensation.

Compensation for vacation upon dismissal with a minus sign

The employee has not worked for a full year, but has already spent all of his vacation and decided to quit? In this case, the employer has the right to withhold the amount of overpaid vacation pay. But he can’t always do this.

An employer can forgive an employee's vacation debt. But to do this, you will have to draw up an appropriate agreement and subsequently recalculate the income tax.

What is the compensation payment mechanism?

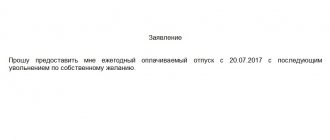

To receive compensation, a working employee must submit an application indicating the period of work and the number of vacation days provided for it. Guided by it, the employer issues a decree on the appointment of the appropriate payment.

Vacation compensation to a resigning employee must be paid on his last working day. If the employment relationship is not terminated, compensation can be included in the salary for the current month.

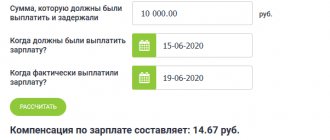

Evasion of payment of compensation threatens the employer and officials with administrative fines, as well as disciplinary sanctions. If payment deadlines are violated, the employee is awarded additional compensation for each day of delay (Article 236 of the Labor Code of the Russian Federation).

How to fire an employee in 1C 8.3 Accounting

To dismiss an employee from an organization in the Enterprise Accounting 3.0 program, you need to go to the salary and personnel section, then personnel, personnel documents.

Create a dismissal document. This document only makes personnel movements; compensation upon dismissal is accrued in the “Payroll” document.

In the document that opens, fill in the employee field, the date of dismissal and under what article of the Labor Code of the Russian Federation he was dismissed. To reflect the dismissal in the SZV-TD and STD-R reports, you need to check the “Reflect in the work book” checkbox. If the employee had deductions and they should be applied to accruals after dismissal, then check the appropriate box in the document. After entering all this information, we carry out the document; by clicking the print button, you can select to print the dismissal order and the certificate for unemployment benefits.

If personnel documents are not maintained in the program, i.e. there are no documents “Dismissal”, “Personnel transfer”, “Hiring”, then you need to go to the salary and personnel section, then personnel and the employee item.

Go to the employee and at the top there will be a dismiss button. When clicked, a window will open in which we indicate the date of dismissal, click “Ok” and write down the employee’s card. In this case, printed forms will be available by clicking the print button from the employee’s card itself.

If necessary, personnel records can be enabled in the main section, then settings, functionality.

Go to the employees tab and check the “Personnel documents” checkbox. Without using the settings for personnel documents, data on dismissal in the SZV-TD and STD-R reports will need to be added manually.

Compensation upon dismissal is calculated in the salary document, which is located in the salary and personnel section, then the salary item, all accruals.

We create a payroll document by clicking the fill button in the tabular section and the payroll will be calculated for all employees for the month. If you need accrual only for a resigning employee, then add the employee to the document through the selection button. Select the line with the desired employee, then the accrue button and select accrual of vacation compensation upon dismissal.

In the window that opens, indicate the amount of compensation; the calculation of compensation in the program is not automated. After specifying the amount, click on the “Ok” button, the amount will appear in the accrued column.

If an employee took vacation in advance and needs to be withheld, then in the payroll document, select the withhold button. Since the list of holds does not contain what you need, we select a new hold.

We indicate the name and amount of the deduction; automatic calculation is also not supported. After entering the data, click the “Ok” button. The retention will be reflected in a separate column.

To reflect the amount of deduction in transactions, let's go to the transactions section, then accounting, the transaction item entered manually.

We create a transaction document and enter the debit account 70 and credit account 91.01.

In this method, when withholding for unworked vacation days, taxes and contributions are not reduced. To reduce it, you need to enter the deduction as an accrual, but with a negative amount. To do this, go to the salary and personnel section, then directories and settings, and the salary settings item.

In the window that opens, go to the salary calculation item and follow the “Accruals” link.

We create a deduction accrual for vacation used in advance with the specified settings, save the accrual using the “Record and close” button.

In the salary calculation document, use the accrue button to select deduction for unworked vacation and indicate the amount with a minus. Then click “Ok”, the accrual amount will decrease, taxes and contributions will be recalculated.

The consultation was prepared for you by a specialist from our Consultation Line.

Order a test consultation on your program with us by phone.

*To provide consultation, you must provide the TIN of your organization, the registration number of your program (for 1C:Enterprise programs of the PROF version, an active 1C:ITS PROF agreement is required)

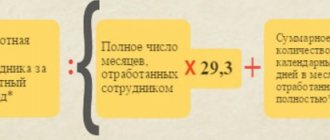

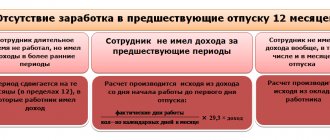

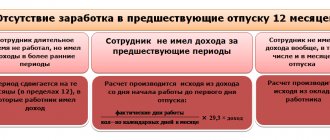

Calculating average daily earnings

To calculate the average daily earnings, you need to know what salary the employee was paid over the last 12 months and how many of them he actually worked. If the salary has changed during the billing period, it is also necessary to apply the indexation rule. In general, use the formula:

At the time of calculation, employees usually have not worked for an exact number of months. In this case, paragraph 35 of the Leave Rules prescribes:

- if an employee worked most of the month, consider it as full;

- if the employee worked less than half a month, do not take him into account.

On a note!

When calculating average earnings, material assistance and social benefits are not taken into account.

Calculating the amount of compensation

Now that the number of unused vacation days and the average earnings for 1 day are known, it is not difficult to calculate compensation using the formula:

Let's analyze the calculation algorithm using a specific example:

The employee submitted her resignation on December 22, 2022. She has been working at the company since November 12, 2016. Her average daily earnings are 935.45 rubles. Annual leave at this enterprise is 28 days. During her work, the employee used 52 days of vacation.

- We determine the employee’s vacation experience: 12/22/18-11/12/16= 2 years 2 months. Then: Unused vacation days = 2 years * 28 days + 28 days / 12 * 2 months - 52 days = 8.67, rounded to 9 days.

- The average earnings are known, we can calculate the amount of compensation: Compensation amount = 935.45 * 9 = 8,419 rubles 5 kopecks

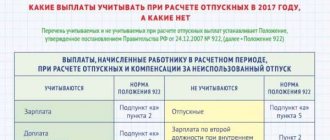

What taxes are paid on vacation compensation?

Regardless of the taxation system used by the enterprise, personal income tax and insurance premiums must be withheld from vacation compensation. It is important to take into account several nuances:

- When calculating income tax, the date of receipt of income is considered to be the day the compensation is paid.

- The amount of accrued income tax must be entered on an accrual basis into the calculation of 6-NDFL and reflected according to the income code 2013 in 2-NDFL.

- If vacation compensation is not paid due to dismissal, you must additionally accrue unified social tax on it.

To stay up to date with current changes in tax legislation and reporting requirements, take part in webinars for accountants.

To determine income tax, depending on the method used by the enterprise for accounting for income and expenses, compensation includes:

- in the number of direct or indirect expenses - using the accrual method;

- as expenses at the time of issue to the employee - using the cash method.

Accounting for unreturned accountable amounts

Let us consider below typical transactions for recording settlements with accountable persons. The postings were generated based on the instructions for the chart of accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

| the name of the operation | Dt | CT |

| Money was given to the accountant | 71 | 50 (51) |

| The unused amount of the advance was returned within the period for which the advance was issued | 50 (51) | 71 |

| The employee did not return the advance at the end of the period for which it was issued | 94 | 71 |

| Debt is withheld from salary or final payment upon dismissal | 70 | 94 |

| The employee's debt to the organization is reflected if it is impossible to withhold it from the salary | 73 | 94 |

| The debt is repaid by the employee upon expiration of the period for which the advance was issued | 50 (51) | 73 |

| The debt is written off upon expiration of the statute of limitations or upon forgiveness of the debt by the employer | 91.2 | 73 |

| By decision of the organization, insurance premiums were charged for the amount of the unrepaid debt | 91.2 | 69 |

| Personal income tax is withheld from the employee’s final payment when signing an agreement between the employee and the organization on debt forgiveness under the report or when the employee refuses to repay the debt | 70 | 68 |

How to reflect compensation in accounting?

In accounting, compensation must be reflected among labor costs by postings:

- Debit 20 Credit 70 - compensation accrued (what);

- Debit 70 Credit 68 subaccount “Settlements for personal income tax” - personal income tax is withheld;

- Debit 70 Credit 50(51) - compensation issued (what kind).

If the institution is not a small business entity, a reserve for vacation pay must be created in the accounting records. In this case, compensation is recognized not as a current expense, but as the fulfillment of a previously provided obligation. After payment, it is written off to reduce the reserve for vacation pay.

Accounting

Workwear is reflected in account 10. Usually subaccounts 10 and 11 are used, respectively, “Workwear and equipment in warehouse” and “Workwear and equipment in operation.”

If an employee, upon resigning, hands over PPE to a warehouse, this operation is reflected by internal wiring Dt10/10 Kt 10/11. In addition, the following wiring can be used:

- Dt94 Kt 10/11 – upon delivery to the warehouse, the commission declared the workwear unusable.

- Dt91/2 Kt 94 - its cost is included in other expenses.

- Dt73 Kt 94 (91/1) - the amount of work clothes not returned by the employee upon dismissal is recorded.

- Dt 70 Kt 73 – the amount of personal protective equipment is withheld from the employee’s salary.

- Dt 50 Kt 73 – the amount of personal protective equipment is paid by the employee to the cash desk.

- Dt 51 Kt 73 – the amount of personal protective equipment was transferred by the employee to the organization’s account.

- D 94 K 10/11 – the cost of unreturned workwear was written off.

- D 91/2 K 94 – shortage of workwear is reflected in expenses.

The last two entries are used if the employee has already quit, and the organization was unable to recover compensation for personal protective equipment.

Accounting for personal protective equipment is carried out on the basis of various primary documents, for example, a card for issuing personal protective equipment, a record sheet for issuing special clothing, etc.

Main

- Workwear is the property of the employer, and upon dismissal the employee is obliged to return it.

- If the employee refuses to return the workwear, its cost may be deducted from dismissal payments.

- The employer does not have the right to withhold more than 20% (in exceptional cases 50%) from payments to the employee.

- Similar amounts are not withheld from state benefits and compensation payments.

- The return of workwear is recorded by internal wiring according to count 10.

- If the clothes have become unusable and it was not possible to receive compensation for them from the dismissed employee, use account 94.

- Compensation for workwear is carried out on account 91/1 or 94, in correspondence with account 73, repayment of amounts from the employee is reflected on loan 73, in correspondence with accounts for cash payments or wage settlements.

Summary

So, we found out that compensation for vacation can be provided upon dismissal and to some categories of working employees. In general, it is calculated in proportion to the length of leave, and in the event of a change in salary, it is subject to indexation. This payment is subject to personal income tax, insurance premiums and must be reflected in the accounting records.

Don't stop at accounting! Take the comprehensive IPFM: Professional Finance Manager course to learn IFRS, internal auditing, management accounting and strategic management. Register and take the 1st module of the course for free!

Professional Financial Director Course

What else would you like to do besides accounting?

The employee did not repay the debt as reported: general information

If the employee does not return the unused advance or its remaining portion within the period established by the employer, then in accordance with Art.

137 of the Labor Code of the Russian Federation, an organization or individual entrepreneur can deduct the amount of this advance from the salary, but no later than a month from the date of expiration of the period for its return and if the employee agrees with the amount and basis of the deduction. The letter of Rostrud dated 08/09/2007 No. 3044-6-0 states that it is necessary to obtain the employee’s written consent to withhold. The deduction is made on the basis of an order approved by the manager. ATTENTION! As of November 30, 2020, the rules for issuing reports have been simplified. Now, in the application for the issuance of accountable money, it is not necessary to indicate the amount of the advance and the period for which the accountable amounts are issued. The organization sets the deadline independently. The requirement to submit an advance report within three days has been removed. Employers were also allowed to issue one order for several cash payments to one or more employees. In this case, you need to indicate the name, amount and period for which the money is issued for each employee.

ConsultantPlus experts told us what other innovations in the procedure for recording cash transactions came into effect on November 30, 2020. Get trial access to the K+ system and go to the review material for free.

Another opportunity to repay the accountant’s debt is to withhold it from the final payment amount upon dismissal. Upon dismissal, an employee most often receives a bypass sheet, which must contain the signatures of responsible persons confirming the fact that the employee does not have any debts. This way, the accountant responsible for the calculation will be aware of the employee’s debt or will not forget to check it himself. Deduction from the employee's final pay is possible only with the consent of the employee, as well as deduction from the monthly salary (Article 137 of the Labor Code of the Russian Federation).

It must be remembered that with each salary payment, no more than 20% can be withheld from it (Article 138 of the Labor Code of the Russian Federation). If the amount withheld upon dismissal is not enough to cover the debt, then the employee must return the rest to the cashier himself.

Find out how to withhold unreturned accountable amounts from your salary in the ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

If the resigning employee does not agree to repay the debt, and the settlement amount does not cover it completely, then the organization has the right to sue this employee. You must file a claim within a year from the date when the period for which money was given for reporting expired (Article 392 of the Labor Code of the Russian Federation). If the court is unsuccessful or the organization decides not to go there, after the expiration of the statute of limitations, the reporting debt is written off as other expenses in accounting, and in the tax account it can be taken into account as non-operating expenses in accordance with subparagraph. 2 p. 2 art. 265 Tax Code of the Russian Federation. The general limitation period is 3 years (Article 196 of the Civil Code of the Russian Federation).