What are assets

In simple terms, assets are resources that can generate income. The term refers to all types of property, both tangible and intangible. The first includes real estate, equipment, vehicles, the second - money or copyrights.

Various criteria are used to classify assets, as listed in the next section. Here it is necessary to note one of their main properties - the presence of an initial cost used to be reflected on the balance sheet of the enterprise.

Assets in investments

After an ongoing assessment of net worth, the LFP preparer sets financial goals and develops a plan to achieve them. This is where investments come in.

Classification

Investment assets are instruments in which an investor invests money in order to generate income.

The choice of a specific investment option will depend on:

- financial goal;

- investment horizon;

- attitude towards risk (your risk profile);

- financial and time possibilities.

The parameters listed are part of the investment strategy that every investor should have. The result of its practical implementation will be an investment portfolio filled with assets. The main ones include:

- Shares are equity securities of a specific company, which allow their owner to receive profit from the business in the form of increased quotes and dividends.

- Bonds are debt securities for which an investor, when purchasing a security, lends money to the issuing company and has the right to return the money invested and receive a profit in the form of coupons.

- Index funds (ETFs and mutual funds) are baskets of securities from several dozen or hundreds of companies, the composition of which depends on the index being tracked. As the return on the index increases, so does the return on index funds. And vice versa.

- Mutual funds are mutual investment funds, a variant of trust management, when money is collected from investors by a management company, invested in some assets, and the profit received is distributed among the fund participants.

- Precious metals – investments in gold, silver, platinum and palladium can be through metal bank accounts, shares of mining companies, ETFs, bullion, investment coins.

- Currency – purchasing cash currency, opening a foreign currency deposit, purchasing securities for foreign currency.

- Profitable movable and immovable property - residential and commercial real estate for rent, resale after completion of the facility, repair, redevelopment, investments in real estate funds REIT and closed-end mutual funds, purchase of profitable cars.

Accounting and evaluation

Investments, like any financial instrument, need accounting. The investor’s task is not only to record each transaction for the purchase and sale of an asset, but also to evaluate the result of his investment. Otherwise, you can easily end up in a situation where you do not earn money, but lose money. It is important to consider not only the transaction price, but also the amount of commissions and taxes paid. Over a long period of time, it is these costs that can eat up a significant part of the capital.

To account for and evaluate the profitability of an investment portfolio, use:

- Excel spreadsheets or Google Sheets. There is no single template. Each investor develops them for himself or uses the developments of others. There are a lot of options. Some involve complex mathematical formulas and require significant time to figure out and customize to your needs.

- Electronic resources for portfolio management. There are paid and free options. In them, the interface adapts to the majority of users so that everyone can understand it.

I described my personal experience in accounting and evaluating investments here. Read it, I will be glad if my work is useful to you.

The main task performed by investment accounting tables is to estimate the cost of capital at any given time. This allows you to make informed and timely decisions on rebalancing and selling underperforming instruments. Ultimately, such work will lead to strict adherence to the investment strategy and obtaining the result that was planned.

Types of assets

As noted, assets are the property of a business entity, of all kinds, the classification of which occurs according to three main parameters. The first of them is functionality. Based on this parameter, the following types of assets are distinguished:

- Material. Includes real estate (land, buildings), products, equipment, transport, raw materials for production.

- Intangible. Illustrative examples of assets of this type are trademarks, licenses, patents, and copyrights.

- Financial. A simple and understandable resource, which is expressed in the form of cash - cash and non-cash, as well as debts of counterparties.

The second criterion for classification is participation in the production process. In this case, a distinction is made between current and non-current assets. The former are used in the main economic activities of the enterprise. Current assets include:

- money in any form;

- short-term investments;

- industrial reserves in the form of raw materials, inventory and finished products;

- debt by the debtor within a year;

- VAT that is subject to offset.

Non-current assets are involved in the activities of the enterprise many times. They transfer value into the price of the product gradually - through depreciation. Despite the complexity of the definition, examples of non-current assets provide a clear idea of the essence of the term. These include buildings, long-term investments, equipment and intangible assets.

The final criterion for dividing into types is the source of asset formation. According to this parameter, they are classified into gross and net. The acquisition of the former involves the use of own and borrowed funds. The purchase of the latter occurs using exclusively its own resources.

In the relevant literature you can find two more types of assets - hidden and imaginary. The first refers to assets that are not reflected on the balance sheet. For example, ongoing expenses for purchasing a license that did not bring results.

Imaginary assets are those that appear on the balance sheet but have no real value. A typical example is a debt that will not be repaid. Most of the imaginary assets are subsequently simply written off.

What is included in the active part of the balance sheet

This is any property of the institution. For example, cash on hand, inventories, fixed assets, buildings, machines and other material and financial assets that directly belong to the company.

The assets of the balance sheet group the current and non-current assets of the enterprise. When preparing reports, it should be taken into account that a balance sheet asset is a grouping of assets according to their useful life, as well as according to the speed (time) of their turnover, that is, liquidity.

In the form of a balance sheet, assets are grouped according to their degree of liquidity. The resources of the enterprise that are the least liquid are indicated first, and then in ascending order. In other words, a balance sheet asset is a grouping of economic resources according to the speed of their circulation into means of payment.

Let us note that the most liquid assets are, of course, cash: cash in the cash register and in the company’s current accounts. And the least liquid include the institution’s fixed assets, intangible assets and long-term financial investments, which cannot be realized quickly and without losses.

The assets of the balance sheet present in grouped form the accounting indicators as of the reporting date. Analysis of these accounting indicators allows us to draw a conclusion about the solvency of the enterprise.

What are liabilities

Liabilities mean the expenses of an enterprise aimed at forming assets, as well as the obligations of an economic entity in relation to counterparties who act as creditors.

Examples of liabilities are:

- taxes;

- mortgage and consumer loans;

- money that is borrowed;

- various types of property.

The last point requires separate explanation. The fact is that any property forms both assets and liabilities of the enterprise, which depends on the nature of its practical use. For example, buying an apartment is accompanied by expenses and acts as a liability. But in case of further rental, the property begins to generate income and becomes an asset.

The example shown clearly demonstrates the difference between an asset and a liability. At the same time, the relationship between both terms is clearly visible, which is discussed in more detail below.

The principle of equal balance

The basic principle of drawing up a balance sheet is that the total value of assets is always equal to the total indicators of liabilities in the report. Of course, arithmetic differences are allowed in exceptional cases. But all identified discrepancies must be justified economically.

The equality of assets and liabilities of the balance sheet is due to the fact that all entries in accounting are reflected using the double entry method. The essence of this method is that when reflecting any fact of economic activity on the balance sheet accounts of an enterprise, an entry is formed in the debit of one account and at the same time in the credit of the corresponding account, but in the same amount.

The principle of double entry expresses the pattern that when one side of the balance sheet, asset or liability, changes, a similar movement must be reflected on the other side. If the amount of an asset increases in an institution, then at the same time the indicator of liabilities or capital - the sources through which property assets were acquired - must increase. Or a decrease in other types of assets is reflected.

For example, an increase in the value of fixed assets. If the company has paid for the cost of the property, then as the indicators of non-current assets increase, the indicator of current assets (cash) decreases. It turns out: the non-current asset increased and at the same time the current asset decreased. For example, a company purchased and paid for materials. In this case, the dynamics of the indicators is reflected within one section of the balance sheet “Current assets”. The value of inventory increases, but the amount of cash decreases.

If a company has received fixed assets (equipment, machinery), but has not yet paid for them, then accounts payable are formed in the company’s accounting. The value of a non-current asset increases, and the amount of debt obligations on the balance sheet also increases. Short-term or long-term - depending on the period of settlements.

Types of liabilities

Liabilities are classified according to two basic criteria. The first is the nature of formation. According to this parameter, liabilities are divided into the following categories:

- Capital and reserves. They represent constituent capital, accumulation funds, retained earnings and other similar sources of asset formation.

- Obligations of the enterprise. They are further divided into two groups: short-term, which provide for repayments within a year, and long-term with a closing period exceeding 12 months. Examples of financial obligations of an organization are loan debt, deferred tax payments, debts to counterparties, etc.

Based on how they are reflected in the balance sheet and the need for repayment, liabilities are divided into three categories:

- Imaginary. By analogy with assets, they are reflected in the balance sheet, but are either already closed or do not require return.

- Hidden. Existing debts, but for some reason not reflected in the balance sheet. Usually taken into account in the next reporting period.

- Actual. The usual type of liabilities that actually exist and are reflected in the balance sheet.

Grouping of assets by liquidity

In the balance sheet, each type of asset is not located randomly, but in a strict order. Thus, less liquid assets are located at the beginning, and more highly liquid ones are located closer to the final part.

You can see examples of how assets are reflected on the balance sheet in the Guide to Accounting from ConsultantPlus. Trial access to the system can be obtained for free.

According to the degree of liquidity, assets are divided:

- for illiquid ones (when they cannot be sold at their real value or they are not in demand at all);

- low-liquidity (overdue debts, securities that are not quoted on the stock market, etc.);

- medium-liquid (fixed assets that are in demand);

- highly liquid (examples - cash or money in a bank account, government securities, etc.).

Interaction of assets and liabilities

One of the basic principles of accounting is that the assets and liabilities of an organization are always equal to each other. This is achieved by reflecting each transaction in two accounts at once - one for credit, the other for debit. The rule is called the double entry method.

We need to give a simple example. Operation – purchase of bricks. Accounting for the organization's assets reflects the transaction by reducing the amount of cash and increasing the amount of inventories by a similar amount. The overall value does not change. The transaction does not affect the liabilities in any way. The result of the accountant’s work and the double entry rule is that the amount of assets and liabilities remains equal.

With some degree of convention, the balance sheet of an enterprise can be presented in the format of the table below. It lists the main types of assets and liabilities of a business entity.

| Organizational assets | Liabilities of the organization |

| Negotiable. Includes goods for sale during the year and cash. | Equity. Owners' funds collected in the form of a foundation fund. |

| Non-negotiable. Property not intended for sale: real estate, equipment, vehicles, long-term investments, etc. | Reserves for future payments. Accumulation funds and other enterprise reserves. |

| Future expenses. Costs that are reflected in accounting for the next reporting period. For example, office rent paid for 2 years. The payment for the second year is deferred. | Long term duties. Loans with a maturity of more than a year, shares and bonds issued by the enterprise, debts to counterparties that do not require payment within the next year. |

| Revenue of the future periods. The situation is similar to that described in the previous paragraph. But it applies to income that is not yet reflected in the balance sheet. For example, an advance payment for goods that will be delivered next year. | Short-term liabilities. Current expenses of the enterprise planned for the next 12 months. |

How to correctly prepare a balance sheet liability

Let's present the information in a table.

| Passive | What to include in the liability lines of the balance sheet |

| III. CAPITAL AND RESERVES 6 | |

| Authorized capital (share capital, authorized capital, contributions of partners) | The liability line is formed as information on the credit of account 80. |

| Own shares purchased from shareholders | Reflected based on the amount of account 81 balances formed as of the reporting date. |

| Revaluation of non-current assets | Information is reflected if, during the reporting period, the organization carried out a revaluation of fixed assets and intangible assets. The account balance is formed. 83. |

| Additional capital (without revaluation) | When forming additional capital, the company reflects information on account balances 83. Please note that the amount is indicated without taking into account the revaluation of fixed assets and intangible assets. |

| Reserve capital | In the liability line of the balance sheet, include the balance of account 82 at the end of the reporting period. Reflects information about the formed reserve capital for the organization. |

| Retained earnings (uncovered loss) | When generating the liabilities of the annual balance sheet, use the data from account balance 84. When generating interim reporting, this figure is two account balances 84 (financial result of previous years) and 99 (financial result of the current period of the reporting year). Please note that if the result is a loss, the amount is reflected with a minus. |

| Total for Section III | The total value for the corresponding liability section of the balance sheet. |

| IV. LONG TERM DUTIES | Liability obligations whose maturity exceeds 12 months. |

| Borrowed funds | We reflect the balance of account 67 in the liability side of the balance sheet if the liability period exceeds one year. Please note that interest on loans must be included in the current liabilities section. |

| Deferred tax liabilities | It is an indicator of account balance 77, filled out based on the provisions of PBU 18/02. |

| Estimated liabilities | We reflect the balance of account 96 “Reserves for future expenses” for a period of more than one year. |

| Other obligations | In this line, disclose information about other types of long-term liabilities that were not detailed in other lines of the balance sheet. |

| Total for Section IV | Summarizes the section row metrics. |

| V. SHORT-TERM LIABILITIES | Liability obligations with a duration of less than 12 months. |

| Borrowed funds | The balance of account 66 is reflected. In this case, interest paid on long-term loans should be included in this liability line of the balance sheet. |

| Accounts payable | The indicator is formed as the sum of credit balances for accounts 60, 62, 68, 69, 70, 71, 73, 75, 76. |

| revenue of the future periods | The indicator is equal to the sum of account balances 86 (targeted funding received) and 98 (deferred income). |

| Estimated liabilities | Create a balance on account 96 (reserves for future expenses) for those reserves whose use period is less than 12 months. |

| Other obligations | Here, decipher short-term liabilities that are not included in other liability lines of the balance sheet. |

| Total for Section V | Sum of rows by section. |

| BALANCE | The total value for the liability sections of the balance sheet. |

IMPORTANT!

The values of assets and liabilities are always reflected in monetary terms. Moreover, transactions are recorded exclusively in rubles. If settlements are made in foreign currency, then the transaction must be converted into rubles. The exchange rate approved by the Central Bank of Russia at the time of the economic activity is used.

The balance sheet and other financial statements are prepared in rubles or thousands of rubles. If the company’s turnover is significant, then it is permissible to indicate the amounts in the balance sheet in millions of rubles.

Difference between assets and liabilities

As noted, an asset differs from a liability, first of all, in that it acts as a source of income. It is important to understand that such ability is determined by the actions of the owner, and not at all by the characteristics of the property.

The example given earlier is very clear. An apartment that is used by the owner for his own residence is a liability. But when it is rented out to a tenant, it becomes an asset, as it generates income.

A similar situation arises in relation to almost any type of property. The main thing that distinguishes assets from liabilities is the method of use by the owner.

What to do with assets and liabilities

The basic principle of accounting clearly demonstrates the interconnection of the concepts under consideration. Without liabilities, it is impossible to form assets and, as a result, increase the real market value of the enterprise. Therefore, it is necessary to maintain a balance between the income received and the expenses incurred.

In such a situation, economic assets and liabilities increase, but this growth is due to objective reasons. The main one is the efficient operation of the company. To achieve this development, you need to follow a few simple recommendations. They include the following actions, available to both the head of the enterprise and the individual:

- Determination of liabilities, that is, the level of current expenses that can ensure the normal operation of an enterprise or comfortable living conditions for a person.

- Analysis of the obtained figures from the point of view of the possibility of eliminating unnecessary cost items.

- Identification of income-generating assets broken down into calendar periods similar to those used for liabilities.

- Comparison of the obtained results. A good option is equality of assets and liabilities. Optimal is the excess of the former over the latter, which will create a safety net that is relevant for both the organization and the individual.

What are liabilities and their classification in the balance sheet

Balance sheet liabilities include all the obligations of the organization that were accepted by it in the reporting period, as well as the sources of the formation of material assets and resources of the institution. In other words, the liability side of the balance sheet is a grouping of assets according to the sources of their formation, that is, liabilities are the sources of formation of material assets, cash, and intangible assets.

The main classification of balance sheet liabilities is the division of liabilities into capital and liabilities.

Capital is recognized as funds allocated by the founders to carry out activities, for example, to purchase property, to provide guarantees to creditors, and to create reserve funds. Liability capital can be own or borrowed. Own funds are capital that belongs to the founders, the creators of the company. And borrowed capital liabilities are funds received from third-party organizations and individuals for temporary use.

Balance sheet liabilities are the company's debt to third parties to fulfill certain financial or property requirements. In turn, liabilities are divided into long-term (more than 12 months) and short-term debts, which must be fulfilled 12 months or earlier.

Examples of assets and liabilities

As a logical end to the article, it makes sense to once again give the most frequently encountered examples of the concepts discussed in the article. Assets should be considered:

- Money. The simplest and most understandable example. Cash is classified as an asset because it represents income expressed in the form of finance.

- Real estate. One of the most valuable assets. Includes land and permanent buildings or structures standing on it.

- Equipment, transport and technology. Liquid property that usually has considerable value. It is used in almost all types of enterprise activities.

- Commodity and production inventories. They represent raw materials, consumable tools and finished goods intended for sale.

- Accounts receivable. Provides for the receipt of funds or property from the debtor.

- Intangible assets. Includes licenses, trademarks, patents and copyrights.

- Other assets reflected in the balance sheet of the enterprise. For example, securities of other organizations, short-term and long-term investments.

Liabilities include the following types of sources of asset formation:

- Founding capital. Represents owner contributions.

- Reserves. They are formed during the operation of the enterprise in order to increase financial stability.

- Loans and other financial obligations (short-term or long-term).

- Company property that is not used to generate income. For example, employee apartments provided for free accommodation, or company transport.

Reflection of non-current assets

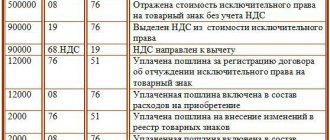

Non-current assets are reflected in financial statements - a commodity accounting program or paper documents. Recorded using accounting entries. Line 08 indicates “Investments in VA”. The complete type of wiring depends on the operation.

Let's look at an example. The company built a warehouse to store finished products. This building is classified as VA. The debit is reflected as 08 “Investments in VA”. There are many costs incurred during the construction phase that are taken into account against the loan. It can be:

- “Settlements with creditors” - 76 account;

- “Materials” - count 10.

Situations may arise when non-current assets end up in the loans column. They are recorded only in cases where the construction phase is completed. The debit will reflect 01 “Fixed Assets”. In other words, the funds received from commissioning are directed to the main revenue of the company.