Insurance premium rates

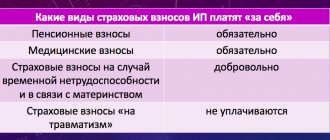

The legislation of the Russian Federation provides for the following types of compulsory insurance: compulsory pension insurance (OPS); compulsory health insurance (CHI); compulsory social insurance in case of temporary disability and in connection with maternity (OSS); compulsory social insurance against accidents at work and occupational diseases (OSS NS and PZ).

Insurance is provided by contributions to the relevant funds. The procedure for calculating and paying contributions to compulsory health insurance, compulsory health insurance, compulsory health insurance is regulated by the norms of Chapter 34 of the Tax Code of the Russian Federation. Wherein:

- contributions to compulsory pension insurance are credited to the budget of the Pension Fund for the purpose of forming pension savings for citizens of the Russian Federation (Article 3 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”);

- contributions for compulsory medical insurance go to the Federal Health Insurance Fund and are intended to be received by insured persons in case of need of free medical care (Article 3 of the Federal Law of November 29, 2010 No. 326-FZ “On Compulsory Medical Insurance in the Russian Federation”);

- contributions to OSS go to the Social Insurance Fund in order to provide citizens with benefits in cases of disability, pregnancy and childbirth, child care (Articles 1.2, 1.4 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity").

The procedure for calculating and paying contributions to OSS NS and PZ is regulated by Federal Law No. 125-FZ of July 24, 1998 “On compulsory social insurance against industrial accidents and occupational diseases.”

Contributions to OSS NS and PZ are credited to the budget of the Social Insurance Fund of the Russian Federation and form insurance compensation for harm caused to the life or health of individuals during the performance of their work duties (Article 3 of Law No. 125-FZ).

Tariffs of insurance premiums for compulsory medical insurance, compulsory medical insurance, compulsory medical insurance are regulated by paragraph 2 of Article 425 of the Tax Code of the Russian Federation.

For 2022, the maximum base for insurance premiums for compulsory health insurance at the basic tariff has been set in the amount of RUB 1,292,000. and for OSS - 912,000 rubles. (Resolution of the Government of the Russian Federation dated November 6, 2019 No. 1407).

Tariffs and procedures for paying insurance premiums for OSS NS and PZ were established for 2006 by Federal Law dated December 22, 2005 No. 179-FZ and continue to be applied in 2022 (Federal Law dated December 27, 2019 No. 445-FZ).

For payments in favor of individuals with disabilities, 60% of the generally established insurance tariff for contributions to OSS NS and PZ is provided (Article 2 of Law No. 445-FZ, Article 2 of Law No. 179-FZ).

The size of the insurance tariff for OSS NS and PZ depends on the main type of activity of an organization or individual (including an entrepreneur) and the class of professional risk corresponding to such activity (Article 21 of Law No. 125-FZ). Moreover, for separate divisions of the organization, separated into an independent classification unit (SCU), it is possible to set a tariff that is different from the main one for the organization. The separation of non-core activities into independent classification units allows policyholders to reduce premiums for insurance against accidents and occupational diseases.

| 1C:ITS For more information about the types of contributions for compulsory insurance, tariffs and payers, see the section “Legislative Consultations”. |

Confirmation of the type of economic activity in the Social Insurance Fund

Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55 determined the procedure for confirming the types of economic activities of the insured for compulsory social insurance against industrial accidents and occupational diseases. According to paragraph 9 of Order No. 55, the decision on the allocation of divisions of the insurer to SKE is made by the territorial body of the Social Insurance Fund.

The procedure for isolating SKE:

- the policyholder submits to the territorial body of the Social Insurance Fund a complete package of documents in accordance with the list established by paragraph 8 of Order No. 55;

- The territorial body of the Social Insurance Fund sends the submitted documents to the fund for approval within 7 working days;

- within 20 working days from the date of receipt of the documents, the FSS reviews them for compliance with the requirements specified in Order No. 55, and informs the territorial body of the FSS at the place of registration of the policyholder about the results;

- the territorial body of the Social Insurance Fund notifies the policyholder within two weeks of the insurance rates in force since the beginning of the current year, corresponding to the classes of professional risk, for each SKE;

- The policyholder has the right to apply tariffs corresponding to the professional risk classes for each SKE. Contributions at the appropriate rate must be calculated from the beginning of the year.

Requirements for a unit to allocate it to SKE:

- implementation by divisions of the insured of types of economic activities that are not the main type of economic activity of the insured;

- maintenance by the insured of accounting of the financial and economic activities of the insured's divisions with reflection of the corresponding income in the report in Form 4-FSS, approved. by order of the Ministry of Health and Social Development of Russia dated February 28, 2011 No. 156n;

- submission to the territorial body of the Fund within the established time frame of Form 4-FSS;

- correspondence of the names of types of economic activities indicated by the policyholder in the confirmation certificate and specified in the application for the division of the policyholder's divisions into independent classification units within the policyholder;

- absence of outstanding debts for payment of insurance premiums, penalties and fines under OSS NS and PZ.

The type of economic activity must be confirmed annually no later than April 15 (clause 3 of the Procedure, approved by Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55).

The deadline for confirmation of the main type of activity for 2022 is no later than 04/15/2020. The allocation of SKE is carried out annually as part of the procedure for confirming the main type of economic activity.

The list of supporting documents that must be submitted is also given in paragraph 3 of the Procedure, approved. Order No. 55.

Please note that documents to confirm the type of economic activity can be submitted not only in paper form, but also in electronic form (clause 8 of the Procedure, approved by Order No. 55). You can generate and send to the Social Insurance Fund all the necessary documents to confirm the main type of activity of the policyholder and allocate divisions in SKE in the 1C-Reporting service.

For more information about the service, see the 1C:ITS Portal.

What are personal injury contributions?

Mandatory payments to the Social Insurance Fund also include insurance premiums for accidents - funds accumulated in Social Insurance are used for employee compensation in terms of compensation for damage to health.

Such payments are mandatory for all insurers - entrepreneurs and legal entities using the labor of hired specialists (Law No. 125-FZ of July 24, 1998). Employers pay contributions to the Social Insurance Fund to insure employees against accidents at work. The rate depends on the danger of production, it is determined according to OKVED.

The fund's current injury rate ranges from 0.2 to 8.5% of employee benefits. For the same period, all previously valid benefits will remain in effect. We are talking about reducing contributions to 60% if they are paid for employees who are disabled people of groups I, II or III. This norm works for both companies and individual entrepreneurs, even if they are not members of public all-Russian organizations of disabled people.

The employer is obliged to monthly calculate insurance premiums for injuries in 2022 to the Social Insurance Fund from the amounts of accrued income in favor of employees (under employment contracts). The following factors directly influence the amount of payments:

- tariffs for contributions approved at the legislative level;

- main type of activity of the subject;

- the right to apply tariff benefits in the reporting year;

- compliance with the procedure for applying benefits.

ConsultantPlus experts discussed how to calculate insurance premiums against industrial accidents and occupational diseases. Use these instructions for free.

Tariffs of insurance premiums in “1C: Salaries and personnel management 8” (rev. 3)

Tariff of insurance premiums for compulsory medical insurance, compulsory medical insurance, compulsory social insurance

The rate of insurance premiums for compulsory medical insurance, compulsory medical insurance, compulsory social insurance in the program “1C: Salaries and Personnel Management 8” edition 3 must be specified when setting up the organization’s Accounting Policy

(

Settings

-

Organizations

Accounting policy and other settings

tab -

Accounting policy

) on the

Insurance premiums

in the

Tariff type

.

The choice is made depending on the category of insurance premium payer to which the organization belongs. Follow the link History of tariff type changes...

You can view the history of changes in tariffs applied by the policyholder in different periods.

You can get acquainted with the specific rates of contributions for compulsory health insurance, compulsory medical insurance, compulsory social insurance in the card of the selected tariff (directory Insurance premium rates) on the Insurance premium rates tab (Fig. 1).

Rice. 1. Directory “Insurance premium rates”

Tariff of insurance premiums for OSS NS and PZ

In the program "1C: Salary and Personnel Management 8" edition 3, the rate of insurance premiums for OSS NS and PZ must be set when setting up the Accounting Policy of the organization (menu Settings - Organizations - tab Accounting Policy and other settings - link Accounting Policy) on the tab Insurance premiums in field Contribution rate to FSS NS and PZ (see Fig. 2).

Rice. 2. Contribution rate to the Social Insurance Fund for OSS NS and PZ

Registration of SKE

The functionality required for registration in the SKE program and calculation of contributions at the rates established for SKE is connected on the same tab. Insurance premiums with the flag. Divisions are registered in the Social Insurance Fund as independent classification units (SCU), see fig. 2.

Go to the directory Independent classification units

is possible on the tab of the same name in the

Organization

.

Independent Classification Units

card (Fig. 3) indicates

the Code according to OKVED

rev.

2 and Professional risk class

, which determine the tariff and are set on the specified date.

Rice. 3. Directory “Independent qualification units”

Within the selected contribution rate for SKE, the contribution rate may change. The contribution rate to the FSS NS and PZ is stored along with the history of its changes for the tariff.

It is possible to indicate in the program that a department is allocated to SKE only for separate departments. If the This is a separate division flag is checked in the Division card, then the Independent Classification Unit card is available for filling out and editing (Fig. 4).

Rice. 4. SKE in the card of a separate unit

Current benefits in 2022

In addition to the main tariff relaxations, officials have provided special types of benefits. Such privileges are available to all policyholders, without exception, in relation to payments in favor of disabled people of groups I, II and III.

The benefit is provided regardless of the legal form of the entity and the chosen taxation regime. The source of funding and the category of remuneration also do not matter.

IMPORTANT!

Individual entrepreneurs have the right to take advantage of benefits on insurance premiums.

If your organization employs disabled people (group I, II, III), then the rates of accident insurance premiums according to OKVED in favor of these categories of workers are 60% of the total rate.

For example, an organization has a tariff of 8%. This means that when calculating payments to disabled people, it is allowed to reduce the rate to 4.8% (60% of the current rate).

Reporting on insurance premiums in 2022

Calculation of insurance premiums

Based on the results of calculating contributions for compulsory health insurance, compulsory medical insurance, compulsory insurance, the policyholder submits a report Calculation of insurance premiums

(RSV) (clause 7 of article 431 of the Tax Code of the Russian Federation).

Starting with reporting for the first quarter of 2022, changes were made to the regulated report by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

Differences between the contribution reporting form in force in 2022 and the 2022 report:

1. In accordance with the requirements of Federal Law No. 325-FZ of September 29, 2019, employers whose number of individuals in whose favor payments were made in the reporting period are more than 10 are required to submit the DAM only in electronic form.

2. A separate division that independently makes payments in favor of individuals submits a calculation of insurance premiums to the inspectorate at the place of its registration. If a separate division is closed or its authority to accrue payments to individuals is terminated, but an updated calculation is required, then it must be submitted by the parent organization. In this case, special fields are filled in on the Title Page: “Code - 9”, indicating the deprivation of authority or closure of a separate unit, and the INN/KPP of such unit.

3. In the absence of payments, individuals should fill out a new column 001 of Section 1:

- if payments were made, then code 1 is indicated in column 001;

- if there were no payments - code 2. If there are no payments, the report can only contain the Title Page and Section 1.

4. To reflect the expenses of an individual arising as part of the execution of an author's agreement, an agreement on the alienation of the exclusive right to the results of intellectual activity or a license agreement, new lines are intended: 045 of subsection 1.1 and line 045 of subsection 1.2 of Appendix 1 to Section 1. Remunerations under such agreements are taxable contributions to compulsory health insurance and compulsory medical insurance (contributions to compulsory health insurance are not assessed). When determining the base for calculating contributions, the remuneration accrued to an individual is reduced by documented expenses (clause 8 of Article 421 of the Tax Code of the Russian Federation) or a fixed deduction amount if supporting documents are missing (clause 9 of Article 421 of the Tax Code of the Russian Federation).

Consequently, lines 045 in subsections 1.1 and 1.2 reflect either the amount of expenses supported by documents or the amount of the deduction.

5. Appendix 2 to Section 1, reflecting information on the calculation of contributions to OSS, is supplemented with the following fields and lines:

- field 001 “payer tariff code”. The codes are established in accordance with the basis for the application of reduced contribution rates;

- line 015 “Number of individuals from whose payments insurance premiums are calculated” (as opposed to line 010 “Number of insured persons”).

6. The 2022 RSV form no longer contains:

- sheet “Information about an individual who is not an individual entrepreneur.” This does not mean an exemption from the obligation to pay contributions and report on them for citizens without individual entrepreneur status, but paying remuneration to other individuals. Now they must fill out a separate sheet with information about themselves - only full name. in special fields on the Title Page;

- Appendices 6 and 8 to Section 1 (for payers on the simplified tax system and individual entrepreneurs on the PSN, to confirm their right to reduced contribution rates). From 01/01/2019, such reduced rates do not apply.

7. A special subsection has been added for organizations producing animation products - Appendix 5 to Section 1.

8. The content of Section 3 has changed:

- lines 010-050 were excluded, which indicated: adjustment number, settlement (reporting) period, calendar year, number, date;

- excluded lines that indicate the characteristics of the insured person for each type of compulsory insurance (compulsory insurance, compulsory medical insurance, compulsory insurance);

- a field has been added - “Sign of cancellation of information about the insured person” with the value “1”, which is used when it is necessary to cancel or correct information previously submitted for an insured individual;

- in subsection 3.2.2 the column “Insured Person Code” has been added. The codes correspond to the working conditions established based on the results of the special assessment;

- information about the amount for 3 months of the billing (reporting) period is excluded. This information is reflected only on a monthly basis.

9. The list of codes for payers applying reduced tariffs has been updated.

Form 4-FSS

Based on the results of calculating contributions to OSS NS and PZ, the policyholder submits a report in Form 4-FSS, approved. by order of the FSS of the Russian Federation dated September 26, 2016 No. 381 as amended by order of the FSS of the Russian Federation dated June 7, 2017 No. 275. Data on SKE are included in the 4-FSS report as a whole for the policyholder in a separate table (Fig. 5).

Rice. 5. Report on SKE as part of 4-FSS

Reporting

In addition to the completeness and correctness of calculation of mandatory payments, policyholders must report to regulatory authorities. The Social Insurance Fund requires quarterly reporting on insurance coverage for NS and PZ.

Unified reporting form - 4-FSS. The form was approved in Appendix No. 1 to FSS Order No. 381 dated September 26, 2016 (as amended by Order No. 275 dated June 7, 2017).

Submit Form 4-FSS for contributions for injuries to Social Security within a certain time frame. Submit your reports to the Social Insurance Fund no later than:

- The 20th day of the month following the reporting quarter, if the report is prepared on paper;

- On the 25th day of the first month following the reporting quarter, if the form is completed electronically.

IMPORTANT!

If the average number of employees of an enterprise exceeds 25 people, then the report on contributions to Social Security will have to be submitted in electronic format. Entities with a staff of less than 25 people send calculations on paper or electronically.

If you submit reports not in the form required by law, the organization will be punished. For such an offense a fine of 200 rubles is provided.

Reporting on insurance premiums in “1C: Salaries and personnel management 8” (rev. 3)

In the 1C: Salary and Personnel Management 8 program, edition 3, all insurance premiums are calculated automatically in accordance with the specified tariffs for each individual on the Contributions tab when filling out documents:

- Calculation of salaries and contributions;

- Dismissal;

- Holiday to care for the child.

It is convenient to analyze the calculation of contributions using the Analysis of Fund Contributions report. 1C-Reporting service built into 1C

allows you to submit regulated reports to regulatory authorities, including the Federal Tax Service of Russia, the Pension Fund of the Russian Federation, the Social Insurance Fund directly from the 1C program, without uploading or downloading to other programs.

The service supports automatic completion of regulated reports, including Calculation of insurance premiums and 4-FSS. The 1C-Reporting service allows you to:

- send electronic reports to regulatory authorities directly from the program in electronic form using an electronic signature;

- make requests for certificates about the status of settlements;

- receive responses to requirements and other types of electronic interaction with regulatory authorities;

- visually monitor the status of document flow with regulatory authorities.