Almost any enterprise has property that is included in current assets and is necessary for carrying out current activities. However, if everything is clear with equipment and financial savings, then intangible assets raise more questions. They are not expressed in material form; they usually exist in the plane of legal rights. But, despite the fact that they do not have any physical expression, intangible assets are also the most important component of any company, reflect its liquidity and stability, and allow it to make a profit.

How to draw up an act of commissioning an intangible asset ?

Essential features of intangible assets

Intangible assets must meet the following criteria:

- lack of physical fitness;

- application in various work processes of the company (for example, intangible assets may be required to organize management or production processes);

- being in circulation for at least a year;

- profit can be made from intangible assets in the current time, or they will ensure the implementation of financial goals as part of strategic planning;

- correct registration (if a company has rights, but they are not formalized by law, then it is difficult to call them full-fledged assets);

- assets can be transferred to other persons.

The organization must register ownership of intangible assets.

Question: Is it legal to include in non-operating expenses the amounts of underaccrued depreciation on written-off intangible assets (clause 8, clause 1, article 265 of the Tax Code of the Russian Federation)? View answer

Composition of intangible assets

The intangible assets may include objects:

- Scientific discoveries.

- Works of art, literary works.

- Computer programs.

- Various inventions.

- Trademarks.

- Copyright.

- Rights to use natural resources.

- Industrial designs.

Are intangible assets subject to corporate property tax ?

Obviously, intangible assets usually include rights to various works and inventions. But they may include the reputation of the company. This is an absolutely intangible concept, but it significantly affects the activities of the enterprise.

EXAMPLE. The person acquired an unprofitable company. During its activity, important inventions were made, which attracted the attention of competitors and investors. Promising contracts have been concluded that promise future profits. All this increases the value of the company, opens up new horizons for it, and therefore has all the characteristics of intangible assets.

What is not included in the IMA?

Intangible assets do not include:

- expenses incurred in connection with the registration of a legal entity;

- business qualities of company employees.

How to conduct an inventory of intangible assets ?

The ability to work and qualifications of personnel is an asset of the enterprise, which allows you to make a profit and build a business reputation. However, these objects are not rights. They cannot be transferred and, therefore, do not have all the characteristics of intangible assets.

What accounting data is used when filling out line 1110 “Intangible assets” ?

How do intangible assets differ from fixed assets?

To understand how intangible assets differ from fixed assets, let's consider each concept separately.

According to clause 5 of PBU No. 6, fixed assets are recognized as real estate, namely: buildings, structures, land plots. In addition, this includes equipment, various instruments and devices, computers, transport, production tools, livestock, perennial plantings, etc. Also included in the fixed assets are capital investments and property used on the basis of long-term lease relationships.

Assets will be taken into account if a number of conditions are simultaneously met:

- used in production or for administrative needs;

- used for more than a year;

- will generate income for the company;

- there are no plans to implement them.

Intangible assets do not have a natural form. According to PBU No. 14, intangible assets will include exclusive rights to authorship and patents (their value is taken into account), as well as long-term investments of the company.

As well as fixed assets and intangible assets, it is necessary to have a period of use of more than a year, as well as the likelihood of generating income for the company in the future.

Reasons for the occurrence of intangible assets

Intangible assets arise on certain grounds. Their presence must be documented. This is especially important when accounting for intangible assets. You can confirm the grounds for obtaining rights with the following documentation:

- Patents.

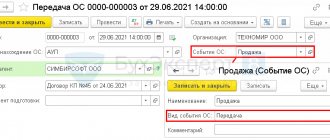

- Agreements for the transfer of rights.

- Purchase and sale agreements.

- Licenses for the right to operate.

- Agreements on the transfer of rights to inventions and know-how.

Intangible assets can be either created by the enterprise itself or acquired. In the first case, you need to obtain a patent. For example, a company made an invention in the manufacturing industry and is actively using it. However, the discovery will not be included until a patent is granted. Another example: an organization uses the invention of another person. To obtain rights to it, you need to draw up an agreement for the transfer of an intangible asset.

The discovery may belong to the employees of the enterprise. In this case, an agreement on the execution of R&D is concluded with employees. The mere fact that an employee invented something does not mean that the discovery belongs to the enterprise.

Valuation of intangible assets

The principles for valuing intangible assets were invented by economist Leonard Nakamura, working in the United States. He proposed three main criteria for assessment:

- Estimated financial result. That is, you need to calculate how much profit the acquired or developed asset will bring.

- Costs associated with the creation or acquisition of intangible assets.

- Increase in operating profit due to the introduction of intangible assets.

IMPORTANT! The cost is determined based on the price of the item at the time of its receipt. Typically, the primary cost can be determined based on the concluded contract for the transfer of rights. They can be transferred to the company free of charge. In this case, the assessment is carried out based on the market value of similar objects.

The basis for the assessment may be the totality of costs associated with obtaining the asset. The list of expenses may include:

- amount paid to the seller;

- payment for intermediary services;

- receiving advice related to the acquisition of an asset;

- customs duties.

It will be more difficult to evaluate assets that were created by the enterprise itself. The price will include the following expenses:

- developer salaries;

- social Security contributions;

- material costs for carrying out development activities.

The original cost can only change when revalued or depreciated. For example, an organization bought a patent, the market value of which jumped. However, later there was a sharp decline. The value of the asset indicated in the accounting documents should be brought into line with its actual value.

Inventory of fixed assets and intangible assets

An inventory of fixed assets and intangible assets is carried out based on the order of the head of the company or upon inspection by the tax authorities. A special commission is being created for this purpose. During the inventory the following is checked:

- availability and correct completion of primary documentation for commissioning and operation;

- condition of cards and other analytical accounting registers;

- correct reflection of the primary cost of objects;

- correct reflection of data on the movement of fixed assets and intangible assets on accounts.

When unaccounted for fixed assets are identified, they are classified as non-operating profit received in kind.

If a shortage of intangible assets or assets is detected, then it is necessary to identify the guilty employees. When these are not established or the court refuses to compensate for losses, the shortage is written off as production costs or a decrease in funds. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Rules for accounting for intangible assets

The unit of measurement of intangible assets is an inventory object. This term refers to the totality of all rights associated with the purchase of one asset. An object may include rights to a collection of objects.

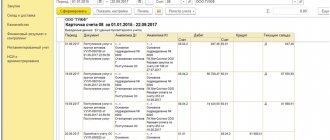

Objects are recorded in account 04 “Intangible assets”. The accounting must indicate their original cost. The situation is somewhat more complicated with depreciation. In relation to some assets, it cannot be reflected on account 05 “Depreciation of assets”. Accruals are indicated in the credit column of account 4 “Intangible assets”. The receipt of objects into the enterprise is reflected in the debit of account 04. The correspondence will be account 08 “Investments in non-current assets”.

Accounting for non-current assets at an enterprise

To account for operational movements, a separate account is provided for each group of non-current assets by order of the Ministry of Finance dated October 31, 2000 No. 94n and rules for their reflection are given.

Let's look at each group of non-current assets in more detail.

Accounting of intangible assets

Intangible assets are a long-term asset (with a useful life of more than 1 year) without a tangible form, used by an enterprise to obtain financial benefit. Accounting for intangible assets is regulated by PBU 14/2007.

- Intangible assets are reflected in accounting at cost, which includes the amount of costs incurred for its production, acquisition and other associated costs.

- The organization also needs to determine the expected period of use of the asset, which may be equal to the period of the contract concluded for its use or the expected period of income, but not exceed the life of the enterprise itself.

- It is also possible to account for intangible assets with an unformed period of use; in this case, according to clause 23 of PBU 14/2007, depreciation charges are not made on it.

IMPORTANT! The estimated service life of intangible assets should be examined every year for the need for revaluation. This need is indicated by clause 27 of PBU 14/2007.

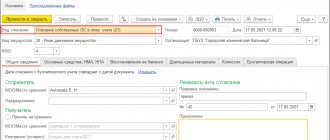

To reflect intangible assets, the following entry is entered into accounting: Dt 04 Kt 08.

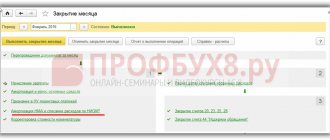

Depreciation charges for intangible assets can be made using one of the three existing methods described in PBU 14/2007. Accruals are made from the beginning of the next month after the asset is accepted onto the balance sheet and continue until it is written off or the entire cost is repaid.

To reflect depreciation in accounting, the following entry is used: Dt 44 (20, 23, 25, 26) Kt 05.

When an intangible asset is disposed of, all depreciation accrued during its use is transferred to the general account “Intangible assets”: Dt 05 Kt 04.

Next, the residual value of the asset is determined and it is written off from the enterprise’s balance sheet by posting: Dt 91 Kt 04.

OS accounting

The conditions for accepting an asset as a fixed asset, as well as the rules for their accounting, are described in PBU 6/01. This category includes:

- building,

- equipment,

- devices and instruments used in work,

- vehicles,

- livestock,

- household equipment and other objects.

ATTENTION! From 2022, PBU 6/01 will no longer be in force. It will be replaced by FSBU 6/2020 “Fixed Assets” and FSBU 26/2020 “Capital Investments”.

ConsultantPlus experts explained in detail which accounting entries to reflect the main transactions with fixed assets when applying FAS 26/2020 and FAS 6/2020. If you do not have access to the K+ system, get a trial demo access and go to the Ready solution.

Fixed assets are recorded in accounting at their original cost, which can subsequently be revised, but not more than once a year (clause 15 of PBU 6/01).

To accept fixed assets for accounting, it is necessary to determine their future period of use. This is done on the basis of the Classification of fixed assets introduced by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1.

The cost of fixed assets is entered into accounting with the entry: Dt 01 Kt 08.

To calculate depreciation, a credit from the “Depreciation of fixed assets” account is used, corresponding to the accounts that record sales or production costs: Dt 44 (20, 23, 25, 26) Kt 02.

To carry out the disposal of fixed assets from the balance sheet, the current instructions to the Chart of Accounts provide for the possibility of creating subaccount 1 “Disposal of fixed assets” to the main fixed assets account. In this case, the following records are created: Dt 02 Kt 01.1, Dt 91 Kt 01.1.

You can familiarize yourself with the nuances of accounting for fixed assets in accounting and calculating depreciation in the article “Fixed assets in accounting (nuances).”

Accounting for profitable investments in materiel

Assets in the form of income-generating investments include property acquired for the purpose of obtaining economic benefits from providing it for temporary use (PBU 6/01).

A record of profitable investments is made on account 03 at their actual cost by accounting entry: Dt 03 Kt 08.

To reflect depreciation, account 02 is used: Dt 44 Kt 02.

Accounting for the write-off of income-generating investments from the balance sheet is carried out similarly to fixed assets. The only difference is that instead of account 01.1, account 03.1 is used: Dt 02 Kt 03.1, Dt 91 Kt 03.1.

Accounting for financial investments

The group of financial investments includes long-term investments in various income-generating assets (money market securities, authorized capital of enterprises, etc.). The basics of accounting for financial investments are regulated by PBU 19/02.

Financial investments are reflected as follows: Dt 58 Kt 52 (50, 51, 75, 76, 80, 91, 98). The corresponding account depends on the method and means of mutual settlement.

The disposal of assets recorded on account 58 is recorded as follows: Dt 91 Kt 58.

Depreciation

There are two methods used to calculate depreciation:

- Linear. The linear method takes into account depreciation rates determined on the basis of the period of use of the object.

- Declining balance. Deductions are calculated based on the residual value at the beginning of the reporting period.

EXAMPLE. The company acquired assets in the amount of 12,000 rubles. The period of use is 4 years. To calculate annual deductions, you need to divide the amount by the terms. Get 3,000 rubles. This amount can be divided by 12. This will determine the monthly deductions.

EXAMPLE. Assets were purchased for the amount of 10,000 rubles. To determine the annual rate, you need to divide 10,000 rubles by 100%. It will be 10%. The annual depreciation amount will be 1,000 rubles (10,000 times 10%). The residual value will be 9,000 rubles (10,000 – 1,000).

Intangible assets, despite the lack of physical form, must be correctly reflected in accounting. To do this, you need to know the signs of intangible assets and the rules for calculating depreciation charges.